Food fraud is a growing problem that affects businesses and consumers alike. It involves deliberate deception for financial gain, such as adulteration, mislabeling, substitution, or counterfeiting of food products. This guide explains how to identify and prevent food fraud, protect your supply chain, and safeguard your finances.

Key Takeaways:

- What is Food Fraud? It’s any intentional misrepresentation of food for profit, including adulteration (e.g., mixing cheaper oils into olive oil), mislabeling (e.g., falsely claiming a product is organic), substitution (e.g., swapping red snapper with tilapia), and counterfeiting (e.g., fake branded goods).

- Why It Matters: Food fraud costs billions, damages reputations, disrupts operations, and can harm public health.

- Regulations: U.S. agencies like the FDA and USDA enforce strict rules, such as hazard analysis for economically motivated adulteration and labeling requirements.

- Prevention Strategies: Conduct risk assessments with tools like VACCP, assess supplier reliability, and implement fraud-specific control points in your supply chain.

- Detection Methods: Use technologies like DNA analysis, isotope testing, NIR spectroscopy, and blockchain for transparency and verification.

- Financial Protection: Trade credit insurance (ARI) can shield your business from financial risks like non-payment or supplier bankruptcy.

Food fraud prevention requires a mix of detection technologies, robust supplier management, and financial safeguards. By integrating these measures, you can protect your business, customers, and reputation.

What is Food Fraud and Food Defense (Types, Impact, Implementation and Prevention)

Food Fraud Risk Assessment Methods

Preventing food fraud effectively starts with identifying weak spots in your supply chain before fraudsters can exploit them. This proactive approach sets the stage for implementing detection and prevention strategies tailored to specific risks.

Food Fraud Vulnerability Assessment (VACCP) Process

The Vulnerability Assessment and Critical Control Points (VACCP) process is a structured method to pinpoint and mitigate food fraud risks across your supply chain. Its primary focus is on economically motivated adulteration.

To identify vulnerabilities, assess each ingredient, supplier, and process step for potential fraud. This includes evaluating factors like ingredient value, supply chain complexity, and historical fraud cases. Ingredients such as saffron, vanilla, and organic products are particularly at risk due to their high value and limited supply sources.

A key tool in this process is supply chain mapping, which helps trace ingredients back to their origins. This step also involves examining supplier transparency and certification records. Complex supply chains often have higher fraud risks, especially when relying on single-source ingredients from regions with few suppliers. These bottlenecks are frequent targets for fraudulent activities.

Supplier reliability assessment is another critical component. This involves reviewing each vendor’s certifications, audit history, and any past quality issues. Suppliers with clear sourcing practices and strong quality controls should be prioritized.

Finally, control point establishment focuses on implementing measures to monitor and prevent fraud at the most vulnerable points. Actions might include increasing testing frequency, conducting additional supplier audits, or exploring alternative sourcing options for high-risk ingredients.

Supply Chain Critical Control Points

Establishing fraud-specific control points requires a different approach than traditional food safety measures. Fraud control points focus on areas where the financial incentives for adulteration are highest and where detection is most challenging.

One of the first critical control points is raw material receiving, where incoming ingredients are tested to verify their authenticity. Sampling protocols should address fraud risks, not just safety concerns. For example, olive oil might undergo fatty acid analysis to detect substitution with cheaper vegetable oils, while organic products may require pesticide residue testing.

Supplier transitions pose another risk, as urgent procurement needs can lead to accepting questionable ingredients. Emergency supplier protocols should ensure fraud prevention practices remain intact during such transitions.

At the product labeling and documentation stage, companies must verify that claims like organic certifications, origin declarations, and quality grades match the actual product. Implementing documentation traceability systems allows for quick validation of product claims throughout the supply chain.

Lastly, finished product storage and distribution control points help maintain product integrity after manufacturing. Measures like securing storage areas, restricting access, and maintaining chain-of-custody documentation play a vital role. For temperature-sensitive products, controlled storage conditions further protect against tampering or degradation.

Integrating these control points into existing safety systems strengthens overall risk management efforts.

Adding Fraud Prevention to Food Safety Systems

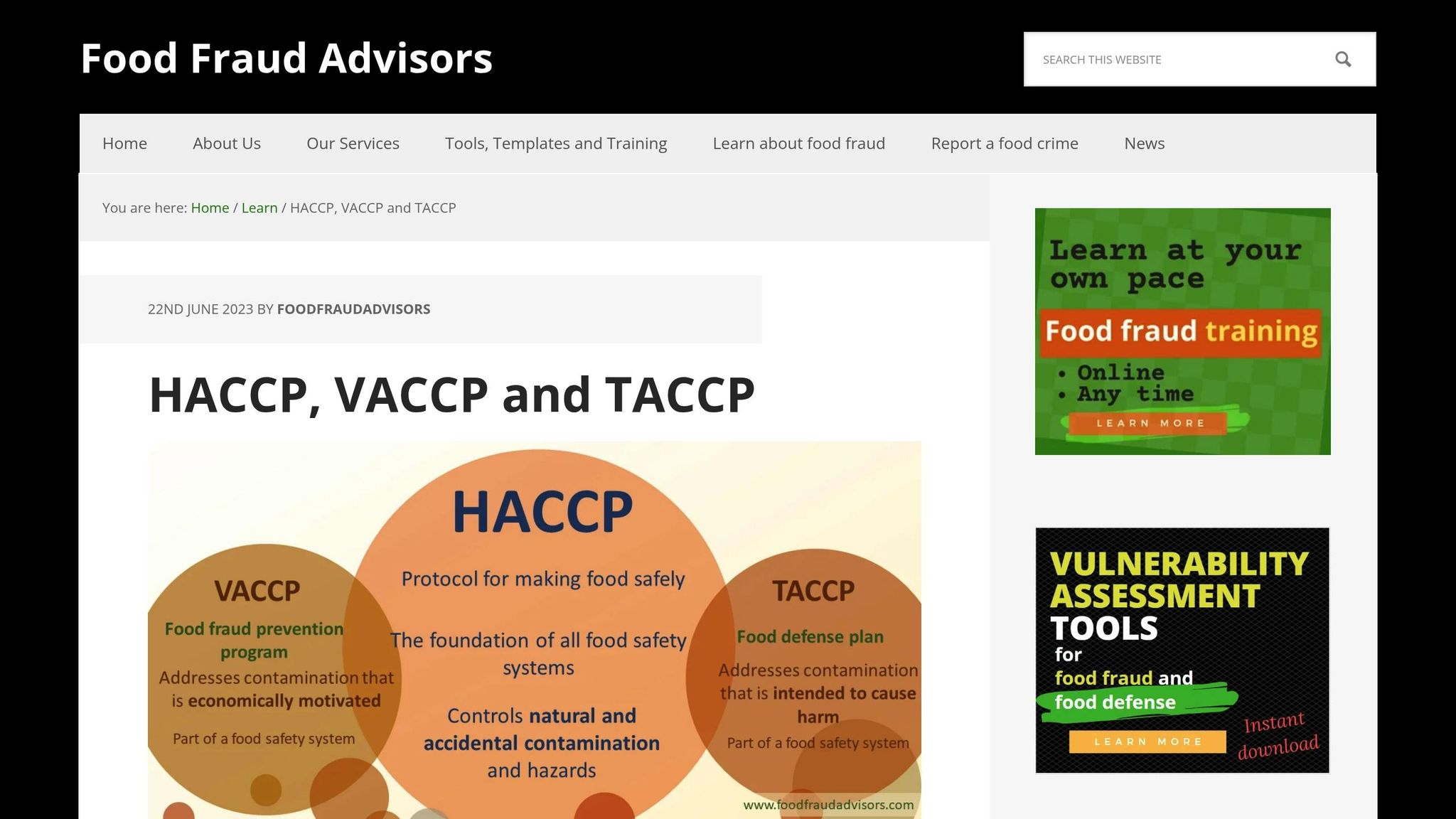

Combining fraud prevention with food safety systems involves aligning HACCP, TACCP, and VACCP measures. While HACCP focuses on food safety hazards, VACCP addresses economic fraud risks, and TACCP tackles intentional contamination threats.

System integration works best when overlapping risks and control points are identified. For example, a temperature control point used for food safety could also help prevent fraud if temperature abuse might conceal ingredient substitution.

Unified documentation simplifies managing these assessments by consolidating food safety, security, and fraud risks into a single framework. This reduces administrative work while ensuring thorough risk coverage.

Training integration ensures all staff understand their role in fraud prevention. Quality assurance teams need to recognize fraud indicators, while purchasing teams should be aware of supplier risk factors. Cross-functional training fosters a coordinated approach to managing risks.

Audit coordination enhances supplier evaluations by combining food safety, security, and fraud prevention assessments into one comprehensive process. This not only provides a clearer picture of supplier capabilities but also reduces audit fatigue for both parties.

When integrating these systems, businesses should balance resources, staff expertise, and regulatory requirements. The goal is to create a streamlined risk management framework that addresses all potential threats without unnecessary complexity or redundancy.

Food Fraud Detection and Prevention Methods

Once you’ve pinpointed vulnerabilities in your supply chain, the next step is implementing detection technologies and prevention strategies to create a comprehensive defense. These methods build on earlier risk assessments, reinforcing your ability to combat fraud effectively.

Modern Detection Technologies

Using the insights from risk assessments, these detection tools transform potential weaknesses into actionable safeguards.

DNA Analysis

DNA testing is one of the most reliable ways to verify the authenticity of products, especially when it comes to meat, seafood, and plant-based ingredients. It can accurately detect species substitution. For example, it can reveal if pricey white tuna (albacore) has been swapped for a cheaper escolar fish or if organic soybeans are mixed with genetically modified ones. The process involves extracting DNA from a sample and comparing it to known profiles, with results available in 24–48 hours. While it’s not suited for real-time testing, it works well for raw or minimally processed ingredients since heavy processing can degrade the genetic material.

Isotope Ratio Analysis

This method examines the chemical "fingerprints" of food to verify its geographic origin. It’s particularly useful for high-value products like olive oil, wine, and honey, where origin claims significantly influence pricing. By analyzing stable isotopes of elements such as carbon, nitrogen, and sulfur, it can distinguish, for instance, authentic Italian extra virgin olive oil from cheaper alternatives. Though accurate, isotope testing requires specialized equipment and trained personnel, making it more expensive – but worth it for premium products where origin matters.

Near-Infrared Spectroscopy (NIR)

NIR spectroscopy offers quick, non-invasive testing that can be performed on-site. It uses light absorption to create a unique spectral fingerprint for the product, making it ideal for detecting adulteration in powdered ingredients, grains, and dairy products. The biggest advantage of NIR is its speed – results are ready in minutes. However, it requires proper calibration for each product type and may struggle with complex mixtures.

Blockchain-Based Tracking Systems

Blockchain technology ensures tamper-proof digital records of a product’s journey through the supply chain. Each transaction, from the farm to the retailer, is logged as an immutable block of data. For example, Walmart introduced blockchain tracking for leafy greens in 2018, reducing the time needed to trace contamination sources from weeks to just seconds. While blockchain excels at preventing documentation fraud, it doesn’t detect physical adulteration and relies on widespread industry adoption.

Prevention Strategies

Strengthening fraud prevention requires a proactive approach to supplier management, traceability, and employee training.

Supplier Management

Evaluate suppliers with fraud-specific criteria, such as unannounced audits, verified certifications, and detailed risk assessments. Establish clear contracts with clauses that define quality standards, testing protocols, and penalties for non-compliance. Regular performance reviews can help flag suppliers whose standards may be slipping.

Traceability Systems

Maintain detailed records of product movement and transformations throughout the supply chain. This includes batch codes, supplier certifications, and testing records for each ingredient. Digital traceability systems are superior to paper-based ones, as they minimize human error and allow for quicker investigations. During supplier transitions, ensure there are no gaps in the product’s history to maintain an unbroken chain of custody.

Secure Packaging and Storage

For high-risk products, use tamper-evident packaging and secure storage areas. Limit access to authorized personnel and consider additional measures like security cameras, locked storage containers, or even escort services during transportation.

Employee Training

Train staff to recognize signs of fraud and respond appropriately. For example, purchasing teams should understand supplier risk factors, while quality control teams need to know testing protocols and how to interpret results. Regular refresher courses and clear reporting channels ensure employees stay alert to emerging fraud schemes.

Detection Method Comparison

Here’s a quick breakdown of detection methods, highlighting their strengths, limitations, and costs:

| Method | Best Use Cases | Advantages | Limitations | Typical Cost |

|---|---|---|---|---|

| DNA Analysis | Species verification, GMO detection | High accuracy, definitive results | 24-48 hour turnaround, processing can degrade samples | $50-200 per test |

| Isotope Testing | Geographic origin verification | Effective for origin fraud, works on processed foods | Expensive equipment, requires expertise | $100-500 per test |

| NIR Spectroscopy | Rapid screening, composition analysis | Fast results, non-destructive | Requires calibration, limited to known adulterants | $15-50 per test |

| Blockchain Tracking | Documentation verification, traceability | Tamper-proof records, full transparency | Doesn’t detect physical adulteration, requires industry adoption | $0.01-0.10 per transaction |

| Chemical Analysis | Pesticide residues, additive verification | Precise quantification, regulatory compliance | Laboratory-based, slower results | $75-300 per test |

The most effective fraud prevention programs combine multiple detection methods tailored to specific product risks and business needs. For example, high-value or frequently targeted goods may warrant more expensive testing, while routine checks can rely on faster, more affordable approaches.

When planning, consider the total cost of implementation, including equipment, training, and ongoing expenses. Starting with one or two methods and expanding gradually is often more practical than trying to implement everything at once.

Testing frequency should align with supplier risk levels and product vulnerability. New suppliers or high-risk ingredients may need testing for every shipment, while trusted suppliers with strong track records might only require periodic checks. The key is finding a balance between thorough protection and operational efficiency.

sbb-itb-2d170b0

Industry Best Practices and Programs

Strengthening defenses against fraud starts with adopting well-established initiatives. Below are some key programs and standards that are shaping the way industries tackle fraud prevention.

Organic Fraud Prevention Programs

The Strengthening Organic Enforcement (SOE) final rule, effective March 19, 2024, requires all organic operations to include a fraud prevention plan as part of their Organic System Plan. This rule underscores the importance of proactively identifying and addressing potential fraud risks. Additionally, the Organic Trade Association‘s fraud prevention program is gaining momentum among organic producers and stakeholders. Many of these initiatives now mandate a documented food fraud vulnerability assessment (FFVA) and a mitigation plan to help organizations systematically manage fraud risks.

Industry Networks and Training Programs

Beyond organic-specific measures, broader industry networks and certification programs are enhancing food fraud prevention efforts. Programs certified by GFSI, such as BRCGS, FSSC22000, and SQF, require food professionals to exhibit fraud prevention expertise. These structured approaches not only strengthen individual company defenses but also contribute to a more secure and trustworthy food supply chain. By participating in these programs, companies can better safeguard against fraudulent practices while meeting industry standards.

Financial Protection Against Food Fraud

Protecting finances is just as crucial as detecting and preventing food fraud. Fraudulent activities can lead to severe financial consequences, including non-payment and even bankruptcy, both of which can jeopardize a company’s cash flow. That’s why having a solid plan for financial protection is a key part of mitigating the broader risks of food fraud.

Managing Financial Risks

When suppliers engage in fraudulent behavior, companies may face situations where goods are delivered but payments are never made. This is where trade credit insurance, also known as accounts receivable insurance (ARI), steps in. This type of insurance acts as a financial safety net, particularly for businesses operating in international markets where additional challenges, like political instability, can arise. By covering losses from non-payment and bankruptcy, ARI helps businesses maintain steady cash flow, even in tough circumstances. It works hand-in-hand with technical fraud detection measures, creating a well-rounded strategy to protect against fraud.

Accounts Receivable Insurance (ARI) Services

ARI offers businesses a tailored solution to shield themselves from the financial fallout of food fraud, with coverage options designed for both domestic and international operations.

- Risk Assessments: ARI helps businesses identify weak spots in customer credit and supplier stability, empowering them to make smarter credit and market decisions.

- Claims Management: If non-payment occurs, ARI facilitates efficient claims processing to recover funds, minimizing disruptions to operations.

- Global Reach: With access to a worldwide network of credit insurance carriers, ARI ensures that businesses operating across borders have the protection they need, even in areas where political risks could threaten financial security.

In addition, ARI offers customized endorsements tailored to the unique challenges of the food industry. By combining domestic and international coverage, businesses with complex, global supply chains can secure the financial protection they need to navigate the risks of food fraud effectively.

Building Your Food Fraud Prevention Strategy

Developing a strong food fraud prevention strategy involves a layered approach that combines detection, oversight, and financial protections. These elements work together to strengthen supplier verification processes and ensure regular audits are conducted.

Start by examining the vulnerabilities identified in your VACCP (Vulnerability Assessment and Critical Control Points). This review should extend beyond your immediate suppliers to include their suppliers and the broader network of vendors involved in your food production. Pay particular attention to high-risk ingredients and suppliers operating in regions with a history of fraud.

Incorporate detection systems designed to verify product authenticity and identify adulterants throughout your supply chain. But keep in mind – technology alone won’t solve the problem. It must be paired with robust supplier verification protocols and consistent auditing practices.

Transparency across your supply chain is one of the most effective tools against fraud. Set clear documentation standards for all suppliers, requiring items like certificates of analysis, third-party testing results, and traceability records.

Finally, bolster your strategy with financial safeguards. These protections can help mitigate losses from recalls, legal fees, or non-payment. Fraudulent suppliers might fail to meet payment terms or even declare bankruptcy, putting your business at risk for unpaid accounts receivable.

Key Takeaways

A strong food fraud prevention strategy rests on four main pillars: risk assessment, detection technologies, industry collaboration, and financial protection.

- Risk Assessment: Conduct regular evaluations to stay ahead of new fraud risks and adapt as your supply chain changes.

- Detection Methods: Use a combination of tools like lab testing, supplier audits, and document verification to ensure no single method carries the entire burden of detection.

- Industry Collaboration: Engage with industry networks and information-sharing initiatives to get early warnings about emerging fraud schemes and problematic suppliers.

- Financial Protection: Consider safeguards like Accounts Receivable Insurance to protect your cash flow from non-payment or supplier insolvency.

Treat food fraud prevention as a critical business function, allocating the necessary resources and attention. By embedding these four pillars into your operations, you not only safeguard your products but also protect your financial stability.

FAQs

How can businesses integrate food fraud prevention into their existing food safety programs?

To make food fraud prevention a natural part of existing food safety programs, businesses should begin with vulnerability assessments to pinpoint where risks might arise. Once those risks are identified, creating specific control plans that align with established systems like HACCP is the next step. This approach ensures that fraud prevention efforts fit smoothly into the broader framework of safety protocols.

Ongoing efforts like regular monitoring, thorough employee training, and periodic updates to these measures are essential for keeping up with new and changing threats. By weaving fraud prevention into everyday operations, businesses not only guard against food fraud but also reinforce their commitment to maintaining high food safety standards.

What are the most affordable and effective technologies small and medium-sized businesses can use to detect food fraud?

For small and medium-sized businesses, there are cost-effective ways to tackle food fraud detection without breaking the bank. One practical option is using portable testing devices. These tools leverage infrared, ultraviolet, or visible light to analyze products, delivering quick, on-the-spot results. Plus, they’re user-friendly, making them a great choice for non-experts.

Another reliable approach includes chemometric methods and compact analytical tools like NMR spectroscopy or high-resolution mass spectrometry. These technologies are excellent for checking food authenticity while keeping expenses manageable.

By combining affordability with efficiency, these solutions are perfect for businesses aiming to boost food safety while staying within their budget.

How can trade credit insurance help protect businesses from financial risks related to food fraud?

Trade credit insurance acts as a financial safety net for businesses, protecting them from losses when customers fail to pay, including instances tied to food fraud. This coverage helps maintain a steady cash flow, even when unexpected fraudulent activities disrupt payments.

Beyond protection, it boosts confidence for growth and securing financing. Lenders and suppliers are more likely to extend credit when they see businesses taking steps to manage risks like food fraud and economic instability. In this way, trade credit insurance plays a key role in supporting stable operations and fostering long-term business resilience.