Trade credit insurance protects businesses from financial losses caused by unpaid invoices. This type of insurance is crucial because accounts receivable often represent 20% to 80% of a company’s assets, and unpaid debts can lead to significant cash flow issues or even bankruptcy. Here’s how it works:

- Coverage Against Non-Payment: Protects 75%–95% of unpaid invoices due to buyer insolvency, bankruptcy, or payment delays.

- Mitigates Political Risks: Covers losses from trade embargoes, currency restrictions, or political unrest.

- Real-Time Risk Monitoring: Insurers provide real-time insights into buyer creditworthiness, helping businesses identify risks early.

- Improves Liquidity: Insured receivables are seen as high-quality collateral, leading to better financing terms from banks.

- Supports Growth: Enables businesses to safely enter new markets and offer competitive payment terms to buyers.

In 2025, record-high U.S. bankruptcies (up 23.5% from 2024) and fluctuating tariffs on imports highlighted the importance of this safety net. While trade credit insurance covers $9.5 trillion annually, only about 15% of global trade is insured – leaving many businesses vulnerable. By securing coverage, companies can stabilize cash flow, protect against supply chain disruptions, and confidently manage financial risks.

Woodruff Whiteboard Breakdown: Trade Credit Insurance

Supply Chain Risks Covered by Trade Credit Insurance

Trade credit insurance addresses three major risks that can disrupt your supply chain. Since accounts receivable often account for 20% to 80% of a company’s assets, safeguarding them is just as crucial as protecting physical inventory or equipment. By covering these risks, businesses can ensure a more stable and resilient supply chain.

Non-Payment by Buyers

When buyers fail to pay their invoices, the consequences ripple far beyond a single transaction. Issues like insolvency, bankruptcy, or prolonged payment delays can severely impact cash flow. This is especially concerning because receivables are often the largest uninsured asset on a company’s balance sheet.

The numbers tell a concerning story: in 2025, U.S. business bankruptcies reached their highest level since 2010, with a 23.5% increase in filings compared to the previous year. Adding to the challenge, the U.S. prime interest rate stood at 7.5%, pushing borrowing costs higher and making it harder for struggling buyers to meet their obligations.

"Trade credit insurance helps solve this dilemma by covering the risk of unpaid invoices caused by a customer’s insolvency, mitigating the risk of buyer defaults while freeing up capital and improving cash flow."

– Jerry Paulson, Senior Vice President, HUB International

Trade Disruptions and Political Instability

Political and trade-related risks can disrupt supply chains in ways that no amount of preparation can fully anticipate. Trade credit insurance steps in to cover losses stemming from government actions, civil unrest, trade embargoes, currency transfer restrictions, and even expropriation.

For example, in 2025, the tariff environment became a minefield for U.S. businesses. In February, the Trump administration introduced a 10% tariff on Chinese imports. This quickly escalated to 20%, then skyrocketed to 145% in April, before settling at 30% by May. These rapid changes left 57% of surveyed U.S. companies reporting shrinking gross margins, with raw material costs climbing by 15–20%. On top of political risks, natural disasters and climate events further destabilized supplier reliability. A major default can amplify these pressures, creating financial chaos.

Financial Domino Effect

The collapse of a key customer can trigger a chain reaction, disrupting payments to suppliers, delaying payroll, and halting operations. This domino effect is responsible for 25% of all corporate bankruptcies.

A striking example of this occurred in January 2018 with the collapse of UK construction giant Carillion. With liabilities nearing £7 billion, the fallout affected around 30,000 subcontractors and suppliers, leading to a 20% surge in insolvencies within the construction sector.

"If a business takes out a policy… and that buyer then not be able to pay an invoice as expected… the credit insurer will pay out. This prevents a domino effect of failures throughout supply chains."

– Raluca Ezaru, External Relations Officer, ICISA

How Trade Credit Insurance Reduces Supply Chain Risks

Trade credit insurance plays a key role in managing risks, protecting cash flow, and offering tools for proactive risk management.

Assessing Buyer Creditworthiness

Insurers provide access to vast databases that are beyond the reach of individual businesses. For instance, Allianz Trade monitors over 85 million companies globally, while Atradius tracks more than 240 million businesses. These databases provide continuous, real-time updates on buyers’ financial health, helping businesses identify risks like deteriorating credit quality or payment delays before they escalate into defaults.

Unlike buyers who may only share favorable trade references, insurers have insights into millions of buyer relationships, eliminating potential bias. They also employ local credit analysts to evaluate market-specific risks that standard credit reports might miss. Using advanced analytics, insurers assess the "5 Cs" – Character, Capacity, Collateral, Capital, and Conditions – to predict potential defaults.

Business credit scores typically range from 1 to 100, with scores of 75 or above considered excellent.

"Sellers should know their clients better than anybody. If a company isn’t doing its due diligence, it may be purchasing more insurance than is otherwise needed, or its insurance may be more expensive than it should be."

– Jason Benson, Global Head of Structured Working Capital, J.P. Morgan

Relying solely on credit reports can be risky, as they may not reflect recent financial changes. Instead, insurer-provided real-time data offers a more accurate picture of financial shifts. For businesses involved in international trade, country reports can provide valuable insights into factors like currency fluctuations, political stability, and trade sanctions. Debt-to-income ratios are another key metric – buyers with ratios below 36 are often preferred, though this benchmark can vary by industry.

Once real-time insights are established, the next step is securing coverage that meets your specific needs.

Securing Customized Insurance Coverage

The process of obtaining trade credit insurance starts with an in-depth review of your customer portfolio. Insurers analyze each buyer’s financial strength and payment history to recommend appropriate credit limits. Businesses can choose to insure their entire receivables portfolio, selected buyers, or key customers.

Policies can be tailored based on repayment periods and product types. Short-term coverage (up to one year) is ideal for consumer goods and materials, while medium-term coverage (one to five years) suits large capital equipment. Additionally, businesses can manage their exposure through options like co-insurance or deductibles.

For example, EXIM often reimburses 90% to 100% of an invoice in the event of a buyer default. Short-term export credit insurance typically covers 90% to 95% of risks, while medium-term policies for large equipment cover about 85% of the net contract value. The cost of multi-buyer insurance policies is generally less than 1% of the total insured sales volume.

| Feature | Short-Term Coverage | Medium-Term Coverage |

|---|---|---|

| Repayment Period | Up to 1 year | 1 to 5 years |

| Coverage | 90% to 95% | 85% |

| Typical Products | Consumer goods, materials | Large capital equipment |

| Risk Focus | High-volume sales | Single large transactions |

For cost-effective solutions, specialty insurance brokers can help compare private carriers with government-backed options like EXIM. Exporters using an EXIM working capital guarantee may even qualify for a 25% premium discount on multi-buyer policies. It’s important to secure coverage early – insurance is meant to prevent future issues, not to fix existing bad debt.

With the right policy in place, businesses can actively manage risks in real time.

Managing Risks in Real-Time

After securing coverage, insurers offer digital platforms to monitor your accounts receivable portfolio. Tools like Atradius Insights and AIG‘s TradEnable allow businesses to identify high-risk areas and adjust credit limits dynamically. These systems provide alerts when a buyer’s financial condition worsens or if they fail to meet payment obligations.

Automated notifications ensure you’re promptly informed about buyer insolvency or late payments. For international trade, country risk maps from insurers can help assess political or regulatory risks. If an insurer reduces a credit limit for a buyer, this can serve as an early warning to renegotiate payment terms or limit exposure before a default occurs.

"If a customer’s credit begins to deteriorate or they’re not paying, and you continue to sell to them, that may be a potential issue."

– Jason Benson, Global Head of Structured Working Capital, J.P. Morgan

Filing Claims and Maintaining Cash Flow

In cases of buyer default or political disruptions, the claims process acts as a financial safety net. Insurers typically reimburse 85% to 95% of the invoice value, ensuring businesses can meet their financial obligations. This protection helps prevent a chain reaction of supply chain disruptions.

Many policies also include professional debt collection services at no extra cost, with the insurer managing the recovery process. To file a claim, businesses must provide proof of non-payment, such as invoices and delivery evidence. However, trade credit insurance only covers undisputed amounts and does not apply to cases where buyers claim goods were defective or undelivered.

Using Insured Receivables for Financing and Growth

Insured receivables are seen as high-quality collateral by banks, allowing businesses to access better borrowing terms and increased credit limits for working capital. This transforms accounts receivable from a potential liability into a tool for growth.

The global trade credit insurance market was valued at $9.39 billion in 2019 and is expected to grow to $18.14 billion by 2027, with an annual growth rate of 8.6%. Unlike factoring, trade credit insurance preserves standard payment terms while protecting against non-payment. At less than 1% of insured sales, it provides a cost-effective way to protect your business while maintaining control over receivables.

sbb-itb-2d170b0

Benefits of Trade Credit Insurance for Supply Chain Stability

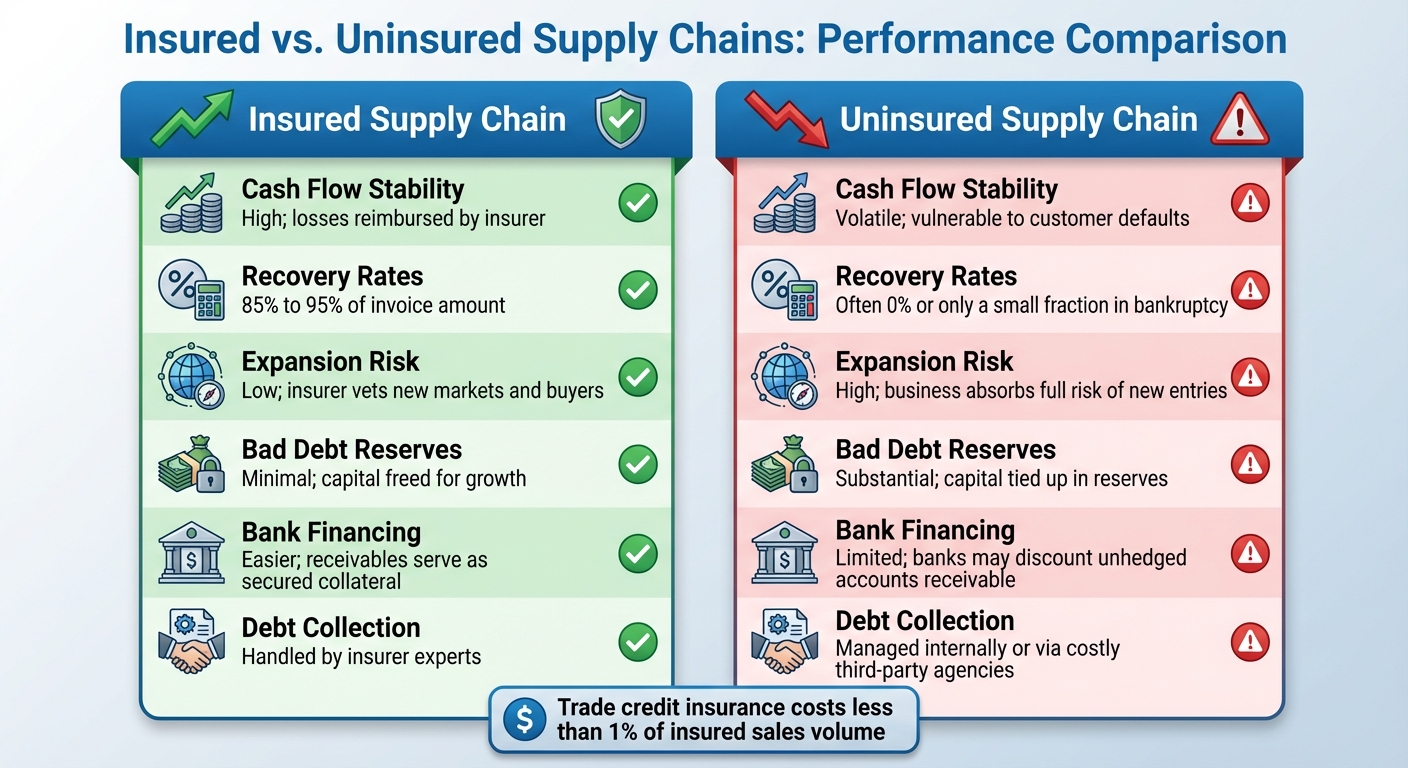

Insured vs Uninsured Supply Chains: Key Performance Metrics Comparison

Reducing Bad Debt Risks

Trade credit insurance provides a safety net for businesses by covering 85% to 95% of the value of unpaid invoices when buyers fail to pay. This safeguard is crucial, especially when you consider that 82% of small business failures stem from poor cash flow management. Imagine this: a single $100,000 loss could force a company with a 5% profit margin to generate $2 million in additional revenue just to recover. With bankruptcy rates and customer defaults posing ongoing threats, trade credit insurance steps in to prevent a ripple effect of financial instability. It also helps businesses lower their bad-debt reserves, freeing up capital for other needs.

Improving Supplier Relationships

Trade credit insurance offers more than just loss protection – it enhances relationships with suppliers and improves financial flexibility. Banks often view insured receivables, which can make up as much as 40% of a company’s total assets, as high-quality collateral. This recognition can lead to better financing terms and greater borrowing capacity. With improved cash flow, businesses can negotiate better payment terms and place larger orders, strengthening their supply chain position.

Additionally, having trade credit insurance allows businesses to extend attractive credit terms to buyers. Since 85% of B2B buyers prefer to purchase on credit rather than paying upfront, offering flexible payment options can be the key to securing contracts. Unlike factoring, which might alienate buyers by involving third-party collections, trade credit insurance keeps the company in direct control of customer relationships.

Building Confidence for Sales Growth

Trade credit insurance transforms risk into opportunity, empowering businesses to explore new markets and buyers with confidence. Insurers maintain databases that monitor over 240 million companies worldwide, providing real-time insights into potential financial risks. This data helps businesses identify early warning signs of financial distress and adjust credit terms accordingly.

"Whether trading with established customers or seeking new markets, a company can use trade credit insurance to protect its cash flow and balance sheet against the unexpected shock of non-payment."

– Jochen Duemler, CEO, Euler Hermes Americas Region

The growing demand for trade credit insurance underscores its value. The global market has grown from $9.39 billion in 2019 to a projected $18.14 billion by 2027. At less than 1% of insured sales volume, the cost is minimal when compared to the extensive protection and growth opportunities it offers. This level of security creates a stark difference between insured and uninsured supply chains.

Insured vs. Uninsured Supply Chains Comparison

| Metric | Insured Supply Chain | Uninsured Supply Chain |

|---|---|---|

| Cash Flow Stability | High; losses reimbursed by insurer | Volatile; vulnerable to customer defaults |

| Recovery Rates | 85% to 95% of invoice amount | Often 0% or only a small fraction in bankruptcy |

| Expansion Risk | Low; insurer vets new markets and buyers | High; business absorbs full risk of new entries |

| Bad Debt Reserves | Minimal; capital freed for growth | Substantial; capital tied up in reserves |

| Bank Financing | Easier; receivables serve as secured collateral | Limited; banks may discount unhedged accounts receivable |

| Debt Collection | Handled by insurer experts | Managed internally or via costly third-party agencies |

How Accounts Receivable Insurance Supports Risk Management

Expanding on the topic of mitigating supply chain risks, Accounts Receivable Insurance (ARI) plays a critical role in managing financial uncertainties. It does so through customized policies, continuous risk assessments, and access to a global network of credit insurance carriers.

Customized Coverage for Domestic and International Needs

ARI policies are designed to align with the unique needs of your business. You have the option to insure your entire accounts receivable portfolio, focus on specific buyers, or even cover a single high-value trading partner. This flexibility is key to addressing the varying risk levels across your customer base.

For businesses operating internationally, ARI provides tailored solutions to address challenges specific to global markets. On the domestic front, policies are crafted to target risks unique to local transactions. Companies with foreign subsidiaries can utilize Controlled Master Programs (CMP) to maintain cohesive global coverage while issuing localized policies. These local policies address region-specific concerns such as currency transfer restrictions or insolvency risks. Additionally, some insurers offer non-cancellable credit limits, ensuring coverage remains stable throughout the policy period, even amid market fluctuations.

Given the rising complexity of global trade – like U.S. tariffs on Chinese imports reportedly hitting 145% by early 2025 – this kind of tailored coverage has become indispensable. It ensures businesses can adapt to volatile trade environments while maintaining financial security.

Credit Risk Assessments and Claims Handling

A key feature of ARI is its ability to evaluate customer credit risk and set specific credit limits for each buyer. Insurers rely on global databases that monitor the creditworthiness of 190 million to 240 million businesses across over 185 countries. This ongoing monitoring acts as an early warning system, helping businesses spot potential defaults before they disrupt cash flow.

"Typically, receivables – the lifeblood of a company fueling cash flow – are the largest uninsured asset on the balance sheet. Having the insurance greases the wheels of global trade."

– Marc Wagman, Managing Director of Credit and Political Risk, Gallagher

Digital tools further enhance the process by allowing businesses to request additional coverage, report overdue payments, and track buyer creditworthiness in real time. If a claim arises, professional debt collection services step in to handle recovery efforts, easing the administrative workload on your team.

By combining tailored policies with real-time risk assessments, ARI ensures businesses are better equipped to manage financial risks and navigate claims efficiently.

Access to a Global Network of Credit Insurance Experts

ARI also connects businesses to an extensive global network of credit insurance carriers. These carriers provide access to risk specialists located in dozens of countries. These experts bring in-depth knowledge of local economic conditions, legal systems, and political factors that might influence a buyer’s ability to pay. For instance, Coface offers guidance through its specialists in 46 countries and provides coverage solutions in nearly 200 markets.

This global reach is particularly valuable for recovering unpaid invoices from international buyers. Credit insurers leverage these networks to effectively manage collections in high-risk regions. The scale and expertise of these networks give businesses the confidence to expand into new, potentially risky markets while safeguarding their financial interests.

Conclusion

Supply chain disruptions and payment defaults can shake the foundation of any business. Trade credit insurance steps in as a shield, protecting cash flow, enabling safer market expansion, and providing real-time insights into buyer creditworthiness. With unpaid debts contributing to roughly 25% of corporate bankruptcies and U.S. business bankruptcies climbing by 23.5% in 2025 compared to the prior year, the need for a financial safety net has never been more apparent. This is precisely where trade credit insurance proves invaluable.

But the benefits go beyond just minimizing risk. Insured receivables open doors to better financing terms from banks and free up capital that would otherwise sit idle in bad debt reserves. This kind of protection can mean the difference between weathering financial turbulence and suffering severe setbacks.

Accounts Receivable Insurance (ARI) takes this a step further by offering tailored solutions for both domestic and international transactions. With policies customized to your needs, continuous credit monitoring of over 240 million companies, and access to a global network of credit insurance carriers, ARI equips businesses to navigate commercial and political risks with confidence.

Efficient claims processing and real-time risk assessments allow you to focus on growing your business instead of worrying about payment uncertainties. Considering that nearly 1 in 10 B2B invoices goes unpaid, having comprehensive protection is essential for maintaining stability and driving long-term growth. Trade credit and accounts receivable insurance not only safeguard your cash flow but also empower your business to expand with confidence and resilience.

FAQs

How does trade credit insurance help improve cash flow?

Trade credit insurance, often called accounts receivable insurance, acts as a financial safety net for businesses by protecting them from the risks of unpaid invoices. If a customer fails to pay due to insolvency or other issues, the insurer steps in to cover most of the outstanding amount. This helps businesses maintain a steady cash flow, even when faced with payment delays or losses from unpaid debts.

By minimizing the impact of bad debt, companies can keep their working capital flowing smoothly, avoiding cash flow interruptions. This ensures they can fund essential operations, meet payroll obligations, or invest in growth without turning to expensive short-term loans. Beyond financial protection, this insurance also gives businesses the confidence to extend credit to new or higher-risk customers, enabling them to grow and explore new opportunities, even during uncertain economic times.

What’s the difference between short-term and medium-term trade credit insurance?

Short-term trade credit insurance is designed to cover invoices with payment terms of up to 180 days, making it ideal for businesses with smaller policy limits and quicker cash flow cycles. In contrast, medium-term trade credit insurance provides coverage for payment terms that range from one to five years – and sometimes even up to ten years – with policy limits that can go as high as $25 million.

These options give businesses the flexibility to select coverage that matches their financial timelines, whether they need protection for short-term transactions or longer-term agreements.

How does trade credit insurance help businesses safely expand into new markets?

Trade credit insurance, often referred to as accounts receivable insurance, plays a crucial role in helping businesses venture into new markets by shielding them from financial setbacks like non-payment, insolvency, or political upheavals. It provides a safety net by reimbursing businesses for unpaid invoices, making it easier to extend credit to new customers without hesitation.

With coverage that can span 90–100% of invoice amounts, this type of insurance eases concerns about non-payment. It also empowers businesses to offer competitive open-account terms, which are often key to attracting customers in both domestic and international markets. Policies can be customized to include new buyers, and continuous credit monitoring helps businesses keep a close eye on potential risks.

Beyond protecting against losses, trade credit insurance unlocks working capital, allowing businesses to reinvest in growth initiatives. It enables companies to explore opportunities in markets that might otherwise feel too uncertain, offering peace of mind against financial and political challenges.