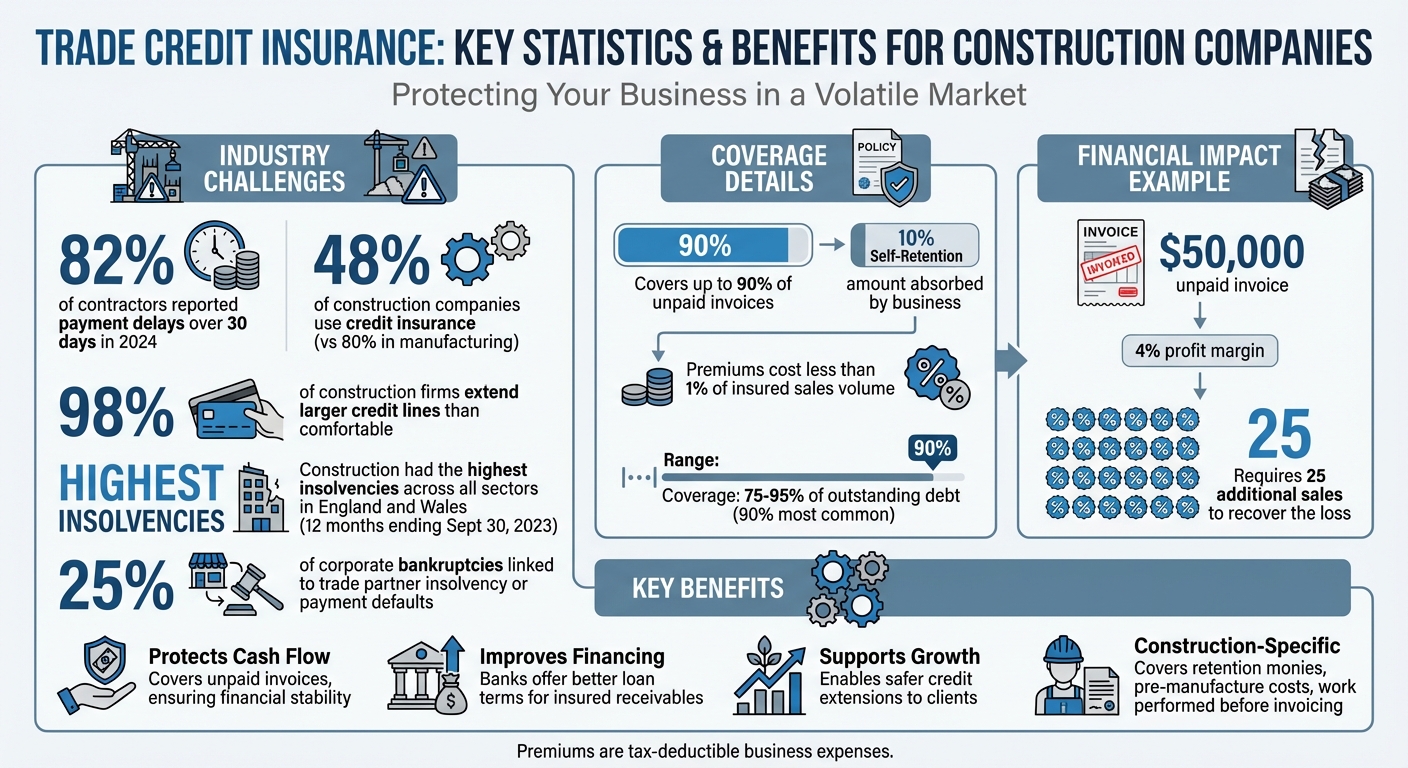

Late payments are a major challenge in the construction industry, with 82% of contractors in 2024 reporting delays of over 30 days. These delays disrupt cash flow, increase costs, and can even force businesses to close. Trade credit insurance helps by protecting your accounts receivable, covering up to 90% of unpaid invoices due to customer defaults, bankruptcies, or insolvency. It also offers credit monitoring and risk assessment to identify problems early.

Key Benefits of Trade Credit Insurance:

- Protects Cash Flow: Covers unpaid invoices, ensuring financial stability.

- Improves Financing Options: Banks may offer better loan terms for insured receivables.

- Supports Growth: Enables safer credit extensions to clients, securing larger contracts.

- Tailored for Construction: Covers unique risks like pre-manufacture costs, retention monies, and work performed before invoicing.

Trade credit insurance is not just a safety measure – it’s a way to strengthen your business and manage risks effectively in an industry prone to payment delays.

Trade Credit Insurance Benefits and Statistics for Construction Companies

What is Trade Credit Insurance? | Credit Insurance explained in 5 minutes

sbb-itb-2d170b0

Trade Credit Insurance Basics for Construction Companies

Trade credit insurance provides a financial safety net for construction companies when customers fail to pay their invoices. It helps address the challenges of delayed payments and the uncertainty that comes with extended receivables, both of which are common in the construction industry.

What’s Covered Under Trade Credit Insurance

This type of insurance primarily protects businesses in two key scenarios: customer insolvency (when a client goes bankrupt or becomes legally insolvent) and protracted default (when payments are significantly overdue). Typically, trade credit insurance reimburses about 90% of the outstanding debt, with the remaining 10% left as a self-retention amount that the business absorbs.

For construction companies, the coverage goes beyond standard protections to include industry-specific needs. Policies often cover:

- Retention monies (funds withheld until a project is completed to satisfaction)

- Contract variations

- Work performed on-site before invoicing

- Pre-manufacture costs (expenses for materials and equipment purchased in advance)

- Applications for payment and day work

This expanded coverage is critical because construction projects often require a significant upfront investment long before formal invoices are issued.

In addition to protecting against commercial risks, many policies also shield businesses from political and macro risks. These include non-payment due to events like war, government sanctions, and natural disasters – factors that can disrupt long-term projects and add unexpected financial strain.

Neon Mavromatis from Kerry London Ltd highlights the value of this protection:

"Trade Credit Insurance can be a lifeline for construction businesses because it offers protection against losses from late and unpaid trade credit invoices."

Despite the clear advantages, only 48% of construction companies report using credit insurance. This is much lower than adoption rates in industries like manufacturing or life sciences, even though construction firms in England and Wales faced the highest number of insolvencies across all sectors in the 12 months ending September 30, 2023.

Now that the coverage is clear, let’s look at how the insurance process works for construction businesses.

How the Insurance Process Works

The process starts with a consultation with a specialist broker who helps tailor the policy to your business needs. Insurers assess factors like your company’s financials, client credit histories, and specific project risks to determine coverage terms and premium costs. These premiums, which are often tax-deductible, are calculated based on turnover, industry risk, customer volume, and past loss history.

Once the policy is active, the insurer sets a credit limit for each customer, capping the amount covered in case of non-payment. As your business grows, you can request expanded coverage for new clients or higher limits for existing ones. Many insurers also provide online tools for quick credit limit adjustments, enabling faster decisions on new projects.

To minimize risks, insurers continuously monitor the financial health of your customers. They use tools like financial statements, public records, and site visits to provide real-time insights. This proactive monitoring acts as an early warning system, giving you the chance to adjust credit exposure before a client’s financial troubles escalate.

If a covered loss occurs, the claims process is straightforward. You’ll work with your broker and the insurer’s claims team to submit the necessary documentation. Once insolvency is confirmed or the protracted default period ends, the insurer processes the claim and issues payment.

| Coverage Category | Specific Protections for Construction |

|---|---|

| Commercial Risk | Customer insolvency, protracted default, and bad debt recovery |

| Political Risk | Non-payment due to war, currency restrictions, or expropriation |

| Construction Specifics | Pre-manufacture costs, work on-site, payment applications, contract variations, retention monies, and day work |

| External Factors | Natural disasters, climate-related events, and trade interruptions |

Understanding these protections helps construction companies see why trade credit insurance can be an essential tool for managing today’s payment and project risks.

Why Construction Companies Need Trade Credit Insurance

Trade credit insurance is more than just a safety net against payment defaults – it’s a tool that strengthens the financial foundation of construction companies and supports their growth. Let’s break down how these benefits translate to everyday operations. These points build on the coverage and claims process discussed earlier.

Maintaining Steady Cash Flow

In the construction industry, cash flow is everything. When a customer doesn’t pay, trade credit insurance typically covers around 90% of the unpaid invoice, helping businesses stay afloat during disruptions. For example, consider a $50,000 unpaid invoice: with a slim 4% profit margin, a construction company would need to secure 25 additional sales just to recover that loss. Beyond this, the coverage extends to industry-specific costs like pre-manufactured materials, on-site work performed before invoicing, and retention monies.

This insurance also brings added perks, such as professional debt collection services and real-time credit monitoring. These tools can alert you when a client’s financial stability begins to waver, enabling proactive decisions. Plus, unlike bad debt reserves that simply sit idle, the premiums for trade credit insurance are tax-deductible business expenses, adding another layer of financial efficiency.

Better Financing Options

Having trade credit insurance can improve your access to financing. Banks often view insured receivables as a more secure form of collateral, which can lead to better loan terms. As Neon Mavromatis from Kerry London Ltd points out:

Banks are more likely to lend more capital to businesses with trade credit insurance simply because it demonstrates an extra level of financial security.

This added credibility can help construction firms secure higher credit limits, obtain more working capital, and even negotiate lower interest rates. Considering that trade credit insurance usually costs less than 1% of the insured sales volume, it’s a small investment for the potential to unlock significant funding for future growth and projects.

Extending Credit with Less Risk

In an industry where relationships often hinge on flexible payment terms, trade credit insurance allows construction companies to extend credit more confidently. Nearly 98% of construction firms stretch their credit limits to maintain client relationships. With insurance safeguarding receivables, companies can offer competitive payment terms to attract larger clients and secure higher-value contracts without undue risk.

Additionally, insurers provide valuable market insights and financial monitoring services, giving you a clearer picture of your customers’ creditworthiness. This information helps you make informed decisions about extending credit, ensuring that you can pursue growth opportunities while minimizing financial exposure.

Selecting the Right Policy for Your Construction Business

Now that the advantages of trade credit insurance are clear, the next step is finding a policy that aligns with the specific risks your construction business faces.

Assessing Your Coverage Requirements

Before committing to a policy, take a close look at the unique challenges your business encounters. Start by evaluating the financial stability and creditworthiness of your current and potential clients to determine appropriate credit limits for each. This step is crucial for understanding how much risk you’re carrying.

In construction, certain risks stand out – on-site work, pre-manufacture costs, payment applications, contract adjustments, day work, and retention monies. These exposures often follow payment cycles that don’t align with standard invoices, so it’s important to confirm that your policy addresses these specific challenges.

Another factor to weigh is your risk concentration. If your revenue comes from a diverse group of smaller clients, a whole-turnover policy may be the best fit, as it covers your entire customer portfolio. On the other hand, if a few major clients generate most of your income, selected risk coverage can safeguard your business against potential defaults from these key accounts. This is especially important since roughly 25% of corporate bankruptcies are linked to trade partner insolvency or payment defaults.

For businesses operating across state lines or internationally, additional risks, such as currency restrictions, trade disruptions, and political instability, can affect payments. Insurers will also review your historical loss data to calculate a self-retention level – typically around 10% – and to set your premium costs.

Policy Types and Structures

Construction companies can choose from several types of trade credit insurance policies, each designed to meet different business needs:

- Whole Turnover Policies

These policies cover your entire customer base and typically come with the lowest premium rates – often less than 1% of the insured sales volume. They include ongoing monitoring of your portfolio and may offer "discretionary limits", allowing you to trade up to a certain amount without requiring individual buyer approval. - Selected Risk Policies

These policies focus on specific high-value accounts or unique risks. They’re a good choice if most of your clients are low risk, but you have a few large accounts that could significantly impact your business if they default. - Single Transaction Policies

Designed for one-off contracts or buyers, these policies are ideal for complex international projects or unusually large deals. They typically cover between 75% and 95% of the outstanding debt, with 90% being the most common coverage level. - SME-Specific Policies

Tailored for small to medium-sized contractors, these policies simplify the process with easy-to-understand terms and 100% online management. They’re especially cost-effective for businesses with annual sales between $1 million and $25 million.

| Policy Type | Best For | Key Features | Typical Cost |

|---|---|---|---|

| Whole Turnover | Diverse customer bases | Covers all buyers; portfolio monitoring | Less than 1% of insured sales |

| Selected Risk | Few large clients | Focuses on key accounts; protects against major losses | Higher per-account premiums |

| Single Transaction | One-off, high-value projects | Covers specific contracts; ideal for large or international deals | Project-specific pricing |

| SME-Specific | Small to medium contractors | Simplified terms; online management | Competitive rates for $1M–$25M annual sales |

When selecting a policy, make sure it explicitly covers retention monies, as these funds often represent a significant risk due to their extended holding periods. Additionally, check whether the policy can be assigned to your lender, which could help you secure better borrowing terms or lower interest rates.

Jason Benson, Global Head of Structured Working Capital at J.P. Morgan, highlights the importance of doing your homework:

Sellers should know their clients better than anybody. If a company isn’t doing its due diligence, it may be purchasing more insurance than is otherwise needed.

Implementing Trade Credit Insurance in Your Operations

Once you’ve chosen the right trade credit insurance policy, the next step is to weave it into your daily operations. This integration not only enhances your financial safeguards but also ensures the policy works seamlessly with your existing systems and processes.

Setting Up Policy Administration

To get the most out of your trade credit insurance, connect it with your accounts receivable (AR) system. This allows you to monitor credit limits and track customer solvency, helping you identify potential risks before they become bigger issues. Some platforms, like Accounts Receivable Insurance, even offer online tools that let you request credit limit increases almost instantly – perfect for managing new or expanded contracts.

Another key step is coordinating with your banks or lenders. Insured receivables can often be used as secure collateral, which may lead to better financing terms or even higher credit lines. Check if your policy can be assigned to your lender, as this can open up more favorable borrowing opportunities.

Internally, set clear protocols for managing your relationship with the insurer. Assign specific team members to handle reporting, especially for events that could trigger a claim. Many policies come with strict disclosure timelines, and missing these deadlines could mean losing out on coverage. Additionally, factor insurance premiums and coverage details into your project budgets and financial plans. This ensures all stakeholders are aware of how the policy impacts overall risk management.

Once your policy is fully integrated, it’s essential to understand how to handle claims effectively.

Filing and Managing Claims

When it’s time to file a claim, timing and accuracy are everything. Coverage typically kicks in after a waiting period – usually 60 days or more from the original payment due date. Claims can be filed for issues like customer insolvency or extended payment defaults, as well as political risks such as currency restrictions, war, or expropriation.

Notify your insurer as soon as a payment is overdue. Waiting until a formal default occurs might jeopardize your claim. John Gibbons, Partner at Blank Rome LLP, advises:

One of the ways to protect yourself is to make sure you have leeway in terms of providing notice to the insurer before you put the entity into formal default or nonpayment after their obligation has come due.

Pay close attention to any "stop shipment" clauses in your policy. If a buyer is 90 or more days past due, continuing to send goods or provide services could leave those additional costs uninsured. Joseph Jean, Partner at Pillsbury Winthrop Shaw Pittman LLP, highlights the risk:

If you keep shipping after the 91st day, and your policy says you have to stop when they are late, then you are on the risk for any shipments after they are late.

Good record-keeping is also critical. Keep detailed documentation of shipment dates, receipts, and payment applications. Insurers require thorough paperwork to process claims, and missing documents can delay or complicate the process. It’s also worth noting that trade credit insurance typically covers only undisputed amounts. If there’s a disagreement over delivery quality or quantity, the insurer won’t pay out until the issue is resolved.

Lastly, many policies provide access to professional debt collection services. Using these services early can help recover funds without escalating to a formal claim. This not only protects your cash flow but also preserves relationships with clients.

Conclusion: Protecting Your Construction Business with Trade Credit Insurance

Trade credit insurance safeguards your finances by covering approximately 90% of outstanding invoices. This means that even if a client defaults, your cash reserves remain intact, and subcontractor relationships stay stable – a critical advantage in an industry ranked third for insolvencies .

But it’s not just about protection. Trade credit insurance can also fuel your business’s growth. Banks view insured receivables as reliable collateral, making it easier to access working capital . As Marsh explains:

Investing in credit insurance is not merely a defensive measure; it is a strategic enabler that supports sustainable growth.

Another significant benefit is the market intelligence that comes with your policy. Real-time solvency ratings allow you to identify financially unstable clients before signing contracts, helping you avoid potential bad debts altogether . And with cost-effective premiums, the overall value of trade credit insurance becomes even more compelling . By protecting your receivables and opening doors to growth opportunities, this insurance aligns perfectly with the needs of today’s construction businesses.

Despite these advantages, only 48% of construction companies currently use trade credit insurance – a stark contrast to the 80% adoption rate in manufacturing. In a sector where 98% of businesses admit to extending larger credit lines than they’re comfortable with, this coverage provides the confidence to manage those risks without jeopardizing your operations.

With rising material costs and labor shortages, trade credit insurance transforms what could be a vulnerability into a competitive advantage. It turns your accounts receivable into a strategic asset, ensuring dependable payments and robust financial stability.

For tailored trade credit solutions, visit accountsreceivableinsurance.net.

FAQs

What doesn’t trade credit insurance cover on construction projects?

Trade credit insurance usually excludes coverage for non-payment stemming from contractual disputes, poor workmanship, or situations where a buyer’s insolvency is caused by fraud or intentional misconduct. These exclusions focus on risks that aren’t part of the typical financial loss protections offered for construction projects.

How do credit limits work for each customer or job?

Insurers determine credit limits by carefully analyzing various customer details, including financial stability, payment patterns, and the specifics of the project in question. They evaluate key factors like the risk of insolvency and the overall conditions within the industry. Based on this review, they decide on the maximum coverage amount that can be extended to a customer or specific job. These limits can be fully approved, partially granted, denied, or even adjusted later to account for shifts in financial risk.

What steps should I take to file a claim for non-payment?

If you’re looking to file a claim under your trade credit insurance due to non-payment, here’s how to approach the process step by step:

- Verify the reason for non-payment: First, ensure the debt in question is valid and not being contested. This step is crucial to avoid unnecessary delays or disputes during the claim process.

- Check your policy timeline: Double-check that your claim falls within the allowed filing period outlined in your policy. Missing this window could result in a denied claim.

- Prepare documentation: Gather all necessary records, such as invoices, proof of delivery, and any other relevant documents that support your claim. Proper documentation is key to a smoother review process.

- Submit the claim: Each insurer has its own specific process for filing claims. Make sure to follow their instructions closely to avoid any issues.

- Follow up: Stay engaged during the review process. If the insurer requests additional details or clarification, respond promptly to keep things moving.

By staying organized and proactive, you can help ensure your claim is handled efficiently.