Trade credit insurance protects businesses from the financial risks of customer non-payment, covering issues like insolvency, delayed payments, or political disruptions. This insurance enhances creditworthiness by securing receivables, which makes lenders more confident in providing financing. Here’s why it matters:

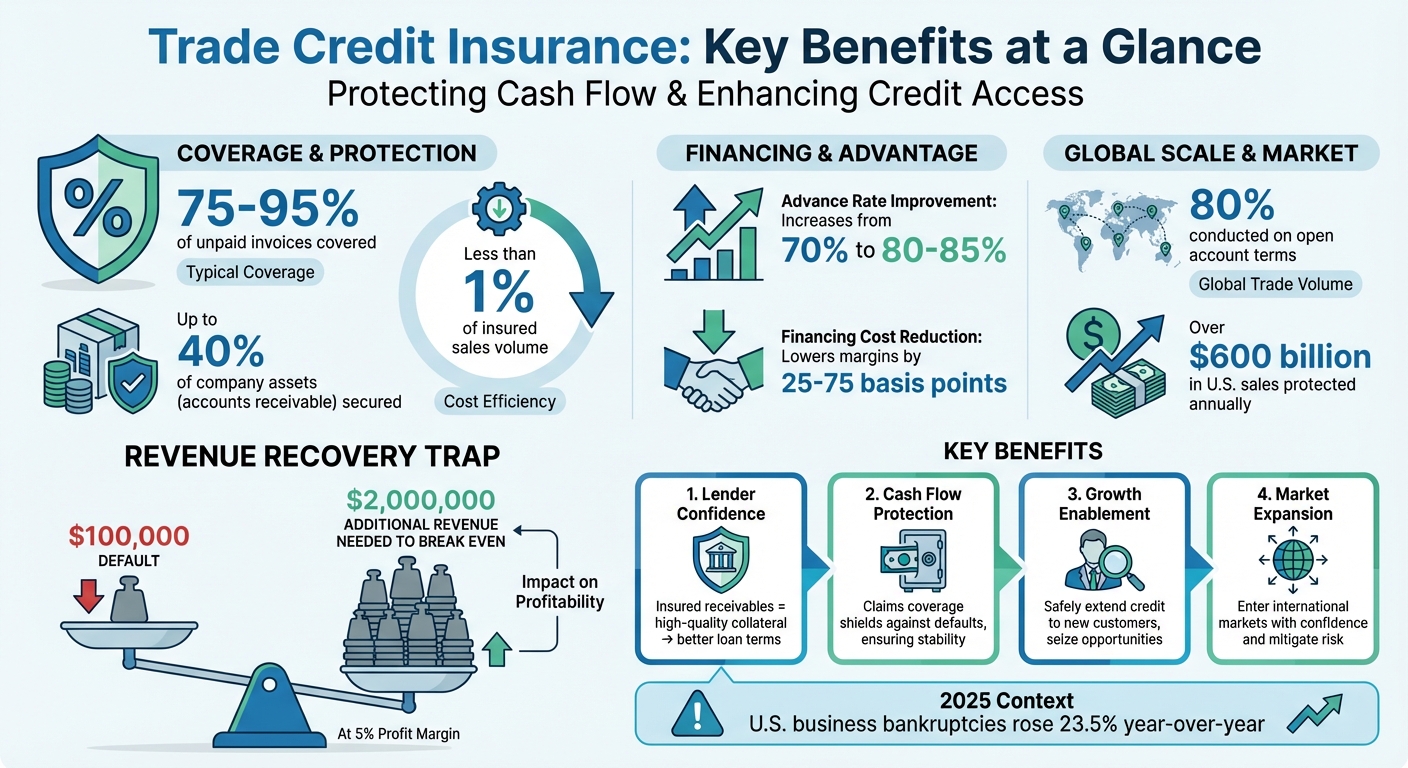

- Covers 75–95% of unpaid invoices: Protects cash flow against defaults.

- Boosts lender confidence: Insured receivables are treated as high-quality collateral, leading to better loan terms.

- Supports growth: Enables businesses to safely extend credit to new customers and expand into international markets.

- Costs less than 1% of insured sales: Affordable protection without tying up capital.

How Trade Credit Insurance Strengthens Business Creditworthiness

Creditworthiness Challenges for B2B Businesses

Accounts Receivable as a Risk Factor

When lenders assess a business’s financial health, they take a close look at every asset listed on the balance sheet. Uninsured accounts receivable often raise serious concerns. If a large portion of your receivables comes from just a few customers, lenders see this as a major risk. Why? Because if one of those key customers defaults, it could jeopardize your ability to repay loans.

"The company’s bank becomes concerned about this concentration and requires trade credit insurance to fully leverage the accounts receivable as collateral." – Jochen Duemler, CEO, Euler Hermes Americas Region

Without trade credit insurance, lenders may either exclude or heavily discount receivables when calculating collateral value. This can lead to stricter financing terms, such as higher interest rates, reduced credit limits, or outright rejection of loan applications. Companies that choose to self-insure face their own challenges, as they must set aside large cash reserves to cover potential losses. This ties up capital that could otherwise fuel growth. The risks tied to uninsured receivables not only affect how lenders view your business but can also lead to severe financial strain if customer payments are delayed or missed.

How Customer Non-Payment Damages Financial Health

For businesses operating on thin profit margins, a single default can have a ripple effect. Consider this: at a 5% profit margin, a $100,000 default means a company would need to generate $2 million in additional revenue just to break even. This creates what’s often called a "revenue recovery trap", where businesses are forced to chase higher sales volumes simply to offset their losses.

"If a customer’s credit begins to deteriorate or they’re not paying, and you continue to sell to them, that may be a potential issue." – Jason Benson, Global Head of Structured Working Capital in Trade & Working Capital, J.P. Morgan

The financial fallout from customer non-payment doesn’t end there. Late payments or outright defaults disrupt cash flow, making it harder for businesses to meet their own obligations – whether that’s paying suppliers, employees, or other creditors. This kind of volatility can hurt credit ratings and make financial forecasting less reliable. In some cases, the uncertainty alone is enough to prevent banks from extending additional credit, setting off a chain reaction that threatens the company’s stability and growth. Using trade credit insurance is a practical way to manage these risks and maintain a strong credit profile.

sbb-itb-2d170b0

How Trade Credit Insurance Strengthens Creditworthiness

Building Lender Confidence

When applying for a loan or line of credit, banks closely evaluate your receivables to gauge how much they can safely lend. Insured receivables change this dynamic significantly. Since the risk of non-payment shifts to a dependable insurer, lenders consider these receivables as high-quality collateral. This adjustment often increases advance rates from 70% to 80–85% and lowers financing margins by 25–75 basis points.

"Trade credit insurance may also enhance a company’s access to financing, as banks may view insured receivables as lower risk."

- J.P. Morgan

By issuing a loss payee endorsement or assigning proceeds to your lender, you ensure the bank directly receives the insurance payout if a customer defaults. This setup is particularly useful for receivables that banks typically exclude from lending calculations, such as those tied to foreign customers or accounts exceeding concentration limits. Additionally, non-cancellable limits provide consistent coverage, offering lenders the assurance they need to extend larger credit lines or improve lending terms. This stability not only strengthens collateral standards but also safeguards cash flow when defaults occur.

Protecting Cash Flow Through Claims Coverage

Trade credit insurance covers 75–95% of the invoice amount if a customer fails to pay, whether due to insolvency, prolonged default, or political risks. Considering that accounts receivable can account for up to 40% of a company’s total assets, this protection shields your balance sheet from the financial shock of non-payment. It acts as an immediate safety net, complementing earlier efforts to manage receivables risk.

But the benefits go beyond just receiving an insurance payout. This coverage helps preserve your cash flow and reduces the strain of chasing delinquent accounts by assisting with debt collection. For a relatively small premium – typically less than 1% of your insured sales volume – you can free up reserves for working capital, ensuring operational stability even if a major customer faces financial trouble.

Using Credit Risk Assessments

Trade credit insurers provide access to vast proprietary databases that monitor millions of companies, offering credit risk analysis far beyond what most businesses can achieve on their own. Acting as an "early warning system", these tools track the financial health of your buyers and alert you to potential risks before losses occur.

"Coface are a valuable source of information about potential and existing customers and will go out and meet a customer if necessary. That adds significant value for us."

- John O’Connell, Group Treasurer, Origin Enterprises

These insights allow you to set real-time credit limits, often securing higher approved limits that can drive sales growth. Additionally, having your receivables vetted and insured demonstrates to lenders that your assets are reliable and low-risk. This directly improves your credit profile and gives you an edge in financing negotiations. By leveraging this data, you not only protect your business but also position yourself for future growth, reinforcing your financial standing and paving the way for expansion into new markets.

How trade credit insurance works for banks and their clients

Growing Sales and Entering New Markets

Trade credit insurance doesn’t just reduce risk – it opens doors to growth, making it a powerful tool for businesses looking to expand their reach.

Extending Credit to New Customers

Winning contracts often comes down to offering competitive payment terms. With 80% of global trade conducted on open account terms, demanding upfront payments can put you at a disadvantage. Trade credit insurance helps by covering 85% to 95% of invoice amounts if a new customer defaults. This shifts the focus from guesswork to a data-backed approach.

This coverage allows businesses to approve credit for new customers more quickly, paving the way for larger orders and better supplier terms. By extending higher credit limits and longer payment periods safely, you not only encourage bigger orders but also improve your leverage in supplier negotiations.

"Sellers should know their clients better than anybody. If a company isn’t doing its due diligence, it may be purchasing more insurance than is otherwise needed, or its insurance may be more expensive than it should be."

- Jason Benson, Global Head of Structured Working Capital, J.P. Morgan

These advantages don’t just apply locally – they also create opportunities for international expansion.

Entering International Markets

Expanding into international markets comes with risks beyond customer insolvency. Issues like political instability, trade embargoes, currency transfer restrictions, or government interference can disrupt payments. Trade credit insurance protects against these challenges, giving you the confidence to compete in unfamiliar territories. Instead of asking buyers to arrange costly Letters of Credit, you can offer open account terms – the backbone of 80% of global trade.

Insurers provide up-to-date intelligence and solvency ratings for foreign buyers across numerous markets. They also handle global debt collection, navigating the complexities of different legal systems for you. Additionally, insured foreign receivables are often seen as lower-risk collateral by banks, which can lead to better financing terms and increased borrowing capacity for international operations. These improved terms enhance your financial flexibility, making sustainable global growth more achievable.

"Export credit insurance equips businesses with the confidence needed to enter new markets, take on new customers, and expand sales to existing ones."

Conclusion: Trade Credit Insurance for Financial Stability

Trade credit insurance transforms up to 40% of your accounts receivable into secure collateral, making your business more appealing to banks. This can lead to better financing terms, including lower interest rates and higher credit limits, which are key to fostering growth.

But the benefits go beyond just shielding against losses. By eliminating the need for large bad debt reserves, you unlock capital that can be redirected into operations, new product development, or expanding into new markets. For businesses operating on narrow margins, a $100,000 default could require generating an additional $2 million in revenue to offset the loss at a 5% profit margin.

This added financial security becomes even more critical in uncertain economic climates. For example, U.S. business bankruptcies rose 23.5% in 2025 compared to the previous year, highlighting the importance of safeguarding cash flow. Trade credit insurance serves as a safety net, ensuring that a single default doesn’t disrupt your business. With over $600 billion in U.S. sales already protected by this coverage annually, it’s clear that businesses across sectors understand its importance.

As J.P. Morgan aptly stated:

"Trade credit insurance may also enhance a company’s access to financing, as banks may view insured receivables as lower risk."

- J.P. Morgan

At a cost of less than 1% of your insured sales volume, this coverage offers far-reaching benefits. It strengthens your balance sheet, improves payment terms, and acts as both a financial shield and a catalyst for growth.

FAQs

How does trade credit insurance help businesses secure better financing options?

Trade credit insurance plays an important role in helping businesses secure financing by lowering the risks tied to accounts receivable. When receivables are insured, lenders are more likely to see these assets as dependable collateral. This can translate into higher credit limits and better loan terms.

By safeguarding companies against losses caused by non-payment or insolvency, trade credit insurance helps maintain a consistent cash flow. It also signals financial stability to lenders, providing businesses with an added layer of credibility. This increased security can open doors to the funding needed for growth and expansion.

What risks do B2B businesses face without trade credit insurance?

Without trade credit insurance, B2B businesses leave themselves exposed to major financial risks if customers default on payments due to insolvency or bankruptcy. This can create serious cash flow problems, making it tough to manage day-to-day expenses or fund future growth opportunities.

On top of that, businesses operating in international markets may encounter political risks like trade restrictions or economic instability, which can put their receivables at even greater risk. Over time, these challenges can erode financial stability and impact creditworthiness, potentially making it harder to secure financing or build strong partnerships.

How does trade credit insurance support businesses in expanding to international markets?

Trade credit insurance plays a key role in helping businesses venture into international markets by safeguarding them against risks like customer insolvency, non-payment, and political turmoil. With this protection in place, companies can confidently offer credit terms to overseas clients, even in less familiar territories, while minimizing financial uncertainty.

This type of insurance also strengthens a company’s financial standing by securing accounts receivable as reliable collateral. As a result, businesses can access financing more easily, maintain a steady cash flow, and provide attractive payment terms to clients. This added financial flexibility supports investments in new growth opportunities abroad. By reducing risks and creating a stable foundation, trade credit insurance empowers businesses to take on global markets with greater assurance.