Credit insurers manage highly sensitive financial data, making cybersecurity a critical priority. A data breach can lead to financial penalties, lawsuits, and loss of trust. To address this, insurers rely on structured cybersecurity frameworks that align with regulations like the Gramm-Leach-Bliley Act (GLBA) and streamline risk management.

Here are three key cybersecurity frameworks tailored for credit insurers:

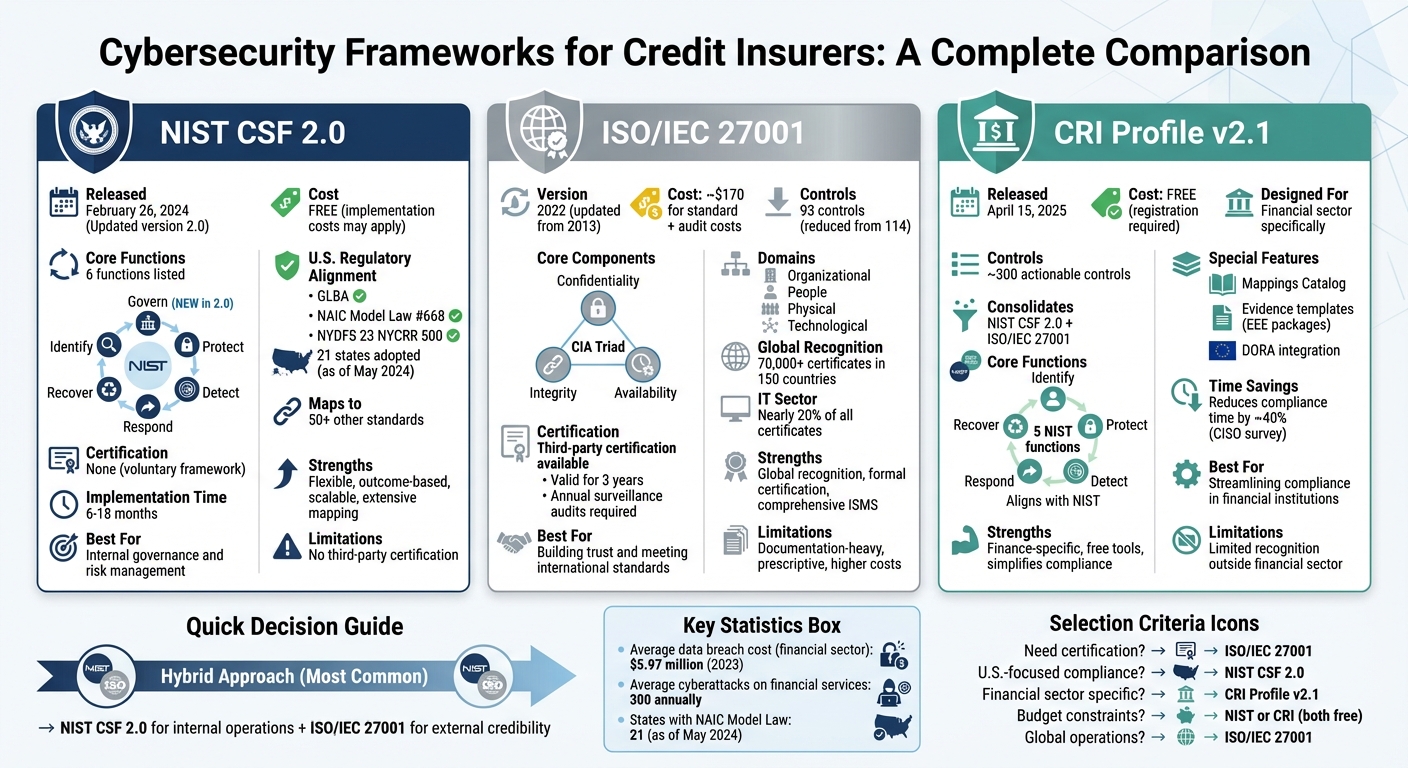

- NIST Cybersecurity Framework (CSF) 2.0

- Updated in February 2024, this framework organizes cybersecurity into six functions: Govern, Identify, Protect, Detect, Respond, and Recover.

- It’s free, flexible, and aligns with U.S. regulations like GLBA and NAIC Model Law.

- Best for internal risk management and scalable strategies.

- ISO/IEC 27001

- A globally recognized standard for Information Security Management Systems (ISMS).

- Offers third-party certification, ensuring compliance with international regulations.

- Requires purchasing and audit costs but provides strong external validation.

- CRI Profile (v2.1)

- Designed for the financial sector, it simplifies over 2,500 requirements into 300 actionable controls.

- Free to use, with tools for regulatory alignment, including the Digital Operational Resilience Act (DORA).

- Ideal for insurers prioritizing compliance efficiency.

Quick Comparison:

| Framework | Key Features | Cost | Best For |

|---|---|---|---|

| NIST CSF 2.0 | Flexible, aligns with U.S. regulations, outcome-based design | Free (implementation costs may apply) | Internal governance and risk management |

| ISO/IEC 27001 | Globally recognized, certification available, structured ISMS | ~$170 + audit costs | Building trust and meeting international standards |

| CRI Profile v2.1 | Tailored for finance, simplifies compliance, free tools for regulatory mapping | Free | Streamlining compliance in financial institutions |

Credit insurers often use a hybrid approach, combining NIST CSF 2.0 for internal operations and ISO/IEC 27001 for external credibility. This ensures robust protection while meeting regulatory and client expectations.

Cybersecurity Frameworks Comparison for Credit Insurers: NIST CSF 2.0, ISO/IEC 27001, and CRI Profile

Risk Management and NIST Cybersecurity Framework Fundamentals – Lunch & Learn

sbb-itb-2d170b0

1. NIST Cybersecurity Framework (CSF 2.0)

On February 26, 2024, the National Institute of Standards and Technology (NIST) released the updated version of its Cybersecurity Framework, CSF 2.0. This framework is available at no cost – no licensing fees, no subscriptions – making it an appealing choice for credit insurers. Alongside the framework, NIST provides a wealth of tools, guides, and reference materials to support its adoption.

Core Components

CSF 2.0 builds on its reputation for being adaptable across industries by organizing cybersecurity into six key functions: Govern, Identify, Protect, Detect, Respond, and Recover. These functions aim to outline desired outcomes rather than prescribe specific steps, giving credit insurers the flexibility to tailor the framework to their unique needs.

A major update in version 2.0 is the addition of the Govern function, which underscores the importance of executive oversight. It integrates cybersecurity into broader enterprise risk management, placing cyber threats on the same level as financial or reputational risks.

"The CSF 2.0 provides guidance to industry, government agencies, and other organizations to manage cybersecurity risks. It offers a taxonomy of high-level cybersecurity outcomes that can be used by any organization – regardless of its size, sector, or maturity." – National Institute of Standards and Technology

Credit insurers can use Organizational Profiles to focus on specific priorities, such as safeguarding personal data or combating fraud. The framework also includes Informative References, which link CSF outcomes to other standards like ISO/IEC 27001, making it easier to align with multiple compliance requirements.

Financial Compliance Alignment

For U.S.-based credit insurers, CSF 2.0 aligns with critical regulations, including the Gramm-Leach-Bliley Act (GLBA), the NAIC Insurance Data Security Model Law (#668), and the New York Department of Financial Services‘ (NYDFS) 23 NYCRR 500. The Govern function, in particular, supports NYDFS requirements for executive-driven risk management strategies.

As of May 2024, 21 states have adopted the NAIC Model Law, which requires insurers to implement comprehensive information security programs. Additionally, state insurance regulators rely on NIST standards through the U.S. Treasury’s Financial Banking and Information Infrastructure Committee to address cybersecurity risks across the financial sector. This alignment allows credit insurers to meet multiple regulatory requirements without duplicating efforts.

Implementation Cost

While the framework itself is free, implementing CSF 2.0 involves some investment. Credit insurers need internal resources, such as staff time for governance and training, and may occasionally require third-party security tools. For those just starting, NIST’s Enterprise Risk Management Quick-Start Guide (SP 1303) provides practical steps for integrating cybersecurity into existing financial risk management processes.

To simplify adoption, the CSF 2.0 Reference Tool offers machine-readable formats, making it easier to integrate cybersecurity efforts into risk management workflows. Framework management tools can also help map current controls to regulatory requirements, identifying any gaps in security.

Suitability for Credit Insurers

CSF 2.0’s outcome-oriented design makes it a strong fit for credit insurers, whether they are small, regional players or multinational organizations. Its flexibility allows insurers to adapt their cybersecurity strategies based on available resources and their specific risk profiles. The framework’s alignment with regulatory standards further solidifies its role as a vital tool for protecting sensitive financial data.

"CSF 2.0, which builds on previous versions, is not just about one document. It is about a suite of resources that can be customized and used individually or in combination over time as an organization’s cybersecurity needs change and its capabilities evolve." – Laurie E. Locascio, Under Secretary of Commerce for Standards and Technology and NIST Director

The framework also addresses supply chain risks, a critical issue for credit insurers who rely on third-party vendors like cloud providers and managed service providers. NIST guidelines help insurers assess and prepare for the potential impact of large-scale cyber events on these essential partners.

Next, we’ll look at ISO/IEC 27001 to compare its approach to cybersecurity standards.

2. ISO/IEC 27001

ISO/IEC 27001 provides a globally recognized framework for establishing an Information Security Management System (ISMS). This standard offers a structured approach to safeguarding data by focusing on people, policies, and technology. Unlike the free NIST framework, ISO/IEC 27001 requires purchasing the documentation (CHF 155, approximately $170) and undergoing formal certification audits. According to the 2022 ISO Survey, over 70,000 certificates have been issued across 150 countries, with the IT sector accounting for nearly 20% of them.

Core Components

At its core, ISO/IEC 27001 is built around the CIA Triad: Confidentiality, Integrity, and Availability. For credit insurers, maintaining data integrity is especially important when handling sensitive financial statements and third-party information.

The framework mandates adherence to Clauses 4 through 10, which cover areas like understanding organizational context and driving continuous improvement. For example, Clause 4 focuses on identifying stakeholders (e.g., regulators) to meet legal and regulatory requirements, while Clause 5 emphasizes board-level involvement, requiring active management reviews and policy authorization.

"The days of the CISO signing off in a basement are over. The Board must authorise the policy, ensure resources are available, and communicate the importance of the ISMS." – iso27001.com

The 2022 update streamlined the framework, reducing 114 controls to 93, grouped into four domains: organizational, people, physical, and technological. Organizations are required to implement only the controls relevant to their specific risk assessments. For credit insurers, ISO/IEC 27102:2019 (CHF 100, about $110) provides tailored guidelines for managing underwriting and claims data, addressing vulnerabilities unique to credit insurance operations.

This structured approach not only boosts data security but also aligns seamlessly with U.S. financial regulations.

Financial Compliance Alignment

ISO/IEC 27001 integrates well with U.S. financial regulations, such as the New York Department of Financial Services’ 23 NYCRR Part 500. These regulations require financial services companies to implement cybersecurity programs, conduct risk assessments, and establish governance structures. The standard’s focus on leadership and board-level accountability supports these requirements, ensuring that cybersecurity becomes a key element of broader risk management strategies.

| ISO/IEC 27001 Clause | Requirement | Alignment with NY DFS Part 500 |

|---|---|---|

| Clause 5: Leadership | Top management commitment and policy authorization | § 500.4: Cybersecurity Governance (CISO and Board oversight) |

| Clause 6: Planning | Information security risk assessment and treatment | § 500.9: Risk Assessment requirements |

| Clause 8: Operation | Implementing risk assessments and controls | § 500.2: Cybersecurity Program implementation |

| Clause 9: Performance | Monitoring, measurement, and internal audits | § 500.5 & 500.6: Vulnerability management and audit trails |

| Annex A Controls | 93 specific technical and organizational controls | § 500.7–500.15: Access privileges, MFA, and encryption |

By focusing on risks rather than generic measures, the framework allows credit insurers to address real threats effectively.

Implementation Cost

Costs extend beyond purchasing the standard to include staff training, resource allocation, and third-party audit fees. Certification is valid for three years, with annual surveillance audits and a recertification process every three years.

Credit insurers can manage these expenses by narrowing the scope of their ISMS to specific units or locations. For smaller organizations, the Information Security Basics Package (CHF 179, about $196) combines the standard with a practical handbook, offering a more budget-friendly option. This targeted approach not only optimizes spending but also reduces potential costs linked to data breaches.

Suitability for Credit Insurers

ISO/IEC 27001’s flexible framework makes it suitable for credit insurers of all sizes. For companies like those associated with Accounts Receivable Insurance, adopting this standard is a key step in managing risks tied to financial statements and sensitive third-party data.

"An information security management system implemented according to this standard is a tool for risk management, cyber-resilience and operational excellence." – ISO

Auditors now prioritize executive involvement during certification reviews. CEOs, not IT managers, are expected to articulate the security policy clearly. Failing to do so can result in a "Major Non-Conformance". Additionally, organizations still operating under the 2013 version should transition to the 2022 update by April 30, 2024, as certification for the older version will no longer be available. The updated version’s consolidated controls and modernized "Attributes" system are better equipped to handle threats from cloud services and evolving cyber risks.

3. CRI Profile for Financial Institutions

The CRI Profile v2.1, introduced by the Cyber Risk Institute on April 15, 2025, is a cybersecurity framework specifically designed for the financial sector, particularly credit insurers. Built on established frameworks like NIST CSF 2.0 and ISO/IEC 27001, it simplifies over 2,500 global requirements into 300 actionable controls, offering a streamlined approach to cybersecurity compliance.

"The profile was developed in response to a survey of chief information security officers from financial institutions that indicated nearly 40% of their time was spent on compliance and reconciling competing, duplicative, redundant, and inefficient cybersecurity supervisory examinations." – Financial Services Sector Coordinating Council (FSSCC)

Core Components

At its heart, the CRI Profile uses diagnostic statements to standardize the evaluation of cybersecurity practices. These statements align with the five core functions of NIST CSF 2.0 – Identify, Protect, Detect, Respond, and Recover – but include additional guidance tailored to the financial sector. For credit insurers, this means targeted controls addressing critical areas like third-party risk management, cloud security, and business continuity.

The framework also includes a Mappings Catalog, which connects its controls to regulations like the Digital Operational Resilience Act (DORA). Additionally, EEE packages with pre-defined evidence templates reduce the need for manual mapping, making compliance efforts more efficient. This structure bridges the gap between regulatory requirements and operational resilience, ensuring smoother alignment with global standards.

Financial Compliance Alignment

The CRI Profile acts as a central baseline for regulatory examinations, allowing credit insurers to meet various compliance mandates through a single, unified implementation. This not only cuts down on the time and resources spent reconciling different requirements but also provides flexibility for organizations of all sizes. Smaller credit insurers, for instance, can adopt only the controls that align with their specific risk profiles.

By consolidating compliance efforts, the framework helps reduce implementation costs and simplifies ongoing regulatory management.

Implementation Cost

The CRI Profile is available for free download from the Cyber Risk Institute’s website, though users must register to access it. While actual implementation costs depend on factors like an institution’s size and existing infrastructure, the efficiency gains often outweigh these expenses. By automating the process of mapping internal controls to multiple regulations, credit insurers can reallocate resources from compliance paperwork to strengthening their cybersecurity defenses.

For companies in areas like Accounts Receivable Insurance, the tools provided – such as the Mappings Catalog and EEE packages – offer a practical, cost-effective alternative to building custom compliance frameworks from scratch.

Suitability for Credit Insurers

With its focus on the financial sector, the CRI Profile is an excellent fit for credit insurers. It addresses specific regulatory and operational risks, providing a cohesive compliance tool that simplifies audit preparation and ensures consistency during regulatory reviews.

"The CRI Profile v2.1 is a cybersecurity framework developed by the Cyber Risk Institute specifically for the financial sector, aimed at helping institutions efficiently manage and assess cyber risk while simplifying regulatory compliance." – Cyber Compliance Watch

For credit insurers already familiar with NIST CSF 2.0, adopting the CRI Profile is straightforward. The two frameworks share a similar foundation, but the CRI Profile enhances usability with tailored diagnostic statements and ready-to-use evidence templates, making it a practical choice for financial institutions.

Advantages and Disadvantages

Each cybersecurity framework brings its own strengths and challenges, tailored to meet credit insurers’ unique needs for risk management and compliance. Here’s a closer look at how they stack up.

NIST CSF 2.0 stands out for its flexible, outcome-oriented design. It includes a searchable catalog that maps to over 50 standards, such as ISO/IEC 27001 and NIST SP 800-53. The addition of the Govern function emphasizes cybersecurity as a critical enterprise risk, on par with financial and reputational concerns – key for insurers managing complex risks. However, as a voluntary framework, it doesn’t come with third-party certification, which could limit its external validation.

ISO/IEC 27001, on the other hand, offers third-party certification, providing external validation through accredited audits. Its 93 controls cover a wide range of areas, from physical security to legal compliance, as part of a structured Information Security Management System (ISMS). The downside? Its rigid Plan-Do-Check-Act model demands extensive documentation and strict adherence to processes, which can make it more time-consuming compared to flexible frameworks like NIST.

The CRI Profile v2.1 is tailored for the financial sector, simplifying over 2,500 requirements into about 300 actionable controls. It’s available for free and comes with evidence templates to ease compliance efforts. Its integration with the Digital Operational Resilience Act (DORA) is particularly useful for insurers operating in Europe. However, its recognition is largely limited to financial services, which may reduce its appeal for broader use.

| Framework | Key Strengths | Key Weaknesses |

|---|---|---|

| NIST CSF 2.0 | Maps to 50+ standards; flexible and outcome-based; strong supply chain guidance | No formal certification; requires internal effort to define Profiles and Tiers |

| ISO/IEC 27001 | Third-party certification builds trust; comprehensive ISMS; globally recognized | Documentation-heavy and prescriptive; less adaptable than NIST |

| CRI Profile v2.1 | Tailored for finance; condenses 2,500+ requirements into ~300 controls; free with evidence templates | Limited recognition outside the financial sector |

These frameworks cater to different priorities, and many credit insurers mix and match to get the best of all worlds. For organizations prioritizing client trust and global reach, ISO/IEC 27001 certification offers strong external validation. NIST CSF 2.0 is ideal for internal risk management due to its flexibility, while the CRI Profile simplifies compliance with financial-sector-specific regulations. A hybrid approach – leveraging NIST for internal operations and ISO/IEC 27001 for external assurance – is increasingly common among credit insurers.

Conclusion

Choose a framework that aligns with your insurer’s needs and goals. NIST CSF 2.0 provides flexible and scalable security options, with Implementation Tiers ranging from Partial to Adaptive. This allows you to tailor your approach based on your risk tolerance and available resources, while seamlessly integrating into larger Enterprise Risk Management strategies – typically within a 6–18 month timeframe. Its adaptability makes it a strong tool for managing risks in an ever-changing threat environment.

For insurers operating internationally, ISO/IEC 27001 stands out. Its formal certification process offers external validation, helping meet global B2B contract requirements and Third-Party Risk Management standards. Considering that the average cost of a data breach in the financial sector reached $5.97 million in 2023, this certification not only builds trust but also helps mitigate long-term risks.

If regulatory compliance is a priority, the CRI Profile provides a practical solution. It streamlines over 2,500 requirements into roughly 300 actionable controls. Available for free, it includes evidence templates that simplify the often-complex regulatory reporting process.

In many cases, a hybrid approach offers the best of both worlds. Combining frameworks – using NIST for agile internal governance and ISO/IEC 27001 for external credibility – allows insurers to remain nimble internally while building trust externally. With financial services organizations facing an average of 300 cyberattacks annually, the right framework isn’t just about meeting compliance standards. It’s about creating resilience to safeguard your business and your clients.

FAQs

How do I choose between NIST CSF 2.0 and ISO/IEC 27001?

Choosing between NIST CSF 2.0 and ISO/IEC 27001 comes down to what your organization needs and prioritizes.

- NIST CSF 2.0 is a U.S.-centric framework that emphasizes flexibility and a risk-based approach. It’s particularly useful for organizations focused on meeting regulatory requirements and enhancing operational resilience within the United States.

- ISO/IEC 27001, on the other hand, is a globally recognized standard. It provides a structured, certifiable approach to information security management, making it a strong choice for businesses with international operations or those seeking formal certification to demonstrate compliance.

If your focus is on adaptability and aligning with U.S. regulations, NIST CSF 2.0 might be the better fit. However, for global consistency and the added benefit of certification, ISO/IEC 27001 is a solid option.

Can NIST CSF 2.0 and ISO/IEC 27001 be used together?

Yes, NIST CSF 2.0 and ISO/IEC 27001 can complement each other seamlessly. NIST CSF offers a flexible, results-oriented method for handling cybersecurity risks, while ISO/IEC 27001 provides a well-defined framework to build and maintain an Information Security Management System (ISMS). By combining these two approaches, organizations can improve their cybersecurity strategies and reinforce their overall security measures.

What evidence do regulators expect for CRI Profile controls?

Regulators require clear, documented evidence to confirm that organizations meet regulatory expectations. This often includes policies, procedures, and mappings that illustrate compliance efforts. For example, businesses must demonstrate how cybersecurity frameworks, like the NIST Cybersecurity Framework (NIST CSF), are applied to fulfill the control requirements outlined in the CRI Profile.