Expanding globally means taking on new risks, especially when it comes to ensuring buyers pay on time. Third-party credit data helps businesses navigate this challenge by providing detailed, up-to-date insights into buyer financial health, payment behavior, and market risks. Here’s how it helps:

- More Accurate Credit Risk Assessment: Combines global payment histories and public records to better predict defaults.

- Real-Time Monitoring: Alerts you to changes like payment delays or legal issues, so you can act fast.

- Custom Insurance Design: Tailors credit insurance policies to match buyer risks, reducing unnecessary exposure.

- Simplified Buyer Vetting: Speeds up due diligence with global databases, even in high-risk markets.

- Improved Claims and Recovery: Enhances debt recovery with detailed data and local expertise.

These tools allow businesses to confidently set credit terms, avoid bad debt, and protect cash flow in international markets.

This article explains how third-party data helps U.S. exporters reduce risks, improve credit decisions, and grow safely in global trade.

1. Improves Credit Risk Assessment Accuracy

Better Risk Insights

Relying only on self-reported data leaves a lot of gaps. Third-party credit data providers step in to fill those gaps by pulling together information from various sources like financial statements, payment histories, public records, trade data, and credit bureau files. This creates a more complete picture of a buyer’s creditworthiness, something you just can’t get from a single source. With this richer data, you can better estimate the likelihood of default and set credit limits and terms that match the risk level of each international customer.

Take this example: A mid-sized U.S. chemicals exporter was considering a $250,000 open-account limit for a new buyer in Latin America. They based their initial decision on order size and verbal references. But when they checked with a third-party credit data provider, they discovered the buyer had a history of 60+ day payment delays with multiple suppliers and rising leverage ratios. As a result, the exporter reduced the credit limit to $75,000, shortened payment terms to net 30, and added trade credit insurance. Six months later, the buyer faced liquidity issues. Thanks to these proactive measures, the exporter avoided a six-figure loss and stayed protected with insurance coverage.

Having detailed profiles is important, but keeping that data current is just as critical.

Staying Current with Updates

A buyer’s financial situation can change quickly due to factors like liquidity stress, economic shifts, or political instability. Top third-party providers offer frequent updates – often monthly or even more frequently for active accounts – and real-time alerts for major events like new legal actions, credit rating downgrades, or severe payment delays. These automated updates allow you to react swiftly and adjust credit terms as risks evolve.

This real-time responsiveness ties seamlessly into global monitoring efforts.

Broad Global Coverage

Third-party credit data providers maintain massive databases that cover millions of companies across both developed and emerging markets. They gather information from local registries, partners, and credit bureaus, filling in gaps that exporters might struggle to cover on their own. This global reach is especially valuable for U.S. businesses expanding into unfamiliar regions where they lack local expertise or banking relationships. These datasets provide standardized identifiers, comparable risk scores, and localized insights – like country-specific legal and political risks – so you can apply consistent credit policies whether you’re evaluating a buyer in Germany or Vietnam. At the same time, the data incorporates local nuances that only on-the-ground sources can provide.

Tailored to Your Business Needs

Top-tier data providers offer tools that let you integrate credit scores, financial ratios, and payment trends into custom scorecards and rules that align with your business strategy. For instance, a U.S. machinery manufacturer dealing in high-value equipment might prioritize metrics like leverage and cash flow, enforce stricter thresholds in riskier countries, and set higher credit score requirements for open-account terms compared to transactions backed by letters of credit or trade credit insurance.

You can also set up custom triggers – like two months of worsening payment behavior or a credit rating drop below a certain level – that automatically prompt a review or adjustment of credit terms. For U.S. exporters working with specialists such as Accounts Receivable Insurance (ARI), these robust third-party data feeds support tailored policy structures. This helps ensure maximum coverage while managing premiums and exclusions effectively, keeping your risk exposure under control in the process.

Trade Credit I Managing Credit Data I Explainer Video

2. Enables Real-Time Monitoring of Buyer Financial Health

Detailed data is essential for assessing risk, but real-time monitoring takes it a step further. It allows businesses to respond quickly to financial changes, shifting from static profiles to dynamic, ongoing oversight.

Timeliness of Updates

Annual reviews often miss rapid financial changes that can jeopardize trade agreements. With third-party data platforms, you get real-time alerts about critical events like payment delays, credit limit reductions, legal filings, or rating downgrades. Instead of waiting weeks for a formal report, these updates arrive within hours. For example, exporters using real-time alerts were able to adjust terms proactively, leading to a 2.5 log point reduction in export declines. Research confirms that products backed by intensive credit monitoring faced smaller export losses compared to those without such measures.

Accuracy of Risk Insights

By combining internal accounts receivable data with external sources, businesses can close information gaps and identify early warning signs. Third-party data can reveal if a buyer is delaying payments to other vendors or showing signs of financial distress. For instance, Moody’s uses diverse data sources to generate precise risk scores, helping reduce false positives when evaluating default risks. Additionally, World Bank research highlights that effective credit information sharing improves risk assessments and lowers default rates.

Global Coverage and Reach

Third-party providers maintain extensive databases covering over 200 countries, including regions with limited local financial disclosure, such as emerging markets in Asia, Latin America, and Africa. For U.S. exporters looking to expand internationally, this global reach is invaluable. These platforms offer localized financial insights, including payment histories, legal filings, and sector-specific risks, which would be nearly impossible to gather independently. According to the World Bank, sharing global credit information reduces knowledge gaps, particularly for small businesses entering new markets.

Customization for Business Needs

Monitoring tools from third-party providers can be customized to highlight metrics most relevant to your industry, such as shipment sizes, payment term risks, or sector volatility. These platforms also integrate with ERP systems, ensuring that updated scores and credit limits flow seamlessly into order workflows. For example, if a buyer’s cash flow shows signs of trouble, you can pause shipments, tighten credit terms, or activate insurance protections. One exporter used this approach to avoid $500,000 in potential losses. Tailored dashboards and real-time insights provide the tools needed to manage risks effectively and protect your bottom line.

3. Supports Custom Insurance Policy Design

Precision in Risk Assessment

Third-party data has transformed the way insurance policies are designed, moving away from broad assumptions to more precise, data-driven decisions. Instead of relying on generalized limits based on a country or industry, underwriters can now use actual default probabilities to set credit limits, deductibles, and pricing. For instance, external data revealing a buyer’s history of payment delays or recent liens allows underwriters to lower insured limits for that buyer, while offering higher limits to companies with stronger performance in the same market. This detailed approach ensures that your policy reflects the real risk landscape across your customer base. Naturally, this level of customization requires regular updates to keep the data relevant, as explained below.

Real-Time Updates for Better Decisions

Credit data is refreshed frequently – weekly or even daily for high-risk accounts – by leveraging sources like credit bureaus, bank trade data, public registries, and insurer payment networks. This steady stream of updates empowers insurers and brokers to adjust credit limits and buyer approvals far more often than the traditional annual policy renewals. For U.S. exporters working with net-30 or net-60 payment terms, these timely updates mean you can respond quickly to buyers showing signs of financial instability while maintaining coverage for those with stable payment records. This ability to make rapid adjustments helps prevent unexpected claim surges and aligns with a broader global data strategy to refine policy terms.

Expanding Global Reach

Access to global data enables underwriters to set insured limits that vary by country and buyer segment. By combining insights from local credit bureaus, in-country collection partners, and insurer payment histories, they can create accurate buyer risk profiles – even in regions where U.S. exporters might otherwise lack visibility. For example, higher limits can be offered in OECD countries with strong legal systems, while more conservative limits are applied in higher-risk jurisdictions. At the same time, coverage can still be tailored for specific buyers with strong local reputations and payment histories. This global perspective is critical for U.S. exporters navigating the complexities of international markets with diverse legal and financial recovery environments.

Tailored Policies for Business Goals

Third-party data enables underwriters to segment portfolios by factors like industry, company size, region, and payment behavior. This segmentation allows them to align policy terms – such as credit limits and deductibles – with specific risk profiles. For example, a U.S. technology exporter might offer higher limits and longer payment terms to investment-grade telecom operators but impose stricter terms on smaller distributors with weaker financials. Accounts Receivable Insurance (ARI) uses this data, along with its network of global carriers, to customize policy terms – including credit limits, co-insurance percentages, and territorial coverage – based on a client’s existing customer base and growth plans, whether domestic or international. This buyer-specific customization ensures that U.S. exporters are protected, with coverage that accounts for the unique legal and financial conditions in various jurisdictions.

sbb-itb-2d170b0

4. Simplifies Global Buyer Vetting and Due Diligence

Accuracy of Risk Insights

Third-party data plays a key role in verifying buyer financial history and spotting hidden risks. When direct credit data is unavailable, resources like an importer’s bank or global credit databases provide dependable ways to assess creditworthiness and reduce the likelihood of defaults. For instance, letters of credit (LCs) often depend on bank credit evaluations to confirm a buyer’s reliability when other data sources are limited. This approach becomes particularly critical in high-risk markets, where it can uncover concealed debts, prior defaults, or other warning signs that might not surface in self-reported financial information. This thorough verification process allows for quick, well-informed adjustments.

Timeliness of Updates

Buyer conditions can change quickly, making real-time alerts essential. Third-party data providers supply updates on critical developments, such as credit rating changes, payment delays, or indications of economic instability. For U.S. exporters operating with net-30 or net-60 payment terms, these instant updates make it easier to adapt credit decisions promptly and avoid potential financial setbacks.

Global Coverage and Reach

Access to aggregated global data ensures coverage of buyers in over 100 countries, offering detailed regional insights. This extensive reach is especially valuable when entering emerging markets where local data might be limited or less reliable. For example, during the COVID-19 pandemic, products with higher LC reliance (90th percentile) experienced significantly smaller export declines compared to those with lower reliance (10th percentile), as shown in U.S. and EU-15 export data from 2017–2020 to the top 100 destinations. Accounts Receivable Insurance (ARI) uses its global network of credit insurance carriers to conduct in-depth due diligence on buyers worldwide, making the vetting process much easier – even in regions where U.S. exporters might face visibility challenges.

Customization for Business Needs

Data feeds can be tailored to spotlight specific risks, such as those tied to a particular industry, region, or transaction size. Many providers also support API integrations, enabling real-time global data to be incorporated into custom dashboards. This allows businesses to track key metrics, like payment terms flexibility in LCs, with ease. Customization like this can significantly cut vetting times – from weeks to just days – by automating screening processes and concentrating on the most pressing risk factors. For example, when handling high-risk LC transactions, adding political risk data to the mix offers a broader perspective, ensuring due diligence aligns with both immediate cash flow needs and long-term growth strategies. These streamlined practices fit seamlessly into broader strategies for managing global trade credit risk.

5. Improves Claims Management and Recovery Rates

Third-party data plays a crucial role in streamlining claims management and enhancing recovery efforts, building on detailed risk assessments and real-time monitoring.

Accuracy of Risk Insights

Using third-party data, claims management becomes more precise by relying on hard evidence. When a buyer defaults, claims teams can tap into aggregated data that reveals payment behaviors, overdue accounts, delinquencies, and insolvencies from thousands of transactions. This information provides a clear picture, helping distinguish between losses that are truly unrecoverable and those with potential for partial recovery. Instead of writing off every claim or wasting resources on unlikely recoveries, companies can prioritize claims based on realistic recovery probabilities. This approach not only protects cash flow but also strengthens credit strategies. For U.S. exporters, it means more manageable loss reserves on the balance sheet and more predictable outcomes for claims.

Timeliness of Updates

When it comes to recovery, timing is everything. Real-time alerts on defaults and credit events enable swift action on claims. For example, if a buyer in another country stops paying multiple suppliers, third-party data can flag this early warning sign. Exporters and insurers can then suspend credit limits, negotiate payment terms, or start collection efforts while there are still recoverable assets. Additionally, having quick access to corporate registry and court data in the buyer’s country speeds up document verification, shortening the time from filing a claim to receiving payment.

Global Coverage and Reach

Recovering debts internationally often requires local expertise, which many U.S. exporters lack. Third-party databases with global reach provide standardized credit scores, payment trends, and legal status details for buyers in a wide range of markets – including those with limited financial transparency. These resources connect claims teams to local law firms, collection agencies, and investigators, leveraging their expertise to handle country-specific insolvency challenges. Accounts Receivable Insurance (ARI) uses its global network of credit insurance carriers to coordinate these efforts, ensuring consistent claims processes across regions rather than a disjointed, country-by-country approach.

Customization for Business Needs

Every claim is unique, and third-party data allows insurers to tailor their responses. By analyzing sector- and geography-specific recovery statistics, insurers can customize claims protocols based on factors like industry, buyer size, and market risk. For example, a U.S. manufacturer selling to large EU buyers might allow longer negotiation periods due to strong recovery trends in the region. On the other hand, claims involving smaller distributors in higher-risk markets might lead to quicker escalation to legal action. ARI applies this data to craft policy terms, deductibles, and loss-mitigation measures that align with each client’s risk profile. This tailored approach ensures claims protocols are designed to fit cash-flow priorities and risk tolerance, forming a key part of a broader international trade credit strategy.

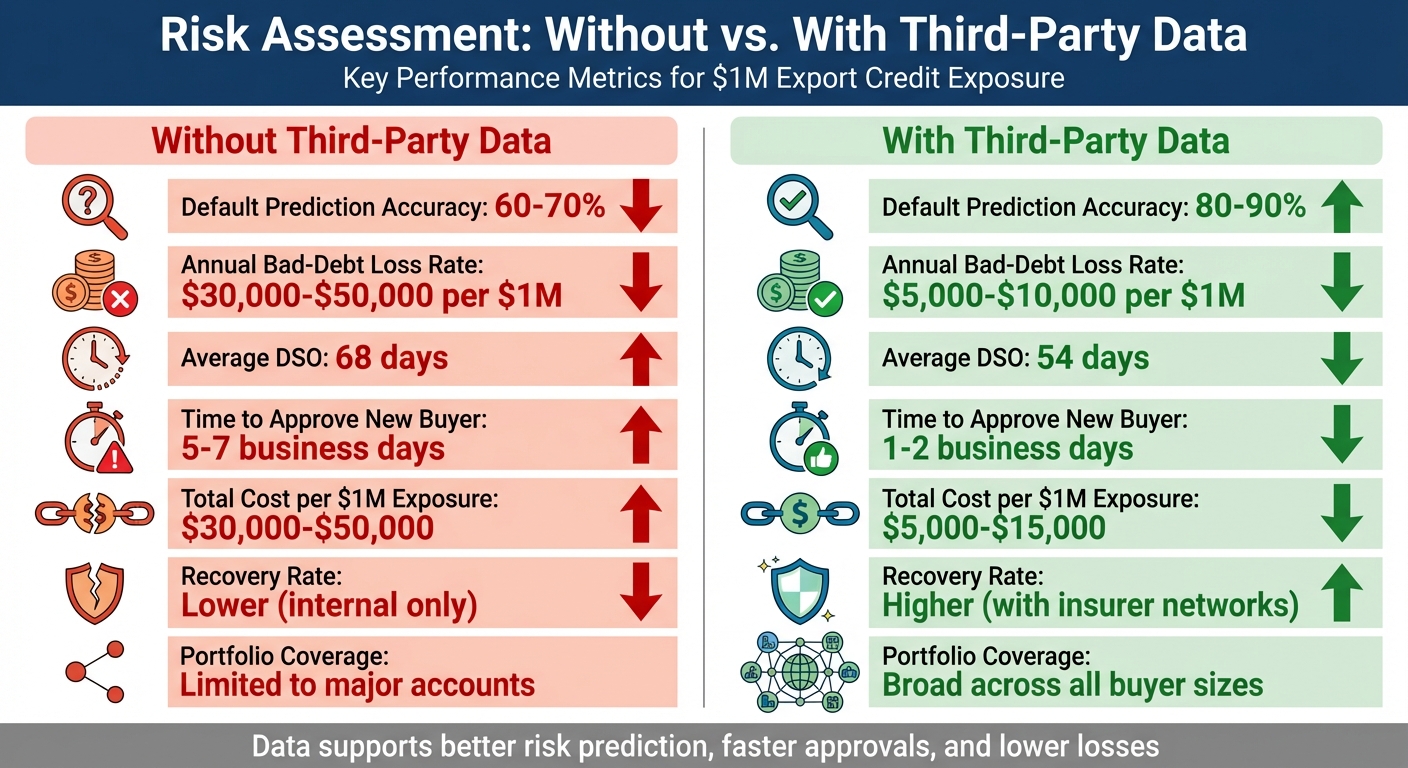

Comparison Table: Risk Assessment Without vs. With Third-Party Data

Risk Assessment With vs Without Third-Party Data: Key Metrics for Exporters

When comparing internal records to third-party data, it becomes clear that U.S. exporters gain stronger risk predictions and improved financial outcomes by incorporating external insights. Companies that rely solely on internal data often face higher default rates, longer collection periods, and unpredictable losses. Adding external data sources – such as credit bureaus, trade insurer databases, and alternative data – leads to more reliable results. The impact is evident in the performance metrics below.

The table evaluates key metrics for U.S. exporters managing $1,000,000 in international credit exposure. Without third-party data, default prediction accuracy for new foreign buyers typically ranges from 60–70%, as assessments depend on limited buyer-supplied financials and sparse internal payment history. By using third-party data, this accuracy jumps to 80–90%, resulting in fewer write-offs and more confident credit decisions.

| Metric | Without Third-Party Data | With Third-Party Data |

|---|---|---|

| Default Prediction Accuracy | 60–70% for new foreign buyers | 80–90% with external credit data |

| Annual Bad-Debt Loss Rate | $30,000–$50,000 per $1,000,000 exposure | $5,000–$10,000 per $1,000,000 exposure |

| Average DSO (Export Receivables) | 68 days | 54 days |

| Time to Approve New Buyer | 5–7 business days (manual review) | 1–2 business days (instant scoring) |

| Cost per $1,000,000 Exposure | $30,000–$50,000 (losses + internal labor) | $5,000–$15,000 (data/insurance + reduced losses) |

| Recovery Rate After Default | Lower; handled internally without specialist support | Higher; leverages insurer networks and local expertise |

| Portfolio Coverage (Active Buyers Assessed) | Limited to major accounts; smaller buyers under-assessed | Broad coverage across all buyer sizes and markets |

Incorporating third-party data not only improves risk prediction but also reduces costs. For example, annual write-offs for every $1,000,000 in exposure drop from $30,000–$50,000 without external data to $5,000–$15,000 when third-party data and Accounts Receivable Insurance (ARI) are used.

Additionally, trade finance tools supported by third-party data help U.S. exporters stay more resilient during economic downturns. This is due to better risk selection and proactive credit limit adjustments, which help control losses and maintain stability in export operations.

Third-party data also speeds up buyer approvals, enforces tighter credit terms for higher-risk buyers, and enables proactive adjustments to credit limits. Accounts Receivable Insurance relies on this data to craft policies tailored to each client’s risk profile, ensuring that coverage, deductibles, and loss-mitigation strategies align with cash flow needs and risk tolerance. These improvements highlight how third-party data strengthens customized insurance solutions and helps protect international trade.

Conclusion

Third-party data is transforming how U.S. exporters manage international trade credit, effectively bridging the information gaps between sellers and foreign buyers. The strategies discussed – accurate risk assessment, real-time monitoring, customized insurance design, streamlined vetting, and improved claims recovery – work together to make cross-border trade safer and more predictable.

With access to detailed, up-to-date data, exporters can better distinguish between high- and low-risk buyers, enabling more confident credit decisions. Research highlights that trade supported by strong risk mitigation tools tends to remain stable during global disruptions, while unprotected trade often faces severe challenges.

This tailored approach is the backbone of layered protection strategies. For U.S. exporters venturing into global markets, Accounts Receivable Insurance (ARI) uses this data to craft policies that shield against risks like non-payment, bankruptcy, and political instability – both at home and overseas. By combining data-driven insights with specialized insurance coverage, companies can confidently offer open-account terms to vetted buyers without jeopardizing their financial health.

The result? Secured cash flow, reduced bad-debt losses, faster collections, and steady export growth. In today’s complex global trade environment, third-party data isn’t just helpful – it’s essential for U.S. businesses aiming to protect their finances and grow their export operations with confidence.

FAQs

How does third-party data help businesses manage credit risks in international trade?

Third-party data is an essential tool for businesses managing credit risks in international trade. It provides valuable insights into the financial stability of trading partners, helping companies assess potential risks with greater precision. This type of data allows businesses to track the financial health of their customers over time and anticipate the chances of payment defaults.

With this information in hand, companies can make smarter decisions about offering credit terms, reducing the risk of financial losses, and safeguarding their cash flow. Taking this proactive stance is key to handling the challenges of international trade while ensuring financial stability.

How does real-time monitoring support managing a buyer’s financial health?

Real-time monitoring offers businesses a clear view of a buyer’s financial health as it evolves, enabling them to anticipate and address potential risks. By keeping a constant eye on creditworthiness, companies can promptly spot red flags such as late payments or worsening financial conditions.

This continuous vigilance empowers businesses to act swiftly, make informed decisions, and safeguard their cash flow. It’s a crucial strategy for reducing the risk of non-payment and ensuring financial stability, especially in the unpredictable world of international trade.

How does third-party data help tailor trade credit insurance policies?

Third-party data is a game changer when it comes to tailoring trade credit insurance policies. It provides in-depth insights into a customer’s creditworthiness and financial health, helping insurers pinpoint potential risks like non-payment or bankruptcy. This allows policies to be crafted in a way that aligns with a business’s unique needs and risk appetite.

With access to this data, businesses gain the advantage of more precise risk evaluations and customized coverage options. This ensures they’re better protected against financial uncertainties, whether they’re dealing with local or international trade.