Staying compliant with U.S. credit insurance laws is critical to avoid penalties and protect your business. Here’s what you need to know:

- Credit insurance covers risks like unpaid invoices, customer bankruptcies, and delayed payments, helping businesses manage financial uncertainty.

- Non-compliance risks include fines up to $53,088 per violation under federal rules, with additional state-level oversight.

- Key regulations: States regulate most aspects under the McCarran-Ferguson Act, while federal laws like Dodd-Frank and the Bank Secrecy Act add layers of oversight.

- Compliance essentials:

- Verify insurer and broker licenses in every state.

- Design policies that meet state and federal requirements.

- Set up internal compliance procedures, including training and audits.

- Monitor regulatory updates and adjust practices accordingly.

Why it matters: Non-compliance can void coverage and lead to legal trouble. By integrating compliance into daily operations and staying informed about regulatory changes, you can safeguard your business while leveraging credit insurance for growth.

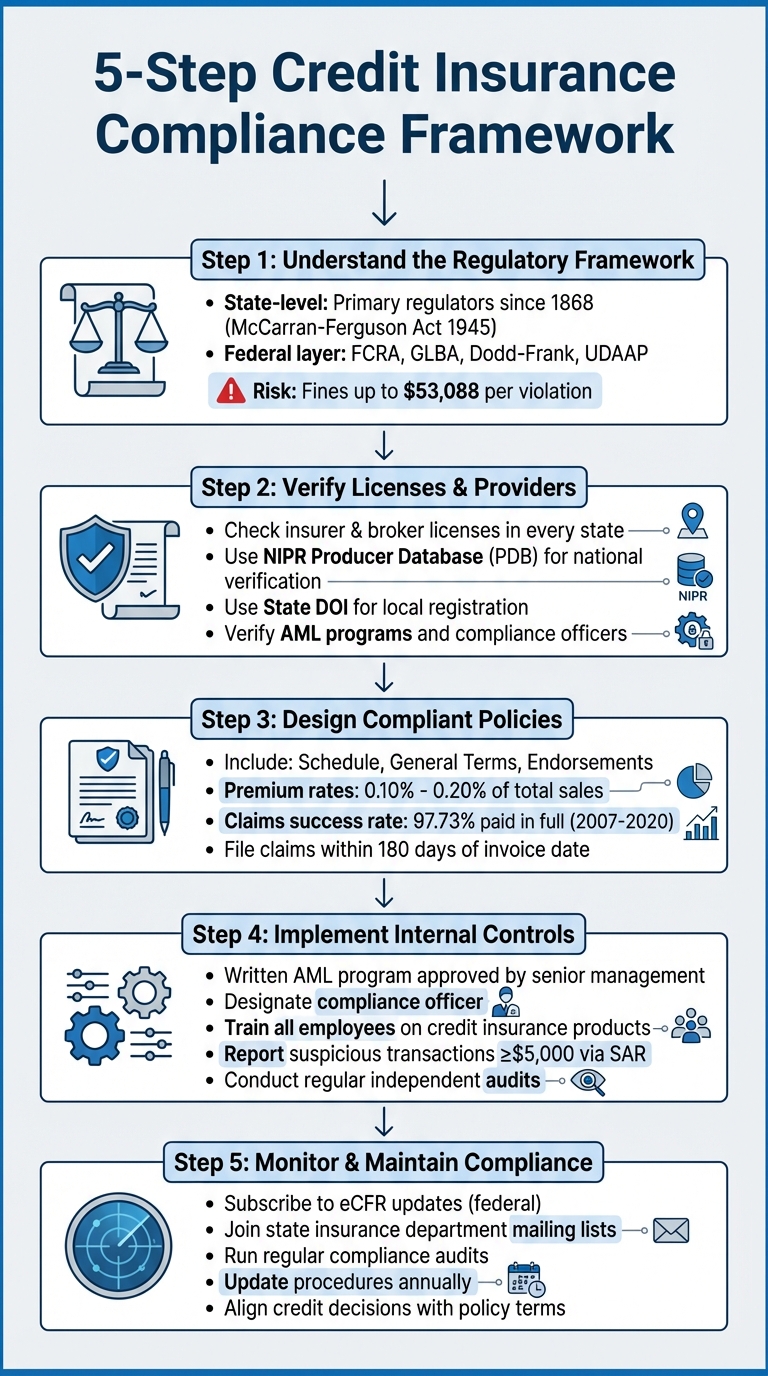

5-Step Credit Insurance Compliance Framework for U.S. Businesses

What Constitutes An Insurance Regulatory Violation?

U.S. Credit Insurance Laws and Regulations

Credit insurance in the United States operates under a dual regulatory framework. States manage the day-to-day oversight, while federal laws add an additional layer of consumer protection and financial governance. To ensure compliance, it’s important to understand how these levels interact.

State-Level Regulations

States have been the primary regulators of insurance since 1868, a role solidified by the McCarran-Ferguson Act of 1945. Each state enforces its own insurance code, with regulatory bodies overseeing market practices.

Before any policy can be issued, it must pass several state-level checks. Insurers must be authorized by the state and can only operate through licensed agents or brokers. Additionally, policies, certificates, applications, and endorsements must be submitted to the State Insurance Commissioner for review. The Commissioner can reject filings if the benefits don’t align with the premiums charged.

Premium rates also require state approval. In some states, like Delaware, Commissioners set prima facie rates – rates automatically deemed reasonable. Policies cannot exceed the rates currently on file.

Consumer protections are woven into state regulations. Before purchasing credit insurance, consumers must be informed in writing that the coverage is optional and not a requirement for obtaining credit. They are also entitled to a 30-day "free look" period, during which they can cancel the policy for a full refund.

Claims handling is tightly regulated as well. Payments must be made promptly via draft, check, or electronic transfer. Creditors are generally barred from acting as claim representatives to adjust or settle claims on behalf of insurers.

Federal Laws That Apply

While states take the lead, federal laws impose additional obligations on credit insurance providers.

The Fair Credit Reporting Act (FCRA), passed in 1970, governs the collection and use of consumer information. If an insurer uses a credit report for underwriting, they must have a "permissible purpose". If a credit report leads to a denial or less favorable terms, the consumer must receive an adverse action notice that includes the name of the credit reporting agency and information on disputing the report.

The Gramm-Leach-Bliley Act (GLBA) ensures that insurance subsidiaries remain under state oversight, while the Federal Reserve supervises financial holding companies. Additionally, the Dodd-Frank Act established the Federal Insurance Office to monitor the industry and gave the Financial Stability Oversight Council the authority to designate certain insurers as systemically important.

Federal consumer protection rules also apply. The prohibition against Unfair, Deceptive, or Abusive Acts or Practices (UDAAP) extends to credit insurance providers. Moreover, 12 CFR Part 343 sets federal standards for insurance sales, including required disclosures and restrictions on certain practices.

State-to-State Differences

The combination of state and federal regulations is further complicated by variations across individual states. Businesses operating in multiple jurisdictions face unique challenges due to these differences. As the Congressional Research Service explains:

The individual states have been the primary regulators of insurance since 1868. Following the 1945 McCarran-Ferguson Act, this system has operated with the explicit blessing of Congress.

For example, definitions of credit insurance vary by state. Delaware’s Consumer Credit Insurance Model Act focuses on credit life and credit accident and health insurance. California, on the other hand, includes specific provisions for credit property and credit unemployment insurance.

Policy terms also differ. In Delaware, credit insurance cannot extend more than 15 days beyond the scheduled maturity date of the debt. The state excludes coverage for credit transactions exceeding 10 years or those secured by a first mortgage for real estate purchases. Other states set their own thresholds.

Rate filing requirements add another layer of complexity. While all states require rate filings, their approval processes and standards for determining reasonable rates vary. Some states use prima facie rates, while others rely on alternative methodologies.

To encourage consistency, the National Association of Insurance Commissioners (NAIC) develops model laws. However, these only take effect when adopted by individual state legislatures, a process that often lacks uniformity. To simplify operations across states, the National Association of Registered Agents and Brokers (NARAB) Reform Act allows licensed insurance producers to operate in multiple states without obtaining separate licenses, provided they meet NARAB requirements and pay applicable state fees.

| Federal Law | Primary Focus | Key Requirement |

|---|---|---|

| McCarran-Ferguson Act | Jurisdictional Authority | Establishes states as primary regulators |

| NARAB Reform Act | Producer Licensing | Streamlines multi-state licensing for agents and brokers |

| 12 CFR Part 208 (Reg H) | Bank Sales of Insurance | Prohibits tying insurance to credit; requires physical segregation |

| 31 CFR Part 1025 | Anti-Money Laundering | Requires suspicious activity reporting and AML programs |

| 15 USC § 8221 | Reinsurance | Preempts non-domiciliary state laws for NAIC-accredited insurers |

Setting Up a Compliant Credit Insurance Program

Creating a credit insurance program that aligns with state and federal regulations involves careful selection of providers, thoughtful policy structuring, and implementing strong internal compliance procedures.

Verifying Insurer and Broker Licenses

Before diving into policy design, start by confirming that your insurers and brokers are licensed in every state where you operate. The NIPR Producer Database (PDB) is a valuable tool, consolidating licensing information across U.S. jurisdictions. With one report, you can access details like demographic data, current licenses, appointments, and any regulatory actions.

To access the PDB, you’ll need a "permissible purpose" as defined by the Fair Credit Reporting Act, which most businesses meet when evaluating potential partnerships. For state-specific verification, use online tools provided by state insurance departments, such as "Find an Insurance Company" or "Find an Insurance Agent", to ensure agents and companies are authorized to operate locally.

Additionally, verify that providers have a written AML (Anti-Money Laundering) program approved by senior management. Providers should also have a designated compliance officer and a formal AML training program. Proper license verification is crucial for building policies that meet legal standards.

| Verification Level | Resource/Tool | Information Provided |

|---|---|---|

| National | NIPR Producer Database (PDB) | Multi-state licensing, appointments, and regulatory actions |

| State | State Dept. of Insurance (DOI) | Local registration, certificate of authority, and contact info |

| Federal | FinCEN (31 CFR Part 1025) | AML program requirements and suspicious activity reporting |

Designing Policies That Meet Requirements

Once licensing is confirmed, focus on designing policies that address all regulatory needs. A compliant policy typically includes:

- Schedule: Details premiums, coverage limits, and applicable laws.

- General Terms: Defines losses and exclusions.

- Endorsements: Covers specific adjustments.

The Schedule should clearly state the applicable law and designate the competent court for handling legal disputes. Other critical elements include the maximum liability limit, the longest allowable credit period for buyers, and the contract’s currency. Policies may feature cancelable or non-cancelable credit limits, and understanding this distinction is essential for consistent coverage. Claims must be filed within 180 days of the invoice date.

Premium rates usually range from 0.10% to 0.20% of total sales, depending on forecasted sales, the quality of the buyer portfolio, and historical loss data. Between 2007 and 2020, a remarkable 97.73% of trade credit insurance claims were paid in full, highlighting the reliability of well-structured policies.

To ensure claims are supported, maintain key documentation such as purchase orders, invoices, aging reports, and bills of lading (including Proof of Delivery). Align your standard terms of sale with policy requirements to avoid claim denials. Review your policy annually with a broker to ensure it continues to address current debtor risks and any changes in your business.

Establishing Internal Compliance Procedures

After finalizing the policy, enforce compliance through robust internal procedures. Start with a written AML program approved by senior management. This program should aim to prevent money laundering and terrorist financing. Assign a compliance officer to oversee its implementation, monitor adherence, and update the program as needed.

Employee training is another critical step. Register all employees acting as endorsees and provide comprehensive training on credit insurance products, ethics, and market practices. For instance, California requires businesses to file an Annual Certificate of Compliance and a list of authorized employees (Form LIC CI 40) to maintain their ability to sell insurance legally. Any updates to training materials must be submitted to state regulators at least 30 days before use.

Regular independent audits are essential to evaluate the effectiveness of your compliance program. The frequency of these audits should align with the risk level of the products offered. Suspicious transactions involving $5,000 or more must be reported via a SAR (Suspicious Activity Report). These internal controls are vital for reinforcing compliance measures outlined in your policies.

For financial institutions, ensure that insurance transactions are conducted in a separate area from where retail deposits are accepted. Provide clear oral and written disclosures stating that the insurance is not a deposit, is not FDIC-insured, and may carry investment risk. Obtain written or electronic acknowledgment from consumers to confirm they’ve received these disclosures. Finally, strictly prohibit "tying" practices, where loan approval is contingent on purchasing insurance from the institution or its affiliates. These steps are key to maintaining ethical and legal operations.

sbb-itb-2d170b0

Maintaining Compliance in Daily Operations

Once your credit insurance program is up and running, it’s crucial to weave compliance into every aspect of your daily operations. This includes every credit decision, collection activity, and even how you handle data. Below, we’ll break down some essential practices to help you stay aligned with your policy terms.

Aligning Credit and Collections with Policy Terms

Your insurer sets specific credit limits for each buyer, and exceeding these limits – even by a small amount – can void coverage for the excess. Many policies include a "discretionary limit", which lets you approve credit up to a certain threshold without prior approval. To use this effectively, establish clear internal guidelines that outline the criteria and documentation your team needs before exercising this discretion.

Keeping an eye on your customers’ creditworthiness is equally important. Most policies require ongoing monitoring and immediate reporting of any financial decline to your insurer. If a buyer’s financial health worsens or they stop making payments, you must stop further sales to them right away. Extending credit to a non-paying customer can violate your policy and lead to denied claims. Jason Benson, Global Head of Structured Working Capital at J.P. Morgan, underscores this point:

The policy coverage also needs to match how your business operates.

To avoid unprotected exposures, ensure your sales and credit teams are in sync. Use metrics like Days Sales Outstanding (DSO) and Average Days Delinquent (ADD) to monitor customer behavior and alert your sales team immediately if a customer breaches their credit limit or loses their qualification.

Handling disputes is another area that requires close attention. Insurers typically exclude amounts under dispute, such as claims for short deliveries or quality issues. Train your collections team to quickly identify and resolve these disputes, as coverage usually applies only to undisputed amounts. File claims within the insurer’s deadlines and maintain all required documentation to avoid complications.

By establishing these protocols, you’re not just protecting your coverage – you’re also setting your team up for success.

Training Your Team on Compliance Requirements

Compliance isn’t just a one-time effort – it’s an ongoing responsibility. Federal mandates and state regulations require continuous training for all staff involved in your credit insurance program. A designated compliance officer should oversee this training to ensure everyone understands their roles and responsibilities. This includes employees, insurance agents, and brokers.

Training should address prohibited practices under federal law, such as confessions of judgment, waivers of exemption, and certain wage assignments. Violations of the Credit Practices Rule can result in civil penalties of up to $53,088 per infraction. If your business operates within a financial institution, your team must also know how to provide proper disclosures, such as stating that insurance products are "not FDIC-insured" and "may go down in value".

Employees should also be trained to spot and report suspicious transactions. For example, Suspicious Activity Reports (SARs) are required for any transaction – or series of transactions – totaling $5,000 or more if illegal activity is suspected. Insurance companies are responsible for ensuring their agents and brokers report these activities.

Regular training sessions reinforce the importance of compliance and highlight the risks of actions like extending credit beyond approved limits or failing to report deteriorating accounts. These missteps can void your coverage when you need it most.

Protecting Customer Data and Privacy

Just as compliance safeguards your financial risks, it also extends to protecting your customers’ privacy. Always obtain explicit authorization before insurers contact your customers. Atradius USA emphasizes this:

We will not mention your name (unless you give us explicit authorization to do so…) if we have to contact your customers so that your privacy will remain safeguarded.

When providing disclosures electronically, comply with the E-SIGN Act by securing affirmative consent and ensuring the format allows customers to save or print the information. Always obtain written or electronic acknowledgment from customers confirming they’ve received required insurance and privacy disclosures at the time of purchase.

The disclosures provided shall be conspicuous, simple, direct, readily understandable, and designed to call attention to the nature and significance of the information provided. – 12 CFR Part 343, Federal Deposit Insurance Corporation

If your business operates within a financial institution, keep insurance transaction areas separate from where retail deposits are handled. This helps protect sensitive financial data and avoids confusing customers. For telephone transactions, secure oral acknowledgment of disclosures, document the interaction thoroughly, and follow up with written disclosures within three business days.

Timing is key when it comes to credit disclosures. These should be provided at the time of the credit application – not when the policy is issued. This ensures customers understand that credit approval isn’t contingent on purchasing insurance, which would violate federal laws against tying practices.

Keeping Up with Regulatory Changes

Credit insurance regulations are in constant flux. Both federal agencies and states frequently update their requirements, making it essential to stay informed to maintain compliance and avoid penalties.

Tracking State and Federal Updates

The regulatory landscape at the federal level changes rapidly. While the Code of Federal Regulations (CFR) is updated annually, relying solely on the yearly edition can leave you behind. Instead, the Electronic Code of Federal Regulations (eCFR) provides a continuously updated online version, incorporating amendments from the Federal Register as they are published [32,33]. Steven Lofchie, a partner at Norton Rose Fulbright, highlights the importance of specialized resources:

US Regulatory Intelligence was created to deliver real-time, expert financial regulatory analysis.

Lofchie’s platform, for instance, distributes a daily newsletter to 20,000 subscribers, offering curated insights on financial regulations and litigation. For businesses managing credit insurance programs, tools like these can help identify regulatory changes early – long before they become costly surprises during an audit.

To stay ahead, subscribe to updates on specific regulatory sections through the eCFR website. For example, 12 CFR Part 343 (Consumer Protection in Sales of Insurance) or 31 CFR Part 1025 (Rules for Insurance Companies) are key areas to monitor [33,16]. These subscriptions provide automatic notifications whenever amendments are made.

At the state level, tracking changes requires a different approach. Many state insurance departments offer mailing lists for proposed regulatory actions. For instance, the California Department of Insurance allows stakeholders to subscribe to updates in categories such as "Property & Casualty", "Agents, Brokers, Adjusters", and "Market Conduct". Signing up for these lists not only keeps you informed but also gives you the opportunity to participate in the rulemaking process before regulations are finalized.

| Resource Type | What to Monitor | Where to Access |

|---|---|---|

| Federal Regulations | eCFR for updates and the Federal Register for amendments | eCFR.gov |

| State Regulations | Mailing lists for proposed regulatory actions | State insurance department websites |

| Legal Intelligence | Daily news and expert analysis | Platforms like Norton Rose Fulbright |

With these tools in place, make sure to integrate any updates into your internal compliance processes.

Running Regular Compliance Audits

Once you’ve gathered the latest regulatory updates, it’s critical to conduct regular internal audits to ensure compliance. Start by mapping out specific regulatory requirements against your business activities. Documenting how each obligation is met creates a clear compliance trail.

Consider running mock examinations with external experts to identify potential gaps before an official inspection occurs. A cautionary example: In April 2025, the financial firm Block faced significant penalties – $40 million to New York State and $255 million in federal and state settlements – due to shortcomings in its anti-money laundering (AML) and know-your-customer (KYC) programs. As part of the settlement, the company was required to appoint an independent monitor for a year. This underscores the high cost of overlooking compliance issues.

Your audit should cover several critical areas. For instance:

- Employee behavior and conflicts of interest: Monitor for issues like gifts, entertainment, and outside business activities.

- Communications monitoring: Use tools like keyword alerts and natural language processing to scan emails, chats, and SMS for potential violations.

- Transaction monitoring: Look for patterns tied to financial crimes, such as structuring or transfers to high-risk jurisdictions.

Additionally, update your written supervisory procedures (WSPs) at least once a year to address emerging risks [35,37]. For example, in September 2024, the SEC charged nine registered investment advisers for violating the Marketing Rule, citing unsubstantiated performance claims and missing disclosures. These violations resulted in $1.24 million in combined civil penalties. Regular reviews of your policies can help prevent similar issues.

To bolster your compliance efforts, consider deploying specialized software for trade, transaction, and communication surveillance. Ensure that your Chief Compliance Officer has direct access to the board and operates independently from business units. This independence is crucial for identifying and addressing problems that might otherwise go unnoticed.

Conclusion

Main Points to Remember

Navigating U.S. credit insurance laws requires a thorough and structured approach that integrates compliance into every aspect of your business. Start by ensuring that insurers and brokers hold valid state licenses and that your policies align with both federal and state regulations.

Your compliance program should include a dedicated compliance officer tasked with overseeing and updating your procedures. This role involves providing continuous training for your team and keeping your Anti-Money Laundering (AML) policies up to date. It’s also important to file a Suspicious Activity Report (SAR) for any transactions involving $5,000 or more, as required by law.

Day-to-day operations demand meticulous attention to compliance. This includes aligning credit and collections processes with policy terms, maintaining accurate underwriting documentation, and implementing strong internal controls. Regular training for your team helps ensure these standards are consistently met, reducing the risk of penalties.

Regulatory monitoring is a long-term commitment. Stay informed by subscribing to updates from the eCFR for federal regulations and state insurance department mailing lists for local changes. With Title 31 of the eCFR most recently updated on January 2, 2026, it’s clear that regulations can shift quickly, requiring constant vigilance.

By following these steps, you can maintain a streamlined and effective compliance strategy.

How Accounts Receivable Insurance Can Help

Partnering with experts can make compliance significantly easier. Accounts Receivable Insurance offers tailored solutions to help businesses design credit insurance programs that meet regulatory requirements and align with their unique risk profiles. Their team conducts detailed creditworthiness assessments, ensuring that your credit decisions are based on reliable financial data while staying within legal boundaries.

In addition to policy design, ARI handles the claims and recovery process, ensuring all actions comply with policy terms and legal standards. This support is especially valuable for businesses expanding into new markets, whether domestically or internationally. Exporters, in particular, can benefit from ARI’s expertise in managing risks like political instability and changes in import/export regulations. This guidance helps businesses maintain compliance while navigating the complexities of global trade.

With the U.S. trade credit insurance market valued at $2.02 billion in 2023 and expected to grow at a rate of 10.6% annually through 2030, having professional support in this intricate regulatory environment is vital for achieving sustainable growth.

FAQs

What steps should businesses take to comply with U.S. credit insurance laws?

To stay aligned with U.S. credit insurance laws, businesses should take these essential steps:

- Familiarize yourself with federal and state laws: Understand key regulations like the Credit Practices Rule and state-specific insurance requirements. Ensure your credit insurance products align with these legal standards.

- Review contracts and disclosures carefully: Go through all agreements to confirm they include the necessary disclosures and exclude any prohibited clauses, such as waivers of consumer rights.

- Educate your team and monitor compliance: Train employees on relevant credit insurance laws, establish internal compliance policies, and perform regular audits to identify and address potential issues early.

- Secure licensing and maintain records: Obtain the required state insurance licenses, submit policy forms when necessary, and keep thorough records of disclosures, contracts, and compliance processes.

It’s equally important to stay updated on regulatory changes at both the federal and state levels to ensure your practices remain compliant as laws evolve.

What are the best ways for businesses to stay compliant with U.S. credit insurance laws?

To ensure compliance with U.S. credit insurance laws, businesses should take an active approach by staying informed about regulatory changes and integrating compliance into everyday practices. A good starting point is subscribing to updates from trusted sources like the Federal Register or the National Credit Union Administration (NCUA). These updates will keep you in the loop about any new requirements. Additionally, conducting regular compliance reviews can help confirm that your policies meet both federal and state standards. Be sure to document any updates or changes you make.

Partnering with industry experts, such as Accounts Receivable Insurance, can also be a smart move. They can offer customized advice, perform risk assessments, and provide updates on policy changes. Regular training for your staff is equally important, ensuring your team understands new regulations and reporting obligations. By combining expert guidance, technology, and continuous education, businesses can confidently navigate regulatory changes while reducing potential risks.

What happens if a business doesn’t comply with U.S. credit insurance laws?

Failing to follow U.S. credit insurance laws can have serious consequences for businesses, impacting them in several ways:

- Fines and penalties: Businesses that don’t comply with state or federal rules may face hefty fines or other financial penalties.

- Legal troubles: Actions like adding credit insurance without proper consent can lead to lawsuits, customer disputes, and even financial damages.

- License suspension: Regulatory authorities have the power to suspend or revoke licenses, effectively halting a business’s ability to offer credit insurance.

- Reputation damage: Consumer complaints or enforcement actions can tarnish a company’s reputation and attract more scrutiny from regulators.

Staying compliant with credit insurance laws is crucial to sidestep these financial, legal, and operational risks.