Emerging markets offer immense growth opportunities but come with serious risks. Political instability, inflation, currency volatility, and trade barriers can disrupt operations and lead to financial losses. For businesses, managing these challenges is critical to thriving in volatile regions.

Here’s the key takeaway: Trade credit insurance can help protect your business from non-payment risks. It safeguards against customer defaults caused by bankruptcy, political events, or economic shocks, ensuring steady cash flow even in uncertain markets.

Key Risks in Emerging Markets:

- Political Instability: Elections, civil unrest, and government interventions can disrupt trade and payment cycles.

- Inflation and Currency Fluctuations: Rising costs and volatile exchange rates strain buyers’ ability to pay.

- Trade Barriers: Tariff changes and export restrictions increase costs and complicate supply chains.

- Sovereign Debt Issues: Payment delays from government entities and liquidity shortages impact cash flow.

- Social Unrest: Protests and operational disruptions can lead to non-payment and business losses.

How Trade Credit Insurance Helps:

- Covers unpaid invoices due to buyer insolvency or political events.

- Provides intelligence on buyers’ financial stability.

- Protects against risks like currency restrictions and trade sanctions.

- Improves access to financing by securing insured receivables.

Bottom line: With trade credit insurance, you can confidently navigate emerging markets, mitigate risks, and unlock growth opportunities.

Key Risks in Emerging Markets: Statistics and Impact Data

Political Instability and Geopolitical Risks

How Political Events Disrupt Trade

Political instability can throw business operations into chaos, disrupting payment cycles, triggering currency fluctuations, and creating regulatory uncertainty that makes long-term planning a challenge.

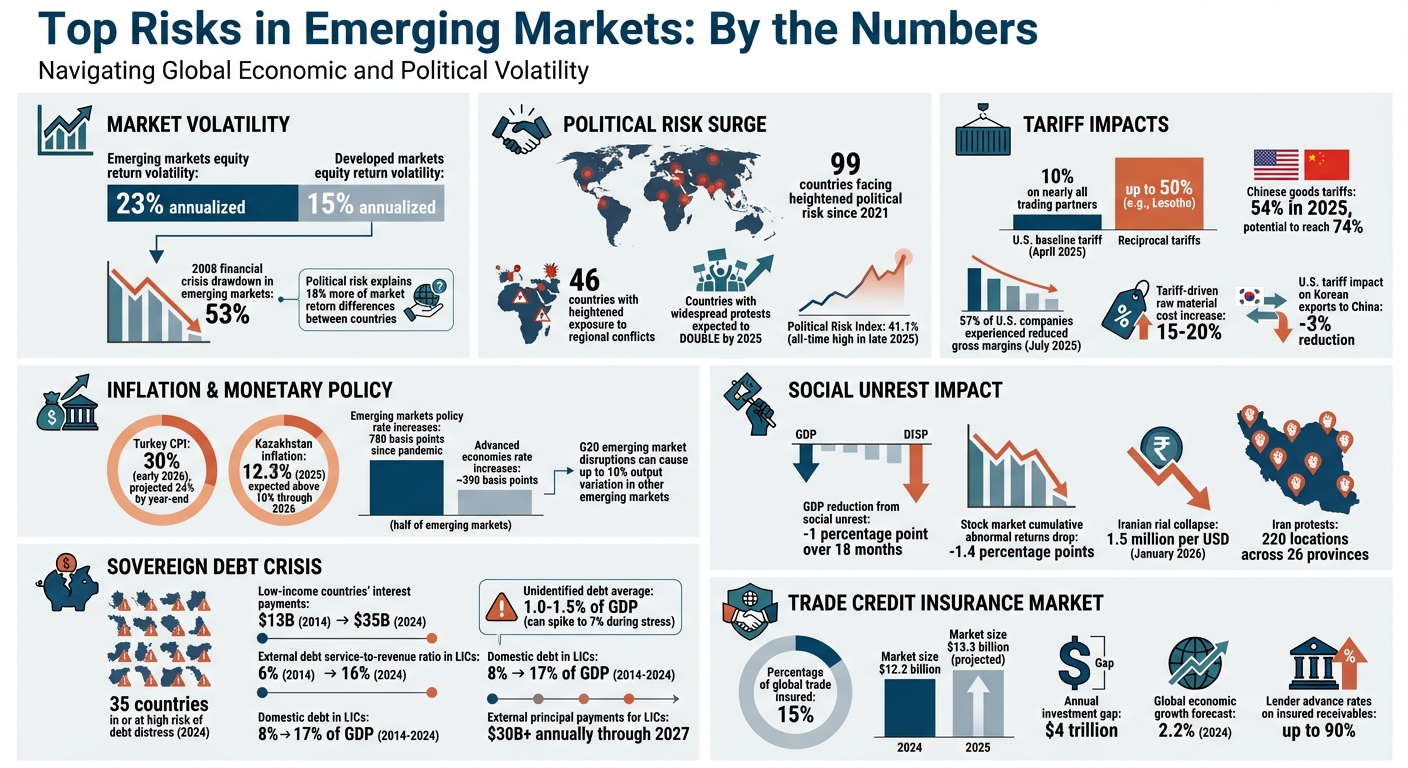

The numbers paint a clear picture of this vulnerability. For example, emerging markets face an annualized equity return volatility of 23%, compared to 15% in developed markets. During the 2008 financial crisis, these markets experienced a staggering 53% drawdown. A formal political risk measure explains 18% more of the differences in market returns between countries. To illustrate, Brazil’s 2014 election and India’s 2014 general elections caused noticeable spikes in correlations between equities and bonds, signaling heightened market instability.

Elections and leadership changes often bring uncertainty about future policies on taxes, trade tariffs, labor laws, and privatization. New governments may nationalize industries, renegotiate contracts, or impose sudden foreign ownership restrictions. Civil unrest, riots, or coups can escalate the risks further, leading to property damage, asset losses, or even complete business shutdowns. A real-world example is Ethiopia, where protests led to targeted attacks on foreign companies seen as politically aligned, causing major operational setbacks.

"Political risk is an important driver of emerging market returns. However, it is difficult to measure and its impact on asset prices is underappreciated and poorly understood."

– Eurasia Group and Nikko Asset Management

Since 2021, political risk has surged in 99 countries, with 46 of them facing heightened exposure to regional conflicts. By 2025, the number of countries affected by widespread protests is expected to double compared to those where unrest will decline. These disruptions often lead to cash flow issues, pushing businesses into defaulting on payments to global partners. Addressing these risks requires strong and proactive risk management strategies.

Using Trade Credit Insurance to Manage Political Risks

Trade credit insurance offers a practical solution for navigating these challenges. Policies can cover political events like expropriation, war, civil unrest, terrorism, and embargoes.

Accounts Receivable Insurance provides tailored endorsements for businesses operating in politically unstable regions. These policies protect against unpaid invoices and bad debts caused by domestic or international political turmoil, helping businesses maintain steady cash flow and avoid insolvency. Coverage is customized to each market’s political risk profile, with assessments evaluating 160 countries on a scale from A1 (Very Low) to E (Extreme).

Beyond compensation, trade credit insurance offers preventive tools, such as customer research and risk assessments. Before signing contracts, businesses can access tailored credit opinions that highlight the likelihood of non-payment based on current political conditions. For longer-term projects, "Single Risk" solutions provide specialized, non-cancellable coverage for individual transactions, shielding businesses from both political and commercial risks. This targeted protection allows companies to explore emerging markets with confidence, knowing their cash flow is safeguarded.

"After more than 70 years of peace, political risk has been back in the forefront, in various forms… notably due to the reshaping of the world order and the climate emergency, two major sources of uncertainty and instability for the years to come."

– Ruben Nizard, North America Economist and Head of Political Risk, Coface

Geopolitical shocks tend to hit emerging market stock prices harder than those in advanced economies. These fluctuations often lead to adjustments in insurance coverage and premiums based on a country’s specific risk exposure.

sbb-itb-2d170b0

Inflation and Monetary Policy Risks

Business Impact of Inflation and Currency Fluctuations

Inflation’s unpredictability creates hurdles for international trade, especially when local currencies become overvalued, making it harder for buyers to meet payment obligations. Consider Turkey, where the Consumer Price Index (CPI) surged to 30% in early 2026, with projections suggesting a drop to 24% by year-end. Similarly, Kazakhstan faced inflation of 12.3% in 2025, which is expected to remain above 10% through 2026.

These inflationary trends have pushed central banks to take aggressive measures. In emerging markets, policy rates have increased by an average of 780 basis points since the pandemic – almost double the rate hikes seen in advanced economies. While these hikes aim to combat inflation, they also drive up borrowing costs, leaving local buyers with tighter cash flows. This makes it increasingly difficult for them to settle invoices, particularly those denominated in U.S. dollars .

Currency volatility adds another layer of risk. For example, the Turkish lira’s overvaluation raises the likelihood of sudden corrections, which could severely impact local importers’ ability to pay dollar-based invoices. Additionally, domestic economic disruptions in G20 emerging markets like Turkey and Argentina can account for up to 10% of output variation in other emerging markets over a three-year span. These challenges highlight the importance of implementing strong risk management strategies.

Protecting Against Economic Shocks with Trade Credit Insurance

When rising costs or insolvencies lead to payment defaults, trade credit insurance steps in to cover unpaid invoices .

"Trade credit insurance is vital to keeping liquidity in supply chains… It is the glue that keeps world trade going."

– Sarah Murrow, President and CEO, Allianz Trade Americas

Accounts Receivable Insurance offers a proactive approach to managing risk by including real-time solvency monitoring. Insurers leverage intelligence networks to track buyers’ financial health, identifying credit quality issues before defaults happen . This feature is especially critical in markets where inflation erodes profit margins and monetary tightening limits access to traditional bank credit.

Beyond insolvency protection, this insurance also covers political risks often encountered in unstable economies, such as currency transfer restrictions and government interventions that can block payments . Insured receivables also make for more attractive collateral, helping businesses secure better borrowing terms from banks . A July 2025 survey revealed that 57% of U.S. companies experienced shrinking gross margins due to higher costs of imported goods. This underscores how trade credit insurance can safeguard cash flow when margin pressures threaten buyers’ financial stability.

Trade Barriers and Tariff Changes

Effects of U.S. Tariffs and Trade Policy Changes

The days of predictable, uniform tariff rates are behind us. In April 2025, the U.S. introduced a 10% minimum baseline tariff that applies to nearly all trading partners, marking a significant departure from the "Most Favored Nation" principle that previously shaped global trade. Instead of applying consistent rates across all World Trade Organization members, the U.S. now negotiates country-specific agreements, leading to reciprocal tariffs as high as 50% for some nations, like Lesotho.

This shift has created a ripple effect of rising costs. New tariffs often stack on top of existing duties, such as Section 232 tariffs on steel and aluminum, driving up importers’ overall expenses. For instance, Chinese goods faced tariffs of 54% in 2025, with the potential to climb to 74% due to additional duties on Venezuelan oil. Between February and October 2025, tariffs on Chinese imports fluctuated wildly – starting at 10%, spiking to 145% in April, and settling at 30% by May.

These changes don’t just impact bilateral trade; they disrupt global supply chains and regional economies. Emerging markets that supply intermediate goods to Chinese manufacturers feel the pinch when U.S. tariffs reduce Chinese exports, which lowers demand for their inputs. For example, the Bank of Korea found that U.S. tariff hikes on China in 2018 reduced Korea’s exports to China and related production by about 3%. On top of that, export restrictions on technology can leave manufacturing facilities outdated, as they lose access to essential advanced equipment.

"Uncertainty will be a defining attribute of much of global trade for the foreseeable future." – BCG

The financial toll is clear. A survey from July 2025 revealed that 57% of U.S. companies experienced reduced gross margins due to tariff-driven import costs. With an import elasticity of –0.8, tariff shocks tend to have lasting effects on trade, investment, and economic output across impacted regions. These pressures, much like political and inflation risks, highlight the importance of having strong trade credit protection.

Managing Trade Barriers with Export Credit Insurance

As tariffs tighten profit margins and strain cash flow, having the right insurance solutions in place becomes essential. When higher tariffs cut into buyer margins, the risk of payment defaults rises. Export credit insurance plays a critical role here, protecting businesses from defaults – risks that grow as tariffs increase raw material costs by 15% to 20%.

Accounts Receivable Insurance offers tailored export credit coverage to help businesses navigate this volatile landscape. Insurers use advanced tools to track external factors like tariff changes, interest rates, and geopolitical risks, alerting businesses to potential customer vulnerabilities before a default occurs. This proactive approach is especially valuable in times of sudden policy shifts, such as the rapid tariff changes seen in 2025.

"Trade credit insurance helps solve this dilemma by covering the risk of unpaid invoices caused by a customer’s insolvency, mitigating the risk of buyer defaults while freeing up capital and improving cash flow." – Jerry Paulson, Senior Vice President, HUB International

Export credit insurance also opens doors for growth in uncertain times. By transferring credit risk to insurers, exporters can confidently pursue opportunities with new partners in emerging markets – even when geopolitical tensions complicate traditional risk evaluations. This type of coverage complements broader risk management strategies, addressing tariff-related challenges alongside political and economic uncertainties. With 15% of global trade now covered by trade credit insurance and the market expected to grow to $13.3 billion in 2025 (up from $12.2 billion in 2024), more businesses are recognizing its role as a key tool for international trade.

For now, market conditions are favorable for buyers of this coverage. Despite rising geopolitical risks, the trade credit insurance market remains competitive in early 2026, supported by high capacity and aggressive pricing, thanks to low claims during the pandemic. Risk managers should consider securing coverage now to lock in favorable terms before tariff-related losses lead to tighter market conditions.

Sovereign Debt and Fiscal Pressures

How Sovereign Debt Affects Emerging Markets

Fiscal instability, much like political and inflation risks, can seriously disrupt growth in emerging markets, making targeted protections essential.

One of the biggest challenges comes from rising sovereign debt, which often leads to payment delays for businesses operating in these regions. By 2024, 35 countries were considered to be in or at high risk of debt distress. This problem is particularly severe in low-income countries (LICs), where interest payments on public debt have skyrocketed – jumping from $13 billion in 2014 to $35 billion in 2024.

The real issue, however, lies in liquidity shortages. While governments may have the ability to repay debt over the long term, they often lack the immediate funds to meet short-term obligations. This leads to the "crowding out effect", where rising interest payments take priority over commercial obligations [43, 44]. For LICs, the external debt service-to-revenue ratio rose sharply from 6% in 2014 to 16% in 2024, leaving businesses struggling to secure payments.

Another complication is "unidentified debt", a term used by the IMF to describe arrears and contingent liabilities that don’t show up in standard fiscal metrics. On average, this debt accounts for 1.0% to 1.5% of GDP annually but can spike to 7% during periods of financial stress. When governments guarantee state-owned enterprise (SOE) debt through securitized or collateralized contracts, businesses risk sudden payment defaults if those guarantees are triggered.

"Unidentified debt – that is, the change in government debt that is not explained by budgetary deficits… stems from the materialization of contingent liabilities and fiscal risks as well as from arrears."

– IMF Fiscal Monitor

The link between sovereign debt and the banking sector further worsens the situation. In LICs, domestic debt surged from 8% to over 17% of GDP between 2014 and 2024. When local banks hold significant amounts of government debt, any financial distress at the sovereign level can destabilize the banking system. This makes it harder for businesses to access trade financing or process international payments [5, 43]. With LICs facing external principal payments exceeding $30 billion annually through 2027, competition for foreign currency reserves becomes even fiercer.

These fiscal challenges highlight the importance of creating robust mechanisms to manage risk, including tailored trade credit insurance solutions.

Increasing Credit Limits with Trade Credit Insurance

In light of these sovereign risks, businesses can turn to trade credit insurance as a way to transfer the burden of potential defaults. For instance, Accounts Receivable Insurance allows companies to shift the risk of non-payment – especially for contracts involving government entities or SOEs – to insurers. This is particularly useful when payment delays are caused by liquidity issues rather than outright insolvency.

Trade credit insurance also protects against political risks that can lead to non-payment, such as government-imposed currency inconvertibility, transfer restrictions, or trade sanctions. If a government freezes fund transfers or implements capital controls due to debt pressures, businesses with this coverage can maintain cash flow and keep operations running smoothly.

"Trade credit insurance is designed to address the risk of non-payment for goods or services, which may include defaults arising from customers in politically unstable countries affected by sanctions or currency inconvertibility."

– Marsh

Additionally, having trade credit insurance can boost a company’s creditworthiness. Lenders often view insured receivables as less risky, enabling businesses to secure better financing terms. This is especially helpful in markets with high debt-to-revenue ratios, where access to both domestic and international financing might otherwise be limited [5, 39, 41].

To navigate these challenges effectively, businesses need to monitor key financial indicators. Instead of relying solely on debt-to-GDP ratios, tracking debt service-to-revenue ratios can provide better insights into potential payment delays. When combined with trade credit insurance, this proactive strategy helps companies manage fiscal instability and continue growing in emerging markets.

Social Unrest and Business Disruptions

Recent Cases of Social Unrest in Emerging Markets

Social unrest, distinct from political instability or economic crises, has become a persistent threat to businesses, disrupting operations and payment systems in ways that are hard to predict. In fact, the Coface Social and Political Risk Index hit an all-time high of 41.1% in late 2025, with 99 countries facing heightened risks of political and civil unrest. Key drivers include rising food and fuel prices, which have fueled public discontent across emerging markets.

The economic fallout is both immediate and far-reaching. Social unrest can shave about 1 percentage point off a country’s GDP over 18 months. Stock markets respond just as quickly, with cumulative abnormal returns dropping by an average of 1.4 percentage points after such events.

Take Iran’s nationwide protests in January 2026 as an example. Triggered by the rial’s collapse to 1.5 million per USD, the unrest spread across 220 locations in 26 provinces, leading to significant casualties and mass arrests. The government imposed the most extensive internet blackout in its history, lasting over two weeks. This action paralyzed international trade, with authorities even seizing two foreign oil tankers in the Persian Gulf. For businesses reliant on Iranian customers, this combination of currency collapse, communication shutdowns, and operational chaos made collecting payments nearly impossible. Events like these highlight the importance of tools like trade credit insurance, such as the specialized coverage offered by Accounts Receivable Insurance, to protect businesses from sudden disruptions.

The ripple effects of such unrest are felt across industries. Manufacturing and retail sectors face reduced output and fewer customers, as uncertainty keeps people away. Financial services experience heightened volatility and weaker investor confidence, while energy companies grapple with supply chain disruptions and regional conflicts. These cascading challenges emphasize the need for strong risk management strategies tailored to address unrest-related disruptions.

Political Risk Coverage for Unrest-Related Non-Payment

When social unrest disrupts payment flows, political risk coverage within trade credit insurance becomes an essential safety net. Providers like Accounts Receivable Insurance offer protection against non-payment caused by operational issues unique to unrest, such as communication shutdowns, sudden currency restrictions, or infrastructure failures that prevent buyers from meeting payment obligations.

This type of coverage is particularly valuable when government actions during civil unrest block payment flows. For instance, during Iran’s January 2026 protests, the government’s internet and phone network shutdown left businesses unable to communicate with clients or collect payments. Companies with political risk insurance could file claims for invoices rendered uncollectible by the blackout. Similarly, if emergency currency controls prevent buyers from converting funds or transferring payments internationally, the insurance compensates for these losses. Coverage also extends to damages caused by riots, strikes, or other unrest-related events that force buyers to halt operations and default on payments.

"Trade credit insurance is designed to address the risk of non-payment for goods or services, which may include defaults arising from customers in politically unstable countries affected by sanctions or currency inconvertibility."

– Marsh

Beyond protecting individual transactions, this insurance strengthens a company’s financial standing. Insured receivables are seen as higher-quality collateral by lenders, who may offer advance rates of up to 90% on qualifying receivables, even in unstable markets. This improved access to financing enables businesses to maintain operations and seize growth opportunities, even as competitors struggle with cash flow issues. By shifting unrest-related payment risks to insurers, companies can confidently extend credit terms to customers in high-risk regions, safeguarding their financial health and competitive edge.

Ep. 15: Risk Mitigation in Emerging Markets. Lessons from 600+ Transactions

Conclusion

Emerging markets present a wealth of potential for growth, but they come with a unique set of challenges that can complicate expansion. As Xavier Durand, CEO of Coface, aptly put it, "The only certainty is being surprised".

With global economic growth expected to hover at just 2.2% in 2024 and corporate insolvencies becoming more frequent and severe, businesses must prioritize protection. Trade credit insurance already safeguards nearly $9.5 trillion in global transactions annually. However, with only 15% of global trade currently insured, a significant portion of transactions remains exposed to risk. This type of coverage not only shields businesses from defaults but also enhances their financial stability.

Accounts Receivable Insurance offers tailored solutions designed to address the wide range of risks inherent in emerging markets. These policies cover issues like commercial insolvency, payment delays, and even political disruptions such as currency inconvertibility or government intervention. By protecting a company’s accounts receivable – often its most critical asset – these policies enable businesses to extend competitive credit terms with confidence and secure favorable financing from lenders.

Private sector participation is essential to closing the $4 trillion annual investment gap, and trade credit insurance plays a key role by mitigating risks and enabling businesses to operate in unpredictable markets. It helps companies safeguard their balance sheets while navigating economic and geopolitical volatility.

In today’s uncertain global landscape, proactive risk management is essential for businesses aiming to thrive in emerging markets. With the right insurance partner, what once seemed like insurmountable obstacles can be turned into manageable risks, allowing businesses to seize opportunities others might avoid. Trade credit insurance can be the key to transforming these risks into pathways for sustainable growth.

FAQs

How can trade credit insurance help manage risks in emerging markets?

Trade credit insurance plays a key role in helping businesses navigate the uncertainties of emerging markets by safeguarding them from financial losses due to non-payment. This protection extends to scenarios like buyer insolvency, bankruptcy, or prolonged payment delays – issues often encountered in areas with unstable economies. It also covers risks tied to political factors, such as government interventions, expropriation, or civil unrest, which can disrupt trade or block payments.

By assessing the creditworthiness of customers and offering coverage for unpaid invoices, trade credit insurance enables businesses to explore new markets with confidence. It reduces vulnerability to unexpected political or economic challenges, providing a sense of security and stability as companies seize growth opportunities.

What are the main advantages of using trade credit insurance for businesses?

Trade credit insurance plays a key role in protecting businesses from financial setbacks like customer non-payment, insolvency, or even disruptions caused by political turmoil. By securing cash flow, it helps companies stay steady, even when faced with unexpected challenges.

Beyond protection, this insurance also opens doors for growth. It allows businesses to explore new markets with confidence, knowing they have a safety net against potential risks. Plus, having insured accounts receivable can make it easier to secure financing, as lenders often view them as a more reliable asset.

How does political instability affect businesses in emerging markets?

Operating in emerging markets often comes with a unique set of challenges, particularly when political instability is involved. This instability can bring about serious risks, including asset confiscation, expropriation, civil unrest, or even war. Such events can severely disrupt business operations, leading to property damage, asset losses, and unforeseen interruptions.

So, how can businesses protect themselves in these unpredictable environments? One effective solution is trade credit insurance. This type of coverage helps shield companies from financial losses tied to political and economic upheavals. By having this safeguard in place, businesses can maintain greater stability and resilience, even when navigating volatile markets.