Political Risk Insurance (PRI) shields businesses from financial losses caused by political events in foreign countries. It’s a key tool for U.S. exporters, investors, and contractors operating in volatile regions. Here’s what PRI typically covers:

- Expropriation: Protection against government asset seizures.

- Political Violence: Coverage for damages from wars, riots, or terrorism.

- Currency Inconvertibility: Safeguards when funds can’t be transferred due to government controls.

- Breach of Contract: Ensures compensation if foreign governments or state entities fail to honor agreements.

PRI enables businesses to confidently enter high-risk markets, secure trade financing, and protect receivables from disruptions. Partnering with experts like Accounts Receivable Insurance (ARI) ensures tailored policies, efficient claims management, and comprehensive protection for international operations. By combining PRI with Trade Credit Insurance, businesses can address both political and commercial risks, ensuring stability in uncertain markets.

What Is Political Risk Insurance And How Does It Work? – SecurityFirstCorp.com

Types of Political Risks in International Trade

Political Risk vs Commercial Risk in International Trade

Common Political Risk Factors

For U.S. businesses operating in international markets, political risks can severely disrupt operations and complicate receivable collections. One major concern is expropriation and nationalization, where governments seize assets outright or gradually diminish their value. A striking example is Venezuela in the 2010s, where government actions caused foreign companies to lose billions of dollars and left many with uncollectible receivables.

Another significant risk is political violence, which includes wars, coups, terrorism, and civil unrest. These events can destroy physical assets and disrupt supply chains. For instance, the 2021 coup in Myanmar halted manufacturing operations and left exporters with unpaid invoices, highlighting the financial vulnerability tied to such instability.

Currency inconvertibility and transfer restrictions also pose challenges. These occur when governments impose capital controls, making it difficult for businesses to convert local currency or transfer funds. From 2019 to 2023, exchange controls in Argentina delayed over $10 billion in receivables, leaving U.S. exporters unable to retrieve payments.

Furthermore, sanctions and embargoes can render receivables uncollectible if payments would violate sanctions laws. Breaches of contract by governments or state-owned enterprises are another concern, often leaving businesses with limited options when public buyers fail to honor agreements. According to UNCTAD‘s 2025 report, political instability and unpredictable government actions cost global trade and investment approximately $184 billion annually in lost opportunities.

Political Risk vs. Commercial Risk

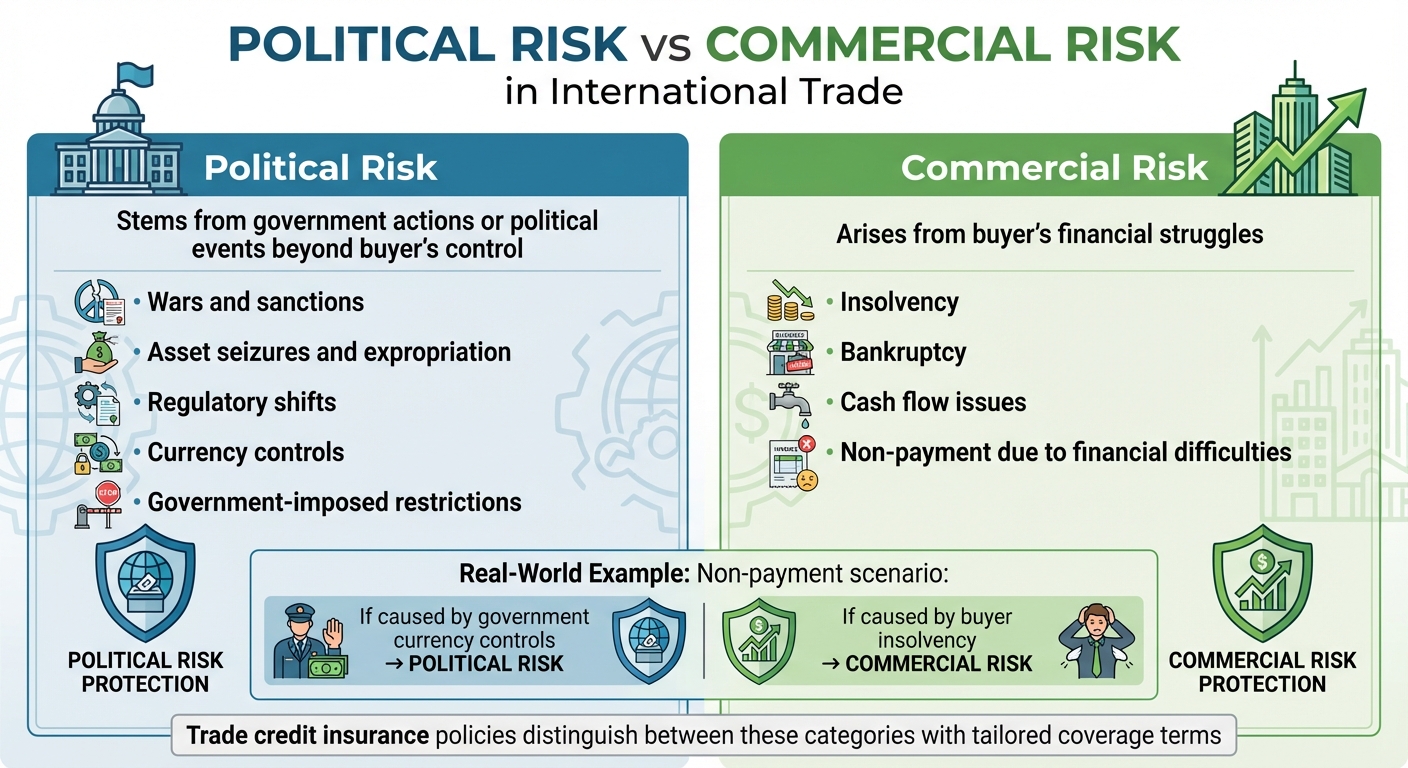

Understanding the difference between political and commercial risks is essential for effective risk management. Political risks stem from government actions or political events – such as wars, sanctions, asset seizures, or regulatory shifts – that are beyond the buyer’s control. On the other hand, commercial risks arise from the buyer’s financial struggles, including insolvency, bankruptcy, or cash flow issues leading to non-payment. For example, if a buyer cannot pay due to insolvency, that’s a commercial risk. However, non-payment caused by government-imposed currency controls falls under political risk. Trade credit insurance policies often distinguish between these two categories, offering tailored coverage terms or sublimits to address each appropriately.

How to Assess Country-Specific Risks

Assessing country-specific risks involves using clear metrics and trusted indicators. Sovereign credit ratings from agencies like S&P, Moody’s, and Fitch are a key tool, as they provide insights into a country’s likelihood of default. Countries with ratings below BBB tend to have 20–30% higher non-payment rates on receivables. Additionally, governance indicators from the World Bank, which evaluate factors like political stability, corruption, and the rule of law, help predict how reliably governments will honor contracts.

Geopolitical analysis from insurers such as Euler Hermes and Coface also plays a crucial role. These analyses track sanctions regimes, election cycles, regional conflicts, and regulatory changes. Businesses should actively monitor resources like the U.S. Treasury’s (OFAC) sanctions lists and the Department of Commerce’s export controls to identify markets with potential trade restrictions. Companies like ARI use these tools to customize political risk coverage in trade credit policies and frequently update risk assessments to reflect changing conditions.

How Political Risk Insurance Policies Work

This section dives into how Political Risk Insurance (PRI) policies are structured to address the unique challenges businesses face in uncertain global markets.

Policy Types and Coverage Options

PRI policies are designed to protect businesses engaged in international trade, with two primary structures: single-buyer policies and multi-buyer policies.

- A single-buyer policy focuses on risks tied to a specific counterparty. For example, this type of policy is ideal for a U.S. exporter working exclusively with a government entity or a state-owned enterprise in a politically unstable region.

- A multi-buyer policy, on the other hand, offers broader protection. It covers a portfolio of international buyers, shielding businesses from political risks across multiple countries. Imagine a U.S. machinery manufacturer shipping to buyers in several emerging markets – this policy would safeguard against events like sudden sanctions or civil unrest that could disrupt payments from any of those customers.

PRI coverage typically includes the following modules:

- Expropriation: Protection against government seizure of assets.

- Currency inconvertibility: Coverage for situations where funds can’t be converted or transferred due to exchange controls.

- Political violence: Protection from losses caused by war, terrorism, or civil unrest.

- Contract frustration: Coverage for losses when government actions prevent the fulfillment of a contract.

Policies can extend for up to 15 years, aligning with the timelines of long-term projects. They generally cover 90–95% of eligible losses, with the insured retaining a small portion as co-insurance to maintain aligned incentives.

Claims Process and Payment Terms

Claims are activated when a verifiable political event leads to financial loss. This could include non-payment due to expropriation, sanctions, or government-imposed currency restrictions. To file a claim, businesses must provide documentation such as government notices, invoices, or police reports to confirm the political event.

Waiting periods – ranging from 30 to 180 days – allow insurers to verify the claim. For example, claims related to contract frustration or non-payment often require the full 180 days.

Once approved, indemnity payments typically cover 80–95% of the loss. For instance, a policy with 90% indemnity would reimburse $900,000 on a $1 million loss after verification. Businesses should factor these timelines into their cash flow planning, as payments are not immediate. Working with experienced brokers, like those at Accounts Receivable Insurance, can help streamline documentation and expedite claims processing.

Combining PRI with Trade Credit Insurance

Political Risk Insurance works best when paired with Trade Credit Insurance, offering businesses a comprehensive safety net.

- Trade Credit Insurance focuses on commercial risks, such as buyer insolvency or prolonged payment delays.

- Political Risk Insurance addresses political events, like expropriation or government-imposed payment restrictions.

Together, these policies close coverage gaps. For example, if a buyer defaults due to bankruptcy, Trade Credit Insurance steps in. If government actions block payment, PRI provides protection. By coordinating both coverages, U.S. exporters can confidently extend credit terms to international buyers, even in volatile markets.

At ARI, tailored solutions combine PRI and Trade Credit Insurance, simplifying administration while ensuring businesses are covered from all angles. This integrated approach empowers U.S. exporters to navigate global trade challenges with greater confidence and security.

sbb-itb-2d170b0

Using Political Risk Insurance in Business Operations

Following our earlier discussion on PRI policy structures, let’s dive into how this insurance can be woven into everyday business operations. Political Risk Insurance (PRI) acts as a safety net, shielding businesses from risks like government actions, civil unrest, and currency restrictions. For U.S. companies, it opens doors to high-risk markets that might otherwise seem off-limits, turning them into potential growth opportunities.

Enabling International Trade Transactions

PRI plays a crucial role in making international trade smoother, even in politically unstable regions. For instance, it allows U.S. exporters to offer open account sales – such as 180-day payment terms – in countries where political or economic instability might otherwise demand prepayment or letters of credit. Imagine a U.S. manufacturer doing business in a country with strict currency controls that block U.S. dollar transfers. With PRI in place, the manufacturer can confidently offer competitive credit terms, helping them win contracts and expand their global footprint despite these challenges.

In structured trade deals, PRI ensures payments are protected, even for larger transactions or those with extended payment terms. It’s especially valuable in supply chain financing, where it protects funders from financial losses caused by sudden political events like nationalization, war, or sanctions. This means businesses can maintain working capital and keep operations running, even when the broader economic environment becomes unstable.

Improving Access to Trade Financing

For banks and lenders, PRI acts as a powerful risk management tool. When a loan or bond is backed by PRI, lenders feel more secure extending better terms – such as longer repayment periods, higher credit limits, or lower interest rates – for cross-border transactions. To make this work, lenders often require a detailed PRI policy, outlining covered risks like expropriation, political violence, or currency inconvertibility, along with the policy’s limits and deductibles. This ensures that political risks tied to collateral are adequately addressed.

PRI also reassures lenders by securing key foreign receivables, which can improve advance rates and reduce the cost of working capital. Many U.S. businesses pair PRI with trade credit insurance, which allows insured receivables to be treated as high-quality collateral. This combination can make deals that were previously unworkable now feasible, enabling companies to expand into markets they might have otherwise avoided.

Working with Brokers to Customize Coverage

Specialized brokers are invaluable when it comes to tailoring PRI to a company’s specific needs. They analyze country-specific risks, contract details, and business relationships to pinpoint insurable risks and negotiate the best terms. Important factors like waiting periods, definitions of political violence, sanctions clauses, and coinsurance levels are all carefully considered to craft a policy that fits the business rather than relying on generic templates.

Accounts Receivable Insurance (ARI) often partners with brokers to create comprehensive solutions. For example, PRI on receivables can be integrated with broader coverage for assets and investments. By working with a global network of credit and political risk insurers, ARI can match U.S. businesses with carriers that have a strong track record in their specific industries and regions. This ensures that both pricing and coverage are optimized.

To get the most out of a broker, businesses should come prepared with detailed information. This includes data on foreign investments, trade flows, and contract terms, as well as internal country risk assessments and records of past disruptions – like delayed payments due to currency controls or temporary license cancellations. Sharing details about lender requirements for political risk mitigation can also help brokers recommend the right policy limits and terms. Armed with this information, brokers can focus on the most pressing risks and negotiate competitive terms that align with the company’s objectives.

Managing Political Risk: Practical Steps for Businesses

Navigating political risk effectively requires businesses to establish strong internal systems that can anticipate and respond to potential disruptions. With geopolitical instability costing organizations approximately $184 billion annually in trade and investment challenges, U.S. companies operating internationally must adopt structured strategies to safeguard their operations.

Building Internal Risk Management Systems

Start by developing country-specific risk policies that outline acceptable levels of exposure. Use trusted resources like U.S. State Department advisories, World Bank MIGA assessments, and commercial political violence monitors to inform these policies.

Integrate political risk assessments into your credit management process. When evaluating international customers, consider political risks alongside traditional creditworthiness checks. This not only protects your financial interests but also ensures compliance with U.S. regulations, such as OFAC sanctions and export controls. Setting up alerts for critical events – like wars, nationalization, or currency restrictions – allows you to adjust your exposure before risks escalate.

Once internal systems are in place, leveraging external expertise can further strengthen your risk management efforts.

Partnering with Experienced Insurance Brokers

Accounts Receivable Insurance (ARI) provides U.S. businesses with the tools needed to handle complex political risks. ARI conducts tailored risk assessments, analyzing country-specific threats and designing policies that align with your trade exposures. Unlike one-size-fits-all solutions, these policies are customized to fit your business model and risk tolerance.

ARI also offers invaluable claims support when political events disrupt payments. For instance, if a coup leads to non-payment, currency inconvertibility arises due to new capital controls, or a contract is unenforceable after nationalization, ARI helps you navigate the documentation process and ensures timely payouts. Additionally, ARI can optimize your coverage by combining political risk insurance with trade credit insurance, offering a comprehensive solution for both political and commercial risks in volatile markets.

Updating Coverage as Conditions Change

As your internal systems and broker partnerships evolve, regularly reviewing and updating your coverage is crucial. The political landscape can change rapidly, and your insurance should reflect these shifts. Conduct quarterly reviews for regions with higher risks and annual audits for all international exposures. Adjust your policies when significant events occur, such as elections, new sanctions, civil unrest, or currency devaluations.

Collaborate with your broker to reassess country-specific exposures using the latest risk indices and update your policies to address emerging threats. For example, if a U.S. energy company operates in a country experiencing a coup, it might need to immediately add coverage for contract non-enforcement. Proactive updates like these are not just a precaution – businesses that review their policies quarterly have reported 20-30% better risk-adjusted returns, according to insurer analyses. This approach ensures your coverage keeps pace with your operations and the ever-changing global environment.

Conclusion: Protecting Global Trade with Political Risk Insurance

Political risk insurance (PRI) plays a crucial role for U.S. businesses engaged in international trade. In an era of growing geopolitical uncertainty, PRI provides a financial safety net that allows companies to navigate volatile markets with greater confidence. By covering losses from risks like expropriation, political violence, currency inconvertibility, and government interference, PRI transforms high-risk ventures into secure, financeable opportunities.

The numbers speak for themselves. As of June 30, 2023, the Multilateral Investment Guarantee Agency (MIGA) reported $33.2 billion in gross exposure for political risk guarantees, supporting projects in over 120 developing countries. This demonstrates how PRI has become a cornerstone in facilitating global trade.

Building on the policy structures discussed earlier, Accounts Receivable Insurance (ARI) takes a tailored approach to protection. Rather than relying on one-size-fits-all solutions, ARI develops policies that align with your specific business needs, country exposures, and risk tolerance. These policies safeguard your receivables from political disruptions and commercial defaults.

"We act as your advocate in the complex world of credit insurance. We leverage our expertise and relationships with multiple trade credit insurance companies to find the right coverage for your business at the best possible price. We also provide ongoing support, including risk assessments, claims management, and policy renewals." – Accounts Receivable Insurance

Partnering with ARI, an Elite/Preferred Broker, opens doors to a global network of carriers, expert claims support, and continuous guidance to adapt coverage as conditions evolve. This partnership not only secures your current trade operations but also empowers you to explore opportunities in markets that might otherwise seem too risky. With the right support, political risks become manageable, turning challenges into opportunities for growth.

FAQs

What is the difference between Political Risk Insurance and Trade Credit Insurance?

Political Risk Insurance helps businesses shield themselves from losses resulting from political events like expropriation, armed conflicts, or government actions that disrupt trade operations. This type of coverage is specifically tailored to protect investments and transactions in regions where political instability poses a threat.

On the other hand, Trade Credit Insurance – often referred to as Accounts Receivable Insurance – centers on safeguarding businesses against non-payment risks. These risks can stem from financial defaults, bankruptcies, or even political issues that prevent customers from settling their invoices. While both types of insurance address political risks, Trade Credit Insurance primarily focuses on ensuring businesses are compensated for unpaid receivables.

What are the benefits of combining Political Risk Insurance (PRI) with Trade Credit Insurance?

Combining Political Risk Insurance (PRI) with Trade Credit Insurance creates a strong layer of protection for businesses. Together, these coverages shield companies from a range of risks – PRI addresses challenges like government actions, civil unrest, or expropriation, while Trade Credit Insurance steps in to cover issues such as customer non-payment or bankruptcy.

This pairing allows businesses to protect their cash flow and navigate financial uncertainties with greater confidence. It’s especially valuable for companies looking to explore new markets, even those with potential instability, offering peace of mind in both domestic and international trade activities.

How can businesses evaluate political risks in different countries?

Businesses can manage political risks by conducting in-depth assessments and keeping a close eye on political and economic changes in the regions where they operate or plan to expand. Staying informed about the financial health of trade partners is equally crucial to reduce the chance of unexpected losses.

Working with specialists, like trade credit insurance providers, adds another layer of protection. These experts deliver personalized evaluations, continuous monitoring, and tailored strategies, giving businesses the tools they need to handle uncertain markets with greater assurance.