When selling internationally, political risks – like government embargoes, civil unrest, or currency restrictions – can disrupt payments, even from reliable buyers. Insurers factor these risks into trade credit insurance premiums, using country risk ratings (A1 to E) and buyer-specific data. Higher-risk countries lead to higher premiums. Here’s what you need to know:

- Political Risks: Include expropriation, currency inconvertibility, political violence, trade embargoes, and contract breaches.

- Premium Factors: Country risk ratings, buyer financial health, and policy terms (e.g., coverage scope, indemnity levels).

- Calculation Steps:

- Assess country risk using ratings or sovereign yield spreads.

- Evaluate buyer risk (credit history, financials).

- Adjust for risk mitigation (e.g., diversification, guarantees).

For example, exporting $500,000 to Brazil with a base premium of 0.85% would cost $4,250. Discounts, like a 25% reduction for risk mitigation, can lower this to $3,187.50.

Political risk insurance not only protects cash flow but also supports business growth in uncertain markets.

What is Political Risk and Why Does It Affect Premiums?

Political risk refers to the potential financial losses a business might face due to instability, regime changes, or policy shifts in a foreign country. Unlike commercial risks, which usually result from a buyer’s inability to pay, political risks arise from government actions or political events that disrupt payments.

"When it comes to political risk, we say it could be defined to a certain extent by its unpredictability. Contrary to most other types of insurance, it’s not always possible to model this type of risk based on historic data." – Pierre Lamourelle, Deputy Global Head of Specialty Credit, Allianz Trade

Because political events are unpredictable and can halt payments abruptly, insurers factor these risks into premium calculations. The political risk insurance market processes about $2 billion in premiums annually, with the theoretical single risk capacity reaching nearly $3 billion as of early 2017. Countries with higher risk ratings face higher premiums and stricter coverage terms.

Types of Political Risks

Political risks come in a variety of forms, each potentially impacting a business’s ability to collect payments:

- Expropriation and Nationalization: Governments may seize private assets or impose discriminatory measures, stripping businesses of their investments.

- Currency Inconvertibility: Restrictions on converting local currency to U.S. dollars or transferring funds out of the country can block payments.

- Political Violence: Events such as war, terrorism, riots, or civil unrest can damage a buyer’s premises or disrupt operations, making payments impossible.

- Trade Embargoes and Sanctions: These can be introduced suddenly, halting imports or exports with specific countries.

- Breach of Contract: Occurs when governments or state-owned entities fail to honor contracts or financial commitments.

How Insurers Evaluate Political Risk

Insurers rely on a range of data sources to assess political risk and set premium rates. Country risk ratings often use scales, like A1 (Very Low) to E (Extreme), or numerical scales such as 1 to 7. Coface, for instance, assesses 160 countries using these systems.

Underwriters also analyze key economic indicators – such as foreign exchange reserves, external debt ratios, and current account balances – to gauge a nation’s ability to meet its obligations. Market data, including Credit Default Swap (CDS) margins and bank lending rates, further help benchmark pricing. These combined factors establish the base premium rate for each country’s coverage.

sbb-itb-2d170b0

Factors That Determine Political Risk Premiums

When insurers calculate political risk premiums, they rely on three main factors: country risk ratings, buyer characteristics, and coverage terms. Each factor contributes uniquely to shaping the cost of protection, ensuring premiums align with the risks involved.

Country Risk Ratings

Country risk ratings form the backbone of political risk insurance pricing. Agencies like OECD, Allianz Trade, Coface, and Credendo use standardized systems to evaluate a nation’s risk level. For example, Allianz Trade employs a dual-rating system: a Medium-Term Rating (ranging from AA to D) and a Short-Term Rating (from 1 to 4), which together capture both immediate and long-term risks.

These ratings combine hard numbers – like external debt ratios, foreign exchange reserves, and current account balances – with qualitative insights into political stability, institutional strength, and the rule of law. Unsurprisingly, nations with higher risk classifications face higher premiums, as insurers adjust costs to reflect the likelihood of non-repayment.

"The Participants’ country risk classifications are a fundamental building block of the Arrangement rules on minimum premium rates for credit risk." – OECD

The OECD also plays a role in standardizing premiums for medium- and long-term export credits. Their Arrangement on Officially Supported Export Credits sets Minimum Premium Rates (MPRs) for participating countries, ensuring that premiums reflect actual risk and discouraging underpricing. Notably, high-income OECD and Euro-zone nations are evaluated differently, with market-based ratings guiding their premiums.

Buyer Characteristics

Insurers don’t just look at countries – they also scrutinize individual buyers. Financial health, credit history, and payment behavior are key factors, often assessed using extensive business databases. For instance, Allianz Trade tracks data on millions of companies, helping insurers gauge buyer reliability. Buyers with strong financials and a history of timely payments benefit from lower premiums, while those with defaults or late payments face higher costs.

The buyer’s industry and status also come into play. Public or state-owned entities may require specialized coverage for risks like sovereign non-payment or contract frustration. Additionally, insurers consider concentration risk. If a company relies heavily on a single large customer, premiums may increase, or specific terms like "Key Account" coverage might be required.

Here’s an example: Trade credit insurance premiums often hover around 0.25% of sales. A business with $20 million in annual revenue might pay less than $50,000 for coverage.

"Sellers should know their clients better than anybody. If a company isn’t doing its due diligence, it may be purchasing more insurance than is otherwise needed, or its insurance may be more expensive than it should be." – Jason Benson, Global Head of Structured Working Capital in Trade & Working Capital, J.P. Morgan

The nuances of buyer assessments directly influence how insurers shape premium rates and coverage terms.

Coverage Terms and Conditions

The structure and scope of a policy also play a big role in determining premiums. Policies usually cover 75% to 95% of outstanding debt, with the exact indemnity level affecting the cost. Whole turnover policies, which cover an entire portfolio of buyers, often offer more competitive rates since risks are spread across multiple customers. On the other hand, key account policies – focused on major buyers – tend to have different pricing due to higher concentration risks.

Export policies, which include political risks like expropriation, currency inconvertibility, and political violence, are generally pricier than domestic policies that cover only commercial risks within the home country. The broader scope and longer time horizons of export policies drive these higher costs. Some policies also feature non-cancellable limits, guaranteeing a fixed coverage amount for the policy year regardless of changes in the buyer’s credit risk. Additionally, many contracts include a minimum premium to account for uncertainties in future turnover. Risk mitigation tools like credit insurance or tailored credit opinions further refine the final premium rates.

How to Calculate Political Risk Premiums: A Step-by-Step Guide

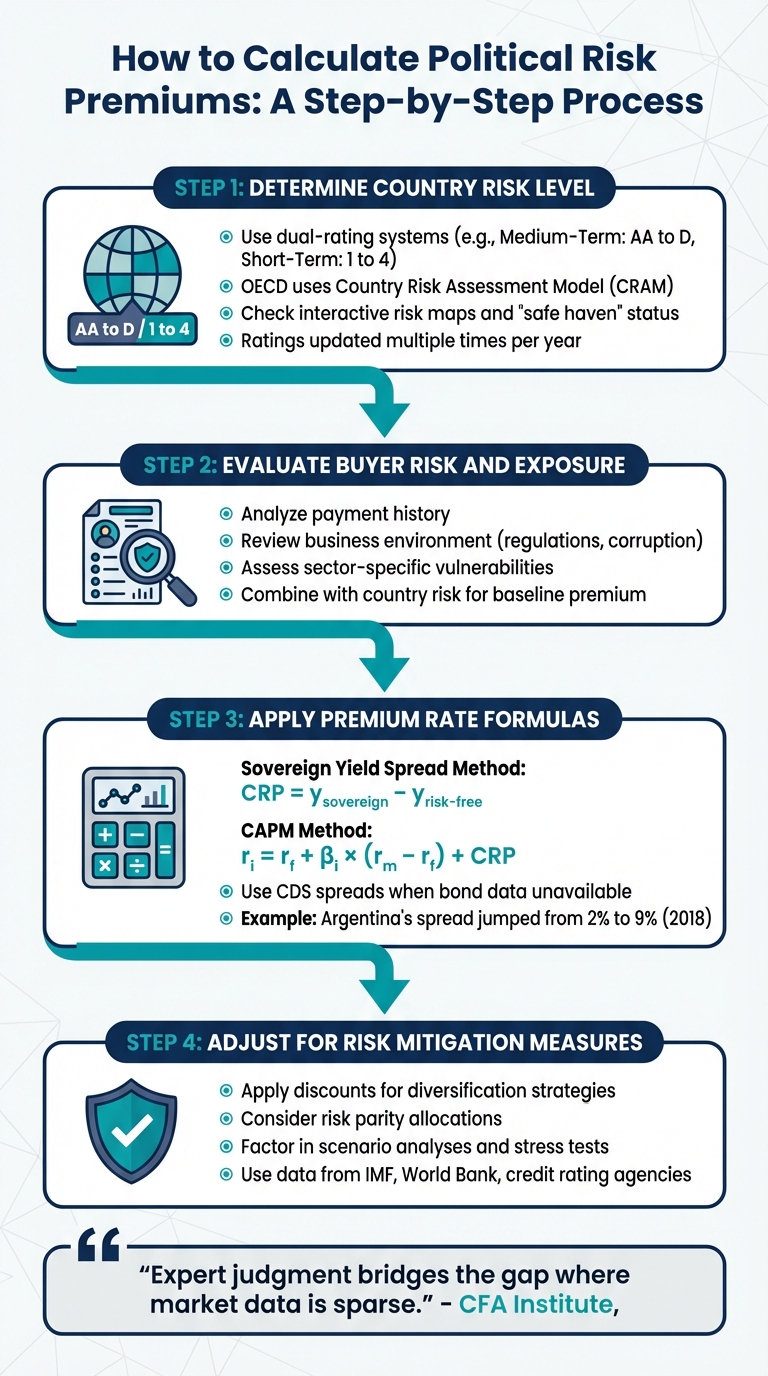

How to Calculate Political Risk Insurance Premiums: 4-Step Process

Calculating political risk premiums involves more than just educated guesses – it’s a structured process that blends hard data with expert analysis. Let’s break down how insurers assess these premiums to help businesses safeguard against political risks.

Step 1: Determine Country Risk Level

Start by pinpointing the country where the buyer operates and examine its risk classification. Insurers like Allianz Trade use a dual-rating system: a Medium-Term Rating (graded from AA to D) and a Short-Term Rating (scaled from 1 to 4). Meanwhile, the OECD employs a two-step approach, combining its Country Risk Assessment Model (CRAM) with qualitative expert reviews to establish Minimum Premium Rates (MPRs).

The CRAM model evaluates critical factors like payment performance, economic health, and institutional stability using specific indicators. These ratings are updated frequently, as the OECD Country Risk Experts’ Group meets several times a year to reassess each country at least once.

For up-to-date insights, you can explore interactive risk maps provided by insurers or check whether the country qualifies as an OECD "safe haven", which may help lower the baseline premium. Once the country risk is established, the next focus shifts to the buyer’s risk profile.

Step 2: Evaluate Buyer Risk and Exposure

After determining the country’s risk, the buyer’s individual risk profile comes into play. Insurers analyze factors such as payment history, the broader business environment (including regulatory frameworks and corruption levels), and sector-specific vulnerabilities. Together with the country risk assessment, these insights form the foundation for calculating the premium using established formulas.

Step 3: Apply Premium Rate Formulas

Insurers rely on two main methods to calculate the premium rate. The first is the Sovereign Yield Spread, which measures the gap between a country’s sovereign bond yield and a risk-free benchmark, such as U.S. Treasuries:

$CRP = y_{sovereign} – y_{risk-free}$.

The second method uses the Capital Asset Pricing Model (CAPM), which incorporates the Country Risk Premium (CRP) into the required return:

$r_i = r_f + \beta_i \times (r_m – r_f) + CRP$.

A real-world example: In 2018, Argentina’s sovereign spread jumped from 2% to 9% during a currency crisis, significantly raising its country risk premium. Similarly, in 2021, Turkey’s political instability and soaring inflation pushed its country risk premium to 7%, impacting foreign investment and insurance costs.

"Ignoring country risk in valuation is like navigating a storm without checking the weather." – Aswath Damodaran, Professor, Stern School of Business

When sovereign bond data is unavailable, insurers often use Credit Default Swap (CDS) spreads as an alternative to estimate the risk premium.

Step 4: Adjust for Risk Mitigation Measures

Once you’ve applied the premium rate formulas, adjustments are made based on risk mitigation strategies. Insurers may reduce premiums if you implement measures like risk parity allocations, scenario analyses, or stress tests to evaluate your portfolio’s resilience under political or commodity-price shocks. Diversifying your buyer base across multiple countries can also help lower concentration risk.

Accounts Receivable Insurance can guide businesses through these adjustments by providing tailored risk evaluations and access to a global network of credit insurance providers. Their expertise can help identify the most effective strategies to influence your premium calculation.

For the most reliable estimate, gather data from multiple sources like the IMF World Economic Outlook, World Bank Governance Indicators, and credit rating agencies such as Moody’s, S&P, and Fitch. Setting up alerts for changes in sovereign ratings or foreign exchange interventions can keep you ahead of potential risks.

"Expert judgment bridges the gap where market data is sparse." – CFA Institute

Example: Calculating a Political Risk Premium

Let’s look at a U.S. manufacturer in Ohio exporting $500,000 worth of industrial machinery to Brazil. This example shows how these calculations influence premium costs.

Step 1: Gather Baseline Data.

Start by comparing government bond yields. The 10-year U.S. Treasury yield is 3.5%, while Brazil’s 10-year government bond yield is 7.5%. The difference, or sovereign yield spread, is calculated as 7.5% – 3.5% = 4.0%.

Step 2: Calculate Premium Amount.

For multi-buyer export credit insurance covering short-term transactions, premiums are typically less than 1% of insured sales. Given Brazil’s higher country risk premium of 4.0%, the insurer adjusts the base rate upward. Assume the premium rate is set at 0.85% of the insured value:

$500,000 × 0.85% = $4,250.

This amount is then subject to further adjustments based on risk mitigation.

Step 3: Apply Risk Mitigation Discounts.

With an EXIM working capital guarantee, the exporter qualifies for a 25% discount on the premium:

$4,250 × 0.75 = $3,187.50.

This results in a savings of $1,062.50.

Step 4: Incorporate the Cost into Pricing.

To maintain profit margins, the final premium must be factored into the selling price. Assuming a 10% profit margin, ignoring this expense would require an additional $31,875 in sales to cover the cost.

How Accounts Receivable Insurance Helps with Political Risk Coverage

Accounts Receivable Insurance plays a key role in managing political risk exposure by acting as an extension of your credit department. By connecting businesses to a global network of carriers – such as Allianz Trade, Coface, Atradius, and Ex-Im Bank – it ensures access to targeted and reliable coverage options.

With local underwriting teams based in critical markets, businesses benefit from real-time insights that shape customized risk management strategies. This localized expertise is especially valuable in emerging markets where conditions can shift rapidly.

Policies can be tailored to address specific political risks, including currency inconvertibility, government expropriation, political violence (like war, terrorism, and civil unrest), and breach of contract by state entities. In high-risk regions where standard coverage may be limited, specialized brokers can step in to secure single-transaction solutions or use confidential buyer data to help underwriters approve larger limits.

Another advantage of credit insurance is its ability to enhance bank advance rates – potentially up to 90% on qualifying receivables. This can be particularly beneficial when banks provide minimal margining. Additionally, the cost of the political risk premium can often be recouped by reducing bad debt allowances, effectively reclaiming those reserves as income.

Industry leaders highlight the strategic value of such insurance:

"Export accounts receivable insurance is more than just a safety net. It is a strategic tool that empowers your business to navigate the complexities of international trade with confidence." – ARI Global

Efficient claims management further strengthens the appeal of this coverage. Specialist brokers with underwriting expertise pre-screen claims to ensure they meet all necessary criteria, enabling faster payouts during political or economic disruptions. This process helps businesses maintain stable profit margins and cash flow even under challenging circumstances. For example, in a 2026 case involving a marine fuel supplier, the lead insurer Beazley reserved and processed a multi-million dollar claim in just 21 and 27 days, respectively.

Conclusion

Political risk is unpredictable, making it crucial to understand how it affects premium calculations to ensure financial stability. Unlike commercial risks, which rely on historical data for modeling, political events – such as currency inconvertibility or government expropriation – demand more nuanced evaluation methods. These methods often incorporate factors like country risk ratings, buyer profiles, and specific coverage terms.

The best way to navigate these uncertainties is by partnering with specialized insurers who have access to real-time intelligence across key regions. Providers like Accounts Receivable Insurance, for example, combine frequent country assessments with a global network to help businesses adapt to rapidly changing political conditions. This capability is especially important as countries with a combined GDP of $44.6 trillion head to the polls in 2024, driving demand for political risk coverage to new heights.

Beyond offering protection, political risk insurance can enhance financial flexibility. It improves bank advance rates – sometimes covering up to 90% of eligible receivables – and boosts access to capital, giving businesses a competitive edge.

Thriving in uncertain geopolitical climates requires a proactive approach. Regularly monitoring country ratings and sharing detailed exposure data with underwriters are key steps to maintaining stable cash flow during disruptions. Working with brokers who specialize in complex political risk policies ensures companies receive tailored solutions that address their unique exposures.

With the right coverage in place, businesses can confidently pursue opportunities in emerging markets instead of retreating to less risky but lower-reward territories.

FAQs

How often do country risk ratings change?

Country risk ratings are usually updated every quarter to account for shifts in economic and geopolitical conditions. This regular updating process helps keep the ratings accurate and relevant for evaluating political risks across various regions.

What information do insurers need about my buyer?

Insurers often need specific details about your buyer, including their financial stability, payment history, and exposure to political risks. They also consider factors related to the buyer’s country or region, such as political instability, civil unrest, or government policies that could disrupt payment obligations. Supplying clear and detailed information allows insurers to assess these risks more accurately.

What actions can quickly lower my premium?

To reduce your political risk insurance premium, aim to showcase a lower risk profile. Start by conducting detailed risk assessments to identify and address potential political threats in your operating regions. Actively manage these risks by implementing strategies that mitigate exposure. Additionally, focus on maintaining strong financial health and ensuring your business operations remain stable. Insurers tend to favor businesses with solid risk management practices and a track record of stability, often rewarding them with lower premiums.