Domestic and international trade differ significantly in payment terms, risk levels, and complexity. Domestic transactions are simpler, with predictable terms like Net 30 or Net 60, minimal documentation, and lower risks. International trade introduces challenges like currency fluctuations, political risks, and complex documentation, requiring tools like Letters of Credit and Accounts Receivable Insurance to mitigate risks.

Key Takeaways:

- Domestic Trade: Predictable, lower risk, faster payments, fewer documentation requirements.

- International Trade: Higher risk, slower payments, extensive documentation, and reliance on secure methods like Letters of Credit or prepayments.

Quick Comparison:

| Aspect | Domestic Trade | International Trade |

|---|---|---|

| Payment Terms | Net 30/60, open account | Letters of Credit, prepayment, D/A, D/P |

| Risk Level | Lower risk, no currency issues | Higher risk, currency and political risks |

| Processing Time | 1–3 business days | 5–15 business days |

| Transaction Costs | Lower fees | Higher fees, currency conversion costs |

| Documentation | Minimal (invoice, P.O.) | Extensive (bills of lading, certificates) |

| Legal Framework | Unified, easy enforcement | Complex, cross-border enforcement |

For domestic transactions, simplicity and speed dominate. In international trade, careful planning and safeguards like insurance are crucial to manage risks and ensure financial stability.

5 Payment Methods for International Trade

1. Domestic Payment Terms

Doing business within the United States offers a more predictable and secure environment compared to international trade. Familiarity with domestic payment structures can help businesses manage cash flow effectively while reducing financial risks.

Payment Methods

In the U.S., businesses use several reliable payment methods that emphasize speed and cost-efficiency:

- ACH transfers are the backbone of domestic B2B payments. Over 80% of transactions are processed electronically, with costs ranging from $0.20 to $1.50 per transaction. These transfers typically settle within one business day, making them a great choice for recurring payments.

- Wire transfers provide same-day settlement for high-value transactions. However, they come with higher fees, usually between $15 and $30 per transaction.

- Checks remain popular in sectors like construction and professional services. Despite their familiarity, processing times of 2–5 business days make them less appealing for businesses looking to speed up cash flow.

- Credit card payments offer immediate cash flow and built-in dispute resolution. While merchant fees range from 1.5% to 3.5%, the convenience and reduced collection efforts often make this option worthwhile.

Risk Levels

Domestic transactions generally involve less risk than international ones. Operating under the same legal framework and similar business practices simplifies due diligence and offers clear legal recourse. Even so, risks like customer bankruptcy, late payments, and defaults still exist. These are easier to manage in domestic settings due to proximity and consistent legal protections.

Standard payment terms in the U.S. usually range from 30 to 60 days, which helps limit exposure compared to the longer terms often seen in international trade. However, businesses with concentrated customer bases or those in volatile industries may face elevated risks of payment defaults.

Documentation Requirements

Domestic transactions benefit from straightforward documentation. Essential paperwork typically includes invoices, purchase orders, and proof of delivery. Invoices should clearly outline payment terms, due dates, and itemized charges.

With the rise of electronic invoicing, many businesses now use integrated accounting software to automate invoice generation, track payments, and send reminders. This approach reduces errors and speeds up processing, ensuring smoother transactions.

Delivery confirmations, often captured through electronic signatures or tracking systems, serve as sufficient proof of completion. These simplified processes align with the robust legal framework in the U.S., making transactions more efficient and secure.

Legal and Financial Safeguards

The Uniform Commercial Code (UCC) provides a standardized legal framework across U.S. states, simplifying commercial transactions and offering clear remedies for contract breaches. Additionally, credit reporting systems like Dun & Bradstreet and Experian allow businesses to assess a customer’s creditworthiness before extending trade credit.

To protect against potential losses, businesses often turn to Accounts Receivable Insurance. This insurance covers non-payment risks due to customer insolvency, bankruptcy, or prolonged defaults, enabling companies to extend credit with greater confidence.

"Accounts Receivable (Trade Credit) Insurance protects your company’s receivables from non-payment due to bankruptcy, slow payment and political risks." – AccountsReceivableInsurance.net

State and federal courts provide enforceable remedies for payment disputes, offering businesses options like collections, liens, or other legal measures without the complexities of navigating foreign legal systems. For high-value transactions, many companies opt for escrow services, which ensure neutral third-party oversight and protect both parties in capital-intensive deals.

2. International Payment Terms

When it comes to domestic trade, standard practices and clear legal frameworks usually keep things straightforward. But international trade? That’s a whole different ballgame. Cross-border transactions introduce layers of complexity – different currencies, legal systems, and financial institutions – that require specialized approaches to manage risks effectively. While domestic strategies provide a foundation, international trade demands extra precautions to handle the increased unpredictability.

Payment Methods

Businesses trading internationally have several payment options, each with its own balance of security and complexity.

- Telegraphic Transfer (TT): This method involves pre-payment, offering sellers a high level of security but placing the risk squarely on buyers. It’s particularly useful for new trade relationships or custom orders of significant value, where upfront payment is necessary.

- Documents Against Payment (DP): DP strikes a middle ground. Buyers make payments when banks release shipping documents, ensuring goods have been shipped before funds are exchanged. This setup protects both parties – buyers know the goods are en route, while sellers retain control until payment is secured.

- Documents Against Acceptance (DA): With DA, buyers accept time drafts, typically for 30, 60, or 90 days. This method is often used in established relationships, as it involves greater trust but also increases risks for sellers. The 30-70 payment structure is a common example, where buyers pay 30% upfront and the remaining 70% upon delivery or inspection. This approach works well for large orders with less familiar partners.

- Letters of Credit (LC): LCs involve banks as intermediaries, guaranteeing payment once all required documents are presented. While this significantly reduces the risk of non-payment, it also adds complexity and costs.

- Open Account Terms: Similar to domestic net-30 arrangements, open accounts allow buyers to pay after receiving goods. However, the risks are much higher in international trade, making this option suitable only for long-standing, trusted relationships.

Risk Levels

International transactions carry far greater risks than domestic ones, and businesses need to be prepared for these challenges.

- Currency Exchange Fluctuations: Exchange rates can swing dramatically, impacting profit margins. For instance, a 5% currency fluctuation on a $100,000 deal could mean a $5,000 difference in proceeds.

- Geopolitical Instability: Political events, regulatory changes, or sanctions can disrupt payments or even freeze assets without warning, creating uncertainty.

- Processing Delays: Longer transaction times mean extended periods of risk exposure. With multiple financial institutions involved, there are more opportunities for errors or delays.

- Legal and Cultural Barriers: International deals require navigating unfamiliar legal systems, languages, and business practices. This makes due diligence harder and dispute resolution costlier and more time-consuming. Fraud detection also becomes more challenging in this environment.

Documentation Requirements

International payments come with a mountain of paperwork that far exceeds what’s required for domestic transactions. Essential documents include commercial invoices, bills of lading, certificates of origin, and insurance documents. For U.S. exporters, proper export documentation and compliance certificates are crucial to avoid delays and penalties.

For payment methods like LCs and Documentary Collections, documentation must be flawless. Even small errors can lead to payment delays. In fact, documentation errors are one of the top reasons for delays in international trade payments. While electronic systems are helping to streamline some processes, physical documents remain critical for customs clearance, regulatory compliance, and resolving disputes.

U.S. businesses need to ensure their documentation meets both domestic export requirements and the import standards of the destination country. Precision and attention to detail are key to avoiding costly mistakes.

Legal and Financial Safeguards

Given the heightened risks of international trade, businesses need strong safeguards in place. Banks play a crucial role in methods like Letters of Credit and Documentary Collections, acting as intermediaries to verify documents and guarantee payments once contract terms are fulfilled. While this adds security, it also increases costs and processing times.

Trade credit insurance is another essential tool. It protects businesses from non-payment risks, whether due to buyer bankruptcy, extended defaults, or political upheaval that could impact entire countries. Specialized products like Accounts Receivable Insurance are designed specifically for cross-border transactions.

To manage currency risks, businesses often turn to hedging strategies. Clear contractual terms that outline dispute resolution mechanisms also provide a legal framework for addressing conflicts. U.S. companies benefit from working with financial institutions experienced in international trade and maintaining relationships with legal experts familiar with cross-border commerce.

For new buyers, start with conservative terms like TT or LC. As trust develops, you can transition to more flexible options like DP or DA. Regular risk assessments and ongoing monitoring of customer financial health are critical, especially when dealing with international partners, where information can be harder to verify.

sbb-itb-2d170b0

Advantages and Disadvantages

When comparing domestic and international payment terms, key differences emerge in areas like cash flow, risk, and complexity. Here’s a breakdown:

| Aspect | Domestic Payment Terms | International Payment Terms |

|---|---|---|

| Risk Level | Lower risk of payment defaults, no exposure to currency fluctuations, minimal fraud risk | Higher risk of payment defaults, exposure to currency changes, increased fraud risk |

| Processing Time | Quick settlements (1–3 business days), straightforward banking processes | Slower settlements (5–15 business days), multiple intermediary steps |

| Transaction Costs | Lower fees, no currency conversion charges, minimal intermediary expenses | Higher fees, currency conversion costs, and additional bank fees |

| Payment Flexibility | Flexible terms like net 30/60/90 and open account options | Limited flexibility, often requiring secure methods like Letters of Credit or advance payments |

| Regulatory Compliance | Simple compliance under one regulatory framework | Complex compliance across multiple regulatory systems |

| Enforcement | Easy access to local legal systems for dispute resolution | Costly and challenging cross-border legal enforcement |

| Documentation | Minimal paperwork (invoices, purchase orders) | Extensive documentation (commercial invoices, bills of lading, certificates of origin) |

The table highlights these differences, which we’ll explore further below.

Domestic Payment Terms: Simplicity and Cost Efficiency

Domestic payment terms are straightforward and cost-effective, especially for businesses operating within the United States. A unified legal framework ensures predictable dispute resolution, while the absence of currency risks eliminates a source of financial uncertainty. Additionally, lower transaction fees help businesses maintain healthier profit margins. Payments are processed quickly – typically within 1 to 3 business days – making cash flow management much easier.

International Payment Terms: Opportunities with Added Complexity

On the other hand, international payment terms open doors to larger markets and potential profits. Businesses can access regions with less competition and tailor payment methods to fit specific relationships. Options range from conservative methods like Telegraphic Transfers to more flexible arrangements like Documents Against Acceptance. However, these opportunities come with significant challenges.

Currency fluctuations can heavily impact profitability. For example, a 5% swing in exchange rates on a $100,000 transaction amounts to a $5,000 difference – a substantial hit to the bottom line. Processing times are also longer, taking 5 to 15 days, which can strain cash flow. Political and regulatory risks further complicate matters, with sudden policy changes, sanctions, or political instability potentially disrupting payments. Legal disputes across borders are another hurdle, often involving high costs and lengthy processes.

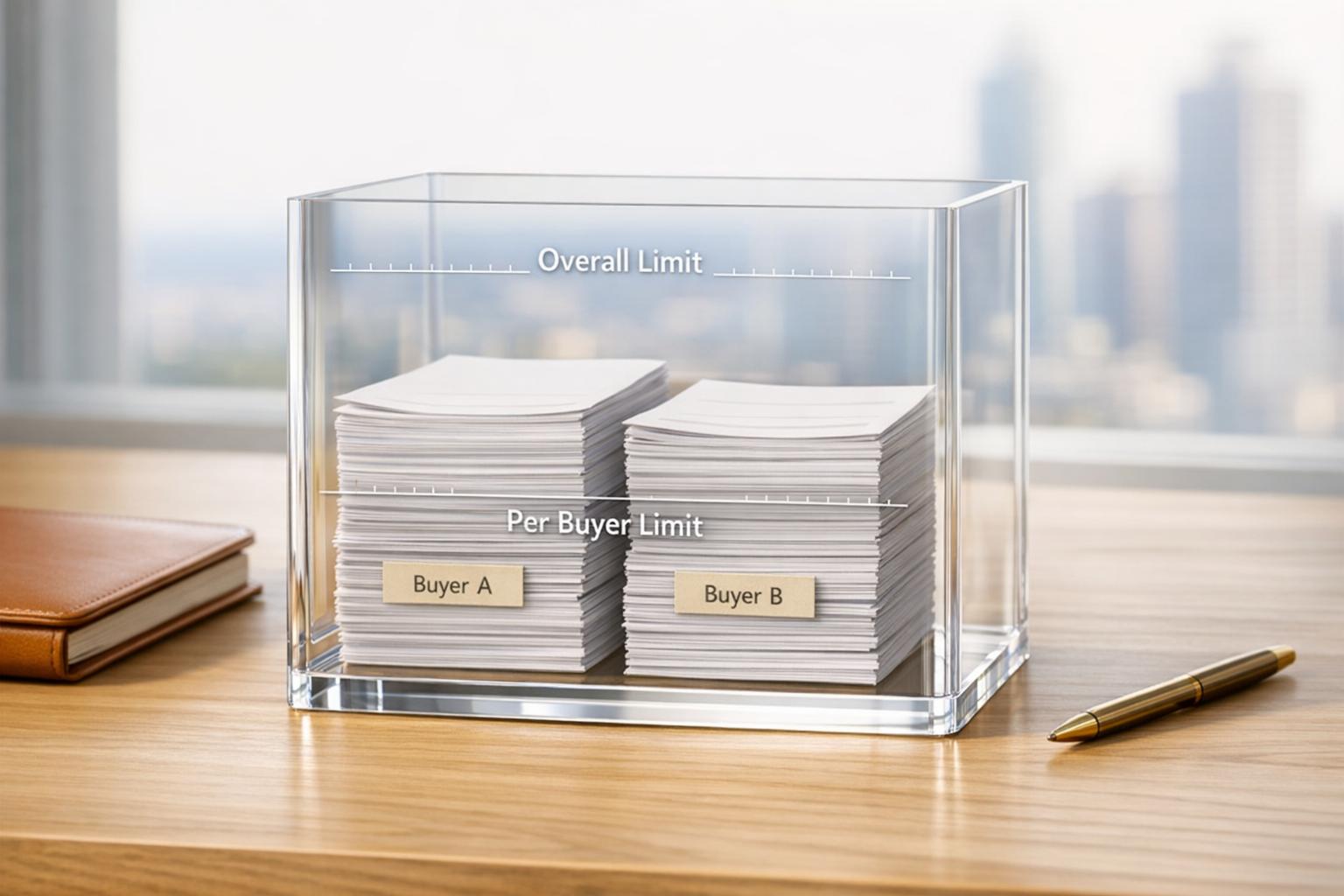

Mitigating Risk with Accounts Receivable Insurance

To manage these challenges, many businesses turn to Accounts Receivable Insurance. This coverage safeguards against non-payment due to factors like bankruptcy, extended defaults, or political disruptions. It’s particularly valuable for companies offering open account terms internationally, a practice that accounts for over 80% of global trade according to the International Trade Administration. By transferring risk to specialized insurers, businesses can confidently offer competitive terms without jeopardizing financial stability.

This insurance is especially critical for companies using flexible payment structures, such as 30–70 arrangements. It allows businesses to embrace international growth while protecting themselves from catastrophic losses, effectively balancing the simplicity of domestic operations with the opportunities of global markets.

A Balanced Strategy for Global Success

Savvy businesses often adopt a hybrid approach. For new international relationships, conservative payment terms like Letters of Credit provide security. As trust develops, these companies may transition to more flexible arrangements. Pairing this strategy with insurance coverage ensures both protection and growth potential in a global marketplace. This balance allows businesses to seize international opportunities while safeguarding their financial health.

Conclusion

Deciding between domestic and international payment terms ultimately comes down to weighing immediate cash flow needs against long-term risk. Domestic transactions offer simplicity and predictability, thanks to unified legal systems and stable currencies. On the other hand, international payments open doors to global markets and the potential for higher profits, though they come with added complexities and risks.

When determining payment terms, it’s essential to consider factors like transaction value and the history of your business relationship. For high-value international deals or new partnerships, secure methods such as letters of credit can provide critical protection. Over time, as trust develops, you might transition to more flexible arrangements. For example, while open account terms are used in over 80% of domestic B2B transactions, they are applied in fewer than 40% of international deals due to the increased risks involved. This highlights the need for strong safeguards when operating globally.

Accounts Receivable Insurance is a key tool in managing these international risks. It offers protection against non-payment caused by issues like bankruptcy, delayed payments, or political instability. This coverage ensures financial stability, particularly for businesses relying on open account terms, which can put a strain on working capital.

FAQs

What challenges do businesses face when adjusting payment terms for international trade?

When transitioning from domestic to international trade, businesses often face hurdles like non-payment, currency fluctuations, and political instability. These challenges can complicate efforts to secure timely payments and maintain steady cash flow.

To reduce the risk of financial setbacks, businesses can consider options like trade credit insurance. This type of coverage helps protect against issues such as non-payment, customer insolvency, or unforeseen political events, offering businesses more peace of mind as they venture into global markets.

What are the best ways for businesses to manage currency exchange risks in international trade?

Managing currency exchange risks is a key priority for businesses engaged in international trade. It’s all about safeguarding profitability while navigating the challenges of fluctuating exchange rates. One practical way to address this is by leveraging financial tools such as forward contracts or currency options. These tools allow businesses to either lock in exchange rates or maintain some flexibility to counter unfavorable currency shifts.

Another strategy is invoicing in your home currency. This effectively transfers the exchange rate risk to the buyer. However, this approach might not always be an option, depending on the buyer’s preferences or market norms.

Diversifying market exposure is another smart move. Relying too heavily on a single currency can make your business vulnerable, so spreading risk across different markets is a safer bet. For added peace of mind, consider solutions like Accounts Receivable Insurance. This type of coverage not only protects against non-payment risks but also helps shield your business from financial losses tied to currency fluctuations or political instability in global markets.

How does Accounts Receivable Insurance help reduce risks in international trade payment terms?

Accounts Receivable Insurance is designed to protect businesses from financial setbacks in international trade. It provides coverage against risks like customer bankruptcy, late payments, or even disruptions caused by political instability. By offering protection tailored to fit your business needs, it helps maintain steady cash flow, even in unpredictable markets.

This insurance is particularly useful in global trade, where payment terms can be less certain than in domestic transactions. It gives businesses the assurance to operate confidently, knowing they’re safeguarded from potential financial losses.