Trade credit insurance helps auto businesses avoid financial losses when customers fail to pay their invoices. It covers risks like bankruptcy, payment defaults, and political disruptions, reimbursing up to 90–95% of unpaid amounts. This protection is especially useful in the automotive sector, where long payment terms (60–90 days) and reliance on a few key customers can create cash flow problems. By securing receivables, businesses can stabilize operations, improve access to financing, and confidently pursue growth opportunities, including international markets. Accounts Receivable Insurance (ARI) provides specialized solutions tailored to the unique challenges of the automotive industry, offering risk assessments, claims management, and global coverage.

What is Trade Credit Insurance? | Credit Insurance explained in 5 minutes

What Is Trade Credit Insurance

Trade credit insurance is a safety net for businesses, shielding them from financial losses when customers fail to pay outstanding invoices. This often happens due to insolvency or bankruptcy. For automotive companies, where transactions frequently involve high-value goods and extended credit terms – typically 60 to 90 days – this type of insurance can be a lifeline. It helps maintain cash flow and minimizes financial turmoil if a customer cannot meet their payment obligations.

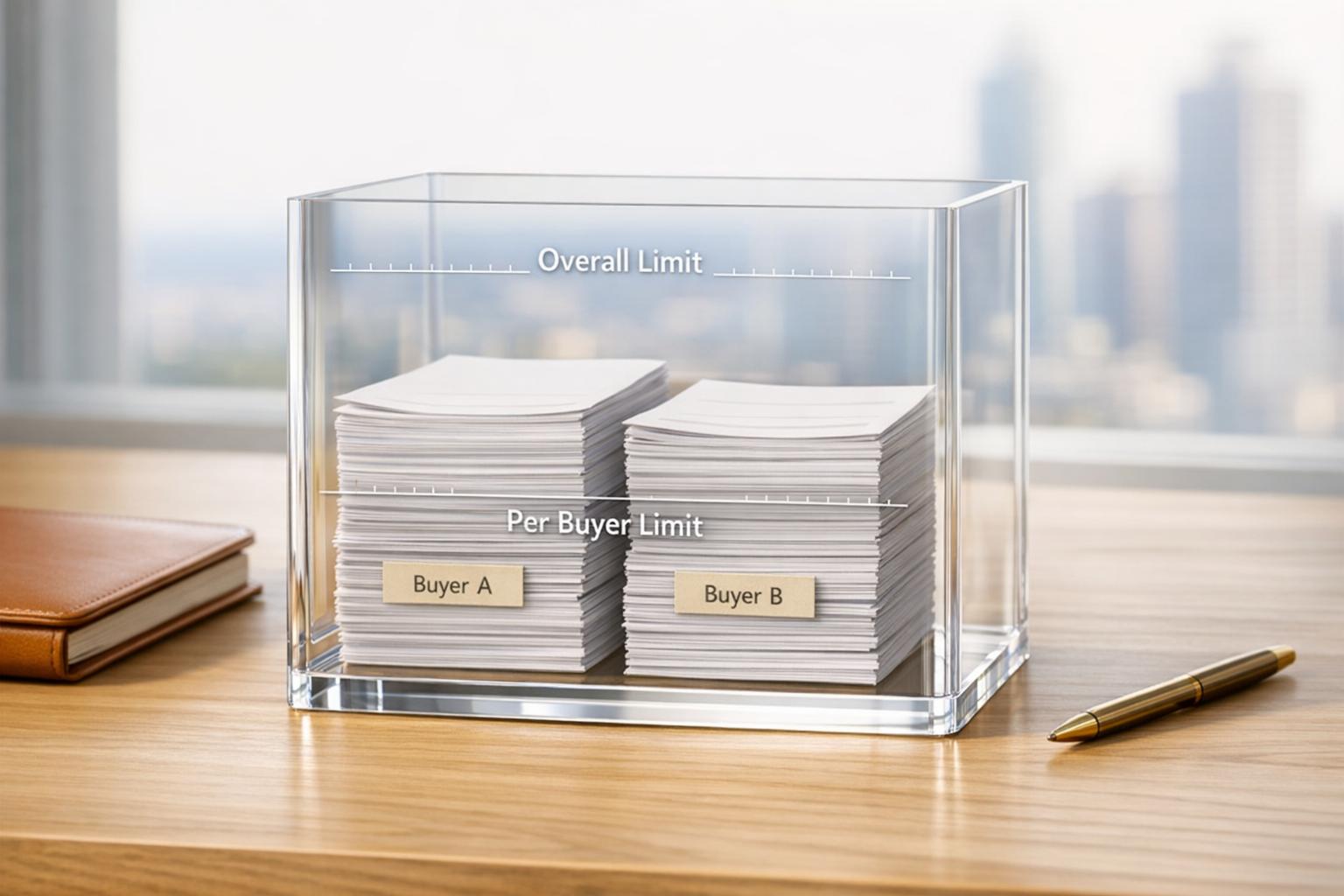

By shifting the risk of unpaid invoices to an insurer, businesses gain more than just financial protection. Insurers often assess the creditworthiness of customers and set clear coverage limits. If a customer defaults within the agreed terms, the insurer steps in to reimburse most of the unpaid amount, typically after confirming the default.

Trade Credit Insurance Definition

Trade credit insurance is a financial tool designed to protect businesses from losses caused by unpaid invoices. It covers situations like customer insolvency, bankruptcy, or extended delays in payment, often reimbursing 90–95% of the outstanding amount. The cost of this protection is relatively modest, with premiums averaging about 0.25% of the annual coverage amount.

For instance, imagine an auto parts supplier extending $1 million in credit to a customer with net 90 payment terms. If the customer declares bankruptcy, the insurer might cover up to $900,000 of the unpaid amount. This makes trade credit insurance an effective way to manage credit risks without derailing business operations.

Main Features of Trade Credit Insurance

Trade credit insurance comes with several key features that make it a valuable resource for businesses:

- Insolvency Coverage: Protects against financial losses when customers go bankrupt or are otherwise unable to pay.

- Protracted Default Coverage: Covers situations where payments are significantly overdue, often between 90 and 180 days past the due date.

- Political Risk Coverage: Helps safeguard international transactions from losses caused by issues like currency restrictions, government actions, or trade interruptions.

Beyond financial reimbursement, many policies also include support services such as regular credit assessments and assistance with debt collection. However, there are limits to what trade credit insurance covers. It typically excludes losses from payment disputes, bad faith agreements, sales to buyers in high-risk regions, or situations where credit terms were extended beyond what was initially agreed. Additionally, it won’t cover non-payment caused by a buyer’s unwillingness to pay rather than their inability to do so. These limitations are especially important to consider for automotive businesses, as they often deal with unique credit risks.

What Is Accounts Receivable Insurance

Accounts Receivable Insurance (ARI) builds on the foundation of trade credit insurance by offering tailored solutions and broader risk management options. These policies are designed to address specific industry challenges, providing customized coverage, in-depth risk assessments, and proactive claims handling.

For automotive businesses, ARI offers a targeted approach to managing credit risks, whether operating domestically or in international markets. By leveraging a global network of credit insurance carriers, ARI ensures that auto businesses can navigate the complexities of credit management with confidence. For more information, visit Accounts Receivable Insurance.

Financial Risks Auto Businesses Face

The automotive industry comes with its own set of financial challenges, which can significantly impact cash flow and overall business stability. Recognizing these risks is key to protecting your operations with the right insurance solutions. Let’s take a closer look at how long payment cycles, supply chain dependencies, and international uncertainties create financial vulnerabilities.

Long Payment Terms and Cash Flow Problems

In the automotive world, businesses often face extended payment cycles ranging from 30 to 120 days. This delay creates a gap between when you incur expenses and when you actually receive payment for your work. For instance, after delivering parts to a dealership or completing services for a manufacturer, you might wait months before seeing any revenue.

These long waits can lead to serious cash flow issues. Even as you wait for outstanding invoices to be paid, operational costs like payroll, inventory restocking, and facility expenses don’t pause. Alarmingly, cash flow problems are responsible for about 82% of business bankruptcies, often triggered by customers failing to pay on time. Accounts receivables typically make up more than 40% of a company’s assets, so a few unpaid invoices can quickly push even a profitable business into financial trouble.

For example, a delayed payment of $500,000 could force you to seek emergency financing or delay payments to your own suppliers, creating a ripple effect of financial strain across your operations.

Supply Chain and Customer Concentration Risks

Many automotive businesses rely heavily on a small number of major customers, with 50% to 60% of revenue often tied to just a few accounts. This creates a precarious situation: if one key customer defaults, it can severely impact your revenue stream.

The interconnected nature of the automotive supply chain makes these risks even more pronounced. During the 2008 financial crisis, for example, several major automakers faced bankruptcy, triggering payment delays and defaults across their supplier networks. This left many smaller auto businesses facing significant losses, particularly those without trade credit insurance. On top of that, about 10% of invoices in B2B sectors, including automotive, end up delinquent. For businesses with high customer concentration, even one delinquent invoice can represent a large chunk of expected revenue.

International Business and Political Risks

While relying on a few domestic customers poses challenges, expanding into international markets brings its own set of risks. Currency fluctuations, trade restrictions, and political instability can disrupt payments and lead to financial losses.

Political events, in particular, can create sudden and unexpected obstacles. Currency controls, trade sanctions, changes in import/export regulations, or civil unrest can prevent even reliable customers from meeting their payment obligations. Additionally, economic volatility in foreign markets can complicate matters. For example, a sudden drop in a foreign currency’s value might make your products unaffordable for international clients, leading to canceled orders and unpaid invoices. Unlike domestic payment issues, international collections are often more complex and expensive due to legal and jurisdictional challenges.

In 2023, U.S. corporate bankruptcies hit their highest level in 13 years, reflecting growing risks of payment defaults across industries. For automotive businesses operating globally, this trend – combined with political and economic instability – creates a challenging environment. Trade credit insurance can provide much-needed protection, ensuring stability when customers fail to pay due to insolvency, political events, or economic disruptions.

These risks highlight the importance of customized trade credit solutions to safeguard the financial health of automotive businesses. By addressing these vulnerabilities head-on, businesses can better navigate the challenges of this complex industry.

How Trade Credit Insurance Protects Auto Businesses

Trade credit insurance tackles the financial challenges auto businesses face by offering three key layers of protection. Together, these benefits help shield your operations from credit-related risks.

Coverage for Non-Payment and Insolvency

One of the primary ways trade credit insurance helps is by covering losses when customers fail to pay their invoices. Typically, it reimburses up to 90–95% of the outstanding invoice amount if a customer defaults due to bankruptcy, insolvency, or prolonged non-payment. For example, if a dealership owing you $500,000 declares bankruptcy, the insurance compensates you for the covered amount after deductibles. It also extends coverage to political risks, safeguarding international transactions when government actions or currency restrictions block payments.

Here’s a practical example: An auto parts supplier received an early warning from their insurer about a key client’s financial troubles. Armed with this information, the supplier adjusted credit terms and avoided a significant loss.

Improving Cash Flow and Supporting Financing

Trade credit insurance does more than just cover losses – it plays a vital role in improving financial stability. By securing receivables, businesses can enjoy steadier cash flow and even access better financing terms, such as higher credit limits and lower interest rates. Plus, the insurance premiums are tax-deductible.

For auto businesses managing long payment cycles – often ranging from 30 to 120 days – this stability is crucial. It allows you to confidently invest in inventory, expand services, or explore growth opportunities without the constant worry of cash flow interruptions.

Risk Assessment and Credit Decisions

Another advantage of trade credit insurance is the access it provides to professional credit risk assessments. Insurers use vast financial databases and real-time business intelligence to evaluate creditworthiness. This third-party analysis helps you make informed decisions about new customers or adjust credit limits as needed. Continuous monitoring also alerts you to potential risks early on.

For instance, ARI offers customized risk assessments tailored to both domestic and international markets. Their services include claims management and access to a global network of credit insurance carriers. This professional support ensures that your credit decisions are backed by reliable data, which is especially valuable when entering new markets or taking on higher-risk ventures.

sbb-itb-2d170b0

How to Set Up Trade Credit Insurance for Your Auto Business

Setting up trade credit insurance involves a straightforward three-step process: understanding your risks, choosing a policy tailored to your needs, and integrating it with your credit management system. Let’s break it down.

Evaluating Your Risk Profile

Before reaching out to an insurer, take a deep dive into your business’s exposure to credit risks. Start by analyzing your customer base. Relying heavily on just a few clients can significantly increase the risk of financial loss if one of them defaults. For instance, in 2022, a Michigan-based auto parts supplier with $25 million in annual sales lost $1.2 million after a major customer went bankrupt.

Next, review your payment terms and historical payment patterns. Many auto businesses offer 30- to 120-day payment terms, which can leave them vulnerable to delayed or missed payments. Also, calculate how much of your annual sales are made on credit versus cash. If your business generates more than $10 million in annual sales and has substantial receivables, trade credit insurance could be a smart move.

Don’t forget to factor in your geographic exposure. If you’re operating internationally or considering new markets, you’ll want coverage for risks like political instability or currency restrictions. For example, an automotive manufacturer expanding into Latin America in 2023 used trade credit insurance to safely extend $3 million in open credit. This decision boosted their regional sales by 18%. Keep in mind that, on average, about 7% of B2B invoices turn into bad debt, which can seriously disrupt cash flow.

Once you’ve outlined these risks, you’ll be ready to choose a policy that addresses your specific vulnerabilities.

Choosing the Right Policy

Trade credit insurance isn’t a one-size-fits-all product, especially in the automotive sector, where businesses often face unique challenges. Depending on your customer base and growth plans, you might need domestic coverage, international coverage, or both.

"Accounts receivable (trade credit) insurance is not a one-size-fits-all solution; we customize a policy to match your business model and risk tolerance", explains Accounts Receivable Insurance.

Most policies cover 90–95% of unpaid invoices caused by customer insolvency or prolonged payment delays. For U.S. businesses, premiums generally range from 0.1% to 0.5% of insured turnover. For example, a company with $10 million in annual credit sales could expect annual premiums between $10,000 and $50,000.

It’s a good idea to work with a broker who specializes in the automotive industry. They can help you select the right endorsements and set appropriate coverage limits. Many insurers assign individual credit limits for each customer based on financial analysis, ensuring your most valuable accounts are well-protected.

"Our job is to select the endorsements that benefit you, not the insurance company", notes a representative from Accounts Receivable Insurance.

Once your policy is in place, it’s essential to align it with your overall credit management strategy.

Combining Insurance with Credit Management

Trade credit insurance works best when it’s integrated into your broader credit management processes. Many insurers provide tools like real-time credit ratings and business intelligence, which can guide your daily credit decisions.

Set up procedures to report payment issues to your insurer as soon as they arise. For example, if a dealership delays payment, notifying your insurer early can help initiate intervention or a claim. These practices not only enhance your credit control but also help you establish appropriate credit limits and terms.

"We act as your advocate in the complex world of credit insurance. We leverage our expertise and relationships with multiple trade credit insurance companies to find the right coverage for your business at the best possible price", explains Accounts Receivable Insurance.

Additionally, aligning your internal credit policies with your insurer’s requirements – like keeping customer credit information up to date and following specific claims procedures – can make a big difference. Trade credit insurance can also improve your access to financing. Banks and lenders often view insured receivables as lower-risk, which could help you secure larger loans or better interest rates. For instance, the Michigan auto parts supplier mentioned earlier was able to obtain a $5 million line of credit at a reduced interest rate after implementing its trade credit insurance policy.

Growth Benefits of Trade Credit Insurance

Trade credit insurance does more than just safeguard accounts receivable – it actively fuels growth for automotive businesses. By mitigating financial risks, it empowers companies to explore new markets and seize high-value opportunities with greater confidence.

Expanding Into New Markets

Entering unfamiliar markets can feel like a leap into the unknown, especially when it comes to assessing buyer creditworthiness. Trade credit insurance simplifies this process by offering detailed credit evaluations and protection against potential non-payment. This layer of security allows businesses to approach new markets with clarity and assurance.

Insurers conduct thorough underwriting, leveraging credit histories and transaction data to evaluate risks. These insights help businesses make informed decisions about which opportunities to pursue and which to avoid, turning uncertainty into actionable intelligence.

"Accounts Receivable (Trade Credit) Insurance protects your company’s receivables from non-payment due to bankruptcy, slow payment and political risks."

– AccountsReceivableInsurance.net

For companies expanding internationally, trade credit insurance provides additional safeguards against political risks, currency restrictions, and trade disruptions. This protection enables auto dealers and suppliers to confidently offer extended payment terms – 30, 60, or even 120 days – to new customers in both domestic and global markets.

Competitive Advantage in Bidding

In the competitive automotive industry, the ability to offer favorable payment terms can make or break a deal. Trade credit insurance gives businesses the confidence to extend net 60, 90, or even 120-day terms to fleet operators, government agencies, and corporate clients – often tipping the scales in their favor during bidding processes.

This insurance-backed flexibility allows businesses to handle substantial credit exposure, sometimes amounting to millions of dollars in accounts receivable, without taking on excessive financial risk. It also signals strong financial management and risk assessment capabilities, enhancing credibility during negotiations.

By relying on the insurer’s creditworthiness analysis, businesses can tailor payment terms to individual clients while keeping their risk exposure manageable. This not only strengthens their competitive position but also opens the door to exploring opportunities that might otherwise seem too risky.

Confidence in Pursuing Higher-Risk Opportunities

Trade credit insurance doesn’t just help businesses compete – it also enables them to take calculated risks. By covering insolvency, payment defaults, and political risks, it allows companies to engage with higher-risk customers, such as those in economically unstable regions, new dealerships with limited credit history, or industries facing financial challenges.

"It’s particularly valuable for companies with a high concentration of risk in their customer base, those expanding into new markets, or those operating in industries prone to economic volatility."

– AccountsReceivableInsurance.net

This protection extends beyond direct losses, covering costs like loan interest on receivables-backed financing and collection expenses. For businesses with annual sales exceeding $10 million, this can be a game-changer when entering new markets or targeting customer segments with higher profit margins but greater payment uncertainties.

Additionally, companies with a heavy reliance on a few major customers – where 50–60% of revenue comes from a small group – can use trade credit insurance to diversify without overexposing themselves to financial risk. Insured receivables also improve a company’s standing with lenders, making it easier to secure financing for growth initiatives rather than tying up resources to cover potential bad debts.

"With our specialized trade credit insurance solutions, you can safeguard your cash flow, expand into new markets with confidence, and secure your business’s financial future."

– AccountsReceivableInsurance.net

Conclusion: Protecting Your Auto Business with Trade Credit Insurance

Trade credit insurance acts as a financial safety net for automotive businesses operating in today’s unpredictable market. The automotive sector is especially prone to risks that can disrupt cash flow, posing serious challenges even for well-established companies.

This type of insurance steps in to cover unpaid invoices when customers default, declare insolvency, or face political risks. But it’s not just about recovering losses – it helps stabilize cash flow, enhances access to financing, and supports strategic growth opportunities.

One standout benefit is the tax advantage: premiums are fully deductible, unlike bad-debt reserves that can lock up capital without offering any tax relief. For businesses with annual revenues exceeding $10 million, this becomes even more crucial as transaction volumes and customer relationships grow increasingly intricate.

Adopting trade credit insurance should be a calculated move. By assessing risk exposure, understanding customer concentration, and planning for growth, businesses can create a solid foundation for long-term success. Whether you’re supplying auto parts to dealerships or venturing into international markets, this insurance transforms uncertainty into a chance for growth.

Your accounts receivable are likely your largest and most vulnerable asset. Protecting them isn’t just about preventing financial losses – it’s about ensuring your business has the stability to grow confidently in a volatile environment. By incorporating trade credit insurance, your auto business safeguards not only its receivables but also its ability to thrive in the future.

FAQs

How does trade credit insurance help protect automotive businesses from financial risks?

Trade credit insurance offers automotive businesses essential financial security by covering losses from unpaid invoices caused by customer insolvency, non-payment, or other unexpected events. This helps businesses maintain steady cash flow and shields their profits, even during tough economic times.

Given the nature of the automotive industry – where large transactions and extended payment terms are the norm – this type of insurance plays a key role in reducing financial risks. It also empowers businesses to explore new markets or partner with unfamiliar clients, providing peace of mind that they’re protected against potential payment challenges.

How can auto businesses assess their financial risks before setting up trade credit insurance?

To manage financial risks effectively, auto businesses should begin by examining their accounts receivable. This means pinpointing areas where there might be a risk of non-payment or customer insolvency. Key factors to evaluate include a customer’s payment history, their credit reliability, and the current state of the market. Partnering with knowledgeable trade credit insurance brokers can be a smart move – they can help you assess these risks thoroughly and design a policy that shields your business from potential financial setbacks. With expert advice, you can ensure your coverage is tailored to fit your unique needs and business objectives.

How does trade credit insurance help auto businesses secure financing and expand into global markets?

Trade credit insurance plays a crucial role in supporting auto businesses by safeguarding their cash flow from risks like customer insolvency or non-payment. With this protection in place, companies can operate with greater financial confidence. Plus, insurers often provide detailed risk evaluations, which can be a valuable asset when seeking loans or credit lines – lenders tend to appreciate the added security these assessments offer.

Another advantage of trade credit insurance is its ability to encourage businesses to expand into international markets. It helps mitigate risks associated with foreign customers, such as political unrest or economic uncertainty. This means auto businesses can pursue growth opportunities abroad while keeping their accounts receivable secure and ensuring their financial foundation remains strong.