Accounts receivable insurance (ARI) is a financial safety net that protects businesses against unpaid invoices. The structure and design of your policy can directly influence how effectively your business handles customer defaults, bankruptcies, or other financial disruptions. Here’s what you need to know:

- Customized Policies vs. Standard Policies: Customized policies are tailored to your business’s specific risks, while standard policies often take a one-size-fits-all approach. The former offers flexibility but may require more time and management; the latter is simpler but may leave gaps in coverage.

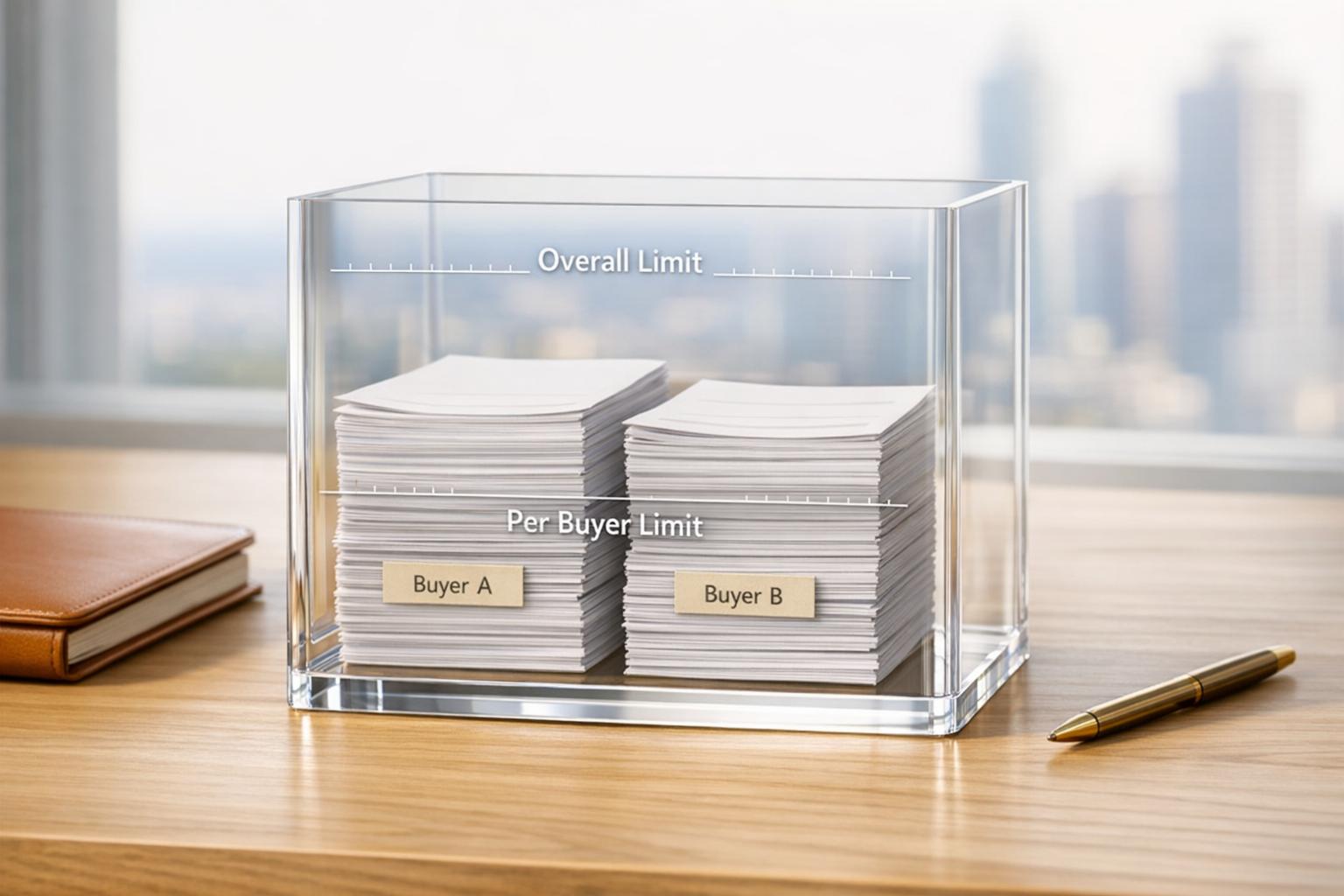

- Coverage Limits: Factors like customer creditworthiness, geographic location, and industry risks play a role in determining how much coverage you’ll receive.

- Claims Process: A clear and efficient claims process ensures faster access to funds during financial challenges.

- Risk Management: Proactive measures like credit monitoring and early intervention can prevent small issues from escalating.

Key takeaway: A well-structured policy, combined with strong internal credit controls, ensures better financial stability. Businesses should evaluate their needs carefully and consider expert guidance for tailored solutions.

1. Accounts Receivable Insurance (ARI)

Policy Structure and Coverage Scope

Accounts Receivable Insurance (ARI) is designed to safeguard businesses from the risks of unpaid invoices, offering a structured approach to protect against financial setbacks. The policy framework focuses on minimizing exposure to bad debt, especially when customers face financial challenges.

ARI covers a range of scenarios, including bankruptcy, insolvency, and geopolitical risks that can disrupt international trade. The policy’s structure adapts coverage limits based on detailed risk evaluations, ensuring that businesses are adequately protected. Unlike standard policies that often impose waiting periods for claims, ARI customizes timelines to align with industry standards and payment cycles. This ensures a more reliable cash flow during periods of financial uncertainty.

Transparency is a key feature of ARI. Coverage limits and percentages are clearly outlined for different customer groups and transaction types, reducing confusion and simplifying the claims process.

Factors Influencing Coverage Limits

ARI tailors its coverage limits to match the specific risks your business faces, creating a highly personalized safety net. While annual sales are a starting point, other factors play a crucial role in determining limits:

- Customer Creditworthiness: ARI evaluates the financial stability of your key customers. Long-term, reliable clients may qualify for higher coverage, while newer or higher-risk customers are assigned more conservative limits.

- Geographic Diversity: Coverage limits also account for the economic and political stability of the regions where your customers operate. Businesses in stable markets with strong legal systems typically receive higher limits compared to those in more volatile regions.

- Industry-Specific Risks: Industries prone to frequent market fluctuations may require stricter limits. ARI incorporates these factors into its policies, ensuring your coverage remains relevant as market conditions evolve.

Risk Mitigation and Financial Stability

Beyond its robust policy structure, ARI actively helps businesses manage risks before they escalate. When early signs of financial distress are detected, ARI steps in with solutions like collection assistance, payment plan negotiations, or adjustments to credit limits. These proactive measures help prevent small issues from turning into significant financial losses.

The claims process is designed to be efficient and straightforward. Clear documentation requirements and prompt assessments mean businesses can access funds quickly, maintaining steady cash flow during difficult times.

As your business grows or enters new markets, ARI offers flexible endorsements that allow for adjustments in coverage terms, limits, or additional protections – without requiring a complete overhaul of your policy. Continuous monitoring of customer risks ensures timely updates, such as revised credit terms or added security measures, to mitigate potential losses.

2. Standard Accounts Receivable Insurance Policies

Policy Structure and Coverage Scope

Standard accounts receivable insurance policies often take a one-size-fits-all approach, which can leave businesses with gaps in their coverage. These policies generally provide blanket protection for outstanding receivables but fail to consider the unique risks tied to specific customers or the challenges faced by different industries. For example, they may impose waiting periods or exclude payments that are consistently delayed, creating a mismatch with a company’s payment cycles and cash flow requirements.

Geographic restrictions are another common limitation. Many standard policies reduce coverage for international operations or exclude regions labeled as high risk. Even when political risk coverage is included, it often comes with separate deductibles and a narrower scope. Additionally, annual coverage limits are typically rigid, which can be problematic during seasonal sales spikes or periods of rapid business growth. This generalized approach is far less effective compared to policies tailored to a company’s specific needs.

Factors Influencing Coverage Limits

Coverage limits under standard policies are influenced by several restrictive factors. For instance, these policies often use historical sales data and broad industry classifications to determine limits, ignoring individual customer risk or payment history. Limits are frequently calculated as a multiple of monthly sales, which may not accurately reflect a company’s true exposure. Credit scoring relies heavily on third-party data, which may not capture the nuances of customer relationships or industry-specific payment behaviors. Similarly, industry risk multipliers are applied broadly, which can result in overly conservative limits for stable businesses or inadequate protection for fast-evolving industries.

Seasonal fluctuations add another layer of complexity. Consider a retailer that generates most of its revenue during the holiday season. A standard policy based on average monthly sales might not provide enough coverage during these peak periods, leaving the business vulnerable when it matters most.

Risk Mitigation and Financial Stability

When it comes to managing risk, standard policies often take a reactive approach. Instead of focusing on prevention, these policies rely on monitoring after problems arise. The claims process can be cumbersome, requiring extensive documentation and multiple layers of approval. Businesses must demonstrate significant debt collection efforts before their claims are even considered, which can delay much-needed payments.

Some providers include basic credit monitoring alerts, but these are typically limited in scope and fail to offer the in-depth analysis needed to detect emerging risks. Adjustments to coverage – like updating customer credit limits or changing terms – usually involve lengthy applications and underwriting reviews, making it difficult for businesses to respond quickly to changing circumstances.

From a financial perspective, standard policies emphasize predictable premiums, which can be appealing for budgeting. However, this predictability often comes at the cost of flexibility. As a business grows or evolves, these rigid policies may leave critical gaps in coverage, exposing the company to unnecessary risks during pivotal times. Unlike tailored solutions that adapt to a business’s specific needs, standard policies often fall short when it comes to providing comprehensive protection.

What is credit insurance and how does it work? | Atradius

sbb-itb-2d170b0

Advantages and Disadvantages

When shaping your accounts receivable risk strategy, it’s essential to weigh the pros and cons of different policy options. Each approach offers specific benefits and challenges that influence a company’s financial security and operational flexibility. This analysis aligns with ARI’s commitment to creating personalized coverage solutions.

Standard Policies: Predictability with Trade-Offs

Standard policies provide predictable budgeting, with premiums generally ranging from 0.1% to 1% of covered receivables. This consistency simplifies financial planning and can be particularly appealing for businesses seeking straightforward solutions. However, relying solely on these policies may foster a false sense of security. Companies might assume insurance fully replaces sound credit practices, potentially weakening internal credit controls. Additionally, the standardized nature of these policies may leave gaps in coverage, especially for businesses with unique customer bases or seasonal fluctuations.

Customized Policies: Flexibility with Complexity

Customized policies, on the other hand, offer the flexibility to tailor coverage to your business’s specific needs. These policies allow businesses to adjust coverage limits, focus on key customers, choose higher deductibles, or bundle with other risk management tools. This adaptability ensures the policy aligns closely with the risks your company faces. However, customization often brings added complexity, requiring more administrative effort and potentially leading to higher premiums for specialized coverage.

Shared Limitations

Both types of policies share some common drawbacks. For instance, insurance typically covers only 80% to 95% of eligible losses, which underscores the importance of maintaining strong credit management practices. Policies often exclude losses tied to customer disputes, contractual disagreements, or political risks, and they may impose waiting periods before claims can be filed. Additionally, navigating the claims process can be challenging, requiring careful documentation and adherence to insurer guidelines.

Key Differences at a Glance

To help you decide, the table below highlights major distinctions between standard and customized policies:

| Feature | Standard Policies | Customized Policies |

|---|---|---|

| Premium Cost | 0.1% to 1% of covered receivables | Variable, potentially higher |

| Coverage Flexibility | One-size-fits-all; may have gaps | Tailored to specific business needs |

| Implementation Speed | Faster, streamlined processes | Slower, due to detailed risk assessments |

| Administrative Complexity | Lower, standardized procedures | Higher, requiring ongoing management |

Maximizing Benefits with Proactive Measures

The best way to balance the advantages and disadvantages of any policy is to combine insurance with accounts receivable automation. While insurance protects against unavoidable losses, automation helps prevent payment issues from occurring in the first place. It’s also critical to maintain strong internal credit controls – insurance is designed to complement, not replace, diligent credit practices.

To ensure your policy works effectively, businesses should regularly assess their accounts receivable portfolios. This includes identifying key customers, analyzing payment histories, evaluating concentration risks, and monitoring aging reports for vulnerable receivables. Training your accounts receivable and finance teams to align with insurer requirements – such as periodic reporting and flagging unusual customer behavior – can also streamline claims processing when needed.

These proactive steps, combined with well-structured policy terms like those offered by ARI, can help safeguard cash flow and support long-term financial stability.

Conclusion

The way you design your insurance policy directly impacts how well your business weathers financial challenges. A well-thought-out policy structure is critical for ensuring effective coverage, managing risks, and securing long-term financial stability for businesses across the U.S.

This discussion highlights the trade-offs between standard insurance policies and customized options. Standard policies offer predictable premiums, making budgeting easier, but they often fall short in addressing unique risks or specific customer concentration issues. These gaps can leave businesses exposed to unexpected vulnerabilities.

On the other hand, customized policies require a deeper dive into risk assessment and management but provide tailored protection. By adjusting coverage limits, prioritizing key customers, and seamlessly integrating with your existing risk management strategies, these policies create a stronger financial buffer.

It’s important to remember that insurance alone isn’t a cure-all. A well-designed policy should complement strong internal credit controls and effective accounts receivable management. Together, these elements form a comprehensive approach to minimizing losses and safeguarding your business.

For businesses looking to strengthen their financial resilience, partnering with experts like Accounts Receivable Insurance can make all the difference. Their personalized policy designs, thorough risk assessments, and access to a global network of credit insurance carriers provide tailored solutions that align with your specific needs. These services work hand-in-hand with strong internal credit practices, reinforcing the importance of strategic risk management.

Think of accounts receivable insurance as a key part of your risk management toolkit. By investing in well-structured policies, maintaining disciplined credit practices, and regularly reviewing your receivables portfolio, your business can face economic uncertainties with greater assurance and control.

FAQs

How can I decide if a customized or standard accounts receivable insurance policy is right for my business?

Deciding whether to go with a customized or standard accounts receivable insurance policy often comes down to understanding your business’s specific needs and financial priorities.

Customized policies are designed to address unique risks, such as managing high-value receivables or working with a diverse or specialized customer portfolio. These policies are particularly useful for businesses with complex operations or those engaged in international trade. While they offer targeted protection and greater flexibility, they typically come with higher costs.

Standard policies, in contrast, provide straightforward coverage, making them a good fit for smaller businesses or those with less complicated requirements. They are generally more affordable and simpler to administer, offering essential protection without the need for additional adjustments.

When deciding between the two, think about factors like your level of risk exposure, the nature of your customer base, and your budget. If your business faces specific challenges that require tailored solutions, a customized policy could be a worthwhile investment. On the other hand, if your operations are relatively straightforward, a standard policy might deliver the protection you need at a more manageable cost.

What strategies can I use with accounts receivable insurance to strengthen my financial stability?

To bolster financial stability alongside accounts receivable insurance, it’s smart to adopt proactive risk management strategies. Begin by categorizing your customers based on their credit risk profiles and conducting regular credit evaluations. This helps you spot potential challenges early on. Establishing clear and consistent credit policies can also reduce overdue payments and standardize practices across your operations.

Another key step is to refine your invoicing process. Send invoices promptly and consider offering flexible payment options to encourage customers to pay on time. Pair this with a well-structured collections process to handle late payments efficiently. When combined with the security of accounts receivable insurance, these measures can minimize credit losses, improve cash flow, and contribute to stronger financial stability for your business.

How does a company’s geographic reach impact accounts receivable insurance coverage limits?

Geographic Reach and Its Impact on Coverage Limits

The geographic reach of a company can significantly influence the coverage limits of its accounts receivable insurance. Businesses with a broad, international customer base are often seen as less risky by insurers. Why? Because spreading exposure across multiple regions helps minimize the impact of localized economic or political challenges. This broader diversification may lead to higher coverage limits.

However, companies with a customer base concentrated in a single area might face stricter coverage limits. In such cases, localized risks – like political unrest or an economic slump – pose a bigger threat to the company’s ability to collect payments. Insurers also weigh the credit stability and economic health of the regions where a business operates when determining coverage terms. This regional analysis plays a key role in shaping the insurance policy.