Credit insurance helps businesses manage credit limits by protecting against unpaid invoices due to customer defaults, bankruptcies, or political risks. It not only reduces financial exposure but also enables safer credit extension, supports market expansion, and improves cash flow stability. Here’s how it works:

- Coverage: Insurers reimburse up to 90-95% of unpaid invoices, offering financial protection.

- Risk Assessment: Insurers analyze customer creditworthiness, payment history, and market conditions to set appropriate credit limits.

- Monitoring: Advanced tools track customer behavior and market risks, allowing timely credit adjustments.

- Claims Support: Streamlined claims processes ensure businesses recover losses quickly and maintain operations.

With premiums typically below 0.5% of turnover, credit insurance is a cost-effective way to secure growth while mitigating risk. It also boosts financing opportunities, as banks value insured receivables. For U.S. businesses, especially small and medium enterprises, this safety net is critical in today’s volatile market.

What is Trade Credit Insurance? | Credit Insurance explained in 5 minutes

How to Set Credit Limits with Credit Insurance

Credit insurance plays a key role in setting effective credit limits by combining advanced risk assessment tools with expert insights. This approach helps businesses make informed and strategic credit decisions.

How Credit Insurers Evaluate Risk

Credit insurers go beyond traditional credit checks, using a broad range of data to assess risk. They analyze factors such as a customer’s payment history, detailed business credit reports, and trade references from banks and other lenders. Additionally, they incorporate data-driven insights like debt-to-income ratios and trend analysis. For international clients, insurers also consider country-specific risks, including currency fluctuations, political or economic instability, and potential trade sanctions. As one expert put it:

"Credit risk analysis is the means of assessing the probability that a customer will default on a payment before you extend trade credit."

This in-depth analysis provides insurers with a unique view of millions of buyer relationships and transactions, enabling them to develop tailored credit limit policies to suit various business needs.

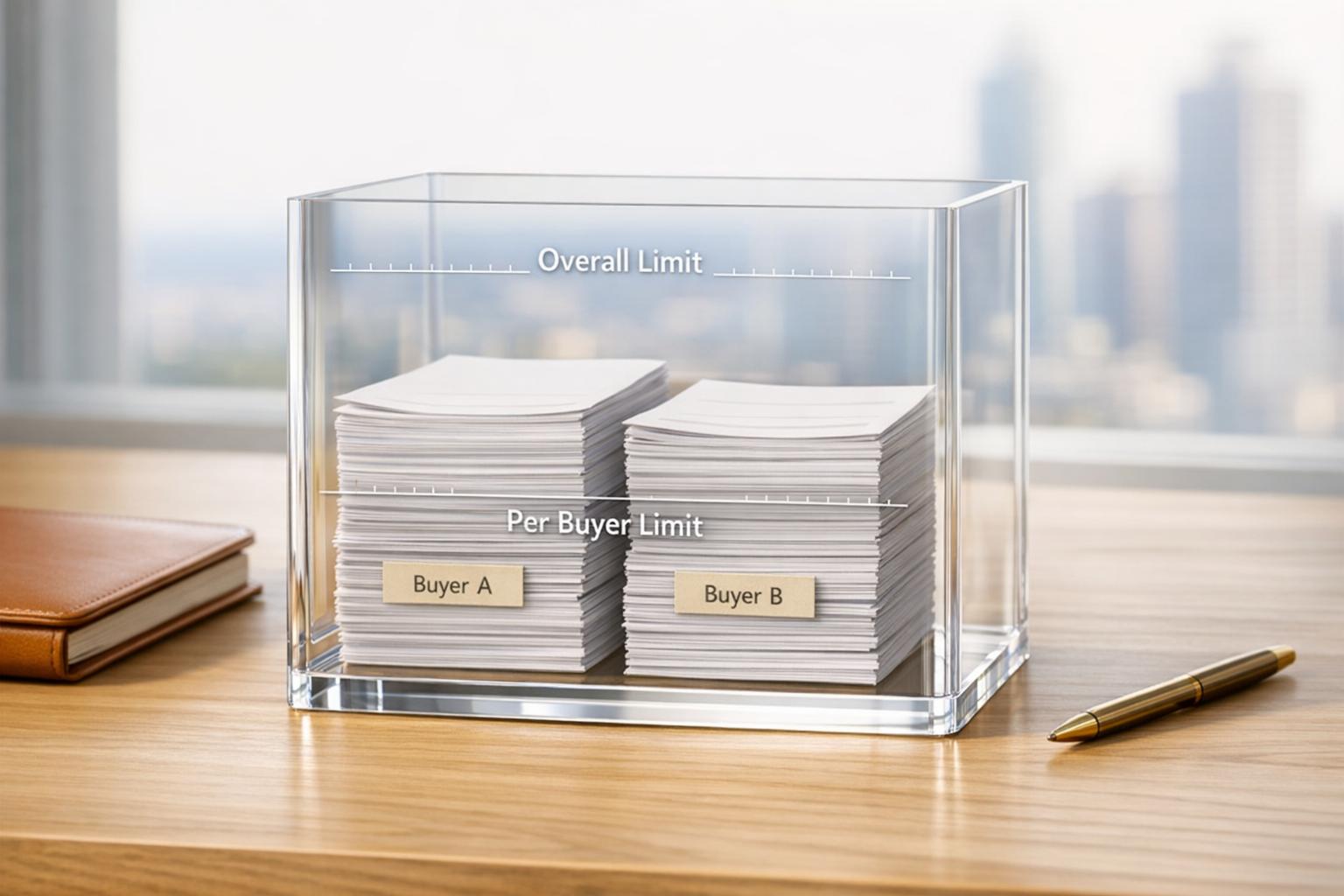

Crafting Custom Credit Limit Policies

Once the risk evaluation is complete, insurers work with businesses to create credit policies that align with their specific goals. This process involves setting clear evaluation criteria, such as using credit scorecards, accounts receivable aging reports, and collection records. Customers can also be segmented based on their payment behaviors, and measures like advance payments or guarantees can be negotiated to secure transactions further. A well-defined credit policy also establishes authorization levels and encourages collaboration across departments.

Accounts Receivable Insurance offers solutions tailored to both domestic and international challenges. These policies are particularly helpful when businesses are entering new markets or working with unfamiliar clients. Features like non-cancellable limits provide added security, ensuring customers can repay large balances in manageable installments, which reduces the risk of unpaid debts.

Confident Credit Decisions for Growth

With customized credit policies in place, businesses can confidently extend credit, even to new or higher-risk customers. Credit insurance transforms credit extension into an opportunity for growth. Coverage, which often reaches up to 90% of a debt, allows companies to expand safely into new markets and take calculated risks.

Gary Lorimer, Head of Business Development for Aon Credit Solutions, highlights this broader benefit:

"It’s known as credit insurance, but it’s more opportunity protection."

He also notes:

"We’re seeing more and more people starting to use credit insurance to access better financing rather than as a risk mitigation tool only."

Additionally, credit insurers actively monitor customers’ purchasing patterns by integrating economic intelligence, market trends, and industry-specific risk analysis. This ongoing monitoring allows businesses to adjust credit limits as conditions evolve. The U.S. trade credit insurance market, valued at $2.02 billion in 2023, is expected to grow at an annual rate of 10.6% from 2024 to 2030, underscoring the increasing importance of credit insurance as a strategic tool.

When choosing a credit insurance provider, businesses should consider factors like the insurer’s reputation, global reach, range of coverage options, and claims support.

How to Monitor and Adjust Credit Limits

Once credit limits are set, keeping a close eye on them is essential to respond effectively to changing risk profiles. Credit insurance offers advanced tools that monitor customer behavior and market conditions, helping businesses make timely adjustments to stay protected against emerging risks. By pairing tailored credit limits with ongoing monitoring, businesses can ensure their credit strategies remain aligned with shifting circumstances.

Ongoing Risk Monitoring Services

Credit insurers provide tools that continuously track the financial health of customers. These platforms often include alert systems that can be tailored to specific indicators, such as credit utilization thresholds, overdue payments, or notable changes in payment patterns. These systems also notify stakeholders about critical events reported by external agencies, like bankruptcy filings or ownership changes. Additionally, insurers grant businesses unlimited access to credit reports for their entire customer base, enabling regular credit score updates and seamless integration with ERP systems.

As highlighted by AM Best:

"Take prompt action with real-time alerts after new rating actions or when key financial indicators change significantly."

This proactive approach ensures businesses can react quickly to potential risks, keeping their credit management strategies effective and up-to-date.

Portfolio Analysis for Credit Management

Analyzing a credit portfolio is a key part of managing credit limits effectively. It helps businesses uncover risks tied to over-concentration, which can lead to significant losses during economic downturns. These risks might stem from heavy exposure to specific customers (name concentration) or industries and regions (sector concentration). Historical examples, such as the financial fallout from Enron and WorldCom in the early 2000s or the sector-specific challenges during the pandemic, demonstrate the dangers of poor diversification.

Credit insurers use advanced modeling to show how diversified portfolios can reduce risks. For instance, minimizing concentration risk has been shown to provide capital relief of up to 21%. Insurers also offer visual reporting tools that highlight payment trends and help businesses refine their credit strategies. These insights enable businesses to make informed credit adjustments, linking strategy with actionable steps.

Timely Adjustments and Notifications

Quick credit limit adjustments are critical for effective credit management. Credit insurers use automated systems to update limits in real time, ensuring swift responses to identified risks. AI-powered tools analyze buyer risk, predict defaults, and recommend credit limits, streamlining processes and improving accuracy.

Take Agilitas Group, for example. By using PolicyManager, the company automated 95% of its credit limit decisions based on trade data and payment histories. Bart De Padt, Group Credit and Billing Manager at Agilitas, shared:

"Thanks to PolicyManager, 95% of our credit limits are determined automatically."

This automation allows credit managers to focus on more complex cases while routine adjustments happen effortlessly. Real-time alerts notify managers of critical developments, such as overdue accounts or customers exceeding credit limits, enabling immediate action. Automated updates through API integrations reduce manual tasks and cut Days Sales Outstanding (DSO) by an average of 30% . This seamless system ensures that businesses can respond swiftly and stay ahead of potential risks.

Accounts Receivable Insurance provides these advanced monitoring and adjustment tools, integrating them into existing business systems. Their platform combines risk assessments with automated policy management, helping businesses maintain optimal credit exposure while reducing administrative workload.

To fully benefit from these tools, it’s important to train staff and establish clear KPIs. Doing so ensures measurable improvements in credit management effectiveness.

sbb-itb-2d170b0

How to Handle Defaults and Claims

Handling customer defaults effectively is crucial for maintaining stable cash flow. Filing claims promptly and managing them efficiently not only helps recover losses but also strengthens your overall credit management strategy. Credit insurance acts as a financial safety net, turning potential losses into manageable outcomes by offering structured recovery processes and protection.

Claim Filing

The first step in the claims process is notifying your insurer as soon as you identify a potential issue, such as a customer default or insolvency. Early communication is critical to ensure your claim meets the required filing deadlines.

Accurate and thorough documentation is key. Collect all relevant paperwork, including purchase orders, contracts, invoices, aging reports, bills of lading, proof of delivery, and collection records. This ensures you can demonstrate due diligence, which speeds up the review process.

Filing deadlines vary depending on the policy. For non-payment, you generally have up to 180 days, while insolvency cases often require filing within 10–20 days. According to Kirk Elken, Co-founder of Securitas Global Risk Solutions:

"The insured might be able to request a claim filing extension if the debtor is making payments, providing the debtor more time to pay. The claim filing extension still has to be requested in the claim filing window. If approved, this allows the insured to still file a claim if the debtor stops making payments or defaults on payment plan".

Once your claim is submitted, insurers review the documentation and assess the situation based on your account history, policy terms, and other factors like salvage opportunities or interactions with administrators. Coverage often reimburses up to 95% of the unpaid invoice amount, offering substantial financial relief.

After filing, insurers typically initiate recovery efforts, which can further stabilize your financial position.

Debt Recovery and Business Continuity

Insurers don’t just stop at compensation – they also take active steps to recover the debt. This dual approach ensures that you receive immediate financial support while they pursue additional collections. As one provider explains:

"We help you collect the right information to support a claim and keep you informed of the action we’re taking".

This process is especially beneficial during periods of economic instability. Instead of writing off bad debts entirely, businesses receive claim payments that help sustain operations and meet financial obligations. Efficient claims processing also improves working capital, ensuring that gains in Day Sales Outstanding (DSO) remain steady even when customers default. For domestic claims, businesses can typically expect funds to be disbursed within 60 days of the loss.

By transferring risk to insurers, businesses can minimize the need for large bad debt reserves, which further enhances their financial flexibility.

Reducing Bad Debt Reserves

Credit insurance significantly reduces the need to maintain large reserves for bad debts. With coverage protecting up to 95% of invoice values, businesses can lower their reserve requirements, freeing up additional working capital. This improved financial flexibility often attracts positive attention from lenders and investors.

Despite its benefits, credit insurance remains cost-effective, with premiums typically below 0.5% of a company’s turnover.

Platforms like Accounts Receivable Insurance simplify the claims process by offering streamlined filing and dedicated support throughout the recovery period. This ensures businesses can maintain steady cash flow while reducing administrative burdens.

Benefits and Considerations for U.S. Businesses

Trade credit insurance provides U.S. businesses with an essential safety net, especially in a competitive landscape where effective credit limit management is crucial. By understanding both the advantages and challenges, businesses can make smarter decisions to safeguard their financial stability and growth.

Benefits of Credit Insurance

Reducing Risk and Ensuring Cash Flow Stability

Trade credit insurance shields businesses from the financial fallout of customer defaults, ensuring they get paid even if a buyer fails to meet their obligations. This is especially critical as business bankruptcies in the U.S. surged by 23.5% in 2025 compared to the previous year. Such protection can be the difference between continuity and crisis for many companies.

Supporting Market Expansion

With credit insurance in place, businesses can confidently explore new markets, knowing their sales and profits are protected from non-payment risks.

Improving Financing Opportunities

Banks often view credit-insured receivables favorably, providing loans for up to 85% of their value. This enhanced borrowing capacity can be a game-changer, giving companies the financial backing they need to grow.

Broad Coverage for Diverse Risks

Trade credit insurance covers a range of risks, including extended payment delays, bad debts from customer insolvencies, and even political risks. With millions of U.S. firms relying on trade credit to fuel their operations, this comprehensive protection is essential for maintaining business stability.

Real-world examples highlight these benefits. For instance, a mid-sized electronics company was able to continue operations confidently after its credit insurer tailored a new program when their previous provider reduced limits. Similarly, a U.S. pharmaceutical firm leveraged credit insurance to distribute test kits efficiently under a government contract.

Key Considerations

- Policy Costs: Premiums typically start at around $3,500 and account for a small fraction of total sales. Companies need to weigh these costs against their risk exposure and potential benefits.

- Documentation Requirements: Accurate records, including customer lists and credit limits, are essential for smooth claims processing.

- Coverage Variations: Terms, conditions, and coverage amounts can differ significantly between providers. Businesses should carefully review policies to ensure they align with their specific needs.

- Active Management: Credit insurance policies require ongoing attention. Businesses must communicate customer updates and conduct regular risk assessments to keep their coverage effective.

- Market and Industry Risks: Expanding into new regions or industries can introduce unique challenges. Economic or political instability in certain areas may affect both coverage availability and pricing.

How Accounts Receivable Insurance Supports U.S. Businesses

Accounts Receivable Insurance (ARI) goes a step further by offering tailored solutions specifically designed for U.S. businesses. While trade credit insurance provides general receivables protection, ARI fine-tunes its services to address the unique needs of domestic and international operations.

Enhanced Risk Analysis

ARI gives businesses access to detailed databases and credit resources, enabling them to evaluate customer creditworthiness more effectively. This helps companies make smarter credit decisions and better manage potential risks.

Expert Broker Assistance

Navigating the complexities of credit insurance is easier with ARI’s dedicated team. They provide guidance on policy renewals, custom endorsements, and ongoing market trends, ensuring businesses have the support they need.

Global Coverage Solutions

For companies operating internationally, ARI’s partnerships with global credit insurance carriers ensure consistent protection across markets. This allows businesses to maintain the same level of security, whether they’re dealing with domestic or international clients.

Efficient Claims Handling

ARI streamlines the claims process, reducing administrative burdens and ensuring business continuity. With 97.73% of claim values paid in full between 2007 and 2020, companies can trust in reliable and prompt claims resolution.

Conclusion

Credit insurance plays a crucial role in helping U.S. businesses secure credit limits and maintain financial stability. The numbers paint a stark picture: business bankruptcies rose by 23.5% in 2025 compared to the previous year. This increase underscores the growing importance of protecting against non-payment risks.

For small-to-medium enterprises, the stakes are especially high. One in five business bankruptcies in this segment stems from customers defaulting on invoices. Even more striking, 25% of companies shut down due to non-payment by their clients. These figures highlight why managing credit limits effectively – backed by insurance – isn’t just helpful; it’s critical for survival. By facing these challenges head-on with robust insurance solutions, businesses can adopt a more strategic approach to credit management.

Key Takeaways

Gary Lorimer of Aon Credit Solutions sums it up well: credit insurance doesn’t just protect – it opens doors to new opportunities.

In the U.S., 28 million businesses rely on trade credit to fuel their operations. Companies that use credit insurance gain a competitive edge by accessing additional working capital, enabling safer open account sales, and confidently entering new markets. At the same time, they benefit from the peace of mind that comes with comprehensive coverage.

This dual benefit supports growth on both ends: the top line grows through sales in new markets, while the bottom line is safeguarded from losses caused by customer non-payment.

And the cost? Surprisingly manageable. Premiums are usually less than 0.5% of turnover, making credit insurance an accessible safety net even for smaller businesses. When compared to the potentially devastating impact of a major customer default, it’s a small price to pay for such significant protection.

Next Steps for Businesses

The first step is a thorough risk assessment. Businesses should evaluate their current exposure, focusing on key customers and any expansion plans that could introduce new risks. Seeking expert guidance is essential for tailoring a strategy that aligns with specific needs.

Accounts Receivable Insurance specializes in providing customized trade credit and accounts receivable insurance solutions for businesses operating across both domestic and international markets. Their approach goes beyond basic coverage, offering detailed risk assessments, access to a global network of credit insurance carriers, and hands-on broker support to help businesses navigate the complexities of policy selection and management. This ensures that your coverage remains flexible and responsive to your evolving needs.

To get started, businesses can share key company and client data for a professional risk assessment. This process helps set appropriate credit limits and commercial terms that align with your goals. By taking a collaborative approach, you can ensure your policy offers the right level of protection while providing the tools to monitor and adjust as needed.

With the trade credit insurance market projected to grow from $14.9 billion in 2024 to $45.49 billion by 2033, now is the time to assess your risk exposure and partner with providers who can deliver tailored, effective coverage. Don’t wait – protect your business today and position yourself for sustainable growth tomorrow.

FAQs

How does credit insurance help businesses secure financing and expand into new markets?

Credit insurance is a valuable tool for businesses aiming to secure financing. By offering lenders confidence in repayment, it enhances a company’s credit profile. This added layer of security often translates into easier access to funding, empowering businesses to support daily operations or invest in growth strategies with greater ease.

Another major benefit is its ability to mitigate financial risks when venturing into new or less familiar markets. Whether it’s the threat of non-payment or economic uncertainty, credit insurance safeguards accounts receivable. This protection enables businesses to explore opportunities both domestically and internationally, promoting expansion and diversification while keeping potential losses in check.

What should businesses look for when choosing a credit insurance provider to meet their unique needs?

When choosing a credit insurance provider, it’s essential to focus on a few critical aspects to ensure they meet your business’s needs. Start by examining their reputation and financial stability – this speaks volumes about their ability to offer dependable coverage and manage claims effectively. A solid provider will have a proven history of reliability and trustworthiness.

Next, take a close look at their claims handling process. Is it straightforward, efficient, and transparent? This can make all the difference when you need to file a claim and want the process to be as smooth as possible.

Another key consideration is the variety of coverage options they provide. Can they customize policies to suit your specific business requirements, whether you operate domestically, internationally, or both? Flexibility in coverage is a big plus, especially if your business has unique operational needs.

Finally, evaluate their industry expertise and understanding of market risks. A provider with deep knowledge of your industry is better equipped to support your credit limit management and adapt to potential challenges. Reviewing their track record and seeking professional advice can help you make a well-informed choice.

How do credit insurers evaluate the risk of international clients, and what challenges might businesses face in managing these risks?

Credit insurers assess the risk of working with international clients by diving into several key areas. They look at a country’s economic stability, political climate, currency fluctuations, and legal systems. On top of that, they evaluate the client’s financial condition, payment track record, and any risks tied to their specific industry. All of this helps determine how likely it is that a client might fail to pay.

For businesses dealing with international credit risks, the challenges can be quite complex. They often have to contend with unpredictable exchange rates, political unrest, and differing regulations from one country to another. These factors demand constant vigilance and customized strategies to manage risks effectively and safeguard against potential financial losses.