Climate change is reshaping how creditworthiness is assessed, affecting businesses and individuals alike. Here’s what you need to know:

- Physical Risks: Natural disasters like hurricanes, floods, and wildfires disrupt operations, hike insurance premiums, and reduce property values, leading to increased defaults on loans and mortgages.

- Transition Risks: Shifting to cleaner technologies and stricter climate policies can strain industries like manufacturing and fossil fuels, impacting their ability to repay debts.

- Key Data: Rising insurance costs in high-risk areas correlate with increased mortgage and credit card delinquencies. For example, a 2025 study found climate risks could cause $1.2 billion in mortgage losses in the U.S.

- Regional Differences: Coastal and disaster-prone areas face higher risks compared to inland, stable regions. Credit conditions are tightening in high-risk zones.

- Solutions: Tools like ESG scoring, scenario analysis, and trade credit insurance help businesses manage climate-related credit risks.

Bottom Line: Climate risks directly affect financial stability. Businesses must adapt by assessing risks, using advanced credit models, and securing insurance to protect against payment disruptions.

Climate Change and Credit Risk – ICA2023

Climate Change as a Credit Risk Factor

Climate change is reshaping how credit risk is assessed, influencing decisions across industries and regions. It does this through two main pathways: physical risks and transition risks. These risks don’t just affect individual businesses – they’re altering the way lenders evaluate creditworthiness on a much broader scale.

Studies reveal that frequent natural disasters and extreme temperature anomalies are linked to lower credit ratings, particularly for sovereign and corporate borrowers in high-risk areas. These findings highlight how the physical effects of climate change are increasingly being factored into credit evaluations and rating decisions.

Physical Risks: Natural Disasters and Financial Impact

Physical risks are the most immediate and visible way climate change impacts creditworthiness. Events like hurricanes, floods, wildfires, and droughts disrupt supply chains, halt operations, and force companies to redirect resources toward recovery efforts. These disruptions often lead to higher costs, reduced revenues, and, in some cases, insolvency.

Another major factor is the rising cost of insurance. As climate disasters become more frequent and severe, insurance premiums in vulnerable regions have surged. For borrowers with high debt-to-income or loan-to-value ratios, these higher premiums significantly increase the likelihood of mortgage and credit card delinquencies.

Property values in high-risk areas are also reflecting these concerns. By 2019, buyers were already demanding a 6.7% price discount on coastal homes at risk of sea-level rise, anticipating that these properties would be underwater far sooner than previously expected. The impact of climate risks on real estate became even more evident in 2023 when a reinsurance shock caused average home values in vulnerable markets to drop by $8,400. This shows how expectations of rising insurance costs are being factored into real estate pricing.

Transition Risks: Policy and Market Changes

While physical risks are immediate and tangible, transition risks present longer-term challenges as economies shift toward sustainability. These risks emerge from new climate policies, advancing technologies, and changing consumer preferences, all aimed at reducing carbon emissions.

Transition risks are particularly pronounced in industries like heavy manufacturing, fossil fuels, and other high-emission sectors. Stricter emissions standards, carbon pricing, and the growing demand for sustainable products are forcing companies to adapt. Businesses unable to make the necessary investments to comply with regulations or shift to cleaner technologies risk seeing their revenues – and creditworthiness – decline.

The financial impact of these risks varies across industries. For example, sectors like utilities, automotive, and insurance are especially sensitive due to their high emissions or direct exposure to extreme weather events. Credit rating agencies are increasingly incorporating these risks into their methodologies. Since the Paris Agreement, agencies have committed to factoring in environmental considerations and have invested heavily in climate analytics to enhance risk assessments.

Although climate-specific downgrades currently account for only 2% to 7% of rating actions, ESG (Environmental, Social, and Governance) factors now influence 13% to 19% of all rating decisions across major credit rating agencies. This indicates that while transition risks are becoming more widely recognized, their full impact on credit ratings is still unfolding.

The Dual Challenge: Physical and Transition Risks

The interplay between physical and transition risks adds another layer of complexity to credit assessments. For instance, a company might face immediate flooding risks while also grappling with new carbon regulations. This dual exposure can amplify credit risks in ways that traditional models struggle to account for. As a result, climate-aware credit assessments are becoming increasingly vital for accurate risk evaluation.

The evolving dynamics of climate-related risks underscore the importance of integrating these factors into credit analysis. By doing so, lenders and rating agencies can better navigate the challenges posed by a changing climate and ensure more accurate evaluations of creditworthiness.

How to Measure Climate Risk Impact on Credit

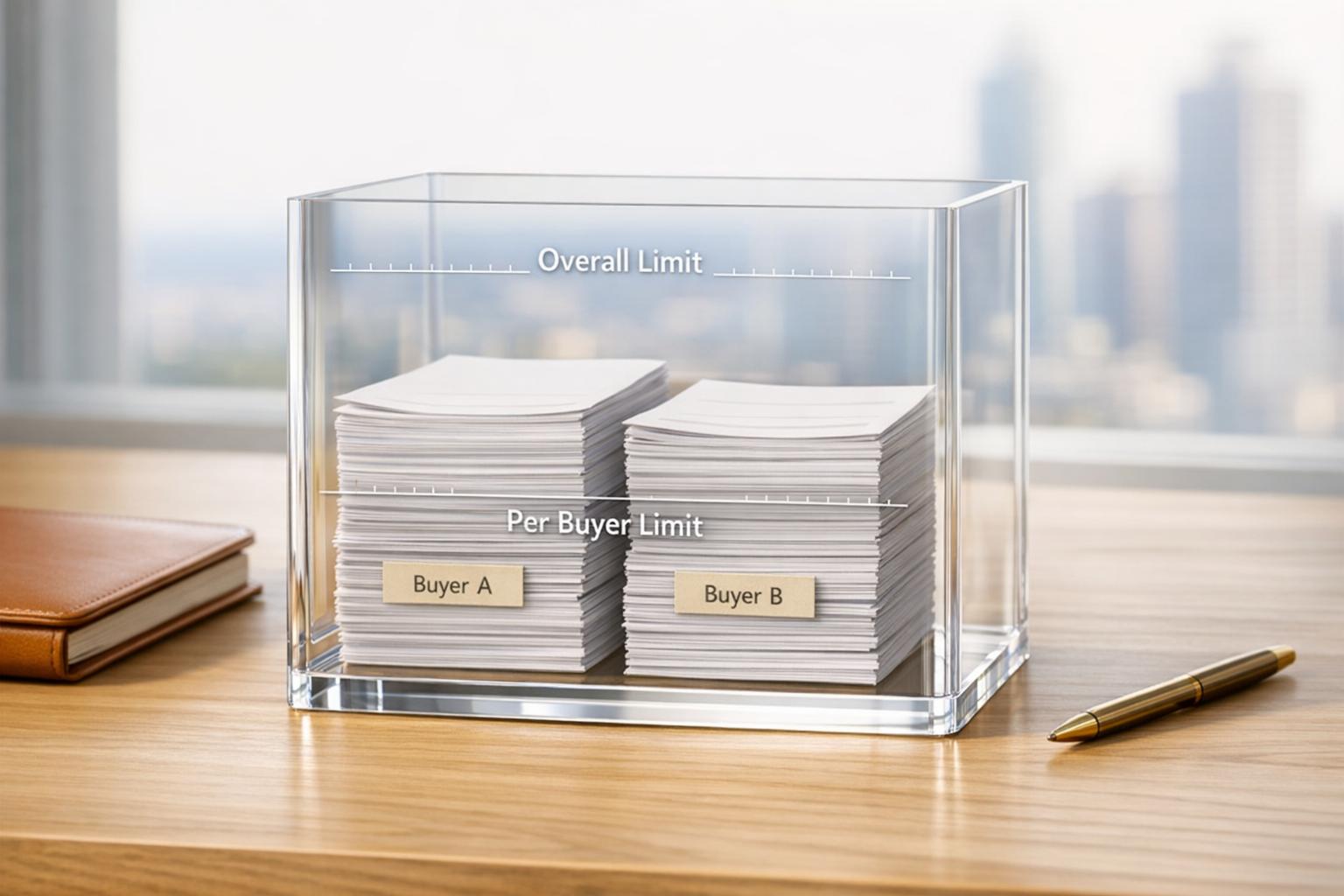

Understanding how climate change affects creditworthiness requires tools that assess both immediate threats and long-term risks. Traditional credit models often miss key factors, such as extreme weather events or policy changes, that can significantly impact a borrower’s financial stability. To address this, newer tools quantify physical and transition risks, offering a clearer picture of their potential influence on credit evaluations. Here’s a closer look at the methods used to bridge these risk assessments.

Scenario Analysis and Climate Risk Models

Scenario analysis has emerged as a critical method for evaluating climate-related credit risks. Rather than predicting a single outcome, this approach explores multiple plausible futures. Rating agencies rely on frameworks like the S&P Global Commodity Insights Energy and Climate Scenarios and the Intergovernmental Panel on Climate Change’s Shared Socioeconomic Pathways to develop these scenarios. By 2025, the European Central Bank (ECB) had taken this further by introducing internal carbon stress tests, which help refine financial projections and credit ratings.

For physical climate risks, models focus on events such as storms and flooding, which can lead to asset destruction and reduced productivity. Transition risk models, on the other hand, analyze the effects of policy shifts, technological innovations, and changing consumer behaviors. These factors may force businesses to adapt their strategies or alter market positions.

ESG Scoring in Credit Reviews

While scenario analysis relies on quantitative modeling, ESG (Environmental, Social, and Governance) scoring incorporates qualitative factors to enhance credit assessments. ESG scoring has gained traction as a standard tool in credit evaluation, now influencing 13% to 19% of rating actions by major agencies. Although climate-related downgrades currently represent only 2% to 7% of rating actions, this number is expected to increase as assessment techniques improve.

ESG scoring evaluates a borrower’s exposure to climate risks by examining data such as emissions levels, energy use, and geographical vulnerabilities. It also considers how these risks might impact creditworthiness, factoring in mitigation strategies like insurance, adaptation measures, and carbon offsets. Industries such as utilities, automotive, and insurance are particularly scrutinized due to their unique exposures to both physical and transition risks.

These evaluations also weigh the financial trade-offs of investing in resilience and adaptation. While such investments can reduce long-term risks, they often involve significant upfront costs that may temporarily strain cash flow and affect debt ratios.

sbb-itb-2d170b0

Climate Risk Differences by Region

Regional factors add another layer of complexity to assessing buyer credit risks in the context of climate change. Geography significantly influences how climate challenges impact a buyer’s ability to meet financial obligations. While tools like scenario analysis and ESG scoring help measure these risks, their impact varies widely depending on where buyers are located. Coastal areas may grapple with hurricanes and flooding, while drought or regulatory shifts dominate concerns elsewhere. These regional disparities highlight the need for credit assessments to account for localized climate realities.

Risk Profiles by Region

Physical climate risks lead to stark regional differences in creditworthiness. For example, coastal areas in the southeastern United States face frequent hurricane threats, while western states endure increasing wildfire risks. These hazards often result in financial strain for buyers, manifesting as property damage, higher insurance premiums, and declining asset values.

The financial impact of these risks is already evident in vulnerable regions. Insurance premiums in disaster-prone areas are significantly higher, and in some cases, insurers have stopped offering coverage altogether. This leaves buyers more exposed to financial losses and adds to their monthly expenses, putting additional pressure on cash flow. According to the Dallas Federal Reserve, rising insurance costs in these areas correlate with higher mortgage and credit card delinquency rates, especially among borrowers with high debt-to-income ratios.

Efforts to adapt to these risks also vary by region. Areas that invest in flood defenses, wildfire prevention, and disaster response systems tend to maintain more stable credit conditions for buyers. On the other hand, regions lacking these measures are more vulnerable to credit deterioration after climate events.

Transition risks – those tied to policy and economic shifts related to climate change – also vary regionally but in different ways. Regions with stringent climate policies often experience faster changes in carbon pricing and regulatory requirements, which can disproportionately affect industries like manufacturing, construction, and trade, depending on their emissions profiles.

These contrasts in regional risk profiles set the stage for a deeper look at how high-risk and low-risk markets differ.

Case Studies: High-Risk vs. Low-Risk Markets

The divide between high-risk and low-risk regions becomes apparent when examining specific markets. High-risk regions such as coastal Florida, wildfire-prone areas in California, and parts of the Gulf Coast present significant challenges for buyer creditworthiness. Buyers in these areas face a triple burden: higher insurance premiums, declining property values, and stricter lending requirements from financial institutions.

Banks are already responding to these regional disparities. Currently, 18% of banks anticipate physical risks will tighten credit conditions over the next year, with the real estate and construction sectors feeling the most impact. This tightening affects not only mortgage lending but also trade credit decisions.

In contrast, low-risk regions – typically inland states with fewer natural disasters – offer more favorable conditions. Buyers in these areas benefit from lower insurance costs, stable property values, and less restrictive lending terms. Their creditworthiness is less susceptible to climate-related disruptions, making them more attractive for trade credit partnerships.

Data highlights this divide: buyers in low-risk regions consistently exhibit more stable credit outcomes and lower delinquency rates compared to those in disaster-prone areas. This stability extends beyond individual transactions to influence broader trade relationships and supply chain strategies.

| Risk Level | Regional Examples | Key Challenges | Credit Impact |

|---|---|---|---|

| High-Risk | Coastal Florida, California wildfire zones, Gulf Coast | Hurricanes, wildfires, flooding | Higher insurance costs, stricter lending, increased delinquencies |

| Moderate-Risk | Tornado Alley, drought-prone agricultural regions | Severe weather, crop failures | Variable insurance costs, seasonal credit stress |

| Low-Risk | Inland states with stable climates | Minimal natural disaster exposure | Lower insurance costs, stable property values, favorable lending terms |

For businesses extending trade credit internationally, these regional variations are equally critical. A buyer in Jakarta faces different climate-related pressures than one in Munich or Toronto. Understanding these localized risk profiles is essential for making informed credit decisions and crafting effective insurance strategies.

The importance of these regional differences is reflected in global financial systems. The European Central Bank reports that 69% of credit ratings from Eurosystem assessment systems now account for climate risks. This represents 56% of the collateral mobilized by banks, underscoring how seriously financial institutions consider regional climate factors in their credit evaluations.

When dealing with buyers in high-risk regions, businesses can reduce exposure through robust trade credit protection. Accounts Receivable Insurance provides coverage against non-payment risks, which may rise due to climate-related financial stress. This ensures stable trade relationships, even when regional climate risks create uncertainty around buyer creditworthiness.

Using Insurance to Reduce Climate Credit Risks

As climate risks increasingly impact buyer credit, businesses are finding that traditional credit evaluations alone aren’t enough to safeguard their operations. Trade credit insurance has emerged as a crucial safeguard, stepping in to protect businesses when climate events disrupt payments. Let’s dive into how this type of insurance helps bridge financial gaps created by climate challenges.

How Trade Credit Insurance Helps

Trade credit insurance provides coverage for non-payment caused by climate-related disruptions, such as hurricanes, floods, or other severe weather events. When buyers are unable to meet their financial obligations due to these events, insurers step in to compensate sellers, ensuring cash flow remains steady and financial stability is preserved. This coverage addresses direct physical damages from extreme weather as well as the broader financial risks tied to market and policy changes driven by climate adaptation efforts.

For instance, after hurricanes hit the Gulf Coast, many U.S. exporters with trade credit insurance were reimbursed for unpaid invoices when their buyers’ facilities were damaged and operations were forced to shut down.

A 2025 survey highlights the growing importance of factoring climate risks into financial models: 61% of banks now include climate risk in their Probability of Default calculations, and 43% consider it in Loss Given Default metrics.

To keep pace, insurers are leveraging advanced tools like historical loss data, climate risk models, and ESG reviews to accurately assess exposures and price policies. This evolution in underwriting has paved the way for specialized solutions like those offered by ARI.

Custom Solutions from Accounts Receivable Insurance (ARI)

ARI provides tailored trade credit insurance solutions designed to address specific climate risks in different regions. Their approach goes beyond standard policies by offering:

- Customized coverage to address unique climate risks in target markets.

- Detailed risk assessments that incorporate climate data and scenario analysis.

- Streamlined claims management to ensure quick recovery after climate-related buyer defaults.

- Access to a global network of credit insurance carriers for consistent international coverage.

Regional climate risks vary significantly, and ARI’s tailored solutions reflect these differences. For example, businesses working with buyers in coastal Florida face hurricane-related risks, while those operating in California may contend with wildfires or droughts. ARI’s in-depth risk assessments help businesses understand these exposures and develop policies that provide the right level of protection.

When it comes to international trade, customized solutions are even more critical. A buyer in Jakarta faces different climate challenges than one in Munich or Toronto. ARI’s global network ensures that businesses can secure coverage that aligns with local climate realities while maintaining consistent protection across all markets.

Another key advantage of ARI’s approach is its claims management process. During climate emergencies, businesses often need quick financial support to keep operations running while their buyers recover. ARI’s expedited claims process ensures that funds are available when they’re needed most, helping businesses weather these disruptions without significant strain.

Conclusion: Getting Ready for Climate Financial Risks

Climate change is reshaping the financial landscape, particularly when it comes to buyer creditworthiness. The numbers speak for themselves: climate-related disasters are expected to result in $1.2 billion in mortgage-related losses by 2025. These projections highlight the urgency for businesses to address climate risks head-on.

The financial effects are already evident. A study involving 6.7 million borrowers found that higher insurance premiums, driven by rising climate risks, significantly increase the likelihood of mortgage and credit card delinquencies. These trends are not speculative – they are measurable, real, and demand immediate action.

Businesses that hesitate to tackle these challenges risk scrambling to protect cash flow when disruptions occur. On the other hand, forward-thinking companies are implementing strategies like climate risk assessments, scenario planning, and insurance solutions to shield themselves from financial turbulence. For example, tailored trade credit insurance – such as ARI’s offerings – provides a critical safety net. These solutions combine personalized coverage, detailed risk evaluations, and efficient claims processes to help businesses weather the storm when climate events disrupt buyer payments.

Regulators and credit agencies are also paying closer attention. ESG factors now influence 13% to 19% of all rating actions by major credit agencies, with climate-specific downgrades making up 2% to 7% of total decisions. As financial institutions increasingly integrate climate considerations into their credit assessments, this trend will only grow.

For U.S. businesses, the path forward is clear: conduct thorough climate risk assessments of your customer base, invest in resilience measures, and secure insurance coverage that addresses both domestic and international exposures. Companies that act now will position themselves to secure credit, attract investment, and maintain strong customer relationships, even as climate impacts escalate.

The bottom line is simple: climate risk is credit risk. Businesses that embrace this reality and take proactive steps – like implementing robust risk management strategies and securing appropriate insurance – will not only survive but thrive. Those that fail to act could face higher borrowing costs, reduced credit access, and greater financial challenges when the next climate event strikes.

FAQs

How does climate change affect the creditworthiness of businesses in high-risk areas?

Climate change can have a profound effect on the financial health of businesses, particularly those located in regions vulnerable to natural disasters or extreme weather. Physical risks, such as hurricanes, floods, and wildfires, can severely disrupt business operations, damage assets, and create cash flow challenges, making it more difficult for companies to meet their financial commitments.

On top of that, transition risks – including regulatory changes, evolving market demands, or rising costs associated with climate-related adaptations – can further strain a company’s financial footing. These challenges can lead to higher chances of default or limited access to credit, especially for businesses that lack strong risk management strategies.

One way to navigate these uncertainties is through tools like accounts receivable insurance. This type of protection helps safeguard businesses against losses from unpaid invoices or insolvency, offering a layer of financial stability in unpredictable times.

How can businesses evaluate and manage credit risks linked to climate change?

Businesses can tackle climate-related credit risks by using trade credit insurance as a safety net against financial losses stemming from non-payment, bankruptcy, or political instability. This involves performing detailed risk evaluations, keeping a close eye on the financial well-being of buyers, and handling claims effectively when necessary.

Taking these steps allows companies to shield their cash flow and sustain financial stability, even when natural disasters or other climate-related challenges arise.

How can trade credit insurance reduce the financial risks of climate-related disruptions to buyer creditworthiness?

Trade credit insurance acts as a safety net for businesses, shielding them from financial losses when buyers fail to pay. This protection extends to risks tied to climate-related events, such as natural disasters, which can disrupt operations and payments. By evaluating risks, keeping a close eye on buyers’ financial health, and managing claims when issues arise, this insurance provides a comprehensive layer of security.

With trade credit insurance, businesses can keep their cash flow steady and reduce the financial strain caused by unexpected challenges. It’s an essential resource for managing the increasing unpredictability brought about by climate-related disruptions.