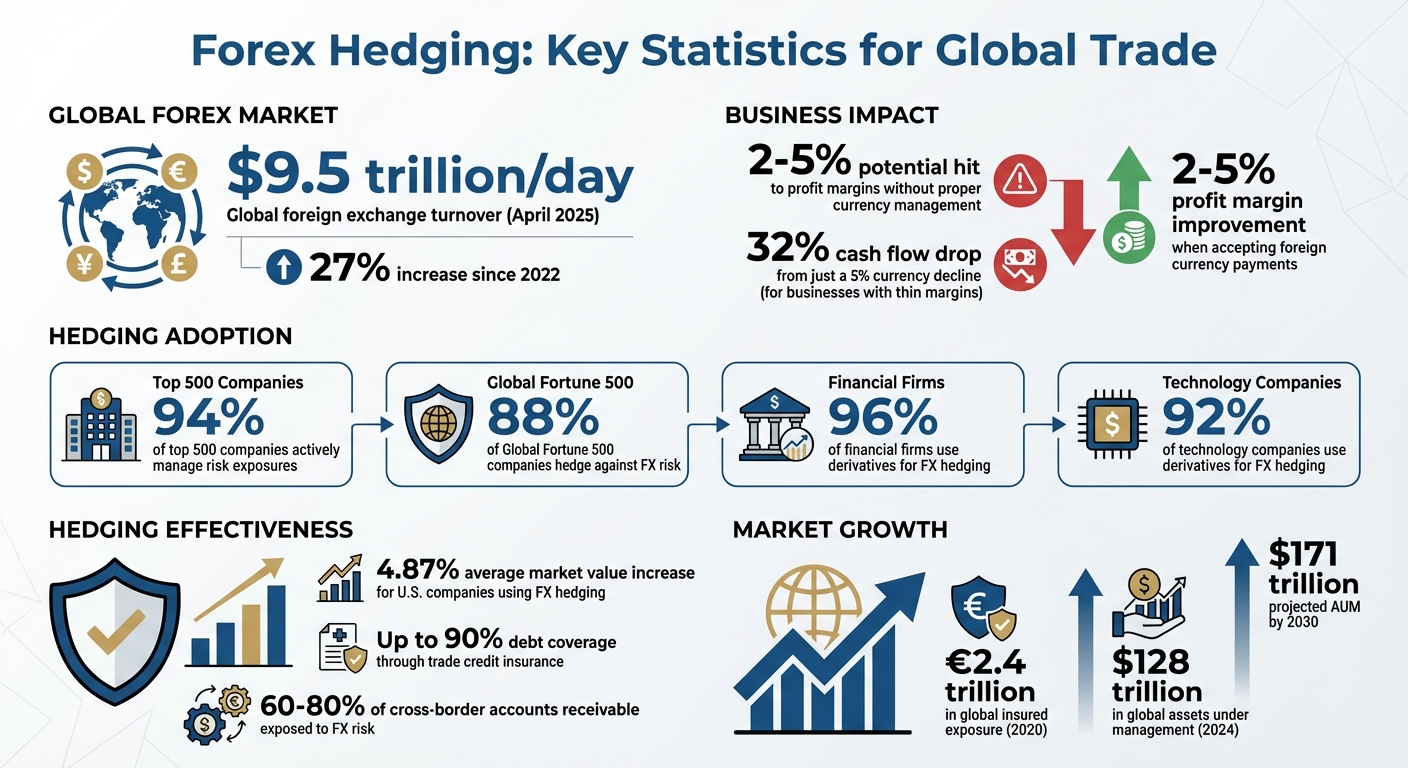

Currency fluctuations can erode profits for U.S. businesses in international markets. Without proper management, companies may face a 2–5% hit to profit margins. Forex hedging offers a solution by locking in exchange rates, protecting against unpredictable shifts. Here’s why it matters:

- $9.5 trillion/day: Global foreign exchange turnover in April 2025, up 27% since 2022.

- 32% cash flow drop: A 5% currency decline can severely impact businesses with thin margins.

- 94% of top companies hedge: Most Fortune 500 firms actively manage foreign exchange risks.

Hedging tools like forward contracts, options, and swaps reduce exposure to currency risks. Combining these with trade credit insurance adds another layer of protection, covering customer defaults. Together, these strategies stabilize cash flow and support international trade growth.

Forex Hedging Statistics: Impact on Global Trade and Business Profitability

FX Risk in International Trade Explained: Understanding Currency Exposure & Hedging Strategies

How Currency Fluctuations Affect Global Trade

Exchange rate shifts during the payment cycle can lead to significant conversion losses for U.S. exporters, creating challenges in managing profitability. Let’s take a closer look at the factors behind these fluctuations and their impact.

Misalignments between costs and revenues can drastically affect cash flow. For example, a German brewer with a 15% cash margin might experience a 32% decline in cash flow from just a 5% drop in the dollar’s value (measured in euros). A more severe 17% drop could push U.S. operations into negative cash flow territory.

Pricing international sales adds another layer of complexity for U.S. businesses. Sellers must decide whether to price goods in dollars, which avoids exchange rate risks but could hurt competitiveness, or to accept foreign currencies, exposing them to potentially significant fluctuations.

What Causes Exchange Rate Volatility

Grasping the factors behind exchange rate swings is crucial for mitigating trade risks. These rates are influenced by macroeconomic trends, geopolitical events, and market dynamics. While nominal exchange rates often dominate discussions, real exchange rates – adjusted for inflation – offer a clearer picture of purchasing power. Studies indicate that deviations from purchasing power parity tend to correct by about 50% within two to three years.

Geopolitical shifts also play a growing role in currency choices. Since 2021, there has been a noticeable link between the invoicing currency used in trade and the geopolitical alignment of trading partners. Although the Chinese renminbi is expanding its presence beyond Asia, the U.S. dollar continues to dominate global trade invoicing.

Currency Risks for U.S. Businesses in International Markets

Building on the drivers of volatility, U.S. businesses face a variety of risks when operating internationally. One of the most immediate is transaction risk, which stems from the time lag between signing a contract and settling the payment. During this window, currency movements can alter the transaction’s final value. Thankfully, this risk can often be managed with financial tools.

Portfolio risk is another concern. It arises when earnings from foreign subsidiaries are converted into U.S. dollars for financial reporting. Even if local operations remain stable, these conversions can impact reported earnings. As Marc Goedhart, Tim Koller, and Werner Rehm from McKinsey & Company explain:

Managers should focus on the potential risk to cash flows rather than on accounting risks such as fluctuations in reported operating profit.

The International Trade Administration emphasizes that most exporters aim to avoid speculating on currency movements and instead focus on minimizing these risks. For example, consulting with international bankers before negotiating contracts can help U.S. exporters navigate situations where buyers request payment in foreign currencies.

Here’s a breakdown of the key risks U.S. businesses face:

| Risk Type | Source of Exposure | Impact on Business |

|---|---|---|

| Transaction Risk | Timing difference between contract and payment | Short-term cash flow volatility |

| Structural Risk | Mismatch between cost currency and revenue currency | Long-term margin compression or financial distress |

| Portfolio Risk | Translation of foreign operations for financial statements | Fluctuations in reported earnings/equity |

| Nonpayment Risk | Devaluation of buyer’s local currency | Buyer inability to meet USD-denominated obligations |

Forex Hedging Strategies to Reduce Currency Risk

Currency risk is a constant challenge for businesses operating across borders. To mitigate this risk, companies often turn to practical tools and strategies. In fact, a staggering 88% of Global Fortune 500 companies actively hedge against foreign exchange risk. The right approach depends on the nature of the exposure – whether it involves specific future payments, uncertain transactions, or balance sheet risks.

Below, we’ll explore some of the most widely used methods, each offering businesses tailored ways to address their unique currency challenges.

Forward Contracts and Futures

Forward contracts are a straightforward way to manage currency risk. They allow businesses to lock in an exchange rate for a future transaction, ensuring predictability in conversion costs. These over-the-counter agreements can be customized to align with specific amounts and dates, usually covering periods from three days to a year.

Currency futures, while similar in purpose, are traded on regulated exchanges and come with standardized contract sizes and settlement dates. Unlike forwards, futures require daily mark-to-market adjustments and margin deposits, which add administrative effort but provide greater transparency. Both tools shield businesses from unfavorable currency shifts but also remove the chance to benefit from favorable rate changes.

A study of U.S. companies revealed that foreign exchange hedging could increase market valuation by 4.87%. Highlighting the practicality of such tools, Paula Comings, Head of FX Sales at U.S. Bank, notes:

The simplicity of setting up a program like this makes it a useful place for treasury professionals to begin their hedging journey.

Currency Options for Risk Management

Currency options add a layer of flexibility that forwards and futures cannot provide. These instruments give businesses the right, but not the obligation, to exchange currency at a predetermined rate. This means companies can protect themselves from unfavorable rate changes while still taking advantage of favorable movements.

However, options come with an upfront premium, which is forfeited if the option goes unused. This makes them particularly valuable for contingent risks – such as when a transaction is uncertain. For instance, a U.S. manufacturer bidding on a European project might purchase an option to secure its profit margin if the bid is successful.

Options are widely embraced, especially among large corporations. Surveys show that 96% of financial firms and 92% of technology companies use derivatives for FX hedging. As Richard Heckinger and Ivana Ruffini from the Federal Reserve Bank of Chicago explain:

Hedging is not a money making strategy, but a loss limiting one.

FX Swaps and Cross-Currency Swaps

FX swaps are another useful tool, designed to manage liquidity and balance sheet volatility rather than specific transactions. These involve the simultaneous purchase and sale of the same currency in equal amounts, with two different settlement dates – typically a spot date and a future date. For example, a U.S. company with a foreign subsidiary might use an FX swap to manage intercompany loans without exposing itself to ongoing currency risk.

Cross-currency swaps expand on this concept, allowing businesses to hedge exposure between two non-domestic currencies. This is particularly valuable for multinational operations dealing with multiple foreign currencies. Unlike forwards, swaps typically don’t require upfront payments aside from the spread, making them a more cost-effective way to manage recorded assets and liabilities.

When it comes to balance sheet hedging, swaps are often simpler to implement than cash flow hedging since they avoid the complex accounting requirements tied to forecasted transactions. These strategies demonstrate just how effective hedging can be in reducing currency risk for businesses.

sbb-itb-2d170b0

Research Findings on Forex Hedging Effectiveness

Studies highlight that forex hedging provides measurable benefits to international traders. For instance, a five-year analysis involving over 6,000 companies across 47 countries found that FX hedging reduces cash flow volatility and enhances market value. Among U.S. companies, this translated into an average market value increase of 4.87%.

The research also points out that combining hedging strategies yields better results. While operational hedging may seem straightforward, its effectiveness is often constrained by factors like timing, transaction frequency, and size. As a result, many international traders lean toward using FX derivatives instead of natural hedges to manage gross cash currency risk effectively. Evidence from Japanese exporting firms supports this approach: companies invoicing heavily in U.S. dollars face greater foreign exchange exposure but successfully mitigate it by blending financial and operational hedging strategies. Financial hedging through FX derivatives not only streamlines cash flow management but also supports trade expansion for global operations.

Larger corporations often prioritize stability, opting to pay higher premiums for longer-term contracts. Remarkably, hedging remains effective even over five-year periods. These insights pave the way for real-world examples that demonstrate how businesses integrate these strategies into their operations.

Case Studies of Businesses Using Forex Hedging

Real-world examples further validate the effectiveness of forex hedging strategies. They underscore the importance of disciplined FX management in stabilizing cash flows and protecting profitability in global trade. Leading multinational companies like Microsoft, Apple, and Coca-Cola rely on advanced FX hedging techniques to shield their revenue and profits from market volatility.

A study of Chilean firms from 2005 to 2018 revealed that operational hedging alone often fell short due to mismatches in transaction maturity and frequency. As a result, these firms increasingly turned to FX financial instruments to better manage cash flow. Similarly, research on Tokyo Stock Exchange–listed companies found that invoicing in Yen significantly reduced foreign exchange exposure compared to invoicing in U.S. dollars – a strategy that complements the use of derivatives for hedging.

In the investment management industry, global assets under management (AUM) hit a record $128 trillion in 2024, marking a 12% increase from the previous year. This growth has pushed fund managers to prioritize hedging as a key strategy to stabilize returns and meet investor expectations. With the international fund market projected to reach $171 trillion in AUM by 2030, the need for effective currency risk management continues to grow.

Combining Forex Hedging with Trade Credit Insurance

How Trade Credit Insurance Works with Forex Hedging

When it comes to international trade, businesses face two major financial risks: currency fluctuations that can eat into profits and customer defaults that jeopardize payments. Compared to domestic trade, international transactions are inherently riskier due to longer payment cycles, potential customer insolvencies, and the added complexity of foreign legal systems.

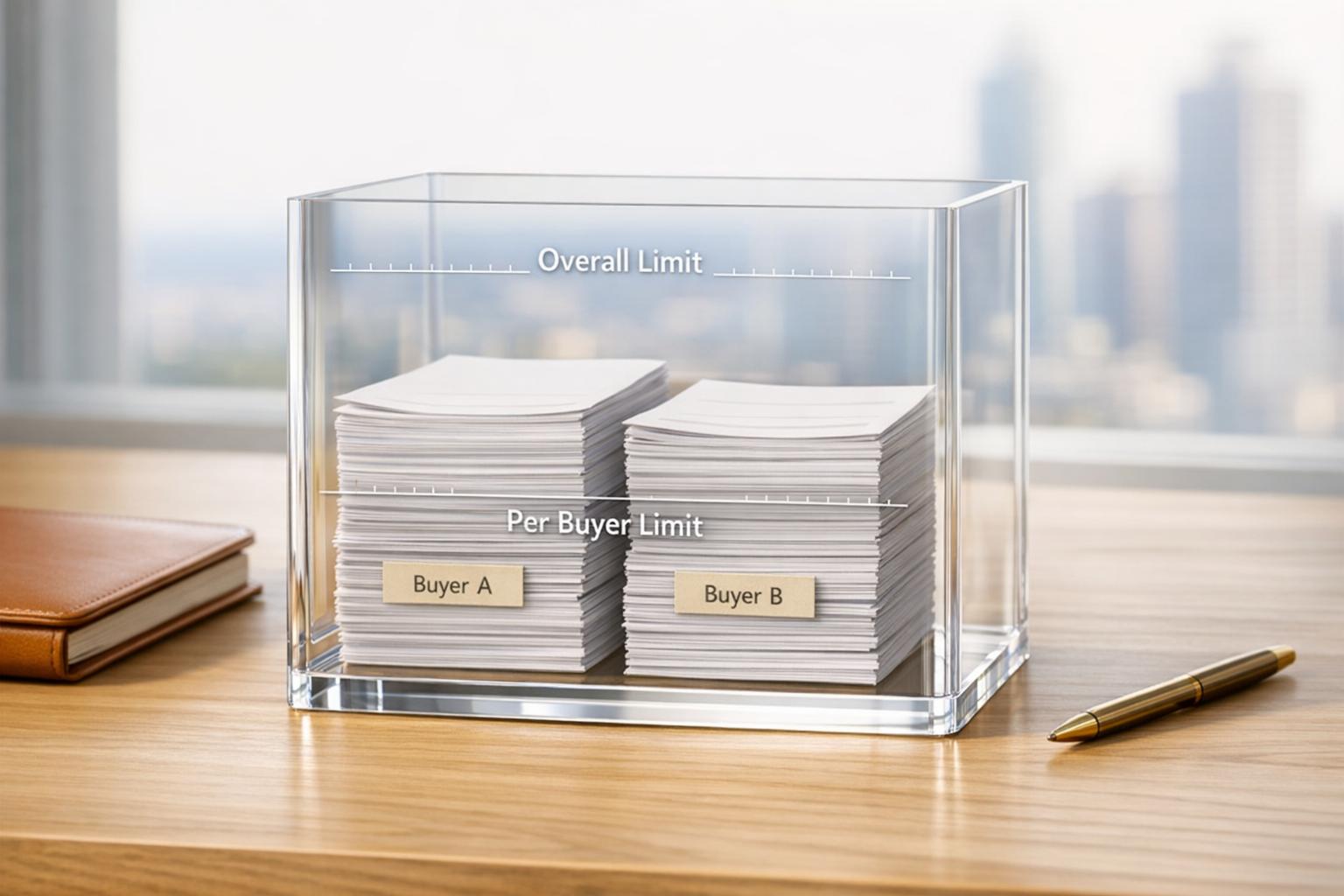

Forex hedging is a strategy that locks in exchange rates, shielding profit margins from unpredictable currency swings. However, it doesn’t protect businesses if a customer fails to pay altogether. That’s where trade credit insurance steps in, covering up to 90% of outstanding debt in cases of customer default. By combining these two strategies, businesses can secure both the value of their payments and the assurance that those payments will actually be received.

This dual-layered approach not only stabilizes cash flows but also enhances financial forecasting, giving businesses the confidence to explore international opportunities. The popularity of this risk management method is evident – global insured exposure through trade credit insurance reached an impressive €2.4 trillion in 2020.

"We’re seeing more and more people starting to use credit insurance to access better financing rather than as a risk mitigation tool only." – Gary Lorimer, Head of Business Development, Aon Credit Solutions

On top of this, businesses can leverage a specialized tool – Accounts Receivable Insurance – to further strengthen their risk management strategy.

Using Accounts Receivable Insurance for Risk Protection

Taking risk management a step further, Accounts Receivable Insurance works hand-in-hand with forex hedging to minimize payment risks. By insuring their receivables, businesses not only protect themselves from customer defaults but also unlock better financing options. Banks and lenders view insured receivables as lower-risk assets, making it easier to secure favorable terms.

Additionally, the premiums paid for this insurance are tax-deductible, freeing up working capital that would otherwise be tied up in non-deductible bad-debt reserves. This becomes especially important for businesses with long payment terms. For instance, payment terms exceeding 45 days can lead to 40% higher currency losses. Combining forex hedging with trade credit insurance is particularly beneficial for companies operating with extended payment windows.

For multinational businesses, 60% to 80% of their cross-border accounts receivable are typically exposed to foreign exchange risk. Employing both strategies ensures safer international expansion and provides a comprehensive safety net. To make the most of these tools, treasury teams should work closely with accounts receivable departments. Delayed payments can quickly increase currency exposure, requiring immediate adjustments to hedging strategies. This integrated approach solidifies a robust financial risk management framework.

Conclusion

Currency volatility and customer payment defaults pose significant challenges to U.S. businesses engaged in international trade. Strategies like forex hedging help safeguard profit margins from unpredictable exchange rate fluctuations, while trade credit insurance mitigates the risk of non-payment. Research highlights that forex hedging can increase a company’s market valuation by 4.87%, showcasing the measurable advantages of managing currency risks effectively.

By leveraging these tools, businesses can adopt a more integrated approach to risk management. For instance, accepting payments in foreign currencies has the potential to improve profit margins by 2%–5%. As Chris Braun, Head of Foreign Exchange at U.S. Bank, explains:

The focus of any currency hedging program is typically on the reduction of risk, not on trading the market.

Pairing Accounts Receivable Insurance with forex hedging creates a robust safety net for businesses dealing with extended payment terms and cross-border transactions. This two-pronged strategy not only stabilizes cash flow but also improves financial planning accuracy, empowering businesses to explore international opportunities without taking on excessive risk.

A structured, policy-driven approach is critical for success. Among the world’s top 500 companies, 94% actively manage risk exposures, with 88% specifically hedging against foreign exchange risks. Adopting such a framework allows U.S. businesses to navigate volatile global markets with confidence, ensuring steady growth and sustainable international operations.

FAQs

How does forex hedging help increase a company’s market value?

Forex hedging plays a key role in improving a company’s market value by reducing earnings instability and shielding against financial risks caused by currency fluctuations. Studies show that companies implementing effective forex hedging strategies can experience an approximate 4.9% increase in valuation.

By ensuring more stable cash flows and guarding against sudden shifts in exchange rates, forex hedging helps build investor trust while reinforcing a company’s financial stability in the competitive landscape of global trade.

What’s the difference between forward contracts and currency options in forex hedging?

Forward contracts and currency options are two widely used methods for managing currency risks, each with its own approach. A forward contract is a binding agreement where you commit to exchanging a specific amount of foreign currency at a predetermined exchange rate on a future date. This approach offers stability since the rate is locked in, but it also means you’re stuck with that rate, even if market conditions improve. The good news? There’s no upfront cost involved.

A currency option, however, provides more flexibility. It gives you the right, but not the obligation, to exchange currency at a set rate by or on a specific date. This means you can take advantage of favorable shifts in the market while avoiding unfavorable ones. The catch is that you’ll need to pay an upfront premium to secure this option.

In essence, forward contracts are all about predictability, while currency options prioritize flexibility – though at a cost. The choice between the two depends on your business’s appetite for risk and its cash flow requirements.

How can forex hedging and trade credit insurance work together to protect businesses in global trade?

Combining forex hedging with trade credit insurance offers businesses a solid way to tackle two major risks in international trade: currency swings and payment defaults. Forex hedging works by locking in the USD value of future foreign transactions, helping businesses shield themselves from unpredictable exchange rate changes. This means steadier cash flows, allowing for better planning when it comes to pricing, inventory, and investments.

On the other hand, trade credit insurance – like the options provided by Accounts Receivable Insurance – steps in to protect receivables from issues such as buyer defaults, bankruptcies, or even political upheavals. Together, these tools create a safety net that secures both the value of future cash flows and the payments owed.

This combined strategy not only helps businesses safeguard their profit margins but also reduces the need for hefty working capital reserves. It also enables companies to confidently extend credit to international buyers. By addressing both currency and credit risks head-on, businesses can focus on expanding into new markets with greater financial stability and peace of mind.