The credit insurance market is growing fast, projected to reach $27.56 billion by 2031, up from $14.19 billion in 2023. This growth is driven by businesses seeking protection against non-payment risks like insolvency and late payments. Europe leads the market, with advancements in AI and digital tools reshaping the industry. Key players like Allianz Trade, Atradius, Coface, and QBE are innovating with tailored policies, risk monitoring, and debt collection services. Here’s a quick breakdown of their offerings:

- Allianz Trade: Known for strong digital platforms like "Allianz Trade Pay", it focuses on trade credit insurance and B2B e-commerce solutions.

- Atradius: Offers flexible credit insurance policies and tools like Atrium for policy management.

- Coface: Provides extensive global data and APIs, supporting businesses with predictive risk tools.

- QBE Insurance: Focuses on industry-specific coverage and real-time risk management tools.

- Credendo Group: Balances public and private insurance, specializing in emerging markets.

Each provider brings unique strengths, from advanced tech to regional expertise, helping businesses manage trade risks effectively.

1. Accounts Receivable Insurance (ARI)

Key Services and Solutions

Accounts Receivable Insurance (ARI) helps businesses safeguard their finances by covering up to 90% of unpaid invoices when customers fail to pay due to insolvency, bankruptcy, or prolonged defaults. Beyond indemnification, ARI provides continuous credit monitoring and access to trade intelligence, helping businesses identify and address potential payment risks early on. It also includes professional debt collection services to recover overdue payments. Additionally, insured receivables can be used as secure collateral, making it easier for businesses to access bank financing and strengthen their borrowing capacity.

Business Approach

ARI offers two main coverage options to suit different business needs.

- Whole Turnover Coverage: This covers an entire portfolio of receivables and is the most popular option, representing 83% of the market.

- Single Buyer Coverage: This focuses on specific high-value or high-risk accounts, providing more targeted protection.

This flexibility allows businesses to choose coverage that matches their unique risk profile. ARI also tailors policies for industries like automotive, food and beverages, and IT, addressing the specific challenges each sector faces. By incorporating data analytics and machine learning, ARI can set premiums with greater precision and predict potential defaults more effectively.

Geographic Presence

ARI operates in both domestic and international markets. Domestically, it shields businesses from risks like insolvency, while internationally, it provides protection against challenges such as political instability and currency fluctuations. The service is particularly prominent in sectors like food and beverages (holding an 18.6% market share), as well as automotive, IT and telecom, healthcare, and energy.

sbb-itb-2d170b0

Trade Credit Insurance Explained

2. Atradius

Atradius has carved out a reputation in the credit insurance industry by offering adaptable solutions and embracing digital tools to meet client needs.

Key Services and Solutions

At the heart of Atradius’ offerings is the Modula Policy, a system built on flexible modules that allow businesses to tailor their insurance coverage for domestic and export receivables. This helps protect against risks like insolvency or non-payment. To support precise underwriting decisions, Atradius monitors a staggering 242 million businesses worldwide.

For multinational corporations, Atradius Global delivers specialized credit management services, with teams structured to align closely with clients’ regional operations. Beyond standard coverage, Credit Specialties provides solutions for unique exposures, including political risk coverage, non-cancellable credit limits, and structured trade financing. Their debt collection services, available globally, can even be accessed without holding a credit insurance policy.

Business Approach

Atradius takes pride in being more than just a service provider – it positions itself as a long-term partner for businesses. With a 95% client retention rate, the company emphasizes trust and reliability. It leverages digital platforms like Atrium for policy management and Insights for data-driven market trends. By incorporating AI and machine learning, Atradius has improved the speed and accuracy of its underwriting processes.

"The relationship and service levels provided by Atradius are second to none. Atradius fully understands our business needs and requirements."

– Vishnu Gopie, General Manager, Credit & AR, LG Electronics LTD

Pricing for policies typically ranges from 0.1% to 0.5% of turnover, which translates to about 10–50 cents per $100 insured. Coverage generally includes 90% to 95% of the debt value in case of a loss. In 2024, Atradius reported approximately $2.7 billion in revenue and holds an A (excellent) rating from AM Best, reflecting its financial strength and credibility.

Geographic Presence

With operations in over 50 countries, Atradius provides local support wherever its clients operate. It has a strong foothold in Europe, where it leads in surety bonds, and maintains a significant presence in North America. Through Atradius Global, the company supports multinational clients with specialized teams that bring over 26 years of expertise in localized credit management.

3. Euler Hermes

Euler Hermes rebranded to Allianz Trade in March 2022, aligning with its parent company, Allianz SE, while maintaining its established local presence. Holding a 34% share of the global market, Allianz Trade continues to lead the credit insurance industry.

Key Services and Solutions

Allianz Trade specializes in Trade Credit Insurance (TCI), safeguarding businesses against losses caused by customer insolvency or extended payment defaults. For larger companies with dedicated credit management teams, it offers Excess of Loss (XoL) coverage. This non-cancellable policy is designed to cover extraordinary losses that exceed a high annual deductible. Unlike traditional credit insurance policies, XoL allows businesses to manage their own credit risks rather than relying on the insurer to set credit limits.

"We think of ourselves as more of a credit management solution than just insurance."

– James Musters, Managing Director of Excess of Loss (XoL) for the Americas

Beyond these core offerings, Allianz Trade provides services such as debt collection, surety bonds, political risk protection, and fraud insurance. Its Credit Intelligence platform grants clients access to proprietary data on over 80 million companies, helping businesses identify reliable partners and keep an eye on potential risks. Interestingly, banks tend to lend up to 80% more on receivables backed by credit insurance.

Geographic Presence

With operations in 52 countries and a workforce of about 5,500 employees, Allianz Trade’s intelligence network monitors solvency in markets representing 92% of global GDP. In 2021, the company insured transactions worth €931 billion and recorded a consolidated turnover of €2.9 billion. Expanding its footprint in the U.S. market remains a key focus for 2025.

Business Approach

Allianz Trade tailors its services based on company size, offering specific solutions for small and medium-sized businesses, large corporations, and multinational enterprises. Its strategy revolves around three main pillars: expanding core trade credit insurance, growing specialty solutions like surety bonds and Excess of Loss, and preparing for the rise of B2B e-commerce.

In April 2023, Allianz Trade partnered with Bueno.money, a Singapore-based B2B Buy Now, Pay Later provider, to offer real-time deferred payment options for online merchants in the Asia Pacific region while managing credit risks. With an AA‑ rating from Standard & Poor’s, the company emphasizes predictive risk management, using daily solvency monitoring to help businesses trade securely.

"Our goal has always been to anticipate and mitigate risks through business intelligence to help firms trade with confidence."

– Clarisse Kopff, CEO of Allianz Trade

Allianz Trade’s evolving strategy highlights how industry leaders are adapting to changing market dynamics and sets the stage for examining other major players.

4. Coface

Coface runs the largest international network in the trade credit insurance industry, operating in 100 countries and supporting clients across nearly 200 markets. The company manages an impressive €715 billion in risk exposure for 100,000 client companies worldwide. Founded in 1946 and privatized in 1994, Coface has earned strong financial ratings – AA‑ from Fitch, A1 from Moody’s, and A+ from S&P Global. This extensive network and financial strength are the foundation of its wide range of services.

Key Services and Solutions

Coface processes 12,000 credit decisions daily, relying on advanced analytics and a team of 400 risk experts. Its primary service, Trade Credit Insurance, safeguards businesses from risks like customer insolvency, late payments, and political disruptions. For more specialized needs, the company offers Single Risk Insurance, designed for individual projects.

Additionally, Coface provides Business Information services via its Urba360 platform, which delivers predictive scoring and credit opinions based on data from 200 million companies. Its international Debt Collection services, supported by a network of 200 partners, are available to both insured and non-insured clients. Other offerings include Surety Bonds in countries like France, Germany, and Italy, as well as Factoring solutions in Germany and Poland.

Geographic Presence

Coface operates across seven regions: North America, Latin America, Western Europe, Central & Eastern Europe, Northern Europe, Mediterranean & Africa, and Asia Pacific. While it supports clients in 200 markets globally, it has direct operations in 58 countries. For example, Western Europe alone employs 1,309 people, while Central and Eastern Europe have 1,071 employees. Recent expansions include acquiring Rel8ed in 2023 to strengthen its North American presence, establishing a New Zealand entity in 2022, and acquiring GIEK Kredittforsikring AS in 2020 to solidify its position in the Nordic region.

"Our international network – the largest in our industry! – allows us to manage export payment risks based closely on local realities."

– Coface Group

Business Approach

Coface’s global reach is complemented by its focus on digital innovation, which is central to its "Power the Core" strategic plan for 2024–2027. This initiative aims to create a comprehensive credit risk ecosystem powered by advanced technology, connectivity, and data-driven tools. The company is moving from "Big Data" to "Smart Data", blending artificial intelligence and data science with insights from risk analysts. This approach reflects a broader industry shift toward more precise and tech-driven risk management.

Clients can access and manage their policies through digital platforms like CofaNet, the CofaMove app, and an API portal that integrates directly with ERP systems. Recent milestones include a partnership with LSEG Risk Intelligence in January 2026 to enhance corporate compliance and the launch of its own syndicate at Lloyd’s in July 2025, offering AA‑rated solutions worldwide.

5. QBE Insurance

QBE Insurance Group stands out as one of the world’s top insurers and reinsurers, offering comprehensive trade credit insurance across more than 180 countries. Serving businesses ranging from small local enterprises to large multinational corporations, QBE caters to industries like manufacturing, wholesaling, and contracting. By combining advanced technology with a strong global network, QBE delivers refined solutions tailored to the needs of businesses worldwide.

Key Services and Solutions

QBE provides a variety of customized policies, including:

- Comprehensive Cover: Protects both domestic and export exposures.

- Excess of Loss: Shields businesses from extraordinary portfolio losses.

- Selective Policies: Focuses on high-value accounts.

- Top-up Insurance: Offers additional coverage beyond primary policies.

- Specialized Products: Designed for financial institutions.

Their trade credit policies can cover up to 90% of unpaid debts, with insolvency claims often processed within 30 days after receiving a Confirmation of Debt from the insolvency practitioner. Premiums are calculated based on turnover or fixed fees, with rates varying by industry, debtor quality, and market scope. Through this diverse range of options, QBE integrates technology into risk management, ensuring clients have access to real-time solutions.

Geographic Presence

QBE’s extensive global network spans Australia, Europe, North America, and the Asia Pacific region, supported by licenses that allow policy issuance through Lloyd’s of London. This setup ensures flexible coverage arrangements – whether local, regional, or global – designed to meet the specific needs of each client. Additionally, QBE supports international trade by offering claims in major global currencies and extending coverage to include offshore political risks and post-shipment contract repudiation.

"With QBE’s global network of offices and expert Trade Credit teams around the world, we can offer Trade Credit solutions to companies operating internationally, including major multinational organisations." – QBE European Operations

Business Approach

QBE emphasizes technology as a core part of its strategy, using tools like its proprietary Trade Credit System (TCS) and QCheck to enhance underwriting and risk management. The TCS enables real-time underwriting decisions, while QCheck provides online credit opinions and debtor alerts. These tools act as an early warning system, helping clients identify and avoid unreliable debtors.

For small and medium enterprises (SMEs) with a turnover under $15 million, QBE offers SME Approve, a user-friendly online tool that simplifies the insurance process with its "Click and Quote" feature. Beyond insurance, QBE collaborates with partners like STA International to provide debt recovery services at discounted, fixed commission rates, offering clients an integrated approach to managing their financial risks effectively.

6. Credendo Group

Credendo Group, established in 1921, holds the distinction of being the world’s second-oldest public credit insurer and ranks as Europe’s fourth-largest credit insurer. Based in Brussels, Belgium, the company has built a strong European presence with branch offices in countries like the UK, France, Germany, Italy, the Netherlands, the Czech Republic, and Poland. These attributes align seamlessly with the competitive strategies discussed earlier.

Market Coverage

Credendo operates under a hybrid model, functioning as both a public Export Credit Agency (ECA) and a private insurance provider [38,40]. This dual approach allows the company to address risks in emerging and developing markets – areas often underserved by private insurers. The group specializes in tailored short-term risk underwriting and offers policies that can cover up to 90% of commercial risks [39,42]. These policies address both commercial risks, such as insolvency and payment defaults, and political risks, including war or currency inconvertibility.

With such extensive market coverage, Credendo has developed a diverse range of products to meet the varying needs of its clients.

Key Services and Solutions

Credendo’s offerings include multi-risk insurance, single-risk insurance, and surety solutions. Its core services cater to both SMEs and large corporations, featuring products like Excess of Loss (XOL) coverage, Supplier Credit Insurance, and Buyer Credit Insurance [40,42]. Beyond traditional insurance, the group provides financial solutions such as prefinancing, forfaiting, and buyer credit extended directly to international buyers [40,44].

Credendo also supports clients through risk participation services, including unfunded risk participation and participation in Letter of Credit confirmations [43,44]. Additionally, the company operates a dedicated claims department to handle complex market debt recovery cases.

Business Approach

Credendo emphasizes customer-focused and technology-driven solutions, even in volatile market conditions. The company’s strategy revolves around offering tailored services that address specific business needs and complex risk scenarios [38,42]. S&P Global Ratings reaffirmed Credendo – Trade Credit Insurance’s "A" rating with a stable outlook as of January 15, 2026, reflecting its strong financial position. Credendo is committed to a "through the cycle" philosophy, maintaining a long-term perspective and resilience during economic downturns.

"We are the first-choice business partner to protect against the risks of trade and investments in the real economy and to facilitate the financing of such transactions." – Credendo Group

Advantages and Disadvantages

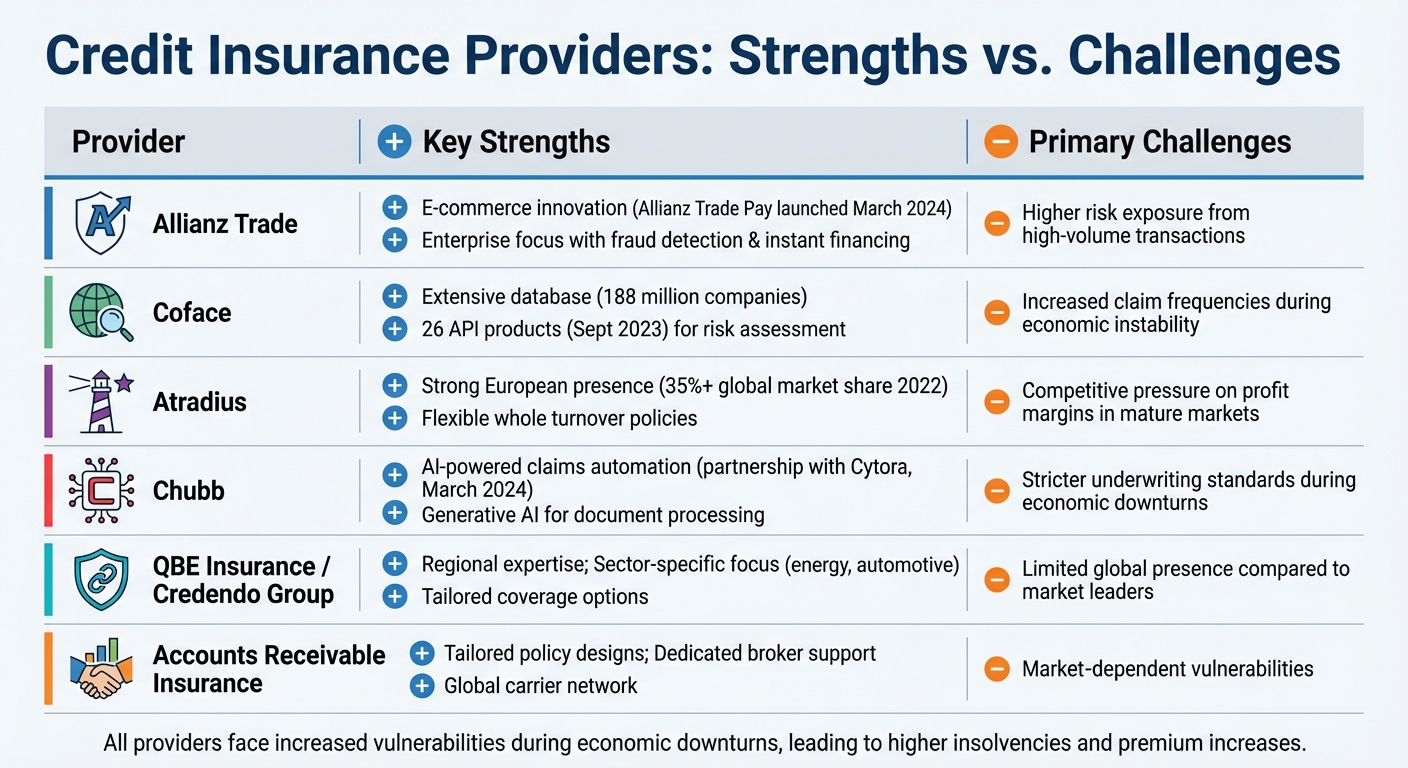

Credit Insurance Providers Comparison: Key Strengths and Challenges

These performance metrics highlight how each provider navigates market challenges and opportunities, as outlined in the earlier profiles.

Allianz Trade has taken a bold step into digital innovation with the launch of "Allianz Trade Pay" in March 2024. This B2B e-commerce platform incorporates features like a fraud detection module, digital buyer onboarding, and instant financing. However, this focus on high-volume transactions increases exposure to heightened risks .

Coface leverages an extensive database that includes 188 million companies worldwide. This data, accessible via 26 API products introduced in September 2023, enhances its ability to assess risks effectively. Yet, during periods of economic instability, the company faces a rise in claim frequencies .

Atradius has a well-established presence in Europe, which accounted for over 35% of the global market share in 2022. Its robust infrastructure and flexible whole turnover policies make it a strong choice in mature markets. However, intense competition in the region continues to put pressure on its profit margins.

Chubb sets itself apart with its advanced use of technology. By partnering with UK-based insurtech Cytora in March 2024, the company has introduced generative AI to automate claims document processing. While this innovation streamlines operations, tighter underwriting standards during economic downturns pose a challenge .

QBE Insurance and Credendo Group excel in offering specialized expertise for specific sectors like energy and automotive. Their tailored coverage options cater to regional needs, but their smaller global presence limits their ability to compete with larger market leaders.

Meanwhile, Accounts Receivable Insurance provides businesses with tailored policy designs and dedicated broker support. Its global network of credit insurance carriers ensures both domestic and international coverage.

Here’s a quick comparison of the key strengths and challenges for these providers:

| Provider | Key Strengths | Primary Challenges |

|---|---|---|

| Allianz Trade | E-commerce innovation; enterprise focus | Higher risk from high-volume transactions |

| Coface | Extensive database; API capabilities | Increased claims in volatile economies |

| Atradius | Strong European base; flexible policies | Competitive pressure on profit margins |

| Chubb | AI-powered claims automation | Stricter underwriting during downturns |

| QBE / Credendo | Regional expertise; sector-specific focus | Limited global presence |

Across the board, all providers face vulnerabilities tied to economic downturns, which tend to increase insolvencies and drive up premiums .

Conclusion

The global credit insurance market is highly competitive, making it essential for businesses to assess providers based on factors like digital tools, global reach, and alignment with their strategic goals – not just the specifics of coverage.

Your choice of provider should reflect your business’s size, trade operations, and priorities. For large enterprises with intricate B2B e-commerce needs, Allianz Trade offers strong digital platform integration. If you’re a multinational corporation, Atradius is a solid option due to its expertise in managing cross-border risks.

For companies focused on data-driven decision-making, Coface excels with its extensive APIs and access to data on 188 million companies worldwide. Meanwhile, Chubb leverages cutting-edge generative AI to streamline claims processing. Small and medium-sized enterprises (SMEs) and micro, small, and medium enterprises (MSMEs) should look into providers that offer embedded insurance solutions within trade finance platforms, as these can enhance access to working capital.

Accounts Receivable Insurance provides customized policy options, personalized broker support, and access to a global network of credit insurers, catering to both domestic and international trade needs. Whether you require whole turnover coverage or single-buyer protection for higher-risk transactions, they can help tailor a solution.

Ultimately, prioritize providers that combine advanced digital tools, comprehensive global data, and industry-specific expertise to meet your trade finance requirements effectively.

FAQs

How do I choose between whole turnover and single-buyer coverage?

When deciding between whole turnover coverage and single-buyer coverage, it really comes down to your business’s specific needs and how much risk you’re comfortable taking on.

- Whole turnover coverage provides protection for your entire customer base. By spreading the risk across multiple buyers, this option works well for businesses with a wide range of customers or high sales volumes. It offers a safety net that covers all your bases.

- Single-buyer coverage is tailored to protect against risks tied to a single, key customer. This option is often chosen by businesses heavily reliant on one buyer or working on large, critical contracts. Keep in mind, though, that premiums may be higher since the risk is concentrated on just one client.

Each option has its strengths, so the best choice depends on the nature of your business relationships and financial priorities.

What does credit insurance usually cost, and what affects the price?

The price of credit insurance hinges on several factors, including how the policy is structured, the type of coverage you choose, the volume of your sales, the credit limits involved, and the risk profile of your buyers. Because these elements can vary widely, it’s important to evaluate your specific requirements and request quotes to get a clear idea of the actual cost.

How can credit insurance help my business get better bank financing?

Credit insurance can play a key role in helping your business secure better financing terms from banks. By reducing the risk lenders face, it offers protection against customer non-payment, which helps stabilize your cash flow. This added security makes your accounts receivable more dependable as collateral, potentially leading to higher advance rates, lower interest rates, and fewer collateral demands.

On top of that, credit insurance enhances the strength of your financial statements, increases your borrowing capacity, and reflects a proactive approach to managing risk. These factors can make your business more appealing to lenders, opening doors to better financial opportunities.