Trade credit insurance protects businesses from losses when customers fail to pay their invoices. It helps stabilize cash flow, reduces bad debt risks, and supports growth by allowing businesses to confidently offer credit terms. However, the type of protection differs between domestic and international trade:

- Domestic Trade Credit Insurance: Covers non-payment and insolvency risks for U.S.-based customers, offering simpler underwriting, affordable premiums (typically <0.5% of turnover), and no protection against political or currency risks.

- International Trade Credit Insurance: Adds coverage for political risks (e.g., war, currency restrictions) and commercial risks in foreign markets. It offers broader protection but comes with higher premiums (usually <1% of insured sales) and complex underwriting processes.

Quick Comparison

| Coverage Aspect | Domestic Trade Credit Insurance | International Trade Credit Insurance |

|---|---|---|

| Primary Risk Focus | Non-payment and insolvency (U.S.) | Commercial, political, and currency risks |

| Underwriting Complexity | Simple (domestic credit assessments) | Detailed (country and political risks) |

| Market Expansion | U.S. markets only | Global markets |

| Cost | Lower (<0.5% of turnover) | Higher (<1% of insured sales) |

For businesses operating both locally and globally, combining domestic and international coverage can offer streamlined protection and financial security under one policy. Choose based on your market exposure, customer base, and growth goals.

What is Trade Credit Insurance? | Credit Insurance explained in 5 minutes

Domestic Trade Credit Insurance

Domestic trade credit insurance is designed to protect U.S. businesses that trade on credit within North American markets. This type of coverage addresses the unique risks and regulatory factors of local markets, offering a tailored way to manage credit risks closer to home. Here’s a closer look at how these policies work and their key features.

Key Features

Core Protection for Receivables

This insurance safeguards accounts receivable against losses caused by nonpayment, insolvency, slow payments, or outright payment denials. Typically, it covers 90–95% of the debt owed.

Policy Structure and Details

A domestic policy outlines the specific risks it covers, requirements for receivables, exclusions, and claim deadlines. It also defines essential terms such as sales basis, premium rates, retention amounts, and buyer credit limits. Endorsements and other specific conditions are clearly stated as well.

Legal and Regulated Coverage

These policies operate under regulated insurance frameworks, ensuring a standardized and legally secure claims process.

Benefits

Financial Stability and Business Growth

Domestic trade credit insurance minimizes the risk of catastrophic financial losses due to customer defaults. By reducing the uncertainty of nonpayment, businesses can confidently extend credit to reliable buyers and explore opportunities for growth.

"Trade credit insurance allows you to take on additional work safely and securely, whether it’s a new customer or expansion from existing customers." – David Edgell, Regional Commercial Manager at Allianz Trade

Improved Cash Flow and Financing Options

Having insured receivables can increase their value as collateral, often leading to better financing terms from lenders.

Streamlined Operations

Domestic policies typically involve simpler underwriting processes. They also provide added value through access to tools like enhanced credit information and risk assessment.

Affordable Premiums

Premiums for domestic trade credit insurance are generally less than 0.5% of turnover. These costs depend on factors like B2B turnover, customer profiles, payment terms, and coverage levels. In many cases, the premiums are offset by benefits such as better financing terms and reduced losses.

Limitations

While domestic trade credit insurance offers many advantages, it does come with some limitations.

Limited Coverage Scope

These policies focus exclusively on nonpayment risks from U.S.-based customers, leaving international risks unaddressed.

No Political Risk Coverage

Domestic policies do not protect against political risks, such as government actions, regulatory changes, or political instability.

Exclusion of Currency Risks

Since most transactions occur in U.S. dollars, domestic policies do not cover losses related to currency fluctuations.

Cost Concerns for Low Claims

If claims are minimal, the cost of domestic credit insurance may outweigh its benefits.

These features make domestic trade credit insurance distinct from international policies, which must account for additional complexities like political risks and currency fluctuations.

International Trade Credit Insurance

International trade credit insurance is designed to protect U.S. exporters from the unique risks that come with global transactions. While it builds on the principles of domestic coverage, this type of policy addresses the additional challenges and uncertainties inherent in international trade.

Key Features

Broad Risk Protection

These policies cover both commercial and political risks that could lead to non-payment. Commercial risks include issues like bankruptcy, insolvency, or prolonged default by foreign buyers. On the political side, coverage extends to situations such as war, terrorism, civil unrest, currency restrictions, expropriation, and abrupt changes in trade regulations.

Currency Inconvertibility Safeguards

Currency inconvertibility protection ensures businesses are shielded from foreign government-imposed restrictions that prevent currency conversion or transfer. This is particularly critical in politically unstable regions where such risks are more common.

Customizable Policy Options

Policies can be tailored to suit specific needs, whether for a single large transaction or a portfolio of multiple buyers. Coverage terms range from short-term agreements (up to one year) to medium-term plans lasting up to five years.

Access to Global Risk Data

With access to databases covering over 400 million buyers worldwide, businesses gain valuable insights into the financial stability of potential customers. This global reach allows for thorough risk assessments and ongoing monitoring across a variety of markets and regulatory frameworks.

Benefits

Confidence in Expanding to New Markets

Having international trade credit insurance in place allows businesses to enter new markets with greater assurance. By mitigating both commercial and political risks, companies can offer competitive open account terms to foreign buyers while reducing the risk of non-payment.

High Levels of Protection

Short-term export credit insurance (ECI) typically provides up to 95% coverage for both commercial and political risks. Medium-term ECI policies, on the other hand, cover 85% of the net contract value, offering strong financial security for exporters.

Better Financing Opportunities

Insured international receivables are often viewed as lower-risk collateral by lenders. This can lead to more favorable financing terms, improved credit facilities, and better cash flow management for businesses.

Proactive Risk Monitoring

Many international policies include advanced tools to track political and economic developments in target markets. This proactive approach helps businesses make informed decisions about credit limits and market exposure.

Challenges

While international trade credit insurance offers invaluable benefits, it comes with its own set of challenges.

Higher Premiums

The cost of international coverage is generally higher than domestic policies due to the added risks involved. Multi-buyer policies typically cost less than 1% of insured sales, but single-buyer policies can vary significantly, reflecting the heightened risk. Political and currency risk assessments across multiple jurisdictions also add to the expense.

Complex Underwriting

The underwriting process is more intricate, requiring evaluations of both the buyer’s creditworthiness and the political and economic stability of their country. This can lead to longer approval times and a need for extensive documentation.

Extended Claims Processing

When claims arise, particularly for political risks, the process can take longer. Verifying circumstances across different legal systems and jurisdictions often involves detailed investigations and additional documentation.

Exclusions for High-Risk Markets

Some policies exclude coverage for countries or regions facing significant political instability. These exclusions can limit opportunities in emerging markets where risks are higher.

"We can’t predict the future. But we can help you understand and analyze the risks associated with proper customer payment while guaranteeing you first-class protection." – Cyrille CHARBONNEL, Group Underwriting Director, Coface

The complexities of international trade credit insurance mirror the challenges of global business. For companies looking to grow internationally, these policies provide crucial protection, enabling them to navigate foreign markets with greater confidence and security.

sbb-itb-2d170b0

Domestic vs International Trade Credit Insurance Comparison

Understanding the differences between domestic and international trade credit insurance is key to choosing the right protection for your business. Each type of coverage addresses unique risks that align with specific trading practices and business goals.

Benefits and Risks Comparison

Domestic trade credit insurance focuses exclusively on buyer risk within the United States. On the other hand, international trade credit insurance goes further, covering additional risks like political instability and currency fluctuations. Here’s a quick comparison of the two:

| Coverage Aspect | Domestic Trade Credit Insurance | International Trade Credit Insurance |

|---|---|---|

| Primary Risk Focus | Buyer insolvency and non-payment | Commercial risks plus political and currency-related risks |

| Underwriting Complexity | Straightforward, based on domestic credit assessments | More detailed, requiring analysis of country and political risks |

| Market Expansion Support | Supports growth within U.S. markets | Enables entry into global markets |

How to Choose the Right Coverage

Choosing the right trade credit insurance starts with understanding your business’s needs and growth strategy. As shown in the table, your decision should consider factors like market exposure, customer base, and operational focus.

For businesses primarily operating within the U.S., domestic trade credit insurance is often sufficient. However, companies with significant export activities or those relying heavily on international customers should explore international coverage. For instance, if your revenue depends on a single foreign buyer, a comprehensive international policy is crucial.

"Credit insurance is a vehicle to help facilitate growth without increasing risk." – Kirk Elken, Co-founder, Securitas Global Risk Solutions

Assessing financial stability is essential for effective risk management. This includes evaluating your buyers and their environments. For international buyers, additional factors like political stability, currency controls, and economic conditions must be considered. With 25% of corporate bankruptcies linked to customer default or insolvency, proactive risk assessment is critical.

Another advantage of trade credit insurance is its impact on financing. Insured receivables are often seen by lenders as lower-risk collateral, making it easier to secure working capital. Many businesses opt for combined policies that cover both domestic and export credit risks under a single agreement. This approach simplifies administration, cuts costs, and ensures comprehensive protection.

Accounts Receivable Insurance excels at creating tailored policies to meet specific business needs. Whether you’re focused on domestic or international markets, their customized solutions help businesses navigate the complexities of credit insurance while maintaining competitive pricing. For many companies, integrating domestic and international coverage strikes the perfect balance in managing diverse credit risks.

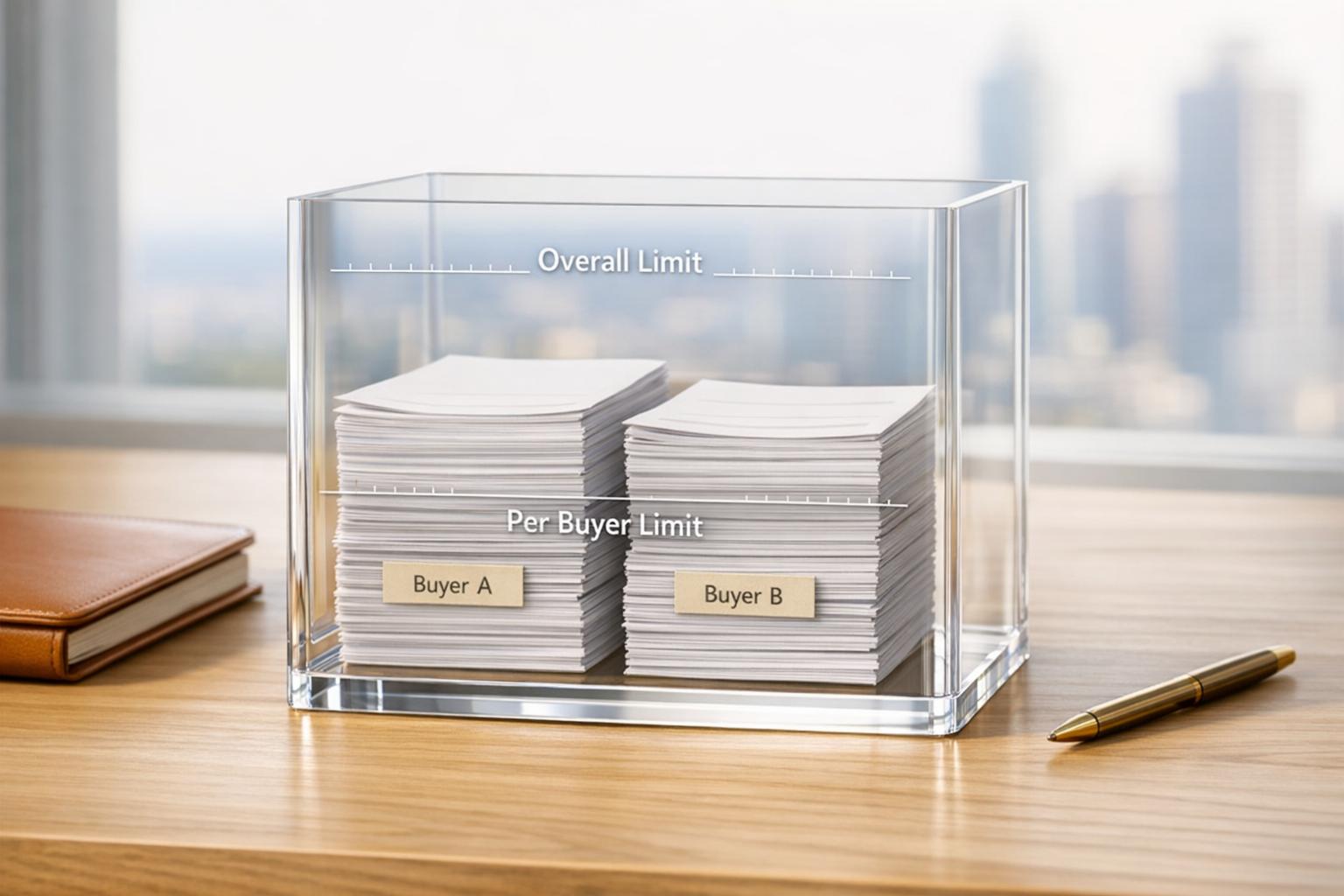

Combining Domestic and International Coverage

For businesses operating both domestically and internationally, having unified credit risk protection is a game-changer. Instead of juggling separate policies for each market, combining domestic and international trade credit insurance into one policy simplifies operations and strengthens financial security.

Benefits of a Combined Policy

A single, unified policy streamlines administration by eliminating the need to manage multiple insurance contracts. Rather than coordinating with different insurers and navigating varied policy terms, businesses gain the ease of working with one provider for all their credit risk needs.

Standardized terms and conditions across both domestic and international coverage create operational consistency. With uniform deductibles, coverage limits, and claims processes, companies can respond faster when deciding to extend credit – whether dealing with a local customer or an overseas client. This consistency minimizes errors and simplifies risk management, making day-to-day operations more efficient.

From a financial perspective, the advantages are clear. Receivables often represent more than 40% of a company’s assets, while coverage costs typically remain under 1% of sales. This makes a combined policy a cost-effective way to protect significant assets.

Doug Konop, CFO at Specialty Forest Products, highlights the strategic value of credit insurance:

"I look at credit insurance as a strategic advantage, not only for our company but for our industry as a whole. Recovery is only going to go quicker if everyone extends more credit."

Additionally, combined policies can improve access to financing. Lenders tend to view insured receivables as lower-risk collateral, which can enhance borrowing capacity and reduce financing costs.

Tips for Setup and Management

To make the most of combined coverage, it’s essential to partner with experienced professionals and establish effective management practices. Start by thoroughly reviewing your customer portfolio. Combined policies can protect businesses of all sizes and industries, offering flexibility to focus on higher-risk accounts when necessary.

Ensure your policy is adaptable, with credit limits that can be adjusted as your business evolves. Multinational trade credit insurance programs are particularly useful for companies with international subsidiaries or significant export operations, as they provide seamless coverage across borders.

Ongoing communication with your insurer is crucial. By regularly discussing emerging risks, shifting customer dynamics, and market changes, you can ensure your policy remains aligned with your business needs.

Accounts Receivable Insurance specializes in creating integrated solutions with tailored policy designs and dedicated broker support. Their expertise in both domestic and international markets helps businesses secure customized protection that addresses specific risks while keeping operations straightforward.

Ultimately, combined coverage isn’t just about bundling two policies. It’s about adopting a comprehensive risk management strategy that protects your entire customer base under one cohesive framework, offering simplicity and peace of mind.

Conclusion: Choosing the Right Trade Credit Insurance

Selecting the right trade credit insurance requires a careful look at your business’s unique risks and operational needs. Whether you need domestic coverage, international protection, or a mix of both, the decision can have a major impact on your financial stability.

Start by considering where your buyers are located and how much your business depends on key clients. For example, if 40% of your assets are tied up in unpaid invoices, securing effective protection becomes critical. International operations bring added challenges, such as navigating different legal systems, regulatory requirements, and local business practices. These factors should guide your evaluation of policy options.

Coverage types vary widely, from whole turnover policies to single risk or buyer credit options that may include political risk protection. This is especially important for small and medium-sized enterprises (SMEs), which often face limited access to trade financing – just 10% of available funding, according to recent data. A combination of coverage types could be the best solution for businesses operating in diverse markets.

It’s also essential to choose a policy that can evolve with your business. Look for flexible options that allow for adjustable credit limits and come with robust global risk assessment tools. When comparing policies, don’t just focus on premiums – evaluate the quality of risk assessments, claims handling processes, and the provider’s expertise in your target markets.

For businesses with international operations, working with experienced professionals is invaluable. Insurance specialists can help tailor coverage to your specific needs, clarify complex policy terms, and ensure there are no gaps in coverage. Their guidance can make a significant difference in navigating the fine print and fulfilling policy obligations.

Accounts Receivable Insurance is one example of a provider offering customized solutions for these challenges. Their expertise spans both domestic and international markets, enabling them to design tailored policies, conduct in-depth risk assessments, and provide dedicated broker support. With access to a global network of credit insurance carriers, they can help you structure coverage that fits your needs – whether through separate policies for domestic and international markets or an integrated solution that ensures seamless protection across all operations.

FAQs

What are the key differences between domestic and international trade credit insurance?

The main distinction between domestic and international trade credit insurance lies in the types of risks they cover and their associated costs. Domestic trade credit insurance is designed to protect businesses from issues like customer insolvency or payment defaults within the United States. It focuses on the financial reliability of buyers operating under the same legal, economic, and regulatory systems.

International trade credit insurance, however, goes a step further by addressing risks specific to cross-border transactions. These include political risks (such as government instability, war, or trade restrictions), currency exchange fluctuations, and complications arising from differing legal systems or business practices in various countries. Because of this wider range of risks, international policies typically come with higher premiums than domestic ones.

Both types of insurance play a crucial role in protecting your business’s accounts receivable, helping to maintain financial stability, and supporting growth – whether you operate locally or in global markets.

What are the benefits of combining domestic and international trade credit insurance for businesses operating globally?

When businesses operate on a global scale, combining domestic and international trade credit insurance can provide a safety net against the risk of non-payment, whether dealing with local clients or customers overseas. This dual-layered protection ensures that companies can maintain financial stability, even when navigating the challenges of different economic climates or varying credit risks across regions.

By merging these policies, businesses can simplify how they manage credit risks, maintain steady cash flow, and protect their accounts receivable. This means they can channel their energy into exploring growth opportunities without constantly worrying about unpaid invoices. In the long run, this strategy supports their ability to compete globally while keeping operations running smoothly.

What should businesses consider when choosing between domestic, international, or combined trade credit insurance?

When deciding between domestic, international, or combined trade credit insurance, it’s important to consider the specific risks your business faces and how you operate. Start by looking at where your customers are located. For international trade, think about risks like political instability, economic ups and downs, or currency shifts. For domestic trade, focus on customer creditworthiness and the current state of your market.

You’ll also want to explore how flexible and customizable the policies are. Does the coverage match your business needs? Features like adjustable credit limits and tailored risk protection can make a big difference. At the same time, compare the cost of the insurance to the benefits it offers – like protecting your cash flow and helping your business grow. Partnering with a reliable provider that has strong claims support and a global presence can add an extra layer of security and confidence.