Digital claims management platforms simplify and automate the claims process from start to finish. These tools replace manual, paper-heavy workflows with centralized systems that handle claims filing, task routing, document management, and real-time analytics. For businesses, especially those relying on accounts receivable insurance, these platforms mean faster claims resolution, lower administrative costs, and better risk management. Key features include:

- Automated Claims Processing: Handles submissions, validates data, flags errors, and routes claims efficiently.

- AI-Powered Fraud Detection: Identifies duplicate claims and unusual patterns to reduce risks.

- Workflow Management: Customizable processes ensure smooth collaboration and timely approvals.

- Analytics Tools: Real-time dashboards and predictive models help businesses make informed decisions.

- Integration with ERP Systems: Syncs data with accounting and financial systems for seamless operations.

- Self-Service Portals: Policyholders can file and track claims in real time, improving transparency and speed.

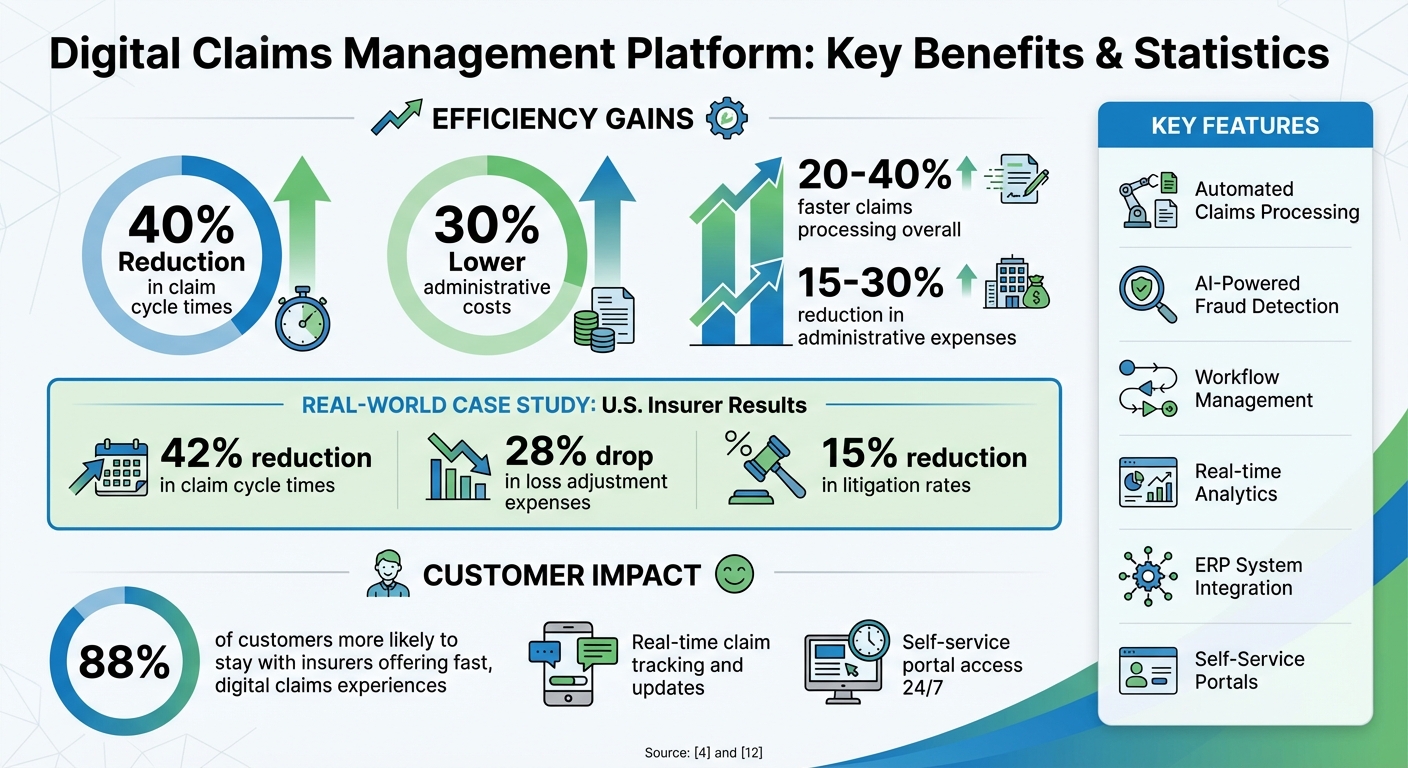

These platforms are transforming claims management for U.S. businesses, especially in handling non-payment or insolvency claims tied to accounts receivable insurance. By automating routine tasks and providing actionable insights, companies can cut claim cycle times by up to 40% and administrative costs by 30%, all while improving customer satisfaction and compliance with regulatory standards.

Digital Claims Management Platform Benefits and ROI Statistics

Core Features of Digital Claims Management Platforms

Automated Claims Intake and Processing

Digital claims platforms streamline the entire submission process by replacing manual tasks with intuitive tools like web portals, mobile apps, and APIs. Policyholders can file claims anytime using multiple channels, ensuring accessibility and convenience. For example, when a claim involving non-payment or bankruptcy is submitted, electronic First Notice of Loss (FNOL) forms gather all necessary details, validate the data automatically, and flag duplicate entries. This immediate validation reduces errors, cutting down on time-consuming back-and-forth corrections.

These platforms use rules-based categorization to route claims efficiently. Complex cases, such as those involving buyer insolvency, are escalated to senior adjusters, while straightforward claims like overdue invoices follow a streamlined approval process. AI-powered pattern analysis adds another layer of precision, identifying potential fraud by spotting red flags like repeated claims against the same buyer or mismatched documentation. This level of automation is especially critical in managing risks tied to accounts receivable insurance. By integrating these processes into structured workflows, claims progress quickly and efficiently.

Workflow Management and Team Collaboration

Customizable workflows guide claims through every step, from assignment to final authorization, with built-in role-based approvals and escalation paths. Features like task queues, service-level agreements (SLAs), and automatic escalations ensure that no claim is overlooked – a crucial safeguard when dealing with complex, multi-party claims involving global credit carriers.

Collaboration tools bring all communication into one place, directly within the claim record. Emails, SMS messages, and shared notes are logged to create a full audit trail, while adjusters can add internal comments, schedule follow-ups using claims diaries, and communicate directly with policyholders through embedded portals. These tools eliminate the need to switch between systems, making the process more efficient. Mobile workspaces extend these capabilities to field teams, enabling real-time updates and remote management. In one case study, introducing automated triage and centralized workflows led to a 42% reduction in claim cycle times and a 28% drop in loss adjustment expenses. Such improvements not only streamline operations but also lay the groundwork for data-driven decision-making.

Analytics and Reporting Tools

Real-time dashboards provide essential metrics like claim cycle times, reserve accuracy, and loss ratios. For accounts receivable insurance, specialized insights – such as days-to-payment on claims, average indemnification ratios, and buyer or industry segmentation – help businesses identify trends and tackle operational challenges. Self-service analytics empower users to explore data independently, uncovering patterns such as spikes in non-payment claims without waiting for IT-generated reports.

Predictive AI models further enhance decision-making by scoring claims for fraud risk and severity, while outlier detection highlights duplicate or unusual submission patterns. These insights can inform credit strategies, enabling businesses to adjust buyer credit limits or tighten payment terms as needed. Automated compliance reporting also simplifies regulatory filings, ensuring that all documentation meets state and federal standards. This combination of analytics and automation supports efficient, secure claims management tailored to the unique demands of accounts receivable insurance.

Business Benefits of Digital Claims Management

Increased Efficiency and Cost Savings

Automation streamlines processes by taking over repetitive tasks like data entry, document tracking, and interdepartmental handoffs. This slashes claim cycle times by 20–40% and reduces administrative expenses by 15–30% as adjusters can focus on more complex, high-value claims that need their expertise.

For example, one U.S. insurer introduced automated triage and integrated workflows, cutting claim cycle times by 42% and lowering loss adjustment expenses by 28%. The system efficiently routed straightforward claims through fast-track approvals while escalating more intricate cases to senior adjusters. This kind of optimization is especially impactful in accounts receivable insurance, where quicker processing of non-payment or bankruptcy claims means policyholders receive indemnifications faster. This helps businesses maintain essential working capital during tough financial situations.

By boosting efficiency, companies not only lower operational costs but also enhance their ability to manage risks effectively.

Better Risk Management and Fraud Detection

AI-driven tools enhance risk management by spotting fraud before it becomes a costly problem. These systems assess claims for risk, flag duplicate submissions, and detect unusual activity – such as repeated claims against the same buyer or inconsistent documentation. These capabilities can reduce litigation rates by 15% and bring more consistency to reserve settings across portfolios.

In accounts receivable insurance, predictive analytics play a vital role in identifying risks tied to buyer insolvency or economic downturns. Real-time dashboards provide insights into trends like non-payment claims, enabling businesses to adjust credit limits or tighten payment terms before issues escalate. This proactive stance not only safeguards revenue but also helps businesses identify potential problem buyers early. Automated audit trails document every decision and interaction, reducing compliance risks while supporting data-backed underwriting decisions. The combination of fraud detection and trend analysis contributes to healthier portfolios overall.

When operations are efficient and fraud detection is strong, the result is a better experience for policyholders.

Improved Policyholder Experience

Speed and transparency are key to earning trust. Self-service portals allow policyholders to submit claims, upload documents, and track their status anytime – no need to wait on hold or send follow-up emails. This level of convenience matters, as 88% of customers are more likely to stay with insurers that offer fast, digital claims experiences.

Real-time updates delivered through email, SMS, or portal notifications keep policyholders informed at every step. For accounts receivable insurance clients dealing with urgent non-payment situations, this immediacy is crucial. Faster claim resolutions help businesses recover funds more quickly, ensuring cash flow during financially challenging times. Integrated communication tools eliminate redundant requests, while personalized updates ensure clients stay informed without feeling overwhelmed. This level of service not only strengthens customer loyalty but also positions digital-first insurers as trusted partners rather than just service providers.

What to Look for When Evaluating Platforms

End-to-End Claims Lifecycle Management

A strong digital claims management platform should cover every stage of the claims process – starting from the first notice of loss all the way through investigation, adjudication, payment, recovery, and closure – within a single system. This typically includes features like omnichannel intake (via web, mobile, email, API), automated case creation, rules-based triage and assignment, integrated document management, workflows for reserves and payments, subrogation tracking, and detailed audit trails for every action.

It’s important to ensure the system supports multi-state handling and offers configurable workflows for different claim types. For Accounts Receivable Insurance, this is particularly important when managing non-payment claims, as it involves validating invoice data, tracking collection efforts, and coordinating recoveries. Vendors should demonstrate how they can set up new workflows – such as adding a fraud-review step for claims exceeding $50,000 – using no-code or low-code tools instead of custom development. To evaluate this, ask for a proof-of-concept where the vendor replicates one of your current claim workflows, including approvals and escalation rules, within a matter of days rather than months.

Lastly, ensure the platform integrates seamlessly with your financial systems.

Integration with ERP and Accounting Systems

A reliable platform must support two-way integration with ERP systems (e.g., SAP, Oracle, NetSuite) and accounting applications (e.g., QuickBooks, Microsoft Dynamics). This ensures synchronization of policyholder accounts, invoices, aging reports, payments, reserves, and write-offs. For Accounts Receivable Insurance, such integrations allow for the importing of open receivables, past-due statuses, and bad-debt write-offs, enabling credit insurance claims to be validated against invoice data and credit limits in near real time.

Look for pre-built connectors, a well-documented REST API, event-driven integration, and compatibility with standard data formats such as JSON and XML. Ask vendors to provide examples of U.S. customers using similar integrations, review uptime and latency service-level agreements (SLAs), and confirm the platform includes robust error handling and logging for failed transactions. Additionally, determine whether the vendor offers integration support or works with systems integrators to minimize project risks and reduce timelines.

Equally important is ensuring the platform meets compliance and security requirements.

Compliance and Security Standards

The platform should comply with state insurance regulations, NAIC models, and record retention requirements. Key features to look for include configurable retention schedules, immutable audit trails, automated regulatory reporting, and secure evidence preservation. These components help protect sensitive financial data and maintain the integrity of non-payment and risk management claims processed under Accounts Receivable Insurance.

Make sure the platform uses encryption for data both in transit and at rest, role-based access controls, multi-factor authentication, single sign-on (SSO) integration, and detailed access logs with granular permissions for adjusters, brokers, and external vendors. It should also hold SOC 2 Type II attestation and follow ISO 27001-aligned practices, with documented incident response and disaster recovery plans. For claims involving sensitive banking details, such as ACH or wire transfers, ensure there is secure handling and proper segregation of duties in payment approvals.

sbb-itb-2d170b0

Implementation Best Practices for U.S. Businesses

Assess Current Workflows and Needs

Before diving into a digital claims management platform, take a step back and map out your entire claims process – from the initial notice to closure. This means documenting every step, including handoffs, approvals, and system interactions. Pay close attention to any workarounds, like using spreadsheets or email, and gather baseline metrics. Look at things like average claim cycle time, the number of manual touches per claim, rework rates, and error rates. This will help pinpoint where delays or compliance risks are most likely to occur.

Talk to the people directly involved in the process – claims handlers, finance staff, IT teams, and anyone managing accounts receivable or credit insurance. Their input will reveal pain points that might not be obvious from a high-level view. Once you have this information, set five to ten specific improvement goals. These could include objectives like "cut claim cycle time by 25%" or "eliminate duplicate data entry into the ERP system." Tailor these goals to the unique needs of ARI workflows, and use them to guide how you configure the platform and measure its success.

This groundwork is essential for smooth data integration later on.

Plan for Data Integration and Migration

Start by identifying your core systems for policies, accounts receivable, and payments. These will act as your central sources of truth for each type of data. Then, map out how data should flow between systems – for example, policies feeding into the platform, reserves and payments updating the ledger, and invoice or credit data syncing between the claims system and ERP.

For critical areas like coverage verification, reserve updates, and payment statuses, focus on real-time integration to minimize risks and improve the customer experience. For less urgent data, like historical claim notes, batch syncing works just fine. When it comes to migrating data, begin with a detailed inventory to figure out which historical claims and accounts receivable records you’ll need for operations, analytics, and regulatory requirements. (In the U.S., this often means keeping five to seven years of detailed data.) Assess the quality of your data, set up cleansing rules, and take a phased approach: start with master data and open claims, then move on to closed claims and legacy documents. Validate each step with sample reconciliations to ensure accuracy before fully implementing the system.

Once data flows are integrated and reliable, your team will be ready to use the platform effectively, making training and performance tracking the next key steps.

Train Teams and Monitor Performance Metrics

Create role-specific training programs that are concise and practical. Use short, scenario-based sessions like "Process a small-dollar claim from start to finish" or "Submit and approve a trade-credit claim for an overdue invoice." Pair these sessions with hands-on practice in a sandbox environment that mirrors real-world U.S. data, currency formats, and sample policies. Designate super users or champions in each department who can receive more in-depth training and serve as go-to resources for their colleagues – this is especially helpful for teams spread across different locations.

Once the system is live, track key performance indicators (KPIs) that align with your improvement goals. For instance, monitor metrics like average claim cycle time, claims processed per adjuster, the percentage of claims handled without manual intervention, and loss adjustment expenses as a percentage of incurred losses. For fraud and risk management, keep an eye on fraud detection rates, confirmed fraud cases, and recovery amounts. Include metrics like how many days it takes from invoice default to claim settlement and overall recovery rates. These KPIs should tie back to the improvement targets you set during the workflow assessment phase to ensure continuous progress.

Leverage dashboards and real-time alerts to help supervisors spot issues early, such as outlier claims or uneven workloads. Conduct quarterly reviews of analytics to identify bottlenecks and fine-tune workflows as needed. This ongoing monitoring will keep your claims process running smoothly and efficiently.

Connected Claims 2.0: Reimaging the Claims Process

Conclusion

Digital platforms are reshaping claims handling in the U.S., replacing manual, disconnected processes with streamlined, automated workflows. This shift brings tangible benefits, particularly for businesses involved in Accounts Receivable Insurance. These platforms accelerate recovery on unpaid invoices, improve documentation for handling high-volume claims, and support global operations where trade credit and political risks come into play. These operational efficiencies provide a solid base for long-term growth.

The return on investment (ROI) from digital platforms is clear. They speed up claim resolution, cut costs, and reduce inefficiencies. Case studies show marked decreases in cycle times, loss adjustment expenses, and litigation rates, while customer satisfaction improves significantly. Automated workflows and self-service tools allow businesses to scale efficiently, handling increased claim volumes without needing to proportionally grow their workforce. Additionally, advanced analytics contribute to better decision-making in areas like pricing, reserving, and capital allocation.

To prepare for this transformation, start by evaluating your current claims workflows and data management processes. Establish baseline metrics such as cycle times, cost per claim, and error rates. Set specific goals – like reducing cycle times by 25% or cutting manual touchpoints by 20% – to guide vendor selection and prioritize essential features like automation, analytics, or tools tailored for AR insurance.

A future-ready platform should manage the entire claims lifecycle, from initial notice of loss to settlement and reporting. It must integrate seamlessly with ERP and accounting systems using modern APIs and include robust security and compliance features to meet U.S. regulatory standards. Multicurrency support is also a critical feature for businesses operating globally.

FAQs

How do digital claims management platforms help detect and prevent fraud?

Digital claims management platforms play a key role in identifying and preventing fraud by using cutting-edge analytics, real-time monitoring, and automated verification tools. These tools collaborate to spot irregular patterns, highlight inconsistencies, and swiftly verify claims data with precision.

By automating the fraud detection process, these platforms help reduce the likelihood of false claims and cut down on financial losses. At the same time, they simplify workflows, enabling businesses to concentrate on processing valid claims while boosting security and operational efficiency.

How do digital claims management platforms integrate with existing ERP systems?

Digital claims management platforms are built to work effortlessly with existing ERP systems using APIs, middleware, or pre-configured connectors. These tools allow for seamless data sharing across essential functions, such as handling credit limits, maintaining customer information, and managing transaction workflows.

This integrated approach minimizes the need for manual data entry, reduces errors, and boosts efficiency in managing claims processes.

What features are most important when choosing a digital claims management platform?

When choosing a digital claims management platform, prioritize tools that streamline processes and minimize risks. Key features to consider include real-time claims tracking, which keeps you updated every step of the way, and customizable policies that align with your specific business requirements. Ensure the platform offers smooth integration with your current systems to avoid disruptions. Additionally, having proactive risk assessment tools and access to licensed professionals for dedicated support can greatly improve the efficiency and reliability of your claims management.