Recovering international debts is tough. U.S. companies face obstacles like legal conflicts, language barriers, and political instability when trying to collect unpaid invoices from foreign buyers. These challenges can disrupt cash flow, delay payments, and increase costs, putting businesses at financial risk.

Key issues include:

- Legal Hurdles: Differing laws, weak enforcement, and insolvency cases make it hard to secure payments.

- Communication Barriers: Language differences and misaligned business practices complicate negotiations.

- Political Risks: Events like war, currency restrictions, or government actions can block payments.

- Documentation Problems: Missing or incomplete contracts often stall legal claims.

Solution: Trade credit insurance helps U.S. exporters protect 90-95% of invoice values, manage risks, and access expert debt recovery services worldwide. By integrating insurance with strong credit policies, businesses can reduce losses and maintain steady cash flow.

Want to safeguard your receivables? Combine insurance with clear contracts, timely reporting, and real-time risk assessments to stay ahead of payment risks.

International Debt Recovery Challenges: Key Statistics and Coverage Rates

Main Challenges in International Debt Recovery

Legal and Jurisdictional Problems

Recovering debts across borders is a complex process requiring both recognition and enforcement of judgments in foreign courts. For U.S. companies, the first step is obtaining recognition of a foreign judgment in the local jurisdiction. Only then can they attempt to seize assets based on that judgment. However, legal systems differ significantly between common law and civil law countries, affecting procedures like asset freezing and evidence collection.

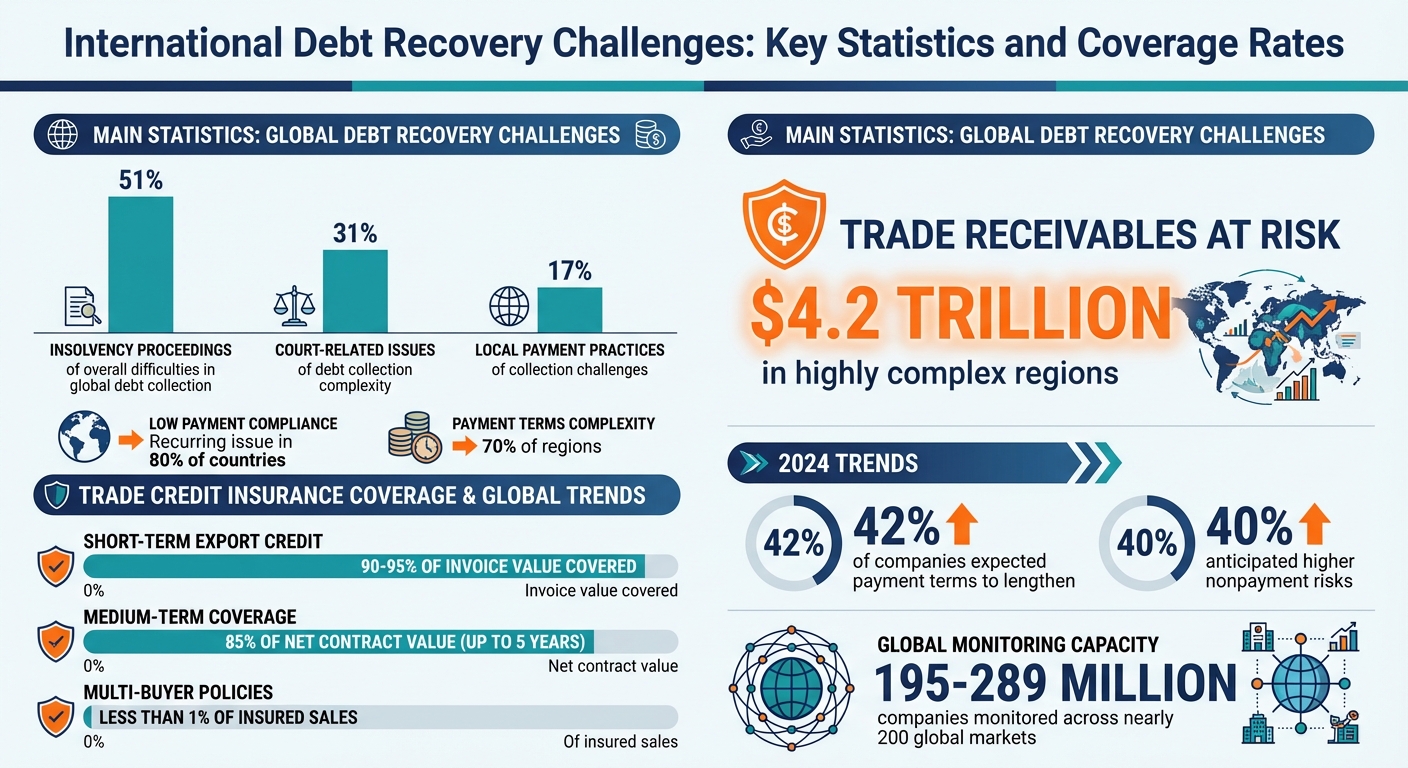

Local insolvency laws often present significant hurdles. When a debtor files for bankruptcy, unsecured creditors usually recover little or nothing. Insolvency proceedings contribute to 51% of the overall difficulties in global debt collection, while court-related issues account for 31%, and local payment practices add another 17% to the complexity. If the debtor is a state-owned entity, sovereign immunity can block lawsuits and asset seizures altogether. Additionally, strict privacy laws and limited discovery rules in many countries make gathering evidence abroad especially challenging.

"The most frequent issue… is the low probability to recover a debt as an unsecured creditor in practice when the liquidation proceedings have commenced." – Allianz Research

To navigate these challenges, U.S. exporters sometimes use state or federal subpoenas targeting financial institutions with a U.S. presence to trace foreign assets without needing foreign court intervention. International treaties, like the New York Convention, also help enforce arbitration awards. Yet, the stakes remain high, with trade receivables at risk in highly complex regions exceeding $4.2 trillion. These legal hurdles often intertwine with difficulties in communication and cultural alignment, further complicating the recovery process.

Cultural, Language, and Communication Barriers

Language differences can create significant obstacles during debt recovery. Misunderstandings over legal or financial terms can derail negotiations, making it harder to reach agreements on repayment plans. Beyond language, variations in business etiquette, negotiation styles, and payment practices can lead to further complications. A seemingly straightforward request in the U.S. might come across as overly aggressive or even offensive in another country.

Many payment disputes arise from technical miscommunications rather than intentional nonpayment. In such cases, direct communication – like a simple phone call – can often resolve issues quickly, avoiding the need for lengthy and costly legal action. Amicable settlements are generally preferred as they preserve business relationships and reduce delays. In some regions, arbitration decisions take so long to enforce that debtors use the waiting period to file for insolvency and avoid payment altogether.

"The simplest and least costly solution to a payment problem is to contact and negotiate with the customer." – U.S. International Trade Administration

Local expertise plays a crucial role in overcoming these challenges. Professionals familiar with regional customs can conduct site visits and build trust with debtors, something foreign creditors often struggle to achieve. They also understand specific requirements, such as the necessity of signed delivery notes in many jurisdictions before initiating legal action. Low payment compliance is a recurring issue in nearly 80% of countries, while payment terms add complexity in 70% of regions. Tailoring collection strategies to fit local realities is essential for success, but it also highlights the operational and political hurdles involved.

Political and Economic Risks

Political instability can disrupt debt recovery efforts in an instant. Events like terrorism, civil unrest, or armed conflict often damage infrastructure and disrupt supply chains, making it nearly impossible for debtors to meet their payment obligations. For example, in June 2024, protests in Kenya against a Finance Bill tied to IMF loan conditions led to dozens of deaths and ongoing economic instability, even after the bill was withdrawn.

Currency controls in unstable markets add another layer of complexity. Governments may restrict the conversion of local currency into U.S. dollars, complicating international payments. When a debt is denominated in U.S. dollars and the debtor’s local currency weakens, servicing the debt becomes more expensive, increasing the likelihood of default. In 2022, Sri Lanka’s sovereign debt default caused severe shortages of fuel and medicine, further deteriorating public services. As many low- and middle-income countries face mounting debt distress, businesses operating in these markets encounter significant challenges in collecting payments.

Governments may also expropriate or nationalize foreign-owned assets, sometimes without fair compensation. In regions where approximately 3.3 billion people live in countries that spend more on interest payments than on health or education, international debts often fall to the bottom of the priority list. Moreover, a ten-point drop in a country’s International Country Risk Guide rating correlates with a 106-basis-point increase in sovereign spreads annually.

"Unsustainable debt is not just an economic issue, it is a major threat to rights and democracy." – Tess Woolfenden, Policy Adviser, Debt Justice

These risks emphasize the importance of robust insurance options and expert recovery strategies to mitigate potential losses.

Documentation and Operational Issues

Incomplete contracts and logistical challenges are some of the most common – and avoidable – issues in international debt recovery. Many jurisdictions require signed delivery notes and properly executed agreements before legal action can proceed. Verbal agreements, which might hold weight in some domestic settings, are generally inadmissible in foreign courts. Missing documentation often gives debtors grounds to dispute claims, complicating the recovery process further. These issues often arise from assuming that home-country practices will work abroad.

Other operational hurdles like time zone differences and varying accounting standards can delay dispute resolution. Companies that fail to research local requirements before extending credit may find that their standard contracts don’t meet foreign legal standards. Incomplete or inadequate documentation exacerbates these challenges. Securing thorough documentation upfront and tailoring it to meet regional legal requirements is a critical step in any international debt recovery effort.

How Trade Credit Insurance Helps with Debt Recovery

Trade credit insurance offers a layer of protection for U.S. exporters, helping them manage the risks tied to international debt recovery while ensuring their cash flow remains steady.

Evaluating Buyers and Markets to Minimize Risk

Before extending credit, insurers dive deep into assessing the creditworthiness of buyers and the stability of their markets. Many major insurers maintain extensive databases, covering up to 195 million companies across nearly 200 global markets. These evaluations include reviewing financial statements, payment histories, and local market conditions. This analysis helps determine which buyers qualify for coverage and sets appropriate credit limits.

Protection Against Nonpayment and Political Instability

Once risks are assessed, trade credit insurance steps in to shield transactions against nonpayment and political upheaval. For short-term export credit, policies typically cover 90% to 95% of the invoice value for risks like buyer insolvency, bankruptcy, or prolonged default. Medium-term coverage, often used for capital equipment sales, generally covers 85% of the net contract value for up to five years. Political risk coverage adds another layer of security, protecting against losses caused by war, terrorism, riots, expropriation, currency inconvertibility, or abrupt regulatory changes.

"ECI significantly reduces the payment risks associated with doing business internationally by giving the exporter conditional assurance that payment will be made if the foreign buyer is unable to pay." – International Trade Administration

Leveraging Global Expertise for Debt Collection

Insurers bring in global collections networks and experienced local legal teams to handle recoveries efficiently and with cultural sensitivity. These experts are well-versed in local requirements, such as obtaining signed delivery notes or adhering to prescriptive periods, enabling them to navigate foreign insolvency laws effectively. They focus on reaching amicable settlements to avoid drawn-out arbitration, understanding that legal processes in some countries can take years to resolve. This localized expertise ensures faster claims processing and ongoing recovery efforts.

Claims and Recovery: Keeping Cash Flow Intact

When a buyer defaults, insurers require proof of recovery attempts before processing a claim. Once the loss is validated, you receive compensation – typically covering 90% to 100% of the invoice amount – to help stabilize your cash flow. Insurers also provide online tools to quickly file claims and monitor their progress. Even after paying your claim, they continue pursuing the debt and may share any recovered funds with you, as outlined in your policy terms. This ensures that recovery efforts don’t stop, even after you’ve been compensated.

sbb-itb-2d170b0

Creating a Debt Recovery Strategy with Trade Credit Insurance

Combining insurance protection with strong internal credit policies can significantly improve debt recovery outcomes. A well-rounded strategy involves weaving your trade credit insurance policy into every aspect of your credit management process. By taking this proactive approach, you can address payment issues early, before they spiral out of control.

Setting Clear Credit and Contract Terms

Start by drafting contracts that meet your insurer’s requirements right from the beginning. Every invoice should clearly outline key details such as governing law clauses, delivery terms, dispute resolution methods, payment due dates, late fees, and accepted payment methods. Additionally, ensure all contracts and documentation comply with local legal standards. These steps provide a solid foundation for your insurer to support your claim if a buyer defaults. Aligning these contract provisions with your internal collections process is essential for creating a seamless recovery strategy.

Matching Collections Processes with Policy Requirements

Your collections workflow should align with your policy’s Maximum Extension Period (MEP). Set up automated alerts in your accounting software to notify you several days before the MEP expires. Promptly report any instances of customer insolvency or prolonged default – delays in reporting could invalidate your claim.

"The exporter must exhaust all reasonable means of obtaining payment before an insurance claim will be honored." – U.S. International Trade Administration

Using Risk Intelligence to Prevent Problems

Beyond initial risk assessments, using real-time data can help you continuously adjust credit limits and avoid defaults. Risk intelligence provided by insurers – covering data on over 289 million companies – can guide you in setting dynamic credit limits based on a buyer’s current financial health. Regularly reviewing accounts receivable aging reports can also help spot emerging late payment trends. For instance, in 2024, 42% of companies expected payment terms to lengthen, while 40% anticipated higher nonpayment risks. By using real-time market insights and factoring in local payment behaviors, you can head off many potential debt recovery issues before they arise.

Conclusion: Improving Debt Recovery with Trade Credit Insurance

Challenges and Effective Solutions

Recovering international debts is no small feat. Businesses often face hurdles like differing legal frameworks, communication barriers, political unrest, and inconsistent documentation practices. This is where trade credit insurance steps in as a safety net. With coverage typically reimbursing 85% to 95% of unpaid invoices when buyers default, it safeguards cash flow against risks like buyer insolvency, prolonged payment delays, or political turmoil. Additionally, insurers offer access to vast databases monitoring over 240 million companies globally. This resource helps businesses identify high-risk buyers before extending credit. In cases of default, insurers leverage global expertise to resolve claims faster than drawn-out arbitration processes. These solutions underscore the vital role of specialized providers in addressing the complexities of international debt recovery.

The Role of Accounts Receivable Insurance

Navigating these challenges demands more than just protection – it requires proactive risk management. Accounts Receivable Insurance (https://accountsreceivableinsurance.net) offers tailored trade credit solutions that shield businesses from both commercial and political risks. Their services include detailed risk assessments of foreign buyers, efficient claims management, and access to a global network of credit insurance providers. Policies are designed to cover risks in both domestic and international markets, with multi-buyer policies often costing less than 1% of insured sales. For mid-sized exporters, this makes robust protection both practical and affordable. ARI also provides dedicated broker support to ensure that policy terms align seamlessly with your internal credit processes, helping you meet documentation and reporting standards with ease.

Recommendations for U.S. Exporters

For U.S. businesses aiming to thrive in global markets, integrating trade credit insurance into financial strategies is a smart move. Insured receivables can be leveraged to secure better financing terms, while prompt action on payment issues helps optimize cash flow. By combining insurance coverage with proactive credit management, businesses can turn accounts receivable into a strategic asset. This approach not only protects against unexpected losses but also supports international growth, transforming potential risks into opportunities for expansion and financial stability.

FAQs

How does trade credit insurance help protect businesses from political risks in global trade?

Trade credit insurance, also known as accounts receivable insurance, plays a crucial role in helping businesses navigate the uncertainties of international trade. It provides protection against losses stemming from political risks, such as government actions, civil unrest, or geopolitical instability. With this coverage, businesses are shielded from situations like asset expropriation, currency restrictions, or the inability to transfer funds out of a country. Instead of absorbing the full financial impact of unpaid invoices, companies can recover a portion of their losses.

For U.S. businesses venturing into emerging markets, this insurance also addresses risks tied to war, terrorism, or abrupt regime changes that could disrupt operations or halt production entirely. Coverage may include compensation for lost revenue, reimbursement for disruption-related expenses, or safeguarding funds that need to be repatriated. By reducing these potential setbacks, trade credit insurance allows companies to explore new opportunities abroad while maintaining a steady cash flow, even in volatile global conditions.

What legal challenges do U.S. companies face when recovering debts internationally?

U.S. companies face tough hurdles when it comes to jurisdiction and enforcement in international debt recovery. Every country has its own legal framework, making it tricky to figure out which court or arbitration panel has the authority to handle a case. Even when a U.S. company secures a judgment overseas, enforcing it back home isn’t straightforward. The U.S. doesn’t have a ratified treaty for enforcing foreign judgments, which means companies often hit a legal wall. On the other hand, arbitration awards under the New York Convention tend to be a more dependable route for obtaining enforceable outcomes.

On top of that, local regulations and protective laws in the debtor’s country can make things even more complex. For instance, strict consumer protection measures, anti-foreclosure laws, and unique procedural requirements can lead to delays and legal headaches. Add in the challenges of navigating cultural and language differences, along with the need for highly accurate documentation, and the process becomes even more daunting. All these factors combine to create a tough environment for U.S. businesses trying to recover debts internationally.

How do cultural and language differences affect debt recovery in international trade?

Cultural differences and language barriers can make debt recovery in international trade a tricky process. For instance, what might be considered a firm yet polite payment request in the U.S. could come across as overly aggressive or even offensive in another country. This misunderstanding can lead to delays or even cause the debtor to avoid payment altogether. On top of that, untranslated documents or unclear communication can create confusion, spark disputes over the owed amount, or lead to claims that payment demands were never properly received.

These complications often result in slower negotiations, higher costs, and longer recovery timelines. To tackle these hurdles, many businesses turn to trade credit insurance solutions that include multilingual support and expertise in local business practices. Accounts Receivable Insurance (ARI) goes beyond just protecting against risks like non-payment, bankruptcy, and political instability. It also connects businesses with global networks of experts who can assist with translations, navigate cultural nuances, and handle legal procedures. This level of support makes it easier for businesses to manage complex cross-border debt recovery and significantly boosts their chances of recovering payments efficiently.