IFRS 9 compliance is all about anticipating credit losses, not reacting to them. This global financial reporting standard requires businesses to estimate potential losses upfront using the Expected Credit Loss (ECL) model. Credit insurance plays a key role here, helping companies lower their ECL provisions by factoring in recoveries from insurance policies.

Here’s what you need to know:

- IFRS 9 Basics: It replaces the old IAS 39 model with a forward-looking approach, requiring businesses to classify financial assets and calculate ECLs using probability-weighted scenarios.

- Credit Insurance’s Role: Credit insurance reduces cash flow shortfalls by covering non-payments from customers, which directly impacts ECL calculations.

- Customization for Compliance: Policies should integrate with IFRS 9’s requirements, including asset classification, risk triggers, and forward-looking data like economic forecasts.

Explaining IFRS 9: Financial instruments

IFRS 9 Requirements for Credit Insurance

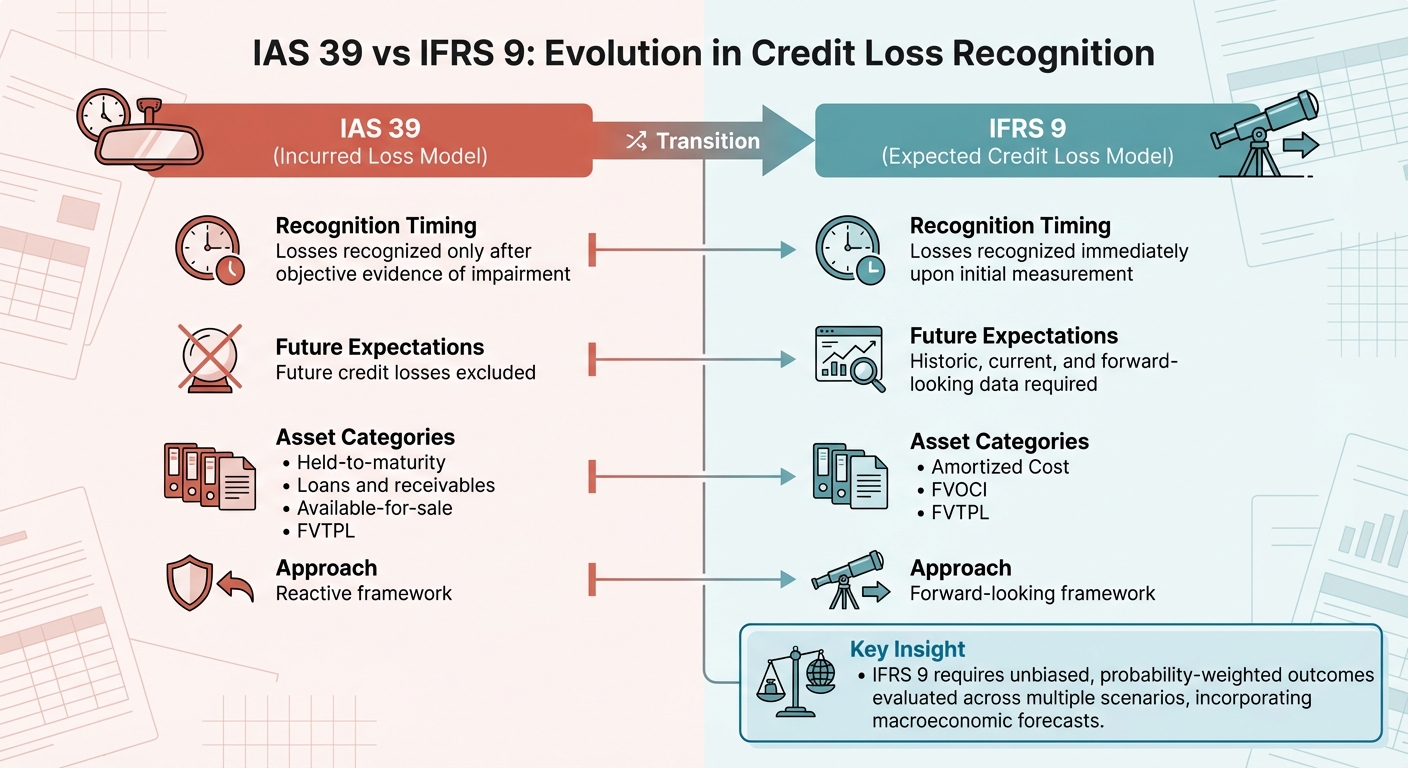

IAS 39 vs IFRS 9: Key Differences in Credit Loss Recognition

To understand how IFRS 9 impacts credit insurance, you need to break it down into three key areas: financial instrument classification, the Expected Credit Loss (ECL) model, and the changes it introduced compared to IAS 39. Let’s explore each of these elements to see how they shape credit insurance policies.

How IFRS 9 Classifies and Measures Financial Instruments

IFRS 9 organizes financial assets into three categories, determined by the business model and the SPPI test (Solely Payments of Principal and Interest):

- Amortized Cost: This applies to assets you hold to collect contractual cash flows, such as trade receivables. These require ECL calculations.

- Fair Value through Other Comprehensive Income (FVOCI): Assets in this category serve a dual purpose – you collect cash flows and may sell the assets.

- Fair Value through Profit or Loss (FVTPL): This classification is typically reserved for trading portfolios.

For credit insurance, cash flows from insurance can reduce the ECL for receivables, provided they’re not recognized separately. Companies issuing financial guarantee contracts – a common credit insurance tool – can choose between IFRS 9 or IFRS 17 (Insurance Contracts) for accounting, but only if they’ve historically treated these contracts as insurance.

The Expected Credit Loss (ECL) Model

The ECL model under IFRS 9 operates through three stages, each dictating how much loss allowance to recognize:

- Stage 1: For assets with no significant credit risk increase since origination, you must calculate a 12-month ECL, covering defaults that could occur within the next year.

- Stage 2: When credit risk significantly increases, the asset moves to Stage 2, requiring a lifetime ECL to account for all potential defaults over the asset’s life.

- Stage 3: This stage applies to credit-impaired assets where there’s objective evidence of impairment. Lifetime ECL is also required here.

The model incorporates weighted probability estimates that consider the time value of money and forward-looking data. This means using economic indicators – such as GDP growth, unemployment rates, and inflation – alongside historical data to predict default probabilities. Companies typically assess scenarios ranging from optimistic to stressed to ensure thorough risk evaluation.

An essential factor in monitoring credit risk is the 30-day past-due threshold, though other indicators like credit rating downgrades or changes in collateral value can also serve as triggers. Additionally, a 2019 clarification from the IFRS Interpretations Committee stated that if credit enhancements must be recognized separately, their cash flows cannot be included in the ECL calculation for the primary asset.

Changes from IAS 39 to IFRS 9

IFRS 9 introduced a forward-looking approach, replacing the reactive framework of IAS 39. Here’s how the two standards differ:

| Feature | IAS 39 (Incurred Loss) | IFRS 9 (Expected Credit Loss) |

|---|---|---|

| Recognition Timing | Losses recognized only after objective evidence of impairment | Losses recognized immediately upon initial measurement |

| Future Expectations | Future credit losses excluded | Historic, current, and forward-looking data required |

| Asset Categories | Four categories: Held-to-maturity, Loans and receivables, Available-for-sale, FVTPL | Three categories: Amortized Cost, FVOCI, FVTPL |

Under IFRS 9, expected losses must reflect unbiased, probability-weighted outcomes, evaluated across a range of possible scenarios. This forward-looking focus means credit insurance policies now need to align with economic forecasts, not just past loss patterns. As a result, insurers must adapt their practices to meet these more dynamic and predictive compliance standards.

How to Customize Credit Insurance for IFRS 9

Adjusting credit insurance to align with IFRS 9 standards involves a structured approach that focuses on classification, measurement, and proactive risk management. The goal is to shift from merely reacting to credit losses to anticipating potential risks and addressing them before they escalate.

Creating IFRS 9-Compliant Policies

Start by assessing the classification and measurement of your financial assets. Determine whether your insured receivables should be measured at amortized cost, FVOCI (fair value through other comprehensive income), or FVTPL (fair value through profit or loss). This decision largely depends on your business model and the SPPI (solely payments of principal and interest) test. For example, trade receivables intended solely for collecting contractual cash flows typically fall under the amortized cost category, requiring expected credit loss (ECL) calculations.

Define specific triggers to recognize significant increases in credit risk. These triggers help decide whether to calculate a 12-month ECL (Stage 1) or a lifetime ECL (Stage 2). Factors like rating downgrades, price fluctuations, or changes in option-adjusted spreads can serve as effective alerts for credit risk.

"A well-defined policy to identify credit deterioration is key to prudent investment management."

– J.P. Morgan Asset Management

For companies issuing financial guarantee contracts as part of their credit insurance strategy, there’s flexibility in choosing between IFRS 9 and IFRS 17 for accounting, provided these contracts have historically been treated as insurance contracts. The choice should align with your financial reporting goals and help reduce accounting mismatches, creating a solid foundation for forward-looking risk analysis.

Adding Forward-Looking Risk Analysis

IFRS 9 requires integrating past data, current conditions, and future forecasts into expected credit loss calculations. This means incorporating macroeconomic indicators such as GDP growth, unemployment rates, and inflation into your probability-weighted scenarios. Use a multi-scenario approach, balancing base, optimistic, and pessimistic forecasts with weighted averages. Update your Probability of Default (PD) and Loss Given Default (LGD) parameters annually using econometric models that reflect market changes, and apply mean reversion techniques for projections beyond the reasonable and supportable horizon.

"This method asks companies to take a forward-looking approach to assessing impairments rather than resolving impairment issues after they have already occurred."

– J.P. Morgan Asset Management

When calculating LGD, credit insurance can serve as a critical recovery mechanism. Under the Basel II foundation approach, large corporations typically receive a 45% LGD assignment, while start-ups are assigned 75%. Credit insurance coverage can lower these percentages, directly reducing the total expected credit loss.

Using Accounts Receivable Insurance for Compliance

External solutions like Accounts Receivable Insurance (ARI) can complement internal assessments and enhance IFRS 9 compliance. ARI provides tailored tools, including detailed credit risk analytics and buyer-specific data, that meet the "reasonable and supportable" data requirements of IFRS 9. These providers also offer continuous monitoring of buyer creditworthiness and economic trends, ensuring your credit risk parameters stay aligned with IFRS 9’s forward-looking framework.

"A bank’s use of experienced credit judgment, especially in the robust consideration of reasonable and supportable forward-looking information, including macroeconomic factors, is essential to the assessment and measurement of expected credit losses."

– Office of the Superintendent of Financial Institutions (OSFI)

By acting as a credit enhancement, ARI can reduce your LGD, which in turn lowers the expected credit loss recognized on your balance sheet. If your policy transfers most risks and rewards to the insurer, you may qualify for asset derecognition. Work closely with your broker to design policies that fulfill IFRS 9’s specific risk transfer criteria while ensuring coverage for both domestic and international receivables.

The symmetry of IFRS 9 allows for reversals of previously recognized impairment losses when a debtor’s credit risk improves – an outcome supported by ARI’s ongoing monitoring. This interplay between credit insurance and financial reporting highlights the importance of maintaining thorough documentation and conducting regular policy reviews.

sbb-itb-2d170b0

Putting IFRS 9 Compliance into Practice

Moving from theory to practical implementation requires a well-structured approach throughout your financial reporting framework. This isn’t a one-and-done task – it’s a continuous process aimed at ensuring precise, forward-looking credit risk evaluations that align with regulatory demands. These steps naturally tie into the next priority: creating effective risk assessment systems.

Setting Up Credit Risk Assessment Systems

The first step is to properly classify financial assets at the time of contracting. Conduct SPPI (Solely Payments of Principal and Interest) tests right away to confirm that receivables meet the criteria for amortized cost. Group financial instruments by shared risk characteristics – such as industry, region, or product type – to simplify impairment evaluations across your portfolio.

Develop clear guidelines for assessing derecognition when credit insurance is used to transfer risk. Your system should calculate and compare the variability in the present value of future net cash flows before and after the transfer. If the transfer results in the substantial removal of risks and rewards of ownership, the asset should be taken off your balance sheet. Schedule regular reviews to ensure that any changes in your business model are reflected in asset reclassifications.

Establish an impairment watchlist that combines both quantitative and qualitative factors to identify early warning signs of credit deterioration. For trade receivables, adopting a simplified method that accounts for lifetime expected credit losses from the outset can help avoid the complexities of staging assessments.

Planning Your Implementation Timeline

Break the implementation process into distinct phases, focusing on classification, Expected Credit Loss (ECL) modeling, and hedge accounting. This phased approach ensures a solid foundation for ongoing updates and risk management.

Update Exposure at Default (EAD) metrics quarterly using real-time portfolio data. Ensure that probability of default (PD) and loss given default (LGD) parameters are recalibrated annually to reflect current market conditions. Additionally, document your business model thoroughly, as it determines the accounting treatment under IFRS 9.

Reviewing and Updating Policies Regularly

To stay ahead in a changing market, regular policy reviews are essential. Establish a routine update process that includes quarterly SPPI tests and ECL calculations, along with annual reviews of PD and LGD parameters. For example, in 2021, a major European bank used a modular diagnostic approach to identify eight key areas for improving IFRS 9 provision accuracy. By revising staging criteria and Significant Increase in Credit Risk (SICR) thresholds, the bank reduced total retail IFRS provisions by 10% immediately, with an additional 10% reduction achieved the following year after auditor validation.

"Credit analysis is fundamental to the managing of core fixed income for insurance companies. We feel that a well-defined policy to identify credit deterioration is key to prudent investment management."

– J.P. Morgan Asset Management

Monitor SICR thresholds on an event-driven basis, adjusting them in response to macroeconomic shifts and specific sector trends. Regularly update investment guidelines to exclude securities that are likely to fail SPPI tests or are at risk of moving to Stage 3 (credit-impaired status), thereby reducing income volatility.

A majority of banks – two-thirds, to be exact – plan to periodically redevelop their IFRS 9 models to better reflect sector-specific nuances and enhance ECL accuracy. To support this, establish a formal risk governance framework with defined metrics, thresholds, and industry benchmarks. While manual overlays can address data uncertainties during volatile periods, regulators are increasingly scrutinizing their justification. In fact, 86% of banks surveyed by McKinsey intended to revert to pre-pandemic SICR criteria within two years of the crisis.

Final Thoughts on IFRS 9 and Credit Insurance

Main Points to Remember

Customizing credit insurance to align with IFRS 9 requirements can help reduce balance-sheet fluctuations and improve the accuracy of asset valuations. Tailored policies ensure that asset and liability valuation methods are in sync, allowing for precise Expected Credit Loss (ECL) calculations by factoring in forward-looking macroeconomic trends.

But the advantages go beyond just meeting compliance standards. These customized solutions can also enhance capital efficiency. By isolating risk factors, businesses can refine their credit loss provisioning and better manage the impact of interest rate changes on earnings.

"IFRS 9 places significant requirements on a company’s data management programs. This includes the need for current information as well as extensive historical data to consider within your accounting estimates." – Moody’s

The shift to IFRS 9 and IFRS 17 marks the most substantial change in insurance accounting in two decades. With the growing use of marking-to-market practices and forward-looking models replacing older incurred loss methods, active risk management has become essential for preserving financial stability.

With these benefits in mind, the next step is to translate this understanding into actionable strategies.

What to Do Next

Start by reviewing your balance sheet to assess how your assets and liabilities are classified and identify any gaps in IFRS 9 compliance. Update your credit insurance policies to ensure they align with IFRS 9 standards and help reduce expected credit losses.

Consider partnering with Accounts Receivable Insurance (ARI) to create solutions tailored to your business model and cash flow needs. ARI offers customized policies, thorough risk assessments, and claims management services designed to meet IFRS 9’s forward-looking requirements. With their global network of credit insurance carriers and expert broker support, ARI can help you fine-tune your policies to minimize balance-sheet volatility while staying compliant with evolving regulations.

FAQs

How can credit insurance help reduce Expected Credit Loss (ECL) under IFRS 9?

Credit insurance plays a key role in lowering Expected Credit Loss (ECL) under IFRS 9 by shifting a portion of your credit risk to the insurer. This transfer directly impacts two critical components of the ECL calculation: the probability of default and the loss given default. With these risks reduced, the resulting ECL amount that must be recorded in financial statements is also lower.

By safeguarding your business against financial risks like non-payment or bankruptcy, credit insurance not only supports compliance with IFRS 9 but also adds stability to the management of receivables. This dual benefit helps protect your company’s financial well-being while ensuring regulatory requirements are met effectively.

How does IFRS 9 differ from IAS 39 when it comes to recognizing credit losses?

IFRS 9 brings a more proactive method to recognizing credit losses compared to the older IAS 39 standard. Under IAS 39, credit losses were recognized only when there was clear evidence of a loss, following an incurred-loss model. IFRS 9, however, adopts an expected-credit-loss (ECL) model, requiring businesses to estimate and account for potential credit losses earlier. This estimation is based on a combination of historical data, current market conditions, and future projections.

This approach allows businesses to integrate their credit risk management more closely with financial reporting, offering a clearer and more timely picture of potential risks in their financial statements.

How can businesses adapt credit insurance policies to meet IFRS 9 requirements?

To align credit insurance policies with IFRS 9 requirements, businesses should focus on adapting coverage to meet the standard’s core principles: classification, measurement, and expected credit loss (ECL) impairment. This means mapping insured receivables to IFRS 9’s business model and SPPI (Solely Payments of Principal and Interest) tests, ensuring assets are classified appropriately – whether as amortized cost or fair value through other comprehensive income.

Coverage can also be adjusted to incorporate forward-looking ECL calculations. This might involve tweaking coverage limits, deductibles, or premiums based on detailed risk assessments. Using tools like provision matrices or macroeconomic scenario analysis helps align with IFRS 9’s approach to loss assumptions. A strong data management system is equally important – tracking credit scores, payment histories, and geographic exposure ensures accurate reporting and compliance.

Accounts Receivable Insurance (ARI) offers tailored solutions to help businesses meet IFRS 9 standards. ARI provides customized risk evaluations, policy adjustments, and analytical tools to align insurance agreements with accounting policies, delivering both compliance and dependable credit risk protection.