Currency fluctuations can disrupt profits, budgets, and overall financial stability for businesses involved in international trade. This guide dives into practical strategies to manage currency risk effectively, ensuring financial predictability and reducing exposure to exchange rate volatility. Key takeaways include:

- Types of Currency Risk: Transaction risks (e.g., exchange rate changes between deal and payment), economic risks (long-term market value impacts), and translation risks (accounting challenges from consolidating foreign earnings).

- Risk Management Strategies:

- Natural Hedging: Align revenues and costs in the same currency to minimize exposure.

- Financial Instruments: Use forward contracts, options, or swaps to lock in exchange rates.

- Accounts Receivable Insurance: Protect against nonpayment due to currency shifts or buyer insolvency.

- Technology Solutions: Automate FX risk tracking, integrate with ERP systems, and gain real-time insights to streamline decision-making.

7 Steps to Effective Exchange Rate Risk Management | TreasuryONE

Types and Sources of Currency Risk

Currency risk can affect businesses in several ways, depending on how they engage with foreign currencies. Understanding these types helps pinpoint vulnerabilities and plan effective strategies to minimize financial exposure.

Transaction Risk

Transaction risk occurs when exchange rates change between the time a deal is made and when payment is received. This fluctuation can directly alter the final amount of revenue or cost.

Take this example: A U.S. company sells $100,000 worth of goods to an Indian buyer, locking in an exchange rate of 59.6 rupees per dollar, expecting to receive 5.96 million rupees. If, after 90 days, the exchange rate weakens to 68.8 rupees per dollar, the 5.96 million rupees would now convert to only about $86,627 – a loss of over $13,000.

Similarly, consider an American importer agreeing to pay €5,000 at a 1:1 exchange rate. If the rate shifts to 1:1.10 by the payment date, the cost increases from $5,000 to $5,500.

While these examples highlight immediate financial risks, longer-term exposures also introduce broader economic and accounting challenges.

Economic and Translation Risk

Economic risk refers to how ongoing currency fluctuations impact a company’s market value and cash flows. Even businesses that don’t operate internationally can feel this pressure. For instance, a Canadian furniture maker selling exclusively within Canada might struggle if a stronger Canadian dollar makes imported furniture cheaper, leading local buyers to favor foreign products. Similarly, if the U.K. pound strengthens against the euro, British exporters could find their goods too expensive for European buyers, even if production costs haven’t changed.

Translation risk, on the other hand, is more of an accounting issue. It arises when companies with foreign subsidiaries consolidate their financial statements. For example, a U.S. parent company converting a German subsidiary’s euro-denominated earnings into dollars might see a distorted picture. If the subsidiary reports a 25% increase in net income in euros but the exchange rate drops from 1.2 to 1.05, the dollar equivalent increase might shrink to just 9%. This can obscure the true financial performance when viewed in consolidated reports.

These risks highlight not only immediate challenges but also the potential for long-term financial impacts, emphasizing the need for a robust approach to managing currency risk.

Currency Risk Throughout the Trade Cycle

Currency exposure doesn’t just appear at one point in an international transaction – it builds throughout the trade cycle. From the moment foreign currency pricing is determined, businesses are exposed to fluctuations until the final payment is received.

For example, when a contract is signed, the foreign currency amount is locked in. However, the exact dollar equivalent remains uncertain until the payment clears. If production and shipping take time, exchange rate movements during these periods can further increase exposure.

Finally, the payment collection phase – often involving terms of 30 to 90 days – adds another layer of risk. The exchange rate on the invoice date might differ significantly from the rate when the funds are received, making this phase particularly critical in managing transaction risk.

Strategies for Managing Currency Risk

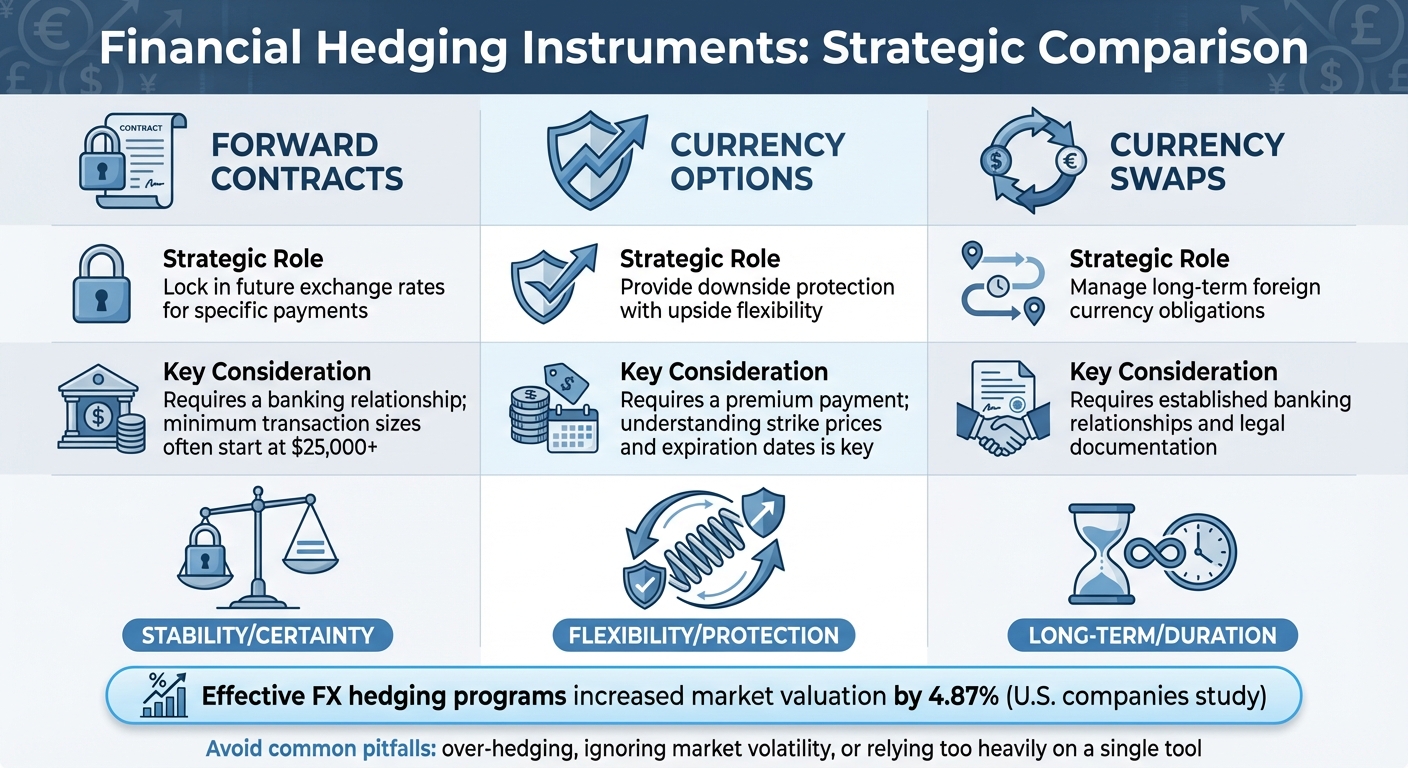

Financial Hedging Instruments for Currency Risk Management Comparison

Once you’ve identified currency risk, the next step is to put practical strategies in place to manage it effectively. A well-rounded approach combines three essential layers of protection: a clear policy framework, operational adjustments that naturally reduce exposure, and financial instruments to lock in rates when necessary. Together, these strategies help mitigate both transaction and economic risks, ensuring stability and predictability.

Creating a Foreign Exchange Risk Policy

A foreign exchange risk policy serves as the foundation for managing currency risk. It outlines objectives like protecting profit margins, ensuring accurate budgeting, and stabilizing high-value transactions. The aim here isn’t to speculate on currency trends or chase profits but to reduce uncertainty and enable better planning and forecasting.

Start by identifying the sources of exposure – such as forecasted transactions, balance sheet remeasurement, earnings translation, net investment, and event risk. Then, establish clear guidelines for decision-making authority and hedge ratios. Accurate assessment of your company’s currency exposure is crucial before implementing any hedging strategy to avoid over-hedging. The policy should also define acceptable risk levels, specifying what portion of exposure will be protected and who has the authority to execute hedging decisions.

Research shows that companies with well-implemented FX hedging strategies experience lower financial volatility and greater stability. Regularly reviewing and adjusting the policy ensures it remains aligned with changing business needs and market conditions.

Natural and Operational Hedging Techniques

Natural hedging is a straightforward way to manage currency risk by aligning revenues and costs in the same foreign currency. By doing this, companies can reduce their net exposure without relying on financial instruments. Management consultant Paul Ainsworth explains:

A natural foreign exchange hedge occurs when a company is able to match revenues and costs in foreign currencies such that the net exposure is minimized or eliminated.

For example, in the early 2000s, a U.S. company operating in Europe used its euro-based income to source products from Europe, balancing its euro inflows and outflows and minimizing exposure to EUR/USD exchange rate fluctuations. Similarly, a UK company sourcing raw materials from both the U.S. and Europe could split payments between USD and EUR, spreading out its risk and softening the impact of sudden currency shifts.

Another operational tactic is invoicing in U.S. dollars, which transfers exchange rate risk to the foreign customer or supplier. Companies can also include foreign exchange clauses in long-term contracts, allowing for revenue adjustments if exchange rates move beyond a set threshold. While these techniques require managing a multi-currency profit and loss statement and balance sheet, they offer protection without the added costs of financial instruments.

When natural hedging isn’t enough, financial instruments can provide the extra layer of security needed.

Financial Hedging Instruments

If natural hedging strategies fall short, financial instruments can step in to manage remaining exposure. Forward contracts allow companies to lock in exchange rates for future transactions, eliminating uncertainty about final amounts. Options provide the right – but not the obligation – to exchange currency at a predetermined rate, protecting against unfavorable movements while still allowing for gains if rates move in your favor. Swaps are useful for longer-term exposures, enabling the exchange of cash flows in different currencies.

| Instrument | Strategic Role | Key Consideration |

|---|---|---|

| Forward Contracts | Lock in future exchange rates for specific payments | Requires a banking relationship; minimum transaction sizes often start at $25,000+ |

| Currency Options | Provide downside protection with upside flexibility | Requires a premium payment; understanding strike prices and expiration dates is key |

| Currency Swaps | Manage long-term foreign currency obligations | Requires established banking relationships and legal documentation |

It’s important to avoid common pitfalls like over-hedging, ignoring market volatility, or relying too heavily on a single tool. A study of U.S. companies found that effective FX hedging programs increased market valuation by 4.87 percent, highlighting the tangible benefits of a well-executed strategy.

Technology Solutions for FX Risk Management

Relying on spreadsheets and periodic reviews to manage currency risk can leave businesses exposed to sudden market changes and human errors. Modern FX risk management tools automate the process, offering real-time insights, tracking exposures, and executing hedges with greater efficiency. This makes decision-making faster and more precise.

Core Features of FX Risk Technology

A solid FX risk management system revolves around real-time tracking and monitoring of currency exposures. These systems pull live exchange rate data and issue alerts when currency values shift beyond pre-set thresholds. They also analyze exposures automatically, identifying areas where the business is vulnerable to currency fluctuations. Automated hedge execution enables swift responses to market changes, ensuring risks are addressed promptly.

Additionally, these tools monitor critical rates – such as budget rates – and measure the effectiveness of hedging strategies, providing a clear and comprehensive view of all FX activities.

From a corporate treasury standpoint, the goal is to provide stability, enabling better planning and forecasting.

This stability comes from eliminating the need for constant manual oversight, lowering stress, and reducing the likelihood of emotionally driven decisions. These systems also integrate seamlessly with broader financial operations, improving overall visibility and control.

Connecting FX Tools with Business Systems

When FX tools are integrated with ERP, accounts receivable, and billing systems, they become a key part of a company’s overall risk management strategy. By automatically pulling data from ERP platforms, these tools consolidate currency exposures across the organization, reducing manual errors and centralizing critical information.

A great example of this integration is Trane Technologies, which implemented Kyriba‘s FX Exposure Management system. Over the course of a year, the company achieved 97% real-time visibility into its group FX exposures and cut global risk by over 50% based on Value at Risk metrics. Chris Donohoe, Assistant Group Treasurer at Trane Technologies, shared:

Kyriba resolves our immediate FX risk management limitations and allows us to develop best-in-class solutions. We in treasury have evolved into a true strategic partner to the business rather than just a corporate function.

Comparing Technology Options

When selecting FX risk management tools, businesses can choose from three main types: standalone tools designed specifically for currency risk, comprehensive treasury systems that handle multiple risk types, and cloud-based platforms offering flexible, remote access. The right choice depends on factors like transaction volume, geographic reach, and available resources.

For smaller treasury teams, automated solutions reduce the need for manual input, saving time and effort. On the other hand, companies with complex, multi-currency operations may require systems that consolidate exposures and enable dynamic hedging strategies. Look for tools that integrate smoothly with your existing systems and provide real-time visibility into currency risks, ensuring they support a robust and cohesive risk management approach.

sbb-itb-2d170b0

Managing Trade Credit and Accounts Receivable Risk

Currency fluctuations can create significant challenges for U.S. exporters, particularly when it comes to ensuring timely payments from international buyers. These fluctuations increase the risk of nonpayment, making it essential to adopt a multi-layered protection strategy that goes beyond just hedging against foreign exchange (FX) risks.

How Currency Volatility Impacts Buyer Payment Ability

When a buyer’s local currency weakens against the U.S. dollar, the cost of paying dollar-denominated invoices rises, potentially straining their financial resources. For example, if an importer in Europe sees their currency weaken from €1 = $1.00 to €1 = $1.10, the amount they owe in euros increases. This shift can lead to delayed payments or even defaults.

For U.S. exporters, the situation can become even more precarious. If the buyer’s currency loses value, their local costs to settle invoices grow, creating financial pressure. As Investopedia explains:

If the selling company’s currency appreciates versus the buying company’s currency, the company doing the buying will have to make a larger payment in its base currency to meet the contracted price.

This financial squeeze is particularly problematic for buyers operating on tight margins or in unstable markets. The result? Delays, defaults, or outright nonpayment. Managing this risk requires more than just FX hedging – it calls for a broader strategy.

How Accounts Receivable Insurance Mitigates Nonpayment Risk

While FX hedging tools can help manage currency value shifts, they don’t address the core risk of a buyer failing to pay. This is where Accounts Receivable Insurance (ARI) becomes invaluable. ARI provides financial protection for U.S. businesses when international buyers default due to insolvency, prolonged nonpayment, or political disruptions worsened by currency instability.

Policies typically cover up to 90% of outstanding receivables and include credit monitoring to flag high-risk transactions. For exporters, export credit insurance goes a step further by covering political risks such as import/export bans or government actions that could block payments.

A Combined Strategy: FX Hedging and ARI

The best way to mitigate these risks is by combining FX hedging with ARI. FX hedging tools manage currency volatility, while ARI safeguards against nonpayment. Together, they create a comprehensive risk management strategy. This approach also allows U.S. exporters to offer pricing in buyers’ local currencies, which can be a significant competitive advantage, without exposing themselves to unmanageable risks.

As the International Trade Administration highlights:

While losses due to nonpayment could be covered by export credit insurance, such ‘what-if’ protection is meaningless if export opportunities are lost in the first place because of a ‘payment in U.S. dollars only’ policy.

To build a solid protective framework, pair forward contracts or other FX hedging tools with ARI policies. This way, you can lock in favorable exchange rates and ensure coverage if a buyer defaults. By integrating these strategies, U.S. exporters can turn international receivables into a secure and reliable asset, supporting sustainable growth.

Building a Complete Currency Risk Management Program

Continuing from earlier discussions on FX strategies and technology, this section focuses on how to bring all the pieces together into a well-rounded currency risk management program. A structured approach is key, combining risk assessment, technology, and coordinated policies. The ultimate goal? To stabilize cash flow and strengthen your position in the competitive global marketplace.

Measuring Your Current FX Exposure

Start by mapping out where currency fluctuations impact your business – revenues, costs, and profits. This involves identifying transaction, translation, and economic risks. Pinpoint the operations and currency pairs you’re exposed to, understand the timing of these exposures, and estimate their potential dollar impact.

Real-world examples highlight the importance of this step. Leading companies have experienced how unfavorable FX movements can significantly affect revenues and operating income. These cases serve as a reminder of why it’s critical to map revenue streams and expense patterns accurately. Tailored strategies depend on this clarity.

In addition to FX exposure, keep a close eye on receivables aging reports to monitor overdue invoices and payment trends. Analyze high-risk accounts regularly, using both detailed and high-level credit reviews. Clearly define your objectives – whether it’s protecting profits, ensuring accurate budgets, or safeguarding high-value transactions.

Once you have a clear understanding of your exposure, the next step is to leverage technology for streamlined risk management.

Setting Up Technology-Based Risk Management

FX risk management software can transform how you handle currency exposure. These tools provide real-time monitoring, analytics, and reporting, making it easier to manage FX workflows and improve visibility.

AI-powered forecasting tools are particularly useful for spotting patterns and predicting currency movements. For instance, KSW Global, a major cocoa producer in West Africa, partnered with Pangea to implement tailored FX risk strategies. This approach helped them secure cost-effective hedging positions, stabilize finances, and boost profitability. Similarly, the nonprofit organization Untold, operating in Africa, utilized Pangea’s advisory services to protect against currency depreciation, projecting $600,000 in savings for 2024.

Integrating FX management tools with your existing systems, such as ERP and Treasury Management Systems (TMS), provides a holistic view of financial exposures. This integration enables better monitoring, reporting, and execution of currency-related operations. It also supports swift and accurate trades, as well as real-time execution of preset hedging strategies.

Once technology is in place, the next step is to establish strong hedging and credit risk policies to round out your program.

Coordinating FX Hedging and Credit Risk Policies

The final piece of the puzzle is setting clear risk management policies that align with your financial goals and risk tolerance. Define acceptable risk levels, establish guidelines for hedging practices, and implement monitoring systems to maintain consistency and minimize subjective decision-making.

Use hedging instruments like forward contracts, options, futures, and swaps to lock in exchange rates and reduce transaction risks. For example, in the 1980s, IBM and the World Bank successfully used currency swaps to manage their debt exposure. Additionally, consider natural and operational hedging strategies, such as aligning foreign currency inflows with outflows by sourcing materials from the same regions where you generate revenue.

Address credit risks by implementing processes to manage deteriorating payment trends. This might include credit holds or escalated collection protocols. Strengthen communication with high-risk customers through additional contact points, as personal interactions can provide valuable insights into their risk profiles. Continuously monitor currency exposures, market trends, and the effectiveness of your strategies.

As MKS&H aptly puts it:

Effective risk management is not just about avoiding losses; it’s about stabilizing cash flow and enhancing competitiveness in global markets.

Finally, prioritize education and training for employees involved in currency risk management. Ensure that finance, operations, and sales teams understand the implications of currency risk. Stay compliant with regulatory requirements by maintaining accurate documentation and aligning hedging practices with accounting standards.

Conclusion

Currency risk is a reality for every U.S. business involved in international trade. From the immediate impact of exchange rate shifts on transactions to broader economic risks that influence competitiveness, the stakes are undeniably high. This guide provides the tools and insights you need to tackle these challenges head-on.

Start by identifying how currency fluctuations affect your revenues, costs, and overall profitability. Set clear goals – whether it’s protecting profit margins, maintaining budget stability, or securing high-value deals. From there, develop a formal foreign exchange risk policy that outlines your approach and strategies.

A balanced approach often works best. Combine operational hedging, such as conducting transactions in U.S. dollars or matching foreign currency revenues with costs, with financial tools like forward contracts and options. These strategies not only help manage cash flow volatility but can also enhance your company’s market valuation. As Chris Braun, Head of Foreign Exchange at U.S. Bank, advises:

The focus of any currency hedging program should be on the reduction of risk, not on trading the market.

Don’t overlook credit risk either. Currency volatility can disrupt your buyers’ ability to pay. Tools like Accounts Receivable Insurance (https://accountsreceivableinsurance.net) offer protection against nonpayment, bankruptcy, and political risks. By combining FX hedging with insurance, you can create a robust safety net that addresses both currency fluctuations and buyer defaults.

To finalize your risk management program, work with FX experts and leverage advanced tools to automate processes, monitor exposures in real time, and execute your strategies effectively. Regularly review and adjust your program as markets and your business evolve. With the right mix of planning, technology, and risk mitigation, you’ll gain the stability and confidence needed to thrive in global markets.

FAQs

What are transaction, economic, and translation risks, and how do they differ?

Exchange rate fluctuations can create several types of financial risks for businesses. Transaction risk occurs when exchange rates shift between the time a contract is signed and when the payment is made or received, potentially altering the value of those transactions. Economic risk takes a broader view, focusing on how long-term currency changes can influence a company’s market position and future cash flow. Lastly, translation risk arises during the process of consolidating financial statements, where the accounts of foreign subsidiaries are converted into the parent company’s currency. This can affect reported earnings and the values on the balance sheet.

What is natural hedging, and how does it help reduce currency risk?

Natural hedging is a strategy businesses use to manage currency risk by balancing their foreign-currency inflows and outflows. The goal is to ensure that fluctuations in exchange rates have little to no effect on profits. For instance, if a U.S. company earns revenue in euros from its European customers, it can reduce its exposure by covering expenses – such as payments to suppliers, operating costs, or loan repayments – in euros. This method avoids the need for financial tools like forward contracts while still mitigating currency risks.

To put natural hedging into action, companies analyze their foreign-currency assets, such as receivables or cash, and liabilities, like payables or loans. They then adjust their operations to align these streams. For example, a U.S. company that generates sales in Japanese yen might choose to fund its Japanese operations with yen-denominated loans. By creating this balance, businesses can protect their profit margins and avoid the extra costs associated with other hedging methods.

How do technology solutions help businesses manage currency risk more effectively?

Technology solutions have become essential for managing currency risk, giving businesses access to real-time market data, automated hedging tools, and a clear view of multi-currency cash flows. These platforms simplify what used to be manual tasks, allowing treasury teams to track exposures, perform scenario analyses, and implement hedging strategies more effectively. They also make it easier to optimize funding options and align hedging actions with cash flow requirements across different countries.

With advanced features like analytics and API-enabled payment systems, these tools take risk management a step further. They streamline processes like automating forward contracts, options, and swaps while delivering real-time reports to guide better decision-making. By cutting down on operational risks and expenses, these solutions help businesses react swiftly to currency fluctuations, ensuring financial stability and supporting sustainable growth.