Protecting your business from political risks is crucial in today’s unpredictable global economy. Trade credit insurance is a practical solution that shields companies from financial losses caused by political instability, unpaid invoices, and disruptions in international trade. Here’s a quick breakdown:

- What It Covers: Political risks like government interference, war, civil unrest, and sanctions, plus non-payment risks.

- Why It Matters: Defaults contribute to 25% of corporate bankruptcies, and U.S. bankruptcies rose 23.5% in 2025.

- Key Benefits: Covers up to 90% of unpaid invoices, improves cash flow, and helps businesses expand safely into new markets.

Quick Comparison:

| Criteria | Trade Credit Insurance | Political Risk Insurance |

|---|---|---|

| Coverage | Broad: Non-payment + political risks | Targeted: Expropriation, violence, etc. |

| Cost | 0.1%-0.4% of invoice value | 1%-3% annually (higher for risky regions) |

| Flexibility | Standard with some customization | Highly tailored to specific projects |

| Claims Process | Streamlined with monitoring | Reactive, requires detailed documentation |

Trade credit insurance is ideal for businesses with diverse trade relationships, while political risk insurance suits those with high-risk, long-term investments. Both tools can safeguard your operations and financial stability.

What Is Political Risk Insurance And How It Relates To Trade Credit Insurance?

1. Trade Credit Insurance

Trade credit insurance plays a crucial role in protecting businesses involved in international trade. It offers coverage for both political and payment risks, providing a more comprehensive solution compared to standalone political risk products. This type of insurance helps businesses navigate the complexities of global trade with greater confidence.

Political Risk Coverage

Trade credit insurance is designed to address a wide array of political risks that could disrupt business operations and lead to unpaid invoices. These risks include government interference, war, civil unrest, terrorism, embargoes, sanctions, and even climate-related issues that may destabilize entire regions.

By assessing both internal and external political stability, trade credit insurance ensures businesses are shielded from unpredictable events that traditional financial tools might not account for. Coverage spans scenarios like currency restrictions, trade disruptions, and expropriation, all of which can severely affect cash flow.

For instance, during the 2017 protests in Ethiopia, many companies faced significant financial challenges due to payment defaults caused by political unrest.

"Trade credit insurance (TCI) is one of the best ways to protect against political risk."

Typically, trade credit insurance covers up to 90% of the outstanding amount owed. This level of protection can be a financial lifeline when political events prevent customers from meeting their payment obligations.

Cost Effectiveness

One of the standout benefits of trade credit insurance is its affordability relative to the coverage it provides. The high percentage of coverage, combined with its broad scope, makes it a practical solution for businesses of all sizes, helping them maintain financial stability.

"Trade credit insurance helps businesses to safely sell more to existing customers or expand to new customers, that may otherwise have been deemed too risky, knowing they are insured should the customer not pay their debts."

Beyond its reasonable cost, this insurance is adaptable to the diverse needs of businesses, further enhancing its appeal.

Flexibility

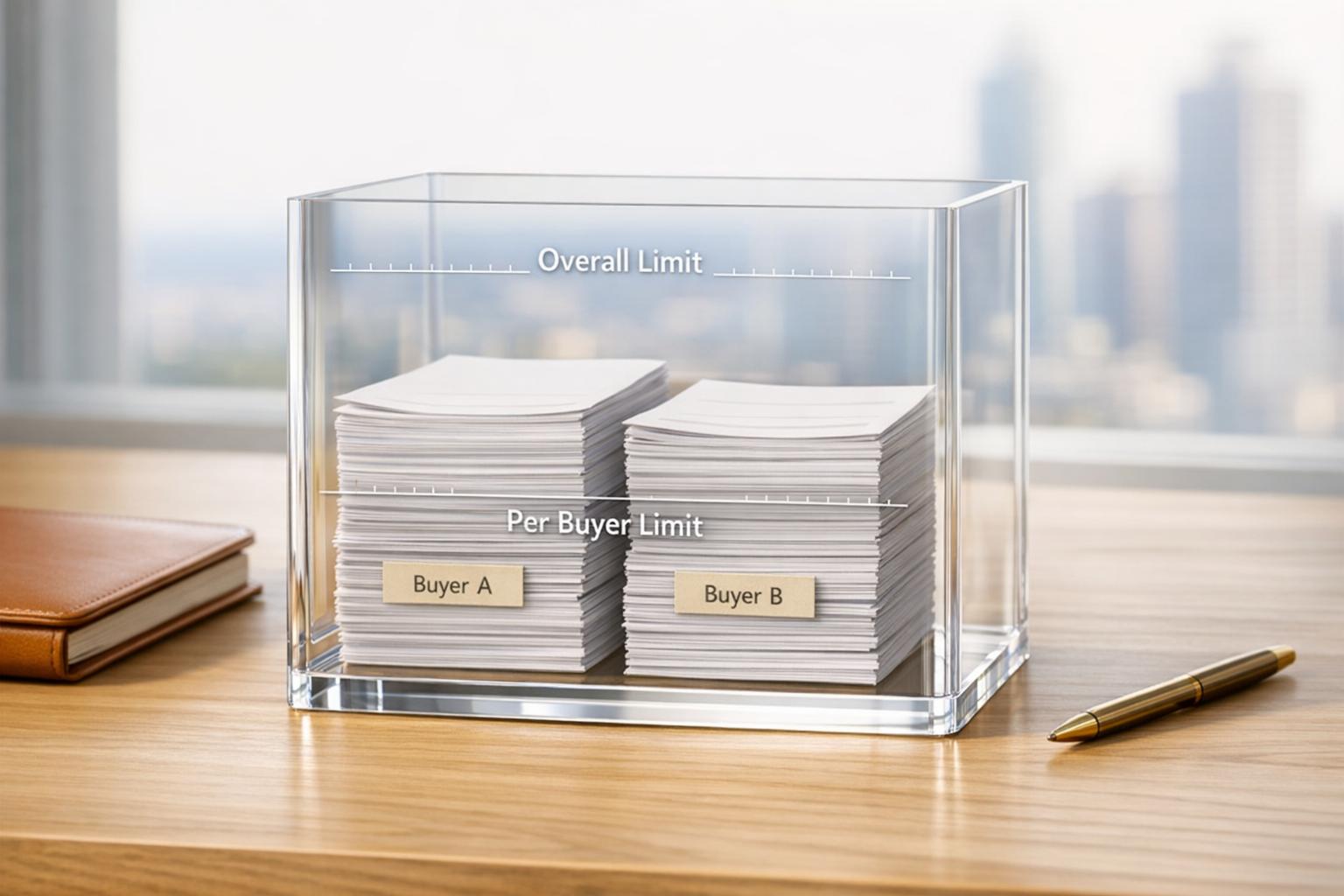

Trade credit insurance is designed to accommodate a wide range of business scenarios, offering flexibility that sets it apart. It provides extensive risk protection without limiting customer bases or enforcing rigid credit criteria.

Policies can also be tailored to meet specific needs. Companies like Accounts Receivable Insurance specialize in creating customized plans, offering coverage for both domestic and international markets. With access to a global network of credit insurance carriers, businesses can secure solutions that align with their unique requirements.

Additionally, trade credit insurance often includes added services such as business information, debt collection, and receivables indemnification. These features create a well-rounded risk management package.

Claims Process

An efficient claims process ensures businesses receive timely compensation when needed. To file a claim, businesses must provide necessary documentation such as unpaid invoices and evidence of the buyer’s insolvency.

After a waiting period – designed to allow proper assessment – the insurer evaluates the claim. If approved, the business receives the insured percentage of the debt as compensation.

Many providers offer professional claims management services to streamline this process. Dedicated claims teams, often specializing in political risk and trade credit issues, work to ensure claims are handled quickly and effectively. Some insurers even provide pre-vetting services to help businesses present their claims in the best possible format, maximizing the chances of approval.

"We can’t predict the future. But we can help you understand and analyse the risks associated with proper customer payment while guaranteeing you first-class protection." – Cyrille Charbonnel, Group Underwriting Director, Coface

The claims process also benefits from regular updates to political risk assessments, ensuring that coverage remains relevant and decisions are based on the most current information available. This dynamic approach helps businesses stay prepared for any uncertainties that might arise.

2. Other Financial Risk Management Tools

When it comes to managing political risks in international operations, trade credit insurance isn’t the only option. Other financial tools are available that address specific aspects of political risk, offering businesses alternative ways to protect their investments. These tools can complement trade credit insurance by focusing on niche risk areas and providing tailored solutions.

Political Risk Coverage

Political Risk Insurance (PRI) is designed to shield businesses from the actions or decisions of governments or political forces that could negatively impact their operations. It covers risks like political violence, expropriation, currency inconvertibility, arbitration award defaults, and credit risks, offering a safety net for companies operating in politically volatile regions. For businesses with significant investments in such areas, standalone credit insurance products can provide an additional layer of protection, covering both nonpayment of financial obligations and political risks.

"Political risk is one of the major headaches faced by multinational businesses involved in cross-border investments." – Racheal Tumelty, Gallagher National Head of Credit, Surety & Political Risks

Cost Considerations

While trade credit insurance provides broad coverage at competitive rates, alternative political risk tools come with their own cost structures. Typically, these tools cost between 1% and 3% annually, though rates can increase significantly in high-risk regions. Dan Riordan, head of political risk and credit at MSIG USA, notes that "pricing for political risk has always remained pretty stable". The demand for these tools is largely driven by emerging markets, with MSIG USA estimating that 70% to 80% of interest comes from regions like Asia, Africa, the Middle East, and Latin America.

Flexibility in Coverage

Unlike the comprehensive nature of trade credit insurance, alternative political risk tools offer specialized flexibility. For instance, major carriers like Chubb provide broad political violence coverage tailored to unpredictable scenarios such as unrest or conflict that don’t fit traditional categories. Some providers go a step further, offering project-specific coverage that aligns with the unique risk profiles of long-term investments. This allows companies to secure protection tailored to specific markets or exposures, offering a more focused approach to risk management.

Claims Process

The claims process for political risk tools varies depending on the product and provider. Political risk insurance often requires businesses to document how specific government actions or civil unrest have impacted their operations. For project-specific coverage, claims may involve technical evaluations of the project’s status and how political interference has affected it. Currency inconvertibility claims, on the other hand, require proof of government-imposed restrictions on currency exchange and evidence of compliance with local regulations.

In contrast to trade credit insurance – which often includes proactive monitoring and early warning systems – political risk tools tend to operate reactively. This means businesses must identify and report relevant political events themselves.

"After more than 70 years of peace, political risk has been back in the forefront, in various forms, and has punctuated the agenda of many countries in recent years. These risks are clearly on the increase, notably due to the reshaping of the world order and the climate emergency, two major sources of uncertainty and instability for the years to come." – Ruben Nizard, North America Economist and Head of Political Risk at Coface

This variability in claims handling highlights the importance of choosing a tool that aligns with the specific risks a business faces, both geographically and operationally.

sbb-itb-2d170b0

Advantages and Disadvantages

Expanding on our earlier discussion, let’s dive into the strengths and challenges of different risk management strategies. Understanding these nuances helps businesses make smarter decisions when safeguarding their international operations. Each approach comes with its own set of benefits and hurdles, requiring careful consideration.

Benefits of Trade Credit Insurance

Trade credit insurance offers more than just protection against non-payment. It covers political risks like transfer restrictions, government-imposed moratoriums, contract breaches, and even civil unrest. This type of policy ensures businesses can recover a significant portion of unpaid amounts, providing a strong financial safety net.

From a financial standpoint, the perks are hard to ignore. Premiums for trade credit insurance are tax deductible and typically range between 0.1% and 0.4% of the invoice value. This relatively low cost is even more appealing when you consider that trade debts can make up 40% or more of a company’s assets.

It’s not just about protecting finances either. Trade credit insurance enhances liquidity by improving receivables margins and lowering interest rates. It also opens doors to new or higher-risk markets and strengthens trust with customers, making it a valuable tool for business growth.

Strengths of Alternative Tools

Political risk insurance and other specialized tools are designed for specific scenarios. They provide targeted protection against threats like expropriation, war, riots, strikes, and terrorism. These tools are highly flexible, often tailored to individual projects, and can be arranged quickly – sometimes in just a few days.

While these specialized options are effective for certain high-risk situations, trade credit insurance remains a broader and more versatile solution for businesses with diverse trading relationships.

Challenges and Limitations

Despite its advantages, trade credit insurance isn’t without its drawbacks. Certain high-risk exposures may not be covered. Premiums can be expensive, with policies starting at around $3,500. Additionally, the claims process can be time-consuming and involve significant paperwork.

Comparing the Approaches

Here’s a side-by-side look at how trade credit insurance stacks up against alternative political risk tools:

| Criteria | Trade Credit Insurance | Alternative Political Risk Tools |

|---|---|---|

| Political Risk Coverage | Broad (transfer risks, government actions, civil unrest) | Targeted (expropriation, political violence, currency issues) |

| Cost Effectiveness | 0.1%-0.4% of invoice value; tax deductible | Typically higher costs |

| Flexibility | Standardized with some customization | Highly flexible, tailored to specific projects |

| Claims Process | Streamlined with integrated monitoring | May require additional documentation |

| Coverage Speed | Standard underwriting timeline | Often faster – arranged in days |

| Market Focus | Broad trade relationships | High-risk, concentrated investments |

This comparison highlights why many businesses lean toward the comprehensive coverage of trade credit insurance. Companies with diverse international trade networks often find its broad protection more suitable. On the other hand, businesses operating in politically unstable regions may prefer the precision of specialized political risk tools.

Additionally, accounts receivable insurance combines these benefits into a customized policy that addresses both domestic and international risks. These services include detailed risk assessments, claims management support, and access to a global network of credit insurance providers, helping businesses navigate the complexities of political risk with confidence.

Conclusion

Trade credit insurance emerges as a powerful tool for U.S. businesses seeking protection against political risks. While specialized political risk insurance focuses on specific events, trade credit insurance offers broader coverage at more affordable premiums.

The urgency for such protection is clear: U.S. business bankruptcies saw a sharp 23.5% rise in 2025, with defaults accounting for 25% of these cases. This highlights the critical need for safeguards in an unpredictable global market.

Industry leaders emphasize the importance of these policies:

"Trade credit and political risk insurance provide critical protection for businesses navigating international trade and investments. These policies safeguard against losses from nonpayment, government actions, political violence, and other unforeseen events, ensuring resilience and confidence in global operations." – IOA

Beyond protection, trade credit insurance offers strategic advantages. For instance, it enables businesses to expand into new markets by allowing them to offer open terms to foreign clients. This flexibility provides a competitive edge over traditional letters of credit, which often tie up operational funds and create inefficiencies. Additionally, lenders may increase advance rates on receivables to as much as 90% when trade credit insurance is in place, enhancing liquidity.

To make the most of these benefits, U.S. businesses should consider the following steps:

- Secure coverage sooner rather than later, as market volatility could limit access to new policies. Look for insurers with strong underwriting capabilities and a focus on loss prevention.

- Use trade credit insurance for short-term, diverse trading relationships, while reserving political risk insurance for long-term, high-risk investments. With 70% to 80% of demand for these policies coming from emerging markets in Asia, Africa, the Middle East, and Latin America, companies expanding into these regions can greatly benefit from the added protection.

FAQs

How does trade credit insurance help businesses manage political risks, and what situations are typically covered?

Trade credit insurance offers businesses a safety net against political risks, protecting them from financial losses tied to events like government actions, political unrest, or conflict. These situations might include asset expropriation, political violence (such as war or terrorism), currency inconvertibility, or restrictions on moving funds out of a country.

This type of coverage helps businesses stay financially stable when political events disrupt operations or payments. It’s particularly beneficial for companies working in international markets or regions where political conditions are less predictable.

What’s the difference between trade credit insurance and political risk insurance, and how can I choose the right one for my business?

Trade credit insurance helps shield your business from financial losses when customers fail to pay due to issues like insolvency, bankruptcy, or default. Meanwhile, political risk insurance focuses on protecting against losses tied to political events such as wars, government actions, or civil unrest that can disrupt your trade operations.

Choosing the right coverage depends on the specific risks your business faces. If your main concern revolves around customers not paying their invoices, trade credit insurance is likely the better fit. But if your business operates in areas prone to political instability and you’re worried about disruptions from political events, political risk insurance might be the smarter option.

What should I consider before purchasing trade credit insurance for international market expansion?

When stepping into international markets, there are several critical factors to think about before investing in trade credit insurance. First, take a close look at the political and economic stability of the country you’re targeting. These conditions can directly influence the chances of payment delays or even defaults. It’s equally important to examine the creditworthiness of your international clients. Understanding their financial reliability helps you gauge potential risks and ensures the insurance coverage fits your specific needs.

Next, explore the coverage options available. These can include protection against issues like late payments, client insolvency, or political disruptions that might interfere with trade. Don’t forget to evaluate the cost of the policy in relation to the benefits it offers. Advantages like steady cash flow, reduced financial unpredictability, and better access to financing can make a policy worthwhile. By thoroughly assessing these elements, you can select an insurance plan that not only supports your expansion but also shields your business from unforeseen challenges.