Credit insurance is a tool that helps financial institutions protect themselves against borrower defaults. It ensures that banks are reimbursed if a borrower fails to pay, covering up to 90% of losses. This type of insurance is especially useful for mitigating risks in receivable-backed lending, managing regulatory requirements, and expanding lending opportunities. Key benefits include:

- Risk Reduction: Transfers the risk of non-payment to insurers, reducing potential losses.

- Increased Lending Capacity: Allows banks to offer higher advance rates and support borrowers more confidently.

- Regulatory Compliance: Helps meet capital requirements by substituting the insurer’s credit rating for that of the borrower.

- Portfolio Stability: Prevents chain reactions of defaults and supports smarter credit decisions through data insights.

How to Implement Credit Insurance: A Step-by-Step Guide

Step 1: Evaluate Your Credit Risk Exposure

Start by setting up an independent credit risk review system that operates separately from your lending operations. This ensures an unbiased evaluation of your portfolio’s vulnerabilities and aligns with CECL guidelines, which focus on forecasting expected losses rather than reacting to incurred ones.

Pay close attention to asset classes like accounts receivable and inventory financing, as they carry different risks compared to traditional commercial lending. Adjust the depth and frequency of your reviews based on your institution’s size, the types of loans you offer, and your overall risk profile. For sectors prone to volatility, such as receivables financing, more frequent monitoring can help identify issues before they affect your financial stability.

"The interagency guidance highlights the important role of credit risk review systems in an institution’s overall risk management program." – FDIC

Assign this task to skilled personnel who are independent of the loan approval process. Their findings should be reported directly to your board of directors and senior management to ensure timely action. Once you’ve clearly defined your risk exposure, you can move forward with selecting insurance coverage tailored to your specific needs.

Step 2: Select the Right Credit Insurance Policy

Choose a credit insurance policy that fits the scale and complexity of your institution, as well as the makeup of your portfolio. Determine whether you need coverage for domestic operations only, or if international receivables also require protection. If your portfolio includes specialized areas like accounts receivable financing, make sure the policy addresses the unique risks associated with those assets.

Consider how the policy aligns with regulatory requirements and integrates with CECL methodology. The right coverage should support ongoing risk reviews and provide the data necessary for regular reporting to management and the board. Providers such as Accounts Receivable Insurance offer tailored policies designed to meet these needs, offering protection for both domestic and international operations.

"Credit risk rating systems, if well-managed, should promote safety and soundness, facilitate informed decision making, and reflect the complexity of a bank’s lending activities and the overall level of risk involved." – OCC

Once you’ve selected the most appropriate policy, incorporate it actively into your lending practices.

Step 3: Add Credit Insurance to Your Lending Practices

With your risk assessment complete and a tailored policy in place, the next step is to integrate credit insurance into your lending framework. Financial institutions can purchase credit insurance policies directly or be named as a "loss payee" under a borrower’s existing policy to protect their interest in the collateral. This approach allows you to expand the eligible asset base to include items that are often excluded, such as international receivables, aged receivables, and accounts with high client concentration.

By insuring receivables, institutions can justify offering higher advance rates, providing borrowers with more capital at better terms. Additionally, credit insurance serves as a recognized risk mitigant under Basel II/III standards, offering regulatory capital relief and helping manage internal obligor or country limit constraints. This allows you to retain assets on your books while transferring the associated risk to private insurers on an unfunded basis.

Step 4: Set Up Risk Monitoring and Claims Processes

Ongoing monitoring is essential to ensure the insured portfolio remains healthy and to reinforce the earlier steps in the process. Establish protocols for continuous risk monitoring that align with your insurer’s pre-claim interventions and claims management support. These systems should provide regular updates to your board on the portfolio’s performance, along with a follow-up process to ensure timely corrective actions are taken when needed.

Some providers, like Accounts Receivable Insurance, offer risk assessment services that help identify potential issues before they develop into major losses. Make sure your chosen provider integrates smoothly with your existing risk review systems, replacing outdated methods with up-to-date practices. This ensures your institution stays ahead in managing credit risks effectively.

Why Financial Institutions use Credit Insurance – challenges, changes and opportunities

Benefits of Credit Insurance for Financial Institutions

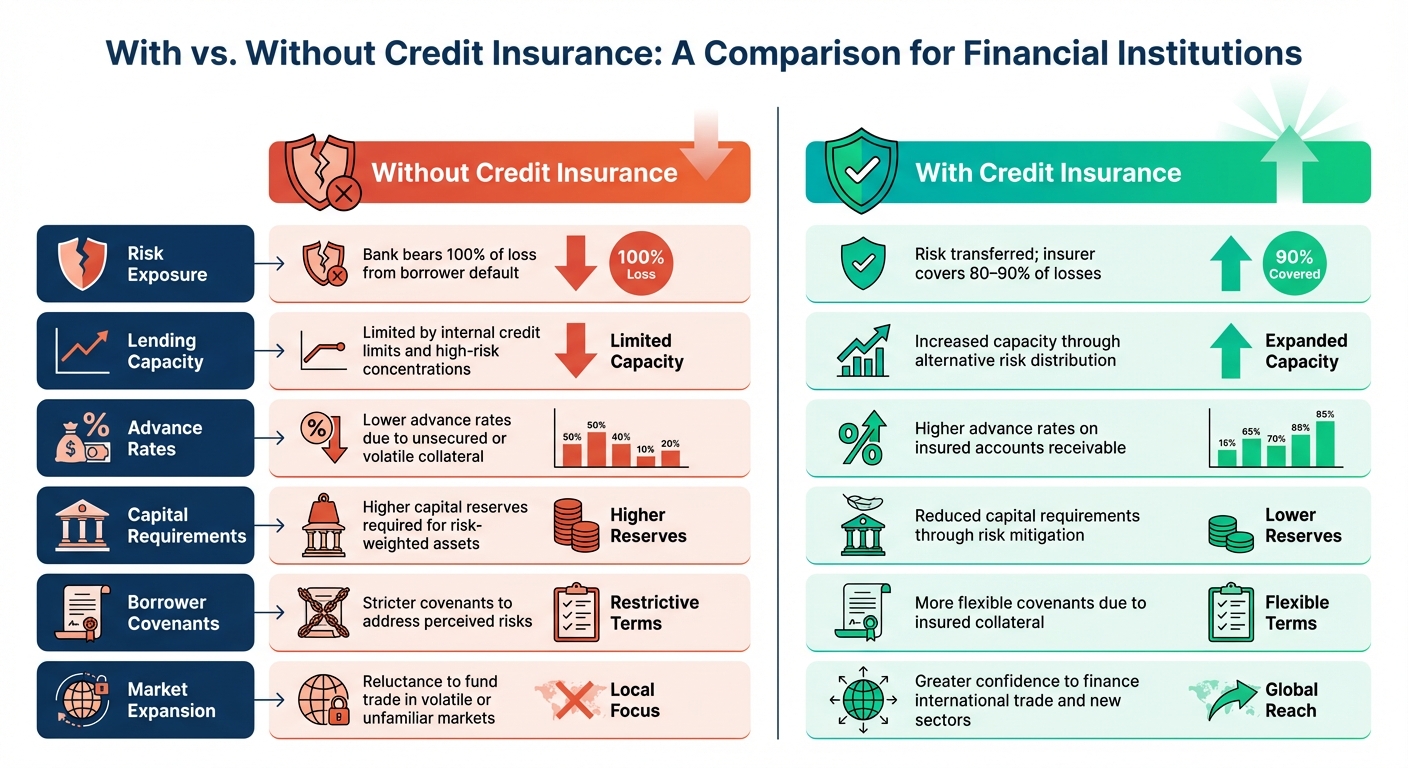

Financial Institutions: With vs Without Credit Insurance Comparison

Credit insurance plays a crucial role in strengthening the risk management strategies of financial institutions, offering both financial and operational advantages. By transferring the risk of borrower non-payment to insurers, banks can significantly reduce their exposure to bad debts. As Cleve Bellar from The Plateau Group explains:

"For financial institutions, the primary advantage of credit insurance is the mitigation of losses. Banks can significantly reduce the likelihood of charge-offs – debts that are unlikely to be collected – by transferring the risk to insurers."

This risk transfer not only shields banks from potential losses but also provides tangible financial relief. Typically, credit insurance policies reimburse financial institutions for 80% to 90% of the covered debt in the event of a default. Considering that accounts receivable often make up around 40% of a company’s balance sheet, this protection is vital for lenders managing such sensitive assets. With U.S. corporate bankruptcy filings expected to remain high through 2025, as noted by S&P Global, the demand for non-payment protection is more urgent than ever.

Credit insurance also helps financial institutions reallocate capital by reducing regulatory burdens. Insured receivables qualify for favorable risk-weighted asset treatment, freeing up capital for additional lending or investments. According to a survey by the International Association of Credit Portfolio Managers, the top three reasons for using credit insurance include increasing lending capacity, achieving regulatory capital relief, and mitigating concentration risk. Marsh highlights this benefit, stating:

"Credit insurance helps banks enable growth and enhance returns by facilitating sales, replacing collateral, securing finance and releasing capital."

Beyond financial gains, credit insurance strengthens client relationships. Doug Konop, CFO of Specialty Forest Products, shares:

"Having trade credit insurance allows us to have an entirely different – and much more comfortable – conversation with our financial partner."

This improved dynamic fosters better lending practices, as insurers provide the assurance needed to support borrowers with complex cash flow cycles, ultimately enhancing portfolio management.

With vs. Without Credit Insurance: A Comparison

The table below highlights the distinct advantages credit insurance brings to financial institutions:

| Feature | Without Credit Insurance | With Credit Insurance |

|---|---|---|

| Risk Exposure | Bank bears 100% of loss from borrower default | Risk transferred; insurer covers 80–90% of losses |

| Lending Capacity | Limited by internal credit limits and high-risk concentrations | Increased capacity through alternative risk distribution |

| Advance Rates | Lower advance rates due to unsecured or volatile collateral | Higher advance rates on insured accounts receivable |

| Capital Requirements | Higher capital reserves required for risk-weighted assets | Reduced capital requirements through risk mitigation |

| Borrower Covenants | Stricter covenants to address perceived risks | More flexible covenants due to insured collateral |

| Market Expansion | Reluctance to fund trade in volatile or unfamiliar markets | Greater confidence to finance international trade and new sectors |

For financial institutions aiming to leverage these benefits, Accounts Receivable Insurance offers tailored solutions to safeguard against non-payment risks and other financial uncertainties.

sbb-itb-2d170b0

How to Optimize and Renew Your Credit Insurance Coverage

Adjust Policies to Match Changing Needs

Once you’ve assessed your risks and integrated your policy, the next step is to continuously fine-tune your credit insurance coverage. Credit insurance isn’t a "set it and forget it" solution – it requires consistent oversight. Financial institutions need to monitor their lending portfolios regularly, making adjustments as they evolve. Insurers, on their end, analyze payment behaviors, financial statements, and public records to update credit limits in real time.

Take a close look at your borrowing base to spot opportunities for expanding coverage. This may involve including assets that were previously excluded. A tiered approach can be particularly useful: offer lower indemnity for higher-risk customers while granting higher limits to those with lower risk. This method helps you balance exposure while maintaining crucial lending relationships.

It’s also important to assess whether your policy aligns with Basel II/III standards, which can allow you to reduce capital reserves by leveraging the insurer’s credit rating instead of the counterparty’s. As market conditions change, collaborate with structured credit teams to tailor protection for specific lending categories, such as supply chain finance or sovereign lending. Companies like Accounts Receivable Insurance specialize in creating customized policies for both domestic and international needs, ensuring your coverage stays relevant.

These ongoing adjustments lay the groundwork for a smoother renewal process.

Review and Renew Your Policy

Staying proactive with your policy evaluations ensures your coverage evolves alongside your institution’s needs. Start the renewal process 90 to 120 days before your policy expires. This gives you enough time to assess the market and avoid potential coverage gaps. As Kirk Elken, Co-founder of Securitas Global Risk Solutions, aptly puts it:

"The renewal process starts the date the policy is renewed".

This means you should be reviewing your policy’s performance year-round – not just when renewal is on the horizon.

When preparing for renewal, gather up-to-date financial statements and aging reports. Underwriters rely heavily on this information to approve buyer limits. At least 60 days before renewal, schedule discussions with your broker to address any significant changes, like increased business size, revenue growth, or shifts in your credit portfolio. It’s also wise to periodically explore the marketplace to compare rates and coverage options. As Eric Price, Christian Risk Advisor, cautions:

"A renewal that has not been proactively marketed to assess competitiveness across carriers is a missed opportunity for your institution".

During the renewal process, emphasize any improvements in your internal risk controls – such as better debt collection practices – to make your institution more appealing to underwriters. This is also the time to push for higher credit limits on key accounts, especially if earlier requests were only partially approved. Keep in mind that claims are typically paid within 180 days of the invoice date and usually cover 85% to 90% of the loss amount. To avoid surprises, ensure you’re fully aware of all filing requirements before finalizing the renewal.

Conclusion

Credit insurance plays a key role in modern risk management by helping lenders reduce charge-offs, free up capital, and extend credit more confidently – even when dealing with international or older receivables. This approach not only increases lending capacity but also ensures compliance with internal credit limits and regulatory requirements.

The financial advantages are hard to ignore. By lowering bad debt reserves and offering improved advance rates, institutions can maintain balance sheet stability even when clients face payment challenges. With access to data on 83 million businesses worldwide from major providers, banks can make smarter credit decisions and better manage concentration risks across industries and regions. This stability strengthens financial institutions while fostering stronger client relationships.

The benefits go beyond numbers. Credit insurance can transform how banks and clients interact. As Doug Konop, CFO of Specialty Forest Products, puts it:

"Having trade credit insurance allows us to have an entirely different – and much more comfortable – conversation with our financial partner".

This collaborative approach creates trust, enabling banks to support their clients’ growth and market expansion plans without taking on excessive risk.

To ensure policies remain effective, regular monitoring and proactive adjustments are essential. Whether the goal is regulatory capital relief or mitigating concentration risk, credit insurance provides a solid foundation for sustainable growth, even in uncertain economic times.

For financial institutions looking to strengthen their credit solutions, Accounts Receivable Insurance offers tailored policies for both domestic and international markets. This ensures your coverage aligns with your unique needs, supporting long-term growth in today’s ever-changing business environment.

FAQs

How does credit insurance help banks increase their lending capacity?

Credit insurance plays a key role in helping banks expand their lending capabilities by managing risk and freeing up capital for additional loans. When a bank uses credit insurance, the risk of non-payment is shifted to the insurer. This safeguards the bank’s balance sheet and strengthens its financial position, making it possible to offer borrowers higher loan-to-value ratios and more flexible loan terms.

Another advantage of credit insurance is its ability to free up regulatory capital. By leveraging the insurer’s credit rating instead of the borrower’s, banks can meet capital requirements while redirecting resources toward new lending opportunities. This combination of reduced default risks and improved capital allocation gives banks the confidence to extend loans more securely and effectively.

How can financial institutions effectively integrate credit insurance into their lending practices?

Integrating credit insurance into lending practices can be a smart way for financial institutions to manage default risks while improving credit offerings. The first step is to evaluate your loan portfolio’s credit-risk profile to pinpoint areas of higher risk. Once you’ve identified these, select a credit insurance product – such as trade credit or accounts receivable insurance – that suits your specific needs. This choice should account for whether you need coverage for domestic risks, international risks, or both.

Collaborate with your insurer to design a policy that aligns with regulatory standards and meets collateral requirements. Incorporate this insurance directly into your loan agreements to reflect the reduced risk, and adjust loan pricing to include the cost of premiums. This ensures you maintain competitive terms without compromising profitability. Additionally, establish a system for monitoring coverage and handling claims, and provide your team with the necessary training to manage this integration effectively. By taking these steps, you not only strengthen your lending operations but also offer added security to both your institution and your borrowers.

How can financial institutions effectively manage and improve their credit insurance coverage?

Financial institutions can make the most of their credit insurance by routinely evaluating their risk exposure and tailoring policies to align with their lending strategies and capital objectives. Begin with a detailed risk assessment to pinpoint areas of concern, such as over-reliance on specific industries or regions, and ensure that coverage limits align with your institution’s risk tolerance and financial needs.

It’s essential to regularly revisit and adjust your coverage to account for changes in your portfolio, like onboarding new clients or fluctuations in credit ratings. Work closely with your insurer to tap into their expertise in setting credit limits and identifying emerging risks. Incorporating the insurance policy into your overall credit management framework can also streamline operations and help maintain adherence to best practices.

Tracking key performance indicators, such as claim frequency and charge-off rates, can provide valuable insights to fine-tune your strategy over time. This proactive approach not only helps in negotiating improved terms but also opens the door to additional solutions – like accounts receivable insurance – to guard against trade credit risks while supporting your institution’s growth plans.