In an increasingly volatile business environment, managing risk is no longer optional – it’s a necessity. Whether you’re a small business owner or a corporate executive, understanding how to identify, assess, and mitigate risks can determine your long-term success. A practical way to accomplish this is by developing a risk matrix, a visual tool that evaluates potential risks and prioritizes them based on impact and probability.

In this article, we delve into the principles of effective risk management, focusing on accounts receivable, while exploring broader risk categories to consider for your business. Drawing from insights shared by risk management expert Rick Kravitz, this guide will help you implement a risk matrix to protect your business and foster sustainable growth.

Why Risk Management Matters

At its core, risk management is all about safeguarding your business against obstacles that could derail profitability and growth. Risks can stem from various sources – internal operations, external forces, or even global disruptions. "Managing risk is not just about avoiding failure but about creating long-term value", Kravitz explains.

For U.S.-based businesses, particularly those offering credit terms, accounts receivable risks are especially critical. Poor handling of credit management and payment collection can lead to cash flow disruptions, customer dissatisfaction, and even insolvency.

Six Key Risk Categories Every Business Should Address

Kravitz identifies six major types of risks that every business – small or large – should evaluate and manage:

1. Strategic Risks

Strategic risks revolve around your business goals and market positioning. Questions to consider include:

- What differentiates your business in the market?

- Are you aware of the risks stemming from competitors or shifts in customer behavior?

- Do you have the right team in place to achieve your strategic objectives?

For instance, a small business offering niche pottery might face risks such as changing consumer tastes or supply chain challenges. Identifying these factors enables you to adapt and stay competitive.

2. Cultural Risks

Your business culture profoundly impacts long-term success. Misaligned values, conflicts in family-run businesses, or unclear succession plans can jeopardize operations.

To address cultural risks, ask yourself:

- Do all stakeholders share the same vision?

- Have you resolved conflicts effectively within your team or family?

- Is your leadership fostering collaboration and trust?

Kravitz emphasizes fostering peer equality through small, inclusive meetings that encourage input from all levels of the organization.

3. Systemic Risks

Technology is a double-edged sword. While essential, reliance on outsourced software, cloud-based systems, and artificial intelligence (AI) introduces vulnerabilities like:

- Data breaches

- Software malfunctions

- Over-reliance on third-party vendors

A critical takeaway from Kravitz is to regularly audit your systems and backup solutions. Businesses should also monitor new technologies like AI chatbots to ensure their accuracy and reliability.

4. Geopolitical Risks

Supply chain disruptions, tariffs, and international instability can severely impact operations. For example, over 300,000 American businesses work with suppliers in Ukraine and Russia – a dependency that poses risks during geopolitical conflicts.

Mitigate risks by:

- Sourcing goods from multiple suppliers

- Monitoring international developments

- Establishing contingency plans for disruptions

5. Reputational Risks

In today’s digital age, reputation is everything. Negative social media feedback or poor Glassdoor reviews can tarnish your business image. Kravitz highlights the need to:

- Actively monitor online platforms like TikTok, Facebook, and Glassdoor

- Address complaints promptly and professionally

- Consider hiring reputation consultants to assess public perception

"Your reputation is an intangible asset", Kravitz notes, "and it can be destroyed in minutes if not properly managed."

6. External Risks (Black Swan Events)

Pandemics, natural disasters, and economic downturns are rare but catastrophic events. The COVID-19 pandemic revealed how unprepared many businesses were for global disruptions.

To prepare for these "black swan" events:

- Develop an action plan to notify stakeholders

- Invest in business continuity strategies

- Build financial reserves to absorb unexpected shocks

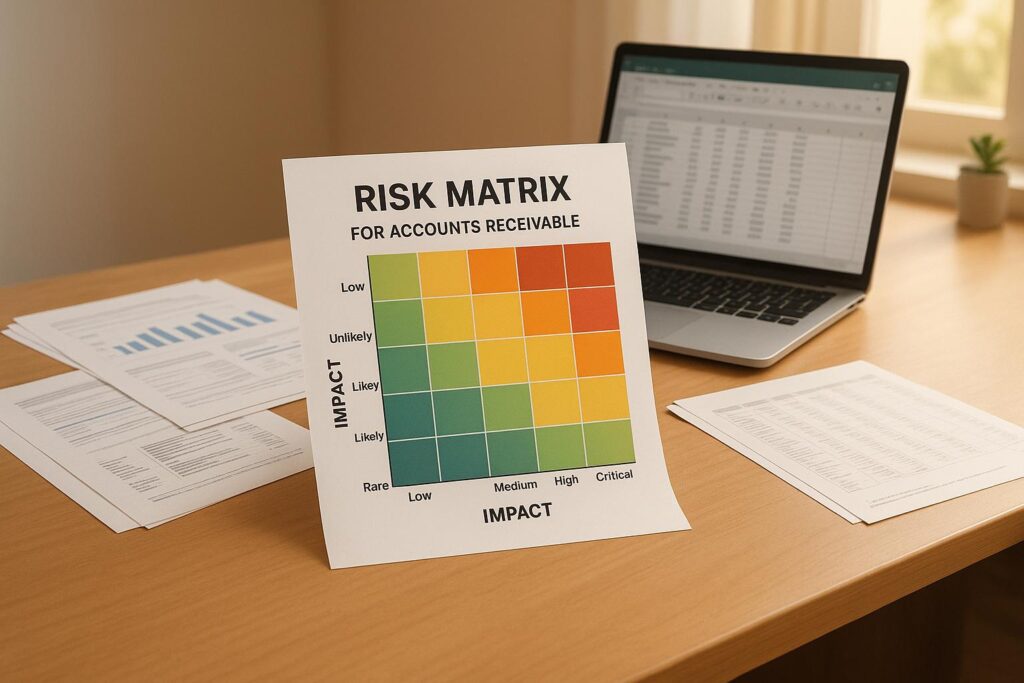

How to Create a Risk Matrix

A risk matrix simplifies risk management by visually categorizing risks based on their impact and probability. Here’s how to create one:

Step 1: Brainstorm Risks

Identify potential risks through team discussions. Include both internal (e.g., staff turnover, software failures) and external risks (e.g., economic recessions, regulatory changes).

Step 2: Assess Impact and Probability

Rate each risk on a scale of 1 to 5:

- Impact: How severely would the risk affect your business?

- Probability: How likely is it to occur?

Step 3: Calculate Severity

Multiply the impact score by the probability score to determine the severity of each risk. For example:

- A risk with a high impact (5) and high probability (5) has a severity of 25, requiring immediate attention.

- A lower-probability risk (impact 5, probability 1) has a severity of 5, making it less urgent.

Step 4: Prioritize and Mitigate

Focus on high-severity risks first. Develop mitigation plans, such as:

- Diversifying suppliers

- Implementing backup systems

- Offering employee training

You can also use software solutions or templates to track risks and update your matrix monthly.

Case Studies: Lessons from Real Businesses

1. Target’s Canadian Expansion

When Target expanded into Canada, it invested in a sophisticated German supply chain system incompatible with its existing operations. The result? Empty store shelves and overflowing warehouses, causing billions in losses.

Takeaway: Always align your strategy with your operational capacity. Listen to internal warnings about potential risks.

2. Small Business Payroll Fraud

A sole payroll clerk in Ohio stole hundreds of thousands of dollars over 18 years due to weak accounting controls.

Takeaway: Separate duties for handling payments, reconciling accounts, and processing invoices to reduce fraud risks.

Key Takeaways

- Embed Risk Management: Incorporate a risk matrix into monthly or quarterly reporting alongside financial metrics.

- Diversify Suppliers: Avoid over-reliance on a single vendor to mitigate geopolitical and supply chain risks.

- Safeguard Data: Regularly update and test cybersecurity measures to protect sensitive customer information.

- Monitor Reputation: Keep a close eye on social media, customer feedback, and employee reviews to maintain a strong reputation.

- Plan for Rare Events: Prepare for black swan events like pandemics or natural disasters with contingency plans and financial reserves.

- Define Culture: Establish shared values and clear communication in family-run or small businesses to reduce internal conflict.

- Use Simple Tools: A straightforward risk matrix can provide clarity and focus on what matters most.

Final Thoughts

Risk management is not just an administrative task – it’s a vital strategy for creating sustainable value. Whether managing accounts receivable or navigating external disruptions, a proactive approach to risk mitigation can help your business thrive. Start small by implementing a risk matrix, and continuously refine your strategies to face an ever-evolving risk landscape.

By taking these steps, you’ll not only protect your business but also position it for long-term success in an unpredictable world.

Source: "Small Business Risk Management" – New York SBDC, YouTube, Jan 1, 1970 – https://www.youtube.com/watch?v=gITUW6nRCPU

Use: Embedded for reference. Brief quotes used for commentary/review.