Country risk ratings help businesses assess the likelihood of non-payment risks in international trade. These ratings evaluate a nation’s economic stability, political environment, and ability to meet external debt obligations. Here’s why they matter:

- Trade Credit Decisions: Risk ratings influence payment terms, insurance premiums, and market entry strategies.

- Short- and Medium-Term Insights: They highlight both immediate liquidity risks (6–12 months) and long-term political or economic challenges.

- Key Metrics: Ratings consider GDP growth, inflation, debt sustainability, governance, and transfer risks (e.g., currency controls).

- Global Monitoring: Organizations like Allianz Trade, Coface, and the OECD provide regular updates to keep businesses informed.

How Country Risk Ratings Are Calculated

OECD Country Risk Classification System

The OECD employs a two-step process to classify country risk, blending quantitative modeling with expert judgment. It begins with the Country Risk Assessment Model (CRAM), introduced in 1997 and updated in January 2024. This model analyzes financial and economic data to create a baseline risk score. Each year, CRAM evaluates roughly 140 countries, focusing on four key areas:

- Payment experience: Data from Export Credit Agencies.

- Macroeconomic indicators: Information sourced from the IMF and World Bank.

- Economic conditions: Factors like policy effectiveness and growth potential.

- Institutional quality: Metrics based on World Bank Governance Indicators.

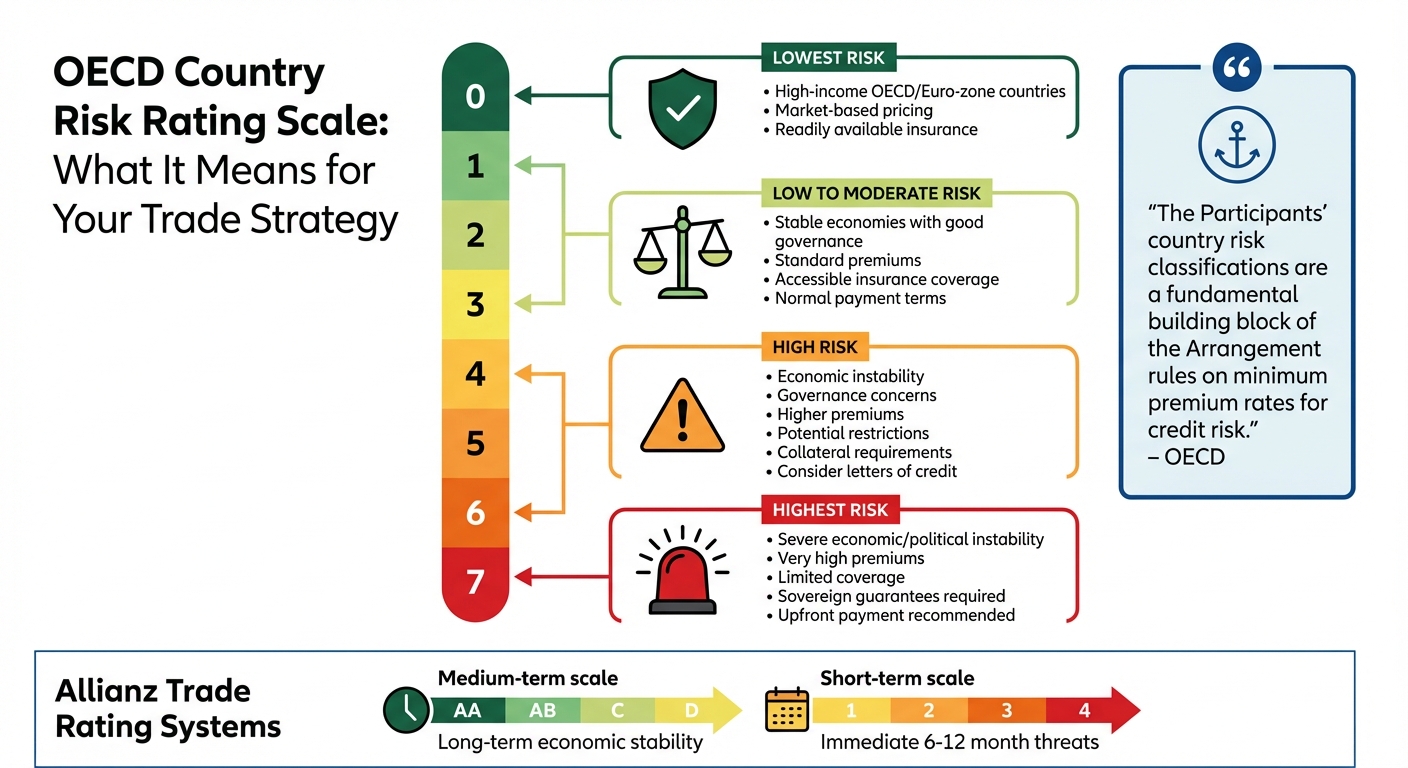

CRAM assigns countries a preliminary score on a scale from 0 to 7, where 0 indicates the lowest risk and 7 the highest.

Next, the Country Risk Experts’ Group (CRE) conducts qualitative peer reviews to refine the model’s results. This step accounts for factors that numbers alone can’t capture – like political instability, emerging crises, or wars.

"No mathematical model can completely cover the complexity of a single country. We need people for that. But a strong predictive tool like CRAM is a valuable tool in the process".

The hybrid approach strengthens accuracy by cross-checking CRAM’s findings with historical default data and past payment records. High-income OECD and Eurozone countries are typically excluded from the 0–7 scale and are instead treated as "market benchmark" nations, subject to market-based pricing. Together, these quantitative and qualitative insights provide a comprehensive framework for assessing country risk.

Key Factors in Country Risk Ratings

Once the classification process is complete, additional indicators fine-tune the risk assessment. These ratings consider both a country’s ability and willingness to meet its external financial obligations.

Economic metrics like GDP growth, inflation, and public debt sustainability help measure financial capacity. For instance, countries with annual inflation rates between 0% and 3% generally earn the lowest risk points in this category. Meanwhile, political stability and strong governance signal a government’s commitment to policies that promote international trade. The January 2024 CRAM update has placed greater emphasis on governance factors, highlighting their growing importance in risk evaluations.

Transfer and convertibility risk assesses the chances of government-imposed currency controls that could block payments to foreign creditors, even if private buyers remain solvent. The updated CRAM model also incorporates emerging risks, such as the effects of climate change. Environmental factors are now recognized as potential triggers for non-payment risks. In fact, some sovereign risk frameworks allocate up to 30% of their weight to Environmental, Social, and Governance (ESG) factors.

Additionally, external shocks – ranging from natural disasters to geopolitical conflicts or force majeure events like wars or expropriations – are evaluated through qualitative reviews. These reviews ensure that risks not evident in historical data are accounted for. This thorough analysis not only shapes country risk ratings but also equips decision-makers with the insights needed for informed trade and investment strategies.

Types of Country Risks That Affect Trade

Political and Sovereign Risks

Political risk refers to the possibility that government actions or instability could disrupt trade operations and cash flow. Sovereign risk, on the other hand, evaluates a country’s ability and willingness to repay its external debts.

Examples of political risks include coups, wars, and civil unrest, which can sever trade routes and eliminate legal protections. Policy changes after elections can also be disruptive, with new leadership potentially introducing higher taxes, stricter regulations, or policies favoring state control of industries. Weak institutions, such as those plagued by corruption or poor governance, further amplify these risks.

"In every country, from the most to the least developed, there is some level of political risk." – Allianz Trade

The impact on businesses can be severe. Political upheaval or a sovereign default might result in non-payment for goods or services already delivered. Governments could seize private assets through expropriation without fair compensation or impose capital controls that restrict currency conversion and fund transfers to foreign creditors. Wars and civil unrest can halt production, disrupt logistics, and cause businesses to miss deadlines or breach contracts.

Credit ratings offer some insight into these risks. Standard & Poor’s assigns an "investment grade" rating to countries rated BBB‑ or higher, while BB+ or lower is considered speculative or junk status. Similarly, Moody’s classifies Baa3 and above as investment grade, with Ba1 and below deemed speculative.

While political factors are a major concern, economic conditions also play a crucial role in trade risk.

Economic and Financial Risks

Economic risks stem from a country’s financial health and its capacity to meet debt obligations, which directly affect the reliability of trade credit. High levels of government debt can trigger inflation and destabilize currencies, creating additional challenges for international trade.

"High levels of government debt can lead to inflation and currency destabilization, both of which are likely to have a real and significant impact on any company doing business in and with that country." – Allianz Trade

Currency instability and fluctuating exchange rates make cash flow unpredictable, complicating financial planning. A stable banking system is also essential; if financial institutions are unreliable or insolvent, cross-border transactions can be jeopardized. Short-term financial risks often appear as interruptions in financial flows, potentially leading to immediate payment defaults on trade receivables. Allianz Trade categorizes short-term risk on a four-level scale, with 1 being the lowest risk and 4 the highest.

Before offering large credit terms, businesses should evaluate a country’s debt-to-GDP ratio and debt service-to-exports ratio. These metrics can help identify whether high debt levels might lead to future inflation or currency instability.

Economic risks are further complicated by external events and regulatory challenges.

Force Majeure and Transfer Risks

Force majeure events – such as natural disasters, wars, expropriation, revolutions, and civil disturbances – can severely disrupt supply chains, damage assets, and make operations impossible.

Transfer risk occurs when governments impose capital controls that restrict currency conversion or fund transfers. Even if a buyer is solvent and willing to pay, these restrictions can prevent transactions from being completed.

"The country risk encompasses: transfer and convertibility risk (i.e. the risk that a government imposes capital or exchange controls that prevent an entity from converting local currency into foreign currency and/or transferring funds to creditors located outside the country), and cases of force majeure (e.g. war, expropriation, revolution, civil disturbance, floods, earthquakes)." – OECD

These risks are integral to country risk classifications, which assess a nation’s likelihood of meeting external debt obligations. Allianz Trade’s medium-term country grades range from AA (lowest risk) to D (highest risk), reflecting both political instability and economic imbalances. Overlooking these factors can result in devastating losses, legal disputes, and even theft, particularly if transparency and oversight are lacking.

Country Risk: The 2024 Update

sbb-itb-2d170b0

How to Use Country Risk Ratings for Trade Decisions

OECD Country Risk Rating Scale and Trade Implications Guide

Reading Risk Scales and Their Trade Implications

Country risk ratings play a key role in shaping trade decisions by influencing export credit insurance availability, premium costs, and payment terms. The OECD’s risk scale, ranging from 0 to 7, categorizes countries based on their risk levels. A higher rating typically means higher premiums for insurance coverage.

"The Participants’ country risk classifications are a fundamental building block of the Arrangement rules on minimum premium rates for credit risk." – OECD

Allianz Trade uses two rating systems to assess country risk: a medium-term scale (AA to D) for evaluating long-term economic stability and business climate, and a short-term scale (1 to 4) focused on immediate threats over a 6- to 12-month period. Export credit agencies, like EKN, review country policies regularly and classify markets as "normal risk assessment", "restrictive risk assessment", or "normally off cover", where guarantees are unavailable. High-income markets often follow market-driven pricing rules.

| OECD Risk Category | Implication for Trade |

|---|---|

| 0 | Lowest risk; primarily high-income OECD/Euro-zone countries with market-based pricing. |

| 1–3 | Low to moderate risk; standard premiums and generally accessible insurance coverage. |

| 4–6 | High risk; higher premiums and potential restrictions, such as collateral requirements. |

| 7 | Highest risk; very high premiums, limited coverage, or reliance on sovereign guarantees. |

These ratings act as a guide for businesses to fine-tune their trade practices and risk management strategies.

Adjusting Trade Strategies Based on Risk Levels

When dealing with higher-risk countries (OECD 5–7 or Allianz 3–4), businesses should reconsider their trade terms. Open account terms may expose companies to unnecessary risk in these environments. Instead, requiring upfront payments or letters of credit can help protect cash flow. It’s also wise to check for available official credit support, such as the Ex-Im Bank Country Limitation Schedule.

Another critical factor is determining whether risk assessments apply to sovereign buyers (government entities) or private companies. To minimize exposure, diversifying your market portfolio is essential – balance investments between high-risk emerging markets and more stable, low-risk countries. Resources like the U.S. Commercial Service‘s Country Commercial Guides or the World Bank’s Ease of Doing Business rankings can provide valuable insights into specific markets.

In countries prone to transfer and convertibility risks, it’s important to monitor short-term indicators, such as import cover and exchange rates, to ensure sufficient U.S. dollar liquidity. For added protection, consider political risk insurance through programs offered by agencies like the Ex-Im Bank or the Small Business Administration. These policies can shield businesses from risks like expropriation or political unrest.

Reducing Trade Risks with Credit Insurance

How Accounts Receivable Insurance Protects Your Business

Export Credit Insurance (ECI) serves as a safety net for exporters when foreign buyers fail to pay. It provides protection against commercial risks – like insolvency, bankruptcy, or prolonged defaults – and political risks such as war, terrorism, currency restrictions, expropriation, or sudden regulatory shifts. This dual protection is particularly valuable when dealing with countries with high-risk ratings.

Short-term ECI can cover up to 95% of losses, while medium-term policies generally protect about 85% of the contract value. Despite this extensive coverage, most policies cost less than 1% of insured sales, making them an affordable way to guard against non-payment. Additionally, U.S. exporters utilizing an EXIM working capital guarantee can benefit from a 25% premium discount on multi-buyer policies.

"By protecting against the non-payment of receivables, TCI safeguards the lifeblood of a business, its cash flow, ensuring that companies can withstand the financial impact of a customer’s default." – ARI Global

Having insured receivables can also improve your borrowing potential. Lenders often extend larger credit lines and offer better financing terms when foreign accounts receivable are insured. This added financial flexibility allows businesses to confidently offer competitive open account terms, even in emerging markets that might otherwise seem too risky. Such coverage provides a strong foundation for crafting tailored risk management strategies.

Custom Policy Design for Risk Mitigation

Beyond broad coverage, policies can be customized to address specific risks. Accounts Receivable Insurance allows businesses to adjust coverage based on their unique needs and the challenges of particular markets. Insurers assign credit limits after carefully evaluating financial and political risks. This approach ensures that your coverage aligns with your actual exposure in different regions.

| Risk Category | Coverage Features |

|---|---|

| Political | Expropriation, nationalization, war, sanctions |

| Economic | Buyer insolvency, prolonged default |

| Transfer | Currency conversion restrictions |

| Force Majeure | Natural disasters, civil unrest |

Private commercial insurers offer flexible credit limits without foreign content restrictions. On the other hand, government-backed agencies like EXIM Bank provide coverage in riskier markets where private insurers may hesitate to operate. However, EXIM Bank requires at least 50% U.S. content in the goods or services being insured. U.S. exporters are encouraged to work with specialized insurance brokers to find cost-effective solutions tailored to their specific market conditions.

Risk Assessments and Claims Management

Proactive risk monitoring plays a crucial role in managing trade risks effectively. This involves staying ahead of potential issues by keeping a close watch on customer and country risks before any visible payment problems arise. Insurers often provide real-time updates on buyer creditworthiness and country-specific risks. For example, major insurers like Coface monitor political and economic conditions in 160 countries, regularly updating their evaluations.

Before entering into contracts, it’s essential to review buyer histories using insurers’ data and expert insights. This helps avoid extending credit to unreliable partners. If a covered loss occurs, insurers typically reimburse up to 90% of the unpaid invoice.

To ensure claims are honored, businesses must strictly follow all policy requirements. Any portion of the loss not covered by the policy remains the business’s responsibility. Additionally, exporters should consult the EXIM Bank Country Limitation Schedule to confirm whether support is restricted or unavailable for specific high-risk countries due to U.S. government policies. It’s worth noting that ECI does not cover physical loss or damage to goods – separate marine or casualty insurance is needed for that.

Conclusion

Country risk ratings play a critical role in navigating the complexities of international trade. These ratings evaluate the likelihood of non-payment stemming from factors beyond a company’s control, such as economic instability or political unrest. By offering a standardized way to assess risks – including transfer and convertibility issues, where capital controls hinder currency exchange, and force majeure events like wars or natural disasters – they provide businesses with the insights needed to make informed decisions in unpredictable markets.

"A country risk assessment can help a business identify and evaluate country-specific risks. In doing so, businesses can determine how much those risks might impact their business and what steps they can take to manage or mitigate those risks." – Allianz Trade

This structured approach not only identifies potential threats but also helps businesses develop practical strategies. In today’s interconnected global markets, understanding factors like political stability, foreign exchange risks, legal systems, and banking infrastructure is essential. Resources such as the U.S. Commercial Service’s Country Commercial Guides and the Ex-Im Bank Country Limitation Schedule offer valuable tools for assessing market conditions. Additionally, keeping an eye on short-term indicators can help businesses anticipate financial crises within a 6–12 month horizon.

Trade credit insurance provides a safety net by turning risk insights into financial security. Products like Accounts Receivable Insurance and trade credit insurance shield businesses from non-payment risks caused by uncontrollable events, including transfer restrictions and force majeure scenarios identified in country risk ratings. This allows companies to channel their efforts into growth and operations rather than worrying about debt collection or constant risk monitoring.

"In an era of increasing economic uncertainty and geopolitical complexity, business leaders need reliable tools to make informed decisions about international operations and investments." – Coface

FAQs

How do country risk ratings influence the cost of trade credit insurance?

Country risk ratings are a key factor in shaping the cost of trade credit insurance. When a country is assigned a higher risk rating – signaling greater financial instability or a higher chance of non-payment – insurers adjust their premiums accordingly to reflect the increased risk.

These ratings provide insurers with insight into potential challenges such as economic turbulence, political unrest, or the likelihood of financial defaults. For businesses trading with countries deemed higher risk, this often translates into higher insurance premiums to cover the added uncertainty. By understanding these ratings, companies can make smarter decisions and better navigate their financial risks in international markets.

What does the OECD consider when determining a country’s risk rating?

The OECD assesses country risk ratings by examining the chances that a nation might struggle to meet its external debt obligations. This evaluation focuses on two main aspects:

- Transfer and convertibility risk: This involves the possibility of government-imposed restrictions, such as currency controls, that could block businesses from converting local currency into foreign currency or transferring money abroad.

- Force majeure risk: This covers unforeseen events like war, political turmoil, expropriation, natural disasters, or other crises that could interfere with debt repayment.

Together, these factors paint a clear picture of a country’s credit risk, offering businesses and insurers valuable insight into potential obstacles in global trade and investment.

How do country risk ratings help businesses adjust their international trade strategies?

Country risk ratings serve as a valuable tool for businesses, offering insights into a country’s economic, political, and legal stability. These ratings help companies evaluate the likelihood of financial disruptions, such as non-payment or currency restrictions. By blending long-term and short-term risk factors, they provide a clearer understanding of the challenges a specific market might present.

With this knowledge in hand, businesses can adjust their strategies accordingly. For markets deemed high-risk, companies might take steps like reducing order volumes, tightening credit terms, or requesting advance payments. Another effective safeguard is Accounts Receivable Insurance, which protects against risks such as non-payment, bankruptcy, or political instability. On the other hand, in low-risk countries, businesses may feel more confident extending payment terms, increasing order sizes, or pursuing new opportunities – while keeping an eye on any shifts in ratings.

By consistently tracking country risk ratings and factoring them into their decision-making processes, companies can better protect their international trade operations and fine-tune their strategies to stay ahead in changing market environments.