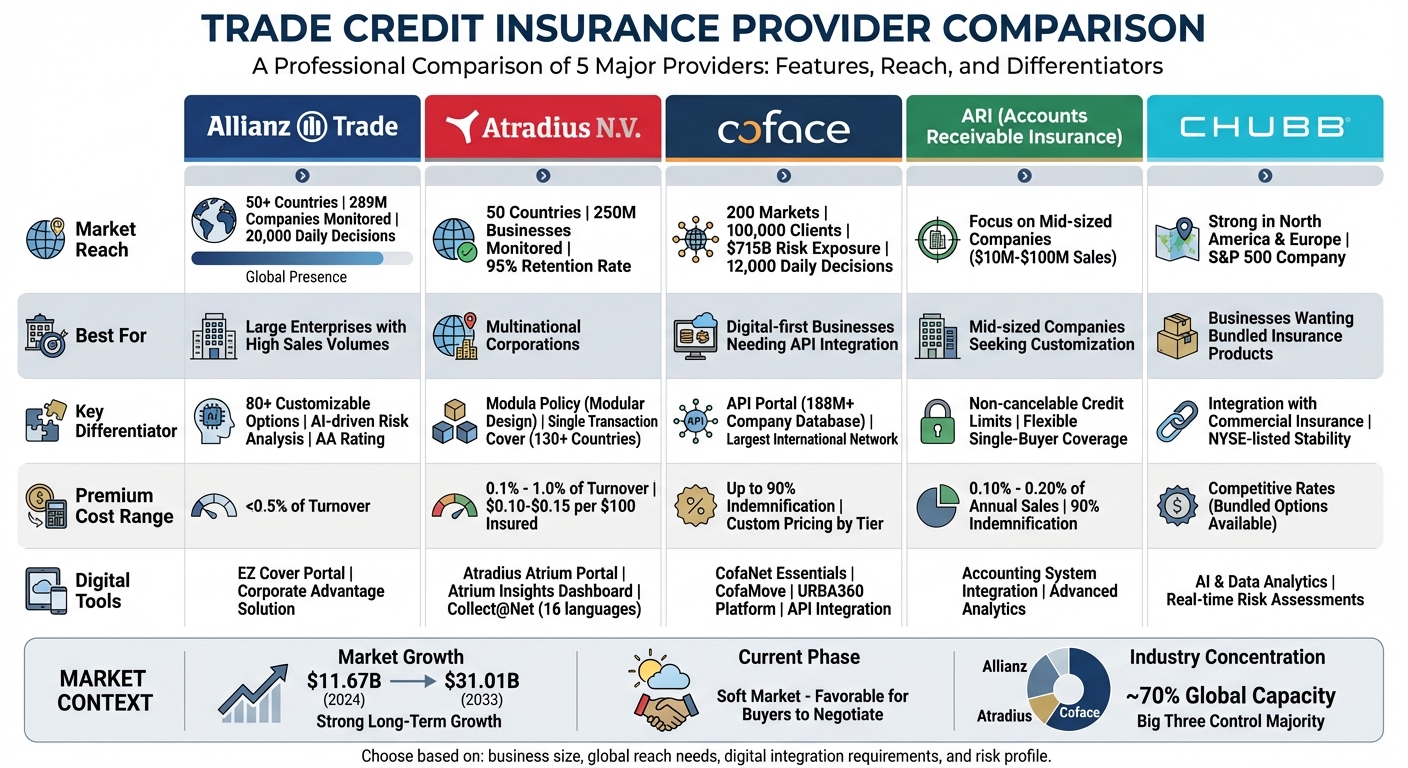

Trade credit insurance is a safety net for businesses, protecting against customer non-payment due to defaults, insolvency, or political disruptions. The market is growing fast – from $11.67 billion in 2024 to $31.01 billion by 2033. Major players like Allianz Trade, Atradius, Coface, ARI, and Chubb are competing by offering tailored solutions, integrated risk tools, and global networks.

Here’s what you need to know:

- Allianz Trade processes 20,000 credit decisions daily and offers flexible coverage options, including AI-driven risk analysis.

- Atradius provides modular policies and global expertise for multinationals.

- Coface leads in digital tools, offering real-time API access to data on over 188M companies.

- ARI specializes in mid-sized businesses with customizable policies and non-cancelable credit limits.

- Chubb integrates trade credit insurance with broader commercial insurance offerings.

Each provider has unique strengths, but the choice depends on your business size, risk needs, and global reach. The industry’s growth offers businesses leverage to negotiate better terms, especially during this "soft market" phase.

Trade Credit Insurance Providers Comparison: Key Features and Capabilities

Trade Credit Insurance Explained

1. Allianz Trade

Allianz Trade stands as a global powerhouse in trade credit insurance, safeguarding approximately $1,400 billion in business transactions annually. Operating in over 50 countries with a diverse team of more than 5,700 employees representing 80 nationalities, the company serves a wide range of clients – from small businesses earning up to $25 million in revenue to large multinational corporations.

Market Coverage

Allianz Trade boasts one of the most extensive risk monitoring networks in the industry, tracking 289 million companies across more than 160 countries and making 20,000 credit decisions daily. This vast reach allows the company to process 90% of credit limit requests within 48 hours. Beyond traditional credit insurance, Allianz Trade offers a variety of specialized products, including surety bonds, business fraud insurance, and e-commerce credit insurance through its Allianz Trade Pay platform. Its financial stability is reflected in its AA rating from Standard & Poor’s, emphasizing its ability to deliver reliable and secure services.

Customization & Services

Allianz Trade provides a highly flexible approach to credit insurance with its Corporate Advantage solution, which includes over 80 customizable coverage options. Among its tailored programs are Transactional Cover, offering non-cancellable limits for up to eight years, and Excess of Loss (XOL), designed to protect company balance sheets. For e-commerce businesses, the EZ Cover portal simplifies the process by offering instant credit decisions for new customers not covered under standard policies. These specialized solutions are designed to meet the unique needs of businesses, enhancing their risk management capabilities.

"Allianz Trade provides tailored credit insights, protects against non-payment risks, and enhances access to financing. With advanced AI technology, local expertise, and a strong global network, we deliver solutions that support financial security and growth."

- Anil Berry, Chief Commercial Officer, Allianz Trade

Risk Management Capabilities

Using a combination of predictive technology, AI, and expert human analysis, Allianz Trade delivers real-time credit assessments. Its global debt collection network includes over 340 professionals working in more than 145 countries, managing over 130,000 debts annually. The company evaluates buyer creditworthiness to establish safe credit limits and provides indemnification of up to 95% for losses resulting from insolvency or extended payment defaults.

Pricing & Affordability

Allianz Trade’s premiums are competitively priced at less than 0.5% of a company’s turnover. Pricing depends on factors such as B2B turnover, geographic regions of operation, customer payment behaviors, and the desired level of coverage. Policies can be structured as either a fixed amount per turnover class or as a percentage of total turnover. While the company maintains a solid 4.0-star customer satisfaction rating from around 500 reviews, some long-term clients have noted that recent policy updates have made renewals more cumbersome, requiring manual requests instead of bulk updates.

2. Atradius N.V.

Atradius N.V. stands out as a leading name in trade credit insurance, operating in 50 countries with a unified global team. The company monitors around 250 million businesses worldwide, drawing on over a century of industry experience. With a customer retention rate of 95%, this Netherlands-based firm provides valuable credit insights that help businesses make smarter credit decisions.

Market Coverage

Atradius focuses on trade credit insurance, debt collections, and surety bonds. Its Global division is designed to support multinational corporations by aligning local expertise with the global needs of its clients. This ensures consistent service quality, no matter where in the world the client operates.

Customization & Services

Atradius’s flagship offering, the Modula policy, is built around a modular design. This approach allows businesses to customize their coverage based on specific trade risks and exposures. The company also offers specialized solutions like political risk insurance and structured trade financing, catering to unique client needs.

As Atradius highlights:

"Modula allows for varying levels of risk and need between customers to be clearly identified and differentiated. Providing a single policy promotes standardization and clarity, while the individual modules allow for a custom fit."

Risk Management Capabilities

To help clients manage credit risks effectively, Atradius provides a suite of digital tools. The Atradius Atrium portal lets businesses request credit limits, file claims, and monitor debtor behavior in real time. Meanwhile, the Atrium Insights dashboard delivers portfolio analysis with interactive maps and trend tracking. For debt collection, the Collect@Net platform offers services in 16 languages, enabling businesses to oversee global collection activities seamlessly.

Pricing & Affordability

Atradius’s pricing for credit insurance typically ranges from 0.1% to just over 1.0% of a company’s turnover. Customers usually pay between 10–15 cents per $100 insured, with premiums billed monthly and renegotiated annually based on turnover and risk profile. Additionally, Atradius offers free, no-obligation quotes, making it easy for businesses to explore their coverage options.

3. Coface

Coface stands out as a leading player in the trade credit insurance market, operating the largest international network in the industry. With a presence in 200 markets and a client base of 100,000 businesses, this France-based company manages a staggering $715 billion in risk exposure. Backed by a global team of over 5,200 experts, Coface handles approximately 12,000 credit decisions daily, leveraging its extensive network and advanced digital tools to navigate and refine risk management.

Market Coverage

Coface’s operations span seven global regions: North America, Latin America, Western Europe, Central & Eastern Europe, Northern Europe, Mediterranean & Africa, and Asia Pacific. The company monitors 13 key business sectors – ranging from agri-food and construction to retail and energy – to align its risk management strategies with local market conditions. In July 2025, Coface expanded its footprint by launching a syndicate at Lloyd’s, offering AA-rated solutions to its clients. Beyond traditional trade credit insurance, Coface provides a range of services, including business information, debt collection, single risk insurance, surety bonds, and factoring. For multinational corporations, it offers centralized contracts that cover subsidiaries worldwide.

Customization & Services

Coface’s diverse offerings are designed to meet the unique needs of businesses of all sizes.

- EasyLiner: A fully digital solution tailored for small and very small businesses.

- TradeLiner: Flexible and customizable coverage for mid-sized companies.

- GlobaLiner: Bespoke contracts with dedicated global teams, designed for multinational corporations through a single point of contact.

For businesses with complex, one-off projects, Coface provides specialized Single Risk insurance to address unique political or payment default risks. Additionally, its API Portal allows businesses to integrate Coface’s data into their credit insurance management systems, ensuring a tailored and seamless experience.

Risk Management Capabilities

Coface relies on a three-pronged strategy for effective risk management: prevention, mitigation, and protection.

- Prevention: Business information and predictive scoring help forecast creditworthiness and flag early warning signs of default.

- Mitigation: Tools like CofaNet Essentials and CofaMove allow for round-the-clock portfolio monitoring, credit limit requests, and real-time alerts about customer solvency.

- Protection: When preventive measures aren’t enough, Coface compensates losses on insured receivables, typically covering up to 90% of the debt. This process is supported by a global debt collection team of over 300 experts.

The Coface Dashboard adds another layer of support by tracking risk concentration and forecasting potential claims, aligning with the industry’s shift toward integrated digital solutions.

Global Network Access

Coface’s infrastructure spans 162 countries, providing localized expertise through a network of over 400 risk experts and economists. These professionals produce macroeconomic analyses, country risk assessments, and sector-specific reports, giving clients invaluable insights into global trade dynamics. Its URBA360 digital platform offers 24/7 access to risk analysis and business information, helping companies evaluate potential partners before extending payment terms.

Pricing & Affordability

Coface structures its pricing to cater to businesses of all sizes.

- EasyLiner: An affordable, fully digital option for smaller companies.

- TradeLiner and GlobaLiner: Custom pricing models designed for mid-sized businesses and multinationals.

Policies generally indemnify up to 90% of insured debts, and the cost of coverage is often offset by better financing terms from banks. In early 2025, Coface reported a net income of €261.1 million for 2024, reflecting an 8.6% year-over-year increase. With strong financial ratings (A+ from Fitch, A1 from Moody’s, and AA- from S&P), the company demonstrates its stability and ability to deliver value across its diverse client base.

sbb-itb-2d170b0

4. Accounts Receivable Insurance (ARI)

Accounts Receivable Insurance (ARI) provides specialized protection for both domestic and international receivables, focusing on the needs of mid-sized companies. While many insurance carriers cater primarily to large multinational corporations, ARI fills an important gap by offering flexible coverage options tailored to businesses with annual sales between $10 million and $100 million. These options include whole turnover coverage, selected buyer protection, or coverage for a single high-value customer. Additionally, ARI simplifies claims processes and integrates smoothly with accounting systems, making it an attractive option for mid-sized businesses.

Customization & Services

One of ARI’s strengths lies in its ability to customize policies to fit the unique needs of each business. Whether a company requires whole turnover coverage, protection for selected buyers, or insurance for a single customer, ARI can deliver. Beyond risk protection, these policies can also improve financing opportunities by allowing insured receivables to serve as collateral.

For instance, a U.S.-based pharmaceutical company leveraged ARI’s coverage to extend critical international credit, ensuring smooth operations in global markets. This adaptability underscores ARI’s commitment to addressing specific business challenges.

Risk Management Capabilities

ARI combines traditional credit protection with advanced analytics to offer a comprehensive risk management strategy. Its coverage extends beyond standard non-payment issues, addressing scenarios such as customer insolvency, prolonged default, and even political risks like currency transfer restrictions, terrorism, or war.

One standout feature is ARI’s non-cancelable credit limits, which provide businesses with a stable safeguard during periods of economic uncertainty. For example, ARI worked with a long-standing food industry client navigating high-risk conditions due to government-imposed restrictions. By advising the client to adjust coverage – insuring higher-risk customers at reduced indemnity levels while increasing limits for lower-risk customers – ARI helped the company maintain essential business relationships while effectively managing its exposure.

Pricing & Affordability

ARI offers its comprehensive coverage at competitive rates, with premiums generally ranging from 0.10% to 0.20% of a company’s total annual sales. The exact cost depends on factors such as the industry, customer risk profiles, historical loss data, and the proportion of domestic versus export sales.

Policies typically indemnify up to 90% of insured debts, providing substantial financial security. Additionally, businesses may find that insured receivables improve their financing terms, as banks often view these assets as more secure collateral. To add to the appeal, premiums may be tax-deductible, further enhancing the overall value of ARI’s services.

5. Chubb

Chubb is a global insurance powerhouse, offering trade credit insurance as part of its extensive portfolio, which includes casualty, property, life, and reinsurance products. Traded on the New York Stock Exchange (NYSE: CB) and a member of the S&P 500 index, Chubb combines financial stability with an expansive global reach, making it a key player in the trade credit insurance market. Its comprehensive approach to risk management and market strategy sets it apart in the industry.

Market Coverage

Chubb has a strong presence in North America and Europe – two of the most prominent regions for trade credit insurance. In 2024, the North American market alone was valued at $4.30 billion, driven by the close integration of trade credit insurance with banking operations. Chubb caters to a wide range of industries, including manufacturing, retail, food and beverages, automotive, and IT and telecom. Unlike companies that specialize solely in trade credit insurance, Chubb incorporates these services into its broader commercial insurance offerings. This integration allows businesses to streamline their insurance needs with a single provider, reinforcing Chubb’s position as a trusted partner in risk management.

Risk Management Capabilities

Chubb’s advanced risk management tools are designed to shield businesses from challenges like customer bankruptcy, insolvency, and prolonged payment defaults. By harnessing AI and data analytics, the company provides real-time risk assessments and early warnings of potential buyer distress. These tools analyze financial statements, trade patterns, and global news to deliver precise credit risk evaluations. Additionally, Chubb’s multinational structure ensures localized expertise across various jurisdictions, a critical advantage given the complexities of international trade regulations.

Global Network Access

Headquartered in Switzerland and listed on the NYSE, Chubb leverages its extensive global network to serve clients across North America, Europe, and the Asia Pacific region. The company offers flexible options, including whole turnover coverage for comprehensive portfolio protection and single buyer coverage for specific high-value transactions. Large enterprises, which made up 60% of global trade credit insurance revenue in 2025, form a significant part of Chubb’s client base. This global reach and tailored approach make Chubb a reliable partner for businesses navigating complex trade environments.

Advantages and Disadvantages

Each provider in the trade credit insurance market brings its own strengths and challenges, influencing how businesses choose their partners.

Allianz Trade stands out for its deep economic research capabilities and industry-specific risk analysis. However, as one of the "Big Three" controlling around 70% of global trade credit risk capacity, their significant market presence might limit pricing flexibility during competitive negotiations.

Atradius N.V. shines with its tailored services, such as the "Special Products Unit" for customized coverage and the "Atradius Global" team dedicated to multinational corporations. Additionally, their Single Transaction Cover now extends to buyers in over 130 countries.

Coface leads the charge in digital integration, offering an API portal with 26 products that grant credit managers instant access to data on over 188 million companies for real-time risk assessments.

These highlights provide a foundation for understanding each provider’s market position alongside the broader risks inherent in the industry.

| Provider | Key Advantages | Key Limitations |

|---|---|---|

| Allianz Trade | In-depth economic insights; hybrid model combining AI with human analysts | Market dominance may restrict pricing flexibility |

| Atradius N.V. | Expertise in multinational solutions; custom coverage through Special Products Unit | – |

| Coface | Advanced API tools; access to a database of 188M+ companies | – |

| Accounts Receivable Insurance | Tailored policy designs; broker-focused support; flexible pricing | Smaller global presence compared to the "Big Three" |

| Chubb | Financial stability as an S&P 500 company; ability to bundle trade credit with other insurance products | Trade credit insurance is a secondary focus within their broader portfolio |

Accounts Receivable Insurance (ARI) takes a more personalized approach, offering policies tailored to the unique needs of businesses. Their broker-centric model often results in more responsive customer service and greater pricing flexibility, making them an attractive option for companies seeking customized solutions.

Chubb, with its robust financial backing as an S&P 500 company, provides a solid foundation for businesses. They also offer the convenience of bundling trade credit insurance with other commercial property and casualty products. However, since trade credit insurance is just one part of their extensive portfolio, businesses requiring a more specialized focus may need to look elsewhere.

Beyond individual provider strengths, it’s important to recognize the inherent challenges of trade credit insurance. The industry tends to be procyclical, meaning that during economic downturns, insurers may quickly tighten credit limits or raise premiums – often at the very moment businesses need protection the most. This cyclical nature presents a risk for even the most reliable providers. However, government interventions during crises like the 2008 financial meltdown and the COVID-19 pandemic have historically offered some relief.

Conclusion

When selecting a trade credit insurance provider, it’s crucial to align their strengths with your specific business needs. For instance, Allianz Trade stands out for its advanced risk analytics and predictive modeling, making it a strong choice for large enterprises managing high sales volumes with extended payment terms. Atradius N.V. caters to multinational corporations through its "Atradius Global" unit, offering Single Transaction Cover in over 130 countries. Meanwhile, Coface provides real-time API connectivity to data on more than 188 million companies, a perfect fit for credit managers who need seamless integration of risk assessments into their systems.

The current market environment favors buyers, with industry experts describing it as a "prolonged soft market". This gives businesses considerable leverage to negotiate customized policies and flexible pricing. Providers like Accounts Receivable Insurance (ARI) stand out by offering personalized broker support and adaptable policy designs, reflecting the growing demand for solutions tailored to diverse risk profiles.

For businesses seeking both global reach and sector-specific expertise, major players offer extensive international networks. However, enterprises in emerging markets might find value in providers focusing on regional expansion strategies. Cost-wise, "whole turnover" coverage tends to be the most budget-friendly option. That said, companies with concentrated high-risk exposures might benefit from single-buyer policies, even if they come with higher premiums.

Small and medium-sized enterprises (SMEs) also stand to gain significantly from trade credit insurance. It not only protects receivables but can also improve financing terms. As Marc Wagman of Gallagher aptly put it, "Having the insurance greases the wheels of global trade". With the market projected to grow from $12.99 billion in 2025 to $31.01 billion by 2033, competition among providers is heating up. This makes now an opportune moment to secure tailored and favorable terms for your business.

FAQs

What should businesses look for in a trade credit insurance provider?

When selecting a trade credit insurance provider, it’s essential to weigh their financial stability and claims-handling efficiency. An insurer with a proven ability to settle claims quickly can help reduce cash flow interruptions if a buyer fails to pay.

You’ll also want to evaluate the scope of coverage and policy flexibility. Opt for policies that cover both domestic and international risks, such as non-payment and political upheavals. Additionally, ensure the insurer offers the flexibility to adapt coverage as your business requirements change.

Finally, consider the provider’s resources and ability to support growth. Key factors include strong partnerships, thorough risk assessments, and access to a global network of carriers. These attributes indicate a provider capable of safeguarding your receivables while allowing you to offer competitive credit terms.

How does the current soft market affect negotiations for trade credit insurance?

In a soft market – a period marked by heightened competition and buyer-friendly conditions – businesses often enjoy more leverage when negotiating trade credit insurance policies. Insurers, eager to attract clients, might lower premiums, expand coverage options, or even customize policies to better suit individual needs.

While this environment can open doors to securing more favorable terms, it’s crucial to thoroughly review policy details to ensure the coverage aligns with your company’s specific requirements. Partnering with seasoned providers can make a significant difference, helping businesses navigate these negotiations with confidence and clarity.

What are the benefits of using digital tools with trade credit insurance?

Integrating digital tools with trade credit insurance brings a host of practical benefits for businesses. These modern platforms make it possible to track buyer creditworthiness in real time, automate risk evaluations, and tailor policies quickly to meet specific requirements. This not only simplifies the underwriting process but also helps save time and cut costs, all while ensuring businesses secure the right coverage for both domestic and international operations.

On top of that, digital tools streamline claims management, allowing for faster payouts when a buyer defaults. This keeps cash flow steady and improves overall customer satisfaction. Moreover, with advanced analytics, insurers can adapt pricing and risk strategies in response to shifting economic conditions. This ensures competitive rates and a higher level of service for U.S. businesses that depend on trade credit insurance to protect their financial stability.