Climate change is reshaping trade credit insurance. Rising natural disaster costs and supply chain disruptions are pushing insurers to rethink risk assessments and pricing. Insured losses from natural disasters have exceeded $100 billion annually for five years. In 2024, U.S. insurers faced $182.7 billion in climate-related damages, while global economic losses reached $357 billion in 2023, with only 35% insured.

Key takeaways:

- Accounts Receivable Insurance (ARI) tailors policies for climate-sensitive sectors like agriculture and shipping, covering physical risks (e.g., extreme weather) and transition risks (e.g., regulatory shifts).

- General Trade Credit Insurers focus on broad, standardized policies, integrating ESG factors and offering solutions like carbon credit insurance.

- ARI provides industry-specific flexibility, while general providers address systemic risks across markets.

With climate-driven losses projected to hit $12.5 trillion by 2050, insurers must adapt now. Companies choosing tailored coverage, like ARI, gain better protection against the evolving risks of a changing climate.

Insurance in the Era of Climate Change

1. Accounts Receivable Insurance (ARI)

Accounts Receivable Insurance (ARI) focuses on trade credit insurance with a forward-thinking approach to climate-related challenges. The company offers tailored solutions that address traditional credit risks while also considering the growing impact of climate events on businesses.

Policy Customization

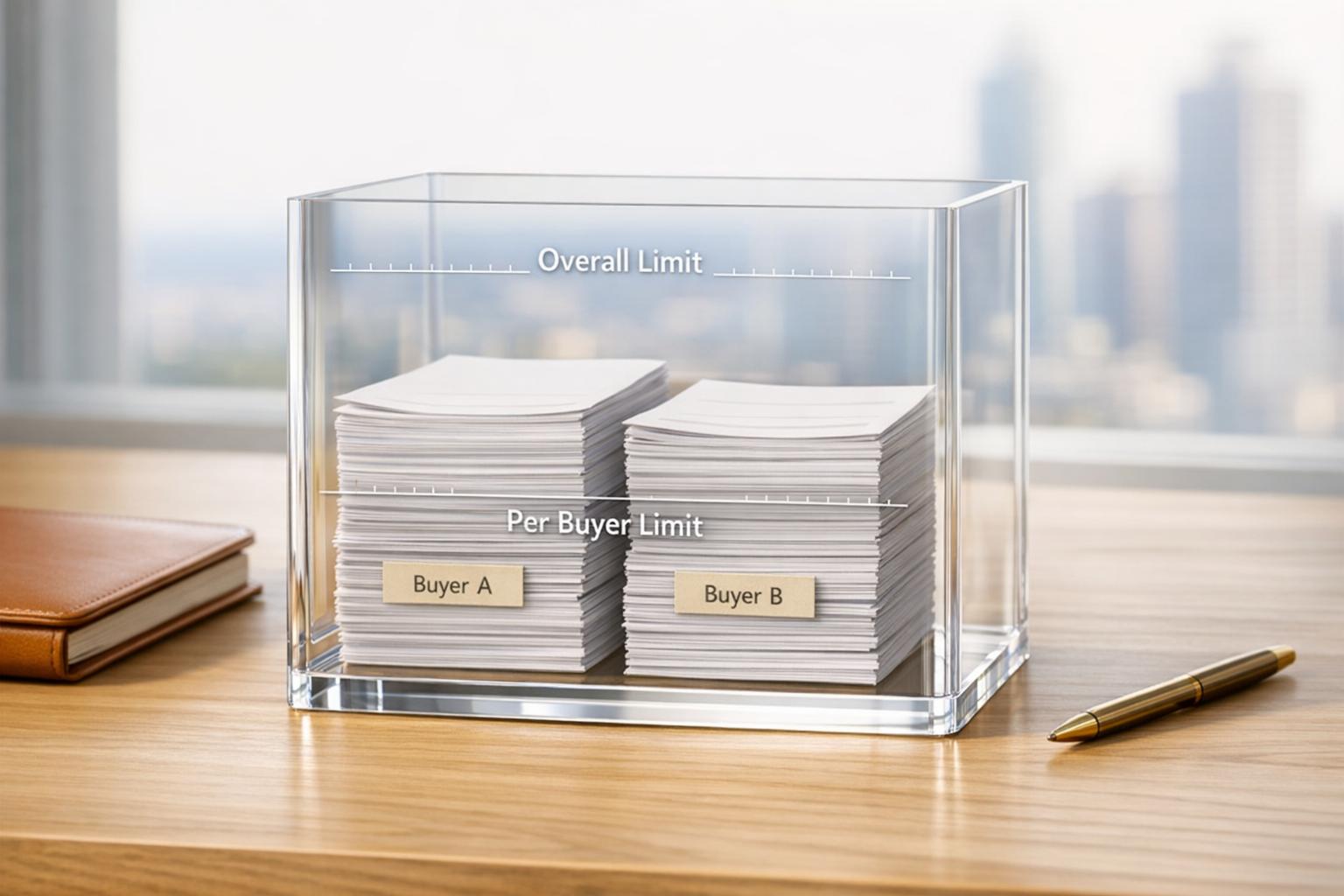

ARI designs policies that align with each client’s specific credit and climate risk profile. By evaluating how climate events affect buyers’ ability to make payments, ARI ensures that their coverage remains relevant. For businesses in climate-sensitive sectors like agriculture, shipping, or manufacturing, ARI creates sector-specific endorsements to address unique risks. Additionally, their renewal process includes regular reassessments of climate exposure, helping businesses maintain uninterrupted coverage as environmental conditions shift.

This personalized approach ensures businesses are prepared for both current and emerging climate-related risks.

Climate Risk Coverage

ARI’s policies provide protection against two key types of climate risks: physical risks and transition risks. Physical risks cover defaults caused by disruptions from extreme weather events, while transition risks address challenges stemming from regulatory changes or technological advancements in industries heavily reliant on carbon.

To reduce the likelihood of payment defaults during extreme weather events, ARI works proactively to restructure payment terms. Their claims process is designed to handle the complexities that often arise during widespread climate disruptions, ensuring businesses can recover quickly.

Global Market Adaptability

ARI’s global network of credit insurance carriers allows the company to respond effectively to evolving climate risks. This network provides coverage in regions where climate concerns are escalating and ensures ARI can maintain capacity even as individual carriers adjust their risk tolerance.

With both domestic and international coverage options, ARI supports businesses operating across diverse markets. Their market analysis evaluates how different carriers handle climate risks, helping clients secure stable and comprehensive protection. Additionally, ARI uses insights from its global network to share best practices and mitigation strategies, ensuring their clients benefit from the latest knowledge on managing climate-related challenges.

Integration of ESG Factors

Incorporating Environmental, Social, and Governance (ESG) considerations into its risk assessments, ARI helps businesses navigate regulatory changes and physical disruptions while building financial resilience. This approach supports the transition to a low-carbon economy and strengthens long-term business stability.

"Sustainability is a strategic advantage. Embedding ESG and sustainability into global trade strategies strengthens financial resilience, enhances brand reputation, and unlocks new opportunities for long-term success." – Allianz Trade

With 22% of companies factoring ESG priorities into decisions like relocating supply chains, ARI offers coverage that aligns with these strategies while managing the associated credit risks. For instance, industries like shipping face significant financial demands, requiring at least $23 billion annually to achieve net-zero emissions by 2050. ARI provides specialized coverage to address these emerging credit risk scenarios.

The company also supports financing for carbon offset projects, offering protection against non-payment and non-delivery risks in these growing markets. This positions ARI as a key partner for businesses navigating the transition to a low-carbon economy, ensuring they are protected from the credit risks tied to these innovative ventures.

2. General Trade Credit Insurance Providers

The trade credit insurance market is shifting dramatically as providers adjust their strategies to tackle climate-related challenges. Many global insurers now weave ESG (Environmental, Social, and Governance) factors into their operations, influencing how they design and price policies. From underwriting to investment decisions, traditional insurers are rethinking their approach as climate change increasingly affects business stability.

Policy Customization

General trade credit insurers are revamping their policies to address climate concerns. They’re using specialized tools and conducting regular risk evaluations to measure companies’ climate resilience. At the same time, insurers are setting clear decarbonization targets for their portfolios. Businesses looking for coverage are now expected to showcase their climate strategies and disclose details about their exposure to physical and transition risks. These changes pave the way for more tailored climate risk coverage.

Climate Risk Coverage

Insurers are also expanding their offerings to cover complex climate risks, responding to regulatory and market demands. A significant 91% of insurers cite investments as the area most affected by climate concerns, followed by risk assessment and underwriting. To meet these challenges, the industry is rolling out specialized products, such as energy efficiency policies and carbon credit insurance.

One standout area of growth is carbon credit insurance. For example, in November 2024, the Multilateral Investment Guarantee Agency (MIGA) introduced a template to help private investors navigate Article 6 carbon markets. This initiative addresses uncertainties around the legality of Letters of Authorization and the validity of carbon credits. Additionally, the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), launched in 2016, provides a global framework for airlines to offset emissions by purchasing carbon credits, with mandatory compliance set to begin in 2027.

Global Market Adaptability

New regulatory requirements for climate risk disclosures are reshaping how insurers operate worldwide. Carriers are being pushed to standardize their approaches while also adapting to local regulations. Among global insurance CEOs, 51% have either committed to net-zero goals (22%) or are working toward them (29%). For those who’ve made commitments, 62% cite the need to mitigate climate risks as a major influence.

Regulators like the Prudential Regulation Authority (PRA) are also stepping in, urging firms to adopt strategic approaches to managing climate-related risks. The PRA is updating its guidance to clarify expectations, which is helping to standardize practices across markets while leaving room for regional adjustments. Insurers are actively participating in global ESG initiatives, promoting the importance of these efforts and sharing best practices to manage climate risks effectively.

Integration of ESG Factors

Unlike ARI’s client-specific approach, general providers adopt ESG factors at an operational level, creating standardized risk assessments across their portfolios. About 26% of global insurers cite minimizing climate change impact as the primary driver behind their ESG efforts. This shift is reshaping traditional underwriting models to prioritize long-term sustainability.

"A +4°C world is not insurable. Unsustainable business will become uninvestable and uninsurable."

- Thomas Buberl, CEO of AXA

Governance stands out as the key ESG pillar, guiding how insurers evaluate organizational structures, board independence, and risk management practices. Strong governance helps ensure that companies can manage environmental and social risks effectively. Beyond risk assessments, ESG integration is influencing product development, encouraging insurers to create offerings that support resilience and adaptation. Climate scenario analysis, once a compliance exercise, is now a strategic tool for understanding the timing and scale of climate risks. Boards are dedicating more attention to overseeing transition plans and scenario analysis efforts.

Advantages and Disadvantages

When it comes to managing climate-related financial risks, there are clear trade-offs between Accounts Receivable Insurance (ARI) and general trade credit insurance providers. Both approaches bring unique strengths and challenges, especially as climate change continues to add layers of uncertainty to global markets.

| Aspect | Accounts Receivable Insurance (ARI) | General Trade Credit Insurance Providers |

|---|---|---|

| Customization | Policies tailored to specific industries or regions sensitive to climate risks | Standardized policies with less flexibility |

| Coverage Scope | Includes political risks, currency fluctuations, and foreign government actions tied to climate impacts | Broad coverage addressing systemic climate risks |

| Premium Structure | Competitive rates, typically 0.2% to 1% of accounts receivable portfolios | Based on broader risk pools, sometimes leading to pricing challenges |

| Market Adaptability | Quick decisions and flexible terms for high-risk markets | Slower to adapt due to standardized processes |

| Risk Assessment | Individualized evaluations to reduce exposure to high-risk clients | Portfolio-wide climate analyses with less client-specific focus |

These distinctions highlight the unique strengths and limitations of each approach, leading to different outcomes based on a company’s needs and market conditions.

ARI’s Climate Risk Benefits

One of ARI’s standout advantages lies in its ability to safeguard accounts receivable – often a company’s largest asset – against climate-related disruptions. These policies offer targeted protection, enabling businesses to navigate volatile markets with confidence. For example, accounts receivable often represent around 40% of a company’s assets, making their protection critical during climate-driven uncertainties.

Mike Libasci, President of International Fleet Sales, shares how ARI has transformed his business:

"Accounts receivable insurance has allowed us to take on customers and transactions we wouldn’t have felt comfortable taking on by ourselves… It has not only allowed my company to take on larger deals, but be more liberal in terms, and the result has gone straight to our bottom line."

This kind of flexibility is especially valuable in climate-sensitive markets. ARI’s export credit component also shields businesses from risks like non-payment due to climate-driven political instability or currency fluctuations.

Ori Ben-Amotz, CFO of Hadco, underscores how ARI enhances competitiveness:

"With accounts receivable insurance, we don’t have to ask for cash up front or payment on delivery, which makes us much more competitive. This is the tool we needed to take more market share from our competitors."

General Providers and Systemic Risk Management

On the other hand, general trade credit insurers take a broader approach, using standardized models to manage systemic risks across industries. While this method is efficient, it may overlook the specific vulnerabilities that ARI’s tailored policies are designed to address. These insurers aim to provide coverage that spans entire markets, offering a safety net for businesses facing widespread climate risks.

Challenges and Market Realities

Despite their benefits, both ARI and general trade credit insurance face challenges, particularly as climate risks grow more unpredictable. Traditional risk models often struggle to keep up with the unprecedented nature of climate-related disasters, making it difficult for insurers to price their policies accurately. The numbers tell the story: in 2023, insurers covered just US$80 billion of the US$114 billion in natural disaster losses, leaving 30% uninsured.

Rising costs are another shared concern. General insurers face regulatory limits on premium adjustments, while ARI’s more focused approach may result in limited coverage for extreme risk cases. This creates affordability challenges across the board. A report from the Congressional Budget Office warns:

"As risk and costs increase, premiums will increase as well, which may make insurance less affordable for homeowners. If state regulators do not allow higher premiums, insurers may exit high-risk areas, reducing the availability of insurance."

The underinsurance gap is particularly concerning for low- and moderate-income households, who are often left more vulnerable to financial hardships after climate-related disasters. This highlights the importance of weighing coverage options carefully before disaster strikes.

Cathy Jimenez, Credit Manager at Del Campo, offers a practical perspective on the cost-benefit balance:

"I tell them there is a cost, but it’s easily offset by what you get. When you think about the benefits and what you could lose if a customer went bankrupt or just failed to pay, the cost of credit insurance balances out. I strongly recommend it."

Alarmingly, only about 25% of extreme weather losses are currently insured. This stark reality underscores the need for more robust solutions to close the gap and protect businesses from escalating climate risks.

sbb-itb-2d170b0

Conclusion

Trade credit insurance is undergoing a significant shift as climate risks reshape the landscape of financial protection. Businesses and insurers alike are rethinking traditional risk models, and solutions like those offered by Accounts Receivable Insurance (ARI) are playing a critical role in helping companies adapt to this new environment. With climate-related disruptions becoming more frequent and severe, the need for tailored insurance policies has never been more pressing.

The incorporation of Environmental, Social, and Governance (ESG) factors has become a key element in effectively managing climate risks. Despite this, a striking gap remains: while 85% of global insurers anticipate ESG will influence every facet of their operations, nearly half (49%) of insurance CEOs admit their companies are not yet equipped to measure greenhouse gas emissions. This highlights the urgency for insurers to move beyond compliance and develop ESG strategies that offer a competitive edge.

ARI stands out by offering customized policies designed for industries and regions most vulnerable to climate risks. This approach not only protects businesses but also helps them align with growing regulatory demands, such as the EU Taxonomy and TCFD frameworks, which are becoming central to risk assessments. By addressing these challenges, ARI enables businesses to demonstrate a commitment to sustainability while navigating increasingly stringent disclosure requirements.

The financial toll of climate-induced disasters continues to rise, with insured losses from natural disasters exceeding $100 billion annually for the fifth year in a row. In response, the trade credit insurance industry is evolving. Future trends point to heightened regulatory scrutiny, a shift toward resilience and adaptation strategies, and the expansion of services that go beyond traditional insurance products. These include advisory support, data analytics, and digital tools to better equip businesses for a climate-impacted future.

Industry leaders are sounding the alarm on the stakes ahead. Thomas Buberl, CEO of AXA, has emphasized the gravity of the situation:

"A +4°C world is not insurable. Unsustainable business will become uninvestable and uninsurable".

This stark warning underscores the importance of proactive climate risk management and the value of partnering with insurers who truly understand the complexities of a changing market.

As the insurance industry continues to transform, those that deeply integrate ESG principles and offer flexible, informed coverage will lead the way. With 51% of global insurance CEOs committed to net-zero goals and 93% planning to collaborate with industry groups on ESG initiatives, companies that align with forward-thinking providers like ARI will be better prepared to navigate the challenges of a climate-driven future.

FAQs

How is climate change influencing risk assessments and pricing in trade credit insurance?

How Climate Change Impacts Trade Credit Insurance

Climate change is transforming how trade credit insurers evaluate risks and determine premiums. The increasing frequency and intensity of natural disasters – like hurricanes, floods, and wildfires – have made it harder for insurers to predict defaults and claims. As a result, many providers are now factoring climate-related risks into their risk assessment models, which has led to tighter underwriting standards and, in many cases, higher premiums.

To navigate these challenges, insurers are turning to advanced tools that help forecast climate-driven losses more accurately. These tools allow them to refine pricing strategies in a way that balances risk management with staying competitive in an unpredictable market. For businesses operating in areas prone to climate risks, this shift might mean adjustments in coverage terms and potentially higher costs as insurers adapt to the changing environment.

How does Accounts Receivable Insurance (ARI) address climate-related risks differently from general trade credit insurers?

Accounts Receivable Insurance (ARI) takes a more personalized approach to addressing climate-related risks compared to standard trade credit insurance. While traditional insurers typically offer broad protection against non-payment caused by events like natural disasters or political upheaval, ARI goes a step further by tailoring policies to fit the unique needs of individual businesses. This involves conducting in-depth risk assessments to pinpoint specific climate vulnerabilities in the markets or regions where a company operates.

Beyond just coverage, ARI focuses on proactive strategies to help businesses prepare for and respond to potential climate-related challenges. By delivering customized solutions, ARI provides businesses with stronger financial protection against risks tied to climate change, whether they operate within the U.S. or on a global scale.

How are environmental, social, and governance (ESG) factors influencing trade credit insurance policies, and why do they matter for businesses in climate-sensitive industries?

ESG Factors in Trade Credit Insurance

Environmental, social, and governance (ESG) factors are becoming increasingly influential in how trade credit insurance policies are designed. Insurers now take these elements into account when gauging the creditworthiness of businesses and their trading partners. This is particularly relevant for industries sensitive to climate-related risks, where events like extreme weather or shifts in regulations can pose serious challenges to financial stability.

For businesses, weaving ESG considerations into their coverage is more than just a smart move – it’s a necessity. It helps safeguard against long-term risks tied to climate and social issues while promoting sustainable practices. Aligning with ESG-focused policies not only minimizes potential disruptions but also signals a company’s dedication to responsible and forward-thinking operations.