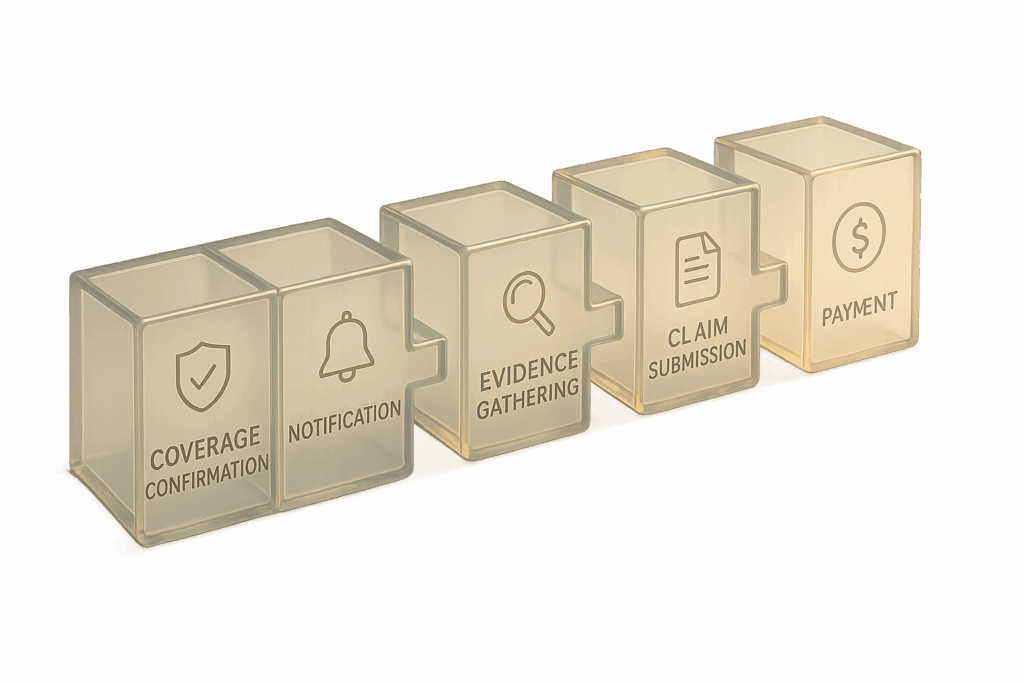

Political risk insurance protects U.S. businesses from financial losses caused by political events like expropriation, currency restrictions, or political violence in foreign countries. If a foreign government seizes assets or blocks currency transfers, you can file a claim to recover losses. Here’s how the process works:

- Confirm Coverage: Ensure the event matches your policy terms and isn’t excluded (e.g., commercial disputes or pre-existing risks).

- Notify the Insurer: Report the incident within the required timeframe to avoid claim denial.

- Gather Documentation: Collect contracts, financial records, and evidence linking the loss to political events.

- Submit the Claim: Provide a complete, organized claim package with all required details.

- Review and Payment: The insurer reviews, investigates, and, if approved, compensates for losses minus deductibles.

Key challenges include late notifications, misinterpreted policies, and incomplete documentation. To avoid these, assign a dedicated claims contact, maintain thorough records, and notify the insurer early. For businesses managing cross-border risks, Accounts Receivable Insurance (ARI) adds protection by covering unpaid receivables due to political disruptions, ensuring cash flow stability.

Preparation and prompt action are crucial for successful claims. Regularly review your policies, train your team, and keep documentation up to date to navigate political risks effectively.

What Is Political Risk Insurance And How Does It Work? – SecurityFirstCorp.com

How to File a Political Risk Insurance Claim

Filing a political risk insurance claim involves several detailed steps, each requiring careful attention to your policy’s terms and deadlines. Following the correct procedures can make the difference between a smooth resolution and a denied claim. Here’s a guide to help you navigate the process effectively.

Step 1: Confirm the Event is Covered

Before filing a claim, verify that the event causing your loss is covered under your policy. Review the policy carefully to ensure the incident matches the listed covered perils, occurred within the policy period, and took place in the insured location.

Pay close attention to exclusions. Many policies do not cover losses from commercial disputes, contract breaches unrelated to political events, or pre-existing conditions. The critical factor is whether your loss stems from political actions rather than market conditions or operational issues. For instance, if a foreign government seizes your facility, it’s likely covered. However, nonpayment due to a local partner’s financial troubles would typically fall under commercial risks.

Bring together a team from legal, finance, risk management, and operations to review the policy. Create a timeline of events and compare each detail against the policy’s coverage terms. Simultaneously, start gathering evidence like emails, news articles, government notices, and security reports that demonstrate the political nature of the event.

Step 2: Notify Your Insurance Provider

Timely notification is crucial. Inform your insurer within the timeframe specified in your policy. Missing this deadline could result in reduced coverage or outright denial of your claim.

Your initial notice should be concise but thorough. Include key details such as what happened, when and where it occurred, who is affected, and which insured assets or agreements are involved. Explain why you believe the incident qualifies as a political event under your policy. Provide a preliminary estimate of the financial loss in U.S. dollars and designate a claims liaison to handle communications with the insurer.

Step 3: Collect Required Documentation

To support your claim, you’ll need to gather and organize several types of documentation, including:

- Legal and contractual documents: Contracts, licenses, or loan agreements to prove the insured transaction existed.

- Financial records: Invoices, bank statements, and financial reports to quantify the loss.

- Evidence of political causation: Government orders, regulatory changes, or news reports that link the loss to political events.

- Mitigation efforts: Records showing the steps you took to minimize the loss.

Organize these materials systematically, creating an index and a narrative that ties each document to the relevant policy terms. This narrative should explain how the evidence supports your claim, from coverage triggers to loss calculations and mitigation actions.

Step 4: Submit Your Claim

Once your documentation is complete, prepare to submit your claim. Insurers typically accept claims through brokers, secure online portals, email, or certified mail, depending on their requirements.

Appoint a single point of contact to oversee the submission process. This person ensures all forms, attachments, and approvals are in order. Submit a well-organized and formally written claim package in U.S. English, with financial amounts in U.S. dollars. Include a cover letter summarizing the claim, referencing the policy number, and listing all enclosed documents.

"Your accounts receivable (trade credit) insurance broker, who structures and installs your program, will be the licensed professional that works with you over the life of your relationship. This provides a one-stop solution with your licensed broker understanding your needs, your ongoing service requirements, and most importantly, will provide direct assistance with your claims."

Step 5: Claim Review and Payment

After submission, the insurer will review your claim in several stages. First, they’ll confirm receipt and assign a claim handler. Then, they’ll conduct an initial assessment to verify the event falls under the policy’s coverage and that all procedural requirements, such as timely notice, were met.

Next comes a detailed investigation. The insurer will examine the facts, confirm causation, and evaluate your loss calculations. They may request additional information, consult local experts, or involve forensic accountants. If there are disagreements over coverage or loss amounts, negotiations may follow.

Once the review is complete, the insurer will issue a decision. If approved, payment will be made via wire transfer in U.S. dollars, minus any deductibles or co-insurance amounts. Be prepared for this process to take several months. Maintain open communication with the insurer, respond promptly to their requests, and provide clear explanations for your calculations. Delays in providing information can slow down the resolution of your claim.

Common Challenges and How to Avoid Them

Filing political risk insurance claims can be tricky for businesses. Understanding common pitfalls and taking proactive steps can make the difference between a successful recovery and a denied claim.

Mistakes That Delay or Deny Claims

One major misstep is not notifying the insurer on time. Insurance policies typically require timely notification, and delays can lead to reduced payouts or outright denials. Often, the problem stems from internal miscommunication – local teams may dismiss government announcements as routine, while headquarters assumes someone else has reported the issue. By the time it’s recognized as a political event, the notification window may have already closed.

Another common issue is misinterpreting policy terms. Many mistakenly believe any government action qualifies as a covered peril. However, policies are very specific about what counts. Losses tied to contractual disputes, financial difficulties, or commercial problems – rather than defined political risks – are often excluded. Additionally, pre-existing risks or certain government actions may fall under policy exclusions, leading to valid claim denials.

Incomplete documentation is another stumbling block. Missing key items like contracts, financing agreements, or correspondence can slow down the claims process. Without these materials, insurers can’t verify the political event, confirm coverage, or calculate losses. This often leads to repeated requests for information, dragging out the process and potentially reducing payouts.

Lastly, not adhering to policy conditions can jeopardize a claim. Policies often require specific actions, like documenting mitigation efforts or responding promptly to inquiries. Failing to meet these conditions can give insurers grounds to deny claims. Staying compliant is critical for a smoother claims process.

Tips for a Faster Claims Process

Avoiding these challenges requires a proactive and organized approach.

Start by assigning a dedicated point of contact for your political risk policies. This person should be responsible for understanding policy terms, managing communication with the insurer, and maintaining a centralized archive of essential documents like contracts, regulatory filings, and financial records. Having a single person in charge eliminates confusion and ensures timely notification.

Set up an escalation protocol to flag potential risks early. Train both local and U.S.-based teams to recognize warning signs, such as:

- New government regulations impacting your sector

- Changes in foreign exchange controls

- Civil unrest near your facilities

- Unusual delays in government approvals

When these red flags appear, notify the insurer right away, even if it’s just a preliminary notice.

Keep thorough and ongoing documentation to support future claims. Maintain records of baseline investment values, details of the political event, and how it impacted your business. Real-time documentation is far more reliable than trying to piece everything together months later, and it minimizes back-and-forth with the insurer.

Work with specialized advisors who understand political risk insurance. A skilled trade credit insurance broker can guide you through documentation requirements, help you navigate global carriers, and strengthen your claim preparation.

"Your accounts receivable (trade credit) insurance broker, who structures and installs your program, will be the licensed professional that works with you over the life of your relationship. This provides a one-stop solution with your licensed broker understanding your needs, your ongoing service requirements, and most importantly, will provide direct assistance with your claims."

Maintain open and transparent communication with your insurer and broker. Share updates as situations evolve, explain your calculations clearly, and respond quickly to any questions. This cooperative approach shows your commitment to resolving claims fairly.

Finally, seek local expertise when needed. Local legal counsel or political risk specialists can help you accurately define events under your policy terms. They can differentiate between covered political risks and other issues, strengthening your claim and reducing the chance of mischaracterization.

sbb-itb-2d170b0

How Accounts Receivable Insurance Helps Manage Political Risks

Accounts Receivable Insurance (ARI) goes beyond streamlining claims processes – it provides a robust framework to help businesses manage political risks through customized coverage and proactive support.

For U.S. companies selling on open-account terms, the challenges can be daunting. Political events like government expropriation, currency restrictions, political violence, embargoes, or sudden regulatory changes can disrupt payments from foreign buyers. These situations can severely impact cash flow and working capital, leaving businesses exposed if their invoices aren’t protected.

ARI steps in to address these challenges. It offers trade credit and accounts receivable insurance tailored to safeguard against political risks. Policies are designed to align with each client’s unique business model, risk tolerance, and international operations, providing a safety net in uncertain times.

Political Risk Protection Through ARI

Political risk coverage under ARI acts as a financial lifeline, helping stabilize cash flow when political turmoil disrupts international payments. Coverage typically reimburses 80–95% of an insured receivable, while leaving a portion with the policyholder to encourage sound credit practices. Policies may also include waiting periods – specific days past due or a set time following a political event – and deductibles that influence reimbursement amounts.

This type of protection is particularly valuable for businesses operating in volatile regions. Picture a U.S. manufacturer shipping millions of dollars’ worth of equipment to a state-owned buyer during election-related unrest. ARI can shield the company from unexpected currency controls or government interference, helping safeguard both revenue and financial stability.

Additionally, insured receivables are often seen as higher-quality collateral by lenders, enabling companies to secure better financing terms.

"Accounts receivable (trade credit) insurance is not a one-size-fits-all solution; we work with you to design a policy that aligns perfectly with your business model and risk tolerance."

ARI also leverages data, risk ratings, and market intelligence to anticipate potential political disruptions. This analysis helps businesses make informed decisions before entering new markets or extending credit limits. Recommendations might include adjusting credit terms, setting maximum credit limits, or increasing coverage percentages in high-risk regions, enabling smarter, data-driven sales strategies.

To create effective political risk coverage, ARI often requests information such as customer lists, sales exposure by country, historical bad-debt data, and payment terms – especially for buyers in high-risk areas. Keeping aging reports, credit policies, and buyer financial details up to date can streamline this process, allowing for more precise risk evaluations and tailored coverage.

This personalized approach ensures businesses are prepared when political risks turn into real challenges.

ARI’s Claims Management Support

When political crises threaten payments, having expert claims support becomes essential. ARI provides dedicated claims management through the same licensed broker who structured the insurance program. This ensures the broker has an in-depth understanding of the client’s business, policy terms, and unique needs.

"Your accounts receivable (trade credit) insurance broker, who structures and installs your program, will be the licensed professional that works with you over the life of your relationship. This provides a one-stop solution with your licensed broker understanding your needs, your ongoing service requirements, and most importantly, will provide direct assistance with your claims."

- AccountsReceivableInsurance.net

This continuity of service sets ARI apart. Unlike other arrangements where ongoing support is handed off to less experienced staff, ARI ensures clients receive consistent, professional guidance from someone who knows their business inside out. This expertise is particularly valuable for navigating complex international claims and trade credit insurance inquiries.

"As an established international credit insurance broker, ARI offers a distinct advantage in guiding you through complex trade credit insurance inquiries and claims across different markets."

- AccountsReceivableInsurance.net

Timely communication is critical when political disruptions occur. ARI advises immediate action, such as halting shipments, documenting communications, preserving evidence, and adhering to contractual obligations. Their team helps policyholders interpret policy triggers, submit notices, and compile necessary documentation – like invoices, contracts, and shipping records – to ensure claims move efficiently toward resolution.

ARI’s global network of credit insurance carriers further strengthens its claims support. By collaborating with insurers experienced in local political and regulatory issues, ARI can expedite fact-finding and improve claim outcomes. This network allows clients to benefit from specialized expertise, no matter where the disruption occurs.

Since its inception, ARI has earned recognition as an Elite/Preferred Broker with major credit insurance providers – a distinction held by fewer than a dozen advisors nationwide.

To get the most out of political risk coverage, businesses should align internal credit policies with their ARI policy terms. Consistently reporting exposures, avoiding unauthorized extensions, and promptly escalating concerns to ARI are vital steps. Proper training for sales, finance, and credit teams on policy conditions, along with maintaining accurate documentation, ensures that claims are not delayed or compromised. This proactive approach helps companies stay protected and prepared in the face of political uncertainty.

Conclusion

Navigating a political risk insurance claim successfully requires preparation, quick action, and thorough documentation. The process starts long before any loss occurs. U.S. companies operating internationally should identify key political risks, ensure contracts align with policy terms, and assign internal claim managers to establish clear crisis-response protocols.

Keep up-to-date copies of your policies, create detailed claim checklists, and train your team to recognize claim triggers. When a political event strikes – whether it’s government expropriation, currency restrictions, or political violence – notify your insurer immediately, even if the full scope of the loss isn’t yet clear. Delays in notification or assumptions about coverage can often lead to claim denials.

Detailed documentation is essential. Investment contracts, government decrees, bank records showing blocked funds, incident timelines, and internal communications all help prove that your loss is tied directly to a covered political event. These records also speed up claim reviews and minimize disputes over payout amounts. However, avoid unilateral negotiations with foreign authorities or counterparties, as these actions could jeopardize your insurer’s ability to recover funds and might even void your coverage.

For U.S. exporters dealing with both political and credit risks, Accounts Receivable Insurance (ARI) adds an extra layer of protection. If foreign buyers fail to pay due to political instability, economic downturns, or insolvency, this coverage helps maintain cash flow and enables more competitive credit terms. ARI offers tailored coverage and expert guidance on complex claims. Their dedicated claims teams assist with evidence collection, coordinate with multiple insurers, and negotiate resolutions that reflect the true scale and timing of your losses. This hands-on support not only simplifies the claims process but also strengthens your broader risk management efforts.

As discussed earlier, political risk and accounts receivable insurance go beyond being safety nets – they’re strategic tools that empower businesses to grow confidently in emerging or volatile markets. By incorporating these coverages into your long-term plans, you can expand exports, invest abroad, and manage cross-border credit risks while keeping potential financial shocks under control. Proactive preparation is key to making the most of these tools.

Start preparing today. Review your current political risk and trade credit policies to spot gaps in documentation or claims procedures. Work with brokers or specialists to evaluate your coverage thoroughly. Create or update a written claims plan that includes key contacts, documentation checklists, and a protocol for involving external experts when necessary. Taking these steps now ensures you’re ready before a claim arises.

FAQs

How can a business ensure their political risk insurance claim is filed correctly and on time?

To make sure your political risk insurance claim moves forward without hiccups, it’s essential to notify your insurer immediately after a covered event takes place. Acting quickly can help you avoid unnecessary delays or potential claim denials.

Gather and submit all necessary documents, such as proof of loss, supporting evidence, and any forms outlined in your policy. Take the time to review everything for accuracy and completeness – missing or incorrect information can slow things down. If you’re unclear about the process or requirements, refer to your policy details or contact your insurer directly for assistance. They’re there to help guide you through the steps.

How does Accounts Receivable Insurance (ARI) help businesses manage political risks and what advantages does it offer?

Accounts Receivable Insurance (ARI) provides businesses with a safety net to protect their receivables from non-payment due to political challenges like government actions, currency restrictions, or political instability. This type of coverage helps businesses operate confidently, whether they’re dealing with domestic or international markets.

Beyond just coverage, ARI supports businesses with in-depth risk evaluations, keeping an eye on the financial well-being of customers and offering advice to help minimize potential losses. If a claim arises, the process is designed to be smooth and efficient, ensuring businesses maintain financial stability and peace of mind even in uncertain circumstances.

What should businesses watch out for in their political risk insurance policy to avoid claim denials?

To prevent claim denials under a political risk insurance policy, it’s crucial to thoroughly review and fully understand the policy’s terms and conditions. Pay special attention to coverage exclusions, as some risks or events might not be covered. Equally important is submitting all required documentation accurately and on time – missing or incomplete paperwork can lead to delays or even invalidate your claim.

Another key factor is adhering to the timelines for reporting claims. Many policies enforce strict deadlines for notifying the insurer after a covered event takes place. Missing these deadlines could put your ability to recover losses at risk. If you have any uncertainties about your policy, reach out to your insurer or consult a trusted advisor to clarify the details before any issues arise.