Expanding into international markets offers growth opportunities, but it also introduces credit risks tied to economic, political, and regulatory factors. Here’s what you need to know:

- Economic and Political Stability: GDP growth, inflation, unemployment, and government debt levels can impact payment reliability. Political instability, policy changes, or corruption can further complicate transactions.

- Legal and Regulatory Environment: Weak legal systems or strict currency controls can make debt recovery difficult. Understanding local contract enforcement and money transfer rules is essential.

- Financial Systems and Payment Practices: Reliable banking systems and local payment habits vary widely. Cultural differences and seasonal trends can influence payment timelines.

- Risk Management Tools: Trade credit insurance, tailored payment terms, and regular monitoring of economic and political changes help mitigate risks.

Key takeaway: Effective credit risk management involves understanding local conditions, tailoring payment terms, and using tools like insurance to safeguard your business. Regular updates to your strategy ensure you stay ahead of evolving risks.

Country Risk Assessment in Practice

Economic and Political Stability Assessment

Economic and political conditions play a critical role in payment collection. Even businesses with excellent credit can face challenges when their home country encounters economic instability or political unrest. By understanding these broader risks, you can make smarter decisions about payment terms, credit limits, and strategies to safeguard your business. Let’s explore some key economic indicators that can help assess a country’s financial health.

Key Economic Indicators to Review

Certain economic metrics offer valuable insights into a country’s financial stability and its potential impact on payment reliability.

- GDP Growth: Tracking GDP growth can reveal whether an economy is expanding or contracting. Consecutive quarters of negative growth may signal widespread financial strain, potentially affecting customer payments across industries.

- Inflation Rates: Rising inflation reduces purchasing power, which can lead to delayed payments.

- Unemployment Rates: High unemployment often indicates economic stress and tighter credit conditions, making it harder for businesses to meet payment obligations.

- Government Debt Levels: Excessive government debt can expose vulnerabilities that ripple into the private sector, affecting payment reliability.

Other indicators, like current account balances, shed light on a country’s trade position. Persistent trade deficits can weaken local currencies and complicate international payments. Additionally, metrics like trade balances and foreign currency reserves help gauge a nation’s ability to support cross-border transactions.

Credit rating agencies such as Moody’s, S&P, and Fitch consolidate these factors into overall risk assessments. Monitoring changes in these ratings can highlight emerging risks, allowing you to adapt proactively.

Political and Sovereign Risk Analysis

Economic data tells only part of the story – political stability is equally important in assessing payment reliability.

- Government Stability: Frequent leadership changes or coalition governments can lead to policy uncertainty, disrupting business operations and delaying payments.

- Regulatory Consistency: In countries where regulations change unpredictably, enforcing contracts and maintaining trade relationships becomes riskier. Sudden shifts in tax policies, import restrictions, or foreign exchange controls can directly impact your customers’ ability to meet payment deadlines.

- Sovereign Ratings: These ratings reflect a government’s debt repayment capacity and can signal potential risks like capital controls or currency restrictions, which complicate international transactions.

Political events such as elections, civil unrest, or international sanctions can also disrupt normal business operations. Even routine democratic transitions may introduce temporary uncertainty, slowing decision-making and payments. Staying informed about political calendars and potential policy changes is essential for managing these risks.

Corruption levels further shape the business environment. In countries with high perceived corruption, legal systems may be less predictable, and enforcing contracts can become challenging. Tools like standardized corruption indices can help compare risks across different regions.

Economic and political factors often intersect, creating compounded risks. For instance, political instability can lead to capital flight and currency devaluation, while economic pressures may fuel further political unrest. Understanding these connections is vital for evaluating the overall risk profile of international customers. This knowledge allows you to fine-tune credit limits and payment terms in line with your global growth strategy.

Finally, the health of a country’s banking sector serves as a barometer of broader stability. Well-regulated banking systems tend to provide more reliable payment infrastructure, while central bank policies on interest rates and currency management offer additional insights into economic oversight.

Legal and Regulatory Environment Review

The legal and regulatory landscape in a country plays a pivotal role in shaping credit risk, alongside economic and political factors. A well-defined legal structure safeguards your business interests by ensuring clarity in contract enforcement and debt recovery. On the flip side, weaker regulatory systems can leave you with limited options when payments are delayed or missed. The effectiveness of local laws directly influences your ability to recover debts and enforce payment terms.

Legal systems vary significantly across regions. While some countries offer strong protections for creditors and efficient court systems, others pose challenges to debt recovery, making it essential to understand the nuances of each jurisdiction.

Contract Enforcement and Creditor Protection

A robust legal framework ensures that contracts are upheld and debts can be recovered with greater efficiency. However, the enforceability of contracts differs widely between countries, directly affecting the risks involved when extending credit to international clients.

Efficient judicial systems are key to resolving payment disputes quickly. Countries with streamlined court processes can expedite debt recovery, while those with overburdened courts may prolong proceedings, increasing costs and uncertainty. The rights of creditors also vary – some nations provide clear bankruptcy laws and asset seizure procedures that favor creditors, while others lean toward stronger protections for debtors, complicating recovery efforts. It’s important to adjust credit terms based on these factors.

In certain jurisdictions, creditors can recover legal fees, making debt collection more feasible. However, in regions where legal costs fall entirely on creditors, pursuing small debts may become financially impractical.

Alternative dispute resolution methods, like arbitration, can offer quicker and more cost-effective outcomes for international disputes. Countries with well-established arbitration systems often provide more predictable results.

The enforceability of foreign court judgments also plays a critical role in shaping your collection strategy. Some nations readily recognize and enforce foreign decisions, while others require lengthy processes – or outright refuse recognition. This can determine whether pursuing legal action locally or in the debtor’s country is more practical.

Additionally, statute of limitations laws, which vary by country and debt type, set strict deadlines for legal action. Missing these deadlines could permanently eliminate your ability to collect.

Beyond contract enforcement, regulatory factors such as currency controls significantly influence payment reliability.

Currency Controls and Money Transfer Rules

Foreign exchange regulations can directly impact your customers’ ability to make international payments, even if they possess sufficient local funds. These controls range from basic reporting requirements to complete restrictions on money transfers.

Capital controls often limit the amount of money that can be transferred out of a country within a specific timeframe. For instance, some nations impose daily, monthly, or annual limits on foreign currency transactions, which can delay payments or require partial installments over time.

Strict approval processes and emergency restrictions may further block or postpone international transfers. In some cases, extensive documentation – such as invoices, contracts, and regulatory filings – is required to verify transactions. Any errors or missing paperwork can lead to payment delays or rejections.

Exchange rate restrictions also add complexity. Countries that maintain fixed currency pegs or multiple exchange rates can create discrepancies between official and market rates, affecting both the timing and amount of payments.

Additional challenges, like limited banking hours and processing delays, can further hinder timely international transfers.

Understanding these regulatory hurdles is crucial when structuring payment terms. For businesses operating in countries with stringent currency controls, Accounts Receivable Insurance can serve as a safeguard against delays or defaults caused by regulatory restrictions outside the customer’s control.

These considerations highlight the importance of ongoing risk assessment and tailoring payment terms to reflect local regulatory realities. By staying informed, you can better navigate potential challenges and protect your financial interests.

Financial Systems and Payment Practices Review

The strength of a country’s financial infrastructure plays a major role in determining payment reliability and shaping credit assessments. A stable banking system with transparent credit reporting fosters trust and reduces risk when extending trade credit. On the other hand, weak financial institutions or limited access to reliable credit data can increase uncertainty. These factors naturally lead to a deeper examination of local payment habits and the reliability of credit data.

By understanding how payments are handled locally and analyzing credit patterns, businesses can set terms that align with market conditions and spot potential issues before they escalate into collection challenges. Together, these elements define the broader credit risk landscape in any given market.

Banking System Reliability

A country’s banking sector is the backbone of secure and timely payments. When banks are unstable, even payments that are intended to be made on time can face delays.

Key indicators, like bank capitalization ratios, provide insights into the strength of financial institutions. Well-capitalized banks that operate under strong regulatory frameworks are better equipped to process international transactions efficiently. Advanced electronic payment systems, robust correspondent banking networks, and solid liquidity positions further enhance their reliability. In contrast, undercapitalized banks or those frequently requiring government bailouts may signal systemic weaknesses that hinder payment processing.

Central bank policies also play a role. Favorable policies on foreign exchange reserves and monetary stability improve payment reliability, while the presence of international banks often indicates higher standards and better global connectivity.

Local Payment Habits and Credit Patterns

Beyond the banking sector, local payment behaviors significantly influence credit risk. Payment norms vary widely across markets, often shaped by cultural and economic factors. For example, while 30-day payment terms might be standard in the U.S., many European countries operate on 60- or 90-day cycles. In cash-heavy economies, immediate or very short-term settlements are often the norm.

Credit patterns also provide valuable insights into financial behavior. For instance, in Kazakhstan, as of early 2023, 53% of adults aged 18 or older had financial obligations to banks, with total consumer credit debt reaching 6.9 trillion tenge. Older adults often take on credit to support families during times of income instability, while younger adults tend to approach borrowing more cautiously. Recognizing these generational differences is crucial when evaluating the reliability of various customer segments.

Cultural attitudes toward debt repayment also impact collection efforts and should be factored into credit policies. Installment payment preferences, particularly for larger purchases, are common in many markets. Structuring payment terms to accommodate these preferences can help maintain cash flow while aligning with local habits.

Seasonal payment trends are another important consideration. In agricultural economies, for example, businesses may experience strong cash flow during harvest seasons but face tighter budgets during planting periods. Similarly, companies in tourist-dependent regions often show significant seasonal variations in payment capacity. These patterns, combined with the availability of reliable credit data, help refine risk evaluations.

Credit Information Availability

Access to accurate credit data is critical for making informed credit decisions. Reliable credit reporting systems provide detailed payment histories, outstanding debt levels, and risk scores, enabling businesses to assess risk more effectively. However, the quality and scope of credit information vary greatly between markets.

Some credit systems focus heavily on bank lending relationships, while others include utility payments, rental histories, or trade credit data. Broader data coverage often results in more precise risk assessments. However, data accuracy and timeliness remain challenges in some regions. Outdated or error-prone credit information can undermine decision-making, highlighting the importance of strong regulatory oversight and data protection measures.

In markets with limited traditional credit reporting, alternative data sources – such as bank account activity, utility payment records, or mobile phone payment histories – can fill in the gaps. That said, cross-border credit information sharing remains limited. Even when domestic credit data is robust, obtaining reliable information about foreign customers can be difficult, adding another layer of risk to international trade credit.

The cost and accessibility of credit information also vary. While some countries offer basic credit checks at low costs, others require expensive subscriptions or impose significant barriers to access. These factors can make credit checks less feasible for smaller transactions.

When credit data is scarce or unreliable, tools like Accounts Receivable Insurance become invaluable. Such insurance provides protection against defaults that may not be predictable through traditional credit analysis methods.

sbb-itb-2d170b0

Business Practices and Local Customs

When evaluating credit risk, it’s not just about crunching numbers or reviewing legal frameworks – understanding local customs and business practices is equally critical. Cultural differences in communication, negotiation styles, and work schedules often shape how payments are handled. What might seem like a simple transaction in one country could become complicated by norms and traditions in another.

These cultural nuances influence how relationships are built, disputes are resolved, and payments are made. Ignoring them can lead to delays, misunderstandings, or even outright payment failures – issues that could often be avoided with better awareness. Let’s dive into how communication styles and local calendars can impact payment behavior.

Business Communication and Negotiation Styles

How people communicate and negotiate varies widely across the globe, and these differences directly affect credit outcomes.

In high-context cultures like Japan, South Korea, and many Middle Eastern nations, business relationships are deeply rooted in trust and long-term connections. Communication tends to be indirect, and payment issues might not be openly discussed until they reach a critical point.

On the other hand, low-context cultures such as Germany, the Netherlands, and the United States prefer direct communication and rely heavily on written agreements. Payment terms are usually clear and openly discussed, making collections more straightforward. However, this directness can sometimes come across as overly aggressive in relationship-focused regions.

In markets like Latin America and parts of Asia, negotiations are often centered around building relationships and can stretch over weeks or even months. Pushing too hard to finalize terms may be seen as disrespectful and could lead to less favorable outcomes. By contrast, in places like the UK or Australia, lengthy negotiations might signal indecision or a lack of commitment.

Dispute resolution also differs from region to region. Western businesses often rely on legal contracts and formal arbitration, while in many Asian and African markets, disputes are resolved through mediation by community leaders or industry groups. Tailoring agreements to align with these local preferences can prevent unnecessary conflicts.

Another factor to consider is hierarchy and decision-making structures. In cultures with strong hierarchical traditions – common in parts of Asia and the Middle East – payment approvals may require sign-offs from multiple levels of authority. Even when funds are available, these extra steps can extend payment cycles beyond the agreed terms.

Local Schedules and Business Calendars

Cultural and religious calendars also play a big part in shaping payment timelines. Holidays, work schedules, and seasonal patterns often influence when payments are processed.

For example, religious and cultural holidays can lead to extended business closures. In Muslim-majority countries, business hours are often reduced during Ramadan, and many transactions are delayed until after Eid. Similarly, Chinese New Year can shut down operations in China for 7-15 days, with disruptions often starting before the holiday and lingering afterward.

In Europe, summer vacations – particularly in July and August – can slow payment processing as key decision-makers take extended breaks. Meanwhile, in agricultural economies, payment cycles often align with harvest seasons, while tourism-heavy regions experience cash flow fluctuations tied to peak and off-peak travel periods.

Workweek variations also matter. While many Western countries follow a Monday-to-Friday schedule, Middle Eastern countries often observe weekends on Thursday and Friday, or Friday and Saturday. These differences can create gaps in international payment processing, adding days to settlement times.

Banking hours and payment processing windows further complicate things. Some countries have limited daily payment windows, while others offer extended hours or even 24/7 processing. Knowing these details helps set realistic expectations and avoid unnecessary delays.

Lastly, end-of-month or quarter-end patterns can vary. Western companies often prioritize month-end payments to close their books, but other cultures might follow different financial cycles, such as lunar months. Being aware of these patterns can help you structure credit terms more effectively.

When cultural complexities cause payment delays, Accounts Receivable Insurance can safeguard your cash flow and keep your business running smoothly.

Risk Management and Protection Methods

When navigating the complexities of international trade, having solid protection methods in place is essential. Building on the credit risk factors discussed earlier, a well-rounded approach combines insurance, customized payment terms, and ongoing monitoring to safeguard your business.

Trade Credit and Accounts Receivable Insurance

Trade credit insurance acts as your first line of defense against country-specific risks that are often out of your control. International trade inherently carries uncertainties, from currency fluctuations to political instability.

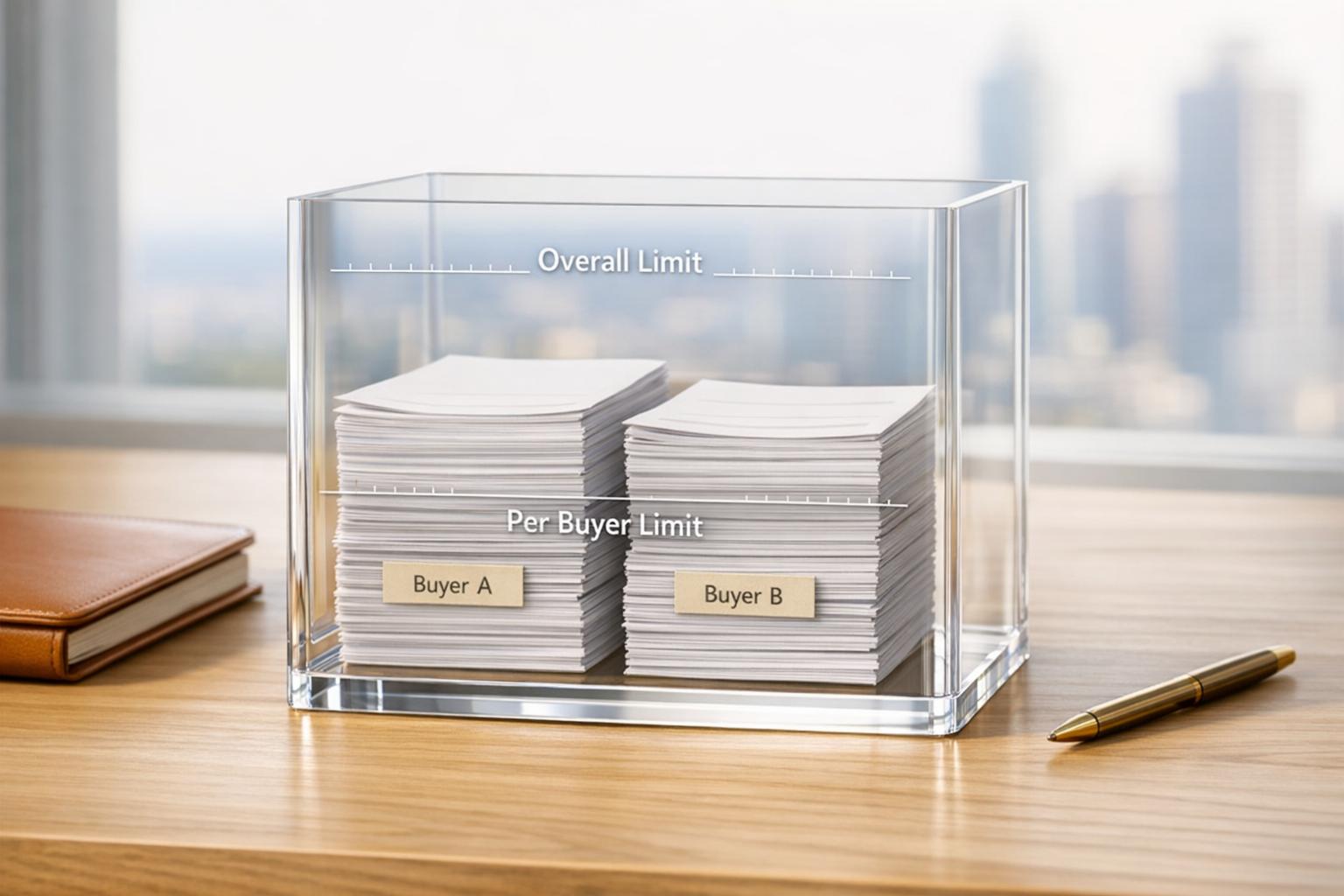

Accounts Receivable Insurance offers protection against non-payment, bankruptcy, and political risks, tailoring policies to the specific challenges of each market. This coverage enables you to confidently extend credit terms, even in regions with higher risk.

For markets that are politically unstable or emerging, specialized policies can address issues like government-imposed currency controls, trade embargoes, or sudden contract cancellations.

Buyer insolvency protection is another critical safeguard. Even established international customers can face unexpected financial setbacks due to economic downturns, industry shifts, or local market disruptions. With the right coverage, you can mitigate these risks while preserving valuable client relationships.

The claims management process also plays a key role. Navigating international disputes often requires expertise in local legal systems and business practices. Many insurance policies offer pre-claim interventions, such as early warning systems and collection assistance, which can help resolve payment concerns before they escalate into formal claims.

These insurance tools work hand-in-hand with structured payment terms, forming a cohesive strategy for managing trade risks.

Payment Terms and Security Requirements

Customizing payment terms to match each country’s risk profile and your relationship with the customer is vital. Depending on the level of risk and transaction size, options like letters of credit, documentary collections, or escrow arrangements can add layers of security.

Shorter payment terms can reduce exposure, but they require careful consideration. For example, shifting from 90-day terms to 15-day terms minimizes risk but may put you at a disadvantage in markets where longer terms are the norm. Striking the right balance between risk management and competitiveness is key.

Security deposits or guarantees from parent companies can provide additional assurance, especially when working with subsidiaries in higher-risk regions. A guarantee from a financially stable parent company in a low-risk country can effectively transfer credit risk to a more secure entity.

Currency considerations are another factor in structuring payments. Requiring payment in US dollars shifts currency risk to the buyer but might make your offer less attractive. To address this, some businesses use currency hedging strategies, which help manage exchange rate risks while maintaining competitive pricing.

Regular Monitoring and Updates

Initial protection measures are just the beginning – continuous monitoring is essential to adapt to evolving conditions. Country risk assessments aren’t one-and-done tasks; they require ongoing attention as political, economic, and regulatory landscapes shift.

Keep an eye on economic indicators like GDP growth, inflation, unemployment, and currency stability. These metrics can provide early warnings of increased credit risks. For instance, rapid currency devaluation can make it difficult for local customers to pay invoices in foreign currency, even if their businesses remain stable.

Political developments also demand close attention, particularly in volatile regions. Changes like elections, new policies, trade disputes, or social unrest can disrupt payment patterns and elevate credit risks. Staying informed through local news and partnerships with in-country contacts can help you anticipate and respond to emerging challenges.

Regulatory changes are another wildcard. New banking rules, tax policies, or trade restrictions can complicate payment processing or contract enforcement with little warning. These shifts can transform routine transactions into complex hurdles overnight.

Regularly review your customers’ financial health to identify potential issues early on.

Insurance policy reviews should be conducted at least annually or whenever there are major changes in your markets or customer base. Adjust coverage limits, country classifications, and policy terms as needed to align with your evolving business needs and market conditions.

Automated alerts for key risk indicators can help you respond quickly to changes. Many credit monitoring services offer country-specific updates on economic, political, or regulatory developments that could impact your customers’ ability to pay.

The goal isn’t to eliminate all risks – that’s neither realistic nor profitable. Instead, the focus is on building a system that allows you to identify, assess, and manage country-specific risks effectively while seizing international growth opportunities.

Summary and Action Steps

Managing country-specific credit risks requires a structured approach built on solid research and practical tools. Here’s a consolidated guide to help refine your international credit strategy and mitigate risks effectively.

Start with the basics: Focus on economic indicators, political stability, and legal frameworks. These elements are the backbone of a reliable risk assessment, as they directly impact your customers’ payment ability and your ability to collect if issues arise. A thorough country risk assessment helps pinpoint and address potential challenges early.

Understand local practices: Business culture matters. Local customs, communication styles, and payment habits can differ significantly. For instance, what might seem like a late payment in one country could simply be a standard business practice in another. Recognizing these nuances ensures you’re not misinterpreting normal operations as financial trouble.

Tailor your strategies to local conditions: Review financial systems and payment patterns in the target country. Structuring deals that align with local norms and constraints can make transactions smoother and reduce friction.

Implement protection measures: Your credit risk management approach should reflect the unique challenges of each market. Tools like Accounts Receivable Insurance provide customized solutions to address risks such as political instability or currency controls. These policies empower businesses to extend credit safely, even in higher-risk environments.

Continuous monitoring is key: A strong risk management system evolves over time. Regularly track economic indicators, political developments, and regulatory changes. Markets can shift quickly, turning a low-risk area into a potential challenge. Staying updated ensures you’re prepared to adapt to changing conditions.

Take a methodical approach: Start with your largest international exposures and work through a checklist systematically. Document findings and update your assessments quarterly or when significant changes occur in target markets. Proactive planning helps prevent defaults and supports smoother cash flow management in global operations.

Finally, extend credit selectively. The goal isn’t to avoid all risks but to make informed decisions about where and how to take them. With careful assessment and the right protections, country-specific risks become manageable, paving the way for successful international growth.

FAQs

What steps can businesses take to evaluate political risks when assessing credit risks in a specific country?

Evaluating Political Risks in Business

When it comes to assessing political risks, businesses need to pay close attention to factors like a country’s political stability, government policies, and recent developments. Start by examining the likelihood of events such as policy shifts, trade restrictions, or civil unrest – any of which could disrupt financial transactions or business operations.

To stay ahead, leverage tools like risk scores, market analysis reports, and expert opinions to pinpoint potential issues. Additionally, having contingency plans in place can be a lifesaver in scenarios like non-payment caused by political turmoil. By taking a proactive approach to evaluating these risks, companies can protect their operations and make smarter decisions when navigating international trade or offering credit.

What legal and regulatory factors should businesses consider when offering credit in international markets?

When extending credit internationally, it’s crucial to navigate legal and regulatory factors to protect your business from financial risks and ensure compliance. Start by researching the export and trade regulations of the target country. Pay close attention to any restrictions, sanctions, or specific requirements that could impact your transactions. At the same time, staying compliant with U.S. Treasury Department rules is essential – not only to avoid penalties but also to maintain eligibility for potential tax benefits.

You’ll also want to assess how enforceable your credit agreements are under the local laws of the country you’re dealing with. If you’re using credit risk protections like guarantees or collateral, verify that these measures are legally valid and enforceable in the jurisdiction. Understanding the legal framework for trade finance is equally important, especially when dealing with tools like letters of credit or navigating jurisdictional complexities.

Finally, don’t overlook political risks. While implied sovereign support might seem reassuring, it’s not always legally enforceable, leaving room for uncertainty.

By addressing these considerations, businesses can better manage potential legal challenges and align their credit practices with both local and international requirements.

How can businesses adjust payment terms to match local practices and reduce credit risks?

To reduce credit risks and align with local business practices, businesses should tailor payment terms to fit both the risk profile of their customers and regional norms. For example, adjusting payment terms from Net 30 to Net 15 for customers deemed higher-risk can help limit potential losses from non-payment.

Thorough credit checks are another essential step before extending credit. Adding penalties for late payments can also encourage timely transactions. Being mindful of regional expectations around payment timelines is equally important, as it ensures your terms remain reasonable and culturally appropriate. These strategies work together to create payment terms that are both practical and effective in managing financial risks across various markets.