How Credit Insurance Supports Credit Limit Management

Credit insurance protects businesses against customer defaults, enhancing cash flow stability and enabling safe credit limit management.

How Payment History Impacts Trade Credit Insurance

Payment history significantly affects trade credit insurance costs and terms, influencing premiums, coverage limits, and risk assessments.

How to Maximize Export Credit Insurance Benefits

Learn how to leverage export credit insurance for risk management, improved cash flow, and confident international market expansion.

Top 5 Industries Using Trade Credit Insurance

Explore how trade credit insurance protects various industries from customer non-payment and fosters financial stability and growth.

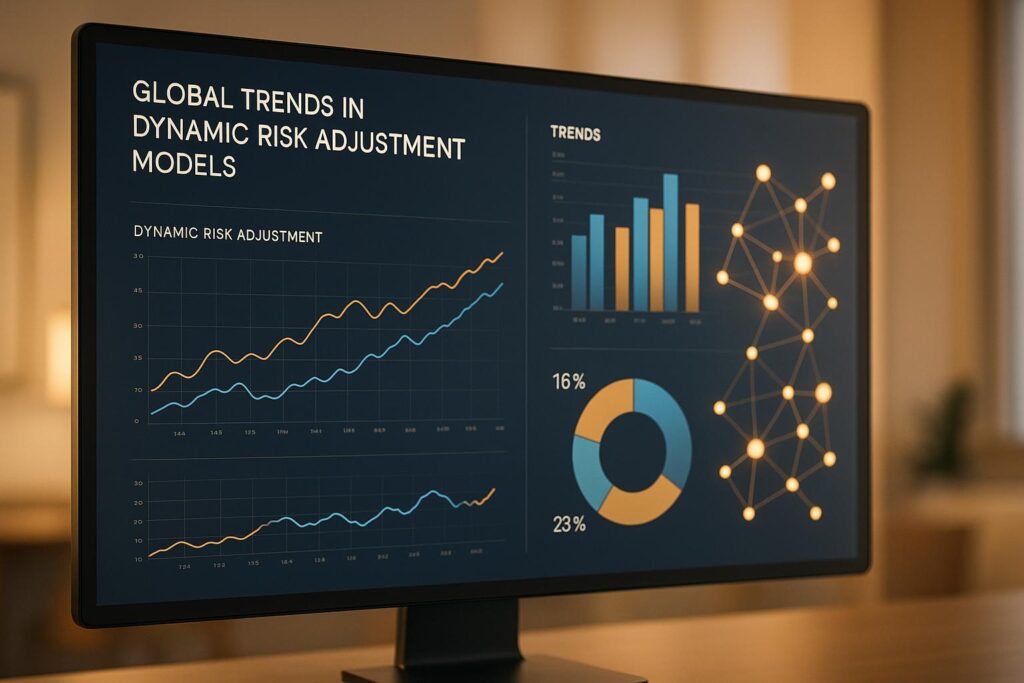

Global Trends in Dynamic Risk Adjustment Models

Dynamic risk adjustment models utilize real-time data to enhance accuracy and responsiveness in risk management, crucial for today’s businesses.

Credit Insurance for Political Risk Protection

Explore how trade credit insurance provides essential protection against political risks and enhances financial stability for businesses.

5 Risks Manufacturers Face Without Credit Insurance

Explore the critical financial risks manufacturers face without credit insurance and learn how to protect your business from potential losses.

5 Ways Credit Insurance Supports Logistics Growth

Explore how credit insurance empowers logistics companies by protecting cash flow, mitigating risks, and enabling strategic growth in uncertain markets.

Domestic vs. International Trade Credit Insurance

Explore the differences between domestic and international trade credit insurance, including coverage, benefits, and risks for businesses operating locally and globally.

Trade Credit Insurance for Agriculture Businesses

Trade credit insurance safeguards agriculture businesses from unpaid debts, ensuring cash flow stability and fostering growth in unpredictable markets.