Currency Inconvertibility Insurance: Benefits for Exporters

Explore how currency inconvertibility insurance protects exporters from financial loss due to government currency restrictions in volatile markets.

Customizing Credit Insurance for Retailers

Explore how tailored credit insurance can protect retailers from financial risks, ensuring stability and confidence in customer transactions.

Geopolitical Shocks and Sovereign Debt: Case Studies

Geopolitical shocks significantly impact sovereign debt, increasing risks for businesses and highlighting the importance of proactive risk management strategies.

Ultimate Guide to Trade Credit Insurance Cost Optimization

Learn how to optimize trade credit insurance costs while ensuring comprehensive coverage tailored to your business’s unique needs.

Trade Policy Changes: Impact on Credit Insurance

Trade policy changes are reshaping the credit insurance landscape, increasing risks and premiums for businesses navigating global markets.

How Country Risk Affects FDI Decisions

Understanding country risk is essential for U.S. companies investing abroad, affecting profitability and operational success.

7 Factors Driving Trade Credit Insurance Costs

Explore the factors influencing trade credit insurance costs, from customer credit quality to industry risk and geographical factors.

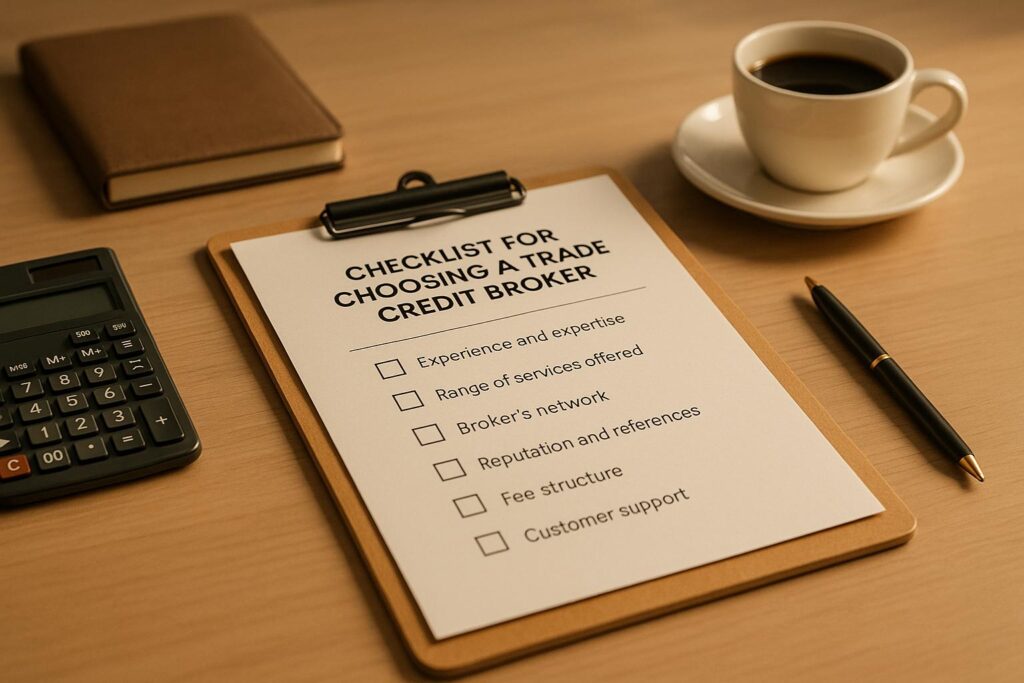

Checklist for Choosing a Trade Credit Broker

Learn how to choose a trade credit broker to protect your business from financial risks with this comprehensive checklist.

Ultimate Guide to Food Fraud Prevention

Learn to combat food fraud through effective strategies, detection technologies, and financial protections to safeguard your supply chain and finances.

Real-Time Credit Monitoring for International Trade

Real-time credit monitoring revolutionizes international trade by providing continuous updates on customer financial health, improving risk management.