IFRS 17, effective January 1, 2023, has completely changed how credit insurers report revenue and liabilities. It replaces the old "premium written" model with "insurance service revenue", meaning profits are now recognized over the coverage period rather than upfront. This ensures better alignment with the actual risks insurers take on. Key changes include:

- Revenue Recognition: Profit spreads over the coverage period, not when premiums are received.

- Immediate Loss Recognition: Losses for unprofitable (onerous) contracts must be reported immediately.

- Discounting Liabilities: All liabilities are discounted, reducing loss reserves and boosting equity.

- Contract Grouping: Contracts are grouped by profitability, with strict rules to avoid offsetting losses with gains.

These updates enhance transparency but also require insurers to overhaul systems, processes, and reporting methods. For short-term policies like accounts receivable insurance, a simplified approach (PAA) is available, easing compliance. However, cross-border operations face added complexity due to currency adjustments.

The shift to IFRS 17 demands collaboration across finance, actuarial, and IT teams, along with updated systems for tracking and reporting. While challenging, this standard provides a clearer picture of an insurer’s financial health and profitability.

IFRS 17 vs IFRS 4: Key Changes in Insurance Accounting Standards

Changes in Revenue Recognition under IFRS 17

How Revenue Recognition Changes

IFRS 17 reshapes how credit insurers account for revenue, moving from the "written premiums" model to an "insurance revenue" framework. Instead of recognizing revenue when premiums are received, insurers now record revenue as they provide coverage over time.

"Revenue is no longer linked to written premiums but instead reflects the change in the contract liability covered by consideration." – Grant Thornton

Under the new standard, insurers must recognize a group of insurance contracts at the earliest of three points: when the coverage period begins, when the first payment from a policyholder becomes due, or when the group is deemed loss-making (onerous).

Revenue is calculated based on fulfilment cash flows (FCF), which include probability-weighted future cash flows, discounting, and a risk adjustment for non-financial risk. These estimates are updated at each reporting date using current assumptions and discount rates, replacing the previous practice of locking in assumptions at policy inception.

Another key change is the introduction of contract boundaries, which define the cash flows included in an insurance contract. Only those related to substantive rights and obligations – where the insurer either has the right to enforce premium payments or a genuine obligation to provide services – are considered. For credit insurers offering accounts receivable insurance, this means carefully assessing which future premiums and claims should be included in revenue calculations. This detailed approach aligns revenue recognition with the actual risks inherent in the coverage provided, ensuring a more accurate financial representation.

Premium Allocation and Loss Recognition

For short-term contracts lasting 12 months or less, the Premium Allocation Approach (PAA) offers a simplified measurement method that closely resembles traditional unearned premium models. With the PAA, the liability for remaining coverage is based on premiums received, and revenue is recognized evenly over the coverage period.

IFRS 17 also enforces immediate loss recognition for onerous contracts. If a group of contracts is identified as loss-making – where expected claims and expenses exceed anticipated premiums – the full loss must be recognized in the profit or loss statement right away.

"If a group of contracts is or becomes loss-making, an entity recognises the loss immediately." – IFRS 17 Standard

Additionally, the standard requires insurers to group contracts at the time of initial recognition. It prohibits offsetting profitable contracts against loss-making ones within the same group. Contracts must be organized into groups based on profitability expectations, and no group can include contracts issued more than one year apart. This ensures a more granular and transparent approach to financial reporting.

IFRS17 Insurance Contracts – summary (applies in 2025)

Measuring Insurance Contract Liabilities

IFRS 17 introduces two approaches for measuring insurance contract liabilities, with the choice depending on the contract’s length and complexity. This decision plays a critical role in how credit insurers value their obligations, influencing how they report revenue and manage liabilities. These models lay the groundwork for discussions on profitability and solvency.

General Measurement Model (GMM)

The General Measurement Model (GMM) is the default method for measuring all insurance contracts under IFRS 17. It calculates liabilities based on three key components: fulfilment cash flows, a risk adjustment for non-financial risk, and the Contractual Service Margin (CSM).

"The GMM requires a group of insurance contracts… to be measured on the basis of a probability-weighted expected value (the fulfilment cash flows), a risk adjustment, plus the unearned profit remaining in the contract (the contractual service margin)." – PwC

Fulfilment cash flows are probability-weighted estimates of future payments and receipts, adjusted for the time value of money. The risk adjustment accounts for the uncertainty in the timing and amount of claims, while the CSM reflects unearned profits, which are recognized systematically as coverage is provided.

This model demands detailed actuarial updates, incorporating current assumptions and discount rates. Long-term credit insurance contracts, such as multi-year trade credit policies, generally require the GMM because they don’t qualify for the simplified approach.

Premium Allocation Approach (PAA)

The Premium Allocation Approach (PAA) offers a simplified alternative for measuring liabilities for remaining coverage. Insurers can use the PAA for contracts with coverage periods of 12 months or less, or when its results closely align with those of the GMM.

"The PAA is an optional simplification for measurement of the liability for remaining coverage for insurance contracts with short-term coverage (that is, generally less than 12 months)." – PwC

Under the PAA, liabilities are calculated by subtracting acquisition costs from premiums received. Unlike the GMM, this approach doesn’t require explicit discounting or risk adjustments unless there is a significant financing component or the contracts become onerous. Revenue is recognized over time as services are provided, making the PAA easier to implement.

Most accounts receivable insurance policies qualify for the PAA, as they typically have coverage periods of one year or less. This approach reduces administrative complexity and costs for insurers managing large volumes of short-term policies. However, insurers must still monitor whether groups of contracts become loss-making if circumstances suggest potential losses. This simplified method, often used for short-term policies like accounts receivable insurance, shapes the financial reporting framework discussed in the next section.

| Feature | General Measurement Model (GMM) | Premium Allocation Approach (PAA) |

|---|---|---|

| Eligibility | Default method for all insurance contracts | Optional for contracts with coverage periods of 12 months or less |

| LRC Measurement | Based on discounted future cash flows, a risk adjustment, and the CSM | Based on premiums received minus acquisition costs |

| Complexity | High; requires detailed actuarial modeling | Lower; reduces administrative workload |

| Profit Recognition | Unearned profit is released via the CSM over the coverage period | Revenue is recognized over the coverage period as services are provided |

How IFRS 17 Affects Financial Metrics and Profitability

IFRS 17 brings a complete overhaul to how credit insurers report their financials. It replaces traditional metrics with updated measurements that aim to better represent the economic reality of insurance contracts. These changes impact everything from revenue calculations to how profits are recognized, reshaping the financial landscape for insurers.

Changes in Profitability Patterns

One of the most significant shifts under IFRS 17 lies in how profitability is reported. The standard introduces insurance service revenue as the main top-line metric, replacing the long-used "gross premium written." This new figure reflects the release of the liability for remaining coverage, which includes expected claims, risk adjustments, and the amortization of the Contractual Service Margin (CSM).

"A key difference between IFRS 17 and IFRS 4 is the focus of IFRS 17 on recognition of an insurance contract’s profit over the duration of the insurance coverage." – AM Best

For contracts that are profitable, revenue and profit are now spread evenly over the policy’s coverage period. However, onerous contracts – those expected to incur losses – must have their losses recognized immediately in the profit and loss statement. This immediate recognition prevents losses from being hidden, providing a clearer picture of financial performance.

Another important change is the requirement to group contracts more granularly. Contracts issued more than a year apart cannot be lumped together, ensuring transparency and preventing underperforming segments from being masked by better-performing ones. Additionally, IFRS 17 separates underwriting profit from finance income and expenses, offering greater clarity on income sources.

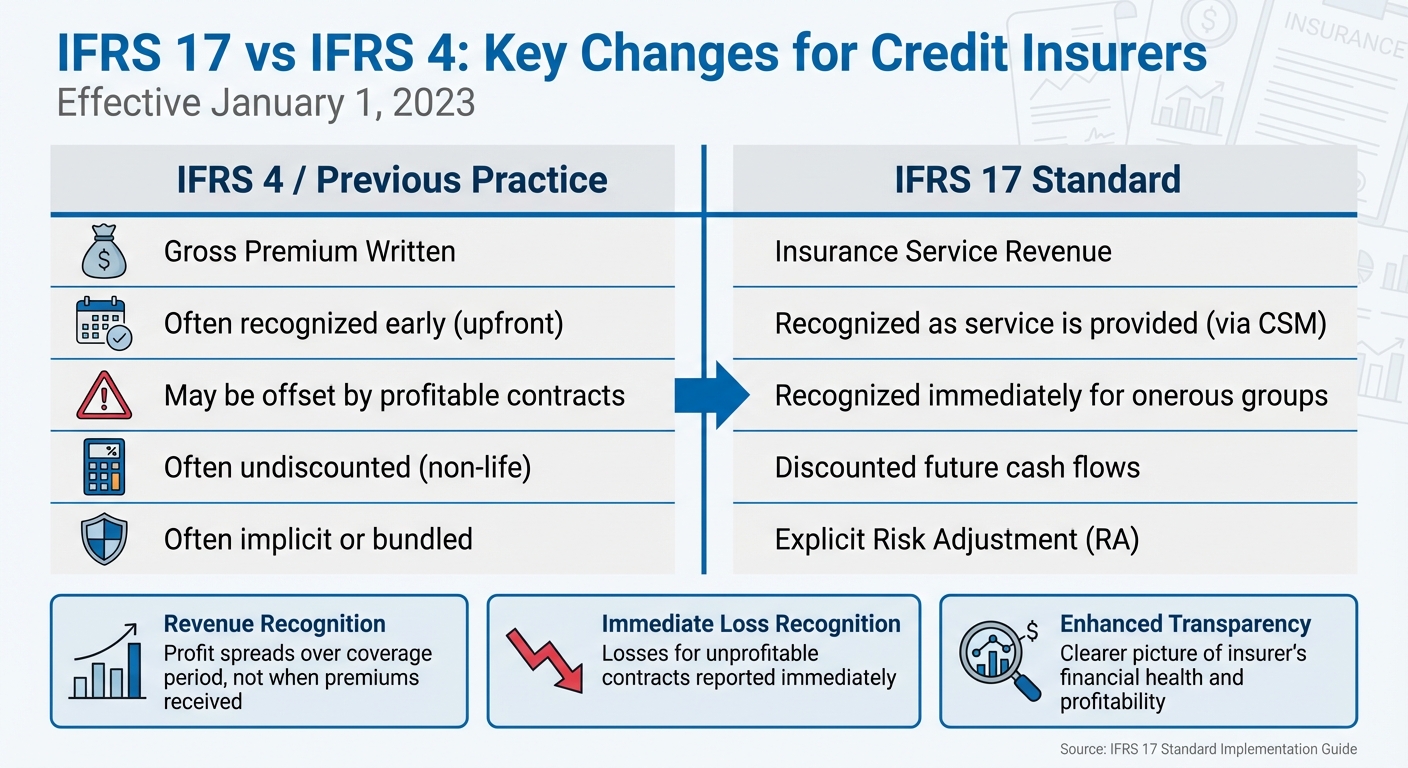

| Metric | IFRS 4 / Previous Practice | IFRS 17 Standard |

|---|---|---|

| Top-line Revenue | Gross Premium Written | Insurance Service Revenue |

| Profit Timing | Often recognized early | Recognized as service is provided (via CSM) |

| Loss Recognition | May be offset by profitable contracts | Recognized immediately for onerous groups |

| Liability Value | Often undiscounted (non-life) | Discounted future cash flows |

| Risk Margin | Often implicit or bundled | Explicit Risk Adjustment (RA) |

Effects on Solvency Metrics

The introduction of discounted future cash flows under IFRS 17 has a noticeable impact on solvency metrics. By discounting liabilities, the reported liability values are reduced, which in turn boosts equity levels and lowers leverage ratios.

"In many cases, this discounting has led to significantly lower loss reserves (now called insurance contract liabilities) and, as a result, has driven equity positions up and leverage ratios down." – AM Best

To address uncertainty in cash flows, IFRS 17 introduces an explicit Risk Adjustment, which acts as a reserve margin. While the CSM reflects the future economic value of contracts, there is ongoing debate about its role in capital structures, as it doesn’t count as "tangible capital" for immediate claim payouts.

Another key benefit of discounting is improved asset-liability matching. By valuing both liabilities and assets at current fair values, insurers can offer regulators and investors a clearer, more accurate view of their financial health. However, the immediate recognition of losses on onerous contracts can create sudden drops in capital if portfolio performance weakens. Traditional metrics, such as the combined ratio, now vary depending on calculation methods, making it harder to compare performance across firms.

These changes in solvency and profitability metrics highlight the far-reaching implications of IFRS 17, fundamentally altering how credit insurers evaluate and communicate their financial standing.

sbb-itb-2d170b0

IFRS 17 and Credit Insurance Contracts

Credit insurance contracts face specific changes under IFRS 17, particularly in how they are classified, measured, and in recognizing losses immediately for onerous groups. These adjustments significantly impact accounts receivable and international credit insurance policies, reshaping how they are managed and reported.

Accounts Receivable Insurance and IFRS 17

Under IFRS 17, accounts receivable insurance introduces distinct reporting requirements compared to earlier revenue and liability models. Financial guarantee contracts, which include many accounts receivable insurance policies, allow issuers to choose between applying IFRS 17 or IFRS 9 if previously classified as insurance. Most of these policies are short-term (12 months or less) and qualify for the simplified Premium Allocation Approach (PAA). This approach reduces the complexity of measurement but still requires discounting future cash flows and incorporating a risk adjustment.

"The purpose of IFRS 17 is to better reflect economic reality and to improve comparability. IFRS 17 will not change the economics, cash or capital aspects of an insurance product… It does, however, require the measurement of insurance contracts at their current value."

– AXA Investment Managers

One of the most notable changes is the shift from reporting "Gross Premium Written" to "Insurance Service Revenue." Under IFRS 17, revenue is recognized as the earned portion of premiums when services are provided, rather than when premiums are received. For companies relying on accounts receivable insurance, this change ensures financial statements more accurately reflect the timing of the protection being delivered.

Contract boundaries are another critical factor, especially for revolving credit insurance arrangements. Only cash flows linked to substantive rights and obligations – such as when an insurer can demand premium payments or is required to offer services – are included. This impacts how multi-year or automatically renewing policies are measured and reported.

International Trade Considerations

Beyond domestic operations, IFRS 17 introduces additional challenges for cross-border insurance activities, particularly due to currency exposures. For insurers operating globally, IFRS 17 complicates currency translation and portfolio management. Contracts must be grouped by currency exposure, as foreign cash flows are treated distinctly under IFRS 17. Exchange rate fluctuations directly influence the Contractual Service Margin (CSM), adding a layer of complexity.

"An entity is required to consider all risks – including currency exchange rate risks – when identifying portfolios of insurance contracts."

– IFRS Interpretations Committee

For businesses using accounts receivable insurance to safeguard international trade receivables, this means insurers may need to segment policies by currency exposure. This segmentation could affect pricing and policy terms. Additionally, the requirement to revalue the CSM at closing exchange rates introduces foreign exchange-driven volatility into financial statements.

While PAA contracts may initially benefit from discounting cash flows, the unwinding of those discounts can later impact profit and loss statements. This dynamic underscores the importance of careful financial planning under IFRS 17 for insurers engaged in international trade.

Transitioning to IFRS 17

Common Implementation Challenges

Credit insurers face significant obstacles in adopting IFRS 17, primarily due to outdated legacy systems and insufficient data infrastructure. Many existing platforms simply aren’t equipped to handle the detailed requirements of the new standard, such as tracking historical discount rates, grouping contracts by profitability, and managing the Contractual Service Margin (CSM). As KPMG highlights:

"Many legacy systems are still in use and may not be capable of accommodating the new data needs of IFRS 17, resulting in necessary systems and processes upgrades".

Another major roadblock comes from organizational silos. Finance, actuarial, and risk teams often rely on separate data systems, making it difficult to ensure consistent and accurate reporting. A successful transition demands close collaboration across these teams and the establishment of a shared data framework.

For credit insurers operating in the United States, the challenge is even greater. They must maintain dual reporting systems to comply with both IFRS 17 and US GAAP (ASC 944), as there are no plans for these standards to align.

The shift to "Insurance Service Revenue" also requires a steep learning curve for stakeholders. Everyone from CFOs to investors must familiarize themselves with new terminology and adapt to interpreting financial statements differently. Masimba Zata of Moody’s explains:

"IFRS 17 is synonymous with complexity, compliance pressure, and operational overhaul, demanding significant system and talent upgrades".

To navigate these challenges, credit insurers need to adopt comprehensive compliance strategies.

Compliance Best Practices

Forward-looking credit insurers are tackling these challenges by embracing strategic best practices. A key move has been replacing manual spreadsheets with automated, cloud-based platforms that integrate actuarial and accounting functions. This shift not only reduces audit risks but also allows staff to focus on analysis rather than repetitive data entry.

Collaboration across departments is essential. As KPMG points out:

"A successful implementation effort will need cross-functional collaboration between IT, actuarial, finance, accounting and operations".

Forming a unified team early in the process ensures that system upgrades address the needs of all stakeholders and that internal controls are strong enough to support ongoing compliance.

Additionally, credit insurers are using the detailed data required by IFRS 17 to create more insightful KPIs that better reflect the economic realities of their contracts. Advanced tools like Moody’s RiskIntegrity™ can integrate IFRS 17 outputs with broader business planning, enabling insurers to evaluate how market changes or catastrophic events might affect their portfolios. As Zata puts it:

"The question is no longer ‘How do we comply?’ but ‘How do we compete?’".

Conclusion

Preparing for Change

IFRS 17 introduces a significant transformation in how credit insurers handle financial reporting. One of the most notable changes is the shift in profit recognition – from being recorded at the start of a contract to spreading it across the entire coverage period. This approach, which incorporates insurance service revenue and discounted, risk-adjusted liabilities, provides a clearer picture of an insurer’s profitability and overall financial health. Additionally, the immediate recognition of losses on onerous contracts adds another layer of transparency, though it also creates a more intricate reporting landscape.

For credit insurers, IFRS 17 represents more than just a regulatory update – it’s a strategic pivot. Traditional metrics like "Gross Premium Written" are being replaced by "Insurance Service Revenue", and the emphasis on discounted, risk-adjusted present values for liabilities marks a fundamental change. Stakeholders will need to adapt to these new metrics to properly evaluate an insurer’s financial standing.

In the United States, aligning IFRS 17 with local reporting practices may require insurers to overhaul their financial systems. This alignment demands strong data systems and close collaboration among actuarial, finance, IT, and operations teams. These shifts also mean businesses must rethink how they work with credit insurers to ensure their needs are met under the new framework.

Working with Accounts Receivable Insurance

These sweeping changes highlight the importance of dependable insurance partnerships. As IFRS 17 reshapes financial transparency and comparability across the industry, businesses need to understand how these updates impact the protection of their receivables. The enhanced clarity in financial reporting makes it easier to assess a credit insurer’s financial strength and profitability.

Accounts Receivable Insurance is here to help businesses navigate this evolving landscape. By offering customized solutions that align with the new IFRS 17 standards, they provide protection against risks like non-payment, bankruptcy, and political instability. Partner with them to ensure your receivables are safeguarded effectively in this new era of financial reporting.

FAQs

How does IFRS 17 enhance financial transparency for credit insurers?

IFRS 17 replaces the varied and inconsistent methods under IFRS 4 with a standardized, risk-adjusted framework for measuring insurance contracts. This updated model requires credit insurers to disclose essential financial details, including the contractual service margin, risk adjustments, and discounted cash flow estimates. The result? Stakeholders gain a clearer picture of how profits are earned over time – not just when premiums come in or claims are paid out.

For credit insurers like Accounts Receivable Insurance, this level of transparency ensures that critical balance sheet elements – such as reserves for doubtful receivables and unearned service margins – are presented in a consistent and straightforward manner. This consistency enables investors, analysts, and other stakeholders to better assess the company’s financial health, risk exposure, and long-term profitability, empowering them to make more informed decisions with greater confidence.

What challenges do credit insurers face under IFRS 17?

Credit insurers are navigating a tough transition with the implementation of IFRS 17. This new standard replaces older accounting methods with a system that focuses on risk-adjusted, present-value calculations, updated every reporting period. To meet these requirements, insurers must invest heavily in new tools and processes for gathering data, calculating discount rates, and grouping contracts. These changes often come with both financial and operational challenges.

For credit insurance specifically, the shift introduces added layers of complexity. Insurers now have to recognize onerous contracts earlier and discount future cash flows, which isn’t straightforward. Long-tail exposures and irregular payment schedules make it necessary to develop detailed models to accurately estimate recoveries, particularly for trade credit portfolios. On top of this, rating agencies are factoring in IFRS 17 metrics, which means insurers must enhance their disclosures and clearly explain how the new standards affect key performance indicators. Balancing these global reporting requirements while staying compliant with U.S. GAAP in certain jurisdictions adds even more pressure.

How does the Premium Allocation Approach make compliance easier for short-term insurance policies?

The Premium Allocation Approach offers a simpler way for insurers to handle compliance for short-term insurance policies. It works by spreading premiums evenly over the coverage period, making revenue and expense recognition much more straightforward. This eliminates the need for complicated processes like cash flow discounting or risk adjustments that are part of the full IFRS 17 model.

This approach is especially useful for policies with shorter durations, as it cuts down on administrative work, helping insurers stay compliant while conserving both time and resources.