Protect Your Business with a Bad Debt Strategy

Running a small business comes with countless challenges, and one of the sneakiest is the risk of unpaid invoices piling up. If you’ve ever had a client fail to pay, you know how quickly that can throw off your budget. That’s where a thoughtful approach to managing financial risks becomes a game-changer. By estimating potential losses and setting aside funds, you can keep your operations running smoothly even when payments fall through.

Why Planning for Financial Risks Matters

Every business, no matter the size, faces the possibility of revenue slipping through the cracks due to non-paying customers. Studies show that bad debt can account for a significant chunk of lost income, especially for small enterprises without deep pockets. Taking a proactive stance—whether through a simple calculator or a detailed forecast—helps you stay ahead of the curve. It’s not about pessimism; it’s about being smart with your money.

Take Control of Your Finances

Don’t let unexpected shortfalls derail your goals. With a clear plan for handling potential losses, you’re building a buffer that protects your bottom line. Start by assessing your annual revenue and typical risk percentage, then decide how much to reserve. A little preparation today can save a lot of stress tomorrow.

FAQs

What exactly is bad debt, and why should I plan for it?

Bad debt is money owed to your business that you’re unlikely to collect, often from unpaid invoices or defaulting clients. Planning for it is crucial because it directly impacts your cash flow. If you don’t set aside funds to cover these losses, you might struggle to pay your own bills or invest in growth. Our tool helps you estimate this risk based on your revenue and prepare accordingly, so you’re not caught off guard.

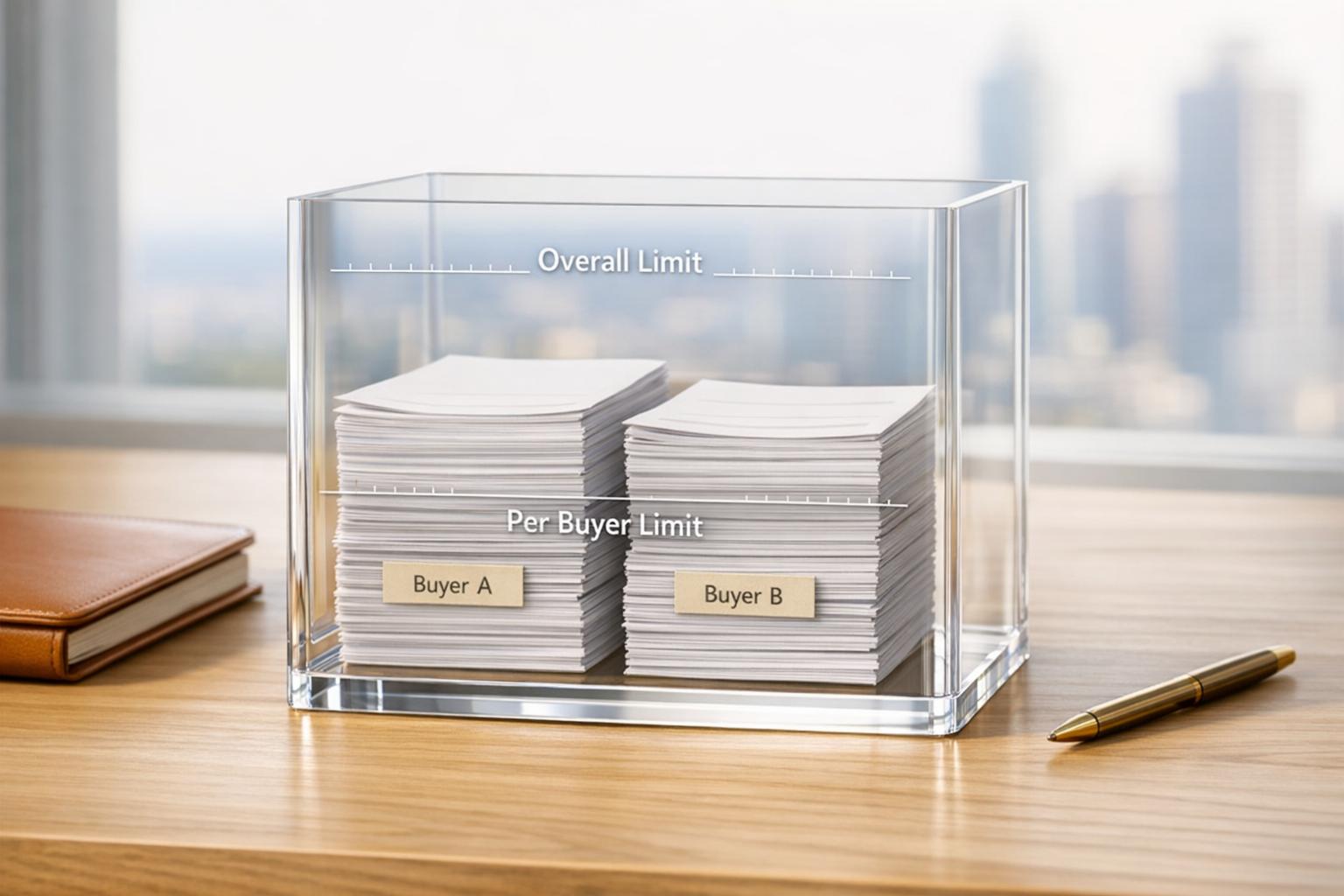

How does the risk tolerance setting affect my reserve amount?

Your risk tolerance reflects how cautious you want to be with potential losses. Choosing ‘Low’ means we suggest reserving 50% of the estimated bad debt amount, assuming you’re okay with some exposure. ‘Medium’ bumps it to 75%, balancing caution and flexibility, while ‘High’ recommends 100% to fully cover the risk. Pick what feels right for your business—there’s no wrong answer, just what matches your comfort level.

Can I trust these calculations for my financial planning?

Absolutely, though keep in mind this tool provides estimates based on the data you input. It’s designed to give you a clear starting point by calculating potential bad debt from your revenue and risk percentage, then tailoring a reserve based on your tolerance. It’s not a substitute for a full financial advisor’s input, but it’s a solid way to get a quick snapshot and start building a safety net for your business.