Trade credit insurance in the Asia-Pacific region is growing rapidly, driven by rising trade activities and increasing financial risks. Here’s what you need to know:

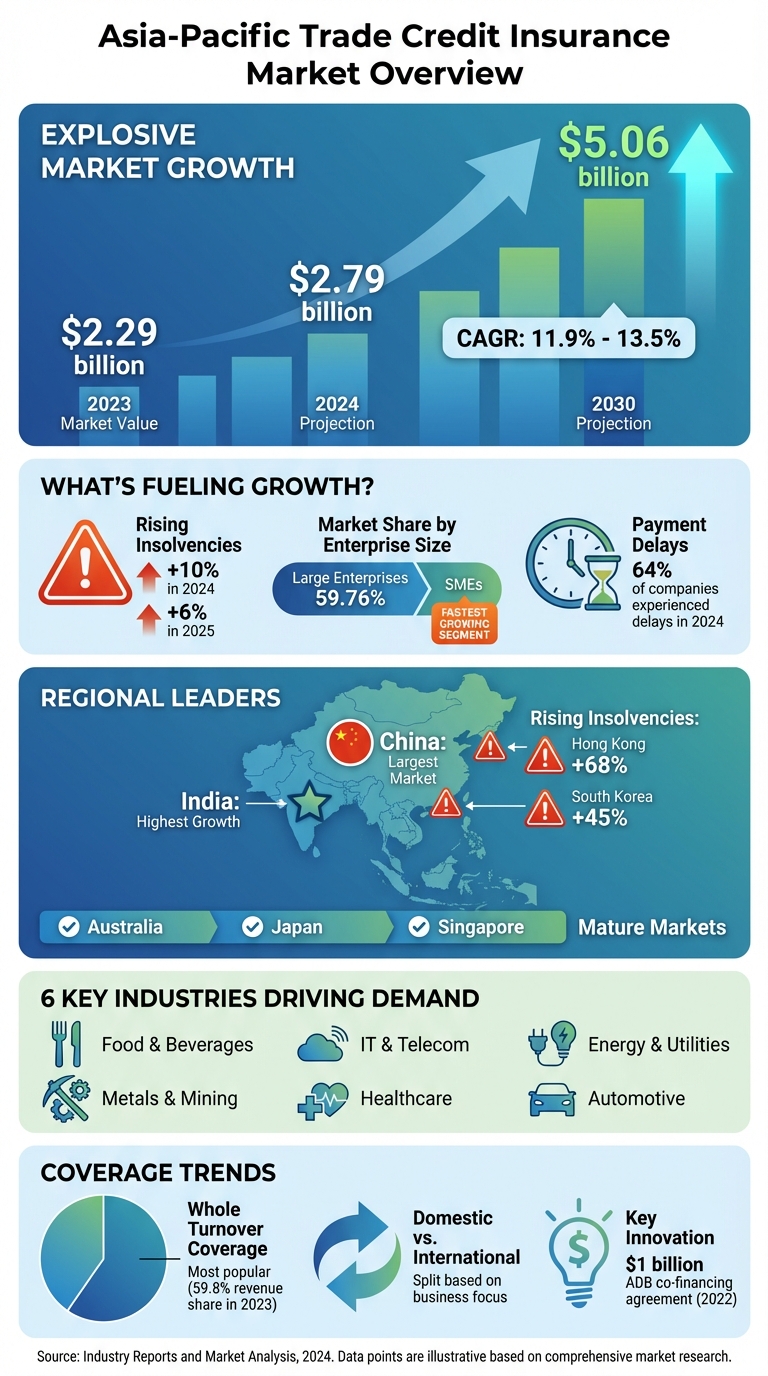

- Market Growth: The market was valued at $2.29 billion in 2023 and is projected to reach $5.06 billion by 2030, with an annual growth rate of 11.9%.

- Drivers: Insolvencies are rising (10% in 2024, 6% in 2025), and businesses are shifting from letters of credit to open-account payment terms, increasing the need for protection.

- Key Markets: China and India lead growth, while South Korea and Hong Kong face higher insolvency risks. Mature markets like Australia, Japan, and Singapore show steady adoption.

- Challenges: SMEs often lack awareness, and limited financial data transparency complicates underwriting in emerging markets.

- Opportunities: AI tools, cloud platforms, and partnerships with banks are simplifying policy management and expanding access for SMEs.

Trade credit insurance is no longer just a safety net – it’s a tool for businesses to manage cash flow, secure financing, and mitigate risks in uncertain markets.

Asia-Pacific Trade Credit Insurance Market Growth 2023-2030

Market Overview and Statistics

Market Size and Growth Projections

In 2023, the market reached a valuation of $2.29 billion (Grand View Research), with projections indicating growth to $2.79 billion in 2024 (Cognitive Market Research). Looking ahead, forecasts suggest the market could hit $5.06 billion by 2030, growing at a 11.9% compound annual growth rate (CAGR), and potentially 13.5% CAGR through 2033. While methodologies differ slightly between sources, both agree on one thing: this is one of the fastest-growing markets globally.

Currently, large enterprises take the lead, holding 59.76% of the market’s revenue share in 2023. However, the fastest growth is happening among small and medium-sized enterprises (SMEs). This surge is fueled by booming cross-border trade and increasing awareness of the need for receivables protection. Leading this growth are countries like China, Japan, South Korea, India, Australia, Singapore, and Taiwan. Among these, India stands out with the highest projected growth rate, driven by its rapidly expanding manufacturing and export sectors. Next, let’s look at how enterprise sizes and coverage preferences impact this growth.

Domestic vs. International Coverage Trends

Market growth trends reveal clear preferences in coverage types across different business segments. Whole turnover coverage, which protects multiple buyers and includes international transactions, leads the way in popularity. Businesses focused on exports lean heavily toward international coverage, while domestic coverage is increasingly favored by SMEs grappling with local credit challenges.

India’s 2021 insurance guidelines have played a significant role in boosting domestic coverage adoption by providing clearer regulatory frameworks. Ultimately, the choice between domestic and international coverage depends on a company’s customer base and its exposure to various risks.

Leading Industry Sectors

Six key industries are driving demand for trade credit insurance: Food and Beverages, IT and Telecom, Metals and Mining, Healthcare, Energy and Utilities, and Automotive. These industries share common traits, including high trade volumes, intricate supply chains, and substantial exposure to payment risks.

Each sector faces unique challenges. For instance, the automotive industry contends with global supply chain dependencies and extended payment terms. Energy and utilities companies often deal with large transaction sizes and political risks, particularly in emerging markets. Meanwhile, food and beverage businesses, operating on tight margins and dealing with volatile commodity prices, rely heavily on trade credit insurance to safeguard their cash flow. These sector-specific risks not only shape insurance needs but also contribute to the market’s overall upward trajectory.

Market Drivers and Challenges

What’s Driving Market Growth

The rise in insolvencies across the Asia-Pacific region is fueling the demand for trade credit insurance. Insurers predict corporate failures to increase by 10% in 2024 and an additional 6% in 2025. Economies like South Korea and Hong Kong are particularly vulnerable due to their reliance on global electronics, shipping, and property industries. High interest rates and inconsistent demand have led to delayed payments, making whole-turnover coverage an attractive solution. These insolvency trends, coupled with broader economic pressures, are driving longer payment delays.

Inflation and tighter credit conditions are squeezing profit margins and reducing working capital, which in turn leads to more frequent payment delays and defaults. Surveys conducted across Asia reveal that businesses anticipate worsening payment behaviors as economic uncertainty grows, with ultra-long payment delays becoming more common. This is especially evident in industries like construction, retail, and manufacturing.

Government initiatives are also playing a role in boosting trade credit insurance adoption, particularly among smaller enterprises. For instance, in August 2022, the Asian Development Bank partnered with five global insurers to provide up to $1 billion in co-financing for financial institutions across Asia-Pacific. This agreement allows banks to lend more securely by using insured receivables as collateral. Similarly, revised insurance guidelines in India, implemented in November 2021, have made it easier for banks and financial institutions to access comprehensive coverage, thereby improving small and medium-sized enterprises’ (SMEs) access to trade credit protection.

Barriers to Market Expansion

In many developing economies, low awareness presents a significant challenge. SMEs often rely on informal methods like personal guarantees or basic credit checks instead of structured risk transfer solutions. Many perceive trade credit insurance as overly complex or costly, particularly when they lack dedicated risk management resources to handle policy terms and endorsements.

Additionally, limited transparency in financial data and weak insolvency frameworks in some emerging markets complicate the underwriting process for insurers. When information about buyers – especially smaller or unlisted companies – is incomplete or unreliable, insurers face greater uncertainty in their risk models. This often leads to cautious capacity deployment. Sector-specific risks, such as heavy reliance on commodities or export-driven manufacturing, along with legal difficulties in recovering unpaid receivables, further complicate insurers’ ability to price risks accurately or enforce guarantees effectively.

Growth Opportunities

Despite these obstacles, advancements in technology and strategic collaborations are opening new doors for growth. AI-driven tools now analyze payment histories, trade flows, and macroeconomic trends to set adaptive credit limits and provide early-warning signals. Cloud-based platforms are also simplifying policy management, allowing real-time declarations and claims tracking, which makes it easier for SMEs to participate.

Partnerships with banks are creating innovative distribution channels. For example, in May 2023, TradeCreditTech joined forces with TreasurUp to automate trade credit insurance and credit risk management for SMEs through bank platforms. These collaborations enable small businesses to access quotes, coverage options, and credit limits directly through online banking systems, eliminating the need for separate applications. For insurers and specialists like Accounts Receivable Insurance, embedded-insurance models provide efficient access to a broad SME customer base while tailoring policies to specific industries and cross-border requirements. These innovations are helping insurers better manage the complexities of emerging markets in the Asia-Pacific region.

Country-Specific Trends

China and India: Leading Growth Markets

China continues to dominate as the largest merchandise trader in the Asia-Pacific region, driving demand for trade credit insurance to protect export portfolios and supply chains. Many Chinese companies are choosing advanced, program-based solutions that integrate with bank financing. These solutions often provide whole-turnover coverage for key industries like automotive, electronics, chemicals, and metals. Meanwhile, tightening liquidity and increasing payment delays in sectors such as construction, real estate, and export manufacturing are prompting businesses to adopt formal credit protection measures. These shifts highlight a broader regional move toward stronger credit safeguards in response to growing global uncertainties.

India, while starting from a smaller base, is expected to see the fastest growth in trade credit insurance across the Asia-Pacific region between 2024 and 2030. The country’s 2021 IRDAI guidelines, along with supportive government initiatives, are making it easier for MSMEs to access tailored coverage, boosting export financing opportunities. Sectors like engineering goods, pharmaceuticals, textiles, and IT-related services are fueling this demand, as MSMEs increasingly use trade credit insurance to secure bank financing and confidently extend credit to new buyers. These trends are creating a dynamic contrast with other markets in the region, where insolvency risks are rising.

Rising Insolvencies in South Korea and Hong Kong

Insolvency rates are climbing rapidly in South Korea and Hong Kong, with Hong Kong witnessing a 68% increase and South Korea seeing a rise of around 45%. Reduced government support and tougher financial conditions are driving businesses in these regions to formalize credit policies and adopt trade credit insurance as a way to protect cash flow and maintain sales to customers at higher risk. In South Korea, industries like electronics, automotive supply chains, shipbuilding, and construction are feeling the pressure. Similarly, in Hong Kong, trading companies, logistics operators, retail/wholesale firms, and SMEs engaged in trade with mainland China are facing mounting challenges.

Insurers are responding by tightening underwriting practices, using more detailed buyer ratings, and carefully managing sector and buyer-specific limits. For higher-risk segments, they are implementing shorter credit terms, higher deductibles or co-insurance, and enhanced monitoring with early-warning systems to flag stressed buyers. A Coface survey found that 64% of companies in Asia experienced payment delays in 2024, with delays increasing significantly in China, South Korea, and Hong Kong – a trend often linked to rising insolvencies. By comparison, more established markets demonstrate stronger risk management approaches.

Established Markets: Australia, Japan, and Singapore

In mature markets like Australia, Japan, and Singapore, trade credit insurance has achieved higher adoption rates. This is largely due to greater awareness among mid-sized and large businesses, as well as its integration into standard risk management and financing strategies. Common users include large corporations in industries such as automotive, food and beverages, metals, technology, and services. Financial institutions, including banks and non-bank lenders, also utilize these policies as part of their receivables financing solutions.

These markets benefit from advanced products, such as multi-country programs and precise underwriting practices. Additionally, their higher levels of digital maturity enable faster policy administration and dynamic adjustments to buyer limits, offering near-instant endorsements – a feature particularly advantageous for SMEs seeking flexibility. Singapore plays a key role as a hub for insurers and brokers, coordinating cross-border programs for multinational clients and influencing product design and risk standards across Southeast Asia. These sophisticated practices enhance the resilience of trade credit insurance in these regions, equipping businesses to navigate evolving challenges effectively.

sbb-itb-2d170b0

How Trade Credit Insurance Providers Support Businesses

Tailored Policies for Different Business Needs

Trade credit insurance providers craft policies that align with the unique ways businesses operate. For instance, Accounts Receivable Insurance (ARI) develops coverage by analyzing specific risk profiles. Companies in stable markets like Australia and Japan might prioritize domestic protection, while those working in high-growth regions like China and India often seek international coverage. Larger enterprises, managing a diverse range of buyers, typically opt for whole turnover coverage – this approach accounted for about 59.8% of the revenue share in the region in 2023. On the other hand, smaller companies or businesses with concentrated customer bases often find single buyer coverage more practical, particularly in high-risk industries such as IT and telecom.

Providers also offer policy endorsements tailored to meet each business’s risk appetite and operational needs. Take, for example, an automotive manufacturer in South Korea. They might combine whole turnover coverage for domestic sales with single buyer add-ons for key international clients. This strategy helps address potential payment delays, as highlighted in Coface’s 2025 Asia Payment Survey. Such flexibility is especially valuable for navigating complex regulatory environments, like India’s supportive 2021 IRDAI guidelines. Through these tailored solutions, insurers not only protect businesses but also enhance their resilience with robust risk evaluations and claims support.

Risk Assessment and Claims Support

Beyond customized policies, effective trade credit insurance relies on thorough risk assessments. Providers like Accounts Receivable Insurance conduct in-depth evaluations of buyer creditworthiness and regional market conditions. This helps businesses mitigate potential losses, especially in markets where corporate failures are anticipated to rise by 10% in 2024 and 6% in 2025. Continuous monitoring, coupled with early-warning systems, ensures businesses stay ahead of potential risks.

When payment issues arise, efficient claims management becomes critical. The brokers who help set up the policies also play a key role in overseeing claims, ensuring the recovery process aligns with the business’s specific challenges. Quick claims decisions and predictable recovery rates are essential for maintaining cash flow and securing bank financing. In industries like energy and utilities, where cash flow is particularly sensitive, streamlined claims processing – often supported by technology – can make a significant difference.

Global Network of Insurance Carriers

Accounts Receivable Insurance (ARI) connects businesses with leading carriers like Allianz SE, Coface SA, and QBE Insurance Group, offering a wide range of coverage options. This global network is especially valuable for U.S.-based companies operating in the Asia-Pacific region. It ensures consistent policy terms and credit limits across multiple countries, simplifying operations for businesses with international reach.

The network also facilitates access to co-financing arrangements. For example, the Asian Development Bank’s $1 billion agreement in 2022 with five global insurers expanded lending support in the region. For exporters, particularly those targeting fast-growing markets like India, these relationships provide additional capacity. By distributing risk among multiple carriers and working with specialized underwriters for specific sectors or countries, providers can negotiate more favorable terms. This extensive infrastructure enables businesses to confidently extend credit to new buyers while safeguarding their financial health.

TCI Week 2023 – Exploring TCI in Asia: Opportunities and Strategies for Success

Conclusion

The Asia-Pacific trade credit insurance market is on a strong growth trajectory, with mid-2020s revenues estimated between $2.3 billion and $2.8 billion and an anticipated compound annual growth rate (CAGR) of 11–14% through 2030–2033. This expansion is fueled by the rapid increase in trade activities in China and India, though tempered by rising insolvencies in regions like South Korea and Hong Kong. Once seen as a purely protective measure, trade credit insurance has now become a strategic tool. It helps businesses stabilize cash flow, improve balance sheets, and confidently extend credit to new buyers – even in unpredictable markets.

For U.S. businesses, insured receivables offer more than just protection against non-payment. They also enhance collateral positions, lower financing costs, and create opportunities for growth. With insolvencies on the rise, companies that incorporate well-structured credit insurance into their operations are better equipped to weather financial shocks and sustain their activities in difficult conditions.

In response to shifting market dynamics, providers have sharpened their focus. Firms like Accounts Receivable Insurance (ARI) are turning trends into tailored solutions, offering both whole-turnover and single-buyer coverage. These providers deliver customized risk evaluations, continuous monitoring, and strong claims advocacy. They also connect businesses to a global network of carriers, making it easier for mid-sized exporters to secure capacity and gain local market insights.

In the Asia-Pacific region, trade credit insurance has become essential for navigating growth and managing uncertainty. Businesses that strategically segment receivables, work with experienced brokers, and adopt scalable coverage options are better positioned to seize opportunities and mitigate risks. By integrating credit insurance into daily operations, companies can respond quickly to changing conditions.

Looking forward, the combination of resilient insurers and supportive regulations is driving product development and encouraging new solutions. Companies that partner with providers like ARI and invest in structured credit-risk strategies will be well-prepared to navigate the evolving trade landscape across Asia-Pacific.

FAQs

What is driving the growth of trade credit insurance in the Asia-Pacific region?

The Asia-Pacific region has seen a noticeable rise in the use of trade credit insurance, driven by a mix of important factors. One major influence is the increase in cross-border trade, which has brought both opportunities and challenges. With economic uncertainty on the rise and businesses facing heightened risks related to customer credit, many companies are turning to trade credit insurance as a safety net. This is particularly true for businesses venturing into unfamiliar markets, where having protection can make operations more secure.

The region’s fast-changing economic environment has also played a role. Companies are increasingly looking for ways to shield themselves from risks like non-payment and political instability. As a result, trade credit insurance has become a go-to solution for managing financial risks in a global market that’s constantly shifting.

How is technology making trade credit insurance more accessible for small and medium-sized businesses?

Technology is reshaping how small and medium-sized businesses (SMEs) approach trade credit insurance, making the process simpler and more efficient. With tools like real-time risk assessments and automated financial monitoring, businesses can now evaluate risks more effectively and safeguard their cash flow. Digital platforms further enhance convenience by enabling businesses to tailor policies and manage coverage remotely, cutting down on time and eliminating the need for face-to-face meetings.

These advancements give SMEs the confidence to explore new markets, knowing they’re protected against challenges like non-payment or customer insolvency. By streamlining claims management and connecting businesses to a global network of credit insurance providers, technology equips SMEs with the resources they need to succeed in today’s fast-paced and interconnected global marketplace.

What are the main challenges insurers face when offering trade credit insurance in emerging markets?

Insurers face a range of challenges when offering trade credit insurance in emerging markets. Among the most pressing issues are political instability, economic uncertainty, and limited access to dependable market data. These hurdles make it difficult to evaluate risks with precision.

On top of that, businesses in these regions often deal with higher default rates and volatile financial conditions, adding another layer of complexity to underwriting. To navigate these challenges, insurers must take a more careful and customized approach to reduce potential losses.