AI is changing how credit decisions are made. Fintech companies now use alternative credit data – like rent payments, utility bills, and even gig economy earnings – to assess borrowers who don’t fit into traditional credit scoring systems. AI processes this data in real-time, identifying patterns and insights that help lenders make faster, more accurate decisions.

Key Points:

- Alternative Credit Data: Includes rent, utility payments, bank activity, and even smartphone usage patterns.

- AI’s Role: Handles unstructured data, improves loan approvals, reduces risks, and expands credit access to underserved groups.

- Impact: Covers 96% of U.S. adults, up from 81% using older methods, opening credit opportunities for young adults, immigrants, and gig workers.

- Challenges: Ensuring data accuracy, avoiding algorithmic bias, and maintaining regulatory compliance.

Fintech platforms are transforming credit scoring by combining real-time data with AI tools, helping lenders approve more borrowers while managing risks efficiently.

How Alternative Data and AI Are Shaping the Future of Lending | Money20/20 USA

sbb-itb-2d170b0

Types of Alternative Data Sources in Fintech

Fintech leverages a variety of alternative data sources to better understand an individual’s financial habits and reliability. Each type of data sheds light on unique aspects of financial behavior, offering insights that traditional credit scores might miss. Here’s a closer look at how these data sources contribute to AI-driven credit scoring.

Behavioral Data and Spending Patterns

AI tools analyze raw bank transaction data – like "ACH CREDIT JPM PAYROLL" – and transform it into easy-to-understand categories such as Income, Spending, or Credit Repayments. This helps lenders uncover financial patterns that standard credit scores may not capture. For example, Plaid‘s LendScore model derives the majority of its predictive accuracy (81%) from cash flow factors, with the remaining 19% coming from network insights. These models examine details like income consistency and account balance trends to paint a clearer picture of financial health.

Some fintech platforms take this a step further by analyzing smartphone metadata, with user consent, to assess financial habits. For instance, consistent phone charging or stable location patterns may signal personal organization and reliability. Affirm incorporates Plaid’s consumer-permissioned cash flow data to evaluate whether a customer has the financial capacity to make payments before approving Buy Now, Pay Later transactions.

Utility, Rental, and Bill Payment History

Payments for rent, utilities, phone services, and even streaming subscriptions can be strong indicators of financial responsibility. These recurring expenses highlight discipline, especially for individuals with limited or no traditional credit history. In fact, Experian Boost users saw their FICO Score 8 rise by an average of 13 points simply by adding utility and streaming payments to their credit profiles.

"For ‘credit invisibles,’ an alternative score built on reliable financial signals – like on-time rent or utility payments – can open the door to affordable credit." – Tom Sullivan, Content Strategist, Plaid

Unlike traditional credit reports, which can lag by weeks, this data provides lenders with a more up-to-date view of a borrower’s financial situation. By combining these recurring payments with digital data, lenders can create a more well-rounded credit evaluation.

Social and Digital Footprint

Fintech companies also assess digital activity to evaluate creditworthiness for both individuals and small businesses. For small and medium-sized enterprises (SMEs) – 75% of which in the U.S. have websites – AI analyzes online metrics like website traffic, e-commerce sales, and customer reviews. For individual borrowers, insights might include gig economy earnings from platforms like Uber or DoorDash, online shopping habits, return rates, and punctuality with Buy Now, Pay Later payments.

The types of financial apps linked to a user’s profile also provide valuable clues. For instance, frequent connections to lending apps could signal higher risk, while consistent use of budgeting or savings apps might suggest strong financial habits. These insights help lenders differentiate between borrowers who lack traditional credit histories and those who may pose higher financial risk.

How AI Processes Alternative Credit Data

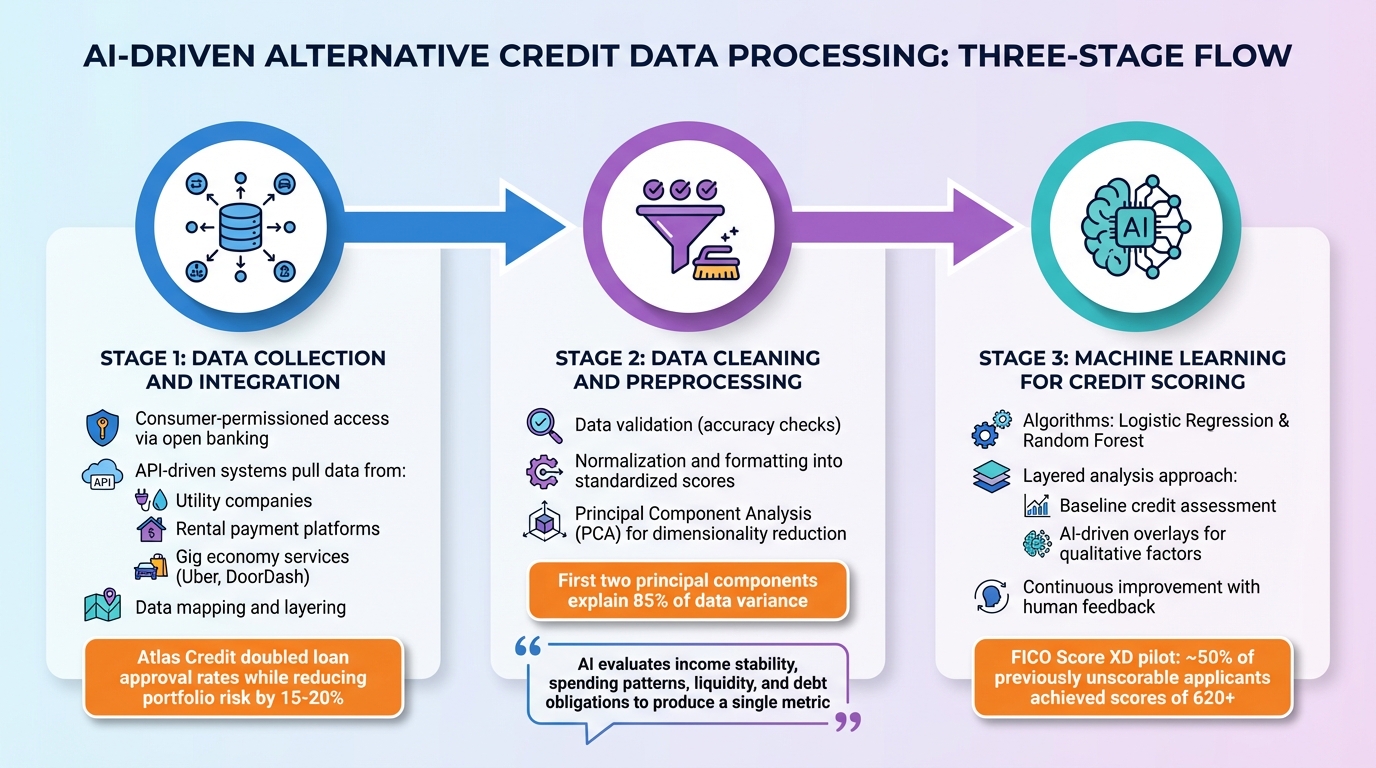

How AI Processes Alternative Credit Data: From Collection to Credit Scoring

Fintech companies transform raw alternative data into practical insights by following a series of technical steps that clean, organize, and analyze the information. These steps help streamline credit decision-making.

Data Collection and Integration

Fintech firms gather alternative data through consumer-permissioned access with the help of open banking providers. This eliminates the need for borrowers to manually upload documents like pay stubs or bank statements. Instead, the data is seamlessly integrated via API-driven systems, pulling information from third-party sources such as utility companies, rental payment platforms, and gig economy services like Uber or DoorDash.

"Access to digitized data that removes the need for documents to be provided or lengthy phone calls is key for providing these [low friction] experiences." – Peter Lemon, Senior Consultant, FICO

After collection, lenders use data mapping and layering to align the alternative data with their existing systems. This is often used as a secondary signal to assist with borderline credit applications. For small businesses, AI tools analyze digital footprints – such as website traffic, hosting details, and e-commerce activity – to provide real-time assessments of creditworthiness. Machine learning models integrated into this process can even uncover patterns in unstructured data, like clickstream activity or customer service call logs.

In 2020, Atlas Credit collaborated with Experian to develop a custom underwriting model that incorporated alternative credit data. By automating the integration of these new data points, Atlas Credit nearly doubled its loan approval rates while reducing portfolio risk by 15% to 20%.

Data Cleaning and Preprocessing

AI plays a critical role in cleaning and standardizing the often messy alternative data collected from multiple sources. This ensures the insights generated are accurate and actionable. The process starts with data validation, which checks for accuracy and ensures the information reflects the borrower’s current financial situation – not outdated records.

Next comes normalization and formatting, where raw data is structured into a standardized format or score. AI and machine learning models evaluate various financial signals – like income, spending habits, liquidity, and debt obligations – to generate a single, easy-to-interpret score.

"The raw data can be used as is or normalized and structured into a standardized score. AI and machine learning models evaluate key signals – such as income stability, spending patterns, liquidity, and debt obligations – to produce a single metric that’s easy for lenders to interpret." – Tom Sullivan, Content Strategist, Plaid

To handle the complexity of high-dimensional data, fintech companies often use Principal Component Analysis (PCA) for dimensionality reduction. A 2025 study showed that applying PCA allowed the first two principal components to explain 85% of data variance, enhancing model training efficiency without losing accuracy. This ensures AI models focus on the most relevant information, avoiding distractions from redundant data points.

Once the data is cleaned and standardized, it’s ready to be processed by machine learning models for credit scoring.

Machine Learning for Credit Scoring

Machine learning algorithms, such as Logistic Regression and Random Forest, are commonly used to analyze preprocessed data and generate credit scores. These models excel at identifying patterns in the financial behavior of individuals who lack traditional credit histories. They evaluate factors like income consistency, spending habits, liquidity, and debt-service coverage ratios.

Many fintech companies use a layered analysis approach. This begins with a baseline credit assessment based on core financial metrics and market indicators. AI-driven overlays then analyze qualitative factors, such as payment behavior and digital footprints, to refine the credit evaluation. Advanced AI systems continuously improve by incorporating human feedback, allowing them to adjust criteria for better accuracy.

In 2016, Equifax partnered with FICO and LexisNexis Risk Solutions to launch "FICO Score XD." This initiative used alternative data, including public records and utility payment histories, to score previously unscorable applicants. The pilot revealed that most of these individuals could now be scored, with approximately 50% achieving scores of at least 620, a common threshold for loan approval.

Benefits and Challenges of AI in Alternative Credit Scoring

AI-driven credit scoring has introduced a new way to evaluate borrowers, offering both operational improvements and analytical precision. Here’s a closer look at how it benefits lenders and borrowers while also highlighting the challenges that come with it.

Key Benefits of AI-Driven Credit Scoring

AI credit scoring, powered by alternative data, goes beyond traditional methods to assess borrowers more inclusively. In the U.S., around 49 million adults are considered "credit invisible" because they lack sufficient credit history for conventional scoring. By using real-time alternative data, AI can identify "invisible primes" – individuals with low traditional scores but strong repayment potential. This approach has opened up credit access for groups like young adults, immigrants, and gig workers.

One of the standout advantages of AI models is their ability to use real-time cash flow data instead of relying on outdated monthly updates. This provides a more accurate snapshot of a borrower’s financial health. For instance, a major U.S. fintech platform revised its model in December 2025 and, by incorporating education and employment data, approved 15% to 30% of applicants previously rejected by traditional scoring systems. These borrowers were offered lower interest rates thanks to a more precise understanding of their risk profile.

"Alternative data strikes right to the core of a person’s upward or downward financial trajectory." – LexisNexis Risk Solutions

AI also speeds up the underwriting process by automating the analysis of massive datasets, removing the need for manual reviews. Beyond efficiency, AI can detect early warning signs of financial trouble, such as declining account balances or missed subscription payments, helping lenders act before defaults occur. LendingClub‘s 2019 findings revealed that its internal ratings were only 35% correlated with FICO scores, enabling the platform to reclassify many "subprime" borrowers into lower-interest loan tiers with comparable default risks.

While these benefits are impressive, implementing AI-driven credit scoring is not without its difficulties.

Challenges and Ethical Considerations

Despite its potential, AI-driven credit scoring faces several hurdles. One major issue is the quality and standardization of alternative data, which often lacks the consistency of traditional credit reports. Fintech companies must establish strict verification practices to ensure the data they use is both accurate and complete.

Another concern is algorithmic bias. AI models, if not carefully designed, can unintentionally reinforce discrimination. For example, alternative data points like education history or online behaviors may inadvertently correlate with protected characteristics such as race or gender. This raises ethical questions and regulatory concerns, especially when AI decisions are difficult to explain due to the "black box" nature of machine learning. This lack of transparency complicates the process of issuing adverse action notices when credit is denied.

"Without sufficient transparency, neither firms nor their regulators can evaluate whether particular models are making credit decisions based on strong, intuitive, and fair relationships between an applicant’s behavior and creditworthiness." – FinRegLab Report

Regulatory compliance adds another layer of complexity. Fintech companies must navigate laws like the Fair Credit Reporting Act (FCRA) to ensure data accuracy and the Equal Credit Opportunity Act (ECOA) to prevent discrimination. Additionally, maintaining model stability can be challenging. AI systems that perform well under historical conditions may falter during economic shifts or changing business cycles. A 2023 report showed that while 62% of financial institutions were already using alternative data, many still face technical and financial barriers, such as the ongoing validation required to keep models effective.

The Role of Accounts Receivable Insurance in Financial Risk Management

Accounts Receivable Insurance (ARI) plays a key role in financial risk management by providing direct financial protection. While AI-driven tools can predict the likelihood of customer defaults, ARI steps in to cover losses when those predictions fall short, creating a more comprehensive safety net for businesses.

How ARI Reduces Credit Risks

ARI helps businesses safeguard their cash flow by covering losses from unpaid invoices due to customer insolvency or non-payment. This protection becomes particularly important during economic downturns or when businesses extend credit to customers with limited financial histories, such as those identified through alternative data scoring methods.

Modern ARI providers are leveraging AI to enhance their services. AI tools analyze diverse data sets to assess credit risks, improve claims processing, and speed up payouts. As André Düsing, Senior Manager Corporate Strategy at Atradius, notes:

"AI promises to streamline this process considerably… allowing insurers to assess credit risks on the basis of effectively much more data for each assessment".

AI systems can evaluate unstructured data – like news reports, annual financial filings, and digital activity – which is particularly helpful for assessing small and medium-sized enterprises (SMEs) that lack traditional credit histories. These tools also expedite claims by cross-referencing data with third-party sources and using pattern recognition to identify potential fraud. Additionally, AI-powered insights can flag early warning signs of financial trouble up to 6 to 8 months before major credit events, giving businesses and insurers a chance to adjust credit limits or coverage proactively. This forward-looking approach enables ARI to adapt to changing risks and provide tailored solutions for various markets.

Customized Solutions for Domestic and International Markets

ARI policies are increasingly customized to reflect real-time financial data, thanks to advancements in AI. Unlike traditional credit scores, which may be outdated by up to 90 days, AI-powered ARI solutions use current financial behaviors and alternative data sources to provide more accurate coverage.

This adaptability is crucial for both domestic and international markets, where financial conditions and data availability can vary widely. For example, AI tools can analyze foreign credit data, social media trends, and website activity from over 75% of U.S. and European SMEs with an online presence. In domestic markets, customized ARI policies enable businesses to extend credit to underserved groups like young adults, immigrants, and SMEs. These groups, often labeled as "invisible primes", have limited credit histories but strong repayment potential, as identified by AI models. By tailoring coverage to these segments, ARI helps businesses safely grow their customer base while managing risk effectively.

Future Trends in AI and Alternative Credit Data

AI credit assessment is heading toward a future where real-time, hyper-personalized data will offer instant insights into a borrower’s financial health. Two key developments are driving this transformation: the use of streaming data from open banking and instant payment systems, and the creation of AI models that can clearly explain their decisions to both regulators and consumers.

Increased Use of Real-Time Data

The way creditworthiness is evaluated is shifting from static, periodic updates to continuous monitoring that looks ahead. Instead of relying on monthly credit reports, future AI systems will leverage streaming data from sources like open banking, embedded finance, and instant payments. This approach allows for immediate decisions, with credit limits that adjust dynamically based on a person’s current financial situation.

For example, in August 2025, Experian partnered with Plaid to integrate real-time cash-flow insights, analyzing 500 million transactions daily. This enabled instant credit decisions and ongoing portfolio monitoring. Similarly, in January 2026, JPMorgan Chase and PayPal collaborated with Nova Credit to use real-time bank account data for underwriting individuals who lack traditional credit histories, often referred to as "thin-file" borrowers.

"The future of credit decisioning is being shaped by open banking, embedded finance, and AI-driven models that learn from streaming data".

Combining traditional credit data with cash-flow insights has been shown to improve predictive accuracy by 40% compared to conventional methods. The Office of the Comptroller of the Currency (OCC) has also expressed support for using alternative data responsibly to widen access to credit, reinforcing the trend toward real-time credit evaluations. As these continuous data streams improve risk monitoring, advances in explainable AI will play a critical role in maintaining trust among consumers and regulators.

Advancements in Explainable AI

While real-time data enhances decision-making, the push for AI transparency is equally important. Complex AI models, like neural networks, often operate as "black boxes", making it difficult to explain their decisions – a challenge that clashes with regulatory requirements for interpretability, such as providing clear reasons for adverse credit actions. To solve this, the industry is turning to tools like SHAP (SHapley Additive Explanations) and LIME (Local Interpretable Model-agnostic Explanations). These tools enable lenders to use high-performing AI models while offering instance-specific explanations for their decisions.

"AI plays a critical role not only in helping to seamlessly monitor alternative datasets on millions of firms… but also in generating the company’s credit score, and in adding natural-language-based context about the output score".

Natural-language explanations are becoming increasingly important, helping both regulators and borrowers understand the reasoning behind credit decisions. These explanations go beyond simple numerical scores, offering actionable insights that make the process more transparent. Additionally, hybrid models that combine advanced AI techniques with more interpretable methods like decision trees and logistic regression are gaining traction. This approach balances the need for high predictive accuracy with the demand for clarity, especially as nearly half of lenders (48%) reported declining confidence in traditional credit data last year.

"Effective integration of AI into credit scoring and risk management requires a reconceptualization of governance structures, moving from static control mechanisms toward adaptive, lifecycle-oriented oversight models".

These advancements ensure that AI systems do more than just predict creditworthiness – they also provide clear, understandable rationales for their decisions. This combination of accuracy and transparency is key to building trust and ensuring that AI continues to serve both consumers and regulators effectively.

Conclusion

Fintech is transforming credit risk management by blending AI with alternative data. Traditional credit scores often fall short, leaving millions of U.S. adults unaccounted for and relying on outdated snapshots instead of reflecting real-time financial behavior. By analyzing factors like cash flow patterns, utility payments, and even digital footprints, AI helps lenders identify "invisible primes" – borrowers who may seem risky under traditional methods but actually have strong repayment potential.

This shift from static credit reports to continuous monitoring isn’t just a technological upgrade – it’s a growth opportunity. Fintech platforms leveraging alternative data have managed to approve 15% to 30% of applicants that conventional models would have rejected, expanding their customer base without increasing risk. With 71% of lenders expecting rising delinquencies and 48% expressing less confidence in traditional credit data, AI-driven tools are becoming critical for protecting revenue streams.

"Credit is no longer a gatekeeper but a growth enabler. Lenders, in turn, are less evaluative and more like financial partners." – FinTech Pulse Staff Insight

For businesses looking to implement these strategies, the key lies in layering alternative data scores alongside existing models. Start small – target specific groups like gig workers or near-prime applicants to test and validate predictive accuracy before scaling. Focus on high-quality data and ensure consumer-permissioned access through open banking to maintain trust and comply with regulations like the Fair Credit Reporting Act (FCRA) and Equal Credit Opportunity Act (ECOA).

To further reduce risk, businesses can pair these advanced scoring methods with tailored insurance solutions. For example, Accounts Receivable Insurance not only protects against non-payment risks but also provides risk assessments that align with AI-driven credit analysis. By combining customized insurance policies with advanced credit monitoring, businesses can confidently extend credit to both domestic and international customers, turning credit decisions into a proactive tool for sustainable growth.

FAQs

What counts as alternative credit data?

Alternative credit data refers to non-traditional information that goes beyond the usual credit report to assess someone’s creditworthiness. This can include details like rent payments, utility bills, small-dollar loans, and bank account transactions. It also encompasses consumer-approved data, such as mobile phone activity or digital footprints. By tapping into these sources, lenders can better understand the financial habits of individuals with limited credit histories, helping to expand access to credit and provide a more complete picture of someone’s financial behavior.

How do I give (and revoke) permission to share my data?

When you grant permission, you usually do so by giving explicit consent via an online form or a secure platform. This involves specifying what data can be accessed and how it will be used. If you need to take back that permission, you can often do so by updating your privacy settings or reaching out to the data provider directly. Many platforms make this process easier by offering user-friendly dashboards or customer service options, so you can stay in control of your data while adhering to regulatory standards.

How do lenders prevent AI credit decisions from being biased?

Lenders are actively working to tackle bias in AI-driven credit decisions by focusing on making machine learning models more transparent and equitable. By ensuring that these systems are easier to understand and interpret, they can spot and minimize bias more effectively. One approach involves using techniques like causal inference to address bias in alternative data sources. Additionally, adhering to fair lending laws plays a crucial role in guaranteeing that outcomes remain non-discriminatory. These efforts aim to create credit decision systems that are fair, clear, and impartial.