Sanctions penalties can severely disrupt businesses. They result from violations of trade and economic restrictions, often enforced by the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC). These penalties include fines, asset freezes, and even criminal charges, with fines reaching millions of dollars and prison sentences up to 20 years.

Key Takeaways:

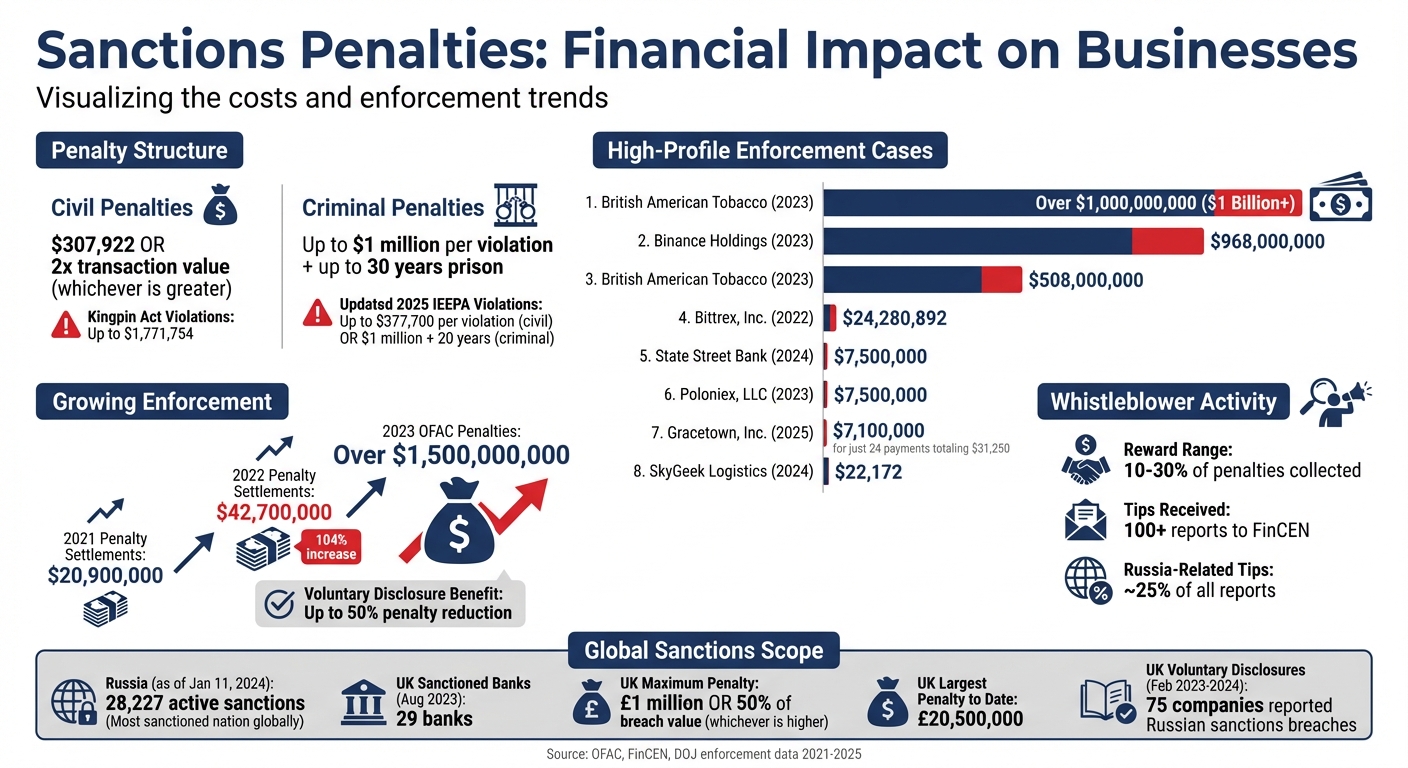

- Financial Costs: Civil penalties start at $350,000 or double the transaction’s value; criminal fines can hit $1 million per violation.

- Operational Disruptions: Compliance failures lead to blocked transactions, frozen assets, and market access loss.

- Reputational Damage: Penalties tarnish brands, making it harder to regain trust from partners and customers.

- Global Reach: U.S. sanctions apply to foreign companies using the U.S. financial system, not just U.S.-based entities.

Recent high-profile cases, such as Binance‘s $968M fine in 2023 and British American Tobacco‘s $508M settlement, highlight the risks of non-compliance. Companies must implement centralized compliance systems, real-time monitoring, and due diligence to avoid these penalties. Proactive measures, like appointing dedicated compliance officers and using advanced screening tools, can help mitigate risks.

BIS And OFAC Penalties – How Bad Are They?

sbb-itb-2d170b0

The Financial and Operational Costs of Sanctions Penalties

Financial Impact of Sanctions Penalties on Businesses: Fines, Violations, and Enforcement Trends

Sanctions penalties bring a triple threat to businesses: steep financial losses, operational disruptions, and reputational harm. Together, these challenges can jeopardize a company’s survival.

Regulatory Fines and Financial Penalties

The financial consequences of sanctions violations are nothing short of severe. Civil penalties often amount to the greater of $307,922 or double the transaction value, while violations tied to international narcotics traffickers under the Kingpin Act can result in fines as high as $1,771,754. Criminal penalties can even include prison sentences of up to 30 years.

But fines are just one part of the story. Regulators can freeze assets like bank accounts and real estate, effectively halting operations. Financial institutions are also required to block transactions involving sanctioned parties, leading to revenue losses and contract fulfillment challenges.

The scale of enforcement has grown dramatically. For instance, in December 2024, SkyGeek Logistics, Inc., an aviation supplier based in New York, was fined $22,172 by OFAC for shipments to sanctioned suppliers in the UAE. In response, the company stopped sales to 45 jurisdictions to avoid further violations. Similarly, Gracetown, Inc., a property management firm in New York, faced a $7.1 million penalty in December 2025 for processing just 24 loan payments totaling $31,250 linked to sanctioned Russian oligarch Oleg Deripaska. OFAC labeled the violations as "egregious" because the company had been previously warned.

Adding to the pressure, whistleblower programs now incentivize individuals to report violations, offering rewards between 10% and 30% of penalties collected. FinCEN has already received over 100 tips under its expanded program, with roughly 25% linked to Russia sanctions.

These financial penalties are just the beginning, as operational challenges further compound the damage.

Operational Disruptions and Lost Market Access

Sanctions penalties force businesses to implement rigorous compliance measures, which can drain resources and slow operations. Companies must use tools like IP blocking and geolocation to prevent prohibited transactions, conduct retroactive screenings of customer databases, and establish recusal policies for U.S.-based employees. These measures require significant time and effort.

Payment processing is another major hurdle. For example, as of August 2023, the UK had sanctioned 29 banks, which disrupted payments even for non-restricted goods. Businesses also face penalties for indirect supply chain violations, necessitating thorough due diligence on end-use throughout their networks.

Consider Binance Holdings, Ltd., which in November 2023 reached a global settlement with OFAC, DOJ, and FinCEN. The agreement required the appointment of a compliance monitor for five years to overhaul its KYC and sanctions protocols. Similarly, State Street Bank and Trust Company‘s $7.5 million settlement in 2024 highlighted the risks of failing to integrate acquired subsidiaries, like Charles River Systems, into centralized compliance systems.

"Parent companies are expected to oversee compliance with applicable U.S. sanctions laws within their subsidiaries, and to empower employees to alert headquarters trade compliance when business dealings need further review." – OFAC

Non-U.S. businesses face even harsher consequences. If found to have "caused" a U.S. sanctions violation, they can be excluded entirely from the U.S. financial system. This forces companies to rely on less efficient and more costly alternative payment methods.

Beyond operational headaches, sanctions penalties can tarnish a company’s reputation in ways that are hard to recover from.

Reputational Damage and Long-term Business Impact

The reputational fallout from sanctions penalties often outweighs the direct financial costs. Once a company is penalized, it becomes stigmatized, making it difficult to rebuild trust with partners – even after achieving compliance.

This stigma can lead to "excess de-risking", where financial institutions and business partners avoid any dealings with a penalized entity to minimize their own regulatory risks. The impact can be immediate and far-reaching.

For example, after Nayara Energy Limited – a refinery in India partially owned by Russia’s Rosneft – was listed in Europe in 2025, the fallout was swift. The company’s CEO resigned, Microsoft suspended its software services, and shipping firms terminated contracts, citing concerns over European insurance and reputational risks.

"Sanctions are no longer just a legal or compliance issue. They are increasingly being used by governments as tools to assert geopolitical influence." – Tobias Wellner, Global Geopolitical & Strategic Risk Advisory, Control Risks

Losing critical third-party services like insurance, shipping, and software licenses can cripple a business. Companies may also lose access to essential technology and long-standing partnerships, creating a ripple effect across their operations.

For some, market exclusion can be permanent. As of January 11, 2024, Russia held the title of the most sanctioned nation globally, with 28,227 active sanctions. Companies operating in or near these regions face constant scrutiny and the risk of losing relationships, no matter how compliant they are.

Common Compliance Failures That Lead to Sanctions Penalties

Understanding where compliance efforts fall short can help businesses avoid the hefty penalties that come with sanctions violations. These failures often stem from outdated processes, inadequate documentation, and fragmented oversight. Regulators actively focus on these areas, as they represent systemic vulnerabilities. Below, we’ll examine each failure with real-world examples to highlight their consequences.

Outdated Sanctions Policy Updates

One of the easiest compliance failures to prevent is keeping sanctions policies up to date. When sanctions lists are updated, businesses must act immediately to apply the changes across all customer accounts.

Take the case of MidFirst Bank in July 2022. The bank processed 34 payments for two individuals who had been added to the SDN List just 14 days earlier. The issue? The bank assumed its vendor was performing daily screenings of its customer base, but the vendor was conducting monthly scans instead. This oversight led to a violation flagged by OFAC:

"MidFirst had reason to know that it maintained the accounts for the blocked persons, and that its vendor was re-screening MidFirst’s existing accounts against changes to the SDN List on a monthly basis only." – OFAC

Similarly, in 2023, Poloniex, LLC faced a $7.5 million settlement with OFAC for failing to screen its existing customer base after implementing a sanctions compliance program. The company unknowingly continued serving customers in sanctioned jurisdictions because it didn’t review older accounts. Microsoft Corporation encountered a comparable issue in 2023, struggling to identify blocked individuals whose names appeared in non-Latin scripts like Cyrillic and Chinese.

These cases reveal a common mistake: treating compliance as a one-time task rather than an ongoing effort. Regulators now expect real-time or daily screening. Companies relying on outdated processes – like monthly batch scans – or failing to account for name variations and transliterations are leaving themselves exposed.

Poor Documentation and Audit Trails

When regulators investigate potential violations, they expect a clear and detailed record of compliance decisions. Without proper documentation, even compliant actions can appear suspicious.

Good documentation should include decision rationales, responsible parties, and the criteria used. Any inconsistencies or missing records raise red flags. For example, in January 2026, the UK’s OFSI fined a bank £160,000 for processing 24 payments for a designated individual. The violation occurred because a name variation bypassed the bank’s screening system, and the institution lacked procedures linking PEP alerts to sanctions risks.

"Internal policies should provide robust and explicit guidance to staff regarding the escalation of potential sanctions concerns." – Office of Financial Sanctions Implementation (OFSI)

Mergers and acquisitions can also complicate compliance. Wells Fargo Bank, N.A. faced penalties for failing to identify a mid-level manager in an acquired business unit who had created software enabling a European bank to deal with sanctioned jurisdictions. OFAC found that Wells Fargo lacked a systematic process for reviewing the compliance of legacy clients.

The takeaway? Compliance decisions need to be documented consistently and retained for at least five years. Without this, businesses may struggle to prove their good-faith efforts during regulatory investigations.

Fragmented Compliance Oversight

Perhaps the most dangerous compliance failure is fragmented oversight, where responsibilities are scattered across departments without a clear leader. This lack of coordination allows critical information to slip through the cracks.

In April 2023, British American Tobacco (BAT) agreed to pay over $1 billion in settlements to OFAC and the Department of Justice. The company had used intermediaries and front companies to hide tobacco sales to North Korea, routing payments through banks that couldn’t detect the connections due to obscured documentation. The root cause? A lack of centralized oversight.

"The uncomfortable reality is that most large-scale financial crime failures are not technology failures. They are governance failures." – Arun Maheshwari, Global Model Risk Control Lead

Another example is 3M Company, which settled with OFAC for nearly $10 million. Two non-U.S. subsidiaries sold materials that were resold to Iranian law enforcement. The issue stemmed from weak oversight of subsidiaries and the absence of clear reporting channels for employees to flag concerns.

OFAC emphasizes the importance of parent companies taking responsibility for compliance across their subsidiaries. Effective oversight requires clear channels for escalating concerns, as well as accountability for monitoring changes in transactions. Without these, even well-meaning compliance efforts can fall short.

To address these risks, companies should assign a single executive – such as a Chief Financial Crime Risk Officer – with direct reporting authority to the board. Centralized oversight not only strengthens compliance but also simplifies risk management, reducing the chances of regulatory breaches.

How to Reduce Sanctions Compliance Risks

Addressing sanctions compliance risks requires practical steps that strengthen oversight, improve monitoring systems, and establish financial safeguards. A well-structured approach combines centralized management, advanced technology, and proactive due diligence.

Creating Centralized and Automated Compliance Systems

One of the most effective ways to mitigate compliance risks is consolidating oversight under a single, dedicated team. When compliance efforts are decentralized, inconsistencies in regulation interpretation and missed details can lead to violations.

"OFAC recommends a single, centralized sanctions compliance program led by one team that is versed in sanctions law and makes decisions about possible violations consistently." – Matt Kelly, Founder, Radical Compliance

Centralization involves appointing a sanctions compliance officer who reports directly to senior management. This ensures the compliance team has the authority to enforce policies organization-wide. However, leadership alone isn’t enough – technology plays a critical role. Screening software must be tailored to an organization’s risk profile, capable of handling fuzzy logic, partial matches, and alternative spellings (like "Habana" versus "Havana"). It should also support non-Latin alphabets, such as Cyrillic or Chinese characters.

Automated compliance systems should update immediately when changes occur in SDN/SSI lists, general licenses, or executive orders. Beyond name screening, advanced tools should monitor IP addresses and physical locations to flag users in sanctioned jurisdictions. For instance, a U.S.-based cryptocurrency exchange faced penalties in 2022 for failing to screen IP addresses, resulting in over 100,000 apparent violations.

Strong controls can significantly reduce penalties. Organizations that voluntarily disclose non-egregious violations often see penalties cut by half. In one case, a $15 million potential fine was reduced to $189,000 after the company demonstrated compliance improvements and self-reported the issue.

Practical measures include regular system testing to ensure proper calibration, maintaining internal "do not onboard" watchlists for high-risk customers, and training systems to detect unusual payment requests, such as third-party payments or missing delivery addresses.

Once centralized oversight is established, it’s critical to focus on thorough due diligence and continuous monitoring.

Improving Due Diligence and Monitoring Processes

Effective due diligence isn’t a one-time effort – it must continue throughout the entire business relationship. A risk-based approach, tailored to an organization’s size, products, customers, and geographic reach, is essential. During the Know Your Customer (KYC) process, assigning sanctions risk ratings can guide future monitoring efforts.

Understanding the 50 Percent Rule is crucial. Any entity owned 50% or more by sanctioned individuals is automatically considered sanctioned, even if it doesn’t appear on any lists. Since U.S. sanctions operate under strict liability, OFAC can issue penalties without proving intent.

Continuous monitoring is vital because a partner’s sanctions status can change over time. Real-time transaction screening against SDN and SSI lists helps avoid prohibited dealings. For higher-risk cases, Enhanced Due Diligence (EDD) involves deeper investigations into transaction chains to uncover hidden originators and beneficiaries.

For international trade, monitoring specific details like vessel ownership, dual-use goods, and transport routes is key. Before the 2022 Ukraine invasion, Russia’s top trading partners included China, Germany, and the United States, among others. Businesses operating in these regions needed to adjust their monitoring processes accordingly.

"Senior Management’s commitment to, and support of, an organization’s risk-based SCP is one of the most important factors in determining its success." – OFAC

Actionable steps include sending questionnaires to customers handling sensitive items (e.g., microelectronics) to understand their counterparties and requiring high-risk customers to provide written confirmations that they don’t operate in prohibited sectors or transfer goods to sanctioned regions. When weaknesses are identified, conducting a root cause analysis helps implement long-term solutions rather than temporary fixes.

While operational controls are essential, financial safeguards add another layer of protection.

Using Accounts Receivable Insurance to Manage Risk

Financial protections like Accounts Receivable Insurance (ARI) can help businesses manage risks tied to trade disruptions. ARI shields companies from settlement risks – such as losing access to payment systems like SWIFT – caused by sanctions.

When major Russian banks were cut off from SWIFT in 2022, businesses with outstanding trade activities faced immediate settlement challenges. Given Russia’s role as a top 10 global economy, this exclusion created widespread payment disruptions. ARI provides financial protection when transactions are halted or rendered illegal due to sanctions.

ARI covers scenarios such as:

- SWIFT Exclusion: Protects against financial losses when standard banking channels are inaccessible.

- Asset Freezing: Mitigates non-payment risks when counterparties’ funds are blocked.

- Trade Embargoes: Offers a safety net for transactions that become illegal mid-process.

- Dual-Use Restrictions: Supports due diligence for goods that may be seized at customs.

| Risk Factor | Impact on Business | Role of ARI |

|---|---|---|

| SWIFT Exclusion | Inability to receive payment through standard banking | Mitigates financial loss from settlement failure |

| Asset Freezing | Counterparty funds become inaccessible | Protects against non-payment from blocked entities |

| Trade Embargoes | Transactions become illegal mid-process | Provides a safety net for prohibited trade activity |

| Dual-Use Restrictions | Goods are seized or blocked at customs | Supports due diligence on goods and end-users |

Businesses should quickly assess settlement risks tied to sanctioned counterparties or banks that have lost SWIFT access. Prioritizing transactions in high-risk regions helps determine which are subject to restrictions and still eligible for insurance coverage. Keeping detailed records and rationales for trade decisions demonstrates a "good faith effort" to regulators in case of accidental breaches.

In the UK, financial sanctions violations can result in penalties of £1 million or 50% of the breach’s value – whichever is higher. The largest penalty to date is £20.5 million, and in the year leading up to February 2024, 75 companies voluntarily disclosed Russian sanctions breaches. These figures highlight the importance of ARI for businesses with global exposure.

Accounts Receivable Insurance offers tailored policies, risk assessments, and global coverage to meet specific business needs. By integrating ARI into a broader compliance framework, companies can better navigate the complex challenges of international trade and sanctions compliance.

Conclusion: Preparing for Increased Sanctions Enforcement

The regulatory environment is shifting rapidly. As Deputy Attorney General Lisa Monaco put it, "Sanctions are the new FCPA". This statement reflects the growing focus on sanctions enforcement, with the National Security Division expanding its efforts and OFAC penalties surpassing $1.5 billion in 2023.

Sanctions compliance now requires constant attention. As of January 15, 2025, violations under the International Emergency Economic Powers Act (IEEPA) can result in civil penalties of up to $377,700 per violation. Criminal penalties for willful violations are even steeper, reaching up to $1 million in fines and 20 years in prison. Between 2021 and 2022, penalty settlements more than doubled, increasing from $20.9 million to over $42.7 million. These numbers highlight how the cost of noncompliance far outweighs the investment needed for a robust compliance program.

Regulators are also expanding their focus to include indirect violations. They’re targeting third-party intermediaries, shell companies, and transshipment points in regions like Turkey, Armenia, and Uzbekistan, which are often used to bypass Russia-related sanctions. Even non-U.S. companies are at risk of penalties if they engage the U.S. financial system, regardless of whether transactions occur on U.S. soil. Additionally, the 50 Percent Rule ensures that entities majority-owned by sanctioned individuals are automatically sanctioned.

Technology has become a critical tool in enforcement efforts. Regulators now expect businesses to use advanced geolocation tools, IP address blocking, and AI-driven analytics to detect and prevent transactions involving sanctioned jurisdictions. For instance, in October 2022, Bittrex, Inc. faced a $24,280,892 settlement with OFAC and FinCEN for failing to block IP addresses that allowed users in Crimea, Cuba, and Iran to access its platform. This example underscores the limitations of relying solely on automated systems without proper oversight.

Taking a proactive approach to compliance offers more than just risk mitigation – it can also provide strategic benefits. Companies that voluntarily disclose violations to OFAC may see penalties reduced by up to 50%. Organizations with strong internal controls, centralized oversight, and consistent monitoring are better equipped to handle enforcement actions with minimal disruption. By implementing automated screening systems, conducting thorough due diligence, and utilizing financial safeguards like Accounts Receivable Insurance, businesses can turn compliance into a competitive advantage, protecting their revenue, reputation, and market access. Strengthening these measures is not just about meeting regulatory demands – it’s about fostering sustainable growth while staying ahead of enforcement trends.

FAQs

Do U.S. sanctions apply to non-U.S. companies?

Yes, U.S. sanctions can impact non-U.S. companies, especially when there’s a connection to the United States. This could involve U.S. individuals, financial institutions, or transactions that pass through U.S. territory. Even non-U.S. entities may face violations if they assist in bypassing or evading these sanctions. It’s crucial for businesses to thoroughly evaluate their dealings and exposure to U.S. sanctions to steer clear of potential penalties.

What is OFAC’s 50 Percent Rule?

The Office of Foreign Assets Control (OFAC) enforces the 50 Percent Rule, which specifies that any entity owned – whether directly or indirectly – by one or more blocked individuals or entities, with a combined ownership of 50% or more, is also treated as a blocked entity. This means the entity is subject to the same restrictions as the blocked persons themselves.

Ownership structures are scrutinized thoroughly to ensure compliance with this rule, as even indirect ownership can trigger these restrictions. This careful analysis helps ensure that no blocked persons can bypass sanctions through complex or layered ownership arrangements.

How can Accounts Receivable Insurance help with sanctions disruptions?

Accounts Receivable Insurance (ARI) supports businesses in handling challenges that arise from sanctions, including frozen assets, payment restrictions, and compliance issues. It offers customized insurance policies and risk evaluations to safeguard companies against non-payment, bankruptcies, and political uncertainties.

By focusing on proactive risk management, ARI helps businesses address legal and operational hurdles. This approach minimizes penalties, protects reputations, prevents supply chain disruptions, and ensures financial stability, allowing businesses to trade with greater confidence.