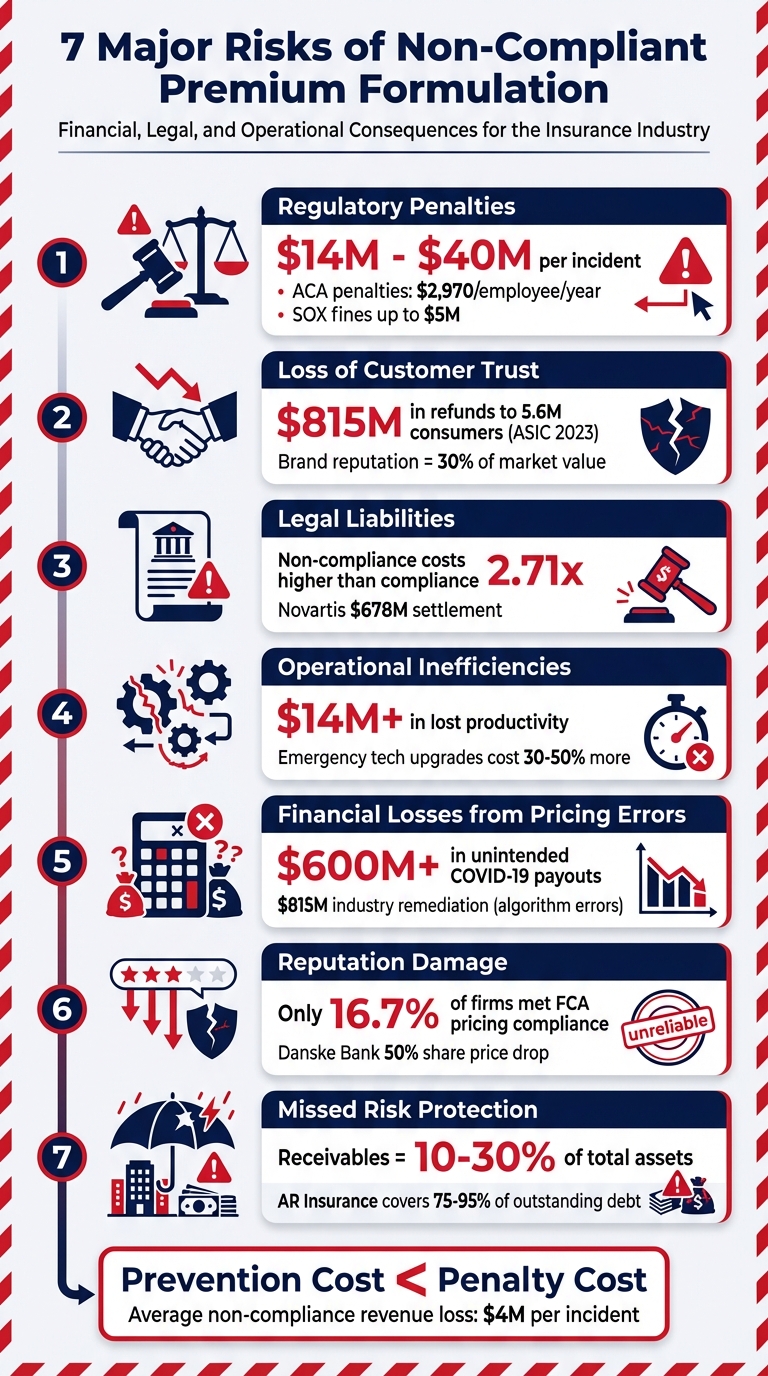

When insurers fail to meet premium compliance standards, the consequences can be severe. Non-compliance leads to financial penalties, legal challenges, and damaged reputations, all of which can destabilize businesses. Here are the seven biggest risks:

- Regulatory Penalties: Fines can range from $14 million to $40 million per incident, with additional ongoing penalties.

- Loss of Customer Trust: Errors in pricing damage relationships with policyholders, leading to customer churn and reduced market share.

- Legal Liabilities: Lawsuits and regulatory actions can result in settlements and criminal charges for executives.

- Operational Inefficiencies: Addressing compliance issues diverts resources, disrupts workflows, and increases costs.

- Financial Losses from Pricing Errors: Miscalculations in premiums can result in underpricing, overpricing, or costly refunds.

- Reputation Damage: Publicized non-compliance erodes trust, reduces market value, and deters partnerships.

- Missed Risk Protection: Without safeguards like Accounts Receivable Insurance, businesses face heightened exposure to financial losses.

Quick Takeaway:

Automating compliance processes, conducting regular audits, and maintaining detailed records can minimize risks. Additionally, tools like Accounts Receivable Insurance provide a safety net against financial instability caused by non-compliance. The cost of prevention is far lower than the price of penalties and reputational harm.

7 Major Risks of Non-Compliant Premium Formulation in Insurance

#AML Compliance in #Insurance Explained: Risks, Red Flags & Best Practices

1. Regulatory Penalties and Fines

When premium formulations fall short of compliance standards, regulatory authorities impose financial penalties that can severely impact a company’s financial health. These aren’t just minor setbacks – the average cost of a single non-compliance incident ranges from $14 million to $40 million. Penalties can escalate quickly depending on factors like the severity of the violation, how long it persists, and whether it was intentional. Regulations such as the Affordable Care Act (ACA) and Sarbanes-Oxley Act (SOX) have their own stringent penalty structures.

For example, under the ACA, failing to provide affordable health coverage can result in penalties of $2,970 per employee per year in 2024. Large organizations face even higher stakes, with fines reaching up to $3,783,000 for late or inaccurate ACA reporting forms. SOX violations tied to financial reporting are even more severe, with fines of up to $1 million for knowingly certifying false reports, and up to $5 million for willful violations. In some cases, enforcement actions in other industries have led to record-setting fines in the hundreds of millions – or even billions – of dollars.

These penalties don’t just stop at one-time fines. Non-compliance can lead to ongoing financial penalties that continue to mount until the issue is resolved, creating prolonged strain on resources. As Terry Trinh from VisiumKMS explains:

"The true costs of non-compliance extend far beyond immediate fines".

The stakes are even higher for executives. In extreme cases, willful misconduct under SOX can lead to criminal charges, with sentences of up to 20 years in prison. This highlights that non-compliance isn’t just a financial burden – it poses serious risks to personal freedom, professional standing, and the overall stability of a business.

2. Loss of Customer Trust

When premium formulations fall short of regulatory standards, companies face the serious risk of eroding customer trust. This trust is the foundation of the relationship between insurers and policyholders, and once it’s damaged, rebuilding it can take years.

Take the findings from a June 2023 report by the Australian Securities and Investments Commission (ASIC): general insurers were required to refund over $815 million to more than 5.6 million consumers due to pricing errors where promised discounts weren’t applied. These missteps don’t just highlight pricing flaws – they undermine the very promise of protection that insurance is supposed to offer.

The fallout from lost trust is often measurable. For instance, Net Promoter Scores (NPS) for many insurers tend to hover just below 30, while companies with stronger reputations often see scores closer to 50. At the same time, customer churn increases as policyholders turn to providers they perceive as more dependable. Add to that the impact of negative media coverage, which can trigger a wave of customer departures and a steep decline in market share.

The essence of insurance lies in fair treatment and delivering on promises. When compliance lapses in premium formulation occur, this fundamental promise is broken. The consequences go beyond immediate dissatisfaction – intangible assets like brand reputation, which can represent as much as 30% of a company’s market value, also take a hit.

As Diligent aptly put it:

"Trust, once lost, requires years to rebuild – if recovery is possible at all".

Even with corrective actions, some customers may never return, leading to long-term revenue losses. This highlights the importance of taking proactive steps to safeguard and rebuild trust before it’s too late.

3. Higher Legal Liabilities

When premium formulations fail to meet regulatory standards, businesses face a range of legal challenges, including costly disputes and lawsuits. These legal risks add to the financial and reputational damage already discussed.

Third-party lawsuits often arise from customers or stakeholders impacted by pricing errors, while non-compliant formulations can lead to securities litigation due to inaccuracies in financial reports. In cases of intentional fraud, companies – and even their executives – may face criminal investigations. Penalties under the Federal Sentencing Guidelines Act are determined by the severity of the offense and whether a compliance officer is in place.

Consider the following examples: In July 2020, Novartis Pharmaceuticals Corp. agreed to pay $678 million to settle allegations of violating the Anti-Kickback Statute, which included fraudulent billing to federal healthcare programs. Similarly, in February 2024, Lincare resolved fraudulent billing allegations with a $25.5 million settlement. These cases highlight how non-compliance can lead to devastating financial consequences for organizations.

Moreover, research shows that the cost of non-compliance is 2.71 times higher than the expense of maintaining compliance. Legal disputes also divert significant management resources toward audits and investigations. As Smartsheet explains:

"Deficiencies discovered in a regulatory audit may be subject to fines. However, any deficiencies that are not discovered in an audit may still subject an organization to a third-party lawsuit."

To reduce legal risks, businesses must prioritize strong internal controls. Regular internal audits, maintaining detailed audit trails, and consulting legal experts to navigate regulatory complexities are essential steps. Addressing compliance issues promptly – ideally within 120 days – can prevent them from escalating into costly legal battles.

4. Operational Inefficiencies

When premium formulations fail to meet compliance standards, it creates ripple effects across an organization, pulling staff and resources away from their primary responsibilities to address urgent corrections. This redirection of time and money from essential business operations to fix compliance issues hampers overall efficiency.

Take audits, for instance. Non-compliant businesses often need to manually track subcontractor payments and generate payroll reports, like Form 941, to avoid hefty surcharges. Insurers may penalize such businesses with payroll surcharges ranging from 20% to 100% for failing to meet audit requirements. On top of that, manual processes for Anti-Money Laundering (AML) checks and premium monitoring consume significantly more time compared to automated solutions. These inefficiencies don’t just slow things down – they also increase financial and reputational risks.

The financial toll of non-compliance is staggering. Organizations can face costs exceeding $14 million due to lost productivity and operational disruptions. Emergency upgrades to compliance technology, often done in a rush, can cost 30%–50% more than planned implementations. For example, in August 2025, Paxos Trust faced a $48.5 million settlement with the New York Department of Financial Services for inadequate due diligence. This included a $26.5 million fine and a required $22 million investment to overhaul their compliance program.

Outdated systems and weak internal controls add to the chaos, forcing businesses to make costly, last-minute technology investments while increasing the risk of errors. Poorly enforced policies further burden managers, who must spend extra time manually verifying and fixing downstream errors.

"A robust premium audit framework can not only protect against these risks but also unlock substantial financial gains, as evidenced by operational transformations seen by Pro Global that yielded up to 18% additional premium on productive audits".

Robert Sherman, US Head of Audit & Advisory at Pro Global, highlights the importance of automation in this context. Leveraging RegTech solutions to automate monitoring and maintaining well-organized documentation – like subcontractor insurance certificates and quarterly payroll reports – can significantly ease the audit process and reduce operational strain. Without these measures, the challenges of non-compliant premium formulation only continue to mount.

sbb-itb-2d170b0

5. Financial Losses from Pricing Errors

Mistakes in premium calculations can hit insurers hard in two ways: underpricing leaves them unable to cover claims and operational costs, while overpricing pushes customers toward competitors. These errors often arise from technical glitches or flawed data, which undermine the reliability of pricing models.

Technical issues can lead to major financial setbacks. For instance, poor data quality – like excluding quotes that didn’t convert into policies – can skew market models. Algorithmic errors are another culprit. A notable example occurred in October 2021, when the Australian Securities and Investments Commission (ASIC) took legal action against Insurance Australia Limited (IAL). The issue? A flaw in their pricing algorithm, known as the "cupping" mechanism, which blocked loyalty discounts from reaching customers. By June 2023, this error had contributed to an industry-wide remediation effort exceeding $815 million. Similarly, in February 2023, ASIC acted against RACQ Insurance for miscalculating discounts by applying them before optional extras were added, shortchanging customers on promised savings. These cases highlight how technical missteps not only breach regulations but also erode profitability.

"Having incorrect information about a customer flowing into the process for calculating their premiums can lead to poor outcomes for both the customer and the insurer." – Mudit Gupta and Sting Fan, Actuaries and Risk Advisors

The financial damage doesn’t stop at refunds. During COVID-19, outdated Business Interruption insurance policies resulted in over $600 million in unintended coverage payouts because the policy wording didn’t align with updated legislation. These incidents, coupled with remediation costs, reveal deeper vulnerabilities tied to outdated practices and weak governance across departments.

To avoid such costly errors, insurers are turning to automation and advanced tools. Automated pricing platforms and sensitivity analyses reduce manual input errors, helping to allocate resources more effectively while minimizing regulatory and operational risks. Without these safeguards, pricing errors can severely impact profitability and lead to expensive corrective actions.

6. Damage to Company Reputation

Faulty premium formulation can wreak havoc on a company’s reputation. Falling short of compliance standards suggests weak internal controls, and that perception can spread like wildfire. Once trust is broken, rebuilding it becomes an uphill battle that takes time and resources.

Regulators often spotlight companies that fail to meet pricing compliance standards, further amplifying the damage. Take the U.K.’s Financial Conduct Authority (FCA) as an example. After reviewing 66 insurance firms, they found only 11 – just 16.7% – met their expectations for pricing compliance. Companies unable to prove their pricing models avoided systematic discrimination were publicly called out for their "shortcomings."

"Should any firms fail to end price walking for their home and motor customers we want to be able to hold the firm and appropriate individuals to account." – Financial Conduct Authority (FCA)

Such public scrutiny not only tarnishes a firm’s reputation but also makes it harder to attract new customers.

The financial fallout from non-compliance can be staggering. In May 2022, Allianz SE’s U.S. subsidiary faced a $6 billion penalty for misleading 100,000 customers and investors over the risks of its "Structured Alpha" funds between 2014 and 2020. Similarly, Aon Corporation paid $14.5 million in 2011 for illegal payments to foreign officials across seven countries – a compliance failure that spanned nearly 25 years. These financial penalties are just part of the story; the long-term damage to customer trust and brand reputation can be even more costly.

Reputation, an intangible asset, can account for roughly 30% of a company’s market value. The fallout from a scandal can be devastating. For instance, Danske Bank‘s failure to monitor €200 billion in transactions for money laundering through its Estonian branch in 2017 and 2018 caused its share price to plummet by 50%. The scandal led to leadership resignations, arrests, and the closure of its Estonian operations. Recovering from such reputational harm often takes years – or even decades – and requires substantial investment.

A damaged reputation doesn’t just affect customers; it also impacts talent recruitment, investor confidence, and business partnerships. Job seekers often steer clear of companies with ethical failures, and partners may distance themselves to avoid being associated with controversy. As Sycurio aptly noted:

"Trust requires years to build yet seconds to lose".

This highlights the critical need for strong risk management tools, such as Accounts Receivable Insurance, to safeguard against such risks.

7. Missed Risk Protection with Accounts Receivable Insurance

Non-compliant premium formulation doesn’t just bring penalties and operational headaches – it can also strip away critical risk protections. One of the most glaring vulnerabilities arises when businesses forgo Accounts Receivable Insurance. Without it, companies face heightened exposure to losses caused by non-payment, customer bankruptcy, or defaults. These risks, when paired with regulatory penalties, can create a perfect storm, jeopardizing financial stability and straining already limited resources.

Here’s the reality: accounts receivable often make up 10% to 30% of a company’s total assets. If left uninsured, these receivables – essentially promises to pay – can quickly turn into financial liabilities when customers fail to meet their obligations. For insurers, premium receivables (unpaid premiums tied to active policies) are equally vital. They fuel liquidity and ensure compliance with regulatory solvency requirements.

The consequences of overdue receivables go beyond cash flow issues. They can invite regulatory scrutiny, damage credit ratings, and inflate administrative costs as teams scramble to manage collections. Protecting these assets is not just important – it’s essential.

"If you need a machine and don’t buy it, then you will ultimately find that you have paid for it and don’t have it." – Henry Ford

This is where Accounts Receivable Insurance steps in. These policies cover 75%–95% of outstanding debt, shielding businesses from the financial fallout of customer defaults, bankruptcies, and prolonged payment delays. Beyond stabilizing cash flow, this type of coverage can even improve access to funding. Lenders are more likely to extend credit when they know a company has safeguards in place, helping prevent financial instability and mitigating the ripple effects of non-compliance.

How to Reduce These Risks

Improving compliance doesn’t mean you have to completely overhaul your operations. A good starting point is to implement automated compliance software. RegTech tools can significantly reduce human error in areas like data entry, reporting, and classification. These systems work in real time, tracking changes and flagging discrepancies before they turn into costly regulatory violations. For instance, a major European insurer managed to cut overdue premium rates from 20% to under 8% in just one year by utilizing improved payment channels and stricter credit screening processes.

While automation is a powerful tool, it’s only part of a broader compliance strategy. Keeping well-organized records – such as payroll reports, sales logs, Form 941, and subcontractor certificates – can help reflect your actual risk profile and simplify audits. Additionally, responding to audit notices promptly (within 10 days) and reporting major business changes – like new locations, equipment, or staffing adjustments – within 30 days can help you avoid automatic premium surcharges.

Regular internal audits are another critical step. Conduct self-inspections and control tests to identify compliance gaps before regulators do. Take the example of Paxos Trust: in August 2025, it reached a $48.5 million settlement with the New York Department of Financial Services after regulators uncovered major anti-money laundering (AML) compliance issues. The settlement included a $26.5 million fine and a required $22 million investment in improving its internal compliance systems. Proactive audits can help you avoid such expensive surprises. Beyond internal controls, don’t forget to scrutinize your external partnerships.

Ensure that vendors and subcontractors carry proper insurance. If they don’t, their costs could be reclassified into your payroll during an audit, potentially inflating your premiums. Keeping current certificates of insurance for all subcontractors is a simple way to avoid this issue.

Finally, consider incorporating Accounts Receivable Insurance as part of your compliance toolkit. This type of policy protects your business from the financial fallout of customer defaults or bankruptcies. Maintaining clean audit histories and solid compliance records can make your business more attractive to insurers, helping you avoid coverage denials or being placed in high-risk pools. Plus, when lenders see that you’ve implemented safeguards, they’re more likely to offer credit – helping you sidestep the financial instability that often accompanies non-compliance.

Conclusion

Failing to adhere to premium compliance standards significantly increases financial risks. The figures speak for themselves: non-compliance costs are 2.71 times higher than the expenses required to maintain proper compliance protocols. Once you account for regulatory fines, potential operational shutdowns, damage to credit ratings, and the erosion of customer trust, a single instance of non-compliance can result in an average revenue loss of $4 million.

The repercussions don’t stop there. Financial losses often lead to personal and organizational liabilities. Executives may face personal penalties, including fines of up to $5 million or even 20 years of imprisonment. On top of that, companies risk losing critical contracts and vendor relationships, especially if audit failures result in canceled coverage.

These risks are avoidable with the right strategies in place. Using automated compliance tools, conducting regular internal audits, and maintaining detailed documentation year-round can shield your organization from costly mistakes. Waiting until audit season to organize records can lead to inflated premium assessments that could triple your expenses.

Consider integrating Accounts Receivable Insurance to protect your receivables. Clean, well-maintained compliance records not only reduce financial risks but also improve your standing with insurers and lenders, helping you avoid being classified as high-risk.

FAQs

What are the best ways to ensure compliance in premium formulation?

To stay on the right side of regulations when it comes to premium formulation, businesses need to prioritize strict adherence to legal requirements and implement strong internal controls. It’s essential to stay informed about the latest laws and guidelines that govern premium calculations. Establishing thorough review processes ensures accuracy and compliance across the board. Regularly training staff involved in premium setting is also a must, helping them stay up-to-date with current standards and practices.

Clear and transparent actuarial methods are another cornerstone of compliance. This means documenting assumptions in detail, conducting regular audits, and addressing any discrepancies as soon as they arise. Incorporating compliance tools and embedding checkpoints throughout the product development process can go a long way in reducing risks.

Building a company-wide culture of compliance is just as important. This involves setting clear policies, holding teams accountable, and maintaining ongoing monitoring efforts. Such a proactive approach not only minimizes the chances of penalties or reputational damage but also ensures premium rates remain competitive while meeting regulatory expectations.

How does automating compliance processes help businesses operate more efficiently?

Automating compliance processes allows businesses to work more efficiently by taking over repetitive manual tasks, cutting down on errors, and speeding up reporting. These systems manage data collection, validation, and monitoring in real time, ensuring regulations are consistently followed while saving both time and money.

Another advantage is the centralized oversight automation offers. It helps organizations stay ahead of potential risks and adjust swiftly to new regulatory requirements. By simplifying these processes, companies can avoid expensive fines, minimize delays, and shift their attention to strategic growth instead of constantly reacting to compliance issues.

How does Accounts Receivable Insurance help protect businesses from financial risks?

Accounts Receivable Insurance (ARI) is designed to protect businesses from financial challenges tied to unpaid invoices, customer insolvency, or even political upheavals. These issues can disrupt cash flow and strain operations, but ARI steps in as a safety net, helping businesses maintain liquidity and stay on top of their financial commitments.

ARI policies are flexible, offering solutions tailored to a company’s unique needs. They often include risk evaluations and claims management, which help pinpoint weaknesses early on, minimize potential losses, and bolster financial stability. By addressing these risks head-on, ARI not only helps businesses stay afloat but also shields them from unexpected financial hurdles.