When extending credit, the risk of non-payment or default is always present. Third-party credit data can help reduce this risk by providing real-time insights into buyer behavior, financial health, and potential red flags. This data goes beyond traditional credit scores, offering tools like probability of default scores, payment behavior analysis, and emerging risk factors such as cybersecurity and ESG ratings.

Key takeaways:

- Real-time monitoring helps detect early signs of financial trouble, such as delayed payments or changes in credit terms.

- Alternative data (e.g., trade credit performance, digital footprint, and transaction patterns) fills gaps in traditional credit assessments.

- Accounts Receivable Insurance (ARI) complements credit data by protecting against non-payment, covering up to 90% of losses in some cases.

Credit Risk Mitigation | Exclusive Lesson

sbb-itb-2d170b0

Non-Payment and Default Risks in Trade Credit

Offering trade credit before receiving payment introduces a significant risk of default and late payments, which can throw off your cash flow and disrupt your operations. Economic uncertainties – like rising energy costs and inflation – are making late payments more common. These delays don’t just create administrative headaches; they can leave you scrambling to meet your own financial obligations, putting your business under unnecessary strain.

The impact of unpaid invoices goes beyond just one missed payment. When too much of your capital is tied up in accounts receivable, you face liquidity risk, which can leave you short on cash for immediate needs. On top of that, if your business relies heavily on a single customer, industry, or geographic area – known as concentration risk – a downturn in that sector could jeopardize your entire portfolio.

"Credit risk is the chance of borrower default or declining credit quality. It affects lenders, businesses, and investors, and becomes more severe during economic or interest-rate stress." – TrustDecision

Supply chain issues add another layer of complexity. In Germany, 76% of businesses reported payment delays due to supply chain disruptions. If a key supplier fails, it slows production, delays order fulfillment, and pushes back your ability to collect payments, creating a domino effect on your cash flow. There’s also the risk of credit migration – where a buyer who appears reliable today may be hiding financial troubles, increasing the risk of future defaults.

The financial consequences can be staggering. For example, recovering from a $10,000 unpaid invoice with a 12.5% profit margin requires generating an additional $80,000 in sales – an 800% increase. Meanwhile, global bank credit losses spiked 16% in 2023, highlighting the urgency of proactive risk management. With trade credit insurance covering around $9.5 trillion in global trade annually, the scale of these challenges is clear.

Next, we’ll look at how leveraging third-party credit data can give you the insights needed to spot these risks before they become costly problems.

How Third-Party Credit Data Improves Risk Management

Third-party credit data has transformed risk management by offering real-time buyer insights that go far beyond outdated financial reports. Traditional financial statements might reflect a company’s position from over 45 days ago, but modern credit data providers deliver continuous updates through API integrations that connect directly to your CRM and ERP systems. This means decisions are based on current, actionable data rather than outdated snapshots.

AI-powered sentiment tools and machine learning models take this a step further, predicting credit events up to six to eight months in advance with an impressive Area Under the Curve (AUC) of 0.854, compared to traditional scores at 0.6. These tools enable early risk detection and provide a clearer picture of buyer behavior in real time.

For example, third-party data can reveal subtle behavioral changes – like a shift from 30-day to 75-day payment terms – that traditional audited financials often overlook. Consensus intelligence platforms aggregate anonymized risk assessments from multiple global banks, offering a "market view" of creditworthiness based on real lending decisions and capital exposure. This is particularly helpful since 90% of entities covered by these platforms lack ratings from agencies like S&P, Moody’s, or Fitch.

"Moody’s Pulse turns anonymized, contributed accounts receivable data into forward-looking payment risk insight so credit teams can spot critical changes to their customer’s financial health in time to act with confidence." – Moody’s

Additionally, these providers monitor emerging risk factors like cybersecurity ratings, ESG scores, and geopolitical risks – key indicators of corporate governance and financial stability. With access to trade credit databases covering 600 million pre-scored companies globally, you gain visibility into private SMEs that are often excluded from traditional credit assessments.

"Nine out of 10 times Moody’s has the information I am looking for on my customers and it saves us lots of money from pulling costly reports with other agencies." – Amanda Slusarczyk, National Credit Manager at Flocor

These tools are essential for identifying and managing trade credit risks before they escalate into costly defaults.

Real-Time Buyer Monitoring Benefits

Real-time monitoring builds on continuous updates, allowing businesses to detect early warning signs before they become major issues. A buyer who appears stable today could pose a significant default risk within a year, making "one-and-done" credit assessments a risky approach. With global business insolvencies rising by 19% in 2024 and projected to remain high through 2025, real-time updates are a crucial defense against unexpected defaults.

This approach enables businesses to act quickly. For instance, tracking payment patterns through third-party data feeds can reveal when a customer starts paying invoices later than usual – a subtle but critical signal that often precedes insolvency by months. Consensus data updates, which can occur weekly, provide a timing advantage over traditional quarterly rating cycles. This allows you to adjust credit terms, request additional security, or reduce exposure before small issues turn into significant losses.

"A customer who presents a minimal default risk today might be a significant risk 12 months down the line. Creditworthiness needs to be continually monitored." – Silvia Ungaro, Senior Advisor, Atradius

State Street Corporation‘s Front-Office Risk team offers a practical example. Managing $370 billion in assets, the team integrated consensus credit data to benchmark internal ratings against industry peers. This not only sped up counterparty evaluations but also uncovered new revenue opportunities by safely reassessing overly conservative internal ratings.

"No one else does what you do. Credit Benchmark data makes my job easier." – Eliott Bryson, State Street’s Front Office Risk team

Automated alerts for credit score changes, legal events, or payment delinquency can be set up through API-based data feeds. You can also define maximum credit limits that trigger reviews if breached or when a buyer’s risk status changes.

Filling Information Gaps with Alternative Data

While real-time monitoring enhances immediate risk awareness, alternative data provides deeper insights for a more comprehensive credit assessment. Beyond traditional metrics, alternative data highlights actual payment behavior and operational health, offering a forward-looking perspective rather than just documenting past performance.

For example, payment and trade credit data reveal real B2B transaction behaviors – such as days beyond terms (DBT), payment aging, and vendor payment patterns – that can signal liquidity issues months before they appear in financial statements. This is particularly relevant since trade credit accounts for about 25% of the average firm’s total debt liabilities across 34 countries. In fact, a 2023 report found that 62% of financial institutions now use alternative data to refine risk profiling and credit decisions.

Digital footprint data adds another layer to credit assessment. Providers analyze e-commerce transaction volumes, website traffic, and online sales data to evaluate market presence and operational transparency in real time. For smaller businesses, even income from gig economy platforms like Uber or DoorDash can demonstrate consistent earnings and financial stability.

| Alternative Data Category | Specific Data Points | Benefit |

|---|---|---|

| Trade Credit | Payment aging, days beyond terms, B2B spend trends | Early warning of liquidity/cash flow stress |

| Consensus Data | Aggregated bank internal ratings, PD curves | External validation for unrated/private entities |

| Digital/E-commerce | Online sales volume, website traffic, social reviews | Real-time operational transparency |

| Emerging Risks | ESG scores, cybersecurity ratings, geopolitical risk | Compliance and governance assessment |

The takeaway? Combine data from 2–4 providers to get a well-rounded view, as no single source covers all needs. Watch for payment "stretching" as a key early warning sign of cash flow trouble. Use consensus probability of default (PD) curves to benchmark internal ratings, especially for regulatory compliance with CECL and IFRS 9 standards.

"The Moody’s AR contribution model is a win-win for everyone and provides a value that is much greater than the cost." – Cody Douglas, VP of Credit & Treasury at Texas Enterprises Inc.

Integrating alternative data into your credit strategy strengthens your ability to manage risks effectively.

Steps to Integrate Third-Party Credit Data

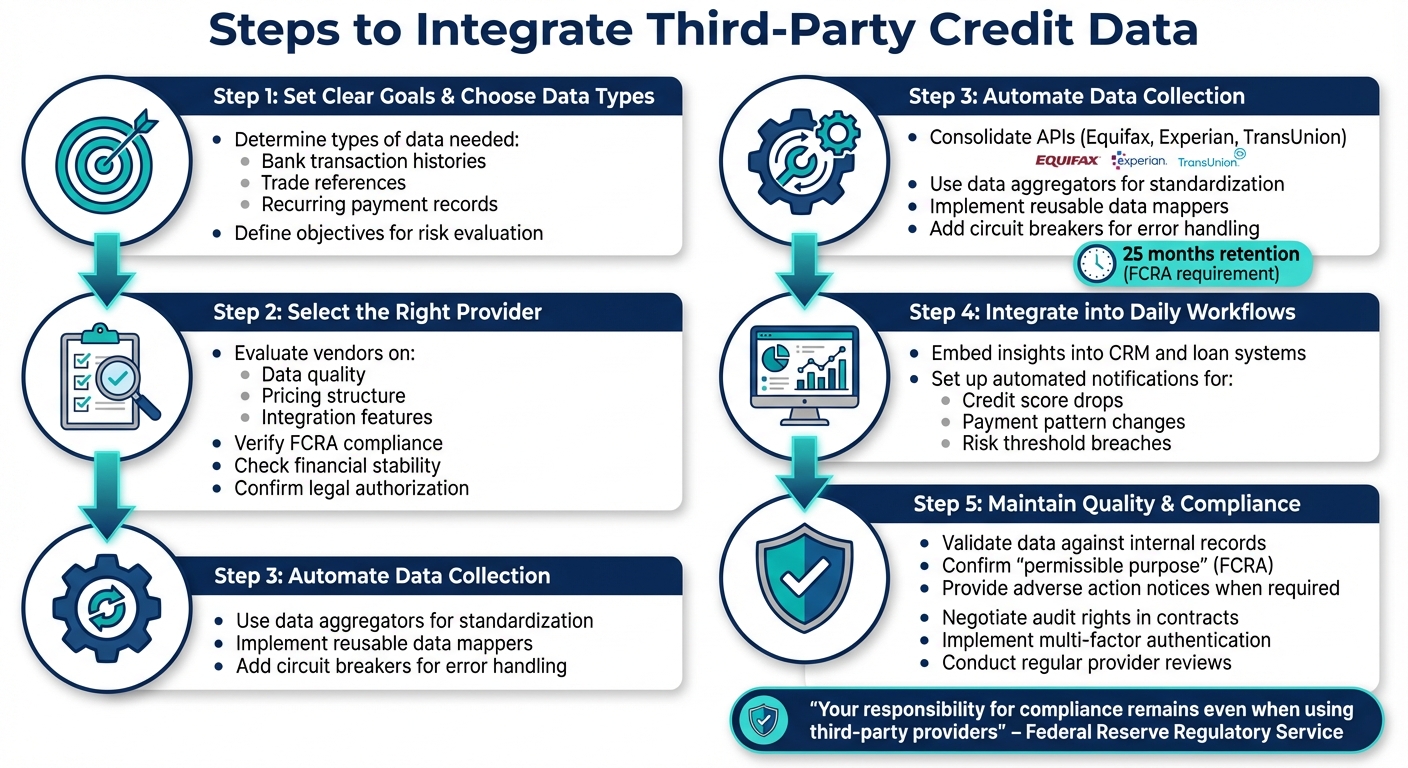

Steps to Integrate Third-Party Credit Data into Your Risk Management System

Integrating third-party credit data starts with setting clear goals to enhance risk evaluation and address non-payment risks early. From there, it’s about balancing technical capabilities with adherence to regulations. First, determine the types of data you need – whether it’s bank transaction histories, trade references, or recurring payment records.

Choosing the right provider requires thorough research. Evaluate vendors based on data quality, pricing, and integration features. It’s also crucial to ensure they comply with Fair Credit Reporting Act (FCRA) standards, have financial stability, and are legally authorized to provide the data you need.

"A banking organization’s use of third parties does not diminish its responsibility to meet [safety and soundness] requirements to the same extent as if its activities were performed by the banking organization in-house." – Federal Reserve Regulatory Service

The technical integration phase involves aligning external data fields with your systems. Collaborate with providers to integrate their feeds into your credit scoring models, loan origination platforms, and decision tools. Start by testing in sandbox environments with synthetic data to avoid triggering real credit inquiries. Once live, keep an eye on metrics like approval and default rates, refining your models based on actual performance. Below, we dive into the key steps for data collection, automation, and compliance.

Automating Data Collection and Standardization

Streamlining your data flow starts with automation. Manual collection is prone to errors and delays. Instead, consolidate APIs to connect with multiple sources, like Equifax, Experian, and TransUnion, through a single integration point. Data aggregators pull information from public records, online sources, and commercial providers, then standardize it into a usable format. Enterprise tools like Oracle Financials use File-Based Data Import (FBDI) templates to bulk-load this data into scoring models.

To build these systems, use reusable data mappers and validation schemas to convert provider JSON/XML payloads into formats your systems can process. Include "circuit breakers" that automatically halt API calls and switch to backup sources if error rates exceed set thresholds. This prevents disruptions from affecting your entire decision pipeline.

Regulations like the FCRA require businesses to retain credit report copies for 25 months when dealing with consumer reports. To ensure compliance, incorporate automated testing into your workflows. This includes unit tests for data transformations and integration tests for API sequences. Map the entire data flow – from customer consent to API calls, response parsing, and downstream routing – to pinpoint potential issues before they impact operations. Programmatic checks should verify and log the "permissible purpose" for every credit data request, keeping your systems aligned with FCRA guidelines.

Adding Credit Insights to Daily Workflows

For credit data to be effective, it must seamlessly integrate into the tools your teams use daily. Whether it’s CRM dashboards, loan origination systems, or account management platforms, decision-makers need real-time access to insights without switching between applications.

Instead of overwhelming users with raw data, design dashboards that highlight actionable alerts. For instance, when a customer’s credit score drops below a set threshold or payment patterns show increased risk, your team should receive immediate notifications. These alerts can trigger reviews of credit limits or payment terms, allowing for proactive risk management.

Timeliness and context are key. When reviewing an account, teams should see up-to-date credit standings, payment trends, and risk flags alongside customer details and order history. Automated workflows can route high-risk accounts for manual review while processing low-risk renewals automatically.

Before fully rolling out these systems, test them with real-world scenarios. Monitor how quickly teams respond to alerts, evaluate the actions they take, and determine whether the insights are driving better decisions. Adjust thresholds and dashboard layouts based on feedback to avoid alert fatigue and ensure critical risks aren’t overlooked.

Maintaining Data Quality and Compliance

Accurate data is critical for informed decision-making. Regularly validate third-party reports against your internal records. For example, if a provider marks a customer as current while your records show consistent late payments, investigate the discrepancy – it could signal a problem with the data source.

Compliance is non-negotiable and remains your responsibility, even when working with third-party providers. Before accessing any consumer credit report, confirm you have a valid "permissible purpose" under the FCRA and certify this compliance to the credit reporting agency. If a credit decision negatively impacts a consumer, provide an adverse action notice that includes their credit score, the reporting agency’s contact information, and details on how to dispute the information.

"You are responsible for regulatory compliance when requesting and using consumer reports, which includes adhering to all applicable federal and state statutes and regulations." – Experian

It’s also important to negotiate audit rights into vendor contracts. This allows you to review their SOC reports, business continuity tests, and security certifications. Providers should notify you immediately of breaches, service disruptions, or major operational changes. Clearly define data retention and destruction policies to comply with privacy laws like GDPR or CCPA, specifying how long data is stored and the protocols for its disposal.

| Stage | Compliance & Quality Best Practice |

|---|---|

| Pre-Integration | Verify "permissible purpose" and certify compliance to the CRA |

| Due Diligence | Review the provider’s security program and SOC reports |

| Contracting | Define data use, retention, and destruction limits |

| Post-Decision | Provide adverse action notices with credit score details |

| Ongoing | Monitor provider changes in strategy, leadership, or risks |

Lastly, secure your systems with multi-layered protections like multifactor authentication, end-to-end encryption, and secure source code management. Conduct background checks on third-party personnel who handle sensitive data, and ensure providers have procedures to remove unsuitable employees. Prepare contingency plans to transition to alternative providers or bring operations in-house if a vendor fails to meet expectations.

"Relying solely on experience with or prior knowledge of a third party is not an adequate proxy for performing appropriate due diligence." – Federal Reserve Regulatory Service

Solving Integration Problems and Getting Better Results

Even with thorough preparation, integrating third-party credit data can bring unexpected hurdles. One major issue is reliance on a single provider. If that provider changes its pricing, access rules, or scoring methods, your entire risk model could collapse overnight. A clear example of this occurred in early 2023 when Twitter transitioned from free API access to a costly enterprise model, upending systems that depended on their data.

Another complication is the lack of transparency in proprietary data. When providers don’t disclose how their data features are created, it becomes difficult to explain credit decisions to regulators or auditors. Relying too heavily on one source can be risky, as shown in the LinkedIn vs. hiQ Labs case (2019–2021), where restricted access disrupted data flows and delayed products.

Model drift poses yet another problem. Vendors may alter their data collection methods or scoring logic without notice, leading to a decline in model accuracy. To address these risks, businesses can integrate multiple layers of data – technical (IP/device), behavioral (online activity), and transactional (payment patterns) – and use standardized, vendor-agnostic APIs. Regularly testing for outages in sandbox environments can reveal weak points, while modular model designs allow for quick replacements of data signals without overhauling the entire system.

Managing Data Privacy and Security

Navigating these challenges requires strict attention to data privacy and security. Even when working with third parties, businesses must uphold high standards for data protection. Starting January 1, 2026, organizations subject to the California Consumer Privacy Act (CCPA) must conduct annual cybersecurity audits and regular risk assessments. Additionally, new rules will give consumers the right to access and opt out of Automated Decision-making Technology (ADMT) used in credit scoring systems.

"Engaging a third party does not diminish or remove a bank’s responsibility to operate in a safe and sound manner and to comply with applicable legal and regulatory requirements… just as if the bank were to perform the service or activity itself."

– Federal Reserve

During due diligence, confirm that providers implement robust security measures like multifactor authentication, end-to-end encryption, and secure source code management. Contracts should include provisions for audits, such as reviewing monthly business continuity test reports and conducting inspections. Clear timelines for reporting data breaches or security incidents are also essential.

Another area to address is "fourth-party" risks – when your third-party providers rely on their own vendors. To mitigate this, review SOC reports, independent certifications, and the financial health of providers using audited statements and SEC filings.

Scaling Risk Monitoring for Business Growth

Once integration and security issues are under control, the next step is scaling risk monitoring to support growth. Manual assessments simply can’t keep up with increasing application volumes, which makes automation a key solution. For example, Cherry Technologies, a healthcare-focused buy now, pay later provider, tackled this issue in 2023. By automating underwriting and litigation checks, they tripled onboarding rates and reduced processing times for low-risk cases to just seconds.

"Coris helped us identify a practice that would have exposed us to nearly $100K in losses. That single event speaks to the value of their litigation and bankruptcy checks."

– Scott Monaco, VP of Practice Intelligence & Risk at Cherry Technologies

Effective scaling involves moving beyond one-time onboarding to continuous monitoring. Automated alerts for litigation, bankruptcy filings, and negative media coverage ensure ongoing oversight. While a false-positive rate of around 30% for risk alerts is considered acceptable, tiered risk management – allocating resources based on the importance of each relationship – helps optimize efforts.

Managing Costs While Maintaining Quality

Balancing cost and quality in integration is essential for effective risk management. Start by conducting a cost-benefit analysis to understand the value of your data investments. Compare expenses like data acquisition and integration against benefits such as higher approval rates and fewer defaults. The growing use of alternative data highlights its potential advantages.

Smaller businesses often struggle to negotiate favorable contract terms, which can lead to agreements lacking key audit rights or data access provisions. One solution is group negotiation, where multiple organizations collaborate to secure better deals. Industry consortiums and shared due diligence efforts can also help reduce costs without sacrificing quality.

Another cost-saving measure is data minimization – only collect the information necessary for your risk assessments. This not only reduces expenses but also ensures compliance with privacy laws like GDPR. Validating incoming data through robust mechanisms to cleanse, format, and verify accuracy is equally important. As Scott Monaco advises:

"Be holistic and specific about what you want from your risk platform. Communicate your needs, run a pilot, and see if the product delivers."

– Scott Monaco, VP of Practice Intelligence & Risk at Cherry Technologies

Finally, focus on high-value data sources that demonstrably improve decision-making. Regularly track performance metrics and eliminate data feeds that don’t justify their cost. This approach ensures you’re getting the most out of your investment while maintaining the quality needed for reliable risk management.

Using Accounts Receivable Insurance with Credit Data

Third-party credit data can provide helpful insights into buyer reliability, but it doesn’t eliminate the risk of non-payment. That’s where accounts receivable insurance (ARI) steps in. ARI not only validates credit data but also offers financial protection, transforming it into a proactive tool for smarter credit decisions. When paired with real-time credit insights, ARI helps businesses move from merely reacting to problems to preventing them altogether.

The trade credit insurance market reflects this growing need. Globally, it was valued at $9.39 billion in 2019 and is expected to reach $18.14 billion by 2027, growing at an annual rate of 8.6%. This surge gained momentum after the economic challenges of 2020, as businesses sought better safeguards against buyer defaults. Interestingly, ARI coverage is quite affordable, usually costing less than 1% of the insured sales volume.

Custom Policies for Domestic and International Markets

ARI providers offer flexibility, tailoring coverage to match specific business needs. Whether you’re insuring your entire portfolio, focusing on high-risk buyers, or protecting a single major account, there’s an option to fit. For businesses expanding internationally, insurers use global credit data to assess potential buyers in regions where local credit information might be sparse.

For example, the Export-Import Bank of the United States (EXIM) provides policies that cover 85% to 95% of the invoice amount against risks such as foreign buyer insolvency or political issues like trade embargoes, government interference, or conflicts. Standard ARI policies often cover up to 90% of the debt if recovery becomes impossible. This extends beyond commercial risks, offering protection against political uncertainties that credit data alone cannot predict.

Jason Benson, Global Head of Structured Working Capital at J.P. Morgan, highlights the importance of thorough research:

"Sellers should know their clients better than anybody. If a company isn’t doing its due diligence, it may be purchasing more insurance than is otherwise needed, or its insurance may be more expensive than it should be."

Tailored coverage like this allows businesses to address risks proactively and intervene early when warning signs appear.

Risk Assessments and Early Intervention

ARI providers continuously monitor the financial health of buyers using extensive credit databases. They send real-time alerts when a buyer’s credit rating drops or their credit limit is reduced. These alerts act as early warnings, giving you the chance to renegotiate payment terms, limit your exposure, or even require prepayment before a default occurs.

Another way to use ARI is during the onboarding process. By checking if a prospective buyer qualifies for insurance, you can identify potential risks early. A low insurance limit can serve as an objective indicator of elevated risk, shifting decisions away from gut feelings to data-driven assessments.

"When used as more than a checkbox, trade credit insurance transforms from a fallback into a forecasting tool, a negotiation edge, and a shield against customer collapse."

Effective ARI management also includes regular portfolio reviews – ideally every quarter. This allows you to adjust coverage, dropping clients who no longer justify the risk and reallocating limits to accounts with growth potential or higher risk. Informing clients that their accounts are insured by a third party can also encourage better payment behavior, as it signals that credit decisions are being closely monitored.

While ARI helps identify risks early, it also ensures that you’re covered when defaults occur.

Full Protection Against Non-Payment

ARI offers comprehensive protection against issues like buyer insolvency, bankruptcy, prolonged default, and political risks. If a debt becomes unrecoverable, insurers typically cover up to 90% of the owed amount, depending on the policy terms. Many policies also include professional debt collection services, where the insurer steps in to negotiate with liquidators or receivers, helping recover funds while preserving customer relationships.

Banks often view insured receivables as lower-risk collateral, which can improve financing terms. This creates an opportunity to offer more attractive credit terms or higher limits to your buyers without exposing your business to unnecessary risk. However, it’s worth noting that ARI generally doesn’t cover payment disputes – insurers typically pay only on undisputed amounts.

Jason Benson underscores the importance of vigilance:

"If a customer’s credit begins to deteriorate or they’re not paying, and you continue to sell to them, that may be a potential issue. The policy coverage also needs to match how your business operates."

The real value of ARI lies in embedding it into your credit policy from the outset. It’s not just a safety net for unpaid invoices – it’s a tool for market expansion, a way to validate credit decisions, and a shield against risks that even the most detailed credit reports can’t foresee. Together, these strategies help create a comprehensive approach to risk management, building a stronger, more resilient credit strategy.

Conclusion: Creating a Strong Risk Mitigation Plan

Building an effective risk mitigation plan means layering multiple protective measures. Using third-party credit data provides early visibility into potential issues – sometimes as much as 6 to 8 months before significant credit events occur for major firms. But relying on data alone isn’t enough to shield your business from unexpected challenges like trade sanctions, political instability, or sudden buyer bankruptcies. That’s where Accounts Receivable Insurance (ARI) steps in, covering risks that even the most advanced credit models can’t predict.

To strengthen your strategy, combine internal and external data sources and align insurance coverage with your specific market exposure. By integrating transaction histories, credit bureau insights, and real-time monitoring with ARI policies, you create a system that not only anticipates risks but also actively protects against them. Financial institutions often view businesses with such robust frameworks as lower-risk borrowers, which can lead to better financing opportunities.

"Trade credit insurance is more than just a safety net. It is a strategic tool that empowers your business to navigate the complexities of international trade with confidence." – ARI Global

When monitoring systems detect signs of buyer stress, act quickly. Adjust credit limits or renegotiate terms to address potential issues before they escalate. This proactive approach, supported by data-driven insights and insurance safeguards, helps you stay ahead of potential losses.

For successful businesses, risk management isn’t a one-time task – it’s an ongoing priority. By continuously refining data sources, updating insurance coverage as your portfolio changes, and adhering to clear policies on data security and compliance, you create a resilient foundation for growth. This integrated approach turns risk management into more than just a defensive measure – it becomes a strategic advantage that fuels long-term success.

FAQs

How can integrating third-party credit data help businesses reduce financial risks?

Integrating third-party credit data gives businesses a sharper edge in managing financial risks by providing a more comprehensive and dynamic picture of a customer’s financial health. Traditional credit assessments often lean heavily on historical financial data, but third-party credit data goes beyond that. It brings in alternative insights like payment patterns, market trends, and other predictive signals, offering a clearer view of potential risks.

With this data in hand, businesses can make smarter decisions – whether it’s setting credit limits, pre-qualifying customers, or assessing risks more accurately. It’s particularly helpful for evaluating private companies or navigating international transactions, where traditional credit ratings might not provide enough clarity. This proactive approach not only helps reduce the chances of bad debt but also strengthens overall financial stability.

How does combining accounts receivable insurance with third-party credit data help mitigate financial risks?

Combining accounts receivable insurance (ARI) with third-party credit data creates a smart approach to managing financial risks. ARI helps protect businesses against losses from non-payment, bankruptcy, or even political issues, ensuring a steady cash flow. When you add third-party credit data – like creditworthiness assessments and real-time risk tracking – businesses gain a clearer picture of their customers’ financial health, enabling smarter credit decisions.

This combination empowers companies to spot potential risks early, adjust credit limits as needed, and react quickly to shifting market conditions. By using both insurance protection and detailed credit insights, businesses can extend credit with confidence while keeping financial losses in check.

Why is real-time credit monitoring important for reducing financial risks?

Real-time credit monitoring plays a crucial role in managing financial risks because it keeps businesses informed about a customer’s financial status as it changes. Instead of relying on periodic updates, continuous monitoring helps spot early warning signs like a drop in credit scores or signs of financial trouble. This allows businesses to respond quickly and reduce potential losses.

With instant alerts, companies can make timely adjustments – whether that means revising credit terms, lowering limits, or starting collection efforts before a situation worsens. This proactive approach not only helps avoid defaults and missed payments but also supports better cash flow and more effective risk management. In a fast-moving economy, having access to the latest financial data ensures businesses can make smarter, more informed credit decisions.