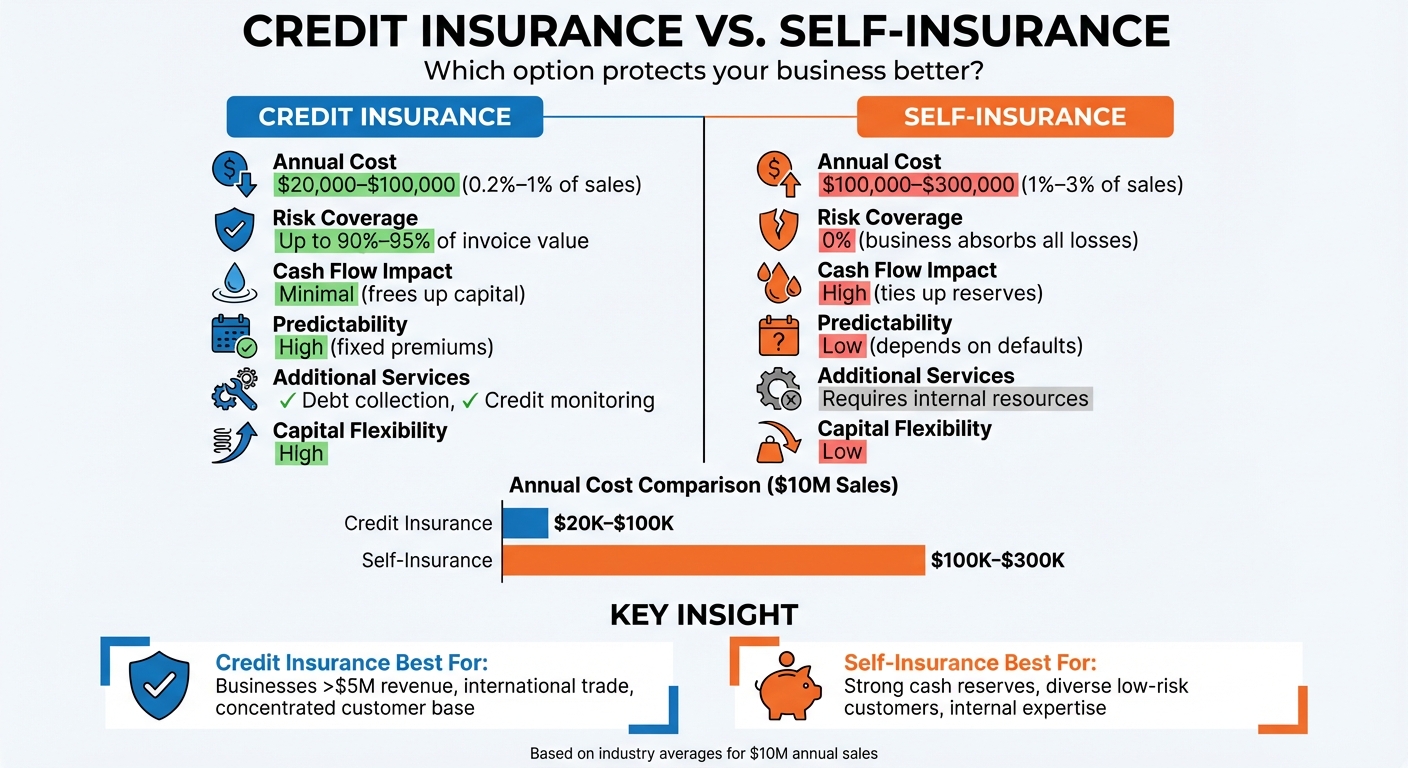

Credit insurance and self-insurance are two ways businesses can handle the risk of unpaid invoices. Here’s the quick takeaway:

- Credit Insurance: You pay a small, predictable premium (usually less than 1% of sales) to transfer risk to an insurer. They cover up to 90%-95% of losses if a customer defaults. It also frees up working capital and provides extra perks like debt collection services.

- Self-Insurance: You set aside your own funds (typically 1%-3% of sales) to cover bad debts. While it avoids premiums, it ties up cash and leaves you exposed to full losses if defaults occur.

Which is better?

Credit insurance works well for businesses with higher revenue, concentrated customer bases, or those expanding into new markets. Self-insurance suits companies with strong cash reserves and low-risk customer profiles.

Here’s a quick comparison:

| Factor | Credit Insurance | Self-Insurance |

|---|---|---|

| Annual Cost (10M Sales) | $20,000–$100,000 (0.2%-1%) | $100,000–$300,000 (1%-3%) |

| Risk Coverage | Up to 90%-95% of invoice value | 0% (business absorbs all losses) |

| Cash Flow Impact | Minimal (frees up capital) | High (ties up reserves) |

| Predictability | High (fixed premiums) | Low (depends on defaults) |

| Additional Services | Debt collection, credit monitoring | Requires internal resources |

For businesses relying on steady cash flow or facing unpredictable risks, credit insurance offers peace of mind and financial flexibility. Self-insurance may save on premiums but can lead to greater exposure and opportunity costs.

Credit Insurance vs Self-Insurance Cost Comparison for $10M Business

Direct Costs: Premiums vs. Reserves

Credit Insurance Premiums

Credit insurance premiums are calculated as a percentage of your annual sales, usually falling between 0.2% and 1% of your insured turnover. On average, businesses pay around 0.25% of sales.

To put this into perspective, a business generating $20 million in annual sales would pay less than $50,000 annually in premiums. This cost is fixed, meaning it doesn’t change regardless of whether customers default. This predictability makes it easier to plan for in your yearly budget and financial forecasts.

Self-Insurance Reserves

Self-insurance operates differently. Instead of paying a fixed premium, businesses allocate cash reserves to cover potential bad debts. These reserves vary based on factors like risk exposure, customer creditworthiness, and the frequency of defaults.

Typically, businesses reserve between 1% and 3% of their turnover to cover losses. For a $10 million business, this means setting aside $100,000 to $300,000. A single large default can deplete these reserves quickly. As Coface explains:

"Self insurance funds can quickly dry up and, suddenly, the cost of a premium is a small fraction to the overall impact to your business".

In addition to the reserves themselves, self-insurance often requires higher internal costs. Tasks like assessing risk, monitoring customer credit, and managing collections demand either dedicated staff or external services.

Cost Comparison Table

| Cost Factor | Credit Insurance ($10M Turnover) | Self-Insurance ($10M Turnover) |

|---|---|---|

| Annual Direct Cost | $20,000 – $100,000 (0.2% – 1% premium) | $100,000 – $300,000 (1% – 3% reserves) |

| Predictability | High (Fixed percentage of sales) | Low (Fluctuates with defaults) |

| Cash Flow Impact | Minimal (Predictable expense) | High (Capital locked in reserves) |

| Risk Coverage | Up to 90% of invoice value protected | 0% protected (100% loss absorbed) |

| Additional Services | Includes monitoring and debt collection | Requires internal staff or third-party fees |

| Capital Flexibility | High (Frees up working capital) | Low (Ties up capital on balance sheet) |

One of the most noticeable differences is predictability. With credit insurance, you know exactly what you’ll spend, making it easier to manage. On the other hand, self-insurance can leave you uncertain about how much cash you’ll need when a customer fails to pay.

Next, we’ll explore how these options impact opportunity costs and financial flexibility.

sbb-itb-2d170b0

Opportunity Costs and Financial Flexibility

Capital Tie-Up in Self-Insurance

Opting for self-insurance means locking up cash that could otherwise fuel growth. Bad debt reserves sit idle, offering no return on investment.

But the effects don’t stop there. Companies without insurance often impose conservative credit limits on their customers to avoid potential financial disasters. While this approach reduces risk, it also restricts sales opportunities and stunts growth. As Allianz Trade puts it:

"Self insurance requires companies to tie up important sources of capital in large bad-debt reserves and credit insurance does not. With credit insurance in place, companies can deploy their capital where it is needed most – as working capital that supports growth or through capital investment that spurs innovation".

Additionally, the effort required to manage self-insurance can pull resources away from core business activities that drive revenue.

Credit insurance, on the other hand, keeps your capital free and boosts financial flexibility, as explained below.

Liquidity and Financial Benefits of Credit Insurance

With credit insurance, instead of locking up funds in reserves, you pay a predictable premium – usually less than 1% of your insured sales – and free up the rest for strategic initiatives. That freed-up capital can go toward hiring staff, increasing inventory, or exploring new markets.

This liquidity advantage also strengthens your relationship with lenders. Banks view insured accounts receivable as secure collateral, which can help you secure better loan terms and larger credit lines. In contrast, uninsured receivables are often seen as risky, limiting your borrowing options.

Credit insurance also allows you to confidently extend competitive payment terms – 30, 60, or even 90 days – without the fear of cash flow issues. This flexibility can give you the edge when vying for larger contracts. As iwoca highlights:

"Trade credit insurance is an important tool that gives businesses… more freedom and room to grow, without having to worry about cash flow or holding back much-needed investment".

For exporters, credit insurance offers additional protection against political risks like trade embargoes or currency restrictions – risks that self-insurance simply can’t address.

Risk Analysis and Break-Even Points

Break-Even Scenarios

When assessing financial risks, identifying break-even points helps determine whether insurance is a worthwhile investment. Credit insurance proves its value when the annual premium is relatively small compared to the potential loss from a major customer default.

Take, for example, a distributor with $100 million in annual sales, paying about $200,000 annually in premiums. If their largest customer defaults on $1.5 million, self-insurance would mean absorbing the entire $1.5 million loss. With credit insurance covering 90% of the loss, the insurer pays $1.35 million. In this case, the business faces a $350,000 total cost (a $150,000 uncovered portion plus the $200,000 premium), compared to the full $1.5 million loss without insurance. This results in a net benefit of $1.15 million from a single claim.

Smaller businesses also benefit in a similar way. A company with $20 million in sales might pay an annual premium of $50,000. If a customer defaults on $500,000, self-insurance means absorbing the entire amount. However, with credit insurance, the loss is reduced to $100,000 (a $50,000 premium plus a $50,000 uncovered portion), saving the company $400,000.

Next, let’s explore how recovery rates further distinguish these two approaches.

Recovery and Payouts

The contrast in recovery rates is striking. Credit insurance typically reimburses 80%–90% of unpaid invoices, with exporters often receiving 85%–95% coverage. On the other hand, under self-insurance, businesses recover nothing and must absorb the entire loss. These recovery benefits also enhance liquidity, as previously discussed.

Another advantage of credit insurance is the inclusion of professional debt collection services. Without insurance, businesses must handle collections internally or hire external agencies, adding extra costs to an already challenging situation.

The table below highlights these differences in risk scenarios:

Risk Comparison Table

| Risk Scenario | Self-Insurance (100% Loss) | Credit Insurance (90% Coverage + Premium) | Net Benefit of Insurance |

|---|---|---|---|

| No Defaults ($20M Sales) | $0 | $50,000 (Premium) | –$50,000 |

| Single Default ($100,000) | $100,000 | $60,000 ($50,000 Premium + $10,000 Uncovered) | +$40,000 |

| Major Default ($500,000) | $500,000 | $100,000 ($50,000 Premium + $50,000 Uncovered) | +$400,000 |

| Multiple Defaults ($1M) | $1,000,000 | $150,000 ($50,000 Premium + $100,000 Uncovered) | +$850,000 |

This table clearly shows that even one major default can offset several years’ worth of premiums. For companies with a concentrated customer base or those operating in unpredictable markets, the break-even point is often reached quickly, highlighting the steep cost of going uninsured.

When to Choose Credit Insurance or Self-Insurance

When Credit Insurance Works Best

Credit insurance is a smart choice for businesses generating over $5 million in annual revenue. For companies of this size, even a single customer default could have serious financial consequences. With premiums typically under 1%, credit insurance offers a cost-effective way to safeguard against such risks.

It’s especially valuable for businesses involved in international trade. Beyond covering insolvency, credit insurance can protect against political risks. For example, the Export-Import Bank of the United States provides coverage for 85–95% of losses, offering peace of mind when trading across borders.

If you’re expanding into new markets or dealing with unfamiliar customers, credit insurance can help mitigate the risks associated with limited knowledge about these buyers. Major insurers like Coface and Allianz Trade maintain financial data on 80 to 83 million companies worldwide. This database can provide valuable insights, helping you make informed decisions about extending credit.

Liquidity is another factor to consider. If a large default could threaten the survival of your business, credit insurance becomes a safety net. It not only covers a significant portion of potential losses but also enhances your ability to secure better financing terms. Banks often view insured receivables as lower-risk collateral, which can lead to more favorable loan conditions.

When Self-Insurance Works Best

On the other hand, self-insurance might be the better route for companies with substantial financial reserves and a customer base that poses minimal risk. However, it’s not without its challenges.

Self-insurance requires a high level of internal expertise. You’ll need teams skilled in due diligence, collections, and legal processes to manage credit risks effectively.

"Sellers should know their clients better than anybody. If a company isn’t doing its due diligence, it may be purchasing more insurance than is otherwise needed, or its insurance may be more expensive than it should be."

– Jason Benson, Global Head of Structured Working Capital, J.P. Morgan

For companies with significant cash reserves and conservative credit policies, self-insurance can work, particularly in industries where formal credit terms are less common. That said, even these businesses aren’t immune to catastrophic risks – those rare but severe losses that can be nearly impossible to predict or absorb.

Pros and Cons Table

| Factor | Credit Insurance | Self-Insurance |

|---|---|---|

| Cost Predictability | High (fixed premiums) | Low (depends on loss frequency) |

| Capital Impact | Frees up working capital | Ties up capital in reserves |

| Risk Coverage | Covers up to 90–95% of invoice value | 0% (business absorbs all losses) |

| Business Intelligence | Access to global risk databases | Limited to internal/third-party data |

| Scalability | High; supports aggressive growth | Low; limited by cash reserves |

| Administrative Burden | Insurer handles collections and claims | High (requires internal teams) |

Understanding these factors can help you decide which approach aligns best with your business needs. Whether you choose credit insurance or self-insurance, the decision should reflect your financial stability, risk tolerance, and growth goals.

Conclusion: Making the Right Choice

Key Takeaways

When comparing credit insurance and self-insurance, the differences in capital use, risk exposure, and growth opportunities are striking. Credit insurance typically costs less than 1% of the insured sales volume and can cover up to 90% of unpaid invoices. On the other hand, self-insurance avoids upfront premiums but places the full burden of bad debt on the business, tying up capital that could otherwise drive growth.

One of the biggest advantages of credit insurance is its ability to free up funds and enhance borrowing power. In contrast, self-insurance locks away resources, often costing businesses more in lost growth potential than the modest premiums of credit insurance.

The risks are also starkly different. Self-insured businesses face unlimited downside risk, which can be devastating if a major client defaults. Credit insurance, however, limits the potential losses to the policy deductible. For companies with a concentrated customer base or tight cash flow, this safety net can be the difference between surviving a financial hit and going under.

Final Recommendations

The findings clearly outline when each approach works best. Credit insurance is ideal for businesses generating over $5 million in annual revenue, expanding into new markets, or relying on a small number of large customers. It’s especially valuable for international trade, where the Export-Import Bank of the United States offers coverage for 85% to 95% of invoice amounts. Beyond risk protection, credit insurance provides access to global risk databases, professional debt recovery services, and improved financing terms, making it a tool for growth rather than just a safeguard.

Self-insurance, on the other hand, might suit businesses with significant cash reserves, a highly diverse customer base, and strong internal credit management systems. Even in these cases, it’s crucial to weigh the opportunity cost of tying up capital against the relatively small expense of credit insurance premiums. For those seeking more limited support, standalone credit decision tools can complement internal processes without requiring a full insurance policy.

FAQs

What are the key advantages of credit insurance compared to self-insurance?

Credit insurance brings a range of advantages that make it a better option than self-insurance for shielding your business from financial risks. One standout benefit is the ability to recover up to 90% of unpaid invoices, which can significantly soften the blow of customer payment defaults. This means your cash flow remains steady, and you won’t need to tie up large reserves to cover potential bad debts. Instead, you can direct those funds toward growth and expansion.

Beyond financial recovery, credit insurance also gives you access to expert services like risk assessments, claims management, and market insights. These tools help you make smarter decisions and steer clear of unexpected losses. In contrast, self-insurance leaves your business vulnerable to unpredictable and potentially large financial hits, making credit insurance a more dependable and well-rounded way to manage risks.

How does credit insurance help improve cash flow and financial flexibility for businesses?

Credit insurance plays a key role in helping businesses manage their cash flow and maintain financial flexibility. By shielding companies from risks like customer insolvency or non-payment, it allows them to offer more attractive credit terms without the constant worry of substantial losses.

Another advantage is how it can improve access to financing. Lenders often see insured receivables as less risky, which makes them more willing to provide funding. On top of that, businesses can avoid tying up large amounts of capital in reserves for potential bad debts. This means more resources can be directed toward growth and other essential operations. In essence, credit insurance acts as a safety net, offering both stability and the freedom to adapt financially.

When is self-insurance a better choice than credit insurance?

Self-insurance might work well for businesses with strong financial reserves that can easily absorb losses from unpaid invoices. It can also be a practical choice for smaller or stable companies with steady cash flow and limited dealings with high-risk clients.

The decision to opt for self-insurance often hinges on whether the cost of credit insurance exceeds the potential financial risks. Businesses that consistently experience predictable payment patterns and have a solid grasp of their customers’ credit reliability may find self-insurance a more budget-friendly alternative.