Performance bonds are financial tools that protect buyers in export contracts by guaranteeing an exporter’s performance. If the exporter fails to fulfill the contract, the bond compensates the buyer for losses. These bonds, often issued as standby letters of credit, help exporters secure international contracts, especially in competitive markets or with new buyers. Typically covering 5-25% of the contract value, they instill buyer confidence and mitigate risks like delayed shipments or poor-quality goods.

Key points about performance bonds:

- Purpose: Protect buyers if exporters fail to meet contract terms.

- Types: Include bid bonds, performance bonds, maintenance bonds, and payment bonds, each serving different phases of a contract.

- Costs: Premiums range from 0.5% to 10% of the bond amount, with collateral often required.

- Support: Programs like EXIM Bank’s Working Capital Loan Guarantee reduce collateral requirements to 25%, easing financial strain for exporters.

Performance bonds are essential for exporters looking to build trust, secure contracts, and manage risks effectively.

When and Why to Use Performance Bonds

Assessing Contract Requirements

Before diving into any contract, it’s crucial to understand your buyer’s expectations and the nature of the agreement. In situations like new business relationships or competitive bidding, performance bonds are often non-negotiable for export contracts. Daniel Ford, Business Development Specialist at EXIM Bank, emphasizes:

"Performance bonds are often required by buyers to award international contracts, particularly when buyers and sellers do not have established relationships."

For international competitive bidding, performance bonds are practically a given. Whether you’re vying for a government contract, a public works project, or a large-scale commercial development, expect this requirement to be part of the process. Similarly, buyers offering advance payments typically demand performance bonds to ensure they can recover their funds if the project isn’t completed as agreed.

When reviewing tender documents or RFPs, watch for terms like "standby letters of credit", "performance guarantees", or "surety bonds". If the project involves public funding or substantial financial investment, it’s essential to account for the bond’s costs and any collateral requirements right from the proposal stage. By clarifying contract requirements early on, exporters can better assess how performance bonds can work to their advantage.

Benefits of Performance Bonds for Exporters

While performance bonds are primarily designed to protect buyers, they also provide exporters with valuable benefits. One key advantage lies in strengthening your competitive position. As EXIM Bank notes:

"A U.S. exporter’s ability to provide a foreign buyer with a bid or performance bond can often be the difference between making and missing a sale."

Without this assurance, you risk losing out on important contracts. Offering a performance bond not only builds trust and credibility with buyers but can also pave the way for securing larger contracts and entering new markets – even if you’re a smaller company or venturing into unfamiliar territories. This added layer of confidence helps reduce disputes during contract execution and fosters smoother partnerships.

From a financial perspective, programs like EXIM Bank’s Working Capital Loan Guarantee can significantly ease the collateral burden. Unlike the typical 100% collateral requirement from commercial banks, this program reduces it to just 25%. This adjustment frees up more working capital, allowing you to focus on fulfilling contracts instead of tying up cash as security. Moreover, the program covers 90% of the lender’s repayment risk, making it easier for banks to issue bonds even to exporters who might not qualify under standard criteria. Up next, we’ll dive into the main types of performance bonds to help you determine the best fit for your contract.

sbb-itb-2d170b0

Types of Performance Bonds for Export Contracts

Main Types of Performance Bonds

Understanding the different types of performance bonds can help you match the right guarantee to each phase of your contract. Let’s break it down:

- Bid Bonds: These bonds ensure the bidder’s commitment during competitive bidding processes. They are commonly required in international competitive bidding to guarantee that the winning bidder will fulfill the contract if selected. For small businesses, the SBA offers bid bonds without charging a fee.

- Performance Bonds: After a contract is awarded, performance bonds provide assurance that the contract will be completed as agreed. These bonds typically cover anywhere from 5% to 25% of the total contract value. For contracts involving upfront payments, an advance payment bond is used to protect the initial down payment. SBA-guaranteed performance and payment bonds come with an affordable guarantee fee of just 0.6% of the contract price.

- Maintenance Bonds: Also known as warranty bonds, these extend protection beyond the delivery of goods or services. They cover post-completion obligations, such as warranty work or ongoing services.

- Payment Bonds: These ensure that suppliers and subcontractors are paid on time, which is especially critical in construction-heavy export contracts. Without payment bonds, unpaid vendors could place liens on the project, causing delays or legal complications.

Each of these bonds serves a specific purpose, providing security at different stages of your contract.

Selecting the Right Bond for Your Contract

Once you understand the bond options, it’s important to align them with the specific requirements of your project. Start by reviewing tender documents or RFPs to identify which bonds are mandatory. The project’s phase will guide your choice:

- Use a bid bond to secure the contract during the bidding stage.

- Transition to a performance bond once the contract is awarded.

- Add a maintenance bond if your contract includes warranty periods or ongoing service requirements.

Financial considerations also play a big role. Banks often require 100% collateral for standby letters of credit used as bonds, which can strain cash flow. To ease this burden, explore financial tools that reduce collateral requirements. For example, some programs cover 90% of the lender’s repayment risk, freeing up your capital for actual contract execution.

When working with third-party suppliers, payment bonds are essential to ensure timely payments and to prevent potential liens on the project. By carefully selecting the right bond type, you can align your guarantees with your export strategy and keep your project running smoothly.

Ex-Im Bank Webinar Series (1 of 3): Access Capital to Fulfill Your Orders” Webinar

How to Obtain a Performance Bond: Step-by-Step Guide

Performance Bond Premium Costs by Credit Score and Bond Amount

Preparing for Bond Acquisition

Before applying for a performance bond, make sure to gather all the necessary documents. This typically includes financial records such as balance sheets, income statements, and tax returns from the past two to three years. You’ll also need your export contract or bid documents, a letter of guarantee, a profile of your foreign buyer, and proof of your business registration and licensing.

Start by securing a nonbinding letter of bondability from a surety company. This letter will help you understand your bonding capacity. For smaller projects, a credit check may suffice, but larger international contracts often require audited financial statements and a detailed tax history spanning several years.

It’s also important to research the buyer’s country. Surety providers will evaluate the economic conditions and political stability of the buyer’s location when determining your eligibility. If cash reserves are limited, look into programs that allow export-related assets to be used as collateral. Assets like export-related inventory, accounts receivable, or work-in-progress can often be used instead of a full cash deposit.

Once all your documentation is in order, you can move forward with the bond issuance process.

The Bond Issuance Process

After compiling the required documents, submit your application to a surety provider or bank. During the underwriting process, providers evaluate the "Three Cs":

- Character: Your reputation and track record.

- Capacity: Your ability to complete the project.

- Credit: Your financial strength.

Underwriters will also review the specifics of your contract, the complexity of the project, and your financial statements to assess the risk of non-completion.

For export-specific bonds, lenders often require a counter-guarantee or indemnity from the exporter. This is because banks are typically cautious about international risks, as recovering assets in foreign jurisdictions can be complicated. If you meet the underwriting criteria, the surety or bank will determine your premium rate and any collateral requirements.

Small businesses may have an easier time getting approved through government-backed programs. For example, the Small Business Administration (SBA) guarantees bonds for non-federal contracts up to $9 million and federal contracts up to $14 million, with a fee of just 0.6% of the contract price. The Export-Import Bank of the United States (EXIM) also offers flexible solutions. Elizabeth Thomas, a Business Development Specialist at EXIM Bank, explains:

"By borrowing the $100,000 from the bank, and having EXIM guarantee that lender, the L/C only needs to be collateralized at 25 percent… freeing up $75,000 for other uses".

This approach can be a game-changer compared to the 100% collateral typically required by commercial banks.

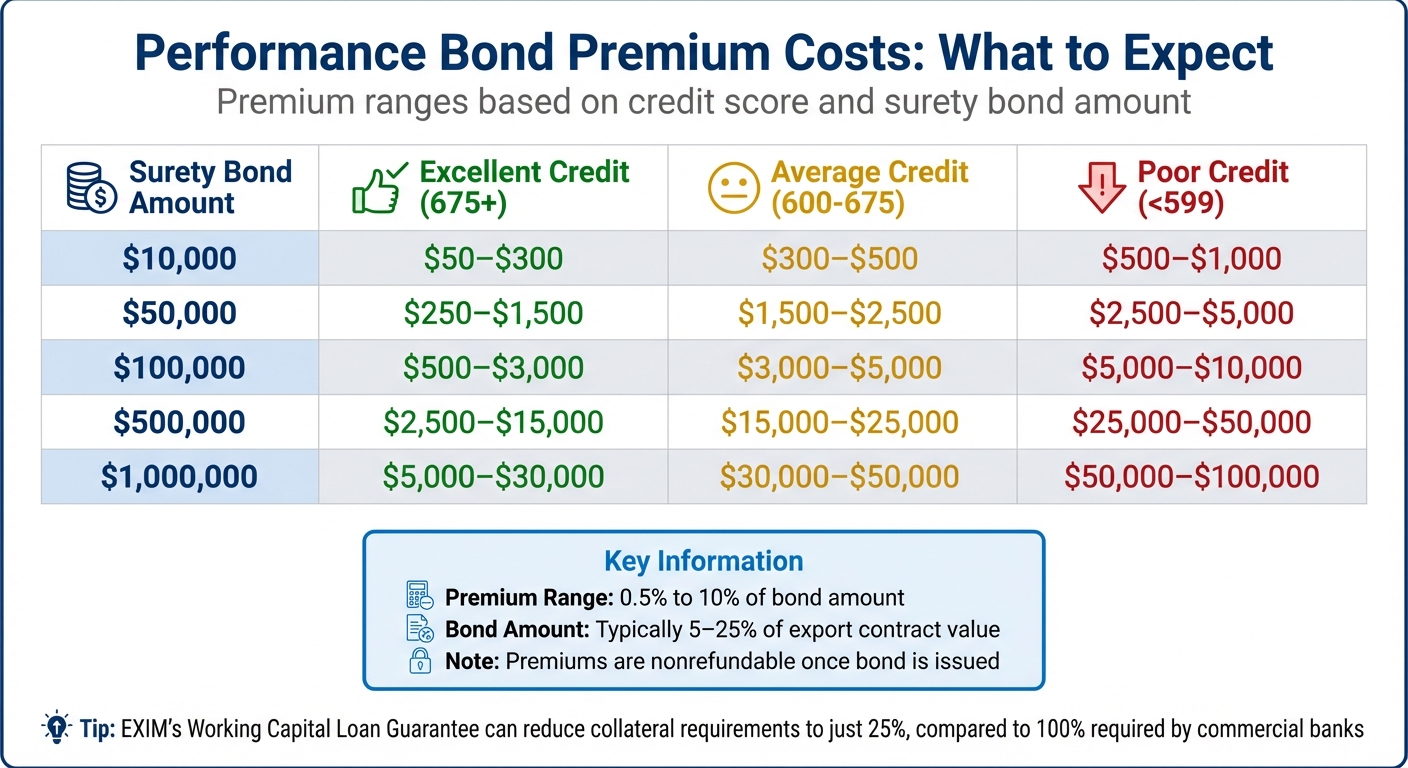

Cost and Collateral Requirements

Performance bond premiums generally range from 0.5% to 10% of the bond amount. The exact rate depends on your credit score, with lower rates available for strong credit (675+) and higher premiums for weaker credit scores. The bond amount is often set at 5% to 25% of the total export contract value.

Here’s a breakdown of typical premium costs based on credit:

| Surety Bond Amount | Excellent Credit (675+) | Average Credit (600-675) | Poor Credit (<599) |

|---|---|---|---|

| $10,000 | $50–$300 | $300–$500 | $500–$1,000 |

| $50,000 | $250–$1,500 | $1,500–$2,500 | $2,500–$5,000 |

| $100,000 | $500–$3,000 | $3,000–$5,000 | $5,000–$10,000 |

| $500,000 | $2,500–$15,000 | $15,000–$25,000 | $25,000–$50,000 |

| $1,000,000 | $5,000–$30,000 | $30,000–$50,000 | $50,000–$100,000 |

Collateral requirements can vary widely. Traditional standby letters of credit from banks often require 100% collateral, which can put a strain on your working capital. However, EXIM’s Working Capital Loan Guarantee program reduces collateral requirements to just 25%, while also covering 90% of the lender’s repayment risk. Eligible collateral for export-related bonds includes cash, export-related inventory, and accounts receivable.

Keep in mind that bond premiums are nonrefundable. Once the bond is issued, the surety earns the premium, regardless of whether the project moves forward or the business closes. If the upfront premium feels overwhelming, some providers offer financing plans. These plans typically require 30–40% as a down payment, with the remaining balance spread over four to six months.

Integrating Performance Bonds into Your Trade Finance Strategy

Building Buyer Confidence and Expanding Opportunities

Performance bonds can give your business a significant advantage when competing for international contracts. As EXIM Bank explains:

"A U.S. exporter’s ability to provide a foreign buyer with a bid or performance bond can often be the difference between making and missing a sale".

By offering a performance bond, you signal to foreign buyers that you are committed to meeting your obligations. This can be especially crucial when establishing relationships with new buyers or handling complex contracts. Consider the bond as a tool to build trust – it demonstrates your willingness to back your commitments with financial guarantees. This not only helps you stand out from competitors but also positions you as a lower-risk partner, potentially leading to more favorable payment terms and access to larger deals. Pairing this trust-building measure with solid risk insurance further strengthens your position.

Reducing Financial Risks with Accounts Receivable Insurance

While performance bonds provide assurance to your buyers, accounts receivable insurance adds another layer of protection to your export strategy. This insurance safeguards you, the exporter, against buyer defaults. Together, these tools form a robust risk management approach: the bond protects the buyer in case of non-performance, while the insurance protects you if the buyer fails to pay due to reasons like insolvency, bankruptcy, or political instability.

Accounts Receivable Insurance (https://accountsreceivableinsurance.net) offers export credit insurance that addresses both commercial risks (e.g., buyer bankruptcy) and political risks (e.g., currency restrictions or government actions). Using these tools, you can confidently offer open-account terms – something many foreign buyers prefer. Additionally, insured accounts receivable can serve as collateral for performance bonds, improving cash flow and reducing financial strain. With EXIM’s guarantee, you can even pledge export-related assets like accounts receivable and inventory, which commercial banks often overlook in international transactions.

Conclusion

Performance bonds play a key role in giving foreign buyers confidence that contractual commitments will be fulfilled. This trust is especially important when breaking into new markets or working with first-time buyers. By offering this financial assurance, performance bonds can enhance your competitiveness and form an essential part of a well-rounded trade finance strategy.

To make the most of performance bonds, it’s important to reduce the collateral requirements they often demand. Programs backed by organizations like EXIM Bank or the SBA can significantly lower these requirements – sometimes to just 25% of the bond’s value – helping you retain the working capital needed to carry out your contracts effectively. Pairing performance bonds with other tools, such as Accounts Receivable Insurance, further strengthens your risk management approach. While the bond ensures your buyer is protected if you cannot deliver, insurance protects your business if the buyer fails to pay.

For small businesses, the SBA offers accessible terms, charging only 0.6% of the contract price as a guarantee fee. This low-cost option can open doors to international markets. By understanding and utilizing performance bonds strategically, U.S. exporters can seize new opportunities while keeping financial risks under control in the global marketplace.

FAQs

What are the main advantages of using performance bonds in export contracts?

Performance bonds offer valuable advantages to exporters by building trust and providing financial security. They reassure buyers that contractual commitments will be fulfilled, which can significantly improve the likelihood of closing deals. This added layer of confidence strengthens relationships and credibility in the marketplace.

Beyond trust-building, performance bonds shield exporters from financial claims by ensuring obligations are met. This reduces the chances of disputes or penalties, offering peace of mind. They also help exporters manage their finances more effectively. Instead of tying up substantial cash or assets as collateral, exporters can maintain healthier liquidity while still offering solid guarantees to their buyers. This balance of security and flexibility makes performance bonds an essential tool for global trade.

How can exporters reduce the financial burden of performance bonds?

Exporters can ease the financial burden of performance bonds by negotiating for lower bond percentages, which usually fall between 5% and 25% of the contract value. Another option is to offer partial collateral – combining cash with other assets like inventory or receivables – to help lower upfront expenses.

Using government-backed programs, such as those offered by the U.S. Export-Import Bank (EXIM), or securing trade credit insurance through Accounts Receivable Insurance, can also make a difference. These measures can reassure bond issuers by reducing perceived risk, which might lead to lower collateral requirements and free up essential working capital. Maintaining strong credit and providing clear, thorough documentation can further improve your chances of securing better terms.

What are the best types of performance bonds for each stage of an export contract?

Performance bonds play a key role in managing risks throughout the various stages of an export contract. During the bidding phase, exporters often rely on bid bonds to demonstrate their financial reliability and commitment to the project. These bonds reassure buyers that the exporter is serious about their proposal and capable of meeting the project’s demands.

After the contract is awarded, a performance bond steps in to ensure the exporter delivers on the agreed terms. If the buyer provides an advance payment, an advance payment bond acts as a safeguard, ensuring the funds are used as intended and protecting the buyer from potential misuse.

As the project moves into the execution phase, the performance bond remains active to uphold the exporter’s obligations. Additional bonds, such as maintenance bonds or retention bonds, may also come into play. These bonds ensure warranties are honored or allow a portion of the payment to be withheld until the buyer is fully satisfied with the work. In cases where customs or specific facilities are involved, customs bonds or facility bonds may be required to guarantee compliance with regulations.

By carefully matching the bond type to each stage of the contract, exporters can effectively mitigate financial risks and build confidence with buyers, ensuring smoother transactions and stronger business relationships.