AI credit scoring models use machine learning to analyze data and predict how likely someone is to repay a loan. Unlike older systems that rely heavily on credit history, these models include data like rental payments, utility bills, and spending patterns. This makes it possible to evaluate people with limited or no credit history, such as gig workers or young adults.

Here’s what makes AI credit scoring different:

- More Data: Combines traditional credit metrics with alternative data like transaction history and behavioral patterns.

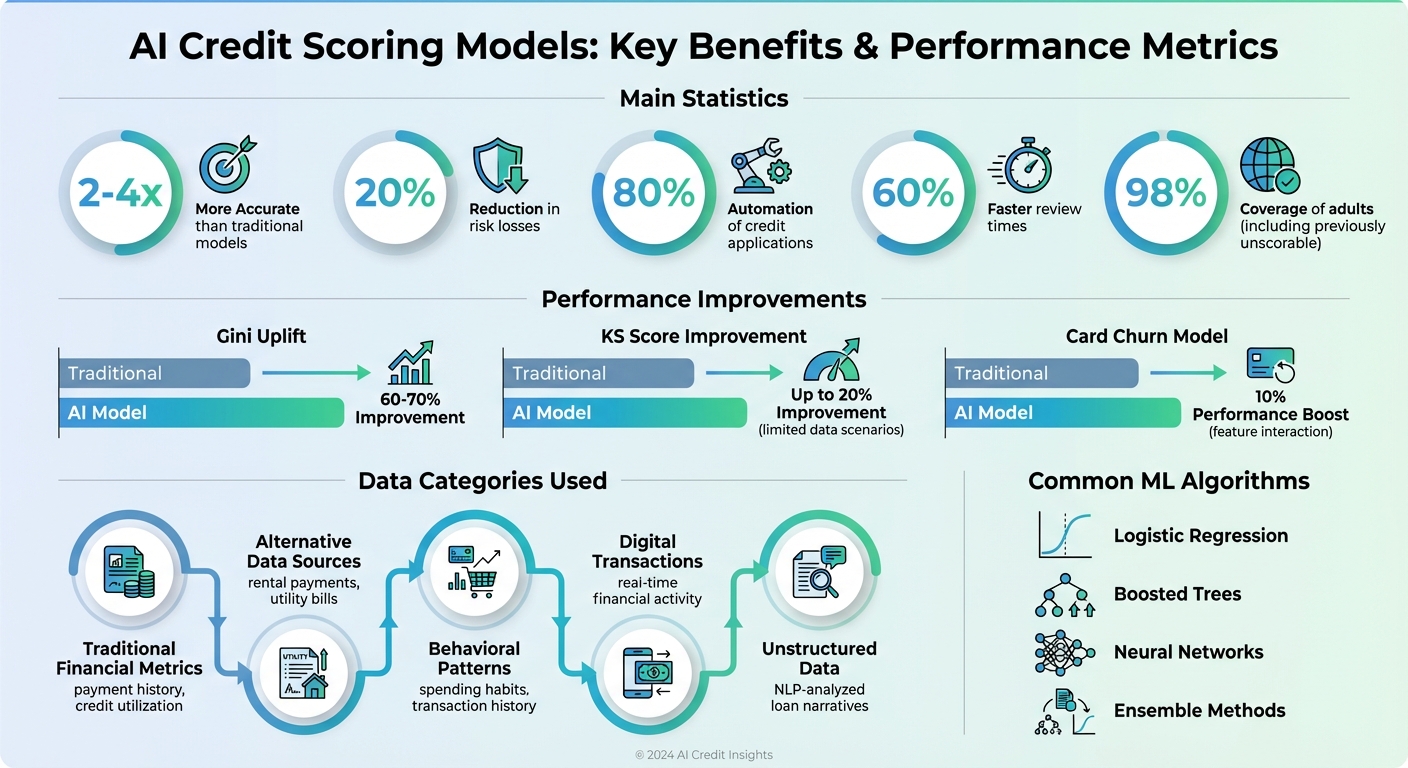

- Better Accuracy: AI models are 2-4 times more accurate and reduce risk losses by up to 20%.

- Faster Decisions: Automates up to 80% of credit applications, cutting review times by 60%.

- Fairer Access: Expands credit evaluations to cover 98% of adults, including those previously deemed “unscorable.”

AI uses algorithms like logistic regression, boosted trees, and neural networks to identify patterns and improve predictions. These systems also learn over time, ensuring they stay relevant as borrower behavior changes.

While AI speeds up decisions and improves accuracy, it’s paired with human oversight to address potential biases and ensure fairness. Businesses using AI credit scoring often see better approval rates and lower delinquency risks.

AI Credit Scoring: Key Benefits and Performance Metrics

Data Inputs for AI Credit Scoring

Types of Data Used

AI credit scoring models rely on five main categories of data to assess creditworthiness. At their core are traditional financial metrics like payment history, credit utilization, length of credit history, and outstanding debts. These factors provide a solid foundation for understanding how someone has managed credit in the past.

What sets AI models apart is their ability to incorporate alternative data sources that go beyond these conventional measures. This includes information like rental payments, utility bills, and digital transaction histories. These inputs are especially useful for evaluating individuals with limited or no credit history, such as gig workers, recent immigrants, and young adults.

AI systems also analyze behavioral and spending patterns to detect real-time changes in financial health. For instance, they monitor recent credit card usage and spending habits to identify potential risks. Some advanced models even utilize Natural Language Processing (NLP) to extract insights from unstructured data, such as loan application narratives or transaction descriptions. Additionally, lenders can combine internal customer data with self-reported details like employment status and income to refine their assessments further.

One of AI’s strengths is its ability to uncover complex, non-linear relationships between these data points. For example, it can analyze how credit utilization might interact with delinquency risk – connections that traditional scoring methods often miss.

With so many data sources feeding into these models, maintaining high data quality becomes critical.

Data Quality and Accuracy

Accurate and reliable data is the backbone of any AI credit scoring system. Advanced platforms, like Experian’s Ascend Intelligence Services Pulse, use automated processes to clean and integrate data, converting unstructured inputs into actionable insights while flagging potential performance issues. These systems also employ techniques to reduce "noise" in the data, eliminating irrelevant correlations that could lead to biased or misleading results.

Deloitte underscores this need for precision: "Data must be monitored and protected throughout its life cycle, with institutions ensuring every data point that influences lending decisions is accurate, well-governed, and clearly understood".

Accurate data doesn’t just improve AI model training; it also ensures that automated credit decisions are fair and reliable. While AI handles much of the heavy lifting, human oversight remains indispensable. During development, human-in-the-loop practices address potential biases and ensure the model’s logic is both ethical and transparent. Rigorous validation processes, using ethically sourced data and adversarial debiasing techniques, help ensure that credit scores accurately reflect true creditworthiness.

Regulatory scrutiny is also intensifying as AI’s role in credit scoring grows.

Rohit Chopra, Director of the Consumer Financial Protection Bureau, explains: "Technology marketed as artificial intelligence is expanding the data used for lending decisions, and also growing the list of potential reasons for why credit is denied. Creditors must be able to specifically explain their reasons for denial. There is no special exemption for artificial intelligence".

Machine Learning Algorithms in Credit Scoring

Common Algorithms Used

When it comes to AI-driven credit scoring, several machine learning algorithms take center stage. These include logistic regression, boosted trees, neural networks, and ensemble methods. Each one brings something unique to the table, helping balance interpretability, predictive power, and compliance with industry regulations. To further demystify these models, tools like SHAP and LIME are often employed to explain the factors influencing decisions.

- Logistic regression serves as a straightforward and interpretable starting point for credit evaluation.

- Boosted trees excel at handling complex datasets by combining multiple decision trees to uncover nuanced patterns.

- Neural networks shine when processing large, diverse datasets, revealing subtle relationships that might otherwise go unnoticed.

- Ensemble methods blend several algorithms to enhance both reliability and accuracy.

The choice of algorithm often depends on a lender’s needs – whether the priority is transparency, regulatory alignment, or pushing the boundaries of predictive performance. However, more complex models can feel like a "black box", making explainability tools essential. These tools clarify how decisions are made, ensuring transparency without sacrificing the model’s power.

"The same complexity that fuels the accuracy of machine learning underwriting models can make it more difficult to understand how a model was developed", explains FinRegLab.

These algorithms are the backbone of detecting subtle, non-linear patterns in credit data, providing a more nuanced understanding of borrower risk.

How AI Models Identify Complex Patterns

Building on this algorithmic groundwork, AI models take risk evaluation to the next level by spotting intricate relationships that traditional methods often overlook. One of their key strengths lies in identifying non-linear interactions. For example, while credit utilization alone might suggest moderate risk, its interplay with delinquency patterns can paint a more accurate and detailed picture of borrower behavior.

Scott Zoldi, Chief Analytics Officer at FICO, highlights this advantage:

"A nonlinear combination of these [features] can produce more optimal results in a machine learning model".

AI models also excel in micro-segmentation, grouping borrowers into highly specific archetypes based on their spending and credit habits. For instance, FICO data scientists discovered that interactions between the recency and frequency of card usage improved their credit card churn model’s performance by 10%. Similarly, in a home equity portfolio with limited data, fine-tuning machine learning parameters led to a 20% performance boost over traditional scorecards.

These real-world examples demonstrate the transformative potential of machine learning in credit decisioning. In fact, such applications have achieved a Gini uplift of 60% to 70% compared to conventional methods, showcasing the power of AI in reshaping credit risk evaluation.

Model Training and Validation

Training AI Models with Historical Data

AI credit scoring models are built by analyzing a wide range of historical data. This includes not just traditional credit bureau records but also rental and utility payments, as well as digital transactions. By incorporating these diverse data sources, the models can gain a deeper understanding of borrower behavior, going beyond the limitations of conventional methods.

A key part of this process is feature engineering. This involves identifying meaningful combinations of variables that reveal underlying patterns while filtering out noise and irrelevant correlations to ensure the model remains unbiased. For instance, FICO data scientists found that combining the recency and frequency of card usage boosted the performance of a card churn prediction model by 10%.

Scott Zoldi, Chief Analytics Officer at FICO, highlights the risks of overly complex and opaque models, noting that such models might pick up on noise instead of genuine patterns. This distinction is critical when identifying creditworthy individuals versus those prone to credit misuse.

Once the training phase is complete, rigorous validation ensures the model’s reliability and practical effectiveness.

Validation and Performance Metrics

After training, the models are put through a thorough validation process. This typically involves two phases. First, a standalone assessment checks the model’s mathematical accuracy using metrics like the Gini coefficient and the Kolmogorov-Smirnov (KS) statistic. Then, an enterprise-level business assessment evaluates how well the model performs within real-world business systems and risk management frameworks.

To ensure the model isn’t just capturing temporary trends, out-of-time testing is conducted. This step confirms the model’s ability to generalize beyond short-term patterns. When applied effectively, these models have demonstrated a 60–70% Gini uplift and up to a 20% improvement in KS scores, particularly in scenarios with limited data.

In addition to these standard tests, stress-testing and bias audits are conducted to verify the model’s fairness and performance under varying conditions. As Rohit Chopra, Director of the Consumer Financial Protection Bureau, has pointed out:

"Creditors must be able to specifically explain their reasons for denial. There is no special exemption for artificial intelligence".

This underscores the importance of transparency and accountability, even when leveraging advanced AI systems.

Decision-Making and Continuous Learning

Automated Decision-Making in Credit Scoring

AI has transformed credit scoring by analyzing massive datasets in real time to make automated decisions. Unlike older systems that rely on rigid cutoff points, AI digs deep into subtle behavioral and financial patterns that traditional scorecards often overlook.

With these models, a risk score combines AI-driven insights with a lender’s specific criteria, allowing for automated decisions on the majority of applications. Instead of lumping applicants into broad categories, machine learning creates highly specific micro-segments based on detailed behavioral profiles. This approach ensures decisions are both quick and consistent.

Automation has had a huge impact on lending. Approval rates have gone up, and processing times have dropped significantly. These systems can evaluate 98% of American adults, even those with thin or limited credit histories – people who were once considered "unscorable." Plus, automation saves up to 60% of the time and resources typically spent on the lending process.

AI also considers complex relationships between various factors, such as how recently and frequently a credit card is used. It even incorporates unconventional data points like rental history and qualitative insights from transaction descriptions, thanks to Natural Language Processing (NLP).

While these decisions happen quickly, the process doesn’t stop there. Continuous learning ensures the models remain up-to-date with evolving borrower behaviors.

Continuous Improvement Through Machine Learning

AI systems don’t just stop at initial training – they’re designed to learn and improve over time. They gather new data constantly, retrain using recent outcomes, and adjust predictions to keep pace with changes in borrower behavior.

The system actively tracks its prediction accuracy and identifies when shifts – known as "drift" – occur in borrower behavior or market conditions. When this happens, updates are triggered to ensure the model remains accurate. Feedback loops play a key role here, allowing the AI to refine its logic based on real-world repayment outcomes, improving future risk assessments.

To maintain reliability, many financial institutions use a "champion–challenger" approach. This involves running new "challenger models" alongside the established "champion" model to test alternative algorithms or datasets. If the challenger outperforms the champion, it replaces the older model.

Modern AI systems also allow lenders to deploy specialized models for different customer segments. With automated retraining cycles and version control, these updates happen seamlessly, ensuring the models stay relevant and effective.

sbb-itb-2d170b0

Integration with Trade Credit Risk Management

Using AI with Trade Credit Insurance

Pairing AI credit scoring with trade credit insurance creates a powerful risk management solution. AI models bring precision to underwriting by providing accurate data for policy decisions and detecting potential fraud.

When businesses incorporate AI scoring into their credit decision-making tools, they can automate risk-based approvals. This process works seamlessly with trade credit insurance policies, which serve as a safety net against risks like non-payment, bankruptcy, and political instability. AI systems identify accounts that meet acceptable risk levels, while the insurance safeguards businesses from losses if approved customers still default.

AI-powered early-warning systems take this integration to another level. By analyzing real-time data from sources like news, market trends, and social media, these systems can flag potential defaults early. For companies with trade credit insurance, these alerts enable proactive adjustments to policies and pre-claim interventions, helping to avoid losses entirely. This approach not only secures domestic operations but also equips businesses to handle international credit risks with confidence.

Benefits for Domestic and International Operations

This integrated approach delivers clear benefits for both domestic and global operations. Lenders using machine learning for credit decisions have reported a Gini uplift of 60% to 70% compared to traditional models. This improved accuracy enhances risk management, whether evaluating local customers or navigating the complexities of international markets. For global operations, AI taps into alternative data sources – like utility payments and rental records – to assess creditworthiness in regions where conventional data may be limited.

When combined with Accounts Receivable Insurance, which covers both domestic and international markets, AI-enabled underwriting can lower risk exposure by over 20%, all while maintaining strong approval rates.

GCredit DEMO: AI in Credit Scoring for Data-Driven Decision Making and Accurate Predictions

Conclusion

AI credit scoring models are changing the way businesses evaluate credit risk. By incorporating alternative data – like utility bills and rental payments – alongside traditional credit information, these models are bringing previously "unscorable" borrowers into the fold. The results are impressive, with a Gini uplift of 60% to 70% and a reduction in risk by over 20%.

These systems operate in real time, adapting instantly to shifts in the economy and borrowing behavior. Automation plays a big role here, processing up to 80% of applications without the need for manual review. This not only cuts operational costs but also speeds up the approval process. However, this efficiency must be balanced with strong model governance to ensure reliability and fairness.

Transparency and data quality remain non-negotiable. As Rohit Chopra, Director of the Consumer Financial Protection Bureau, stated:

"Creditors must be able to specifically explain their reasons for denial. There is no special exemption for artificial intelligence."

Blending traditional transparency with AI’s predictive capabilities often delivers the best outcomes.

For businesses managing trade credit risk, combining AI credit scoring with comprehensive trade credit insurance – like the coverage offered by Accounts Receivable Insurance – provides a strong safeguard against defaults and non-payments. This approach is especially useful in global markets, where AI’s ability to analyze alternative data shines in regions with limited access to traditional credit information. Together with trade credit insurance, these tools enhance risk management strategies.

Financial institutions using these systems are seeing tangible improvements in both risk management and operational efficiency. As AI continues to advance, businesses that embrace these technologies – while prioritizing governance and regulatory compliance – will gain the ability to make quicker, more precise credit decisions, setting the stage for long-term financial stability.

FAQs

How do AI credit scoring models ensure fairness?

AI credit scoring models aim to make credit decisions more equitable by addressing bias during their creation and use. Developers rely on diverse, legally approved data sources and incorporate methods like re-weighting or fairness adjustments to ensure that factors such as race, gender, or age do not unfairly impact outcomes. Before these models are put into use, they undergo rigorous testing to uncover and address any disparities.

To maintain fairness over time, these models are continuously monitored to track their performance across different demographic groups. Additionally, tools like explainable AI offer clear, easy-to-understand explanations for decisions, helping lenders meet transparency standards. This approach – combining bias-conscious design, ongoing monitoring, and transparency – aims to deliver fairer credit evaluations for borrowers throughout the U.S.

What kinds of alternative data do AI credit scoring models use?

AI credit scoring models use a mix of financial and non-financial data to deliver a broader and more detailed view of someone’s creditworthiness.

On the financial side, these models examine things like bank transactions, cash flow patterns, income levels, and spending habits. Meanwhile, non-financial data includes factors such as rental and utility payment histories, education and employment details, and even digital behaviors like online shopping habits or transaction records.

By tapping into this wide range of information, AI credit scoring can provide a more tailored and accurate assessment – particularly helpful for individuals or businesses that lack a traditional credit history.

How do AI credit scoring models improve their accuracy over time?

AI credit scoring models grow smarter over time by learning from fresh data. Regular retraining with updated, labeled datasets allows these models to keep up with shifts in financial behaviors and trends. This ongoing process sharpens their ability to predict outcomes and deliver more precise credit assessments.

On top of that, these models refine how they segment borrowers, adapting to new patterns in financial behavior. This ensures they stay effective, even in fast-changing financial landscapes, providing consistent and reliable credit scoring results.