When selling internationally, the biggest challenge is ensuring you’ll get paid. Foreign buyer credit risk comes down to two main factors: the buyer’s financial reliability (commercial risk) and the political/economic stability of their country (country risk). Mismanaging these risks can hurt your cash flow, damage your reputation, or even violate trade laws.

Here’s how you can protect your business:

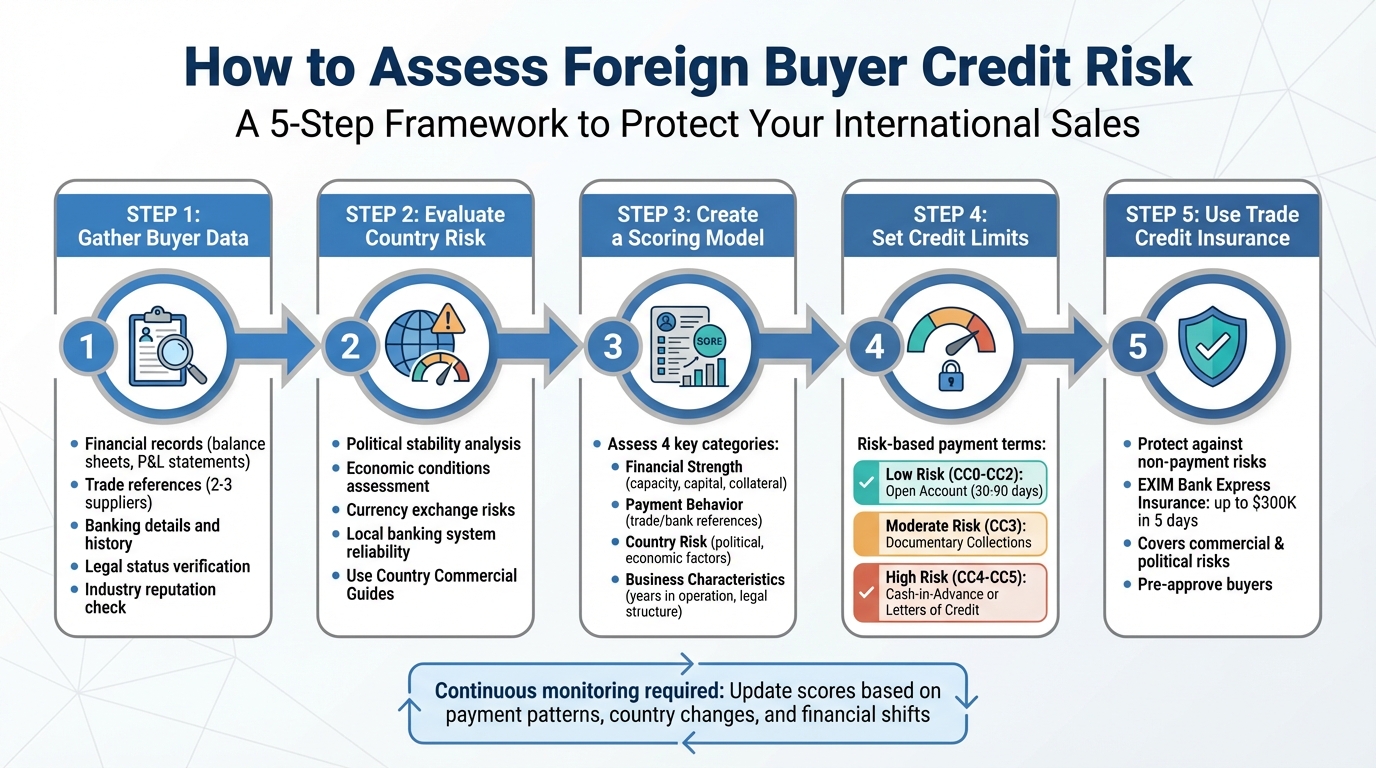

- Gather Buyer Data: Collect financial records, trade references, and banking details. Verify their legal status and industry reputation.

- Evaluate Country Risk: Analyze political stability, economic conditions, and currency risks. Use trusted resources like Country Commercial Guides.

- Create a Scoring Model: Assess buyers on financial strength, payment behavior, country risk, and business characteristics. Assign scores to standardize decisions.

- Set Credit Limits: Use scores to decide payment terms. High-risk buyers may require upfront payments or letters of credit, while low-risk buyers can qualify for open account terms.

- Use Trade Credit Insurance: Protect against non-payment risks with insurance programs like EXIM Bank’s Express Insurance, which can also help pre-approve buyers.

5-Step Process for Assessing Foreign Buyer Credit Risk

Export credit insurance, payment terms, letters of credit and foreign EX

Gathering Data for Foreign Buyer Assessment

Having accurate data is the backbone of reliable credit assessments. Missing financial details or a lack of country-specific context can skew scoring and lead to poor decision-making.

Collect Key Buyer Information

Start by gathering essential details about the buyer. This includes their legal name, address, establishment date, legal status (e.g., corporation or partnership), role in the supply chain, number of employees, and standing within their industry.

Financial records are a must-have. Request the latest year-end balance sheet and profit-and-loss statements to assess their cash flow and overall net worth.

Trade references are another critical piece of the puzzle. These references provide insight into how the buyer handles payments in real-world scenarios. Ask for 2–3 trade references from other suppliers and gather specific information, such as terms of sale, highest outstanding credit, current balances, and payment behavior (e.g., whether payments are on time or delayed by 30, 60, or 90 days). Using a standardized Trade Reference Form can simplify this process and ensure consistency.

"While your customer’s financials can show a healthy cash flow, references from other suppliers exhibit how they have been actually paying their invoices." – Jennifer Simpson, Regional Director, EXIM Bank

Additionally, banking information can add another layer of verification. With the buyer’s consent, confirm details like the length of their banking relationship, average account balances, overdraft history, loans, and collateral. Don’t skip legal compliance checks either – verify the buyer against the Consolidated Screening List to ensure compliance with U.S. laws and review any history of lawsuits or judgments.

Assess Country and Transaction Context

Even buyers with strong financials can face challenges due to external factors. Evaluating country risk is crucial. Look into factors like political stability, economic conditions, currency exchange fluctuations, and the reliability of local banking systems. These elements, often categorized under "Conditions", are a key part of the Five C’s of credit evaluation.

For deeper insights into the local business environment, consult Country Commercial Guides from the U.S. Commercial Service. These guides provide valuable information on trade policies, industry strength, and potential risks.

Transaction details also need verification. For example, use third-party credit reports to confirm the buyer’s operating addresses and ensure goods aren’t being rerouted to U.S.-embargoed nations. To protect against currency risks, consider quoting prices and requiring payments in U.S. dollars.

Standardize and Verify Data

Credit reporting quality varies widely by region. In more developed countries, detailed financial data is often accessible. However, in areas with limited public registries, reports might only provide basic information. Tools like Dun & Bradstreet’s credit reports, which cover over 240 million companies worldwide, can help by converting international data into a standardized format for easier analysis.

Cross-referencing is critical. Compare financial statements provided by the buyer with trade and bank references, as well as government-issued reports. For example, the International Company Profile (ICP) from the U.S. Commercial Service offers detailed credit reports, typically delivered within about 15 days. This step is essential for verifying accuracy and avoiding fraud.

Keep detailed records of all credit checks and due diligence efforts. These documents are not only important for internal audits but also necessary to ensure compliance with insurance requirements. Convert all financial data into U.S. dollars using the current exchange rate, noting the date of conversion, and resolve any discrepancies before finalizing your evaluation.

Creating a Foreign Buyer Credit Scoring Framework

Transforming collected data into consistent risk scores is essential for informed credit decisions. A solid scoring model ensures uniformity and enables you to compare buyers across various markets effectively. This framework leverages previously gathered data to rank risk areas systematically.

Define Risk Categories

Your framework should focus on evaluating four key risk areas. Proper scoring in these areas helps protect cash flow by aligning credit limits with the assessed risk.

- Financial Strength: Examine factors like cash generation, liquidity, and leverage. These align with the "Five C’s" of credit, particularly Capacity (ability to operate successfully), Capital (net worth and equity), and Collateral (access to additional resources).

- Payment Behavior: Analyze willingness to pay by reviewing trade references, bank references, and payment history.

- Country Risk: Assess external influences such as political stability, currency convertibility, economic conditions, and the reliability of the local legal system.

- Business Characteristics: Consider aspects like years in operation, legal structure, management expertise, and industry reputation.

By understanding these categories, you gain a comprehensive view of a buyer’s risk profile. For example, a buyer might have robust financials but operate in a politically unstable country, or demonstrate excellent payment behavior while lacking strong capital reserves. Each category contributes uniquely to the overall risk, making the assignment of weights to these factors a critical step.

Choose Metrics and Scoring Scales

Define key metrics for each category and assign weights based on their importance. For financial strength, track indicators like debt-to-income ratios, cash flow trends, and net worth. When evaluating payment behavior, standardize criteria such as trade and bank references. In international trade, a buyer is often considered "prompt" if they settle invoices within 30 days of the due date. For country risk, use resources like Country Commercial Guides to establish scoring benchmarks. For business characteristics, verify details such as years in operation and legal status through government databases.

Assign numerical scores to each metric (e.g., on a scale of 1 to 10 or 1 to 100) and weight them according to your risk tolerance. Compare performance against industry benchmarks to refine your scoring approach.

Include Insurance Insights

Enhance your framework by incorporating insights from trade credit insurance. External validation strengthens your assessment, offering deeper insights beyond standard credit reports.

Trade credit insurers maintain extensive databases that provide real-time updates on payment behaviors and claims. For instance, Allianz Trade tracks over 85 million companies globally through a network of 1,700 sector-specific credit analysts in 62 countries. Their data includes past-due payments and claims information from more than 55,000 customers worldwide.

"The more extensive the insurer’s database, the better their access to invaluable customer information, based on data from a worldwide network of analysts and clients." – Controllers Council

Accounts Receivable Insurance can further bolster your scoring framework. It provides professional underwriting support and pre-approved credit limits for specific buyers. Programs like EXIM Bank’s Express Insurance offer quick credit decisions – up to $300,000 within five business days. For businesses without dedicated credit departments, insurers can even request and analyze confidential financial statements that buyers might hesitate to share directly, adding another layer of external validation.

sbb-itb-2d170b0

Using the Scoring Model to Evaluate Foreign Buyers

Follow the Scoring Process

To evaluate foreign buyers effectively, start by gathering the seven key elements that form the foundation of a credit report: financial history, legal status, business activity description, industry standing, trade references with payment history, current financial condition, and professional opinions. Trade references from other suppliers and bank references are particularly valuable, as they reveal insights like average daily balances and overdraft history, which help confirm the buyer’s access to capital. For credit limits exceeding $100,000, request year-end balance sheets and profit-and-loss statements to better understand cash flow trends.

Another critical step is cross-referencing the buyer against the Consolidated Screening List – a compliance requirement that applies no matter how strong the buyer’s score might be.

Once you’ve collected this information, apply your scoring model across four key risk categories: financial strength, payment behavior, country risk, and business characteristics. Look for patterns in performance over time and compare the buyer’s debt-to-income ratio with others in the same industry. Tools like CRM systems can track transaction frequency, while machine learning algorithms analyze buyer profiles against large datasets to estimate the likelihood of default. The final scores should align with standardized risk classifications, such as EXIM’s scale, which ranges from CC0 (exceptionally low risk) to CC5 (high to very high risk).

These scores provide a solid foundation for determining credit limits and payment terms tailored to each buyer.

Establish Credit Limits and Payment Terms

Using the scoring results, you can define credit conditions that balance risk and competitiveness. For buyers classified as high-risk (CC4–CC5), implement Cash-in-Advance or Letters of Credit to minimize exposure to non-payment. Moderate-risk buyers (CC3) may qualify for Documentary Collections, while low-risk buyers (CC0–CC2) can be offered Open Account terms with payment windows ranging from 30 to 90 days, allowing you to remain competitive in the market.

When setting credit limits, focus on the buyer’s Capacity to Pay, which can be assessed through financial documents that reveal cash flow and business experience. Pay close attention to the "Opinions and Recommendations" section in foreign credit reports, as these often provide specific guidance on appropriate dollar amounts. Adjust credit limits based on factors such as currency fluctuations, political stability, and the effectiveness of the local legal system. Remember, credit evaluations shouldn’t be a one-time process – monitor the buyer’s debt-to-income ratio on an ongoing basis to stay ahead of potential risks.

Protect Against Risk with Insurance

Once you’ve established credit limits and terms, strengthen your risk management strategy with trade credit insurance. This type of insurance, such as Accounts Receivable Insurance, protects your accounts receivable – often your largest asset – by transferring the risk of buyer default off your balance sheet. It covers both commercial risks (like insolvency or slow payment) and political risks (such as currency restrictions, war, or government actions that prevent payment). Unlike restrictive options like Letters of Credit or pre-payments, insurance allows you to grow sales without imposing stringent terms on buyers.

"A broker is the advocate for your business, representing your interests and not the insurance company." – ARI Global

For faster decisions, EXIM’s Express Insurance Program provides credit approvals for amounts up to $300,000 within five business days. There’s no application fee, and you can submit up to five buyers for pre-approval during the application process. Partnering with a specialty broker like ARI Global can act as an extension of your credit team, helping you monitor policies and manage claims at no additional cost. Within the "5 Cs" framework, credit insurance can also offset weaknesses in other areas – such as limited collateral or capital – by bolstering the Conditions category.

Maintaining and Updating the Scoring Model

Track Buyer and Country Risks

A scoring model isn’t something you can set up once and forget about – it needs constant attention to catch potential risks before they escalate into major issues. Keep an eye on your CRM data to spot shifts in buyer behavior, like changes in transaction frequency or payment patterns. For instance, if a buyer who usually places monthly orders suddenly alters their purchasing habits, it’s worth investigating further. Regularly request updated trade references to see if other suppliers are experiencing delayed payments, even if your buyer continues to pay you on time.

"A good credit score does not necessarily mean a customer is a low risk. Even with a stellar credit history, any business or individual faced with significant or unexpected economic hardships is at risk of default." – Allianz Trade

It’s not just about individual buyers – macro-level risks in a buyer’s country can also impact their ability to pay. Factors like currency fluctuations, trade sanctions, political instability, or rising interest rates can all play a role. Tools like Dun & Bradstreet’s credit reports, which cover over 240 million companies worldwide, can help you identify early signs of financial trouble. Establish clear triggers for reassessment, such as late payments or major geopolitical events, so your team knows when it’s time to re-evaluate credit limits. These practices ensure your scoring model adapts to both buyer-specific and broader economic changes.

Adjust the Model Over Time

Your scoring model should evolve to reflect real-time performance data. For example, rising debt-to-income ratios or consistent payment delays should lead to lower scores. Compare your clients’ stability, growth, or decline against their industry peers, and adjust risk categories as needed. If you notice that buyers in a specific market are consistently paying late compared to industry norms, you might need to weigh country risk more heavily in your model.

Machine learning and AI can simplify this process by analyzing buyer profiles against massive datasets to pinpoint emerging risks. These tools go beyond static credit history, offering insights based on recent behavior and transaction trends. For buyers with credit limits over $100,000, it’s a good practice to request updated year-end balance sheets and profit-and-loss statements annually to confirm their financial stability. By continuously refining your model, you ensure it stays aligned with the realities of buyer behavior and market conditions.

Maintain Documentation and Compliance

Thorough documentation is essential – not just to safeguard your business but also to meet export credit insurance requirements. Every report should include key details like financial history, legal status, business activities, industry position, trade references, and professional evaluations. A standardized approach simplifies risk analysis across various markets.

"A bad choice can result in lost market opportunities, financial loss, legal and liability issues, or a damaged company/product reputation abroad." – International Trade Administration

Partnering with Accounts Receivable Insurance (ARI) can help you streamline documentation while ensuring compliance. ARI supports your credit team by validating documentation, monitoring policies, and assisting with claims. Use external profiles to enhance verification processes, and keep detailed records of all financial and transactional activities. This historical data is invaluable for spotting trends and identifying warning signs, even when payments appear to be on time.

Conclusion

Evaluating foreign buyer credit risk is a crucial step in ensuring steady international growth. Without a proper assessment, businesses face potential cash flow problems, payment defaults, and damage to their reputation. However, using a structured scoring model allows you to safeguard your operations while expanding into new markets. As the Office of Small Business at EXIM Bank explains:

"The extent to which you’re able to demonstrate how well you know your customer and the market in which they operate in, the safer your firm will be from foreign risks".

This framework brings consistency to risk evaluation across different markets and currencies. It replaces guesswork and incomplete data with a reliance on verified financial records, trade references, and broader risk indicators. Not only does this provide a solid foundation for credit decisions, but it also makes lenders and insurers more willing to support your business, knowing that thorough due diligence has been conducted. This systematic approach strengthens your ability to manage risk effectively.

Incorporating Accounts Receivable Insurance (ARI) further enhances your risk management strategy. ARI goes beyond simply covering non-payment; it offers expert underwriting, pre-approvals for foreign buyers, and detailed buyer insights. This is especially valuable when entering less familiar markets or working with buyers who lack extensive credit histories. With policies that address both commercial and political risks, ARI allows you to extend competitive credit terms without overexposing your business to financial uncertainty.

As outlined, credit assessment and insurance work hand in hand to support international growth. But it’s important to remember that credit evaluation isn’t a one-and-done task. Markets evolve, buyers’ financial conditions shift, and new risks can arise. By continuously refining your scoring model and collaborating with experienced insurance providers, you can confidently seize global opportunities while keeping your receivables secure. Pairing diligent credit evaluation with targeted insurance ensures a strong, sustainable foundation for international expansion.

FAQs

What steps should I follow to evaluate the credit risk of an international buyer?

To evaluate the credit risk of an international buyer, start by collecting essential details about their business. This includes their legal name, address, and a thorough look at their financial history. A good starting point is to request a detailed credit report from a reliable agency. This report will help you understand their payment habits, credit limits, and any record of bankruptcies. Additionally, ask for trade references from their current suppliers to get a clearer picture of how they handle payments.

Make use of dependable resources like the U.S. Commercial Service or financial directories to confirm the buyer’s legitimacy and fill any information gaps. It’s also important to assess country-level risks, such as political or economic instability, which could affect even financially sound buyers. Organize all the gathered information in a consistent format, such as U.S. currency and number formatting, to make it easier to analyze. Regularly review this data to stay updated on any changes that could affect your assessment.

How does trade credit insurance help protect against unpaid invoices from international buyers?

Trade credit insurance acts as a safety net for your business, protecting you if an international buyer doesn’t pay. It shields you from commercial risks, like a buyer going bankrupt or simply not paying, and political risks, such as currency restrictions or government actions that block payments.

This coverage helps keep your cash flow steady, even when invoices go unpaid, offering financial security and confidence as you navigate foreign markets.

What should I consider when determining credit limits for international buyers?

When determining credit limits for international buyers, start by evaluating their financial stability and payment track record. This means diving into their financial statements to understand cash flow, profitability, and debt levels. Look for any signs of late payments or past bankruptcies, and check their credit utilization to see if they manage their credit responsibly. These insights can help you gauge how much credit they can realistically handle without overextending.

It’s also important to factor in risks unique to international trade. These include commercial risks, like the buyer’s financial solvency, as well as country-specific risks, such as economic instability or currency fluctuations. Political risks, like trade restrictions or political unrest, should also be considered. To get a better sense of the buyer’s reliability, look at their industry, how long they’ve been in business, their legal standing, and references from other suppliers.

Finally, customize the credit limit based on the details of the transaction. Consider the size of the order, the type of product, and the agreed payment terms. For new buyers, it’s wise to start with a conservative credit limit and adjust as you build a clearer picture of their payment behavior over time. To safeguard your business against potential non-payment, many companies rely on Accounts Receivable Insurance, which offers protection against risks like insolvency or political upheaval.