Managing FX risk in receivables is critical for businesses dealing with international customers. Currency fluctuations between invoicing and payment can significantly impact your revenue. For example, a weakening foreign currency can reduce the actual amount you receive in your home currency. This guide explains the types of FX risk and practical strategies to protect your business.

Key Takeaways:

- Types of FX Risk:

- Transaction Exposure: Impacts cash flow directly when exchange rates change before payment is received.

- Translation Exposure: Affects financial reporting when foreign receivables are converted to your home currency.

- Economic Exposure: Long-term risks affecting market value and competitiveness due to sustained currency shifts.

- Risk Management Tools:

- Forward Contracts: Lock in exchange rates to stabilize cash flow.

- Currency Options: Provide flexibility to benefit from favorable rate changes while protecting against unfavorable ones.

- Natural Hedging: Match foreign currency receivables with payables to reduce exposure.

- Additional Protection:

- Trade Credit Insurance: Covers risks like customer nonpayment, especially in volatile markets, complementing hedging strategies.

- Monitoring FX Risk:

- Use automated tools for revaluing receivables and tracking exposure.

- Regularly run reports and scenario analyses to forecast potential impacts.

Foreign Exchange Risk Management: How to Get Paid in Foreign Currencies

sbb-itb-2d170b0

Types of FX Risk in Accounts Receivable

Three Types of FX Risk in Accounts Receivable: Transaction, Translation, and Economic Exposure

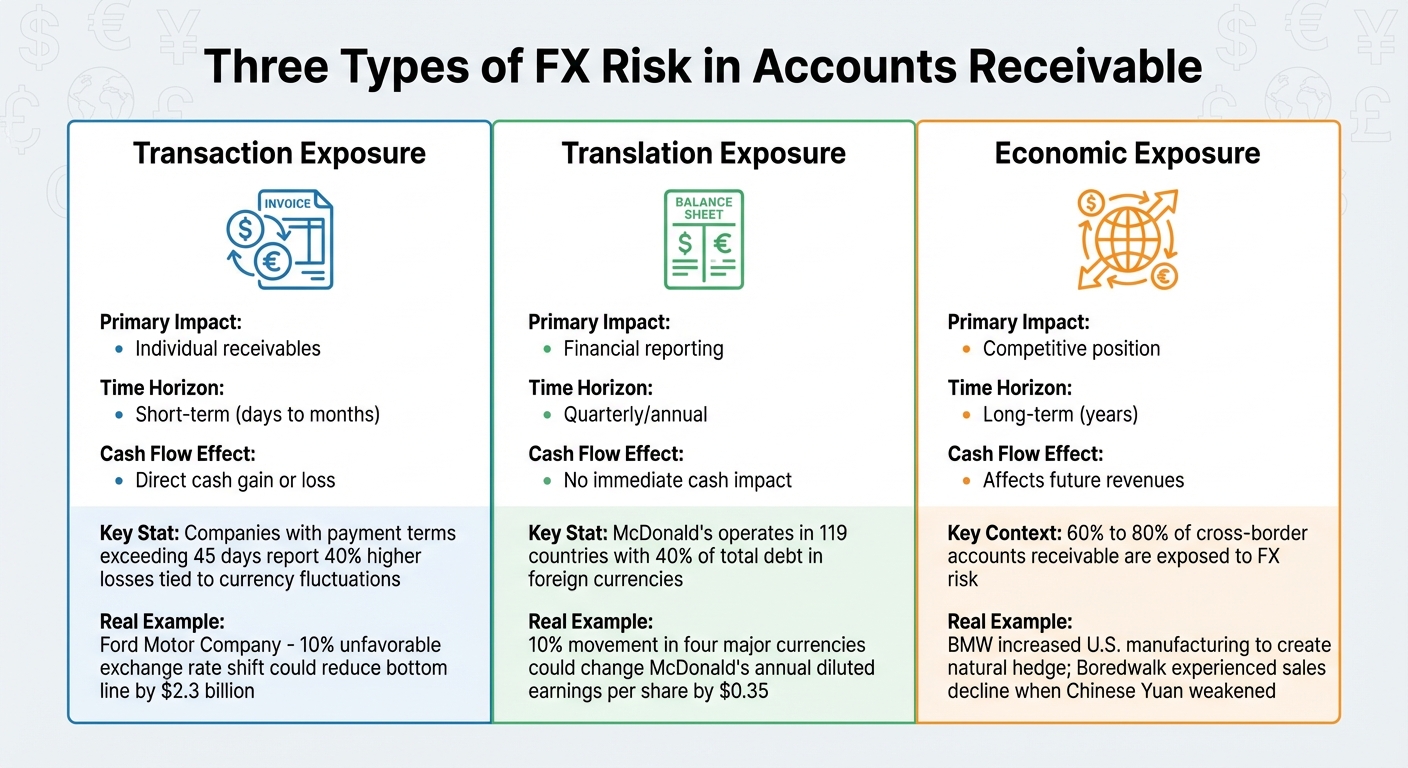

Grasping the various types of FX risk is essential for identifying your business’s vulnerabilities. Each type of risk influences your accounts receivable differently, impacting both short-term cash flow and long-term business competitiveness. With the global foreign exchange market generating $5.3 trillion in daily turnover, multinational companies often find that 60% to 80% of their cross-border accounts receivable are exposed to FX risk. Here’s a closer look at the key types of FX risk and how they affect receivables.

Transaction Exposure

Transaction exposure directly impacts your net income. This risk arises during the time between issuing an invoice in a foreign currency and receiving payment. Any fluctuation in exchange rates during this period can disrupt your expected cash flows. The longer the payment cycle, the greater the risk. For example, companies with payment terms exceeding 45 days report 40% higher losses tied to currency fluctuations.

A real-world example of managing this risk is Ford Motor Company. As of December 31, 2019, Ford used forward contracts to hedge its exposure, reporting a net fair value liability of $596 million. A sensitivity analysis revealed that a 10% unfavorable shift in exchange rates could potentially reduce its bottom line by $2.3 billion.

Translation Exposure

Translation exposure is more about accounting than immediate cash flow. It occurs when foreign subsidiary accounts are converted into U.S. dollars for financial reporting. Exchange rate fluctuations can alter the value of foreign currency receivables on the balance sheet, even if no cash changes hands.

For instance, McDonald’s Corporation operates in 119 countries and reported that 40% of its total debt was in foreign currencies. The company estimated that a 10% movement in its four major currencies – Euro, British Pound, Australian Dollar, and Canadian Dollar – could change its annual diluted earnings per share by about $0.35. While this type of exposure doesn’t affect cash flow directly, it can influence stock prices and investor confidence.

Economic Exposure

Economic exposure is a long-term risk that can affect your market value and competitive position. Unlike transaction exposure, which deals with specific invoices, economic exposure stems from sustained currency fluctuations that impact future cash flows and pricing strategies across entire markets.

BMW addressed this challenge by increasing U.S. manufacturing, creating a natural hedge where dollar-denominated costs matched dollar-denominated revenues. Even domestic companies can face economic exposure indirectly. For example, Boredwalk, a U.S.-based T-shirt company, experienced a sharp decline in sales when the Chinese Yuan weakened against the dollar. This made Chinese-manufactured goods more competitive on platforms like Amazon, despite Boredwalk not engaging in direct foreign currency transactions.

| Risk Type | Primary Impact | Time Horizon | Cash Flow Effect |

|---|---|---|---|

| Transaction | Individual receivables | Short-term (days to months) | Direct cash gain or loss |

| Translation | Financial reporting | Quarterly/annual | No immediate cash impact |

| Economic | Competitive position | Long-term (years) | Affects future revenues |

Strategies for Managing FX Risk in Receivables

Once you’ve identified your foreign exchange (FX) exposure, the next step is selecting the right tools to protect your cash flow. Financial derivatives are widely used for this purpose, with currency derivatives being a top choice for 44% of non-financial firms globally. Below, we explore strategies aimed at safeguarding your margins and stabilizing cash flows.

Forward Contracts

Forward contracts allow you to lock in an exchange rate today for a payment you’ll receive in the future. These over-the-counter (OTC) agreements are tailored to match the exact amount and settlement date of your receivables, ensuring the U.S. dollar value of your foreign invoices remains fixed. Unlike standardized futures contracts, forwards offer flexibility to meet your specific needs.

For example, suppose you invoice a European customer €100,000 with Net 60 terms. By locking in today’s EUR/USD rate of 1.10, you can guarantee a payment of $110,000, regardless of future exchange rate fluctuations.

"The focus of any currency hedging program should be on the reduction of risk, not on trading the market." – Chris Braun, Head of Foreign Exchange, U.S. Bank

Forward contracts are particularly effective for hedging balance sheet risks. The mark-to-market changes in the forward contract naturally offset fluctuations in the spot rate of your receivable’s value. On average, the annual cost of using forwards ranges from 1% to 3% of the transaction value. Studies even show that FX hedging can boost a company’s market valuation by 4.87%.

However, forwards come with some drawbacks. Since these contracts aren’t backed by a centralized exchange, there’s a risk of counterparty default. Additionally, you’re locked into a fixed rate, even if the market moves in your favor. To mitigate costs and exposure, consider shortening payment terms – for instance, from 90 days to 30 days – whenever possible.

Next, let’s look at how currency options can provide protection with added flexibility.

Currency Options

Currency options offer protection while maintaining flexibility. Unlike forward contracts, which lock you into a specific rate, options give you the choice to exchange currency at a predetermined rate. If the exchange rate moves against you, the option safeguards your profit margin. If the rate shifts in your favor, you can let the option expire and take advantage of the better spot rate instead.

This flexibility comes at a price: an upfront premium paid to the seller. Options are particularly useful when dealing with uncertain timing or amounts. For example, if you’re negotiating a large international contract but haven’t finalized the payment schedule, an option provides a safety net without tying you to a specific settlement date.

"The idea isn’t to remove all risk… The idea is to protect against a huge rate swing." – NetSuite

Before purchasing an option, it’s important to weigh the premium cost against the protection it offers relative to your receivable’s profit margin. Working with currency specialists, rather than general banks, can help tailor strategies to your unique cash flow needs. Remember, the goal is to reduce risk and improve forecasting stability, not to speculate on currency movements.

When financial instruments aren’t the right fit, natural hedging offers a straightforward alternative.

Natural Hedging

Natural hedging is one of the simplest ways to manage FX risk: align your foreign currency receivables with payables in the same currency. For instance, if you’re receiving payments in British Pounds, use those funds to pay UK suppliers or employees. This approach eliminates exposure without the need for derivatives, premiums, or counterparty risk.

A five-year study of over 6,000 companies across 47 countries found that FX hedging is linked to reduced cash flow volatility, lower systematic risk, and more stable returns. By matching your cost base with your revenue stream, natural hedging helps protect profit margins from exchange rate fluctuations.

For larger, long-term international contracts, some businesses take it a step further by relocating production or operations to the country where sales occur. This ensures that revenues and expenses are in the same currency, minimizing FX risk. Additionally, diversifying currencies can act as a financial buffer – gains in one currency may offset losses in another, reducing the overall impact of adverse market movements.

Large organizations often use Treasury Management Systems and intercompany netting to streamline currency management and reduce external conversions. Before implementing any hedging strategy, it’s critical to assess your total exposure across all balance sheet items rather than hedging individual transactions. Multi-currency accounts can also simplify payments by holding foreign currency balances, avoiding unnecessary conversions.

"From a corporate treasury standpoint, the goal is to provide stability, enabling better planning and forecasting." – Chris Braun, Head of Foreign Exchange, U.S. Bank

The main limitation of natural hedging is that it requires an operational presence or supplier relationships in the foreign market. Still, when feasible, it’s the most cost-effective way to manage FX risk in receivables, offering a solid foundation for broader currency risk management.

Combining Trade Credit Insurance with FX Risk Management

In the world of global trade, combining hedging strategies with insurance can significantly strengthen your approach to risk management. While tools like forward contracts and options are designed to shield your receivables from currency fluctuations, they fall short in protecting against non-payment risks. That’s where trade credit insurance becomes essential. It provides an additional layer of security by covering risks that FX hedging alone cannot address.

This combination becomes especially critical in situations where currency devaluation leads to payment defaults. For instance, if a buyer’s currency experiences a sharp decline, they may struggle to settle invoices in U.S. dollars. Trade credit insurance steps in to cover such losses. As Marc Wagman, Managing Director of Credit and Political Risk at Gallagher, explains:

"Typically, receivables – the lifeblood of a company fueling cash flow – are the largest uninsured asset on the balance sheet. Having the insurance greases the wheels of global trade".

Let’s explore how trade credit insurance works, its benefits, and when it’s most advantageous to use.

How Trade Credit Insurance Works

Trade credit insurance is designed to protect your business from losses caused by unpaid invoices due to customer insolvency or bankruptcy. Coverage typically reimburses 75%-95% of the invoice amount, depending on the policy. Beyond commercial risks, it can also shield against political risks – such as government intervention, currency restrictions, trade barriers, or conflicts – which are particularly relevant when operating in emerging markets.

Companies like Accounts Receivable Insurance (ARI) specialize in tailoring policies to meet specific business needs. Whether you’re working with a few high-value international clients or managing a diverse portfolio across multiple countries, there’s a solution to fit your requirements. Premiums generally range from 0.1% to 0.5% of covered sales, with factors like your industry, customer creditworthiness, and deductible choices influencing costs. With the trade credit insurance market forecasted to grow to $13.3 billion by 2025 from $12.2 billion in 2024, more businesses are recognizing its importance in today’s unpredictable global economy.

Benefits of Using Insurance with Hedging

Pairing trade credit insurance with FX hedging creates a robust safety net for your business. Banks view insured and hedged receivables as high-quality collateral, which can lead to better loan terms and increased borrowing capacity. This approach can also free up capital that would otherwise be tied up in reserves for bad debts, allowing you to reallocate funds toward growth initiatives like research, development, or market expansion.

This combination also enables you to offer competitive payment terms in multiple currencies without taking on excessive risk. As Jerry Paulson, Senior Vice President at HUB International, puts it:

"Trade credit insurance helps solve this dilemma by covering the risk of unpaid invoices caused by a customer’s insolvency, mitigating the risk of buyer defaults while freeing up capital and improving cash flow".

For example, in February 2024, a U.S.-based food importer extended $500,000 in credit to a European distributor. When the distributor declared bankruptcy, the trade credit insurance policy covered 90% of the unpaid amount, sparing the importer from a potentially devastating cash flow crisis.

When to Use Trade Credit Insurance

To fully manage FX risks tied to receivables, it’s wise to integrate trade credit insurance when conducting transactions outside the U.S. dollar. Selling in local currencies increases exposure to FX risk, but combining hedging with insurance allows you to offer flexible terms while safeguarding your margins and principal. This approach is particularly beneficial if your business relies on a few large international clients for substantial revenue or when entering markets with heightened political or economic instability.

With U.S. bankruptcies through March 2025 hitting their highest levels since 2010, and 57% of U.S. companies reporting shrinking gross margins due to tariffs and rising costs of foreign goods, the need for layered protection has never been clearer. Before negotiating sales contracts in foreign currencies, it’s essential to consult with an international banker or currency specialist to align your hedging tools with appropriate credit insurance limits. Additionally, keeping an eye on metrics like Days Sales Outstanding (DSO) and the Collection Effectiveness Index (CEI) can help identify when added protection through trade credit insurance might be necessary.

How to Monitor and Revalue FX Receivables

Effectively managing foreign currency receivables requires a structured approach to monitoring. Dive deep into your balance sheet exposures and cash flow forecasts at both the parent and subsidiary levels. This helps you understand not only the amounts owed but also the timing of payments and how fluctuations in foreign exchange (FX) rates impact your margins throughout your operating cycle.

The risks are real and can be costly. More than 80% of small and medium-sized enterprises (SMEs) engaged in international trade have experienced FX losses, with some incidents exceeding $1 million. As Oscar Arriaza, SVP of International Banking at Bank of Texas, cautions:

"If you’re just riding the market and hoping for the best, you’re definitely putting your company at a disadvantage. Hope is not a strategy".

Once you’ve assessed your exposure, implementing a consistent month-end revaluation process is critical for maintaining accurate financial records.

Month-End Revaluation Process

At the end of each period, follow these steps to ensure accurate revaluation of your FX receivables:

- Update exchange rates to reflect the latest market values.

- Identify all unpaid or partially paid invoices.

- Compare the original domestic amounts to the current values.

- Review an Unrealized Gain/Loss Report to assess the impact of FX changes.

- Post reversing journal entries to adjust your ledger accordingly.

Before finalizing journal entries, carefully review unrealized gain/loss reports. This step allows you to verify exchange rates and correct any discrepancies, minimizing the risk of costly errors. Use specific document types to simplify audits and ensure the process to create journal entries is only executed once per fiscal period to avoid duplicates.

Tools for Tracking FX Exposure

Manual month-end adjustments can be time-consuming and prone to errors. Automated tools offer a more efficient way to track FX exposure. By replacing spreadsheets with automated systems, you eliminate errors and delays that could lead to missed opportunities. Many modern ERP systems, such as Oracle JD Edwards, provide automated tools that revalue open foreign invoices at the end of each fiscal period. These systems integrate seamlessly with automated accounts receivable (AR) platforms, centralizing tasks like digital invoicing, real-time cash application, and reconciliation.

For forecasting, finance teams often rely on advanced modeling techniques like Earnings at Risk (EaR) and Cash Flow at Risk (CFaR). EaR quantifies potential earnings losses due to currency fluctuations, while CFaR measures possible shortfalls in cash flow caused by FX rate changes. Companies like Kantox provide automated FX management solutions that can trigger hedging actions as soon as sales orders are placed. Antonio Rami, Founder and Chief Growth Officer at Kantox, advises:

"Understand your business, understand how you generate risk and derive a currency process you can automate".

Scenario Analysis and Forecasting

Scenario analysis is a powerful tool for predicting how different exchange rate movements could affect your cash flow and earnings. Before selecting forecasting tools, consider whether your primary concern is the volatility of cash flows (forecasted transactions) or the volatility of earnings (recorded balance sheet items). This distinction will help you choose the right hedging instruments and monitoring strategies for your business.

Regularly running aging reports is another essential practice. These reports allow you to track outstanding invoices by their duration, helping you identify trends and pinpoint receivables with prolonged exposure to exchange rate fluctuations. Use "As Of" reporting to meet financial audit requirements and reconcile open invoices with accounts receivable trade accounts. By combining these tools with hedging strategies, you can create a cohesive approach to managing FX risk.

Conclusion

Key Points Recap

Managing FX risk is a crucial step for businesses involved in international trade. With over 80% of SMEs trading internationally having faced currency-related losses, understanding the three key exposures – transaction, translation, and economic – is essential for building a solid defense.

The best strategies layer multiple protective measures. Tools like forward contracts and currency options help shield profit margins from exchange rate fluctuations, while natural hedging minimizes exposure by aligning revenues and expenses in the same currency. Adding trade credit insurance further strengthens your position by protecting not only the value of your receivables but also safeguarding against customer defaults or insolvencies.

A strong FX risk management plan begins with clear visibility into your balance sheet exposures and cash flow forecasts. Identifying when and where risks arise in your operations is key. Modern automation tools can replace outdated, error-prone manual processes, while programmatic hedging strategies with set parameters offer consistency without the need for constant market monitoring.

With these strategies in hand, you’re now equipped to take actionable steps to protect your receivables and stabilize your financial operations.

Final Advice for Businesses

Relying on a "hope for the best" mindset is not a viable approach to managing currency risk. Even expert currency forecasts are right only 57% of the time, making market timing a risky and often unproductive strategy. Instead, focus your hedging efforts on achieving stability and predictability rather than attempting to outsmart the market.

Evaluate your risk profile to determine whether cash flow stability or earnings volatility is your primary concern. This distinction will guide your choice of hedging tools and monitoring approaches. Collaborate with foreign exchange professionals at your bank to implement straightforward solutions like forward contracts, which don’t require extensive internal treasury resources.

For businesses working with international customers, consider integrating trade credit insurance into your risk management plan. Providers like Accounts Receivable Insurance offer coverage that’s particularly valuable when operating in emerging markets or regions with political instability. Combining FX hedging with credit insurance not only protects your receivables but also enhances your borrowing capacity, as banks view insured and hedged receivables as stronger collateral. This comprehensive approach addresses both currency volatility and payment risks, creating a robust safety net for your international operations.

FAQs

What’s the best way for businesses to choose an FX risk management tool for their receivables?

To choose the right foreign exchange (FX) risk management tool, begin by pinpointing the specific FX risks impacting your receivables. These could include transaction risks, translation risks, or economic risks. Next, clarify your top priorities. Do you need a solution that automates data capture from your ERP or accounting system? Or perhaps you’re looking for real-time dashboards to monitor multi-currency exposure, tools for running scenario analyses, or features that ensure compliance with U.S. GAAP hedge accounting standards.

When evaluating tools, focus on three critical aspects:

- Integration: The tool should connect effortlessly with your current systems to avoid disruptions.

- Usability: Look for intuitive features that provide real-time insights in U.S. dollars and allow for flexible modeling of hedging strategies.

- Compliance: Ensure the tool automates accounting entries and meets regulatory reporting requirements.

Testing a demo or pilot version is a smart way to see how well the tool aligns with your operational needs and budget constraints.

Lastly, weigh the total cost of ownership – including licensing and support – against the advantages it offers. A dependable FX risk management tool can help stabilize cash flow, cut down on manual processes, and enable better decision-making in an ever-changing currency landscape.

What are the benefits of combining trade credit insurance with FX hedging?

Combining trade credit insurance with foreign exchange (FX) hedging creates a strong safety net for businesses managing cross-border receivables. Trade credit insurance helps shield companies from risks like non-payment, buyer insolvency, or political instability, ensuring a steady cash flow even when a buyer defaults. On the other hand, FX hedging stabilizes exchange rates for foreign-currency transactions, minimizing the impact of currency swings and protecting the value of incoming payments.

When used together, these tools empower businesses to invoice confidently in their buyer’s preferred currency, explore new markets, and safeguard their profit margins against unfavorable currency shifts. This combination not only improves cash flow reliability but also supports competitive pricing strategies and strengthens long-term profitability. Accounts Receivable Insurance (ARI) further simplifies the process by offering customized trade credit policies that integrate seamlessly with FX hedging programs. This approach makes risk management more efficient while freeing up working capital to fuel business growth.

How do automated tools help manage FX risk in accounts receivable?

Automated tools make managing foreign exchange (FX) risk in accounts receivable much easier by offering real-time insights into foreign-currency invoices. These tools seamlessly connect with ERP or accounting systems, constantly updating the USD value of receivables as exchange rates shift. This eliminates the need for manual calculations, minimizes errors, and ensures that exposure data stays up-to-date.

Some advanced platforms go a step further by flagging invoices that cross predefined risk thresholds and immediately notifying the risk management team. Many also feature analytics and dashboards to highlight concentration risks, evaluate different scenarios, and support data-driven decision-making. Certain systems even take action automatically, such as initiating forward contracts when exposure limits are surpassed. By simplifying these workflows, businesses can respond quickly, safeguard profit margins, and maintain a clear, accurate view of FX risk within their receivables.