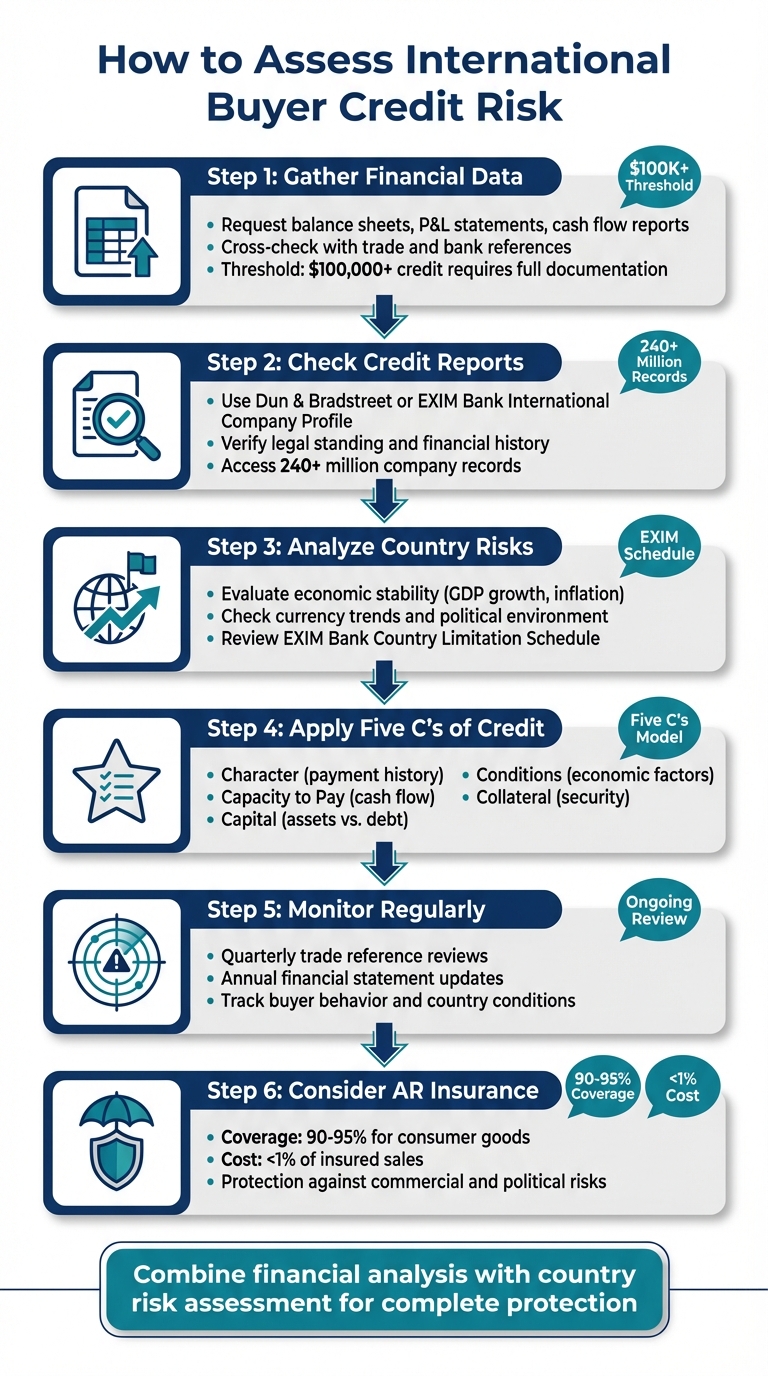

Assessing international buyer credit risk is about ensuring you get paid for your goods or services, even when dealing with foreign customers. The process involves evaluating the buyer’s financial health and the economic or political conditions in their country. Here’s how you can do it:

- Start with financial data: Request balance sheets, profit and loss statements, and cash flow reports. Cross-check these with trade and bank references to verify their payment history and financial stability.

- Check credit reports: Use third-party services like Dun & Bradstreet or EXIM Bank’s International Company Profile to validate a buyer’s legal and financial standing.

- Analyze country risks: Study the buyer’s country’s economic stability, currency trends, and political environment to identify potential payment challenges.

- Use the Five C’s of Credit: Assess Character, Capacity to Pay, Capital, Conditions, and Collateral to build a credit score for the buyer.

- Monitor regularly: Keep track of buyer behavior and country conditions to catch early signs of risk.

- Consider Accounts Receivable Insurance: Protect yourself against losses from nonpayment due to economic or political disruptions.

6-Step International Buyer Credit Risk Assessment Process

Export credit insurance, payment terms, letters of credit and foreign EX

Gathering and Analyzing Buyer Financial Data

Every credit assessment begins with solid financial documentation. For buyers seeking credit exceeding $100,000, start by requesting their most recent year-end balance sheet, profit and loss statement, and cash flow statement. These documents provide a clear picture of their assets, liabilities, revenue streams, and liquidity. To ensure accuracy, cross-check these figures with external payment histories.

Trade references are another key piece of the puzzle. Jennifer Simpson, Regional Director at EXIM Bank, emphasizes that while financial statements might reflect strong cash flow, supplier references often reveal a buyer’s actual payment habits. Ask buyers to provide contact details for 2–3 current suppliers who extend them credit terms. Use a standardized form to gather specific information, such as the highest credit extended in the past year, any current overdue balances, and whether payments are on time or delayed (e.g., 30, 60, or 90+ days late). In global trade, it’s worth noting that a buyer may still be considered "prompt" even if payments are made up to 30 days past the invoice due date.

Third-party credit reports can simplify the process by offering standardized data for easy risk evaluation. Services like Dun & Bradstreet or the U.S. Commercial Service’s International Company Profile can verify a buyer’s legal standing, ownership structure, and any negative history. Once armed with this data, dig into financial trends for a deeper understanding of the buyer’s situation.

Bank references are another essential tool, though privacy laws require a signed release from the buyer before you can access this information. With permission, reach out to the buyer’s commercial bank to confirm their credit line, average daily balances, and any overdraft history. These details shed light on whether the buyer has the operational capital needed to manage their receivables while waiting for payments from their own customers.

When analyzing financial data, focus on the buyer’s capacity, capital, and liquidity. Look for trends in sales, profits, debt ratios, and any recorded liens or judgments. This thorough examination turns raw numbers into meaningful insights, offering a clearer picture of the buyer’s financial health and reliability.

Evaluating Country and Political Risks

While financial data provides a strong foundation for assessing payment risks, understanding country and political risks is just as important. Even if a buyer’s financials appear solid, external factors like economic instability or political shifts can disrupt payments. These risks might prevent buyers from accessing foreign currency or transferring funds, even if they have the means and intent to pay. By combining financial data with country-specific factors, you can form a more complete view of international credit risk.

Economic and Currency Stability Analysis

A good starting point is assessing the economic stability of the buyer’s country. Metrics like real GDP growth can indicate whether the economy is expanding or contracting, while inflation rates reveal if that growth is sustainable. High or unpredictable inflation is a warning sign, as it often leads to macroeconomic instability, making payments from buyers less predictable.

Take a close look at external imbalances such as the Current Account balance and the External Debt-to-GDP ratio. These numbers can show if a country is overly dependent on short-term foreign funding. Between 1993 and 2015, the International Monetary Fund (IMF) documented 56 "sudden stop" events, where investor confidence collapsed, cutting off capital flows and leaving local buyers unable to secure foreign currency for payments. Another critical measure is import cover, which compares a country’s foreign exchange reserves to its monthly import needs. A low ratio here signals potential challenges in meeting trade obligations.

For deeper insights, resources like the U.S. Commercial Service’s Country Commercial Guides can provide a detailed breakdown of a market’s economic conditions. Additionally, the EXIM Bank Country Limitation Schedule offers a quick overview of operational restrictions in specific markets, helping you gauge acceptable levels of risk.

Political Climate and Trade Regulations

Beyond economic indicators, the political environment and trade policies play a major role in payment reliability. Assess aspects such as political transition processes, the effectiveness of governance, and the independence of institutions in the buyer’s country. Countries with weak governance or frequent political instability are more likely to impose capital controls or exchange restrictions, which could prevent buyers from converting local currency or transferring funds abroad. Allianz Trade explains:

A country risk rating measures the risk of non-payment by companies in a given country. This risk is due to conditions or events outside any company’s control.

Their six-level rating system, ranging from AA (lowest risk) to D (highest risk), incorporates political factors along with macroeconomic and business environment assessments. Keep an eye out for force majeure events – such as war or civil unrest – that could completely halt business operations.

Another critical area to monitor is trade regulations and remedies. Check whether your products might be subject to antidumping duties, countervailing duties, or safeguard measures in the buyer’s country. Using tools like International Company Profiles can help you stay updated on regulatory developments. By addressing these potential barriers early, you can reduce the chances of encountering payment challenges later.

Conducting Credit Scoring and Risk Matrix Analysis

After gathering financial data and evaluating country risks, the next step is to turn this information into practical decisions. Tools like credit scoring and risk matrices make it easier to compare buyers and set appropriate credit limits. These methods lay the groundwork for a clear and systematic approach to assessing risk.

Building a Buyer Credit Score

Credit scoring begins with the Five "C’s": Character, Capacity, Capital, Conditions, and Collateral. Character refers to a buyer’s willingness to meet their obligations, which can be evaluated through payment history and trade references. Trade references, in particular, provide valuable insights into a buyer’s payment habits.

To create a comprehensive credit score, combine these qualitative insights with quantitative measures such as debt ratios and cash flow. For markets where credit data is scarce, resources like the U.S. Commercial Service’s International Company Profile (ICP) can offer detailed credit reports and expert opinions on a company’s reliability. It’s also important to keep an eye on buyer scores over time using CRM tools, which can flag early signs of financial distress.

"A good credit score does not necessarily mean a customer is a low risk. Even with a stellar credit history, any business or individual faced with significant or unexpected economic hardships is at risk of default."

Many businesses adopt classification scales similar to those used by EXIM, which range from CC0 (Exceptionally Good) to CC5 (Weak Credit Quality). Buyers rated CC0 are considered very low risk, with strong cash flow and minimal debt, while CC5 buyers are high-risk, often dependent on favorable economic conditions to meet their obligations. For high-performing multinational buyers, check if they’ve achieved a "Better than Sovereign" status. This designation suggests that their offshore assets or international partnerships could help them meet financial obligations even during a sovereign debt crisis.

Applying a Risk Matrix

Once credit scores are established, they can be incorporated into a risk matrix to fine-tune credit limits. This matrix matches credit scores with country risk categories, allowing you to set limits that reflect both buyer reliability and external conditions. For instance, a buyer rated CC2 (Good/Moderate risk) in a stable, low-risk country might qualify for a higher credit limit than a CC1 (Very Good) buyer in a country with currency controls or political instability.

Credit reporting agencies like Dun & Bradstreet and Coface provide access to a vast amount of data – covering over 240 million and 200 million companies, respectively. These databases, often enhanced by AI and machine learning, allow you to benchmark a buyer’s performance against industry peers and spot trends that could signal increasing risk.

Using the risk matrix, you can adjust credit policies based on risk levels. Buyers with low risk may qualify for higher limits and more flexible terms, while those with higher risk might face stricter payment conditions or need to provide additional security. This strategy strikes a balance between fostering growth and managing exposure effectively.

sbb-itb-2d170b0

Ongoing Monitoring and Stress Testing

Credit assessment isn’t something you can set and forget. Since buyer finances and country conditions are always in flux, regular reviews are essential. Keeping a close eye on these changes allows you to spot potential issues early. At the same time, stress testing helps you understand how well your business could withstand worst-case scenarios. Together, these practices create a proactive approach to managing credit exposure.

Monitoring Buyer and Country Risks

Keeping tabs on your buyers’ payment habits can reveal early warning signs of trouble. For instance, reviewing trade references every quarter can help you identify shifts in behavior. If a buyer who used to pay on time starts delaying payments by 30 or 60 days, it’s a signal to dig deeper into their financial health. For accounts with high credit limits, requesting annual financial statements and bank references can provide additional insights. Tools like credit data monitoring can also alert you to lawsuits, changes in ownership, or even address updates that may indicate instability.

"A customer who plans to build a long and strong relationship with their supplier should be willing to share their company financials when you ask for them."

– Jennifer Simpson, Regional Director, EXIM

Beyond buyer-specific risks, external conditions must also be reviewed regularly. For example, Allianz Trade uses a six-level grading system, from AA (lowest risk) to D (highest risk), to evaluate medium-term country risks. Short-term risks are rated on a scale of 1 to 4, focusing on economic performance over the next 6 to 12 months. The EXIM Bank Country Limitation Schedule is another useful resource; checking it quarterly can help you determine if political or economic conditions in a particular market have worsened enough to limit support. Additionally, the Consolidated Screening List should be reviewed frequently to ensure your buyer hasn’t been flagged under new U.S. government restrictions.

Conducting Stress Tests on Credit Exposure

While monitoring keeps you informed, stress testing takes it a step further by helping you prepare for the unexpected. Stress tests involve running "what if" scenarios to see how your credit safeguards hold up under pressure. For example, you can model situations like currency devaluation, political unrest, or regulatory changes. These tests can reveal the potential impact of multiple buyers defaulting at once or an entire country’s economy faltering.

"Assessing the risks of extending credit to customers located in another country will depend upon an evaluation of both the buyer and their country risks."

– Office of Small Business, EXIM Bank

Stress testing also helps ensure your buyers have enough capital to cover receivables during cash flow shortages. For buyers in unstable markets, check whether they maintain active credit lines with local banks – these can serve as a safety net during financial crunches. Resources like the World Bank’s "Ease of Doing Business" ratings and IMF data can help you identify broader economic risks that might lead to payment failures. Finally, consider how your overall credit exposure would fare if your top three buyers in a single country all delayed payments by 90 days or defaulted entirely. This kind of scenario planning can help you stay prepared for even the most challenging situations.

Mitigating Risk with Accounts Receivable Insurance

Even with the most thorough assessments and diligent monitoring, international payment risks can’t always be completely avoided. This is where Accounts Receivable Insurance (ARI) steps in. ARI safeguards businesses against nonpayment caused by insolvency, bankruptcy, or political disruptions. It enables U.S. companies to offer open account terms in global markets without putting their cash flow at risk. In essence, ARI fills the gap between identifying risks and effectively managing potential losses.

Benefits of Trade Credit Insurance

Trade credit insurance provides protection against both commercial risks (like bankruptcy or payment defaults) and political risks (such as war, terrorism, or currency instability). Here’s how it typically works:

- Coverage for consumer goods usually ranges from 90–95% with repayment terms up to 180 days.

- For capital equipment, policies often cover 85% with repayment periods extending from one to five years.

- Costs are generally less than 1% of insured sales.

Beyond risk protection, insured receivables can be used as collateral, which can help persuade lenders to boost your borrowing capacity or offer better financing terms. Businesses can tailor their policies to fit their needs, whether by insuring a single high-risk buyer or adopting a multi-buyer portfolio to cover all eligible export sales.

Accessing Customized Risk Assessment and Claims Management

ARI providers offer more than just coverage – they deliver customized risk evaluations and streamlined claims management. Working with a specialized broker can help you secure a policy that aligns with your specific transaction needs at a competitive cost.

For multi-buyer policies, providers may set Discretionary Credit Limits, allowing you to extend credit based on your own assessments. For individual high-value accounts, you can apply for Special Buyer Credit Limits.

"ECI should be a proactive purchase, in that exporters should obtain coverage before a customer becomes a problem."

– U.S. Trade Finance Guide

The key is to purchase coverage before any signs of trouble arise. ARI is designed to mitigate future risks, not to address existing defaults. For small businesses without dedicated credit teams, ARI policies often include underwriting services to assess foreign buyer creditworthiness, ensuring your risk management strategy is tailored to your export activities.

Ensuring Coverage for Export Risks

Accounts Receivable Insurance builds on your financial and country risk analysis by extending protection to unexpected export challenges. Through a global network of credit insurance carriers, exporters can choose between private insurance policies and EXIM Bank coverage for emerging markets.

- Private insurers provide flexible credit limits without restrictions on foreign content or military sales.

- EXIM Bank offers coverage in higher-risk markets but requires at least 50% U.S. content for eligibility.

To verify eligibility for EXIM Bank coverage, exporters can consult the EXIM Country Limitation Schedule. Additionally, businesses using an EXIM working capital guarantee can benefit from a 25% premium discount on multi-buyer insurance policies. This flexibility ensures that exporters can select the right coverage for their unique market needs, whether they’re targeting established economies or venturing into riskier regions.

Conclusion

Evaluating international buyer credit risk requires a well-rounded approach that considers both the buyer’s financial standing and the broader conditions of their country. This means diving into trade references, credit reports, and cash flow analysis while keeping an eye on political stability, currency fluctuations, and the regulatory landscape of the buyer’s location. By addressing these factors together, you can safeguard both your financial interests and compliance requirements.

The "Five C’s" framework provides a reliable starting point for making informed credit decisions. Gabriel Ojeda, President of Fitz-Pak Corporation and a member of EXIM Bank’s advisory board, emphasizes:

"Knowing your market, the type of buyer you are selling to… and getting to know all about your buyer and their culture".

This insight highlights the need to go beyond just numbers – understanding the buyer’s background and business practices is equally critical.

Even with thorough analysis, uncertainties can still arise. That’s where Accounts Receivable Insurance comes into play. It serves as a safety net, shielding businesses from defaults and political disruptions that might not be captured during the evaluation process.

To enhance your risk management further, credit insurers offer valuable support. With access to data from millions of buyer relationships, they provide early warnings and comprehensive coverage, helping businesses – especially those without dedicated credit teams – protect cash flow and navigate risks. Combining detailed credit assessments with tailored insurance solutions ensures you’re prepared to manage international buyer risks with confidence.

FAQs

How does country risk affect assessing an international buyer’s creditworthiness?

Country risk encompasses the uncertainties tied to political, economic, legal, and currency-related factors in a buyer’s home country that could impact their ability to meet payment obligations. Issues like political unrest, poor economic management, fluctuating exchange rates, or even natural disasters can disrupt payments, even from companies that are otherwise financially sound. Understanding and evaluating these risks is a critical step when offering credit to international buyers.

Exporters often adjust credit terms based on the risk level of a particular country. For instance, businesses dealing with buyers in high-risk nations might opt for shorter payment periods, upfront payments, or require guarantees to minimize exposure. Another common strategy is using Accounts Receivable Insurance, which provides protection against losses stemming from non-payment due to political or economic upheaval. Factoring country risk into your credit evaluations not only safeguards cash flow but also supports smarter, more secure decisions when engaging in global trade.

What are the Five C’s of Credit, and why are they important in assessing credit risk?

The Five C’s of Credit – Character, Capacity, Capital, Collateral, and Conditions – are the core criteria lenders use to assess a borrower’s creditworthiness. Let’s break them down:

- Character reflects how trustworthy and reliable the borrower is, often determined by their credit history and payment behavior.

- Capacity focuses on the borrower’s ability to repay, including factors like income, cash flow, and current debt obligations.

- Capital looks at the borrower’s financial resources, such as savings or investments, which demonstrate their financial stability.

- Collateral refers to any assets the borrower can pledge to secure the loan, offering lenders an added layer of protection.

- Conditions take into account external influences, such as the state of the economy or the specific purpose of the loan.

These factors work together to help lenders evaluate risk. A borrower with a solid character and strong capacity – like consistent income and low debt – poses a lower risk of default. Ample capital and valuable collateral further reassure lenders by providing financial backup. On the other hand, challenging conditions, such as economic downturns, can make lenders more cautious, possibly resulting in stricter loan terms. By weighing these Five C’s, lenders can make smarter decisions about approving loans, setting interest rates, and determining credit limits.

Why is Accounts Receivable Insurance essential for international trade?

Accounts Receivable Insurance is a key tool for businesses engaged in international trade, offering protection against financial risks like buyer non-payment, insolvency, or even political upheaval. These risks can seriously disrupt cash flow and place a heavy financial burden on businesses, particularly when dealing with overseas buyers.

With this insurance in place, companies can extend open-account credit terms with confidence, explore opportunities in new markets, and keep their financial footing secure. It provides a safety net that helps businesses operate smoothly and grow steadily in the ever-changing global trade environment.