Emerging markets offer growth opportunities but come with higher risks for U.S. businesses. Trade credit insurance helps protect against buyer defaults and political instability, but navigating global regulations adds complexity. Here’s what you need to know:

- Key Challenges: Licensing barriers, limited access to buyer credit data, currency fluctuations, and policy inconsistencies complicate market access and increase costs.

- Impact on Insurance: Regulations affect coverage limits, pricing, and product design. Insurers face restrictions on reinsurance, and policies must align with both local and U.S. banking standards.

- Solutions: Specialized intermediaries assist with compliance, policy structuring, and claims management, ensuring coverage meets regulatory and financing requirements.

Market to mobilise: How can credit insurance bridge the trade finance gap in emerging economies?

Main Regulatory Challenges in Emerging Markets

After exploring global regulatory inconsistencies, let’s dive into the specific hurdles tied to licensing and market access in emerging markets.

Licensing and Market Access Barriers

Emerging markets often enforce strict licensing rules, such as limiting foreign ownership and requiring foreign insurers to operate through local subsidiaries. Additionally, policies must frequently be issued by locally admitted carriers. These regulations not only increase setup and compliance costs but also force U.S. businesses to rethink their global insurance programs entirely. As a result, international insurers often face three choices: secure a local license, collaborate with a domestic carrier, or withdraw from the market altogether.

Such restrictions stifle competition and reduce the variety of insurance products available to U.S. exporters. The limited authorization of local insurers further restricts market capacity, leading to higher premiums and less flexible policy terms. In some cases, companies turn to fronting arrangements, where a local carrier issues the policy while a global insurer assumes the risk. However, these arrangements come with added fees and administrative hurdles, slowing down policy issuance and driving up costs for policyholders.

How Regulations Affect Credit Insurance Availability and Costs

Regulations in emerging markets are reshaping how credit insurance is structured, priced, and valued for U.S. businesses. For exporters and lenders, understanding how these rules trickle down can reveal the true costs and limitations of coverage in riskier regions. Here’s a closer look at how these regulatory factors influence credit insurance.

Coverage Capacity and Product Design

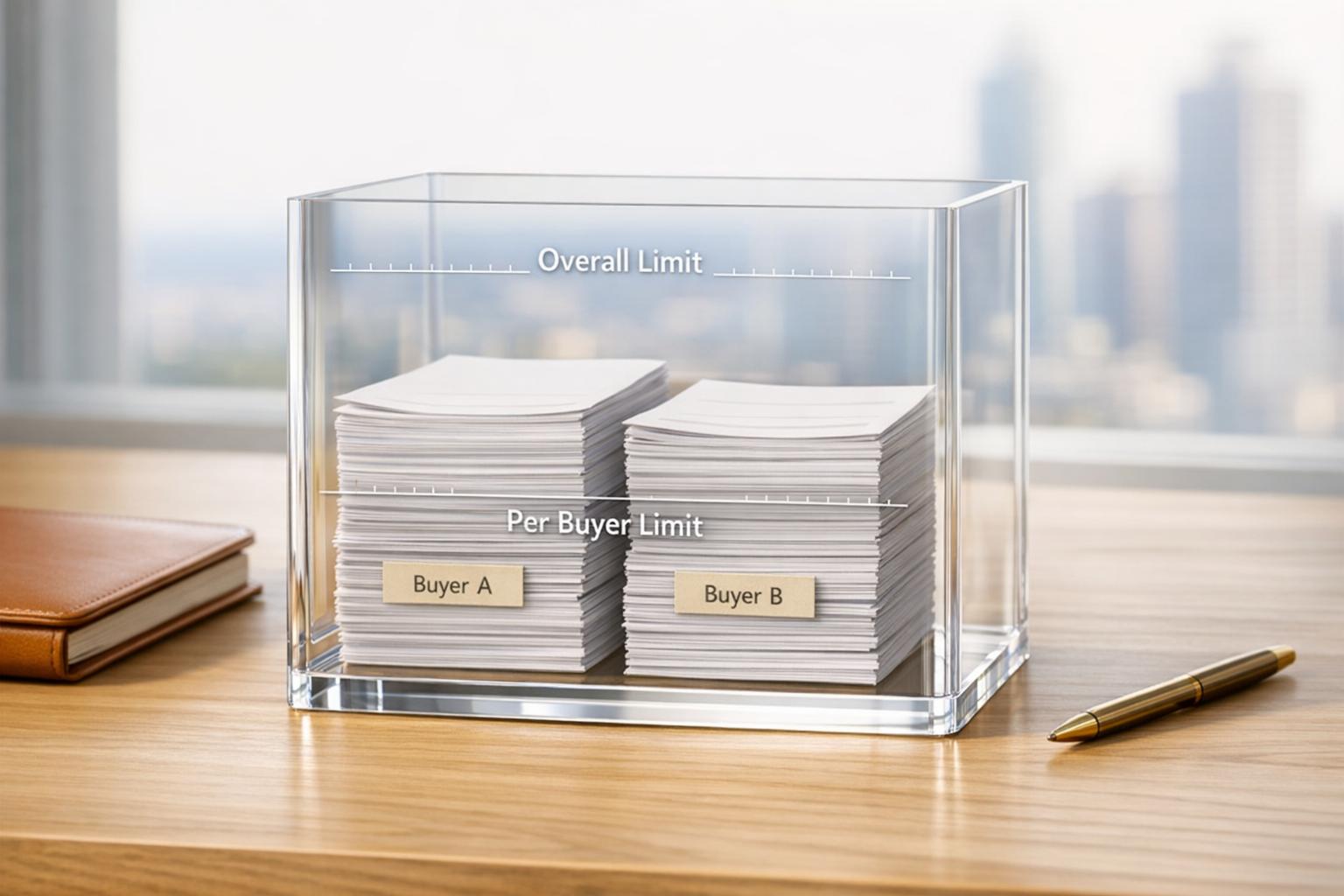

Emerging market regulators often enforce strict limits on credit insurance to manage systemic risks. These restrictions might cap coverage per buyer, industry, or country, directly reducing the amount of credit insurers can underwrite. Additionally, capital requirements impose heavier charges on policies with long durations, concentrated exposures, or cross-border risks, compelling insurers to curtail policy limits or reduce their overall capacity.

Reinsurance hurdles add another layer of complexity. Some markets restrict the use of foreign reinsurers or require pre-approval for large placements, which can dampen insurers’ willingness to back significant infrastructure or trade deals. For U.S. businesses, this often translates into scaled-back programs, quickly exhausted country-specific limits, or single-buyer limits that fall short of commercial needs – especially in smaller or higher-risk regions.

Product classification rules also play a role in shaping coverage. Depending on the market, credit insurance may be categorized as surety, financial guarantee, or property/casualty insurance, with each type subject to different regulatory standards. In jurisdictions with stringent rules on long-term or financial-guarantee products, insurers may favor shorter-term trade credit policies or limit coverage to narrower terms. Moreover, to ensure compliance with banking regulations, policies often need to meet specific criteria – like irrevocability and clearly defined default events – leading insurers to prefer standardized structures over customized solutions.

Pricing and Risk Sharing

Uncertainty around contract enforcement and currency conversion drives up premiums and deductibles in emerging markets. Risks like political instability, regulatory changes, and currency transfer restrictions – such as sudden exchange controls – further inflate base rates. Insurers often respond by requiring co-insurance, where the insured shares in the risk, to manage exposure.

Additional risks like expropriation, contract disputes, or unexpected regulatory actions lead to pricing surcharges, reflecting the potential for significant, hard-to-recover losses. For instance, restrictions on currency transfers or delays in accessing hard currency can disrupt payments in the policy’s currency, adding to costs. Weak bankruptcy systems and difficulties enforcing foreign arbitral awards also increase perceived risks, resulting in stricter claim conditions.

To counter these challenges, insurers often implement higher deductibles and co-insurance requirements. By having policyholders retain a portion of the risk – either through a deductible or a retained quota share – insurers not only reduce their exposure but also encourage better risk management. This approach helps maintain solvency ratios and ensures regulatory compliance. However, for U.S. exporters and lenders working with emerging market buyers, these adjustments mean higher overall costs compared to similar transactions in more stable markets.

Credit Enhancement and Access to Finance

For credit insurance to serve as effective risk mitigation, it must align with Basel-style guidelines and local regulatory standards. This includes provisions like irrevocability, direct recourse, and clearly defined default events. However, in some emerging markets, regulatory ambiguity around how private credit and political risk insurance interact with capital rules can limit the financing benefits for exporters.

In markets with supportive regulations, collaboration with multilateral development banks and export credit agencies can unlock significant opportunities. For example, in September 2023, the International Finance Corporation (IFC) worked with 13 global insurers to mobilize $3.5 billion in credit insurance capacity, enabling over $7 billion in additional lending to financial institutions in emerging markets.

When local laws recognize the enforceability of insurance assignments and accept credit insurance as valid collateral, U.S. exporters can use accounts receivable insurance to secure larger borrowing bases, longer loan terms, or better rates from U.S. banks – even when dealing with higher-risk buyers. On the flip side, in jurisdictions where legal frameworks around assignments, subrogation, or cross-border claims are unclear, banks may discount the value of the insurance as collateral. This reduces its effectiveness as a financing tool.

In such cases, specialized intermediaries like Accounts Receivable Insurance can help bridge the gap. By structuring policies and documentation to meet both U.S. lender requirements and local legal constraints, they enable exporters to access higher advance rates on insured receivables and secure financing options that might otherwise be out of reach. These regulatory dynamics underscore the importance of tailored solutions that align with both U.S. and host-country standards.

sbb-itb-2d170b0

Solutions for Overcoming Regulatory Challenges

3-Step Framework for Credit Insurance Compliance in Emerging Markets

Meeting Licensing Requirements

For U.S. businesses, ensuring that credit insurance complies with local licensing rules is a must. Many emerging markets restrict foreign insurers from issuing direct policies or impose strict controls on cross-border coverage. This is where intermediaries like Accounts Receivable Insurance come in. They analyze each country’s insurance, exchange control, and reinsurance regulations to create programs that meet both U.S. and host-country requirements.

One common approach is a fronting arrangement. In this setup, a locally licensed insurer issues the policy, while the risk is reinsured by a global insurer. Alternatively, businesses can establish master policies governed by U.S. or English law, supplemented by local policies as needed. In higher-risk markets, obtaining written legal opinions is essential to confirm that policies are enforceable and comply with foreign-exchange and tax regulations.

Once licensing challenges are addressed, the next step is ensuring the policies meet the standards required by banks.

Designing Policies That Meet Banking Standards

For credit insurance to be bankable, it must comply with Basel-style and local banking regulations. This means the policies must be irrevocable, unconditional, and clearly outline covered events such as defaults, insolvency, or political risks. Banks often require policies to name them as a loss payee or co-insured, allow assignment of proceeds without the debtor’s consent, and include cancellation terms that make the policy eligible as credit-risk mitigation.

Intermediaries play a key role in refining these policies. They adjust clauses related to unconditional payment, transferability, governing law, and dispute resolution to meet both local and international standards. In cases where local regulators mandate specific governing laws or endorsements, intermediaries can arrange dual-language endorsements while ensuring the main policy remains under New York or English law. This approach not only satisfies regulatory requirements but also opens up additional financing opportunities for U.S. businesses.

With policies in place, businesses must focus on accurate risk evaluation and efficient claims management to maximize the benefits of credit insurance.

Improving Risk Assessments and Claims Management

Emerging markets often come with higher risks due to increased default probabilities and political instability. To navigate this, precise risk assessments are essential. By combining external data, credit ratings, and macroeconomic indicators, intermediaries enhance underwriting accuracy, enabling higher coverage limits and better pricing.

Effective claims management is just as critical. Early-warning systems can help prevent defaults through timely interventions like reminders, negotiations, or local collection efforts. Adhering to policy conditions – such as maximum overdue days, timely notifications, and complete documentation – is crucial to maintaining coverage. Intermediaries like Accounts Receivable Insurance can assist by coordinating with local collectors and legal counsel, advising on restructuring options that align with policy terms, and preparing comprehensive claim files that meet insurer expectations. These measures often reduce disputes and speed up payouts.

Considerations for U.S. Businesses

Managing U.S. and Host-Country Regulations

U.S. exporters face the challenge of meeting both domestic and international regulatory requirements when using credit insurance in emerging markets. Domestically, they must adhere to rules like OFAC sanctions, export controls, and the FCPA. At the same time, host-country regulations often include licensing restrictions, capital controls, and foreign currency rules. In many emerging markets, only locally licensed entities can sell or front insurance products. This means foreign insurers may need to collaborate with local carriers or establish fronting arrangements. Additionally, some jurisdictions mandate that local risks be insured within the country, and solvency or currency controls can delay claim payments or restrict the transfer of proceeds out of the host nation.

To manage these complexities, U.S. companies should implement automated systems to screen buyers, guarantors, and banks against U.S. regulatory lists during onboarding and prior to each shipment. Consulting local legal experts is essential to ensure compliance with host-country trade, exchange, and insurance regulations, particularly to confirm that insured receivables and collateral are enforceable under local laws. Including clear sanctions and legal clauses in policies and contracts can offer additional protection if regulatory conditions shift during the policy term. Successfully navigating this intricate landscape requires a strong focus on risk management and compliance strategies.

Using Credit Insurance for Risk Protection

Emerging markets come with higher default risks – often up to three times that of advanced economies. This heightened risk makes credit insurance a critical tool for U.S. exporters who want to offer competitive open-account terms without jeopardizing their cash flow. Trade credit insurance safeguards companies against commercial non-payment risks, such as buyer insolvency or extended defaults, allowing businesses to extend payment terms while maintaining financial stability.

However, risks in emerging markets go beyond financial defaults. Geopolitical and regulatory events can disrupt operations, making political risk insurance (PRI) equally important. PRI covers threats like expropriation, nationalization, political violence, currency inconvertibility, transfer restrictions, and government contract breaches. These policies are often structured to align with long-term investments, providing essential protection for extended projects.

By combining trade credit and political risk insurance – whether through a single comprehensive policy or coordinated placements – U.S. companies can shield themselves from a wide range of threats. This approach is particularly beneficial for long-term supply agreements, infrastructure projects, and capital-intensive investments. For instance, the World Bank‘s IFC Managed Co-Lending Portfolio Program mobilized $3.5 billion in credit insurance capacity from 13 global insurers in September 2023. This initiative unlocked over $7 billion in additional IFC lending for emerging markets over six years. Given the complexity of these risks, working with experts to design tailored insurance solutions is crucial.

Working with Specialized Intermediaries

Given the regulatory challenges and risks associated with emerging markets, specialized intermediaries offer invaluable support for U.S. businesses. Structuring effective credit insurance policies that meet both U.S. and host-country requirements demands expertise. Brokers and intermediaries with a focus on trade credit and political risk insurance can provide this specialized knowledge, giving businesses access to a wide network of global insurers. They also help benchmark pricing, refine terms, and navigate local regulatory hurdles.

Intermediaries like Accounts Receivable Insurance design credit insurance programs that address regulatory gaps, improve underwriting precision, and streamline claims processes. They ensure policy language meets banking standards for credit risk mitigation, including clear assignment to lenders, irrevocability, and robust claims provisions. These elements can help banks secure capital relief under Basel-style regulations.

Beyond policy design, these specialists coordinate with local collectors and legal counsel, offer guidance on restructuring within policy terms, and prepare detailed claim files that comply with insurer requirements. This often reduces disputes and speeds up claim payouts. For U.S. companies exploring higher-risk markets, this expertise not only enhances coverage and pricing but also ensures a smoother claims experience, making it an invaluable resource for navigating complex global trade environments.

Conclusion

Emerging markets present U.S. businesses with exciting growth opportunities, but they don’t come without challenges. Regulatory hurdles – like licensing restrictions, capital requirements, and product classification issues – can increase costs and complicate market access. These obstacles directly influence coverage availability, policy design, and pricing, often resulting in tighter underwriting standards and reduced capacity in higher-risk markets.

The key to overcoming these challenges lies in creating tailored solutions rather than relying on off-the-shelf policies. Standard insurance wordings developed for U.S. or European markets often fall short when dealing with the legal uncertainties, political risks, and regulatory demands unique to emerging markets. Custom policies, designed to comply with both local insurance regulations and U.S. banking standards, ensure that coverage is enforceable, acceptable to banks, and ready to perform when claims arise. This tailored approach bridges the gap between meeting regulatory requirements and addressing real-world financing needs.

Specialized intermediaries, like Accounts Receivable Insurance, play a crucial role in this process. They craft customized trade credit programs, conduct detailed risk assessments, navigate dual regulatory frameworks, and streamline claims handling. With the help of experienced brokers, businesses can secure policies that meet banking requirements for capital relief, satisfy local regulatory expectations, and cover both commercial and political risks.

To effectively seize these opportunities, U.S. companies need to align their strategies with market realities. This means identifying exposure early, focusing on high-risk markets, partnering with knowledgeable intermediaries, and ensuring policy terms meet lender demands. Properly structured trade credit insurance can unlock financing, stabilize cash flow, and enable businesses to confidently expand into markets that might otherwise seem too risky.

While the regulatory landscape may be complex, the right expertise and tailored solutions empower businesses to extend credit securely, protect their receivables, and pursue growth in some of the world’s most dynamic markets. By working with experts, companies can minimize risk and maximize opportunities in these emerging regions.

FAQs

What are the biggest regulatory hurdles for obtaining credit insurance in emerging markets?

Businesses looking to secure credit insurance in emerging markets often encounter major regulatory challenges. These hurdles might include dealing with intricate legal systems, unpredictable licensing processes, and lengthy approval timelines. The fact that regulations differ greatly from one country to another only adds to the complexity of maintaining compliance across multiple regions.

On top of that, political instability and economic uncertainty in these areas can heighten risks, making the process even more complicated for both insurers and businesses. Partnering with knowledgeable providers who understand the local regulatory environment can go a long way in addressing these obstacles and making the process smoother.

How do currency fluctuations affect the cost of credit insurance?

Currency fluctuations play a key role in shaping the cost of credit insurance by impacting the perceived risk tied to international trade. When exchange rates swing unpredictably, insurers often adjust premiums to reflect the heightened risk of financial losses from unfavorable currency shifts.

This kind of instability can drive up the cost of credit insurance, which might affect a business’s ability to offer credit or secure adequate coverage. For companies working in emerging markets, keeping a close eye on currency trends and exploring customized insurance options can help manage these risks more effectively.

Why should businesses partner with experts for credit insurance?

When it comes to credit insurance, teaming up with experienced specialists can make all the difference. These experts craft policies specifically tailored to suit your business, ensuring your unique needs are met. They don’t just stop at providing coverage – they dig deep into risk assessments, keep a close eye on potential threats, and simplify the claims process. This means you’re better prepared to handle uncertainties like non-payment or political risks.

With their guidance, you can confidently extend credit to both domestic and international clients, knowing your business is protected from unexpected financial setbacks.