Plan Your International Trade with Confidence

When expanding your business across borders, understanding the financial risks is crucial. Many exporters face uncertainties around payment defaults or geopolitical challenges, which can jeopardize cash flow. That’s where a tool like an export credit coverage planner becomes invaluable. It helps you determine the right level of protection for your shipments by factoring in key variables like export value, destination market stability, and credit terms.

Why Coverage Matters in Global Trade

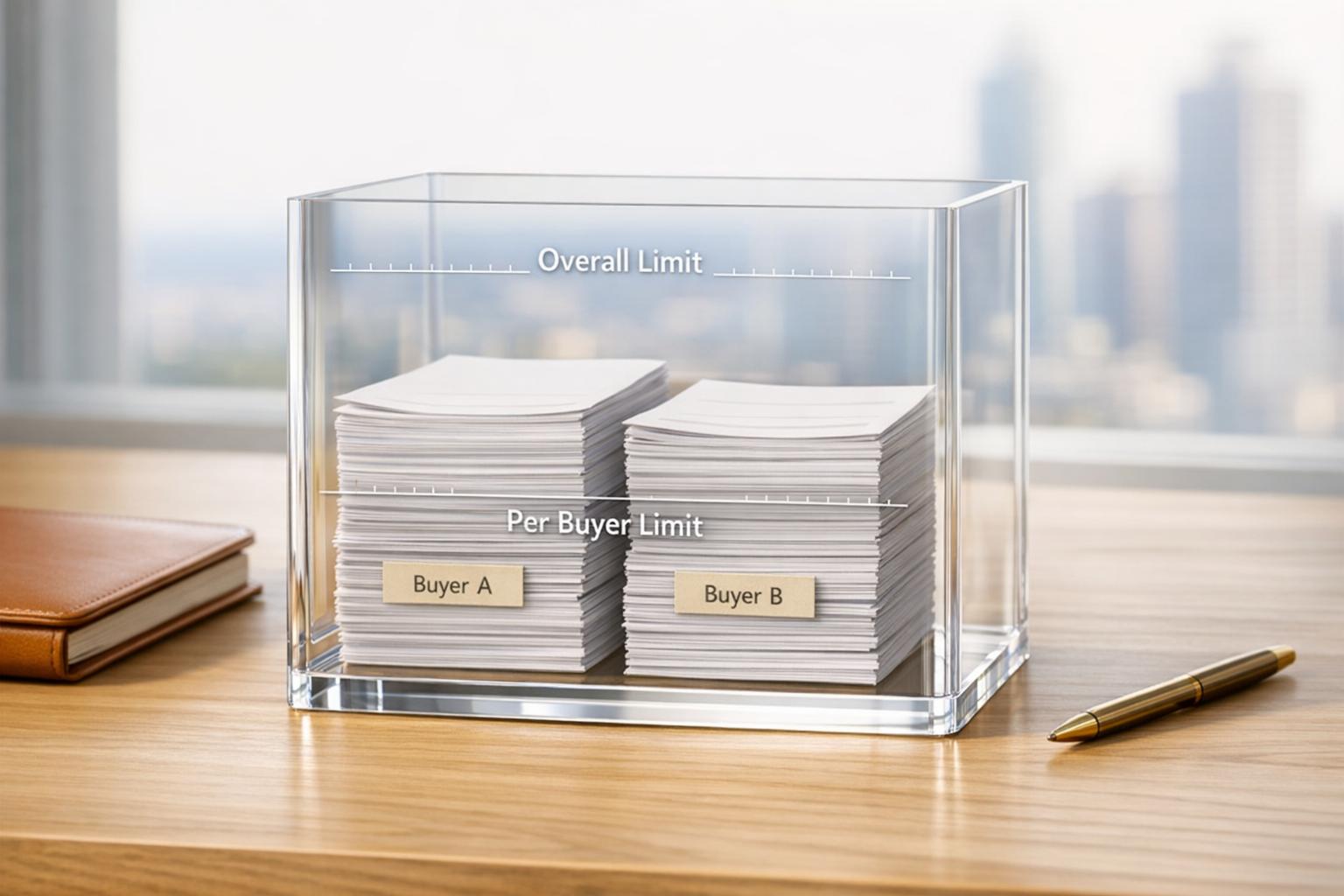

Securing the right amount of trade credit protection isn’t just about peace of mind—it’s a strategic move. Without adequate safeguards, a single unpaid invoice from an overseas buyer could disrupt your operations. By using a calculator tailored for international transactions, you can assess risks tied to specific countries and adjust your approach accordingly. Whether you’re shipping to a stable economy or a volatile region, having a clear picture of your needs empowers smarter decisions.

Tailored Insights for Every Deal

Every export deal is unique, with different values and timelines at play. A reliable planning tool offers personalized outputs, ensuring you’re neither underinsured nor overpaying for unnecessary coverage. Take control of your trade finance strategy today and mitigate risks effectively.

FAQs

Why does country risk affect my export credit coverage?

Country risk reflects the likelihood of payment issues due to political or economic instability in the destination market. A higher risk rating—like ‘High’—means there’s a greater chance of default, so we bump up the recommended coverage by a percentage (e.g., 20%) to protect your interests. It’s a precaution based on real-world trade dynamics, ensuring you’re not left exposed if things go south.

Can I adjust the coverage percentage myself?

Absolutely! You’re in control of how much of your export value you want to cover, anywhere from 0 to 100%. The tool uses your input to calculate a base amount, then adjusts it based on the country’s risk profile. Play around with the percentage to see what feels right for your business strategy and risk tolerance.

Is this tool suitable for small businesses new to exporting?

Yes, it’s perfect for businesses of any size, especially if you’re just starting out in global trade. The planner breaks down a complex topic—credit coverage—into simple steps and clear outputs. You don’t need to be a trade finance expert to use it; just input your numbers, and we’ll guide you to a sensible coverage amount with a note on why adjustments were made.