Understanding Export Credit Insurance Costs for Your Business

When expanding into international markets, protecting your business from financial risks is crucial. One key safeguard is export credit insurance, which covers losses from non-payment or other trade disruptions. But how do you estimate the cost of such a policy without getting bogged down in endless quotes and fine print? That’s where a reliable cost estimation tool comes in handy.

Why Estimate Trade Insurance Costs?

For small and medium-sized businesses, budgeting for international trade protection can feel overwhelming. Factors like the shipment value, destination market stability, and coverage duration all play a role in determining the price. Using a simple calculator can break down these variables—whether you’re shipping to a stable economy or a riskier region—and give you a clear picture in moments. This helps with planning and ensures you’re not caught off guard by unexpected expenses.

Tailored Insights for Smarter Decisions

Every export deal is unique, and so are the associated risks. A quick estimation of your trade credit policy expenses lets you weigh options and adjust plans before committing. Curious about securing your next shipment? Try our free tool to get started and take control of your export strategy today.

FAQs

How is the cost of export credit insurance calculated?

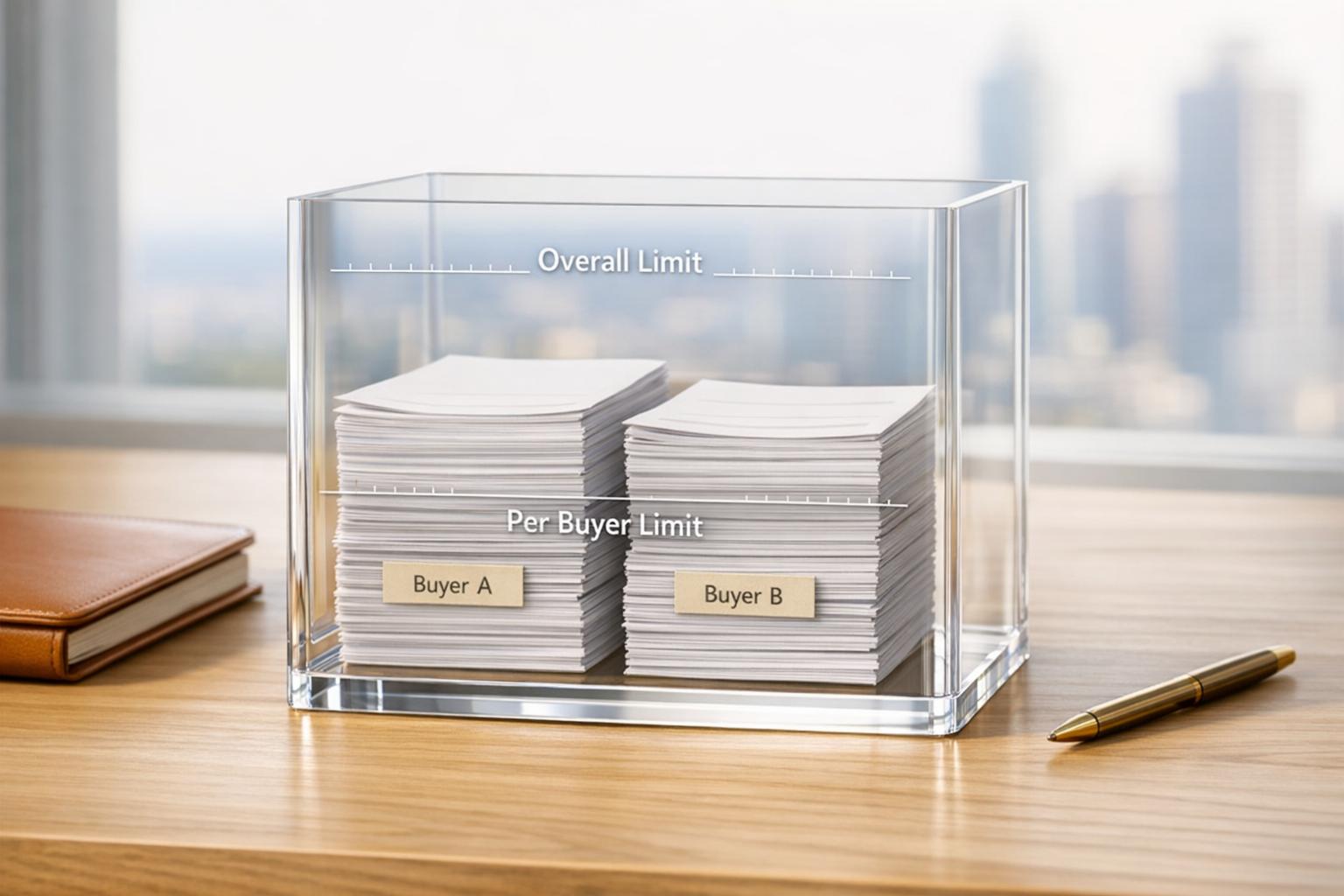

The cost depends on a few key factors. We take the total export value you provide and apply a base rate tied to the destination country’s risk level—0.5% for low risk, 1% for medium risk, and 2% for high risk. Then, we multiply that by the policy duration in months to give you the total estimated cost. It’s a straightforward way to get a ballpark figure without diving into complex paperwork right away.

Why does the country risk level affect the cost so much?

Country risk levels reflect the likelihood of issues like political instability or payment defaults in the destination market. A higher risk means insurers take on more potential liability, so they charge a steeper rate to cover that. For instance, shipping to a stable, low-risk country costs less to insure than a volatile, high-risk one. That’s why we let you pick the risk category—it’s a big driver of the final price.

Can I use this tool for any export value or duration?

Absolutely, as long as the duration is between 1 and 12 months. You can input any export value in USD, whether it’s a small shipment or a multi-million-dollar deal. The tool crunches the numbers instantly based on the risk level and time frame you select. If you’ve got a unique case or need a more detailed quote, though, it’s always a good idea to chat with an insurance provider directly.