Understanding Credit Insurance Costs for Your Business

Running a business often means extending credit to customers, but what happens when they don’t pay? That’s where credit protection comes in, shielding you from financial hits due to unpaid invoices. Figuring out the potential expense for this safety net can feel daunting, especially with varying rates and industry-specific risks. Thankfully, tools like a business credit insurance estimator simplify the process by breaking down costs based on your revenue, sector, and coverage needs.

Why Costs Vary Across Industries

Every sector faces unique challenges. A manufacturing firm might deal with long payment cycles, while construction companies often grapple with project delays that impact cash flow. Insurers account for these differences, adjusting premiums to match the likelihood of default. That’s why a tailored calculation, factoring in your specific field, gives a clearer picture of what you might pay for trade credit protection.

Planning for Protection

Budgeting for this kind of coverage doesn’t have to be a guessing game. By using a dedicated calculator, you can see how factors like credit sales percentage and desired policy level shape the final number. It’s a practical first step to securing your finances without overpaying for peace of mind.

FAQs

How accurate is this credit insurance cost estimate?

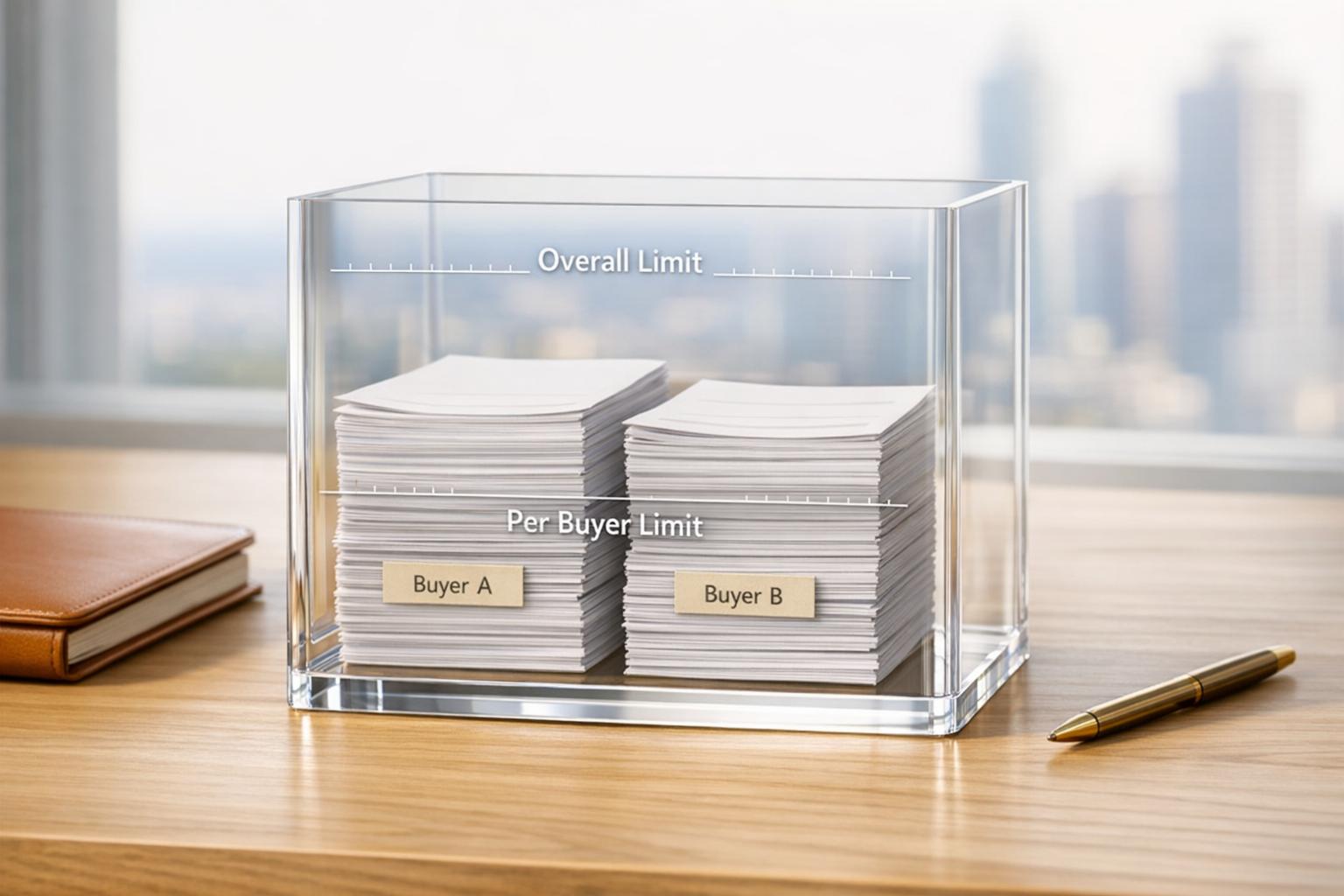

This tool provides a solid starting point based on standard industry rates and risk factors. We use a base rate of 0.5% to 1.2% of credit sales depending on coverage level, adjusted for your sector’s risk profile. That said, actual costs can vary depending on the insurer, your credit history, and specific policy terms. Think of this as a helpful guide to get the conversation started with providers.

Why does my industry affect the insurance cost?

Different industries carry different levels of risk when it comes to credit sales. For example, construction often has higher payment delays or defaults compared to retail, so insurers adjust premiums accordingly. Our tool applies a risk multiplier—say, 1.3 for construction or 1.0 for retail—to reflect these real-world trends and give you a more tailored estimate.

What’s the difference between Basic, Standard, and Premium coverage?

These levels reflect how much protection you’re buying. Basic coverage, with a lower base rate of 0.5% of credit sales, might cover only major defaults. Standard (0.8%) offers broader protection, while Premium (1.2%) typically includes the most comprehensive safeguards against unpaid invoices. The right choice depends on your risk tolerance and budget—we’re just here to show you the cost difference!