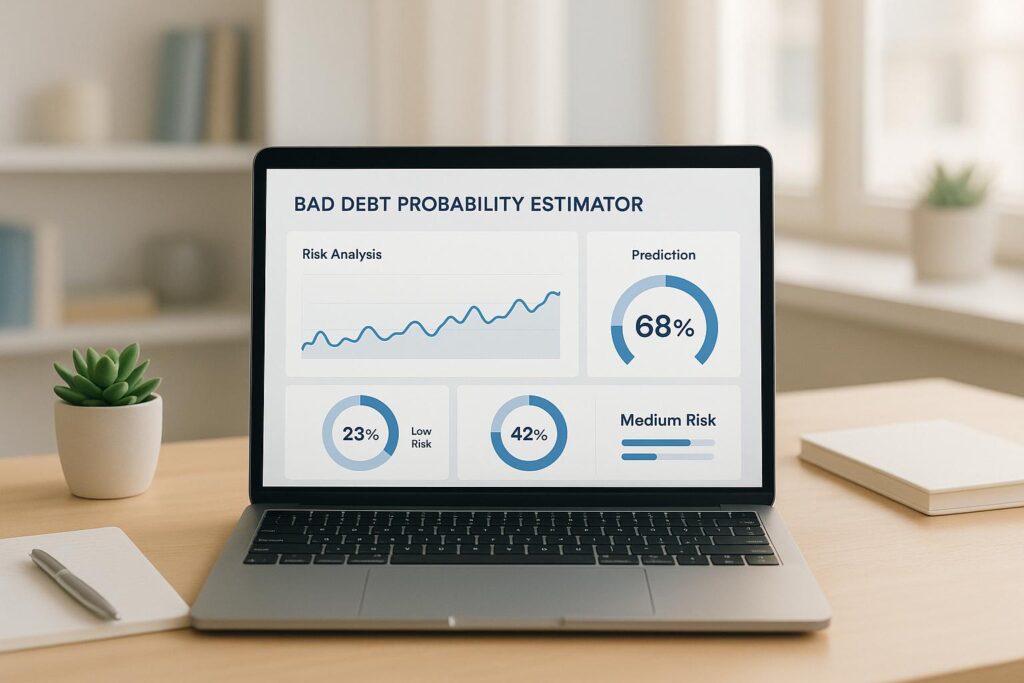

Protect Your Business with a Bad Debt Probability Estimator

Managing cash flow is a top priority for any business, but unpaid invoices can throw a wrench in your plans. That’s where a tool to assess invoice payment risks comes in handy. By evaluating key factors like a customer’s credit score, payment track record, and how long an invoice has been overdue, you can get a clearer picture of potential financial hiccups before they spiral.

Why Predicting Payment Risks Matters

Late payments or outright non-payment can disrupt operations, especially for small businesses with tight budgets. A reliable risk assessment tool lets you spot red flags early. For instance, knowing a customer’s history of delays or seeing an invoice creep past 60 days can prompt you to follow up sooner or adjust credit terms. This isn’t about distrust—it’s about smart planning. With data-driven insights, you’re better equipped to prioritize collections, negotiate payment plans, or even decide which clients to work with in the future. Taking a proactive stance on financial risks doesn’t just save money; it saves time and stress too. So, why not give yourself that edge with a quick, user-friendly way to gauge payment likelihood?

FAQs

How accurate is the Bad Debt Probability Estimator?

While no tool can predict the future with 100% certainty, our estimator uses a logical model based on common risk factors like credit scores, payment history, and invoice age. It’s designed to give you a reliable starting point for assessing risk. Think of it as a guide—combine it with your own judgment and any additional context about the customer for the best results.

What factors most impact the probability score?

The biggest drivers are usually days past due and payment history. If an invoice is over 90 days late, for instance, the risk jumps significantly. Similarly, a customer with frequent delays will push the probability higher. Credit score and invoice amount play a role too, but late payments often signal the most immediate concern.

Can I use this tool for any type of business?

Absolutely! Whether you’re in retail, services, manufacturing, or freelancing, this tool works for any business dealing with customer invoices. The inputs are universal—credit scores, payment patterns, and invoice details apply across industries. Just plug in the data, and you’ll get a tailored risk assessment.